Refrigerated Sea Transportation Market was valued at US$ 9.25 Bn. in 2023 and the total revenue is expected to grow at 6.9% of CAGR through 2024 to 2030, reaching nearly US$ 14.76 Bn.Refrigerated Sea Transportation Market Overview:

refrigerated systems, are available in a variety of sizes and payload capacities, allowing the appropriate unit to be selected based on the quantity of cargo being carried. In order to provide a minute-by-minute report on the temperature levels while the product is in transit, these refrigerated units utilize sensors and IT infrastructure. Therefore, it is projected that the transportation system is expected to advance thanks to the increased usage of telematics, GPS systems, navigation systems, and temperature-monitoring sensors. This is likely to in turn accelerate the market growth for refrigerated sea transportation. This type of transportation requires unique logistical transportation methods, equipment, and agreements. It involves loading and unloading goods utilizing a variety of vehicles, including forklifts, lorry tanks, pick-up trucks, and flatbed trucks. Technological advancements, changing client food tastes, container modification, and globalization are driving the global refrigerated sea transportation market. The refrigerated sea transportation market is expected to expand at a rapid pace during the forecast period, owing to an increase in global demand for perishable commodities. However, the global refrigerated sea transportation market is likely to be restrained by irregular distribution routes, government standards, and increases in the prices of customized containers, which impact the operational cost of transportation.To know about the Research Methodology :- Request Free Sample Report

Refrigerated Sea Transportation Market Dynamics:

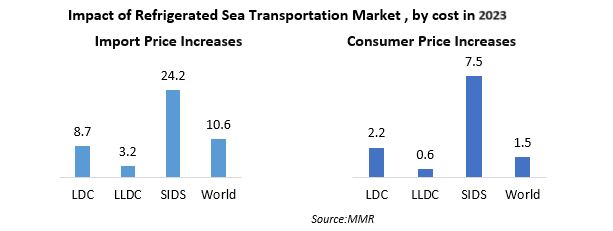

Refrigerated Sea Transportation Challenges for OMEs The most difficult problem would be transit time; the quicker the time it takes to arrive at the destination with the help of the refrigerated sea transportation market, with maintaining higher food quality. Importers would be wise to obtain their goods from a neighboring country. For example, in Taiwan, if you can get a product from Japan, it will undoubtedly be fresher on delivery than the identical product from the United States. Another issue of refrigerated sea transport for OMEs, particularly in low-income areas, is inadequate or non-existent infrastructure. Because some countries lack a robust cold chain infrastructure to support food exports, there is no guarantee that high-quality foodstuffs be placed into containers every time. Thus it hampers the refrigerated sea transportation market. Investment in infrastructure The safety of perishable goods also is connected to the logistics on land as ocean carriers come into port. Many ports are attempting to attract transporters by establishing on-site cold storage facilities, while others are maintaining food safety through alternative techniques. Port Tampa Bay announced in October the installation of a 132,000-square-foot cold storage facility to accommodate chilled import and export commodities. The facility, which is set to open this autumn, will be operated by Port Logistics Refrigerated Services. The facility, which will be built on a 13.7-acre location near the port, will handle both chilled and frozen items and assure Central Florida's future as a hub for importing and exporting refrigerated products. Vessel Connect improves safety even further by removing the need to manually verify the temperature status and condition of reefer containers. If an alert is triggered, it will be automatically displayed on a console, and an engineer will be dispatched to investigate and rectify any concerns. The system also detects non-functioning equipment, allowing shore-based personnel to be notified in advance if repairs are required. "As shipping lines increasingly deploy GPS and GSM-enabled containers, they must bridge the traceability gap on ships at sea, and ORBCOMM's VesselConnect technology gives end-to-end visibility of chilled container operations," and drive the refrigerated sea transportation market. Smaller players and pricing would be impacted by cost pressure, increasing rates, and taxes. The cost of shipping in refrigerated sea transportation has risen significantly since the second half of 2023. Despite higher-than-expected demand for containerized products, logistical obstacles, delays, and a lack of container shipping equipment have all limited shipping capacity in the refrigerated sea transportation market. An increase in surcharges and costs, such as results in reduced detention fees, has also been brought on by unreliable scheduling and port congestion. All merchants and supply chain managers are challenged by these rising prices, but small business owners have particularly affected the refrigerated sea transportation market. Shippers may be less able to absorb the added cost than the bigger companies, which puts them at a disadvantage when negotiating pricing and reserving space on ships. Smaller shippers and goods with minimal value may therefore have trouble obtaining service contracts and may experience and hamper the refrigerated sea transportation market. It's expected that shipping costs would stay high. Strong demand is accompanied by increased supply-side uncertainty and concerns about the effectiveness of transportation and port operations. It is becoming more crucial to keep an eye on market behavior and maintain openness when it comes to determining rates, taxes, and surcharges in the face of severe cost constraints and long-lasting refrigerated sea transportation market upheaval. There have been calls for governments to step in, for regulators to exercise tighter control, and for them to confront unethical refrigerated sea transportation market activities.

Refrigerated Sea Transportation Market Segment Analysis:

Based on Type, the Refrigerated Sea Transportation Market is segmented into Containerized Reefers and Specialized Reefers. Containerized Reefers held the largest market share in 2023. Reefer containers are designed for the transportation of fresh produce. They keep the inside compartment chilly to preserve the contents fresh and in their original state. Reefer containers are mostly used to convey fruits and vegetables, dairy, meat, flowers, and medications. It is simply a freight container outfitted with independent refrigeration equipment and an air/water-cooled heat exchanger that protects perishable goods from degradation caused by exposure to extreme temperatures, humidity, and other environmental variables. They are designed to operate at temperatures ranging from -60°C to +40°C (-85°F to +104°F) regardless of the ambient temperature. these Containerized Reefers are highly in demand during refrigerated sea transportation. Containerized Reefers have huge demand thanks to These non-food items that require optimal temperature and humidity. The bulk of such cargo is pharmaceuticals and medications. This category also includes tobacco, batteries, chemicals, and photographic film. Special handling instructions for packing, stowage, temperature, and humidity management are frequently included and, drive the refrigerated sea transportation market. Based on the Technology, the Refrigerated Sea Transportation Market is segmented into Vapour Compression Systems and Cryogenic systems, Vapour Compression system is expected to dominate the market during the forecast period. Despite their high energy consumption and negative impacts on the environment, vapor-compression refrigeration systems (VCRS) are often employed in refrigerated transportation. In 2019, the market share for traditional transportation refrigeration units, which are powered by diesel engines, was at 20%. A system powered by diesel can produce up to 40% of greenhouse gases. However, development and research effort are required to make the system lighter and more efficient in order to compete with a diesel-driven vapor compression system. During the projected period, the expansion of VCRS is expected to be constrained by the development of substitute technologies for VCRs that have less of an impact on the environment. Reversible compressors powered by electric motors with many cylinders are frequently used in sea refrigeration systems. The benefit of such compressors is that the load may be controlled by cutting individual cylinders in and out, which increases the system's overall effectiveness and drive the Refrigerated Sea, Transportation Market.Based on the Application, the Refrigerated Sea Transportation Market is segmented into Chilled Food Products and Frozen Food Products. Child food products is expected to dominate the market during the forecast period. Fresh fruits and vegetables, seafood, dairy, eggs, sweets, live plants, and flowers are all examples of chilled items. They require low temperatures near freezing points but should not be frozen. Their freshness and shelf life are heavily influenced by their nature and the surrounding environment. Temperature settings for such goods must take into account the stage of the crop being sent. They must be transported with extreme care in order to maintain their economic worth. Asparagus and broccoli, for example, have high respiration rates and hence emit a lot of gases and moisture. They require optimal temperature and humidity conditions to maintain their quality and shelf life. As consumers want more, a number of the world's top sea transporters are constantly adding refrigerated containers to their fleets, making the delivery of fresh, frozen, and chilled cargo less dangerous. Shippers have migrated to steamships as the ability to monitor and track container location and temperature has increased. Controlled environment and other novel technologies, as well as cutting-edge technology that keeps cargo fresher and more stable on extended trips, are helping to keep fresh food safe. The airflow and temperature setting are critical for keeping fresh or perishable commodities like fruits and vegetables fresh during ocean transportation. We have staff members that inspect the containers 3-4 times a day throughout the journey and take the appropriate steps to rectify any temperature issues. They also have a variety of technologies that modify the environment, keeping the product 'asleep' throughout transportation and extending its shelf life. And drive the refrigerated sea transportation market. Because of the global increase in demand for exotic perishable goods, the chilled product category also has a significant proportion of the refrigerated sea transportation industry. Shifting consumer tastes and lifestyle changes, expanding urbanization, and rising disposable income will drive the refrigerated sea transportation market’s global growth.

Refrigerated Sea Transportation Market Regional Insights:

The Asia Pacific region dominated the market with 45 % share in 2023. In recent years, the number of goods moved around the world by container sea transportation has steadily grown. According to data from the Hong Kong Marine Department, Asian ports, particularly those in China, are progressively dominating the market. There were still two European and one North American port on the list of the world's largest refrigerated sea transportation market. Only Rotterdam remained among the top ten in 2023, although at the bottom. The Asian refrigerated sea transportation market has grown rapidly in recent years. Along with other Chinese ports, Singapore and Busan in South Korea rank in the top ten. Completely new refrigerated sea transportation hubs have formed in Malaysia, Taiwan, and Thailand. In contrast to commodities production, improvements in port size in Asia do not indicate that Asian port technology is more inventive, quicker, or competitive. Experts believe that the development of port infrastructure merely reflects the increase in trade volumes. The coronavirus epidemic hampered maritime transportation by disrupting supply networks all around the world. Shipping volumes initially dropped as companies in Asian manufacturing hubs stopped down, only to be overstretched later in the epidemic when restocking demands in developing states produced shipping growth and drive the rafigareted sea transportation marketCompetitive Landscape Mediterranean Shipping Organization (MSC) began the new year as the world's largest sea transport ship company in terms of capacity. Data analysts and consultancy Alphaliner revised its Top 100 rating, putting MSC ahead of Maersk for the first time by just 1,888 TEU, a minuscule percentage of its almost 4.3 million TEU overall capacity. The Danish shipping company now has a fleet of 738 boats with a combined capacity of about 4.3 million TEU. Maersk owns 60 percent of its 330-ship fleet. Maersk has yet to announce plans for a significant increase of its containership fleet, contrary to what its competitors believed. In addition to MSC, several major carriers such as CMA CGM, Hapag, COSCO, ONE, Evergreen, and HMM have indicated intentions to increase capacity by at least 20%. Maersk made headlines in August 2021 when it ordered eight 16,000 TEU boats intended to run on methanol, although its entire order book comprises only 6% of current capacity. Maersk, unlike all of its competitors, has not ordered any of the ultra-large vessels set to surpass the 24,000 TEU mark.

Refrigerated Sea Transportation Market Scope: Inquire before Buying

Refrigerated Sea Transportation Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 9.25 Bn. Forecast Period 2023 to 2030 CAGR: 6.9% Market Size in 2030: US $ 14.76 Bn. Segments Covered: by Mode Of Transportation 1. Containerized Reefers 2. Specialized Reefers by Technology 1. Vapour Compression Systems 1.1 Air-blown Evaporators 1.2 Eutectic Devices

2. Cryogenic System2.1 Cryo-trans indirect (CTD) 2.2 Cryo-trans Indirect (CTI) 2.3 Cryo-Trans Hybrid

by Application 1. Chilled Food Products 1.1 Milk 1.2 Bakery & Confectionery Products 1.3 Dairy products 1.4 Beverages 1.5 Fresh Fruits & Vegetables

2. Frozen Food Products2.1 Ice-cream 2.2 Frozen dairy Products 2.3 Processed Meat 2.4 Fish & Seafood 2.5 Bakery Products

Refrigerated Sea Transportation Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Refrigerated Sea Transportation Market, Key Players are

1. CMA CGM S.A. 2. Seatrade Reefer Chartering 3. Maersk Line, NYK Line 4. China Shipping Container Lines 5. Africa Express Line 6. Geest Line 7. Green Reefers Group 8. APL 9. Klinge Group 10. Kyowa Shipping 11. Hanjin Shipping 12. Maestro Reefers 13. Hamburg Sud 14. Orient Overseas Container Line 15. FSC Frigoship Chartering 16. K Line Logistics 17. Mediterranean Shipping Company 18. SeaCube Container Leasing 19. BLPL 20. STAR Reefers 21. Mitsui O.S.K. Lines 22. KMTC 23. Yang Ming Marine Transport 24. Hapag-Lloyd 25. ZIM Integrated Shipping Services 26. Compania Sudamericana de Vapores 27. United Arab Shipping. Frequently Asked Questions: 1] What segments are covered in the Global Refrigerated Sea Transportation Market report? Ans. The segments covered in the Refrigerated Sea Transportation Market report are based on Product Type and End User. 2] Which region is expected to hold the highest share in the Global Refrigerated Sea Transportation Market? Ans. The Asia Pacific region is expected to hold the highest share of the Refrigerated Sea Transportation Market. 3] What is the market size of the Global Refrigerated Sea Transportation Market by 2030? Ans. The market size of the Refrigerated Sea Transportation Market by 2030 is expected to reach US$ 14.76 Bn. 4] What is the forecast period for the Global Refrigerated Sea Transportation Market? Ans. The forecast period for the Refrigerated Sea Transportation Market is 2024-2030. 5] What was the market size of the Global Refrigerated Sea Transportation Market in 2023? Ans. The market size of the Refrigerated Sea Transportation Market in 2023 was valued at US$ 9.25 Bn.

1. Global Refrigerated Sea Transportation Market: Research Methodology 2. Global Refrigerated Sea Transportation Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Refrigerated Sea Transportation Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Refrigerated Sea Transportation Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Refrigerated Sea Transportation Market Segmentation 4.1 Global Refrigerated Sea Transportation Market, By Mode of Transportation (2023-2030) • Containerized Reefers • Specialized Reefers 4.2 Global Refrigerated Sea Transportation Market, By Technology (2023-2030) • Vapor Compression Systems • Air-blown Evaporators • Eutectic Devices • Cryogenic System • Cryo-trans indirect (CTD) • Cryo-trans Indirect (CTI) • Cryo-Trans Hybrid 4.3 Global Refrigerated Sea Transportation Market, Based on Application (2023-2030) • Chilled Food Products • Milk • Bakery & Confectionery Products • Dairy products • Beverages • Fresh Fruits & Vegetables • Frozen Food Products • Ice-cream • Frozen dairy Products • Processed Meat • Fish & Seafood • Bakery Products 5. North America Refrigerated Sea Transportation Market (2023-2030) 5.1 North America Refrigerated Sea Transportation Market, by By Mode Of Transportation (2023-2030) • Containerized Reefers • Specialized Reefers 5.2 North America Refrigerated Sea Transportation Market, By Technology (2023-2030) • Vapor Compression Systems • Air-blown Evaporators • Eutectic Devices • Cryogenic System • Cryo-trans indirect (CTD) • Cryo-trans Indirect (CTI) • Cryo-Trans Hybrid 5.3 North America Refrigerated Sea Transportation Market, Based on Application (2023-2030) • Chilled Food Products • Milk • Bakery & Confectionery Products • Dairy products • Beverages • Fresh Fruits & Vegetables • Frozen Food Products • Ice-cream • Frozen dairy Products • Processed Meat • Fish & Seafood • Bakery Products 5.4 North America Refrigerated Sea Transportation Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Refrigerated Sea Transportation Market (2023-2030) 6.1. European Refrigerated Sea Transportation Market, by By Mode Of Transportation (2023-2030) 6.2. European Refrigerated Sea Transportation Market, By Technology (2023-2030) 6.3. European Refrigerated Sea Transportation Market, Based on Application (2023-2030) 6.4. European Refrigerated Sea Transportation Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Refrigerated Sea Transportation Market (2023-2030) 7.1. Asia Pacific Refrigerated Sea Transportation Market, by By Mode Of Transportation (2023-2030) 7.2. Asia Pacific Refrigerated Sea Transportation Market, By Technology (2023-2030) 7.3. Asia Pacific Refrigerated Sea Transportation Market, Based on Application (2023-2030) 7.4. Asia Pacific Refrigerated Sea Transportation Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Refrigerated Sea Transportation Market (2023-2030) 8.1 Middle East and Africa Refrigerated Sea Transportation Market, by By Mode Of Transportation (2023-2030) 8.2. Middle East and Africa Refrigerated Sea Transportation Market, By Technology (2023-2030) 8.3. Middle East and Africa Refrigerated Sea Transportation Market, Based on Application (2023-2030) 8.4. Middle East and Africa Refrigerated Sea Transportation Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Refrigerated Sea Transportation Market (2023-2030) 9.1. South America Refrigerated Sea Transportation Market, by By Mode Of Transportation (2023-2030) 9.2. South America Refrigerated Sea Transportation Market, By Technology (2023-2030) 9.3. South America Refrigerated Sea Transportation Market, Based on Application (2023-2030) 9.4 South America Refrigerated Sea Transportation Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 CMA CGM S.A. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Seatrade Reefer Chartering 10.3 Maersk Line, NYK Line 10.4 China Shipping Container Lines 10.5 Africa Express Line 10.6 Geest Line 10.7 Green Reefers Group 10.8 APL 10.9 Klinge Group 10.10 Kyowa Shipping 10.11 Hanjin Shipping 10.12 Maestro Reefers 10.13 Hamburg Sud 10.14 Orient Overseas Container Line 10.15 FSC Frigoship Chartering 10.16 K Line Logistics 10.17 Mediterranean Shipping Company 10.18 SeaCube Container Leasing 10.19 BLPL 10.20 STAR Reefers 10.21 Mitsui O.S.K. Lines 10.22 KMTC 10.23 Yang Ming Marine Transport 10.24 Hapag-Lloyd 10.25 ZIM Integrated Shipping Services 10.26 Compania Sudamericana de Vapores 10.27 United Arab Shipping.