PV Module Market was valued at US$ 63.50 Bn. in 2022 and is expected to reach US$ 84.12 Bn. by 2029, at a CAGR of 4.1 % during a forecast period.PV Module Market Overview:

A solar PV module is a stacked semiconductor module made of silicon that can generate electricity from the sunshine. Photovoltaic (PV) modules convert light into electricity by utilizing semiconducting materials that exhibit the photovoltaic effect. Solar modules, which are made up of several solar cells, are used in photovoltaic systems. Solar panels are an important part of the global transition to sustainable energy, which is necessary to mitigate global warming by reducing CO2 emissions. The movement of electrons inside the module produces this photovoltaic effect, which may be amplified by increasing the number of hours exposed to sunlight. Due to solar power's potential to achieve grid parity with conventional energy resources and technological improvement, solar PV modules have dominated the renewable energy market in recent years. Photovoltaic cells utilize sunlight as a source of energy to generate direct current electricity.To know about the Research Methodology:-Request Free Sample Report

COVID 19 Impact on PV Module Market

The COVID-19 pandemic is expected to hurt the solar PV module market. Production and logistic activities have been hampered by the lockdown, which has hampered the supply of solar PV panels. Labor availability in the global solar PV module sector has also been impacted by social distance and travel constraints. China is the world's leading manufacturer of solar PV panels, and the Chinese government's shutdown and transportation restrictions harmed the product's manufacturing and supply chain globally.PV Module Market Dynamics:

Governments in many locations are continually working to develop policies that will make grid connection easier for photovoltaic installations. PV cell adoption is being vigorously promoted in countries including China, Canada, the United States, and France. For example, in July 2019, the Canadian government announced the Climate Action Incentive Fund (CAIF), a C$150 million (USD 111 million) incentive programmer to combat climate change. Product demand will rise as a result of recent technological developments and R&D operations for efficient power output in large-scale solar applications. Furthermore, the advancement of the business will be aided by favorable government renewable legislation for residential families. Additionally, an increasing number of manufacturers in developing countries generate an opportunity for the PV Module Market. In 2022, LONGi has signed a deal with Sinergia, a Swedish distributor, to deliver 9.2 MW of its Hi-MO4 modules. Around 25,000 PV modules of varying power—23,400 370 W and 1,320 440 W—are included in the deal, in 2020, Canadian Solar announced the initiation of the building of 2 solar PV power projects in Japan. The capacity of these two projects, which are located in Ibaraki Prefecture and Fukuoka Prefecture, respectively, is 13.6 MWp and 13.0 MWp. By the middle of 2022, these projects should be operational. Photovoltaic module installation necessitates a wide range of professions, from Ph.D.-level research in R&D to technicians with special training and certification, as well as a wide range of additional professionals to support all parts of the photovoltaic market. There are not enough trained installers in the industry to manage the installation of this technology. One of the most significant issues in the PV module market has been finding properly skilled labor. High installation costs, the necessity for power conversion and energy storage devices, and low PV module efficiency are all expected to hinder the market growth.PV Module Market segment analysis:

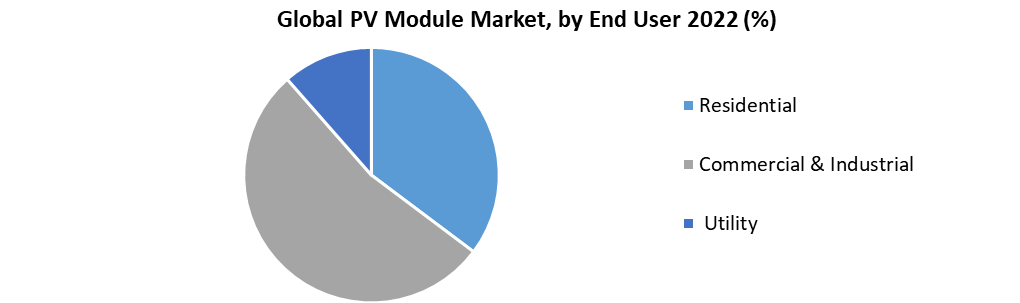

Based on technology, the Thin Film segment held the largest market share of 42.07 % in 2022, owing to its advantages like it has strong durability and high manufacturing flexibility with lightweight materials. Additionally, the factors that are affected the thin-film market include rising demand for efficiency & miniaturization, innovation in technology, government policies and regulations, mandates, and subsidies respectively. Based on connectivity, the off-grid segment held the largest market share of xx% in 2022. Growing energy demand in remote regions across the globe and the development and strict implementation of various regulatory policies aimed at decentralizing the power generation sector is expected to positively impact the growth of the off-grid market in the coming years. Additionally, the off-grid segment has various advantages like it helps reduce electric costs, easy installation, and is easily available in rural areas. Based on end-user, the Commercial & Industrial segment held the largest market share of 40.61% in 2022, owing to the increasing number of utility projects in developing countries fueling the PV module market growth across the globe. Increasing innovation and technological advancement in the industrial segment helps grow the market growth. Furthermore, the advancement of the business will be aided by favorable government renewable legislation for the industrial segment driving the high demand for PV module market growth.

PV Module Market Regional Insight:

APAC region held the largest market share of 54.2 % in 2022. The increasing construction of solar PV modules in China and India is causing an increase in demand for solar PV panels throughout the Asia Pacific. Both globally and in the Asia Pacific, these countries are major markets for solar panels. Additionally, the deployment of sustainable power technologies such as solar PV will be helped by government actions to properly meet the growing electricity demand. Increased demand for more power generation capacity, as well as continued foreign participation, favorable FDI circumstances, and the publication of capacity quota targets will have a beneficial impact on technological acceptability. In 2022, North America held a considerable market share. Power output from industrial solar PV modules has increased in North America over the years as more efficient solar cells have been available. Furthermore, increased market competition has helped lower the cost of electricity produced while also increasing the type of solar panels available. During the projection period, these factors are projected to boost demand for solar PV modules in the region. The objective of the report is to present a comprehensive analysis of the PV Module market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the PV Module market dynamics, and structure by analyzing the market segments and projects the PV Module market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the PV Module market make the report investor’s guide.PV Module Market Scope: Inquire before buying

PV Module Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 63.50 Bn. Forecast Period 2023 to 2029 CAGR: 4.1% Market Size in 2029: US $ 84.12 Bn. Segments Covered: by Technology • Thin Film • Crystalline Silicon by Product • Monocrystalline • Polycrystalline • Cadmium Telluride • Amorphous Silicon • Copper Indium Gallium Di-Selenide by Connectivity • On-Grid • Off-Grid by Mounting • Ground-mounted • Rooftop by End User • Residential • Commercial & Industrial • Utility PV Module Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)PV Module Market, Key Players are:

• Canadian Solar • First Solar • JA Solar Co • Jinko Solar • Renesola • Sharp Corporation • Tata Power Solar Systems Ltd. • Trina Solar • Wuxi Suntech Power Co.Ltd. • Abengoa • Acciona • Kaneka Corporation • Kyocera Corporation • Mitsubishi Electric Corporation • Panasonic Corporation. • Chroma-Q • Apollo Lighting • Philips Lighting Holding B.V. • General Electric • Times Square Lighting • Blizzard Lighting • Altman Lighting • Chauvet Professional Frequently Asked Questions: 1. Which region has the largest share in Global PV Module Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global PV Module Market? Ans: The Global PV Module Market is growing at a CAGR of 4.1% during forecasting period 2023-2029. 3. What is scope of the Global PV Module Market report? Ans: Global PV Module Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global PV Module Market? Ans: The important key players in the Global PV Module Market are – Canadian Solar, First Solar, JA Solar Co, Jinko Solar, Renesola, Sharp Corporation, Tata Power Solar Systems Ltd., Trina Solar, Wuxi Suntech Power Co.Ltd., Abengoa, Acciona, Kaneka Corporation, Kyocera Corporation, Mitsubishi Electric Corporation, Panasonic Corporation., Chroma-Q, Apollo Lighting, Philips Lighting Holding B.V., General Electric, Times Square Lighting, Blizzard Lighting, Altman Lighting, and Chauvet Professional 5. What is the study period of this Market? Ans: The Global PV Module Market is studied from 2022 to 2029.

1. Global PV Module Market: Research Methodology 2. Global PV Module Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global PV Module Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global PV Module Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global PV Module Market Segmentation 4.1. Global PV Module Market, by Product (2023-2029) • Monocrystalline • Polycrystalline • Cadmium Telluride • Amorphous Silicon • Copper Indium Gallium Di-Selenide 4.2. Global PV Module Market, by Technology (2023-2029) • Thin Film • Crystalline Silicon 4.3. Global PV Module Market, by Connectivity (2023-2029) • On-Grid • Off-Grid 4.4. Global PV Module Market, by Mounting (2023-2029) • Ground-mounted • Rooftop 4.5. Global PV Module Market, by End User (2023-2029) • Residential • Commercial & Industrial • Utility 5. North America PV Module Market(2023-2029) 5.1. North America PV Module Market, by Product (2023-2029) • Monocrystalline • Polycrystalline • Cadmium Telluride • Amorphous Silicon • Copper Indium Gallium Di-Selenide 5.2. North America PV Module Market, by Technology (2023-2029) • Thin Film • Crystalline Silicon 5.3. North America PV Module Market, by Connectivity (2023-2029) • On-Grid • Off-Grid 5.4. North America PV Module Market, by Mounting (2023-2029) • Ground-mounted • Rooftop 5.5. North America PV Module Market, by End User (2023-2029) • Residential • Commercial & Industrial • Utility 5.6. North America PV Module Market, by Country (2023-2029) • United States • Canada • Mexico 6. European PV Module Market (2023-2029) 6.1. European PV Module Market, by Product Type (2023-2029) 6.2. European PV Module Market, by Technology (2023-2029) 6.3. European PV Module Market, by Connectivity (2023-2029) 6.4. European PV Module Market, by Mounting (2023-2029) 6.5. European PV Module Market, by End-User (2023-2029) 6.6. European PV Module Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific PV Module Market (2023-2029) 7.1. Asia Pacific PV Module Market, by Product Type (2023-2029) 7.2. Asia Pacific PV Module Market, by Technology (2023-2029) 7.3. Asia Pacific PV Module Market, by Connectivity (2023-2029) 7.4. Asia Pacific PV Module Market, by Mounting (2023-2029) 7.5. Asia Pacific PV Module Market, by End-User (2023-2029) 7.6. Asia Pacific PV Module Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa PV Module Market (2023-2029) 8.1. The Middle East and Africa PV Module Market, by Product Type (2023-2029) 8.2. The Middle East and Africa PV Module Market, by Technology (2023-2029) 8.3. The Middle East and Africa PV Module Market, by Connectivity (2023-2029) 8.4. The Middle East and Africa PV Module Market, by Mounting (2023-2029) 8.5. The Middle East and Africa PV Module Market, by End-User (2023-2029) 8.6. The Middle East and Africa PV Module Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America PV Module Market (2023-2029) 9.1. South America PV Module Market, by Product Type (2023-2029) 9.2. South America PV Module Market, by Technology (2023-2029) 9.3. South America PV Module Market, by Connectivity (2023-2029) 9.4. South America PV Module Market, by Mounting (2023-2029) 9.5. South America PV Module Market, by End-User (2023-2029) 9.6. South America PV Module Market, by Country (2023-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Canadian Solar 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. First Solar 10.3. JA Solar Co 10.4. Jinko Solar 10.5. Renesola 10.6. Sharp Corporation 10.7. Tata Power Solar Systems Ltd. 10.8. Trina Solar 10.9. Wuxi Suntech Power Co.Ltd. 10.10. Abengoa 10.11. Acciona 10.12. Kaneka Corporation 10.13. Kyocera Corporation 10.14. Mitsubishi Electric Corporation 10.15. Panasonic Corporation. 10.16. Chroma-Q 10.17. Apollo Lighting 10.18. Philips Lighting Holding B.V. 10.19. General Electric 10.20. Times Square Lighting 10.21. Blizzard Lighting 10.22. Altman Lighting 10.23. Chauvet Professional