Global Pet Insurance Market size was valued at USD 8.31 Bn. in 2024, and the total Pet Insurance Market revenue is expected to grow by 16.7% from 2025 to 2032, reaching nearly USD 28.59 Bn.Pet Insurance Market Overview:

Pet insurance is a health insurance policy that is meant to cover medical and wellness expenses for domestic animals, specifically dogs and cats, and recently, exotic pets. Originally focused on accident-only policies, the pet insurance industry has grown into a dynamic business model with attractively customizable accident & illness policies, more than one wellness add-on, behavioral, and some guarantees or lifetime benefits. As pet humanization takes root globally, owners are starting to spend more on pet healthcare procedures, diagnostics, surgeries, and preventive care as they treat pets more like family. Specifically, advanced treatments like chemo, MRIs, and behaviour therapy have caused a demand for pet insurance. For example, lifetime policies and in-the-moment insurance processing via mobile apps are now standard in North America and Europe, and increasing in popularity in Asia-Pacific and Latin America as space becomes urbanized, pet ownership changes, and the ability to access new insurance products via mobile. The emergence and growth of digital-first insurance platforms like Trupanion, ManyPets, and Lemonade that cater to tech-savvy pet owners are propelling insurance buy-in from millennials and Gen Z pet owners. The report covered a comprehensive market drivers such as increasing costs of veterinary care, growing interest in pet health, increased access to digital sales channels, and the rise of AI-enabled claims handling. The segments are by policy type, type of animal, service provider, and channel of distribution. Key players in the global pet insurance market, including Trupanion, Petplan (Allianz), Nationwide, Embrace Pet Insurance, ManyPets, and Agria, all of whom are increasingly investing in mobile-first platforms, live reimbursement, and expansion in cross-markets. The report notes that technological innovation, integration with wellness, and country-specific interest are redefining the global pet insurance paradigm. Examples of more recent trends include integration with coverage for mental and behavioral health, multi-pet policies, and ecosystem partnerships with vet clinics, telehealth service providers, and e-commerce providers of pet supplies.To know about the Research Methodology :- Request Free Sample Report

Global Pet Insurance Market Dynamics:

Rising Pet Ownership Rates to Drive Pet Insurance Market Growth

The global acceptance of companion animals, primarily dogs and cats, continues to be an important factor in the growth of the pet insurance market, including Ongoing urbanization, increased disposable income, deep emotional connections, and the ever-increasing acceptance of pet relatives. In the US alone, pet owners make up more than 70% of households based on 2024 estimates, with comparable trends across Europe and growing trends in other parts of Asia-Pacific. This increase in pet ownership leads to more visits to the veterinarian and preventive care, and a greater willingness for pet owners to invest in long-term planning for the health and well-being of their pets.Rising Pet Ownership and Growing Awareness to Create New Opportunities in Emerging Pet Insurance Markets

Emerging regions in the pet insurance market are expanding faster in the Asia-Pacific (APAC), Latin America, and the Middle East & Africa (MEA) regions. Growth in pet ownership rates, disposable income (primarily in developing countries), and awareness of pet health and well-being are leading factors for growth in pet insurance. Urbanization and changes in lifestyles (mainly among millennials) associated with economic development and their existing desire for "better" pet care in markets like India, China, Brazil, and South Africa are also factors for growth in pet insurance.Inconsistent Coding and Administrative Gaps to Create Pet Insurance Markets Challenge

The lack of standardized reimbursement codes in the pet insurance space is causing considerable administrative challenges, slowing down market efficiencies and claims processing. Unlike human health care systems with standardized coding systems like ICD or CPT, a universal framework for coding the diagnoses and treatment of animals is rarely seen. The current lack of standardization increases delays, creates manual reviews of claims, and disagreements between insurers, pet owners, and veterinarians.Global Pet Insurance Market Segment Analysis

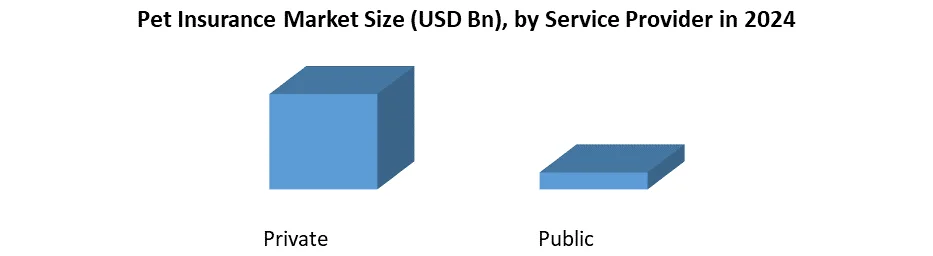

Based on the Policy Type, the global Pet Insurance market is sub-segmented into Accident & illness, Accident only, and Others. The Accident & illness segment held the largest market share of xx% in 2024. High veterinary treatment and diagnostic expenses, the rise of the companion animal population, and increased knowledge of pet insurance are the main drivers of the segment. Lifetime insurance is a complete plan that covers the lives of animals for the rest of their lives. Accident and illness, surgery, and hospitalisation are all covered under the contract coverage. For young animals, this is the most advantageous policy. Also, the Accident only segment held the 2nd largest market share of xx% in 2024. The segment's main drivers include an increase in animal health issues and expensive treatment expenses. Accident-only coverage is only available for animals that are not qualified for lifetime or non-lifetime coverage. In addition, an accident-only coverage can cover older animals with pre-existing conditions.Based on the Service Provider, the global Pet Insurance market is sub-segmented into Private and Public. The private segment is expected to grow at the highest growth at CAGR of xx% during the forecast period due to emerging private insurance companies. The preference of pet owners to buy insurance from private companies has been increasing as the public sector insurers offer only protection against death, while the private players are covering both death and disease. Moreover, strategies such as digital marketing, competitive pricing on the premium, and innovative schemes adopted by the private companies are expected to create major growth opportunities in the private segment.

Pet Insurance Market Regional Insights

Europe dominates the Global Pet Insurance market during the forecast period 2025-2032. Europe held the largest market share of xx% in 2024. As of 2024, 23.0% of pets in the United Kingdom and 30.0 of pets in Sweden were insured, according to the Department of Clinical Veterinary Science and the Pet Food Institute. Pet insurance, on the other hand, covered only 1% of all pets in the United States. The presence of significant corporations and advantageous insurance policies is assisting in the region's growth. North America held the 2nd largest market of xx% in 2024. The key driving factors in the US region are high pet ownership, increased awareness, increased pet insurance, and technical advances in the diagnostics industry. The socioeconomic conditions in the country are sufficient to provide economic support to the market at both the production and end-user levels. As per the 2025-2032 National Pet Owners Survey performed by the American Pet Products Association, 67 percent of US homes, or around 85 million families, own a pet (APPA). As per the 2025-2032 National Pet Parents Survey conducted by the American Pet Products Association, there were 89.7 million dogs and 94.2 million cats in the United States. Asia Pacific is expected to grow rapidly at a CAGR of xx% in the global pet insurance market during the forecast period 2025-2032. The rapid growth of the pet insurance market in the region can be ascribed to factors such as pet owners' concern about their pets' health, increased spending capacity, the number of pet accidents, and government initiatives aimed at animal welfare. The objective of the report is to present a comprehensive analysis of the global Pet Insurance Market to the stakeholders in the industry. The past and current status of the industry, with the forecasted market size and trends, are presented in the report, with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.Pet Insurance Market Competitive Landscape

The Pet Insurance Market is a highly competitive market, which is influenced by numerous InsurTech players and global insurers who are developing cutting-edge features and digital experiences. Key competitors such as Petplan and Trupanion are developing pet insurance products that include accident, illness, wellness, and even behavioral health segments with innovations in claims automation and partnerships with veterinarians. Petplan (UK), which has been acquired by Allianz, is a market leader in the United Kingdom, with a strong network of approved veterinary practices and trust within its brand. Covers dogs, cats, and rabbits and offers comprehensive coverage for a wide variety of types of claims. Petplan has continuously expanded its operability in Europe and emphasized preventive care with its add-on wellness products and educational content. Petplan reports that most major veterinary practices are members of its approved network. Trupanion (USA) reported revenue of USD 327 million in 2024, employs over 860,000 pets enrolled on the basis of its Vet Direct Pay platform, making payments to clinics in real-time, without the requirement of additional administration. Both companies are investing heavily in digital products, personalized features of insurance products, and international expansion to enhance and maintain their footprint and market position in a rapidly changing pet insurance market.Pet Insurance Market Key Recent Development

• In May 2025, Trupanion (US) reported a rise in anxiety-related claims among its insured dogs and cats of 93% in six years, with states reporting claims as high as 150%, indicating an increasing need for behavioral health in pets. • Petplan (UK) released findings from a new survey in January 2025, revealing that 58% of UK "pawrents" are cautiously planning for their pets' future, indicating a stronger consumer focus on long-term pet wellness. • In May 2025, Anicom Holdings (Japan) announced that it achieved record earnings for Q3 FY2025 and announced a USD 3 billion share buyback program and an increase in dividend guidance, evidencing its financial strength and stability in the Japanese pet insurance market. • Embrace Pet Insurance (US) released its annual report regarding 2024 trends and records in February 2025, and provided assurance for continued strong growth; recent reviews in June 2025 focused on its fully customizable coverage, wellness rewards, multi-pet and military discounts. • Nationwide Mutual Insurance (US) is facing a federal class-action proceeding brought on June 4, 2025, and notable consumer backlash after it chose to cancel around 100,000 "Whole Pet with Wellness" policies as veterinary costs have soared.Pet Insurance Market Key Recent Trends

Category Key Trend Example Product Market Impact Behavioral Coverage Inclusion of mental health and behavioral conditions Trupanion Behavioral Health Add-ons Responds to 90% surge in anxiety claims, expanding definition of pet wellness Policy Design Shift toward customizable Accident & Illness plans with add-ons Embrace Wellness Rewards, Trupanion Lifetime Plan Boost in customer retention and average policy value across North America & Europe. Distribution Channel Growth of digital-first direct-to-consumer models Lemonade Pet, Spot Insurance Apps Increased policy uptake among millennials and Gen Z via mobile platforms Pet Insurance Market Scope: Inquire before buying

Global Pet Insurance Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 8.31 Bn. Forecast Period 2025 to 2032 CAGR: 16.7% Market Size in 2032: USD 28.59 Bn. Segments Covered: by Policy Type Accident & illness Accident only Others by Service Provider Private Public by Animal Type Dogs Cats Others by Sales Channel Agency Broker Direct Bancassurance Others Pet Insurance Market by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Pet Insurance Market Key Players are:

North America 1. Warburg Pincus (USA) 2. Nationwide (USA) 3. Trupanion (USA) 4. Hartville Group (USA) 5. Embrace (USA) 6. PetFirst Healthcare LLC (USA) 7. Petsecure (Canada) 8. Floracopeia Inc. (USA) Europe 9. Royal & Sun Alliance (RSA) (UK) 10. Direct Line Group (UK) 11. Agria (Sweden) 12. Petplan Limited (UK) 13. UniKode S.A. (France) 14. Robertet Groupe (France) 15. Lluch Essence Sl (Spain) 16. International Flavors and Fragrances Inc. (USA) 17. Fleurchem Inc (USA) Asia Pacific 18. Anicom Holding (Japan) 19. IPET Insurance (Japan) 20. Japan Animal Club (Japan)Frequently Asked Questions:

1. Which region has the largest share in the Global Pet Insurance Market? Ans: The Europe region held the highest share in 2024. 2. What is the growth rate of the Global Pet Insurance Market? Ans: The Global Market is expected to grow at a CAGR of 16.7% during the forecast period 2025-2032. 3. What is the scope of the Global Pet Insurance Market report? Ans: The Global Pet Insurance Market report helps with the PESTEL, Porter's, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global Pet Insurance Market? Ans: The important key players in the Global Pet Insurance Market are – Petplan (UK), Trupanion (USA), Warburg Pincus (USA), Royal & Sun Alliance (RSA) (UK), Direct Line Group (UK) 5. What is the study period of this market? Ans: The Global Pet Insurance Market is studied from 2024 to 2032.

1. Pet Insurance Market: Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pet Insurance Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Pet Insurance Market: Dynamics 3.1. Region-wise Trends of the Pet Insurance Market 3.1.1. North America Pet Insurance Market Trends 3.1.2. Europe Pet Insurance Market Trends 3.1.3. Asia Pacific Pet Insurance Market Trends 3.1.4. Middle East and Africa Pet Insurance Market Trends 3.1.5. South America Pet Insurance Market Trends 3.2. Pet Insurance Market Dynamics 3.2.1. Global Pet Insurance Market Drivers 3.2.1.1. Rising Pet Ownership Rates 3.2.2. Global Pet Insurance Market Restraints 3.2.3. Global Pet Insurance Market Opportunities 3.2.3.1. Rising Pet Ownership and Growing Awareness 3.2.4. Global Pet Insurance Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Animal welfare laws encouraging pet care 3.4.2. Growth of the pet economy in emerging markets 3.4.3. Rise in nuclear families and single-person households owning pets 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Pet Insurance Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 4.1.1. Accident & illness 4.1.2. Accident only 4.1.3. Others 4.2. Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 4.2.1. Private 4.2.2. Public 4.3. Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 4.3.1. Dogs 4.3.2. Cats 4.3.3. Others 4.4. Pet Insurance Market Size and Forecast, by Sales Channel (2024-2032) 4.4.1 Agency 4.4.2 Broker 4.4.3 Direct 4.4.4 Bancassurance 4.4.5 Others 4.5. Pet Insurance Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Pet Insurance Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 5.1.1. Accident & illness 5.1.2. Accident only 5.1.3. Others 5.2. North America Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 5.2.1. Private 5.2.2. Public 5.3. North America Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 5.3.1. Dogs 5.3.2. Cats 5.3.3. Others 5.4. North America Pet Insurance Market Size and Forecast, by Sales Channel (2024-2032) 5.4.1 Agency 5.4.2 Broker 5.4.3 Direct 5.4.4 Bancassurance 5.4.5 Others 5.5. North America Pet Insurance Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 5.5.1.1.1. Accident & illness 5.5.1.1.2. Accident only 5.5.1.1.3. Others 5.5.1.2. United States Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 5.5.1.2.1. Private 5.5.1.2.2. Public 5.5.1.3. United States Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 5.5.1.3.1. Dogs 5.5.1.3.2. Cats 5.5.1.3.3. Others 5.5.1.4. United States Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 5.5.1.4.1. Agency 5.5.1.4.2. Broker 5.5.1.4.3. Direct 5.5.1.4.4. Bancassurance 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 5.5.2.1.1. Accident & illness 5.5.2.1.2. Accident only 5.5.2.1.3. Others 5.5.2.2. Canada Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 5.5.2.2.1. Private 5.5.2.2.2. Public 5.5.2.3. Canada Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 5.5.2.3.1. Dogs 5.5.2.3.2. Cats 5.5.2.3.3. Others 5.5.2.4. Canada Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 5.5.2.4.1. Agency 5.5.2.4.2. Broker 5.5.2.4.3. Direct 5.5.2.4.4. Bancassurance 5.5.2.4.5. Others 5.5.2.5. Mexico Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 5.5.2.5.1. Accident & illness 5.5.2.5.2. Accident only 5.5.2.5.3. Others 5.5.2.6. Mexico Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 5.5.2.6.1. Private 5.5.2.6.2. Public 5.5.2.7. Mexico Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 5.5.2.7.1. Dogs 5.5.2.7.2. Cats 5.5.2.7.3. Others 5.5.2.8. Mexico Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 5.5.2.8.1. Agency 5.5.2.8.2. Broker 5.5.2.8.3. Direct 5.5.2.8.4. Bancassurance 5.5.2.8.5. Others 6. Europe Pet Insurance Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 6.2. Europe Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 6.3. Europe Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 6.4. Europe Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 6.5. Europe Pet Insurance Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 6.5.1.2. United Kingdom Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 6.5.1.3. United Kingdom Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 6.5.1.4. United Kingdom Pet Insurance Market Size and Forecast, By Sales Channel(2024-2032) 6.5.2. France 6.5.2.1. France Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 6.5.2.2. France Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 6.5.2.3. France Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 6.5.2.4. France Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 6.5.3.2. Germany Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 6.5.3.3. Germany Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 6.5.3.4. Germany Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 6.5.4.2. Italy Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 6.5.4.3. Italy Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 6.5.4.4. Italy Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 6.5.5.2. Spain Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 6.5.5.3. Spain Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 6.5.5.4. Spain Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 6.5.6.2. Sweden Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 6.5.6.3. Sweden Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 6.5.6.4. Sweden Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 6.5.7.2. Austria Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 6.5.7.3. Austria Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 6.5.7.4. Austria Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 6.5.8.2. Rest of Europe Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 6.5.8.3. Rest of Europe Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 6.5.8.4. Rest of Europe Pet Insurance Market Size and Forecast, By Sales Channel(2024-2032) 7. Asia Pacific Pet Insurance Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.2. Asia Pacific Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.3. Asia Pacific Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.4. Asia Pacific Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5. Asia Pacific Pet Insurance Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.1.2. China Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.1.3. China Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.1.4. China Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.2.2. S Korea Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.2.3. S Korea Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.2.4. S Korea Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.3.2. Japan Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.3.3. Japan Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.3.4. Japan Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5.4. India 7.5.4.1. India Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.4.2. India Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.4.3. India Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.4.4. India Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.5.2. Australia Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.5.3. Australia Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.5.4. Australia Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.6.2. Indonesia Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.6.3. Indonesia Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.6.4. Indonesia Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.7.2. Philippines Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.7.3. Philippines Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.7.4. Philippines Pet Insurance Market Size and Forecast, By Sales Channel(2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.8.2. Malaysia Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.8.3. Malaysia Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.8.4. Malaysia Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.9.2. Vietnam Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.9.3. Vietnam Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.9.4. Vietnam Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.10.2. Thailand Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.10.3. Thailand Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.10.4. Thailand Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 7.5.11.3. Rest of Asia Pacific Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 7.5.11.4. Rest of Asia Pacific Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 8. Middle East and Africa Pet Insurance Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 8.2. Middle East and Africa Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 8.3. Middle East and Africa Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 8.4. Middle East and Africa Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 8.5. Middle East and Africa Pet Insurance Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 8.5.1.2. South Africa Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 8.5.1.3. South Africa Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 8.5.1.4. South Africa Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 8.5.2.2. GCC Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 8.5.2.3. GCC Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 8.5.2.4. GCC Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 8.5.3.2. Nigeria Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 8.5.3.3. Nigeria Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 8.5.3.4. Nigeria Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 8.5.4.2. Rest of ME&A Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 8.5.4.3. Rest of ME&A Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 8.5.4.4. Rest of ME&A Pet Insurance Market Size and Forecast, By Sales Channel(2024-2032) 9. South America Pet Insurance Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 9.2. South America Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 9.3. South America Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 9.4. South America Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 9.5. South America Pet Insurance Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 9.5.1.2. Brazil Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 9.5.1.3. Brazil Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 9.5.1.4. Brazil Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 9.5.2.2. Argentina Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 9.5.2.3. Argentina Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 9.5.2.4. Argentina Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Pet Insurance Market Size and Forecast, By Policy Type (2024-2032) 9.5.3.2. Rest of South America Pet Insurance Market Size and Forecast, By Service Provider (2024-2032) 9.5.3.3. Rest of South America Pet Insurance Market Size and Forecast, By Animal Type (2024-2032) 9.5.3.4. Rest of South America Pet Insurance Market Size and Forecast, By Sales Channel (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Petplan Limited (UK) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Warburg Pincus (USA) 10.3. Nationwide (USA) 10.4. Trupanion (USA) 10.5. Hartville Group (USA) 10.6. Embrace (USA) 10.7. PetFirst Healthcare LLC (USA) 10.8. Petsecure (Canada) 10.9. Royal & Sun Alliance (RSA) (UK) 10.10. Direct Line Group (UK) 10.11. Agria (Sweden) 10.12. UniKode S.A. (France) 10.13. Robertet Groupe (France) 10.14. Lluch Essence Sl (Spain) 10.15. International Flavors and Fragrances Inc. (USA) 10.16. Fleurchem Inc (USA) 10.17. Anicom Holding (Japan) 10.18. IPet Insurance (Japan) 10.19. Japan Animal Club (Japan) 10.20. Floracopeia Inc. (USA) 11. Key Findings 12. Analyst Recommendations 13. Pet Insurance Market: Research Methodology