Quenched & Tempered Steel Market size was valued at US$ 25.62 Bn. in 2022 and the total revenue is expected to grow at a CAGR of 6.5% from 2023 to 2029, reaching nearly US$ 39.82 Bn.Quenched & Tempered Steel Market Overview:

Steel and other iron-based alloys are strengthened by the processes of quenching and tempering. Through heating the material and simultaneous cooling in water, oil, forced air, or gases like nitrogen, these methods strengthen the alloys. The main difference between quenching and tempering is the quick cooling of the workpiece during quenching as opposed to the heat-treating of the workpiece during tempering.To know about the Research Methodology :- Request Free Sample Report Report scope: The report's objective is to give industry participants a thorough overview of the quenched and tempered steel market. The report examines the market's past and present conditions as well as expected market size and trends. It also provides a straightforward analysis of complicated data. The important actors, including new entrants, market leaders, and followers, perform active and thorough research. The analysis shows the results of the PORTER and PESTEL analyses as well as the possible outcomes of the market's microeconomic components. Decision-makers will have a clear futuristic vision of the market owing to analysis of internal and external factors that could have a positive or negative impact on the organisation. By analysing market segmentation and forecasting market size, the report also helps readers understand the structure and dynamics of the market. The report serves as a resource for investors with its clear demonstration of the competitive analysis of the major companies in the quenched & tempered steel market by price, financial condition, product, product portfolio, expansion plans, and geographical presence. To assess and forecast the market for quenched and tempered steel, MMR started by gathering data on the major providers' sales. The market is divided into segments according to Steel Type (Carbon, Alloy, Stainless, and Tool), Grade (Grade 80, Grade 400, Grade 500, and Others), and Application (Buildings, Automotive, Industrial, Machine Tools, and Other Applications), taking into consideration the products offered by vendors. In-depth interviews with significant individuals, including chief executive officers (CEOs), vice presidents (VPs), directors, and executives, were later conducted in order to confirm these divisions through primary research. The size of the market is estimated using bottom-up approaches. The quenched and tempered steel market's major players are identified, and primary and secondary research is done to calculate their market revenues. As an alternative to secondary research, which entailed reading the annual and financial reports of the leading manufacturers, primary research involved speaking with important thought leaders and business leaders in the industry, such as CEOs and marketing executives. For the duration of the forecast period, Hebei Iron and Steel Group, ArcelorMittal, Baosteel Group, and Wuhan Iron & Steel Group are just a few of the top significant competitors in the global market. These companies are constantly planning mergers and acquisitions to boost their market shares and growth potential.

Quenched & Tempered Steel Market Dynamics:

Quenched and tempered steel's unique qualities is a key driver that is expected to drive the growth of the market during the forecast period. Numerous growth opportunities will result from the rising use of quenched and tempered steel in a variety of applications, including automotive, mining, storage tanks, industrial equipment, and others. The market for quenched and tempered steel is expected to grow as a result of increased ductility and malleability. Additionally, the quenched & tempered steel market is expected to experience exponential growth due to the rising construction industry's extensive use of this steel type in infrastructure construction. The market for quenched and tempered steel is expected to increase as a result of all these factors. The quenched and tempered steel market is expected to grow at a steady rate in part due to research and development initiatives. The participants engage in research and development efforts aimed at creating new technologies. Additionally, the players make significant investments in these operations to increase their profits, which eventually helps the market for quenched and tempered steel grow. Strategic partnerships are essential for market participants selling quenched and tempered steel. These actions are taken part in by the players to boost their visibility across various segments. The cost of the final product, which is high due to the quenching and tempering process, is expected to hamper the growth of the global market. Additionally, corrosions on quenched and tempered steels are preferred, which hinders growth. During the forecast period, new opportunities for the global quenched and tempered steel market are expected as a result of the better properties of quenched and tempered steel, such as toughness, ductility, high strength, and abrasion resistance.Quenched & Tempered Steel Market Segment Analysis:

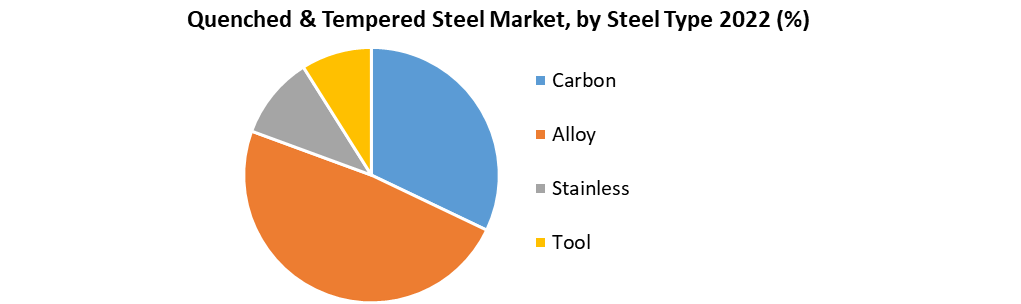

The market is segmented by Grade, Steel Type, and Application. Based on the Grade, the market is segmented into Grade 80, Grade 400, Grade 500, and Others. Grade 80 segment is expected to hold the largest market share of xx% by 2029. High hardness, abrasion resistance, and the right amount of carbon are all characteristics of grade 80 steel, which is best for welding. If low hydrogen consumables are used, care is taken to account for preheat, interpass temperature, heat input, and the level of joint constraint. Grade 80 steel can also be welded to other classes of steel. Grade 400 segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. High hardness, abrasion-resistant steel is grade 400. If considerations for the steel's high strength are taken into account, grade 400 plate can be cold formed effectively. Grade 500 segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Steel of grade 500 has a medium carbon content, a high hardness, and resistance to abrasion. In sliding abrasion applications like earthmoving buckets, cutting edges, wear liners for dump trucks, and ground-engaging tools, grade 500 steel has a long shelf life. Based on the Steel Type, the market is segmented into Carbon, Alloy, Stainless and Tool. Carbon Steel type segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Extremely strong high-carbon steel has a carbon percentage of 0.6-0.99 percent, whereas ultra-high-carbon steel has a carbon content of 1.0-2.0 percent and can be tempered to a high hardness. Tempering changes the size and distribution of carbides in martensite in carbon steels, creating a microstructure known as "tempered martensite." Additionally, normalised steels and cast irons are tempered to improve ductility, machinability, and impact strength. Steel is heated above its recrystallization temperature and quickly cooled during the quenching process, which is also known as quench hardening. Compared to a leisurely cooling, a quick quenching modifies the steel's crystal structure. Alloy Steel type segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Steel alloys have the necessary high strength to maintain such massive buildings. Alloy steels are used as reinforcement in concrete structures to increase strength and decrease overall structural weight. In the building and construction business, smaller products manufactured of alloy steels are employed, such as screws, nails, and bolts. The designations for tempers are alphanumeric. They are placed to the four-digit alloy designations, following them. 6061-T6 is an example. Temper designations indicate to the manufacturer and the consumer how the alloy has been mechanically and/or thermally processed to produce the desired qualities. Stainless Steel type segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Due to its strength, longevity, and resistance to corrosion, stainless steel is a very useful material in the foodservice sector. Stainless steel is a material with a high degree of durability and impact resistance. Stainless steel has a low susceptibility to brittleness at both high and low temperatures, which contributes to this. This guarantees that the material will hold its shape and also makes it easier to weld, cut, manufacture, etc. when the material is at its melting point.

Regional Insights:

North American region is expected to dominate the market during the forecast period 2023-2029. The North American region is expected to hold the largest market share of xx% by 2029. The key growth factor for North America quenched and tempered steel market is the development of infrastructure and the construction industry. The growth of the market in North America is also attributed to the growing industrial sector and the pace of demand growth in the automobile sector. Asia Pacific region is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. Due to its high yield strength, quenched and tempered steel is a great option for light weight applications requiring high carrying capacities. Because it is lightweight while maintaining the necessary strength, quenched and tempered steel is utilised in construction sites for dumping truck bodies, storage bins, and hoppers in the region.Quenched & Tempered Steel Market Scope: Inquire before Buying

Global Quenched & Tempered Steel Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 25.62 Bn. Forecast Period 2023 to 2029 CAGR: 6.5% Market Size in 2029: US $ 39.82 Bn. Segments Covered: by Grade Grade 80 Grade 400 Grade 500 Others by Steel Type Carbon Alloy Stainless Tool by Application Buildings Automotive Industrial Machine Tools Other Applications By Region:

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Quenched & Tempered Steel Market Key Players:

1. Hebei Iron and Steel Group 2. ArcelorMittal 3. Baosteel Group 4. Wuhan Iron & Steel Group 5. JFE 6. Anshan Iron & Steel Group 7. Nippon Steel 8. Jiangsu Shagang Group 9. Posco 10. Dillinger 11. Brown McFarlane 12. Leeco Steel 13. Bisalloy Steel 14. Ruukki 15. Nucor Corporation 16. SSAB Frequently Asked Questions: 1] Which region is expected to hold the highest share in the Quenched & Tempered Steel Market? Ans. The North American region is expected to hold the highest share in the Quenched & Tempered Steel Market. 2] Who are the top key players in the Quenched & Tempered Steel Market? Ans. Hebei Iron and Steel Group, ArcelorMittal, Baosteel Group, and Wuhan Iron & Steel Group are the top key players in the Quenched & Tempered Steel Market. 3] Which segment is expected to hold the largest market share in the Quenched & Tempered Steel Market by 2029? Ans. Grade 80 segment is expected to hold the largest market share in the Quenched & Tempered Steel Market by 2029. 4] What is the market size of the Quenched & Tempered Steel Market by 2029? Ans. The market size of the Quenched & Tempered Steel Market is expected to reach US $ 39.82 Bn. by 2029. 5] What was the market size of the Quenched & Tempered Steel Market in 2022? Ans. The market size of the Quenched & Tempered Steel Market was worth US $ 25.62 Bn. in 2022.

1. Quenched & Tempered Steel Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Quenched & Tempered Steel Market: Dynamics 2.1. Quenched & Tempered Steel Market Trends by Region 2.1.1. North America Quenched & Tempered Steel Market Trends 2.1.2. Europe Quenched & Tempered Steel Market Trends 2.1.3. Asia Pacific Quenched & Tempered Steel Market Trends 2.1.4. Middle East and Africa Quenched & Tempered Steel Market Trends 2.1.5. South America Quenched & Tempered Steel Market Trends 2.2. Quenched & Tempered Steel Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Quenched & Tempered Steel Market Drivers 2.2.1.2. North America Quenched & Tempered Steel Market Restraints 2.2.1.3. North America Quenched & Tempered Steel Market Opportunities 2.2.1.4. North America Quenched & Tempered Steel Market Challenges 2.2.2. Europe 2.2.2.1. Europe Quenched & Tempered Steel Market Drivers 2.2.2.2. Europe Quenched & Tempered Steel Market Restraints 2.2.2.3. Europe Quenched & Tempered Steel Market Opportunities 2.2.2.4. Europe Quenched & Tempered Steel Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Quenched & Tempered Steel Market Drivers 2.2.3.2. Asia Pacific Quenched & Tempered Steel Market Restraints 2.2.3.3. Asia Pacific Quenched & Tempered Steel Market Opportunities 2.2.3.4. Asia Pacific Quenched & Tempered Steel Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Quenched & Tempered Steel Market Drivers 2.2.4.2. Middle East and Africa Quenched & Tempered Steel Market Restraints 2.2.4.3. Middle East and Africa Quenched & Tempered Steel Market Opportunities 2.2.4.4. Middle East and Africa Quenched & Tempered Steel Market Challenges 2.2.5. South America 2.2.5.1. South America Quenched & Tempered Steel Market Drivers 2.2.5.2. South America Quenched & Tempered Steel Market Restraints 2.2.5.3. South America Quenched & Tempered Steel Market Opportunities 2.2.5.4. South America Quenched & Tempered Steel Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Quenched & Tempered Steel Industry 2.8. Analysis of Government Schemes and Initiatives For Quenched & Tempered Steel Industry 2.9. Quenched & Tempered Steel Market Trade Analysis 2.10. The Global Pandemic Impact on Quenched & Tempered Steel Market 3. Quenched & Tempered Steel Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 3.1.1. Grade 80 3.1.2. Grade 400 3.1.3. Grade 500 3.1.4. Others 3.2. Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 3.2.1. Carbon 3.2.2. Alloy 3.2.3. Stainless 3.2.4. Tool 3.3. Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 3.3.1. Buildings 3.3.2. Automotive 3.3.3. Industrial 3.3.4. Machine Tools 3.3.5. Other Applications 3.4. Quenched & Tempered Steel Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Quenched & Tempered Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 4.1.1. Grade 80 4.1.2. Grade 400 4.1.3. Grade 500 4.1.4. Others 4.2. North America Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 4.2.1. Carbon 4.2.2. Alloy 4.2.3. Stainless 4.2.4. Tool 4.3. North America Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 4.3.1. Buildings 4.3.2. Automotive 4.3.3. Industrial 4.3.4. Machine Tools 4.3.5. Other Applications 4.4. North America Quenched & Tempered Steel Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 4.4.1.1.1. Grade 80 4.4.1.1.2. Grade 400 4.4.1.1.3. Grade 500 4.4.1.1.4. Others 4.4.1.2. United States Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 4.4.1.2.1. Carbon 4.4.1.2.2. Alloy 4.4.1.2.3. Stainless 4.4.1.2.4. Tool 4.4.1.3. United States Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Buildings 4.4.1.3.2. Automotive 4.4.1.3.3. Industrial 4.4.1.3.4. Machine Tools 4.4.1.3.5. Other Applications 4.4.2. Canada 4.4.2.1. Canada Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 4.4.2.1.1. Grade 80 4.4.2.1.2. Grade 400 4.4.2.1.3. Grade 500 4.4.2.1.4. Others 4.4.2.2. Canada Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 4.4.2.2.1. Carbon 4.4.2.2.2. Alloy 4.4.2.2.3. Stainless 4.4.2.2.4. Tool 4.4.2.3. Canada Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Buildings 4.4.2.3.2. Automotive 4.4.2.3.3. Industrial 4.4.2.3.4. Machine Tools 4.4.2.3.5. Other Applications 4.4.3. Mexico 4.4.3.1. Mexico Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 4.4.3.1.1. Grade 80 4.4.3.1.2. Grade 400 4.4.3.1.3. Grade 500 4.4.3.1.4. Others 4.4.3.2. Mexico Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 4.4.3.2.1. Carbon 4.4.3.2.2. Alloy 4.4.3.2.3. Stainless 4.4.3.2.4. Tool 4.4.3.3. Mexico Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Buildings 4.4.3.3.2. Automotive 4.4.3.3.3. Industrial 4.4.3.3.4. Machine Tools 4.4.3.3.5. Other Applications 5. Europe Quenched & Tempered Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 5.2. Europe Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 5.3. Europe Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 5.4. Europe Quenched & Tempered Steel Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 5.4.1.2. United Kingdom Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 5.4.1.3. United Kingdom Quenched & Tempered Steel Market Size and Forecast, by Application(2022-2029) 5.4.2. France 5.4.2.1. France Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 5.4.2.2. France Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 5.4.2.3. France Quenched & Tempered Steel Market Size and Forecast, by Application(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 5.4.3.2. Germany Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 5.4.3.3. Germany Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 5.4.4.2. Italy Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 5.4.4.3. Italy Quenched & Tempered Steel Market Size and Forecast, by Application(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 5.4.5.2. Spain Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 5.4.5.3. Spain Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 5.4.6.2. Sweden Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 5.4.6.3. Sweden Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 5.4.7.2. Austria Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 5.4.7.3. Austria Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 5.4.8.2. Rest of Europe Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 5.4.8.3. Rest of Europe Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Quenched & Tempered Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.2. Asia Pacific Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.3. Asia Pacific Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Quenched & Tempered Steel Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.1.2. China Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.1.3. China Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.2.2. S Korea Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.2.3. S Korea Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.3.2. Japan Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.3.3. Japan Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.4.2. India Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.4.3. India Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.5.2. Australia Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.5.3. Australia Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.6.2. Indonesia Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.6.3. Indonesia Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.7.2. Malaysia Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.7.3. Malaysia Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.8.2. Vietnam Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.8.3. Vietnam Quenched & Tempered Steel Market Size and Forecast, by Application(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.9.2. Taiwan Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.9.3. Taiwan Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 6.4.10.2. Rest of Asia Pacific Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Quenched & Tempered Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 7.2. Middle East and Africa Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 7.3. Middle East and Africa Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Quenched & Tempered Steel Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 7.4.1.2. South Africa Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 7.4.1.3. South Africa Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 7.4.2.2. GCC Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 7.4.2.3. GCC Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 7.4.3.2. Nigeria Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 7.4.3.3. Nigeria Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 7.4.4.2. Rest of ME&A Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 7.4.4.3. Rest of ME&A Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 8. South America Quenched & Tempered Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 8.2. South America Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 8.3. South America Quenched & Tempered Steel Market Size and Forecast, by Application(2022-2029) 8.4. South America Quenched & Tempered Steel Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 8.4.1.2. Brazil Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 8.4.1.3. Brazil Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 8.4.2.2. Argentina Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 8.4.2.3. Argentina Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Quenched & Tempered Steel Market Size and Forecast, by Grade (2022-2029) 8.4.3.2. Rest Of South America Quenched & Tempered Steel Market Size and Forecast, by Steel Type (2022-2029) 8.4.3.3. Rest Of South America Quenched & Tempered Steel Market Size and Forecast, by Application (2022-2029) 9. Global Quenched & Tempered Steel Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Quenched & Tempered Steel Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Hebei Iron and Steel Group 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. ArcelorMittal 10.3. Baosteel Group 10.4. Wuhan Iron & Steel Group 10.5. JFE 10.6. Anshan Iron & Steel Group 10.7. Nippon Steel 10.8. Jiangsu Shagang Group 10.9. Posco 10.10. Dillinger 10.11. Brown McFarlane 10.12. Leeco Steel 10.13. Bisalloy Steel 10.14. Ruukki 10.15. Nucor Corporation 10.16. SSAB 11. Key Findings 12. Industry Recommendations 13. Quenched & Tempered Steel Market: Research Methodology 14. Terms and Glossary