Real-Time Payments Market was worth US$ 56.9 Bn. in 2022 and total revenue is expected to grow at a CAGR of 33.0 % from 2023 to 2029, reaching almost US$ 418.9 Bn. in 2029.Real-Time Payments Market Overview:

The payments industry is constantly looking for innovative methods to streamline procedures, cut costs, improve security, and, most importantly, improve consumer satisfaction. When it comes to real-time or instant payments, however, modernizing existing Automated Clearing House (ACH) rails will not be enough to accelerate the adoption of new innovative digital services and products, such as digital wallets. Instead, digital means will be required to enable real-time payments. When it comes to the adoption of innovative digital services enabled by a powerful real-time payment infrastructure. The major players in Industries are RTP Space and Fed now. India, the world's largest real-time payments market, continues to set the bar for what is achievable. For example, Unified Payments Interface (UPI), which is currently leading India's already-growing digital payments industry, with monthly transaction volumes and values increasing.To know about the Research Methodology :- Request Free Sample Report The significant growth in real-time payments in 2022 is undisputed. Maximize market research estimated that there were over 48.5 billion transactions in 2022, compared to around 34 billion in 2022. Due to the relatively early stage of development of many markets worldwide – the volume of real-time payment is currently heavily concentrated in the top 5 markets. Which are around 80 % of global transactions. By far the largest markets are China and India, which together accounted for around 60% of real-time payment. Particularly in India the volume of UPI and IMPS has seen remarkable growth of 112 % from 6 Bn. transactions to 113 Bn transactions in the last 12 months.

COVID-19 Impact on Real-Time Payments Market:

The pandemic affected every corner of the globe, and real-time payments are no exception. The usage of real-time payments accelerated during the pandemic. Over 130 financial institutions in the United States were in the process of implementing RTPs as of September 2022, a five-fold increase from September 2022. The Clearing House's RTP network now connects half of all demand deposit accounts in the United States. A live RTP rail was found in 56 countries, up from 14 countries just six years earlier. With 41 million payments per day, India had the largest RTP market in terms of volume. The Philippines had the largest yearly percentage value rise of 482 %. Bahrain experienced the biggest yearly percentage volume rise, at 657 %.Real-Time Payments Market Dynamics:

The ability of real-time payments to provide consumers and businesses with greater flexibility in making and receiving payments is likely to fuel growth. Businesses can also benefit from real-time payments by enhancing their cash flow and, as a result, their operational efficiencies, budgeting, and overall cash management. As a result, the market is predicted to rise due to the growing popularity of this payment form among businesses. According to MMR Research a payment system firm, 77 % of merchants glow expect real-time payments to eventually replace physical payment cards. Smartphone penetration has reached 70% in industrialized countries, while feature phones are frequently used to replace wallets and currency in many developing economies. Due to catalysts like as social platforms, digital currencies, and near-field communication (NFC) based payments, new domestic person-to-person (P2P) payment providers are springing up on a regular basis. The industry is undergoing significant change as a result of rapid technological advancement. New start-ups, spin-offs, and partnerships are bringing new payment choices. In recent years, a slew of new FinTech companies has emerged with an emphasis on mobile payments. New services, such as security with fraud detection and authentication, improved customer experience, or making funds available to small firms fast after their line of credit is granted, are usually the focus. The next stage for these businesses may be to determine whether real-time payments will become a core business aspect and how to develop an operating model to enable them to deliver better service. Businesses may use real-time payments to win, serve, and retain customers by providing them with more efficient, secure, and engaging commerce experiences. The convergence of eCommerce and real-time payments has aided in attracting new market participants who are providing simple, convenient solutions. Banks may face a number of issues as a result of the proliferation of participants, including the prospect of losing consumers to new financial services providers. Building a whole new payment infrastructure usually provides more flexibility, but it is also a pricey undertaking. The challenge of dealing with systems that were not designed for real-time notice and clearing is rarely solved by simply enhancing the Automated Clearing House (ACH). The ATM and PIN debit infrastructure would most likely entail aligning a variety of networks, integrating with bank cash management systems, and expanding the capacity to use those networks to rely on credit push instead of the existing debit pull processes, which would alter the economic models.Segment Analysis:

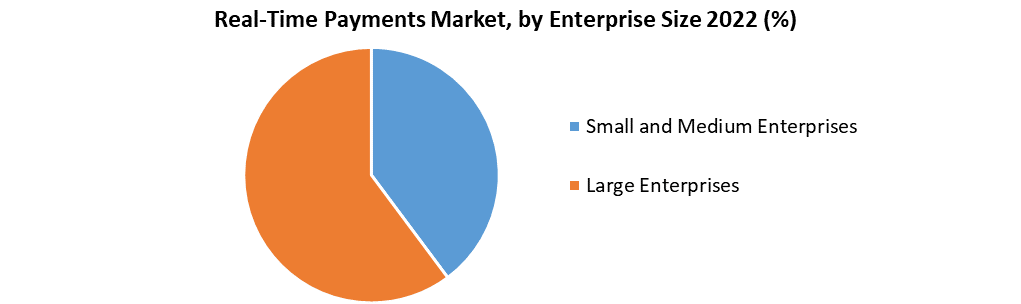

Global Real-Time Payments Market is segmented into Type, Component, and Enterprise size. Based on the Component, the market is sub-segmented into Solution and Service. In 2022, the solutions category dominated the real-time payments market, accounting for over 77.0 % of global revenue. Payment gateways, payment processing, and security and fraud management are all part of the solutions segment. The Payment gateways combine payments from both online and in-store payment portals. This Payment gateway service providers are seeing an increase in the volume of online payments in particular. In 2022, PayPal reported 277 million active PayPal accounts around the globe. According to the Europe Payments Council, in 2022, 36% of retailers in the United States accepted PayPal as a payment method. Technology advancements, combined with the increasing expansion of e-commerce, are boosting the demand for payment security and fraud control solutions. By 2024, the e-commerce market is estimated to be worth USD 6.54 trillion, necessitating the development of innovative, efficient, and secure payment security and fraud management solutions to handle all of the transactions. As a result, businesses all around the world are forming joint ventures to reduce the risk of fraudulent transactions. Based on Enterprise size, the market is sub-segmented into SEMs, Large Enterprises. The large enterprise segment led the market, accounting for more than 66.0 % of global sales. Businesses are putting a lot of money into real-time payment solutions to ensure that payments are processed quickly and easily. The increased preference for digital payment solutions among large retailers to provide a convenient checkout experience for their customers is fueling the segment's rise. At the same time, global corporations are investing in startups in rising markets like China and India to increase their regional footprint. Small and medium-sized businesses are expected to grow at the quickest rate during the projection period. Small and medium businesses are rapidly moving away from paper-based invoicing and toward digital invoicing. Simultaneously, payment partners are exploring a variety of methods, such as mergers and acquisitions and strategic partnerships, to assist small and medium businesses in digitizing their payment systems.

Regional Insights:

India - The digital payments ecosystem in India has grown at a compound annual growth rate (CAGR) of 55.1 % between 2017 and 2022, according to data from the Reserve Bank of India (RBI). The global payments sector is grappling with India's continued rapid growth in real-time and digital payments. So much so, in fact, that the country's extremely successful strategy is influencing the global development of real-time initiatives. China - The Chinese real-time payments sector is quite strong; in 2022, real-time payment transactions alone will exceed 16 billion. The People's Bank of China started the IBPS plan in 2010. (PBC). It provides two sorts of real-time payments: one-time and recurring payments. It also has two options for getting started (bank account and/or mobile number). Most local and foreign banks in China have internet banking capabilities, which the scheme incorporates and utilizes. Customers can now conduct real-time online transactions. UK and Europe - UK's real-time strategy is based on a Request to Pay (R2P) model. R2P is a digital request that the payer receives on their mobile device, either from a banking application or a third-party FinTech application that drives real-time payments usage through digital form factors. The payer will either approve or reject the request after that. If this is accepted, a real-time credit transfer to the payee will be initiated automatically. In the United Kingdom, real-time payments have been accessible for nearly fifteen years. And growth is expected to pick up until 2023, then slow down until after 2025. This would result in a CAGR of 11.6 % over five years. These payment systems, on the other hand, are distinct from real-time payment schemes because they offer a "digital customer experience overlay." The underlying payment rail for R2P could be in the form of a card, whereas systems for real-time payments are being developed across the EU. The European Payments Initiative (EPI) is being researched in Europe as a way to compete with existing card schemes. This is in addition to the existing real-time payment systems in use across the continent. South America - The Brazilian PIX, which combines real-time rail and digital overlay capabilities, was released in 2022. The Brazilian central government was the first to implement this new system, and the volume of transactions in Brazil increased by about 50% between May 2021 and April 2022, according to estimates. Brazil has advanced to the next level in terms of real-time payments thanks to PIX. Argentina has two real-time payment systems which were introduced in 2016, and DEBIN, which was introduced in September 2017. Because both are still in the early stages of development, transaction volumes are minimal. However, this may not be the case in the future. With a year-over-year increase of 145 % and a robust adoption forecast.Report Key Objectives

Comprehensive analysis for stakeholders in the Real time Payment industry. Key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market Real-Time Payments Market Dynamics, structure by analyzing the market segments and Global view of the market. Market strategies and Technology trends Competitor benchmarking and Evaluation of potential co-operation partnersGlobal Real-Time Payments Market Scope: Inquire before buying

Global Real-Time Payments Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 56.9 Bn. Forecast Period 2023 to 2029 CAGR: 33.0% Market Size in 2029: US $ 418.9 Bn. Segments Covered: by Type 24x7x365 Bank Operating time by Component Solution Service by Enterprise Size Small and Medium Enterprises Large Enterprises Real-Time Payments Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Real-Time Payments Market key player

1. ACI Worldwide 2. FIS, Fiserv 3. MasterCard 4. World line 5. PayPal 6. Visa, Apple 7. Ant Financial 8. INTELLIGENT PAYMENTS 9. Wire card 10. Global Payments 11. Capgemini 12. Integra Pay 13. SIA 14. Obopay 15. Ripple 16. Pelican 17. Finastra 18. Nets 19. FSS 20. Montran 21. REPAY 22. Icon Solutions.Frequently Asked Questions:

1. Which region has the largest share in Global Market? Ans: India region holds the highest share in 2022. 2. What is the growth rate of Global Market? Ans: The Global Real-Time Payments Market is growing at a CAGR of 33% during forecasting period 2023-2029. 3. What is scope of the Global Real-Time Payments market report? Ans: Global Real-Time Payments Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Real-Time Payments market? Ans: The important key players in the Global Real-Time Payments Market are – ACI Worldwide, FIS, Fiserv, MasterCard, World line, PayPal, Visa, Apple, Ant Financial, INTELLIGENT PAYMENTS, Wire card, Global Payments, Capgemini, Integra Pay, SIA, Obopay, Ripple, Pelican, Finastra, Nets, FSS, Montran, REPAY, and Icon Solutions. 5. What is the study period of this market? Ans: The Global Real-Time Payments Market is studied from 2022 to 2029.

1. Real-Time Payments Market: Research Methodology 2. Real-Time Payments Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Real-Time Payments Market: Dynamics 3.1. Real-Time Payments Market Trends by Region 3.1.1. North America Real-Time Payments Market Trends 3.1.2. Europe Real-Time Payments Market Trends 3.1.3. Asia Pacific Real-Time Payments Market Trends 3.1.4. Middle East and Africa Real-Time Payments Market Trends 3.1.5. South America Real-Time Payments Market Trends 3.2. Real-Time Payments Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Real-Time Payments Market Drivers 3.2.1.2. North America Real-Time Payments Market Restraints 3.2.1.3. North America Real-Time Payments Market Opportunities 3.2.1.4. North America Real-Time Payments Market Challenges 3.2.2. Europe 3.2.2.1. Europe Real-Time Payments Market Drivers 3.2.2.2. Europe Real-Time Payments Market Restraints 3.2.2.3. Europe Real-Time Payments Market Opportunities 3.2.2.4. Europe Real-Time Payments Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Real-Time Payments Market Drivers 3.2.3.2. Asia Pacific Real-Time Payments Market Restraints 3.2.3.3. Asia Pacific Real-Time Payments Market Opportunities 3.2.3.4. Asia Pacific Real-Time Payments Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Real-Time Payments Market Drivers 3.2.4.2. Middle East and Africa Real-Time Payments Market Restraints 3.2.4.3. Middle East and Africa Real-Time Payments Market Opportunities 3.2.4.4. Middle East and Africa Real-Time Payments Market Challenges 3.2.5. South America 3.2.5.1. South America Real-Time Payments Market Drivers 3.2.5.2. South America Real-Time Payments Market Restraints 3.2.5.3. South America Real-Time Payments Market Opportunities 3.2.5.4. South America Real-Time Payments Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Component Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Real-Time Payments Market 3.8. Analysis of Government Schemes and Initiatives For Real-Time Payments Market 3.9. The Global Pandemic Impact on Real-Time Payments Market 3.10. Business-to-Business (B2B) Payments 3.11. Cross-Border Real-Time Transfers 4. Real-Time Payments Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Real-Time Payments Market Size and Forecast, by Type (2023-2030) 4.1.1. 24x7x365 4.1.2. Bank Operating time 4.2. Real-Time Payments Market Size and Forecast, by Component (2023-2030) 4.2.1. Solution 4.2.2. Service 4.3. Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 4.3.1. Small and Medium Enterprises 4.3.2. Large Enterprises 4.4. Real-Time Payments Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Real-Time Payments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Real-Time Payments Market Size and Forecast, by Type (2023-2030) 5.1.1. 24x7x365 5.1.2. Bank Operating time 5.2. North America Real-Time Payments Market Size and Forecast, by Component (2023-2030) 5.2.1. Solution 5.2.2. Service 5.3. North America Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 5.3.1. Small and Medium Enterprises 5.3.2. Large Enterprises 5.4. North America Real-Time Payments Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Real-Time Payments Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1. 24x7x365 5.4.1.1.2. Bank Operating time 5.4.1.2. United States Real-Time Payments Market Size and Forecast, by Component (2023-2030) 5.4.1.2.1. Solution 5.4.1.2.2. Service 5.4.1.3. United States Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.1.3.1. Small and Medium Enterprises 5.4.1.3.2. Large Enterprises 5.4.2. Canada 5.4.2.1. Canada Real-Time Payments Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1. 24x7x365 5.4.2.1.2. Bank Operating time 5.4.2.2. Canada Real-Time Payments Market Size and Forecast, by Component (2023-2030) 5.4.2.2.1. Solution 5.4.2.2.2. Service 5.4.2.3. Canada Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.2.3.1. Small and Medium Enterprises 5.4.2.3.2. Large Enterprises 5.4.3. Mexico 5.4.3.1. Mexico Real-Time Payments Market Size and Forecast, by Type (2023-2030) 5.4.3.1.1. 24x7x365 5.4.3.1.2. Bank Operating time 5.4.3.2. Mexico Real-Time Payments Market Size and Forecast, by Component (2023-2030) 5.4.3.2.1. Solution 5.4.3.2.2. Service 5.4.3.3. Mexico Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 5.4.3.3.1. Small and Medium Enterprises 5.4.3.3.2. Large Enterprises 6. Europe Real-Time Payments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Real-Time Payments Market Size and Forecast, by Type (2023-2030) 6.2. Europe Real-Time Payments Market Size and Forecast, by Component (2023-2030) 6.3. Europe Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 6.4. Europe Real-Time Payments Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Real-Time Payments Market Size and Forecast, by Type (2023-2030) 6.4.1.2. United Kingdom Real-Time Payments Market Size and Forecast, by Component (2023-2030) 6.4.1.3. United Kingdom Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.2. France 6.4.2.1. France Real-Time Payments Market Size and Forecast, by Type (2023-2030) 6.4.2.2. France Real-Time Payments Market Size and Forecast, by Component (2023-2030) 6.4.2.3. France Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Real-Time Payments Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Germany Real-Time Payments Market Size and Forecast, by Component (2023-2030) 6.4.3.3. Germany Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Real-Time Payments Market Size and Forecast, by Type (2023-2030) 6.4.4.2. Italy Real-Time Payments Market Size and Forecast, by Component (2023-2030) 6.4.4.3. Italy Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Real-Time Payments Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Spain Real-Time Payments Market Size and Forecast, by Component (2023-2030) 6.4.5.3. Spain Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Real-Time Payments Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Sweden Real-Time Payments Market Size and Forecast, by Component (2023-2030) 6.4.6.3. Sweden Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Real-Time Payments Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Austria Real-Time Payments Market Size and Forecast, by Component (2023-2030) 6.4.7.3. Austria Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Real-Time Payments Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Rest of Europe Real-Time Payments Market Size and Forecast, by Component (2023-2030) 6.4.8.3. Rest of Europe Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7. Asia Pacific Real-Time Payments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.3. Asia Pacific Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4. Asia Pacific Real-Time Payments Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.1.2. China Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.1.3. China Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.2.2. S Korea Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.2.3. S Korea Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Japan Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.3.3. Japan Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.4. India 7.4.4.1. India Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.4.2. India Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.4.3. India Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.5.2. Australia Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.5.3. Australia Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.6.2. Indonesia Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.6.3. Indonesia Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.7.2. Malaysia Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.7.3. Malaysia Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.8.2. Vietnam Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.8.3. Vietnam Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.9.2. Taiwan Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.9.3. Taiwan Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Real-Time Payments Market Size and Forecast, by Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Real-Time Payments Market Size and Forecast, by Component (2023-2030) 7.4.10.3. Rest of Asia Pacific Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 8. Middle East and Africa Real-Time Payments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Real-Time Payments Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Real-Time Payments Market Size and Forecast, by Component (2023-2030) 8.3. Middle East and Africa Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 8.4. Middle East and Africa Real-Time Payments Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Real-Time Payments Market Size and Forecast, by Type (2023-2030) 8.4.1.2. South Africa Real-Time Payments Market Size and Forecast, by Component (2023-2030) 8.4.1.3. South Africa Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Real-Time Payments Market Size and Forecast, by Type (2023-2030) 8.4.2.2. GCC Real-Time Payments Market Size and Forecast, by Component (2023-2030) 8.4.2.3. GCC Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Real-Time Payments Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Nigeria Real-Time Payments Market Size and Forecast, by Component (2023-2030) 8.4.3.3. Nigeria Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Real-Time Payments Market Size and Forecast, by Type (2023-2030) 8.4.4.2. Rest of ME&A Real-Time Payments Market Size and Forecast, by Component (2023-2030) 8.4.4.3. Rest of ME&A Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 9. South America Real-Time Payments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Real-Time Payments Market Size and Forecast, by Type (2023-2030) 9.2. South America Real-Time Payments Market Size and Forecast, by Component (2023-2030) 9.3. South America Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 9.4. South America Real-Time Payments Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Real-Time Payments Market Size and Forecast, by Type (2023-2030) 9.4.1.2. Brazil Real-Time Payments Market Size and Forecast, by Component (2023-2030) 9.4.1.3. Brazil Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Real-Time Payments Market Size and Forecast, by Type (2023-2030) 9.4.2.2. Argentina Real-Time Payments Market Size and Forecast, by Component (2023-2030) 9.4.2.3. Argentina Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Real-Time Payments Market Size and Forecast, by Type (2023-2030) 9.4.3.2. Rest Of South America Real-Time Payments Market Size and Forecast, by Component (2023-2030) 9.4.3.3. Rest Of South America Real-Time Payments Market Size and Forecast, by Enterprise Size (2023-2030) 10. Global Real-Time Payments Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Real-Time Payments Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. ACI Worldwide 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. FIS, Fiserv 11.3. MasterCard 11.4. World line 11.5. PayPal 11.6. Visa, Apple 11.7. Ant Financial 11.8. INTELLIGENT PAYMENTS 11.9. Wire card 11.10. Global Payments 11.11. Capgemini 11.12. Integra Pay 11.13. SIA 11.14. Obopay 11.15. Ripple 11.16. Pelican 11.17. Finastra 11.18. Nets 11.19. FSS 11.20. Montran 11.21. REPAY 11.22. Icon Solutions 12. Key Findings 13. Industry Recommendations