Perlite Market was valued at US$ 1.59 Bn. in 2022. The global Perlite Market size is expected to grow at a CAGR of 6.5 % through the forecast period.Perlite Market Overview:

Perlite, also known as pearl stone, is a naturally occurring siliceous rock that is created when molten lava cools quickly. It is often found in a variety of hues, including green, grey, brown, blue, and red, and includes a high concentration of silica. Perlite is a stable amorphous aluminum silicate that possesses a number of qualities, including a high level of heat resistance, a low bulk density, low sound transmission, a large surface area, and a low level of thermal conductivity. Chemicals like calcium, magnesium, iron, and potassium oxides are also present. Perlite is mostly discovered in volcanic areas and is made using open-pit techniques including blasting and ripping.To know about the Research Methodology:-Request Free Sample Report

Perlite Market Dynamics:

Market Drivers: Robust growth in the building & construction industry in developing countries: During the forecast period, it's Expected that expenditure on infrastructure and capital projects would increase dramatically. Significant investments are being made in the building and construction sector by South Africa, Brazil, China, India, and other Asia-Pacific nations. To modernize and commercialize, this investment is necessary. The investment in crucial infrastructure sectors like power, building, and transportation is expected to increase as a result of the rapid urbanization in rising economies like India, Malaysia, Thailand, and Brazil. The usage of perlite is expected to rise as the economic climate in these developing regions improves. In addition to being used as an aggregate in lightweight insulating concrete and plaster in masonry blocks as loose-fill insulation material and as a cavity wall in residential homes, perlite is also used in specialized applications like chimney fills, fireproofing sprays, acoustical sprays, and interstitial floors. Expanded perlite aggregate (EPA), a lightweight material that guarantees financial advantages in building and construction, is utilized as heat and sound insulation. Increasing Demand for Agro-perlite in Fillers: The use of agro-perlite enhances the soil's quality because of its chemical makeup, which is derived from volcanic soil. The crop's ripening period is shortened by 20% when perlite is added to the soil, and the crop's yield is increased by 50%. From 1:3 to 1:4, depending mostly on the soil type is the appropriate perlite to soil ratio. In order to allow for breathing, it is used on a limited amount in soils of the clay and sand kind. Furthermore, it prevents fungal and pest growth. It is simpler for plants or crops to thrive since agro-perlite keeps nutrients nearby. The volcanic rock known as agro-perlite has undergone a heat-treatment process to make it more brittle and permeable to air and water in order to enhance soil properties. It is a safe, eco-friendly product. It can be spread over the top or bottom of the flower container, mixed with soil, or both. Future demand for agro-perlite in fillers is expected to increase due to such causes as well as government help in the form of programs. Market Restraints: Restrictions on the Use of Refractories due to Growing Environmental Concerns: Hazardous gases such sulfur dioxide (SO2), nitrogen oxides (NOx), carbon monoxide (CO), carbon dioxide (CO2), fluorides, and volatile organic compounds are released during the manufacture of refractories (VOCs). While gases and VOCs are released during burning and tar and pitch operations, respectively, PM is released as a result of processes including crushing, grinding, calcining, and drying. The recycling of chrome-based refractories, which are mostly used in the iron and steel sector, is encouraged in the US by rules on the disposal of refractory waste and recommendations for their usage. In a similar vein, initiatives like ReStaR (Review and enhancement of testing Standards for Refractory goods) have been undertaken in Europe to guarantee the accuracy and dependability of the present refractory testing standards. The usage of refractory materials is subject to these environmental rules, which also serve as a barrier to the market's growth for perlite. Hazardous Effects of Perlite: Governments have adopted strict restrictions regarding greenhouse gas emissions from manufacturing facilities as they hinder the production of high-quality perlite materials in response to growing concerns about the environmental effect of perlite. Standard tests are carried out to confirm that the perlite ore complies with the rules set out by the European Industrial Gases Association (EIGA), which is focused on particular issues connected to the usage of particular perlite ores. Regulatory organizations like the US Food and Drug Administration also have performance criteria for the perlite business that it must adhere to (FDA). For its usage in filtration, agriculture, and building, perlite is subject to stringent standards. Perlite falls under the category of nuisance or inert dust; exposure to such dust may occasionally cause transient physical pain, decreased visibility, and an increased risk of chronic illnesses. Such health risks are a barrier to the perlite market's growthPerlite Market Segment Analysis:

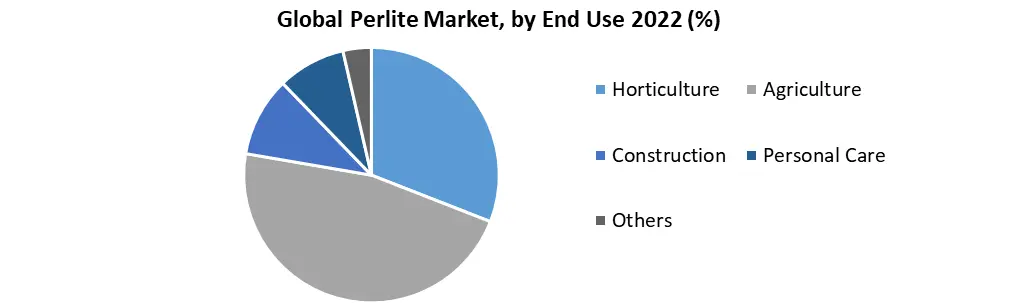

Based on Application, the Perlite Market is segmented into Plaster, Mortar, Ceiling Tiles, Concrete, and Others. In terms of value, the Plaster and Concrete sector will continue to dominate the Perlite market in 2022, with a share of 44 % of the total market. In addition to being used as an aggregate in lightweight insulating concrete and plaster in masonry blocks as loose-fill insulation material and as a cavity wall in residential homes, perlite is also used in specialized applications like chimney fills, fireproofing sprays, acoustical sprays, and interstitial floors. Expanded perlite aggregate (EPA), a lightweight material that guarantees financial advantages in building and construction, is utilized as heat and sound insulation. Based on the End User, the Perlite Market is segmented into Horticulture, Agriculture, Construction, Personal Care, and Others. With a revenue share of nearly 36 % in 2022, the application of construction products led the global market. By 2029, the category is expected to account for more than 34% of the market. Throughout the forecast period, market growth is expected to be boosted by the increased need for strong, lightweight, and efficient raw materials in the building sector. Because it is inexpensive and has a low density, the industrial mineral is used in a variety of building and construction materials, including ceiling tiles, insulation, mortar, concrete, and lightweight plasters. Since rising nations in the Asia Pacific have been developing their infrastructure at a faster rate than those in developed economies, the region has dominated the global construction industry in recent years and is expected to continue dominating the sector. Personal care, environmental protection, soap, toothpaste, and detergents are among the other application segments. Perlite aids are used to filter liquids in the food, beverage, and pharmaceutical sectors because of their inert and sterile characteristics.

Perlite Market Regional Insights:

The Asia Pacific region dominated the market with a 38 % share in 2022. The Asia Pacific region is expected to witness significant growth at a CAGR of 8% through the forecast period. Agricultural output has demonstrated an exceptional yield because of the increased use of perlite in horticulture. Increased yield, which is likely to increase perlite consumption, can also be achieved by using a hydroponic system. Perlite is also utilized in the building sector as a filler for a variety of purposes, including acoustics, ceiling tiles, floor heating insulations, and walls that absorb road noise. Consumption of perlite is Expected to rise throughout the forecast period due to increasing construction activity. In North America, the construction and automotive industries are both showing indications of growth. Some of the factors driving the growth of the construction sector in the area include declining unemployment rates, the implementation of significant infrastructure-related legislation, and lower pricing as a result of shale gas flooding the market. Over the course of the forecast period, rising living standards and growing demand for housing are expected to further fuel the industry. The objective of the report is to present a comprehensive analysis of the global Perlite Market to the stakeholders in the industry. The past and current status of the industry with the forecast market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help understand the Perlite Market dynamic, and structure by analyzing the market segments and projecting the Perlite Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Perlite Market make the report investor’s guide.Perlite Market Scope: Inquire before buying

Global Perlite Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 1.59 Bn. Forecast Period 2023 to 2029 CAGR: 6.5% Market Size in 2029: US$ 2.48 Bn. Segments Covered: by Type Crude Perlite Expanded Perlite Crushed Perlite Vapex Perlite Others by Application Plaster Mortar Ceiling Tiles Concrete Others by End User Horticulture Agriculture Construction Personal Care Others Perlite Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Perlite Market, Key Players are

1. Imerys Minerals 2. Keltech Energies 3. Dupre Minerals 4. Bergama Mining 5. Gulf Perlite LLC 6. Carolina Perlite Company 7. Cornerstone Industries Ltd. 8. Perlite-Hellas Ltd. 9. Genper Group 10. Australian Perlite Limited 11. Aegean Perlites SA 12. Ausperl Pty Ltd. 13. Azer Perlite Corporation 14. Bergama Mining Perlite 15. Cornerstone Industrial Mineral Corporation Frequently Asked Questions: 1] What segments are covered in the Global Perlite Market report? Ans. The segments covered in the Perlite Market report are based on Type, Application, and End User. 2] Which region is expected to hold the highest share in the Global Perlite Market? Ans. The Asia Pacific region is expected to hold the highest share in the Perlite Market. 3] What is the market size of the Global Perlite Market by 2029? Ans. The market size of the Perlite Market by 2029 is expected to reach US$ 2.48 Bn. 4] What is the forecast period for the Global Perlite Market? Ans. The forecast period for the Perlite Market is 2023-2029. 5] What was the market size of the Global Perlite Market in 2022? Ans. The market size of the Perlite Market in 2022 was valued at US$ 1.59 Bn.

1. Global Perlite Market Size: Research Methodology 2. Global Perlite Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Perlite Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Perlite Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Perlite Market Size Segmentation 4.1. Global Perlite Market Size, by Type (2022-2029) 4.1.1. Crude Perlite 4.1.2. Expanded Perlite 4.1.3. Crushed Perlite 4.1.4. Vapex Perlite 4.1.5. Others 4.2. Global Perlite Market Size, by Application (2022-2029) 4.2.1. Plaster 4.2.2. Mortar 4.2.3. Ceiling Tiles 4.2.4. Concrete 4.2.5. Others 4.3. Global Perlite Market Size, by End User (2022-2029) 4.3.1. Horticulture 4.3.2. Agriculture 4.3.3. Construction 4.3.4. Personal Care 4.3.5. Others 5. North America Perlite Market (2022-2029) 5.1. North America Perlite Market Size, by Type (2022-2029) 5.1.1. Crude Perlite 5.1.2. Expanded Perlite 5.1.3. Crushed Perlite 5.1.4. Vapex Perlite 5.1.5. Others 5.2. North America Perlite Market Size, by Application (2022-2029) 5.2.1. Plaster 5.2.2. Mortar 5.2.3. Ceiling Tiles 5.2.4. Concrete 5.2.5. Others 5.3. North America Perlite Market Size, by End User (2022-2029) 5.3.1. Horticulture 5.3.2. Agriculture 5.3.3. Construction 5.3.4. Personal Care 5.3.5. Others 5.4. North America Perlite Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Perlite Market (2022-2029) 6.1. European Perlite Market, by End User (2022-2029) 6.2. European Perlite Market, by Type (2022-2029) 6.3. European Perlite Market, by Application (2022-2029) 6.4. European Perlite Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Perlite Market (2022-2029) 7.1. Asia Pacific Perlite Market, by End User (2022-2029) 7.2. Asia Pacific Perlite Market, by Type (2022-2029) 7.3. Asia Pacific Perlite Market, by Application (2022-2029) 7.4. Asia Pacific Perlite Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Perlite Market (2022-2029) 8.1. Middle East and Africa Perlite Market, by End User (2022-2029) 8.2. Middle East and Africa Perlite Market, by Type (2022-2029) 8.3. Middle East and Africa Perlite Market, by Application (2022-2029) 8.4. Middle East and Africa Perlite Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Perlite Market (2022-2029) 9.1. South America Perlite Market, by End User (2022-2029) 9.2. South America Perlite Market, by Type (2022-2029) 9.3. South America Perlite Market, by Application (2022-2029) 9.4. South America Perlite Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Imerys Minerals 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Keltech Energies 10.3. Dupre Minerals 10.4. Bergama Mining 10.5. Gulf Perlite LLC 10.6. Carolina Perlite Company 10.7. Cornerstone Industries Ltd. 10.8. Perlite-Hellas Ltd. 10.9. Genper Group 10.10. Australian Perlite Limited 10.11. Aegean Perlites SA 10.12. Ausperl Pty Ltd. 10.13. Azer Perlite Corporation 10.14. Bergama Mining Perlite 10.15. Cornerstone Industrial Mineral Corporation