The Global Point of Sale Terminal Market growth is forecasted at a CAGR of 16.06% during 2023-2029, to reach 71.42 Billion by 2029. A detailed description of the factors and market trends pertaining to different regions is given in detail in the report.Point of Sale Terminal Market Overview

Point of Sale Terminal is described as an electronic device used in retail stores, restaurants, and other businesses to process transactions. The Point of Sale Terminal typically consists of a computerized system that allows merchants to accept and process payments from customers using debit or credit cards, as well as other payment methods such as mobile payments, gift cards, and cash. With the use of a Point of Sale Terminal (PoS), businesses can streamline their payment processing, track inventory, manage sales data, and improve customer service. It also enables businesses to offer various payment options to customers, making transactions more convenient and efficient. The Point of Sale Terminal is equipped with hardware components such as a touch screen monitor, barcode scanner, cash drawer, and receipt printer. It is also connected to a payment gateway or processor, which handles the payment authorization and settlement process. The Point of Sale Terminal (PoS) plays a pivotal role in the modern retail and restaurant industries. It provides businesses with the technology necessary to efficiently process transactions and manage sales data. The Point of Sale Terminal enhances the customer experience and improves customer satisfaction. Ultimately, the Point of Sale Terminal Market is a valuable investment for businesses looking to stay competitive in today's fast-paced marketplace.Point of Sale Terminal Market Research Methodology

The research methodology employed for the Point of Sale market included both primary and secondary data sources to ensure a thorough examination and validation of all possible market factors. To estimate market size and forecasts, a bottom-up approach and multiple data triangulation methodologies were used, factoring in variables such as inflation, economic downturns, and regulatory and policy changes. Segments were broken down based on Components and Product type, and country-wise analysis was conducted based on percentage adoption or utilization of the given market size. Major market players were identified through secondary research, while extensive primary research was conducted to verify crucial numbers arrived at through market engineering and calculations and employing several business tools. The report also included GE-Mckinsey’s Matrix, perceptual mapping, internal TWOS analysis, PESTEL analysis, and Porter’s 5 forces model to provide a comprehensive understanding of the market and its future prospects.To know about the Research Methodology :- Request Free Sample Report

Point of Sale Terminal Market Dynamics

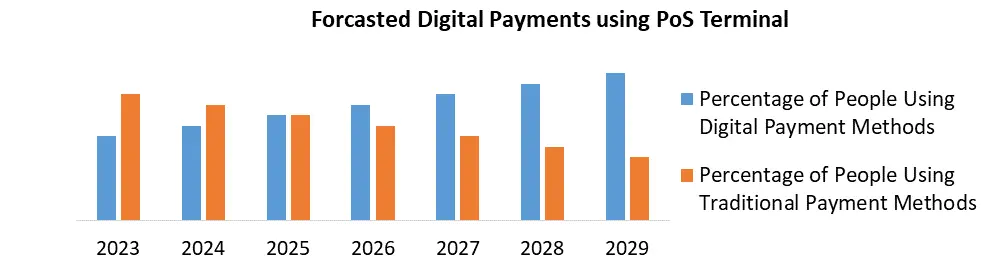

There are various factors which affects the Point of Sale Terminal Industry. Such factors are categorized as market drivers, market restraints and market trends. Each of the mentioned parameter is been thoroughly analysed and their implications are been documented in the complete report. Some of the market drivers, restraints and market trends are briefly introduced below. Point of Sale Terminal Market Drivers: One of the primary market drivers is the increasing adoption of digital payment methods. The rise in digital payment methods has led to an increased demand for Point of Sale terminals that can accept these payment methods. According to a report, the global digital payment market was valued at $4400 billion in 2022 and is projected to reach $10810 billion by 2029, at a CAGR of 13.7% during the forecast period. This trend has significantly contributed to the growth of the Point of Sale Terminal market. The increasing penetration of smartphones and the internet has further fuelled the growth of the Point of Sale Terminal market. As mentioned in the report, the number of smartphone users worldwide is expected to reach 6.8 billion in 2023 and is increasing at a rate of 4.2% annually. This has led to a greater demand for Point of Sale terminals that can accept digital payment methods. In addition, the growing adoption of the internet has made it easier for businesses to integrate their Point of Sale systems with other digital tools, such as inventory management and customer relationship management (CRM) systems.Another driver for the Point of Sale Terminal Market is the growing demand for cloud-based Point of Sale systems. The demand for cloud-based Point of Sale systems is growing rapidly, driven by their scalability, flexibility, and improved data security and accessibility. The development of contactless payment methods, such as NFC and QR code payments, has further fuelled the growth of the Point of Sale market. According to a report by MMR, the global contactless payment market size was valued at US$1368 billion in 2021 and is projected to reach US$5882 billion by 2025, at a CAGR of 20% during the forecast period. This trend has led to an increased demand for Point of Sale terminals that can accept contactless payments. The trend towards omnichannel retailing has also led to a greater demand for Point of Sale Terminal systems that can handle both in-store and online transactions. According to the report, 70% of consumers now expect to be able to buy products online and pick them up in-store. This has led to an increased demand for Point of Sale Terminal Market that can seamlessly integrate in-store and online transactions. Need for businesses to improve customer experience and streamline payment processing: Businesses are increasingly looking for ways to improve their customer experience and streamline their payment processing. In the report, it is mentioned that 58% of consumers say that the payment experience is an important factor in their decision to do business with a merchant. This has led to an increased demand for Point of Sale systems that can offer a seamless and efficient payment experience. Governments around the world are taking initiatives to promote digital payment methods and encourage businesses to adopt Point of Sale solutions. In India, the government's demonetization drive in 2016 led to a surge in digital payments and boosted the adoption of Point of Sale terminals. The government has also launched initiatives such as the Bharat QR Code and the Unified Payments Interface (UPI) to promote digital payments. Point of Sale Terminal Market Restraints One of the major restraints for the point of sale market is the increasing concern over security and data breaches. As Point of Sale systems store sensitive information such as customer payment details, they are vulnerable to cyber-attacks and data breaches. The cost of such breaches can be significant, not just in terms of financial losses but also damage to reputation. The adoption of advanced security measures such as encryption, tokenization, and multi-factor authentication can help mitigate the risk of data breaches. However, implementing these measures can also increase the cost of Point of Sale solutions, which can be a restraint for smaller businesses. Another restraining factor for the Point of Sale Terminal Market in the high initial investment required for Point of Sale systems can also be a restraint for businesses, particularly small and medium-sized enterprises (SMEs). The cost of Point of Sale terminals, software, and installation can be significant, and ongoing maintenance costs can also add up over time. In addition, Point of Sale systems require regular software updates and maintenance to ensure optimal performance and security. These costs can be a burden for smaller businesses, who may not have the financial resources to invest in these technologies. Many businesses, particularly in the retail industry, use legacy systems for their operations. These systems may not be compatible with newer Point of Sale solutions, which can be a restraint for businesses looking to adopt these technologies. In some cases, businesses may need to upgrade their entire IT infrastructure to accommodate Point of Sale systems, which can be a costly and time-consuming process. The adoption of cloud-based Point of Sale solutions can help mitigate some of these compatibility issues, as they can be easily integrated with existing systems. However, the cost of migrating to cloud-based systems can also be a restraint for smaller businesses.

Point of Sale Terminal Market Trend

With constant innovation in technology and adaption of digital and contactless payments, the point of sale industry is been forecasted to show a rapid growth over the forecasted period. The report highlights that the retail industry is the largest end-user segment for POS solutions, as retailers use these systems to process transactions and manage inventory. However, the healthcare industry is expected to witness the highest growth rate during the forecast period due to the increasing adoption of POS solutions to improve patient experience and streamline billing processes.

Point of Sale Terminal Market Segment Analysis:

Product Type: The Point of Sale market is segmented based on product type, such as fixed and mobile POS systems. Fixed POS systems are stationary terminals that are typically used in brick-and-mortar stores, while mobile POS systems are handheld devices that allow for greater flexibility in processing transactions. Component: The Point of Sale is also be segmented based on components, such as hardware and software. Hardware components include terminals, scanners, printers, and cash drawers, while software components include POS software, payment processing software, and inventory management software. Deployment Type: The Point of Sale Terminal market is segmented based on deployment type, such as cloud-based and on-premise POS systems. Cloud-based POS systems are hosted on remote servers and accessed through the internet, while on-premise POS systems are installed on local servers. End-User: The Report also segments Point of Sale Market based on end-users, such as retail, hospitality, healthcare, and others. Retail and hospitality are the largest end-users of POS systems, while healthcare is an emerging end-user due to the increasing adoption of electronic health records. Application: Segmentation based on application includes use cases such as inventory management, payment processing, customer management, and others. Payment processing is the most widely used application of POS systems, while inventory management is gaining traction due to the increasing need for real-time inventory tracking. Geography: The Point of Sale Terminal market is be segmented based on geography, such as North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America and Europe are the largest markets for POS systems, while Asia-Pacific is the fastest-growing market due to the increasing adoption of cashless payment methods and the rise in demand for advanced payment technologies. Size of Business: POS systems is also be segmented based on the size of businesses, such as small and medium-sized enterprises (SMEs) and large enterprises. SMEs often have different requirements than larger enterprises, such as a need for more affordable and easy-to-use POS solutions. Type of Transaction: Point of Sale systems is also be segmented based on the type of transaction, such as online and offline transactions. Online transactions refer to e-commerce transactions processed through a website or mobile app, while offline transactions refer to in-store transactions processed through a POS system. Type of Payment Method: Point of Sale Terminal systems is be segmented based on the type of payment method, such as cash, card, and mobile payments. With the rise in cashless payment methods, POS systems that accept mobile payments, such as Apple Pay and Google Wallet, are becoming increasingly popular. Type of Industry: Point of Sale systems is be segmented based on the type of industry, such as restaurants, grocery stores, and clothing stores. Each industry may have unique requirements for their POS systems, such as the need for kitchen printing and order tracking in restaurants. Level of Customization: Point of Sale Terminal Market is also been segmented based on the level of customization, such as off-the-shelf and customizable POS solutions. Off-the-shelf solutions are pre-built and can be implemented quickly, while customizable solutions allow businesses to tailor their POS system to their specific needs. Type of Connectivity: POS systems is segmented based on the type of connectivity, such as Wi-Fi and Bluetooth. With the increasing need for mobility, POS systems that offer wireless connectivity are becoming more popular.Point of Sale Terminal Market Competitive Landscape:

The competitive landscape of the Point of Sale (POS) market is highly scattered, with several players operating in the market. The market is characterized by intense competition, with players striving to gain a competitive edge by offering innovative and advanced POS solutions. The market players range from large multinational corporations to small and medium-sized enterprises. In 2020, Samsung Electronics Co., Ltd. launched the Galaxy XCover Pro, a rugged smartphone designed for enterprise use that can also serve as a POS device. In 2021, Revel Systems Inc. partnered with Shell Retail to provide POS solutions to its convenience stores in the United Kingdom. In the same year, Zoho Corporation launched Zoho Commerce Plus, an all-in-one ecommerce platform that also includes a POS system.Point of Sale Terminal Market Regional Insights:

The point of sale (POS) market is a global industry with significant regional variations in market size and growth rate. North America is the largest Point of Sale Terminal Market, with the United States being the dominant player, accounting for more than 60% of the regional market share. In Europe, the market size for POS systems is the second-largest in the world, with a high penetration of cashless payment methods and a demand for advanced payment technologies. The Asia-Pacific region is the fastest-growing market for POS systems, with China, India, and Japan being the largest markets within the region. Latin America and the Middle East and Africa are emerging markets for POS systems, with increasing adoption of cashless payment methods and the rising demand for advanced payment technologies in the regions. Brazil and Mexico are the largest markets in Latin America, while the United Arab Emirates and South Africa are the largest Point of Sale Terminal Market in the Middle East and Africa. Overall, the POS market is expected to grow significantly in the coming years, driven by technological advancements, changing consumer behaviour, and the increasing adoption of cashless payment methods globally.Point of Sale Terminal Market Scope: Inquire before buying

Point of Sale Terminal Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 25.24 Bn. Forecast Period 2023 to 2029 CAGR: 16.06% Market Size in 2029: US $ 71.42 Bn. Segments Covered: by Product Type • Fixed PoS • Mobile PoS by Component • Hardware • Software • Services by Deployment • On-Premise • Cloud Based by Size of Business • Small • Medium Sized Enterprises (SMEs) • Large Enterprises by End User • Restaurants • Retail • Entertainment • Others Point of Sale Terminal Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Point of Sale Terminal Market Key Players:

• Samsung Electronics Co., Ltd. (South Korea) • Revel Systems Inc. (USA) • Loyverse (Singapore) • Toshiba Global Commerce Solutions Inc. (USA) • Clover Network Inc. (USA) • Paytm (India) • Verifone Systems Inc. (USA) • Zoho Corporation (India) • Lightspeed POS Inc. (Canada) • Ezetap (India) • Shopify Inc. (Canada) • TouchBistro Inc. (Canada) • NEC Corporation (Japan) • Pine Labs (India) • Mswipe Technologies (India) • Upserve Inc. (USA) • Maitre'D (Canada) • GoFrugal Technologies (India) • Ingenico Group (France) • Toast Inc. (USA) • NCR Corporation (USA) • Oracle Corporation (USA) • PAX Global Technology Ltd. (Hong Kong) • Posist Technologies (India) • Panasonic Corporation (Japan) • ShopKeep (USA) FAQs: 1. What are the growth drivers for the Point of Sale Terminal Market? Ans: One of the primary market drivers is the increasing adoption of digital payment methods. Along with this, Increasing penetration of smartphone also acts as a driver for Point of Sale Terminal market 2. What is the major restraint for the Point of Sale Terminal Market growth? Ans: One of the major restraints for the point of sale market is the increasing concern over security and data breaches. As Point of Sale systems store sensitive information such as customer payment details, they are vulnerable to cyber-attacks and data breaches. 3. Which region is expected to lead the global Point of Sale Terminal Market during the forecast period? Ans: North America Market is forecasted to have highest shares in the global market 4. What is the projected market size & growth rate of the Point of Sale Terminal Market? Ans: The growth of the Telepresence Robotics Market is forecasted at a CAGR of 16.06% during 2023-2029 and the market size is been forecasted to be 71.42 5. What segments are covered in the Point of Sale Terminal Market report? Ans: The Point of Sale Terminal market is been segmented based upon the Product Type, Component, Deployment, End User, Geography and Size of Business

1. Point of Sale Terminal Market: Research Methodology 2. Point of Sale Terminal Market: Executive Summary 3. Point of Sale Terminal Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Point of Sale Terminal Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Point of Sale Terminal Market: Segmentation (by Value USD and Volume Units) 5.1. Point of Sale Terminal Market, By Product Type 5.1.1. Fixed PoS 5.1.2. Mobile PoS 5.2. Point of Sale Terminal Market, By Component 5.2.1. Hardware 5.2.2. Software 5.2.3. Services 5.3. Point of Sale Terminal Market, By Deployment 5.3.1. On Premise 5.3.2. Cloud Based 5.4. Point of Sale Terminal Market, By End User 5.4.1. Restaurants 5.4.2. Retail 5.4.3. Entertainment 5.4.4. Others 5.5. Point of Sale Terminal Market, By Geography 5.5.1. North America 5.5.2. South America 5.5.3. Latin America 5.5.4. Europe 5.5.5. Middle East and Africa 5.5.6. Asia Pacific 5.6. Point of Sale Terminal Market, By Size of Business 5.6.1. Small 5.6.2. Medium Sized Enterprises (SMEs) 5.6.3. Large Enterprises 6. North America Point of Sale Terminal Market (by Value USD and Volume Units) 6.1. North America Point of Sale Terminal Market, by Component (2022-2029) 6.1.1. Hardware 6.1.2. Software 6.1.3. Service 6.2. North America Point of Sale Terminal Market, by Deployment (2022-2029) 6.2.1. On Premise 6.2.2. Cloud Based 6.3. North America Point of Sale Terminal Market, by End User (2022-2029) 6.3.1. Restaurants 6.3.2. Retail 6.3.3. Entertainment 6.3.4. Others 7. Point of Sale Terminal Market (by Value USD and Volume Units) 7.1. Point of Sale Terminal Market, by Components Type (2022-2029) 7.2. Point of Sale Terminal Market, by End User (2022-2029) 7.3. Point of Sale Terminal Market, by Country (2022-2029) 7.3.1. UK 7.3.2. France 7.3.3. Germany 7.3.4. Italy 7.3.5. Spain 7.3.6. Sweden 7.3.7. Austria 7.3.8. Rest of Europe 8. Asia Pacific Point of Sale Terminal Market (by Value USD and Volume Units) 8.1. Asia Pacific Point of Sale Terminal Market, by Component (2022-2029) 8.2. Asia Pacific Point of Sale Terminal Market, by Deployment (2022-2029) 8.3. Asia Pacific Point of Sale Terminal Market, by Country (2022-2029) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Vietnam 8.3.9. Taiwan 8.3.10. Bangladesh 8.3.11. Pakistan 8.3.12. Rest of Asia Pacific 9. Middle East and Africa Point of Sale Terminal Market (by Value USD and Volume Units) 9.1. Middle East and Africa Point of Sale Terminal Market, by Component (2022-2029) 9.2. Middle East and Africa Point of Sale Terminal Market, by Deployment (2022-2029) 9.3. Middle East and Africa Point of Sale Terminal Market, by Country (2022-2029) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Egypt 9.3.4. Nigeria 9.3.5. Rest of ME&A 10. South America Point of Sale Terminal Market (by Value USD and Volume Units) 10.1. South America Point of Sale Terminal Market, by Component (2022-2029) 10.2. South America Point of Sale Terminal Market, by Deployment (2022-2029) 10.3. South America Point of Sale Terminal Market, by Country (2022-2029) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Rest of South America 11. Company Profile: Key players 11.1. Samsung Electronics Co., Ltd. (South Korea) 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Revel Systems Inc. (USA) 11.3. Loyverse (Singapore) 11.4. Toshiba Global Commerce Solutions Inc. (USA) 11.5. Clover Network Inc. (USA) 11.6. Paytm (India) 11.7. Verifone Systems Inc. (USA) 11.8. Zoho Corporation (India) 11.9. Lightspeed POS Inc. (Canada) 11.10. Ezetap (India) 11.11. Shopify Inc. (Canada) 11.12. TouchBistro Inc. (Canada) 11.13. NEC Corporation (Japan) 11.14. Pine Labs (India) 11.15. Mswipe Technologies (India) 11.16. Upserve Inc. (USA) 11.17. Maitre'D (Canada) 11.18. GoFrugal Technologies (India) 11.19. Ingenico Group (France) 11.20. Toast Inc. (USA) 11.21. NCR Corporation (USA) 11.22. Oracle Corporation (USA) 11.23. PAX Global Technology Ltd. (Hong Kong) 11.24. Posist Technologies (India) 11.25. Panasonic Corporation (Japan) 11.26. ShopKeep (USA)