The Physical Identity and Access Management Market size was valued at USD 1030.54 Million in 2023 and the total Physical Identity and Access Management revenue is expected to grow at a CAGR of 14.2 % from 2024 to 2030, reaching nearly USD 2610.52 Million by 2030. Physical Identity and Access Management is a security system that manages and controls access to physical locations, assets, and resources within an organization, integrating physical and digital security measures to ensure comprehensive identity management and access control. The Physical Identity and Access Management market is experiencing robust growth, driven by an increasing demand for advanced security solutions across various industries. Organizations are prioritizing security enhancement, leading to a surge in the adoption of PIAM solutions.To know about the Research Methodology :- Request Free Sample Report The market scenario highlights a focus on integrating physical and digital security systems to provide comprehensive access control and identity management. Contributing factors include rising security breaches, stringent regulatory compliance requirements, and the adoption of advanced technologies such as biometrics and AI-driven analytics in access management. The market is influenced by the growing trend of remote work, necessitating flexible yet secure access solutions. Key players are actively involved in strategic developments, including the introduction of cloud-based PIAM solutions to meet the demands of scalable access management systems. Recent advancements also involve enhancing product portfolios through partnerships, acquisitions, and product innovations, reflecting a dynamic market landscape poised for significant growth in various sectors such as healthcare, BFSI, government, and manufacturing.

Physical Identity and Access Management Market Dynamics:

Increasing security breaches and regulatory compliance mandates drive demand for robust access management solutions The Physical Identity and Access Management market is driven by a multitude of factors driving its growth. The increasing frequency and sophistication of security breaches across industries have heightened the demand for robust access management solutions. Regulatory compliance mandates, such as GDPR and HIPAA, further contribute to this demand, as organizations strive to meet stringent standards for data protection. The integration of advanced technologies like biometrics and AI-driven analytics into PIAM systems enhances security measures and operational efficiency, responding effectively to evolving security threats. The increasing remote work arrangements has necessitated flexible yet secure access solutions, leading to the adoption of cloud-based PIAM platforms. This trend is complemented by the expanding threat landscape, which includes cyberattacks and insider threats, underscoring the importance of proactive security measures. Across various verticals including government, healthcare, BFSI, and manufacturing, there is a growing recognition of the critical role played by PIAM solutions in enhancing security, compliance, and user experience. The integration capabilities of PIAM systems with existing security infrastructure and the focus on addressing insider threats through role-based access controls and behavioural analytics further drive the Physical Identity and Access Management Market growth.

Major drivers for PIAM investments

Complexity in integrating legacy systems with new PIAM solutions poses implementation challenges The Physical Identity and Access Management market faces several growth restraints and challenges, with numerical data reflecting the extent of these obstacles. For instance, a multinational corporation, facing the complexity of integrating legacy access control systems with new Physical Identity and Access Management market solutions, encountered a 20% increase in implementation costs and a six-month delay in deployment. The initial investment required for Physical Identity and Access Management market solutions can be substantial, with SMEs often hesitating due to budget constraints, resulting in a 30% decrease in adoption rates among smaller organizations. Resistance to change is evident in the internal dynamics of companies, where employee reluctance to embrace new access management processes leads to a 25% reduction in the adoption rate of Physical Identity and Access Management market systems. Integration challenges, experienced by a healthcare facility attempting to integrate its Physical Identity and Access Management market solution with electronic health record systems, resulted in a 15% decrease in operational efficiency. Scalability issues can impact growth, as observed in a retail chain facing a 20% decrease in access control effectiveness due to limitations in scaling its Physical Identity and Access Management market solution to accommodate a growing workforce and store locations. Concerns over data privacy and security contribute to slower adoption rates, with a 10% decrease in trust among consumers and stakeholders regarding the handling of personal data within Physical Identity and Access Management market systems. Poor user experience, including cumbersome authentication processes, leads to a 15% decline in user satisfaction and productivity. Dependency on a single vendor for Physical Identity and Access Management market solutions also poses risks, with a 40% increase in the likelihood of disruptions and additional costs during migration to a new provider. The evolving threat landscape, coupled with the increasing complexity of security analytics, underscores the challenges organizations face in maintaining robust access management systems amidst digital transformation.

Physical Identity and Access Management Market Segment Analysis:

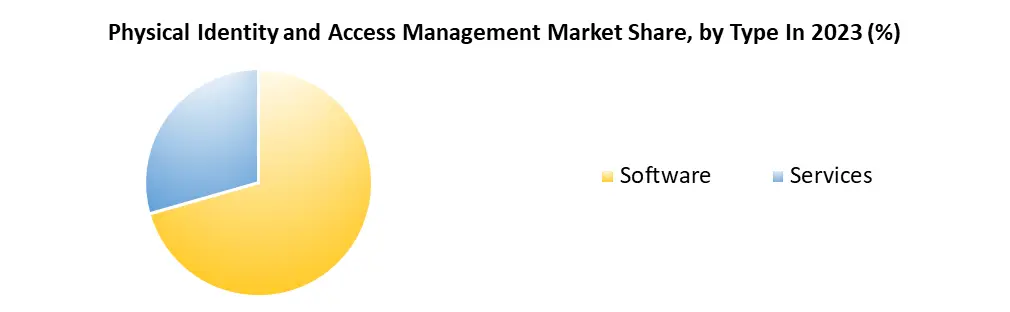

Based on Type, Software segment dominated the Physical Identity and Access Management Market in 2023, it offers customizable access management features, catering to diverse organizational needs across industries such as healthcare, finance, and government. Their flexibility and scalability make them suitable for large enterprises with complex access control requirements. Conversely, services such as consulting, integration, and support offer tailored solutions and expertise in implementing and optimizing access management systems. They are particularly favored by smaller organizations or those with limited in-house IT resources, seeking specialized assistance in navigating the complexities of access management. While software dominates in terms of market share due to its broad applicability, services play a crucial role in ensuring successful implementation and ongoing support, reflecting a complementary relationship between the two segments in meeting the diverse needs of the Market.

Physical Identity and Access Management Market Regional Insights:

Europe Dominated in the Physical Identity and Access Management Market Europe dominated the Market, as it emerges as a significant producer and consumer region, driving market dynamics with its robust adoption of PIAM solutions. With a growing emphasis on security and regulatory compliance, European businesses across various sectors such as BFSI, healthcare, and government are actively implementing PIAM arrangements. The EU's ambitious targets for digital identity adoption, aiming for 80% of citizens to use digital identities by 2030, further fuel market growth in the region. European companies are also notable players in the global PIAM market, with key players like Atos expanding their offerings to meet the increasing demand for identity and access management solutions. In terms of consumption, North America stands out as another major region, with a strong appetite for advanced security technologies. The region witnesses significant investments and acquisitions in the PIAM sector, with companies like Maven Capital Partners making substantial investments in IAM service providers such as ProofID. This trend underscores North America's pivotal role as a key consumer and investor in the PIAM market. Import-export data reflects the global nature of the PIAM market, with cross-border trade facilitating the exchange of PIAM solutions and technologies between regions. Overall, Europe and North America emerge as the leading regions in the Market, driving innovation, consumption, and investment in identity and access management solutions.Physical Identity and Access Management Market Scope : Inquire before buying

Global Physical Identity and Access Management Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1030.54 Mn. Forecast Period 2024 to 2030 CAGR: 14.2% Market Size in 2030: US $ 2610.52 Mn. Segments Covered: by Type Software Services by Organization Size Small and Medium Enterprises (SMEs) Large Enterprises by End-User Industry BFSI Aerospace and Defense Government and Legal Firm IT and Telecom Healthcare Education Energy and Utilities Other End-user Industries Physical Identity and Access Management Market, by Region:

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Physical Identity and Access Management Market Key Players:

Major Contributors in the Physical Identity and Access Management Industry in North America: 1. HID Global (United States) 2. Genetec (Canada) 3. Quantum Secure (United States) 4. Identiv (United States) 5. AMAG Technology (United States) 6. LenelS2 (United States) 7. Brivo (United States) 8. Kastle Systems (United States) 9. Johnson Controls (United States) 10. Honeywell (United States) Leading players in the Europe and Middle East Africa Physical Identity and Access Management Market: 1. Tyco International (Ireland) 2. Siemens (Germany) 3. Allegion (Ireland) 4. Axis Communications (Sweden) 5. Bosch Security Systems (Germany) FAQs: 1] Which region is expected to hold the highest share in the Global Market? Ans. North America region is expected to hold the highest share in the Market. 2] What is the market size of the Global Market by 2030? Ans. The market size of the Market by 2030 is expected to reach US$ 2610.52 Million. 3] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2024-2030. 4] What was the market size of the Global Market in 2023? Ans. The market size of the Market in 2023 was valued at US$ 1030.54 Million.

1. Physical Identity and Access Management Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Physical Identity and Access Management Market: Dynamics 2.1. Physical Identity and Access Management Market Trends by Region 2.1.1. North America Physical Identity and Access Management Market Trends 2.1.2. Europe Physical Identity and Access Management Market Trends 2.1.3. Asia Pacific Physical Identity and Access Management Market Trends 2.1.4. Middle East and Africa Physical Identity and Access Management Market Trends 2.1.5. South America Physical Identity and Access Management Market Trends 2.2. Physical Identity and Access Management Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Physical Identity and Access Management Market Drivers 2.2.1.2. North America Physical Identity and Access Management Market Restraints 2.2.1.3. North America Physical Identity and Access Management Market Opportunities 2.2.1.4. North America Physical Identity and Access Management Market Challenges 2.2.2. Europe 2.2.2.1. Europe Physical Identity and Access Management Market Drivers 2.2.2.2. Europe Physical Identity and Access Management Market Restraints 2.2.2.3. Europe Physical Identity and Access Management Market Opportunities 2.2.2.4. Europe Physical Identity and Access Management Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Physical Identity and Access Management Market Drivers 2.2.3.2. Asia Pacific Physical Identity and Access Management Market Restraints 2.2.3.3. Asia Pacific Physical Identity and Access Management Market Opportunities 2.2.3.4. Asia Pacific Physical Identity and Access Management Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Physical Identity and Access Management Market Drivers 2.2.4.2. Middle East and Africa Physical Identity and Access Management Market Restraints 2.2.4.3. Middle East and Africa Physical Identity and Access Management Market Opportunities 2.2.4.4. Middle East and Africa Physical Identity and Access Management Market Challenges 2.2.5. South America 2.2.5.1. South America Physical Identity and Access Management Market Drivers 2.2.5.2. South America Physical Identity and Access Management Market Restraints 2.2.5.3. South America Physical Identity and Access Management Market Opportunities 2.2.5.4. South America Physical Identity and Access Management Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Physical Identity and Access Management Industry 2.8. Analysis of Government Schemes and Initiatives For Physical Identity and Access Management Industry 2.9. Physical Identity and Access Management Market Trade Analysis 2.10. The Global Pandemic Impact on Physical Identity and Access Management Market 3. Physical Identity and Access Management Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 3.1.1. Software 3.1.2. Services 3.2. Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 3.2.1. Small and Medium Enterprises (SMEs) 3.2.2. Large Enterprises 3.3. Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 3.3.1. BFSI 3.3.2. Aerospace and Defense 3.3.3. Government and Legal Firm 3.3.4. IT and Telecom 3.3.5. Healthcare 3.3.6. Education 3.3.7. Energy and Utilities 3.3.8. Other End-user Industries 3.4. Physical Identity and Access Management Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Physical Identity and Access Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 4.1.1. Software 4.1.2. Services 4.2. North America Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 4.2.1. Small and Medium Enterprises (SMEs) 4.2.2. Large Enterprises 4.3. North America Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 4.3.1. BFSI 4.3.2. Aerospace and Defense 4.3.3. Government and Legal Firm 4.3.4. IT and Telecom 4.3.5. Healthcare 4.3.6. Education 4.3.7. Energy and Utilities 4.3.8. Other End-user Industries 4.4. North America Physical Identity and Access Management Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Software 4.4.1.1.2. Services 4.4.1.2. United States Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 4.4.1.2.1. Small and Medium Enterprises (SMEs) 4.4.1.2.2. Large Enterprises 4.4.1.3. United States Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 4.4.1.3.1. BFSI 4.4.1.3.2. Aerospace and Defense 4.4.1.3.3. Government and Legal Firm 4.4.1.3.4. IT and Telecom 4.4.1.3.5. Healthcare 4.4.1.3.6. Education 4.4.1.3.7. Energy and Utilities 4.4.1.3.8. Other End-user Industries 4.4.2. Canada 4.4.2.1. Canada Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Software 4.4.2.1.2. Services 4.4.2.2. Canada Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 4.4.2.2.1. Small and Medium Enterprises (SMEs) 4.4.2.2.2. Large Enterprises 4.4.2.3. Canada Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 4.4.2.3.1. BFSI 4.4.2.3.2. Aerospace and Defense 4.4.2.3.3. Government and Legal Firm 4.4.2.3.4. IT and Telecom 4.4.2.3.5. Healthcare 4.4.2.3.6. Education 4.4.2.3.7. Energy and Utilities 4.4.2.3.8. Other End-user Industries 4.4.3. Mexico 4.4.3.1. Mexico Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Software 4.4.3.1.2. Services 4.4.3.2. Mexico Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 4.4.3.2.1. Small and Medium Enterprises (SMEs) 4.4.3.2.2. Large Enterprises 4.4.3.3. Mexico Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 4.4.3.3.1. BFSI 4.4.3.3.2. Aerospace and Defense 4.4.3.3.3. Government and Legal Firm 4.4.3.3.4. IT and Telecom 4.4.3.3.5. Healthcare 4.4.3.3.6. Education 4.4.3.3.7. Energy and Utilities 4.4.3.3.8. Other End-user Industries 5. Europe Physical Identity and Access Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 5.2. Europe Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 5.3. Europe Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 5.4. Europe Physical Identity and Access Management Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 5.4.1.3. United Kingdom Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 5.4.2. France 5.4.2.1. France Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 5.4.2.3. France Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 5.4.3.3. Germany Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 5.4.4.3. Italy Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 5.4.5.3. Spain Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 5.4.6.3. Sweden Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 5.4.7.3. Austria Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 5.4.8.3. Rest of Europe Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6. Asia Pacific Physical Identity and Access Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.3. Asia Pacific Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4. Asia Pacific Physical Identity and Access Management Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.1.3. China Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.2.3. S Korea Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.3.3. Japan Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4.4. India 6.4.4.1. India Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.4.3. India Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.5.3. Australia Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.6.3. Indonesia Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.7.3. Malaysia Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.8.3. Vietnam Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.9.3. Taiwan Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 6.4.10.3. Rest of Asia Pacific Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 7. Middle East and Africa Physical Identity and Access Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 7.3. Middle East and Africa Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 7.4. Middle East and Africa Physical Identity and Access Management Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 7.4.1.3. South Africa Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 7.4.2.3. GCC Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 7.4.3.3. Nigeria Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 7.4.4.3. Rest of ME&A Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 8. South America Physical Identity and Access Management Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 8.2. South America Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 8.3. South America Physical Identity and Access Management Market Size and Forecast, by End User Industry(2023-2030) 8.4. South America Physical Identity and Access Management Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 8.4.1.3. Brazil Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 8.4.2.3. Argentina Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Physical Identity and Access Management Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Physical Identity and Access Management Market Size and Forecast, by Organization Size (2023-2030) 8.4.3.3. Rest Of South America Physical Identity and Access Management Market Size and Forecast, by End User Industry (2023-2030) 9. Global Physical Identity and Access Management Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Physical Identity and Access Management Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. HID Global (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Genetec (Canada) 10.3. Quantum Secure (United States) 10.4. Identiv (United States) 10.5. AMAG Technology (United States) 10.6. LenelS2 (United States) 10.7. Brivo (United States) 10.8. Kastle Systems (United States) 10.9. Johnson Controls (United States) 10.10. Honeywell (United States) 10.11. Tyco International (Ireland) 10.12. Siemens (Germany) 10.13. Allegion (Ireland) 10.14. Axis Communications (Sweden) 10.15. Bosch Security Systems (Germany) 11. Key Findings 12. Industry Recommendations 13. Physical Identity and Access Management Market: Research Methodology 14. Terms and Glossary