Global Power Quality Meter Market Size was valued at USD 380.2 Mn in 2022 and is expected to reach USD 2304.7 Mn by 2029, at a CAGR of 7.6 %. Power quality meters are widely used across all industrial verticals for the analysis of electrical parameters, which are related to the flow of electricity. When continuous monitoring of a three-phase system is required, the power quality meter is an excellent solution. Current, voltage, real and reactive power, energy utilization, cost of power, power factor, and frequency are all measured by the power quality meter device. Engineers and electricians use these meters to collect real-time measurements and data for a thorough analysis of the power quality meter. Also, power quality meters are used in a wide range of applications in the industrial, manufacturing, and commercial sectors, including transformers, feeders, motors, motor control centers, and other equipment. The increasing need for power quality meters as essential tools for maintaining a stable power supply due to industrial automation and digitalization as well as technological advancement. Such growing demand and integration of renewable energy sources are driving the Power Quality Meter Market growth.To know about the Research Methodology :- Request Free Sample Report

Power Quality Meter Market Dynamics

The growing demand for uninterrupted and reliable power supply across world end-use industries such as commercial buildings, and residential sectors is a key driver for the global power quality meter market. The power quality meters help to detect fast transients, accurately capture waveforms, automatically display events on an ITIC curve, get graphic views of power quality, and more. Recent advancements in technology have redefined the possibilities for power quality monitoring. Since industries become more dependent on advanced electrical equipment and digital technologies, the need for power quality monitoring solutions increases. The energy management industry is increasing as a result of substantial transformations in global electrical power systems, such as decarbonization, decentralization, and digitization. This growth is assisting advanced power quality meter manufacturers in constructing a line of next-generation power quality instruments. Such factors monitor, record, and analyze crucial electrical patterns in order to improve energy efficiency, process performance, and cost as well as boost the Power Quality Meter Market growth. As a result of the growing demand for energy management solutions, demand for energy and power quality meters is expected to grow across the globe. Increasing Energy Conservation and Sustainability Concerns to Influence Market Growth. Energy generation, transmission, and distribution are all increasing rapidly across the globe. With the growth of the power industry, electricity demand is constantly rising, resulting in a large demand for energy and power quality meters. Additionally, increased urbanization on a global scale is contributing to an increase in the rate of electrification in the residential and commercial end-use sectors, which is expected to fuel the market for power quality meter market growth over the forecast period. Growing Energy demand is driving the need for the power quality meter market across the globe. Organizations and utility providers are adopting power quality meters to optimize their energy usage, reduce costs, and comply with energy efficiency regulations and are expected to drive market growth. The global electricity demand is expected to grow at a rate of 3.2% per year, which is twice the rate of primary energy demand. Electricity's rising share of total final energy consumption rises from 20% in 2018 to 27%in 2022. The growth of electricity demand is expected to be especially in developing economies such as China and India, which in turn are expected to boost the product demand during the forecast period.Manufacturers are merging energy & power quality meter with wireless and linked technologies for greater accuracy and monitoring of power consumption as the Internet of Things (IoT) extends into every sector. Power quality and energy data are managed over the internet or a local network thanks to precise sensors and embedded servers in IoT-enabled energy & quality meters. Also, IoT-enabled devices provide a variety of networking options, including wireless, Ethernet, and others. Energy and power quality meters, when combined with the Internet of Things (IoT), give a great deal of data, including power quality data, revenue, and billing data, as well as power and energy data, ensuring data exchange among various stakeholders in harmony for increased transparency. Additionally, recently developed analytic apps turn collected data into actionable insights, helping operations personnel avoid power outages and equipment damage, and lowering operational costs. The increasing research and development in product innovation is expected to create lucrative opportunities for the Power Quality Meter Market growth potential. Advanced Metering Infrastructure and Customer Systems to Boost the Market Industrial automation development and digitalization across sectors such as manufacturing, healthcare, and transportation require a high-quality and stable power supply. As industries increasingly adopt automation technologies to enhance productivity and efficiency, the demand for power quality meters rises to maintain optimal performance and minimize downtime. Operations and maintenance (O&M) cost savings from remote billing and metering services is a major benefit stream for the AMI business case. Operational efficiencies enhanced revenue collection and improved customer service and satisfaction. For example, industry and government collectively invested $5.21 billion in projects testing one or more AMI and customer technologies accounting for more than two-thirds (67 percent) of the total SGIG investment. However, the integration of renewable energy sources, such as solar and wind, into the power grid presents challenges in maintaining power quality due to their intermittent nature and is expected to restrain the Power Quality Meter Market growth. The Original Equipment Manufacturers (OEMs) of power quality meters include Eaton Corporation, ABB Ltd., General Electric, Siemens AG, Schneider Electric SE. These manufacturers are introducing innovative features such as wireless connectivity, cloud-based monitoring, and advanced data analytics capabilities. These advancements support real-time monitoring, remote access, and comprehensive analysis of power quality data, providing users with valuable insights to optimize their electrical systems. The availability of user-friendly interfaces and customizable reporting further enhances the usability and effectiveness of power quality meters, driving their adoption across diverse industries and increasing Power Quality Meter Market size growth.

Power Quality Meter Market Segment Analysis:

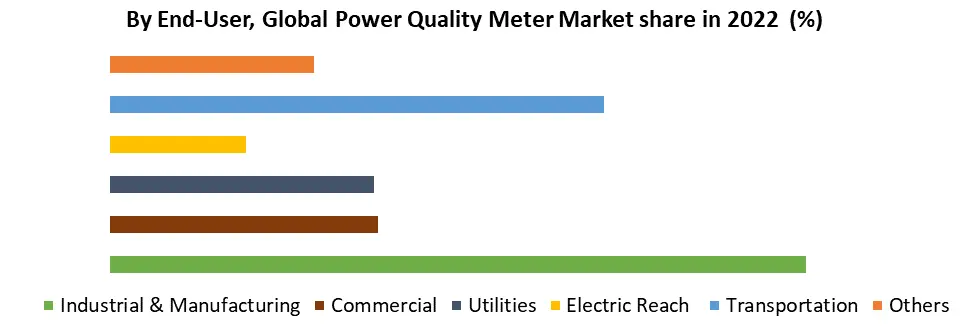

Based on the Phase, the Three-Phase segment held the largest Power Quality Meter Market share at 63 % in 2022. A three-phase power quality meter provides power supply at a steady and efficient rate, as a result, it is extensively used in commercial and industrial facilities to accommodate higher loads. Three-phase power quality meters are ideal for troubleshooting, and logging, and it generates detailed reports in conjunction with easy-to-use, which boosts the product demand for this segment. The Single Phase segment is also expected to witness significant growth at a CAGR of 5.89% during the forecast period. The single-phase power quality meters are easy to handle and portable that giving them the edge over three-phase power quality meters. Based on the End-Users, the Industrial & Manufacturing segment dominated the largest Power Quality Meter Market share, accounting for 35% in 2022. A consistent, efficient, and uninterruptible power supply has become an essential prerequisite for industrial & manufacturing facilities across the globe. Any type of power outage or interruption can disrupt essential industrial activities and result in significant losses, leading to the growing adoption of power quality meters, which in turn power quality meter market growth for this segment. However, mining, manufacturing, agriculture, and construction all account for a major proportion of the overall energy consumption in the industrial sector. The demand for power-quality equipment is expected to rise as these industries, particularly manufacturing facilities, increase their requirement for continuous and reliable power supply.

Power Quality Meter Market Regional Analysis

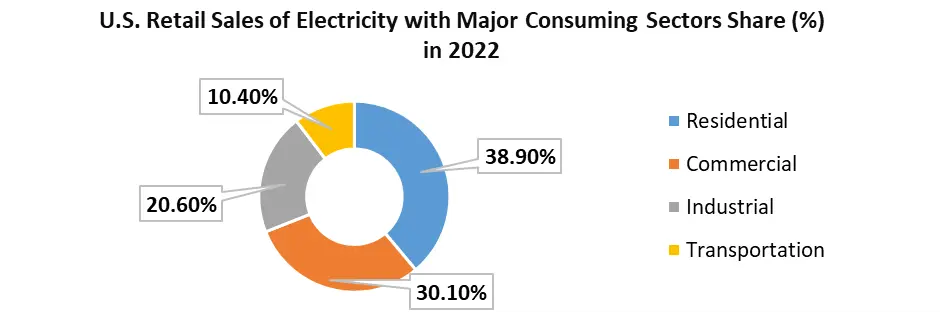

Asia Pacific held the largest Power Quality Meter Market share with 40 % in 2022 and is expected to grow at a significant CAGR over the forecast period. Regional growth is influenced by increasing industrialization and urbanization, which leads to the growing demand for power-quality meters. The governments of China and India, have created several supportive policies in order to enlarge their industrial and manufacturing sectors, which is expected to enhance demand for power-quality equipment. Starting with this snapshot of China’s current electric power system requirements, we used the China 8760 Grid Model to develop scenarios for future requirements. Industry plays a very important role in China’s economy, energy consumption and CO2 emissions. This section clarifies the scope of industry in terms of economic contribution, energy consumption and CO2 emissions. An analysis of industrial fabric will be presented for giving a picture of Chinese industry For instance, to promote the expansion of India's manufacturing industry, the government has implemented initiatives such as Make in India and Production-Linked Investment. In the region, energy demand is expected to increase forecast period, due to rising urbanization, which is expected to increase by 20%. Also, India is the world's third-largest consumer of energy, with consumption expected to increase in the next two decades, and is expected to boost the demand for energy and power quality meters in Power Quality Meter Market during the forecast period. North America region is expected to witness significant growth at a CAGR of 7% during the forecast period. The region’s growth is attributed to increased awareness of the importance of supplying quality power, along with the country's growing number of companies and manufacturing capabilities, which are driving the power quality meter market growth in the region. Growing investments in transmission and distribution infrastructure construction, energy-efficiency measures, and renewable energy projects in the region are expected to boost the number of power quality meters installed during the forecast period. Total U.S. electricity end-use consumption in 2022 was about 2.6% higher than in 2021. In 2022, retail electricity sales to the residential sector were about 3.5% higher than in 2021, and retail electricity sales to the commercial sector were about 3.4% higher than in 2021.

Competitive Landscape of the Power Quality Meter Market

The global power quality meter market is highly competitive with key players such as Schneider Electric, Eaton Corporation, and Fluke Corporation. Factors influencing competitiveness include technological innovation, accuracy, global presence, and customer support. Market trends include the rise of energy efficiency, IoT integration, and the growing focus on renewable energy. The market varies regionally, with North America focusing on smart grids and Europe emphasizing renewable energy integration. Challenges include high initial costs and regulatory hurdles. Despite challenges, the market is expected to grow due to increasing energy demand and the need for reliable power supply. In response to the growing demand for reliable power supply and energy efficiency, power quality meter manufacturers are investing in research and development to introduce advanced features such as real-time monitoring, remote access, and data analytics, driven by the integration of Internet of Things (IoT) and cloud-based solutions.Power Quality Meter Market Scope:Inquiry Before Buying

Power Quality Meter Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1380.2 Mn. Forecast Period 2023 to 2029 CAGR: 7.6% Market Size in 2029: US $ 2304.7 Mn. Segments Covered: by Phase Single Phase Three Phase by End User Industrial & Manufacturing Commercial Utilities Transportation Others by Application Distribution Panels Substation Monitoring Equipment Others Power Quality Meter Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Power Quality Meter Key Players Include

1. Schneider Electric SE 2. ABB Ltd. 3. Fluke Corporation 4. Hioki E.E. Corporation 5. Yokogawa Electric Corporation 6. Siemens AG 7. Eaton Corporation PLC 8. Mitsubishi Electric Corporation 9. Dranetz Technologies, Inc. 10. Elspec Ltd. 11. Megger 12. Sensus 13. Valhalla Scientific 14. Vitrek 15. Wasion Group Holding 16. Zhejiang Yongtailong Electronic 17. B&K Precision 18. Danaher 19. Dranetz Technologies 20. Emerson 21. FLIR Systems 22. Fluke Corporation 23. Honeywell International 24. Itron 25. ABB Ltd. 26. General Electric 27. Schneider Electric SE 28. Eaton 29. Accuenergy LtdFrequently Asked Questions:

1] What is the growth rate of the Global Power Quality Meter Market? Ans. The Global Power Quality Meter Market is growing at a significant rate of 7.6 % during the forecast period. 2] Which region is expected to dominate the Global Power Quality Meter Market? Ans. APAC region is expected to hold the Power Quality Meter Market growth potential during the forecast period. 3] What is the expected Global Power Quality Meter Market size by 2029? Ans. The Power Quality Meter Market size is expected to reach USD 1380.2 Mn by 2029. 4] Which are the top players in the Global Power Quality Meter Market? Ans. The top player of the Power Quality Meter manufacturers is Schneider Electric SE, Siemens AG, ABB Ltd. and others. 5] What are the factors driving the Global Power Quality Meter Market growth? Ans. The advanced metering infrastructure and customer systems of quality power meter are expected to drive the industry expansion.

1. Power Quality Meter Market: Research Methodology 2. Power Quality Meter Market: Executive Summary 3. Power Quality Meter Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Power Quality Meter Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Power Quality Meter Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Power Quality Meter Market Size and Forecast, by Phase (2022-2029) 5.1.1. Single Phase 5.1.2. Three Phase 5.2. Power Quality Meter Market Size and Forecast, by Application (2022-2029) 5.2.1. Distribution Panels 5.2.2. Substation Monitoring 5.2.3. Equipment 5.2.4. Others 5.3. Power Quality Meter Market Size and Forecast, by End User (2022-2029) 5.3.1. Industrial & Manufacturing 5.3.2. Commercial 5.3.3. Utilities 5.3.4. Transportation 5.3.5. Others 5.4. Power Quality Meter Market Size and Forecast, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Power Quality Meter Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Power Quality Meter Market Size and Forecast, by Phase (2022-2029) 6.1.1. Single Phase 6.1.2. Three Phase 6.2. North America Power Quality Meter Market Size and Forecast, by Application (2022-2029) 6.2.1. Distribution Panels 6.2.2. Substation Monitoring 6.2.3. Equipment 6.2.4. Others 6.3. North America Power Quality Meter Market Size and Forecast, by End User (2022-2029) 6.3.1. Industrial & Manufacturing 6.3.2. Commercial 6.3.3. Utilities 6.3.4. Transportation 6.3.5. Others 6.4. North America Power Quality Meter Market Size and Forecast, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Power Quality Meter Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Power Quality Meter Market Size and Forecast, by Phase (2022-2029) 7.1.1. Single Phase 7.1.2. Three Phase 7.2. Europe Power Quality Meter Market Size and Forecast, by Application (2022-2029) 7.2.1. Distribution Panels 7.2.2. Substation Monitoring 7.2.3. Equipment 7.2.4. Others 7.3. Europe Power Quality Meter Market Size and Forecast, by End User (2022-2029) 7.3.1. Industrial & Manufacturing 7.3.2. Commercial 7.3.3. Utilities 7.3.4. Transportation 7.3.5. Others 7.4. Europe Power Quality Meter Market Size and Forecast, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Power Quality Meter Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Power Quality Meter Market Size and Forecast, by Phase (2022-2029) 8.1.1. Single Phase 8.1.2. Three Phase 8.2. Asia Pacific Power Quality Meter Market Size and Forecast, by Application (2022-2029) 8.2.1. Distribution Panels 8.2.2. Substation Monitoring 8.2.3. Equipment 8.2.4. Others 8.3. Asia Pacific Power Quality Meter Market Size and Forecast, by End User (2022-2029) 8.3.1. Industrial & Manufacturing 8.3.2. Commercial 8.3.3. Utilities 8.3.4. Transportation 8.3.5. Others 8.4. Asia Pacific Power Quality Meter Market Size and Forecast, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Power Quality Meter Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Power Quality Meter Market Size and Forecast, by Phase (2022-2029) 9.1.1. Single Phase 9.1.2. Three Phase 9.2. Middle East and Africa Power Quality Meter Market Size and Forecast, by Application (2022-2029) 9.2.1. Distribution Panels 9.2.2. Substation Monitoring 9.2.3. Equipment 9.2.4. Others 9.3. Middle East and Africa Power Quality Meter Market Size and Forecast, by End User (2022-2029) 9.3.1. Industrial & Manufacturing 9.3.2. Commercial 9.3.3. Utilities 9.3.4. Transportation 9.3.5. Others 9.4. Middle East and Africa Power Quality Meter Market Size and Forecast, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Power Quality Meter Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Power Quality Meter Market Size and Forecast, by Phase (2022-2029) 10.1.1. Single Phase 10.1.2. Three Phase 10.2. South America Power Quality Meter Market Size and Forecast, by Application (2022-2029) 10.2.1. Distribution Panels 10.2.2. Substation Monitoring 10.2.3. Equipment 10.2.4. Others 10.3. South America Power Quality Meter Market Size and Forecast, by End User (2022-2029) 10.3.1. Industrial & Manufacturing 10.3.2. Commercial 10.3.3. Utilities 10.3.4. Transportation 10.3.5. Others 10.4. South America Power Quality Meter Market Size and Forecast, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Bosch Rexroth 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Parker Hannifin 11.3. Eaton 11.4. Moog 11.5. Danfoss Power Solutions 11.6. Bucher Hydraulics 11.7. HAWE Hydraulik 11.8. Hydac International 11.9. Interpump Group 11.10. Hydro-Line 11.11. Duplomatic Toselli 11.12. Tolomatic 11.13. Penta, KYB (Japan) 11.14. Hengli Hydraulic (China) 11.15. Linde Hydraulics (Germany) 11.16. Sun Hydraulics (United States) 11.17. Nachi (Japan) 11.18. Nachi (Japan) 11.19. Flowserve (United States) 11.20. PSG Dover (United States) 12. Key Findings 13. Industry Recommendation