Global Sepsis Diagnostics Market size is valued at USD 643 million in 2022 and is expected to reach USD 1044 million by 2029 at a CAGR of 7.17 % during the forecast period.Sepsis Diagnostics Market Overview:

Sepsis is a highly dangerous infection that occurs when the body's response to an infection causes tissue damage. Sepsis continues to be a major issue and can result in multiple organ failures, fast breathing, neurological dysfunction, low blood pressure, and an increased heart rate. Sepsis has become more common in developed countries. According to reports, about 750,000 people in the United States of America are affected by sepsis. According to the Canadian Sepsis Foundation, sepsis is the 12th leading cause of death in Canada. The government here spends a lot of money on treating sepsis. As a result, the rise in sepsis, along with high healthcare expenditure, boosts demand for sepsis diagnostics, supporting the growth of the sepsis diagnostics market. The World Health Assembly recognises sepsis as a major threat to patient safety and global health and has increased its focus on sepsis prevention, diagnosis, and treatment. Immunexpress is developing next-generation clinical sepsis diagnosis assays that can be used in emergency rooms and intensive care units. Prenosis Inc., a precision diagnostics company that uses artificial intelligence to improve clinical diagnosis has expanded its current agreement with Roche Diagnostics to improve and speed the clinical detection of sepsis.To know about the Research Methodology :- Request Free Sample Report To overcome the challenges associated with sepsis detection, the key players developed cost-effective diagnostic technologies. For example, Inflammatix, a pioneering molecular diagnostics company, developed a health economic model demonstrating that the company's HostDxTM Sepsis test is cost-effective as compared to standard methods. The high burden of sepsis, the rising incidence of hospital-acquired infections, the growing proportion of pneumonia cases, the increase in the number of sepsis procedures, and an increase in funding for sepsis-related research activities are the major factors driving the growth of the sepsis diagnostics market.

Sepsis Diagnostics Market Dynamics:

The development of quick diagnostic methods and point-of-care tests for sepsis Point of care (POC) technologies based on biomolecular analysis give a patient or health professional quick, usable information at the time and site of evaluation and treatment. These technologies are typically low-cost, simple to use, and fast, with few infrastructure requirements, making them applicable in a wide range of situations around the world. Microfluidics, lateral flow, dipstick, and smartphones are used to investigate sepsis biomarkers such as proteins, nucleic acids, human cells, bacteria, or pathogens. 17 POC technology may use minimal sample sizes, such as a fingerprick blood sample, and compact standalone devices, as well as only the most basic laboratory equipment, such as microscopes. POC diagnostics have the potential to reach patients in low-resource healthcare communities because of these factors. Single-analyte devices provide the advantage of simplicity and are being tested for POC sepsis diagnosis. Blood lactate levels have been used as a stand-alone sepsis biomarker for risk classification of emergency room patients. Many sepsis diagnostic vendors are extending the range of products they offer for point-of-care sepsis detection, speeding up diagnosis overall. The automated microbiological detection technique offered by the BACTEC Plus, BacT/Alert, and BACTEC FX blood culturing devices developed by BD Company (US) provide a quick diagnosis of sepsis in three hours.Increasing incidence of hospital-acquired infections The number of people suffering from various conditions as well as hospital-acquired infections is increasing the rate of instances of sepsis. This, in turn, is offering lucrative opportunities for the sepsis diagnostics market. Hospital-acquired infections (HAIs) also known as nosocomial infections are a major cause of mortality and morbidity worldwide. Urinary tract infections, pneumonia, and sepsis are the most common hospital-acquired diseases (HAIs). The rising prevalence of infectious diseases such as cholera, pneumonia, salmonellosis, toxic shock syndrome, COVID-19, and others are fueling the overall growth of the sepsis diagnostics market. According to World Health Organization statistics announced in February 2021, about 1.3-4.0 million cases of cholera are recorded worldwide each year. HAIs can cause sepsis in immunocompromised people, the elderly, and those with chronic illnesses. Each year, more than 1,000,000 cases of sepsis molecular diagnostics are predicted among hospitalised patients in the United States. Furthermore, with the global increase in HAIs, the market for sepsis diagnostic devices is expected to develop in the coming years. High cost of automated diagnostic devices and Shortage of skilled healthcare professionals As compared to blood culture tests, which can be purchased for as little as USD 28–35, the price of molecular diagnostic testing is between $300 and $3,000, which is extremely high. Companies are focusing on developing automated diagnostic devices based on advanced technologies, such as molecular diagnostics, for detecting sepsis, but due to limited funding levels, government hospitals (particularly in developing countries) and academic research laboratories cannot afford such devices. Sepsis is a potentially fatal condition that must be detected and treated as soon as possible by trained healthcare personnel. The worldwide shortage of skilled professionals is a major concern; only half of the patients with severe sepsis transported by the EMS system have a paramedic. The shortage of qualified paramedics has an effect on all phases of patient care, including sepsis awareness, evaluating patients for the presence of sepsis, and making appropriate treatment decisions. Therefore, the market is expected to hamper during the forecast period.

Sepsis Diagnostics Market Segment Analysis:

Based on Product, the blood culture media segment is dominating the market with a 45.5% share. The segment is expected to keep up its lead through the forecast period. This is because clinicians view blood cultures as the most practical and economical testing method. The world market has been divided into three product categories based on products: equipment, blood culture media, and test kits & reagents. In a study on sepsis patients in Thailand, it was found that the Septifast assay, PCR-based techniques provided superior diagnostic performance than blood culture. A consistent growth rate is expected to be seen in the instruments market through the forecast period as a result of rising public awareness of healthcare issues and an increase in the number of surgical procedures. For instance, Wolters Kluwer's POC Advisor was implemented by Guthrie, a U.S.-based integrated healthcare system, in September 2021 for sepsis diagnosis and management at four local hospitals.Based on the Technology, the microbiological technology segment is dominating the Sepsis Diagnostics market with a 49.5% share in 2022. This might be connected to the fact that the use of culture medium tests in microbiology technology enables precise detection and identification of bacteria for sepsis diagnosis. New strategic initiatives by important players are also fuelling the segment's growth. For instance, in April 2021, BD introduced its brand-new BD BACTEC platelet quality control media, which aids in the detection and reduction of sepsis among patients getting platelet transfusions. The molecular diagnostics segment is expected to grow at the highest CAGR through the forecast period. The segment is expected to be driven by the adoption of molecular diagnostic technology because of its many benefits, including high sensitivity, accuracy, and quick turnaround times compared to other technologies. This technique's drawback is that it is unable to detect organisms that are impossible to cultivate. Nevertheless, following blood culture, the molecular diagnostics method is regarded as a standard method for identifying pathogens. Based on the Pathogen, the bacterial Sepsis Segment dominated the market with a 79.5% Sepsis Diagnostics Market share in 2022 and is expected to keep leading during the forecast period due to an increase in bacterial sepsis cases, an increase in hospital-transmitted infections, and an increase in surgical operations. Bacterial sepsis is the most prevalent form with 61.2 % of patients infected with gram-negative bacteria and 46.6 % with gram-positive bacteria, as per a report released by SAGE Journals. The market is divided into segments for bacterial sepsis, fungal sepsis, and other pathogen-based sepsis. The gram-negative bacteria sub-segment is expected to lead the market in the bacterial sepsis segment through the forecast period. Despite having a smaller market share, the fungal sepsis category is expected to retain a sizable CAGR during the forecast period. The growing availability and release of a wide variety of innovative sepsis diagnosis instruments for pathogen detection are one of the key factors driving the pathogen segment. The more advanced technology markets in North America and Europe are where these products are most frequently introduced. Intensifying regulatory approvals of novel solutions and robust R&D initiatives are expected to promote segment growth.

Sepsis Diagnostics Market Regional Insights

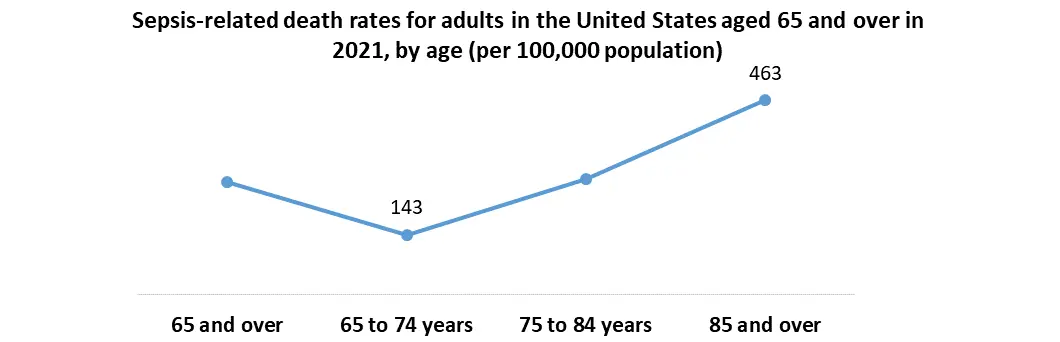

North America is estimated to have a significant share in Sepsis Diagnostics Market and is expected to show a similar trend during the forecast period. According to the Centers for Disease Control and Prevention, It was also discovered that one in every three patients who die in a hospital had sepsis. The increase in sepsis cases in the country is attributed to a surge in the senior population, infections that are incurable by antibiotics, and a significant risk of disease among patients undergoing organ transplantation. Furthermore, the CDC launched the Get Ahead of Sepsis effort to protect Americans from the harmful effects of sepsis. This campaign encourages doctors to educate patients, avoid infections, and detect sepsis early. Rising investments in research and development for sepsis diagnosis are expected to help the industry. The region's well-developed healthcare infrastructure has resulted in the widespread use of sepsis diagnostic devices in laboratories and diagnostic centres. Also, favourable healthcare reimbursement has promoted greater penetration of automated sepsis diagnostic analyzers in the region's nations. These factors all contribute to the robust growth of the North American sepsis diagnostics market. The sepsis diagnostics market in the Asia Pacific region is expected to increase rapidly because of significant economic development in countries such as India and China. Sepsis is one of the leading causes of death in ICUs in China. Furthermore, according to a clinical criteria study, sepsis affects one-fifth of ICU patients and has a 90-day mortality rate. the mortality rate of sepsis remains high due to a lack of epidemiological data. This shows that severe sepsis or septic shock is a high disease burden in the country. As a result, there is an urgent need to improve the early sepsis triage system, develop physicians' core skills, and control nosocomial infections. This increase in sepsis prevalence is expected to raise demand for sepsis diagnosis, driving the growth of China's sepsis diagnostics market over the coming years.Sepsis Diagnostics Market Scope: Inquire before buying

Sepsis Diagnostics Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 643 Mn. Forecast Period 2024 to 2029 CAGR: 7.17% Market Size in 2029: US $ 1044 Mn. Segments Covered: by Product 1. Instruments 2. Blood Culture Media 3. Assay Kits and Reagents by Technology 1. Microbiology 2. Molecular Diagnostics 3. Immunoassays 4. Flow CytometryNear-Field Scanning Optical Microscopes 5. X-ray Microscopes 6. Other Microscopes by Pathogen 1. Bacterial Sepsis 2. Gram-positive Bacteria 3. Gram-negative Bacteria 4. Fungal Sepsis 5. Others by Testing Type 1. Laboratory Testing 2. PoC Testing Sepsis Diagnostics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sepsis Diagnostics Market, Key Players are

1. Becton, Dickinson and Company (US) 2. Thermo Fisher Scientific, Inc. (US) 3. Luminex Corporation (US) 4. Bruker Corporation (US) 5. Cerner Corporation (US) 6. Epic Systems Corporation (US) 7. McKesson Corporation (US) 8. GE Healthcare (US) 9. T2 Biosystems (US) 10. Abbott Laboratories (US) 11. Cepheid (US) 12. Quidel Corporation (US) 13. AdvanDx (US) 14. Beckman Coulter, Inc. (US) 15. Alifax S.r.l. (Italy) 16. F. Hoffmann-La Roche AG (Switzerland) 17. Koninklijke Philips N.V. (Netherlands) 18. Wolters Kluwer N.V. (Netherlands) 19. Siemens Healthineers (Germany) 20. EKF Diagostics (UK) 21. Axis-Shiel Diagnostics (UK) 22. bioMérieux SA (France) 23. Seegene Inc. (South Korea) 24. Boditech Med (South Korea) 25. Immunexpress (Australia) FAQs: 1. Which is the potential market for Sepsis Diagnostics in terms of the region? Ans. In the North America region, surge in the senior population, infections that are incurable by antibiotics, and a significant risk of disease among patients undergoing organ transplantation are expected to drive the market. 2. What is expected to drive the growth of the Sepsis Diagnostics market in the forecast period? Ans. Increasing incidence of hospital-acquired infections are a key factor driving the market growth during the forecast period. 3. What is the projected market size & growth rate of the Sepsis Diagnostics Market? Ans. The total global size of Sepsis Diagnostics Market valued USD 643 million in 2022 and is expected to reach USD 1044 million by 2029 at a CAGR of 7.17% during the forecast period. 4. What segments are covered in the Sepsis Diagnostics Market report? Ans. The segments covered are Product, Technology, Pathogen, Testing Type, and region.

1. Global Sepsis Diagnostics Market: Research Methodology 2. Global Sepsis Diagnostics Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to the Global Sepsis Diagnostics Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Sepsis Diagnostics Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Sepsis Diagnostics Market Segmentation 4.1 Global Sepsis Diagnostics Market, by Product (2022-2029) • Instruments • Blood Culture Media • Assay Kits and Reagents 4.2 Global Sepsis Diagnostics Market, by Technology (2022-2029) • Microbiology • Molecular Diagnostics • Immunoassays • Flow CytometryNear-Field Scanning Optical Microscopes • X-ray Microscopes • Other Microscopes 4.3 Global Sepsis Diagnostics Market, by Pathogen (2022-2029) • Bacterial Sepsis • Gram-positive Bacteria • Gram-negative Bacteria • Fungal Sepsis • Others 4.4 Global Sepsis Diagnostics Market, by Testing Type (2022-2029) • Laboratory Testing • PoC Testing 5. North America Sepsis Diagnostics Market(2022-2029) 5.1 North America Sepsis Diagnostics Market, by Product (2022-2029) • Instruments • Blood Culture Media • Assay Kits and Reagents 5.2 North America Sepsis Diagnostics Market, by Technology (2022-2029) • Microbiology • Molecular Diagnostics • Immunoassays • Flow CytometryNear-Field Scanning Optical Microscopes • X-ray Microscopes • Other Microscopes 5.3 North America Sepsis Diagnostics Market, by Pathogen (2022-2029) • Bacterial Sepsis • Gram-positive Bacteria • Gram-negative Bacteria • Fungal Sepsis • Others 5.4 North America Sepsis Diagnostics Market, by Testing Type (2022-2029) • Laboratory Testing • PoC Testing 5.5 North America Sepsis Diagnostics Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Sepsis Diagnostics Market (2022-2029) 6.1. European Sepsis Diagnostics Market, by Product (2022-2029) 6.2. European Sepsis Diagnostics Market, by Technology (2022-2029) 6.3. European Sepsis Diagnostics Market, by Pathogen (2022-2029) 6.4. European Sepsis Diagnostics Market, by Testing Type (2022-2029) 6.5. European Sepsis Diagnostics Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Sepsis Diagnostics Market (2022-2029) 7.1. Asia Pacific Sepsis Diagnostics Market, by Product (2022-2029) 7.2. Asia Pacific Sepsis Diagnostics Market, by Technology (2022-2029) 7.3. Asia Pacific Sepsis Diagnostics Market, by Pathogen (2022-2029) 7.4. Asia Pacific Sepsis Diagnostics Market, by Testing Type (2022-2029) 7.5. Asia Pacific Sepsis Diagnostics Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Sepsis Diagnostics Market (2022-2029) 8.1 Middle East and Africa Sepsis Diagnostics Market, by Product (2022-2029) 8.2. Middle East and Africa Sepsis Diagnostics Market, by Technology (2022-2029) 8.3. Middle East and Africa Sepsis Diagnostics Market, by Pathogen (2022-2029) 8.4. Middle East and Africa Sepsis Diagnostics Market, by Testing Type (2022-2029) 8.5. Middle East and Africa Sepsis Diagnostics Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Sepsis Diagnostics Market (2022-2029) 9.1. South America Sepsis Diagnostics Market, by Product (2022-2029) 9.2. South America Sepsis Diagnostics Market, by Technology (2022-2029) 9.3. South America Sepsis Diagnostics Market, by Pathogen (2022-2029) 9.4. South America Sepsis Diagnostics Market, by Testing Type (2022-2029) 9.5. South America Sepsis Diagnostics Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Becton, Dickinson and Company (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Thermo Fisher Scientific, Inc. (US) 10.3. Luminex Corporation (US) 10.4. Bruker Corporation (US) 10.5. Cerner Corporation (US) 10.6. Epic Systems Corporation (US) 10.7. McKesson Corporation (US) 10.8. GE Healthcare (US) 10.9. T2 Biosystems (US) 10.10. Abbott Laboratories (US) 10.11. Cepheid (US) 10.12. Quidel Corporation (US) 10.13. AdvanDx (US) 10.14. Beckman Coulter, Inc. (US) 10.15. Alifax S.r.l. (Italy) 10.16. F. Hoffmann-La Roche AG (Switzerland) 10.17. Koninklijke Philips N.V. (Netherlands) 10.18. Wolters Kluwer N.V. (Netherlands) 10.19. Siemens Healthineers (Germany) 10.20. EKF Diagostics (UK) 10.21. Axis-Shiel Diagnostics (UK) 10.22. bioMérieux SA (France) 10.23. Seegene Inc. (South Korea) 10.24. Boditech Med (South Korea) 10.25. Immunexpress (Australia)