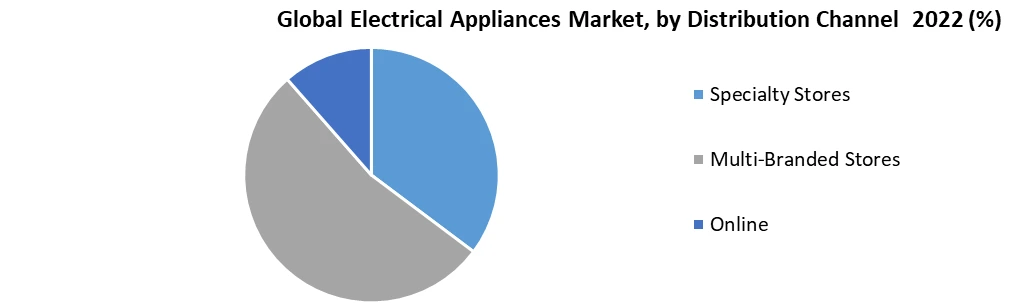

Electrical Appliances Market was valued at US$ 523.13 Bn. in 2022. The Electrical Appliances Market size is estimated to grow at a CAGR of 8.91 % over the forecast period. Electrical appliances are devices, which use electricity to perform a function. A wide range of electrical appliances like refrigerators, wine coolers, washing machines, tumble dryers, vacuum cleaners, steam mops, shavers, trimmers, and water heaters to air conditioners, air coolers, heaters, fans, rice cookers, bread makers, toasters, irons, and juicers are most popular electrical appliances, which has a large consumer population base across the globe. Many companies are focusing to offer innovative products with a range of options to increase the consumer base. An integration of green technology is expected to drive the demand for advanced electrical appliances. The demand growth for electrical appliances is primarily driven by government incentives and regulatory frameworks to adopt green technologies Key players operating in the market are focusing to introduce product innovation, new product development, product differentiation, and the incorporation of several value-added features, which is expected to drive the demand for home electrical appliances during the forecast period. The features of electrical appliances like effectiveness, diversity, sustainability, elegant design, and electric functionality are some of the prominent driving factors behind the market growth. Technological advancements and the development of smart electrical appliances are expected to drive the market growth during the forecast period. Electrical appliances offer innovative features and are more energy-efficient.To know about the Research Methodology :- Request Free Sample Report In recent years, the scale of the electrical supply industry has continued to expand, and its strength has been significantly enhanced across the developing and developed economies. The future growth demand for clean and high-efficiency power generation equipment and UHV, AC, and DC power transmission and transformation equipment has also significantly increased. It indicates that in the future, the electric power industry will grow to meet the demands for electrical equipment and future demand scope for electrical appliances. The rapid development of developing economies has brought about great changes in the demand for electrical supply products and appliances. Many of electrical equipment manufacturers have invested in and built factories in developing countries like China and India. With the further development of the world's developing economies, increased demand is expected to provide broad development opportunities for key players operating in the market. The global electrical appliances market is segmented by product and distribution channel. Based on product, the market is segmented into the refrigerator, entertainment appliances, cooking appliances, and washing appliances. Based on distribution channels, the market is segmented into Online Stores, Multi-Branded Stores, and Specialty Stores. Based on region, the market is segmented into North America, Asia Pacific, Europe, Middle East & Africa, and South America. The research covers the detail analysis of the market trends, new technology, foreign entrance, new rules, government investment, and new uses. It also contains a comprehensive trend analysis, which helps to make business decisions in the electrical appliances market. The report covers the detail analysis with overview of the market, current and future growth prospects, as well as other growth methods employed by key companies to keep ahead of the competition. Electrical Appliances offer enormous development prospects since they are simple to use and serve to improve one's quality of life. Furthermore, the industry is witnessing new trends in terms of sustainability and energy efficiency, streamlining a variety of home activities while promoting well-being. High-quality materials and visually beautiful designs, along with innovative and various functionality, offer market development opportunities.

COVID-19 Impact on Electrical Appliances Market

The COVID-19 pandemic has slowed the growth rate of the electric appliance industry, particularly in 2020 and 2021. The COVID-19 pandemic had an impact on the Electrical Appliances sector, both favourably and badly. The demand for Electrical Appliances like refrigerators, washing machines, and others has surged as a result of the COVID-19 pandemic since most people work from home, and spending more time at home necessitates the use of numerous equipment that can do chores faster than traditional ways. However, amid the coronavirus pandemic, individuals are primarily concerned with fundamental necessities. Furthermore, as a result of the COVID-19 pandemic, the manufacturing capacities have been impacted by suspended production, and the supply of items from producers to end consumers has decreased dramatically. The market for Electrical Appliances is severely fragmented. At the moment, numerous players are working on various systems that use a variety of technologies. It is simple to integrate and connect devices created by the same manufacturer or vendor; however, linking systems built by various manufacturers or suppliers is a time-consuming job that may result in restricted functionality and unreliable services, in addition to incompatibility difficulties.Electrical Appliances Industry Dynamics

Market dynamics are factors that impact the prices and consumer purchase behaviors of the electrical appliances market across the globe. It provides the pricing scenario, which results from the changes in the supply and demand arcs for an electrical appliance. The market dynamics give a clear representation of the macro-economic and micro-economic factors regarding the sale of electrical appliances and information about price, demand, and supply across the countries of North America, Europe, Asia Pacific, Middle East & Africa, and South America. A renewed focus on sustainability drives the market growth: Consumers are expecting a more seamless experience at the time of purchasing. Manufacturing is one of the major industries across the globe. Key players operating in the appliances market are in charge of creating and producing electrical goods and products that make consumers' lives easier. Nowadays, homemakers also prefer convenient and time-saving kitchen tools, which make kitchen labor more comfortable and efficient. Key players operating in the market refocusing on long-term environmental sustainability in their products and operations with the focus on hygiene gradually fading. For instance, Samsung has launched a service, which permits consumers to monitor and analyse the energy used by devices and appliances connected to the SmartThings platform. High consumer disposable income, enhancement in living standards, and the requirement for upgradation of the existing appliances to smarter are expected to drive the market growth in the near future. Consumers commonly purchase home appliances as they provide ease, diminish efforts, and save time. Despite the industry’s fundamentals looking sound, a range of challenges like intensifying regulations, economic uncertainty, and local issues in individual countries have developed to cloud the outlook during the forecast period.Electrical Appliances Market Segment Analysis

Refrigerators are a safe, easy, and convenient way to reserve food and food products. The growth in disposable income across developing economies, and the availability of smart and energy-efficient refrigerator units are driving the demand for refrigerators for household applications. Single-door refrigerators are the widely used door type. They are cost-efficient and easy to use. Key players operating the refrigerators market are trying to come up with innovative models, which have a minimum impact on the environment. The customer preference for eco-friendly and energy-efficient appliances drives the demand for electrical appliances. A refrigerator has become an integral element of a family, and it is one of the first items acquired whenever the household income reaches a certain level. Refrigerators with energy star ratings are in great demand because they include efficient compressors, insulation, and defrosting technologies that assist increase their energy efficiency. As a result of the increased demand for such appliances, manufacturers spend on R&D to develop energy-efficient goods. Appliance buyers are in buying interesting energy-efficient appliances. The usage of programmable thermostats, digital inverter compressors, and sensors by manufacturers permit them to transmute their electronic goods from energy-guzzlers to energy-efficient appliances. An increase in the adoption of the energy-efficient appliance, technological development, rapid urbanization, a rise in per capita income, and a shift in consumer lifestyle is expected to drive the demand for electrical appliances. Key players are adopting various organic and inorganic growth strategies such as mergers & acquisitions, collaborations, expansion, diversification, and investing large amounts in R&D to develop innovative solutions. Refrigerators manufacturers are focusing on the integration of technologies like IoT and embedded sensors in their products to increase overall functionality. Manufacturers are presenting progressive human-machine interface designs in refrigerators and also manufacture refrigerators, which can automatically recognize the type and weight of the food stored. India is considering restricting imports of refrigerators to encourage local manufacturing. According to the analysis, the Indian refrigerator market is expected to reach more than $5 billion, with foreign companies such as Samsung and LG competing with domestic key players including the Tata conglomerate's Voltas Ltd. The online category is predicted to increase rapidly throughout the projection period (2023-2029) because of the rising internet and smartphone usage, as well as technical improvements. Online platforms become popular because they provide delivery to the doorstep by order of products. With an online platform, the consumer can compare the price of electrical appliances on different websites. Online platforms provide home delivery and free shipping and Exchange & return offer turns to increase electrical appliances sales.

Electrical Appliances Market Regional Insights

The Asia-Pacific Electrical Appliances market is expected to grow rapidly because of fast urbanization, an increase in the middle-class population, easy access to products via retail channel development, easy access to consumer finance, and a shift in population habits. Developed nations such as Japan, Singapore, Hong Kong, and Indonesia are likely to see a growth in smart appliance sales, owing mostly to growing energy and labor costs, consumers' high spending power, and increased awareness of smart cities and smart integrated appliances. China has the biggest volume demand for conventional air conditioners in the world because of the government laws that promote energy-saving equipment, a developing property market, and hot weather. In the Asia Pacific, Nowadays, technology has become a basic prerequisite to ensure seamless operations. As regional economies grow, customers have begun to embrace contemporary products and technology to better their homes. Several nations are confronted with social and economic concerns, with structural issues impeding economic progress. Instability in currency rates, inflationary pressures, and poor export performance is putting further financial hardship on big households. With China's economic reform, the country has continuously increased investment in the electrical appliances industry. Customer satisfaction has become a crucial factor in shaping companies' business strategies in the current competitive environment in the electrical appliances market. New entrance key players have to build and maintain long-lasting and effective relationships with consumers to remain competitive in the market. Differentiation has become an important factor as more adoptions are offered to the customers. Pricing and customer-relationship management aspect are also playing a vital role in the benefits of customers. The objective of the report is to present a comprehensive analysis of the global Electrical Appliances Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers.Electrical Appliances Market Scope: Inquire before buying

Electrical Appliances Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 523.13 Bn. Forecast Period 2023 to 2029 CAGR: 8.91% Market Size in 2029: US $ 950.80 Bn. Segments Covered: by Product Refrigerator Entertainment Appliances Cooking Appliances Washing Appliances by Operation Semi Automatic Automatic by Distribution Channel Specialty Stores Multi-Branded Stores Online Electrical Appliances Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Electrical Appliances Market, Key Players are

1. Haier group 2. BSH Bosch & Siemens 3. Midea Group 4. Whirlpool Corporation 5. AB Electrolux 6. Gree Electric Appliiances Inc. 7. LG Electronics 8. Samsung Electronics 9. Hitachi Ltd 10. Panasonic Corporation 11. IFB Industries Limited 12. Hitachi Limited 13. Glen Dimplex Group 14. Amica Wronki S.A 15. Koninklijke Philips N V 16. Arcelik A.s 17. Candy Group 18. Philips 19. Sony Corporation 20. Toshiba Corporation Frequently Asked Questions: 1] What segments are covered in the Global Electrical Appliances Market report? Ans. The segments covered in the Electrical Appliances Market report are based on Product, Operation and Distribution Channel. 2] Which region is expected to hold the highest share in the Global Electrical Appliances Market? Ans. The Europe region is expected to hold the highest share in the Electrical Appliances Market. 3] What is the market size of the Global Electrical Appliances Market by 2029? Ans. The market size of the Electrical Appliances Market by 2029 is expected to reach USD 950.80 Bn. 4] What is the forecast period for the Global Electrical Appliances Market? Ans. The forecast period for the Electrical Appliances Market is 2023-2029. 5] What was the market size of the Global Electrical Appliances Market in 2022? Ans. The market size of the Electrical Appliances Market in 2022 was valued at USD 523.13Bn.

1. Electrical Appliances Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electrical Appliances Market: Dynamics 2.1. Electrical Appliances Market Trends by Region 2.1.1. North America Electrical Appliances Market Trends 2.1.2. Europe Electrical Appliances Market Trends 2.1.3. Asia Pacific Electrical Appliances Market Trends 2.1.4. Middle East and Africa Electrical Appliances Market Trends 2.1.5. South America Electrical Appliances Market Trends 2.2. Electrical Appliances Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electrical Appliances Market Drivers 2.2.1.2. North America Electrical Appliances Market Restraints 2.2.1.3. North America Electrical Appliances Market Opportunities 2.2.1.4. North America Electrical Appliances Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electrical Appliances Market Drivers 2.2.2.2. Europe Electrical Appliances Market Restraints 2.2.2.3. Europe Electrical Appliances Market Opportunities 2.2.2.4. Europe Electrical Appliances Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electrical Appliances Market Drivers 2.2.3.2. Asia Pacific Electrical Appliances Market Restraints 2.2.3.3. Asia Pacific Electrical Appliances Market Opportunities 2.2.3.4. Asia Pacific Electrical Appliances Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electrical Appliances Market Drivers 2.2.4.2. Middle East and Africa Electrical Appliances Market Restraints 2.2.4.3. Middle East and Africa Electrical Appliances Market Opportunities 2.2.4.4. Middle East and Africa Electrical Appliances Market Challenges 2.2.5. South America 2.2.5.1. South America Electrical Appliances Market Drivers 2.2.5.2. South America Electrical Appliances Market Restraints 2.2.5.3. South America Electrical Appliances Market Opportunities 2.2.5.4. South America Electrical Appliances Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electrical Appliances Industry 2.8. Analysis of Government Schemes and Initiatives For Electrical Appliances Industry 2.9. Electrical Appliances Market Trade Analysis 2.10. The Global Pandemic Impact on Electrical Appliances Market 3. Electrical Appliances Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Electrical Appliances Market Size and Forecast, by Product (2022-2029) 3.1.1. Refrigerator 3.1.2. Entertainment Appliances 3.1.3. Cooking Appliances 3.1.4. Washing Appliances 3.2. Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 3.2.1. Semi Automatic 3.2.2. Automatic 3.3. Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Specialty Stores 3.3.2. Multi-Branded Stores 3.3.3. Online 3.4. Electrical Appliances Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Electrical Appliances Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Electrical Appliances Market Size and Forecast, by Product (2022-2029) 4.1.1. Refrigerator 4.1.2. Entertainment Appliances 4.1.3. Cooking Appliances 4.1.4. Washing Appliances 4.2. North America Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 4.2.1. Semi Automatic 4.2.2. Automatic 4.3. North America Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Specialty Stores 4.3.2. Multi-Branded Stores 4.3.3. Online 4.4. North America Electrical Appliances Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Electrical Appliances Market Size and Forecast, by Product (2022-2029) 4.4.1.1.1. Refrigerator 4.4.1.1.2. Entertainment Appliances 4.4.1.1.3. Cooking Appliances 4.4.1.1.4. Washing Appliances 4.4.1.2. United States Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 4.4.1.2.1. Semi Automatic 4.4.1.2.2. Automatic 4.4.1.3. United States Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1.3.1. Specialty Stores 4.4.1.3.2. Multi-Branded Stores 4.4.1.3.3. Online 4.4.2. Canada 4.4.2.1. Canada Electrical Appliances Market Size and Forecast, by Product (2022-2029) 4.4.2.1.1. Refrigerator 4.4.2.1.2. Entertainment Appliances 4.4.2.1.3. Cooking Appliances 4.4.2.1.4. Washing Appliances 4.4.2.2. Canada Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 4.4.2.2.1. Semi Automatic 4.4.2.2.2. Automatic 4.4.2.3. Canada Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.2.3.1. Specialty Stores 4.4.2.3.2. Multi-Branded Stores 4.4.2.3.3. Online 4.4.3. Mexico 4.4.3.1. Mexico Electrical Appliances Market Size and Forecast, by Product (2022-2029) 4.4.3.1.1. Refrigerator 4.4.3.1.2. Entertainment Appliances 4.4.3.1.3. Cooking Appliances 4.4.3.1.4. Washing Appliances 4.4.3.2. Mexico Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 4.4.3.2.1. Semi Automatic 4.4.3.2.2. Automatic 4.4.3.3. Mexico Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.3.3.1. Specialty Stores 4.4.3.3.2. Multi-Branded Stores 4.4.3.3.3. Online 5. Europe Electrical Appliances Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Electrical Appliances Market Size and Forecast, by Product (2022-2029) 5.2. Europe Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 5.3. Europe Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Electrical Appliances Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Electrical Appliances Market Size and Forecast, by Product (2022-2029) 5.4.1.2. United Kingdom Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 5.4.1.3. United Kingdom Electrical Appliances Market Size and Forecast, by Distribution Channel(2022-2029) 5.4.2. France 5.4.2.1. France Electrical Appliances Market Size and Forecast, by Product (2022-2029) 5.4.2.2. France Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 5.4.2.3. France Electrical Appliances Market Size and Forecast, by Distribution Channel(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Electrical Appliances Market Size and Forecast, by Product (2022-2029) 5.4.3.2. Germany Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 5.4.3.3. Germany Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Electrical Appliances Market Size and Forecast, by Product (2022-2029) 5.4.4.2. Italy Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 5.4.4.3. Italy Electrical Appliances Market Size and Forecast, by Distribution Channel(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Electrical Appliances Market Size and Forecast, by Product (2022-2029) 5.4.5.2. Spain Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 5.4.5.3. Spain Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Electrical Appliances Market Size and Forecast, by Product (2022-2029) 5.4.6.2. Sweden Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 5.4.6.3. Sweden Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Electrical Appliances Market Size and Forecast, by Product (2022-2029) 5.4.7.2. Austria Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 5.4.7.3. Austria Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Electrical Appliances Market Size and Forecast, by Product (2022-2029) 5.4.8.2. Rest of Europe Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 5.4.8.3. Rest of Europe Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Electrical Appliances Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.3. Asia Pacific Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Electrical Appliances Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.1.2. China Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.1.3. China Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.2.2. S Korea Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.2.3. S Korea Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.3.2. Japan Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.3.3. Japan Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. India 6.4.4.1. India Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.4.2. India Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.4.3. India Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.5.2. Australia Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.5.3. Australia Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.6.2. Indonesia Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.6.3. Indonesia Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.7.2. Malaysia Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.7.3. Malaysia Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.8.2. Vietnam Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.8.3. Vietnam Electrical Appliances Market Size and Forecast, by Distribution Channel(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.9.2. Taiwan Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.9.3. Taiwan Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Electrical Appliances Market Size and Forecast, by Product (2022-2029) 6.4.10.2. Rest of Asia Pacific Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 6.4.10.3. Rest of Asia Pacific Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Electrical Appliances Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Electrical Appliances Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 7.3. Middle East and Africa Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Electrical Appliances Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Electrical Appliances Market Size and Forecast, by Product (2022-2029) 7.4.1.2. South Africa Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 7.4.1.3. South Africa Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Electrical Appliances Market Size and Forecast, by Product (2022-2029) 7.4.2.2. GCC Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 7.4.2.3. GCC Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Electrical Appliances Market Size and Forecast, by Product (2022-2029) 7.4.3.2. Nigeria Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 7.4.3.3. Nigeria Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Electrical Appliances Market Size and Forecast, by Product (2022-2029) 7.4.4.2. Rest of ME&A Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 7.4.4.3. Rest of ME&A Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Electrical Appliances Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Electrical Appliances Market Size and Forecast, by Product (2022-2029) 8.2. South America Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 8.3. South America Electrical Appliances Market Size and Forecast, by Distribution Channel(2022-2029) 8.4. South America Electrical Appliances Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Electrical Appliances Market Size and Forecast, by Product (2022-2029) 8.4.1.2. Brazil Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 8.4.1.3. Brazil Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Electrical Appliances Market Size and Forecast, by Product (2022-2029) 8.4.2.2. Argentina Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 8.4.2.3. Argentina Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Electrical Appliances Market Size and Forecast, by Product (2022-2029) 8.4.3.2. Rest Of South America Electrical Appliances Market Size and Forecast, by Operation (2022-2029) 8.4.3.3. Rest Of South America Electrical Appliances Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Electrical Appliances Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electrical Appliances Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Haier group 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. BSH Bosch & Siemens 10.3. Midea Group 10.4. Whirlpool Corporation 10.5. AB Electrolux 10.6. Gree Electric Appliiances Inc. 10.7. LG Electronics 10.8. Samsung Electronics 10.9. Hitachi Ltd 10.10. Panasonic Corporation 10.11. IFB Industries Limited 10.12. Hitachi Limited 10.13. Glen Dimplex Group 10.14. Amica Wronki S.A 10.15. Koninklijke Philips N V 10.16. Arcelik A.s 10.17. Candy Group 10.18. Philips 10.19. Sony Corporation 10.20. Toshiba Corporation 11. Key Findings 12. Industry Recommendations 13. Electrical Appliances Market: Research Methodology 14. Terms and Glossary