The Polyurethane Market size was valued at USD 80.23 Bn in 2023 and market revenue is growing at a CAGR of 5.2% from 2024 to 2030, reaching nearly USD 114.41Bn by 2030.Polyurethane Market Overview:

Polyurethanes are a class of materials valued by consumers for their high performance and durability. Polyurethane foam used in furniture, insulation, and bedding is the most easily recognizable product. Polyurethane materials are also found in paints and coatings, adhesives, sealants, elastomer fibers, and rubberized products, such as conveyor belt rollers. In the construction industry, polyurethane is widely used for insulation purposes, contributing to energy efficiency in buildings. The demand for polyurethane-based components in vehicle manufacturing is rapidly increasing. Due to utilization in the manufacturing of various components including seats, dashboards, and bumpers, owing to its lightweight and impact-resistant nature. Especially as the market shifts towards New Energy Vehicles (NEVs). According to the MMR Study Report In 2022, more than 3.4 million NEVs, including battery-electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs), were projected to be sold in China, indicating a boost in the Polyurethane Market.To know about the Research Methodology :- Request Free Sample Report Also, the increasing demand for eco-friendly materials. This means more products are made from renewable sources like soybeans, reducing reliance on fossil fuels. Also, new recycling methods are emerging to reuse polyurethane waste, reflecting a growing focus on sustainability in manufacturing these factors is significantly responsible for the growth of the Polyurethane Market.

Polyurethane Market Dynamics:

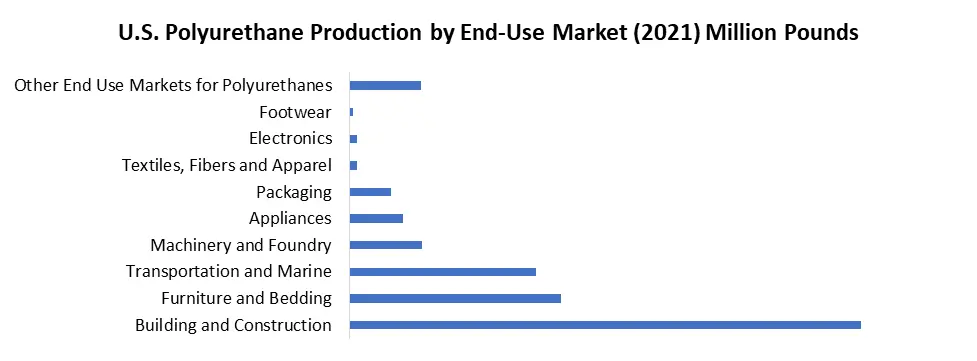

Driver Rising Building and Construction drives the Polyurethane Market The surge in construction activities is increasing the demand for energy-efficient buildings, thus boosting the utilization of polyurethane insulation materials This Factor Significantly drives the growth Polyurethane Market. This trend reflects a growing awareness among builders, developers, and consumers regarding the importance of energy conservation in structures. Polyurethane insulation materials enhance energy efficiency by reducing heat transfer, hence lowering the need for constant heating and cooling. Also, the escalating need for durable sealants and adhesives in construction applications is driving the adoption of polyurethane-based solutions, thanks to their strong bonding and sealing properties. Urbanization further intensifies construction endeavors, particularly in densely populated urban areas, where polyurethane finds extensive application due to its efficiency and effectiveness. The United States leads in polyurethane consumption for construction purposes, with building and construction accounting for a substantial share of this usage. Rigid polyurethane foam stands out as a favored choice for wall and roof insulation, insulated panels, and gap fillers, offering numerous benefits including energy efficiency, high performance, and environmental friendliness. Its exceptional insulating properties allow for thinner walls and lower-profile roofs, maximizing space utilization and reducing operating costs. Also, polyurethane-based coatings, adhesives, and sealants are used to enhance structural integrity, weatherproofing, and overall longevity in diverse construction applications. This symbiotic relationship between rising construction activities and the Polyurethane Market underscores its significance in shaping the modern built environment.Growing demand for environmentally friendly products boosts Polyurethane Market Growth Creating bio-based polyurethane and environmentally friendly formulations corresponds to customer expectations and regulatory changes. Green polyurethane product development increases market share by attracting eco-aware organizations and customers. As environmental awareness continues to rise, consumers become more conscious of the impact of their purchases, which significantly boosts the Polyurethane Market growth. This opportunity is expected to drive an increased demand for green polyurethane products. It increases market size as businesses reach out to a new consumer base who are seeking environmentally friendly and sustainable products. Advancements in technology and material science are expected to result in the development of more efficient and cost-effective processes for producing bio-based polyurethane, making it increasingly attractive for manufacturers. Countries such as Germany, China, Netherlands, and Japan have a strong focus on research and developments in bio-based materials, and growing their emphasis on sustainability and their position as major manufacturing hubs drives the research and development initiatives in bio-based polyurethane technologies. Restrain Exposure Risks and Environmental Concerns limit the growth of the Polyurethane Market The Exposure risks and environmental concerns pose significant challenges to the growth of the polyurethane market. PU production involves potentially hazardous substances such as isocyanates, which adversely affect respiratory health and soil quality. Strict regulations in many countries govern the production of PUs due to their environmental impact, including soil and aquatic contamination. Despite PU's beneficial properties, such as improving strength and erosion resistance, its use raises concerns about pollution, particularly from microplastics. Environmental implications arise from inadequate measures to control contamination during PU application, posing risks to ecosystems. Also, the transportation of PU sealants in soil, facilitated by moisture, exacerbates environmental exposure. Studies indicate that while PU enhances soil mechanical properties, its usage must be carefully regulated to minimize adverse environmental effects. Therefore, exposure risks and environmental concerns surrounding PU production and application inhibit the Polyurethane market growth. Addressing these challenges requires implementing stricter regulations, developing eco-friendly alternatives, and adopting sustainable practices to mitigate environmental impact while harnessing the benefits of PU technology.

Opportunity Rising Demand from Automotive Industry Creates Lucrative Growth Opportunities for the Polyurethane Market Growth The automotive industry sees huge potential in the polyurethane market due to its pursuit of lighter, more efficient, and comfortable vehicles. Polyurethane is widely used in various car components, from seating and interior trim to insulation and structural parts, showcasing its versatility. Flexible polyurethane foams, valued for their lightweight, resilience, and sound absorption, are integral to automobile interiors, including seating, headrests, and HVAC systems. Rigid polyurethane foam serves as insulation in refrigerated trucks and some automotive panels, enhancing energy efficiency and sound absorption. Polyurethane coatings provide durability, scratch resistance, and corrosion protection to vehicle exteriors, while adhesives ensure strong bonds for exterior and interior components. Polyurethane elastomers are used in seals, gaskets, and shock absorbers, offering tire puncture protection and enhancing safety. Thermoplastic polyurethane materials find application in various automobile parts, including exterior body parts and brake systems. Reaction injection molding (RIM) produces lightweight polyurethane parts for vehicle fenders, bumpers, and spoilers, improving shock absorption without adding bulk. This shift from metal alloys to polyurethane versions reduces susceptibility to damage and corrosion. Polyurethane's lightweight nature, coupled with its mechanical properties, addresses automakers' need for fuel efficiency without compromising safety. Its design flexibility allows for complex shapes and contours, meeting both aesthetic and functional requirements. Additionally, polyurethane's acoustic and thermal insulation properties contribute to a quieter and more comfortable cabin environment, enhancing the overall driving experience. As the automotive industry explores new technologies like electric and autonomous vehicles, specialized polyurethane solutions continue driving further innovation and Polyurethane Market growth.

Regulation Aspect Description Environmental Regulations Government-imposed limits on emissions of volatile organic compounds (VOCs) and requirements for pollution control equipment. Worker Safety Regulations Occupational safety and health regulations governing chemical handling, equipment operation, and workplace conditions. Chemical Safety Regulations Regulations on handling, storage, transportation, and disposal of chemicals used in polyurethane production to minimize risks. Product Quality and Labeling Regulations Requirements for product testing, certification, and accurate labeling of polyurethane products to ensure consumer safety and prevent misleading claims. Waste Management Regulations Regulations addressing waste minimization, recycling, and proper disposal of waste materials generated during polyurethane production. Transportation Regulations Regulations governing the transportation of polyurethane materials, including packaging, labeling, and transportation of hazardous materials. Permitting and Reporting Requirements Requirements for obtaining permits, compliance with operating conditions and environmental standards, and reporting of emissions, chemical usage, and waste generation. According to MMR Study Report In 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Therefore, the demand for the polyurethane is rapidly growing

Impact Area Description Description 1. Diisocyanates (MDI, TDI, HMDI,IPDI, HDI) 2. Polyether Polyols 3. Polyester Polyols 4. PTMEG 5. Additive 1. Flexible Foams 2. Rigid Foams 3. Coatings 4. Adhesives 5. Sealants 6. Elastomers 7. Reaction Injection Molding 8. (RIM) 9. Thermoplastic 10. Polyurethane (TPU) 11. Binders 12. Spandex Fibers 1. Appliances 2. Automotive 3. Building & Construction 4. Electronics 5. Footwear 6. Furniture & Bedding 7. Packaging 8. Textiles & Apparel 9. Other Polyurethane Market Segment Analysis

Based On End User, the building and construction segment dominated the End User segment of the Polyurethane Market in the year 2023. Due to its versatile applications and inherent properties. Polyurethane offers exceptional insulation, durability, and versatility, making it ideal for various construction needs such as insulation, roofing, flooring, and sealants. Additionally, its ability to enhance energy efficiency in buildings aligns with global sustainability initiatives, driving its adoption. The segment's dominance is boosted by rapid urbanization, infrastructure development, and increasing demand for energy-efficient solutions worldwide. Also, advancements in polyurethane technology have led to innovative products tailored to meet the evolving needs of the construction industry, cementing its position as a preferred material choice. As construction activities continue to surge globally, the building and construction segment is expected to maintain its dominance in the polyurethane market. According to MMR study Report in the United States primary end-use industries represent an additional $370 billion in revenues and receipts and more than 1 million jobs, nearly 1.0% of total nonfarm employment in the U.S. This section examines the economic impact of the makers of the products and providers of services that rely on the 7.7 billion pounds of polyurethane materials and additives consumed in 2021.

Polyurethane Market Regional Analysis

Asia Pacific region dominated the Polyurethane Market in the year 2023. With growing construction activities and rapid urbanization in China and India, polyurethane usage is increasing. The region's booming construction industry, particularly in countries like China and India, has been a major driver of polyurethane demand. Polyurethane is extensively used in construction for insulation, sealants, adhesives, and coatings, among other applications. With rapid urbanization and infrastructure development, the demand for polyurethane-based construction materials has been consistently high. China, amidst a construction mega-boom, has seen a remarkable surge in construction works output value, reaching USD 3.72 trillion in 2021. With an expected expenditure of nearly USD 13 trillion on buildings by 2030, the demand for polyurethane, a versatile material widely used in construction, is projected to increase. The region's burgeoning middle-class population, coupled with increasing disposable incomes, has led to a surge in demand for consumer goods. Polyurethane is widely used in the production of furniture, footwear, mattresses, and other consumer products due to its versatility, durability, and comfort properties. The robust furniture markets in countries such as China and India have significantly contributed to the dominance of the Asia-Pacific region in the polyurethane market.Polyurethane Market Competitive Analysis The polyurethane market is witnessing intense competition as key players adopt various strategies to maintain and increase their market share. For example, Pearl Polyurethane Systems' expansion into India underscores the importance of geographical expansion to better serve clients in emerging markets. Recital NV/SA's launch of polyurethane insulation boards with bio-circular raw materials reflects a commitment to sustainability, targeting environmentally-conscious consumers. DIC Corporation's introduction of waterborne polyurethane resins highlights a shift towards eco-friendly alternatives, aligning with growing environmental concerns. Covestro AG's inauguration of a new production line and launch of the Desmopan UP thermoplastic polyurethane series signifies a focus on innovation to provide specific industry needs, such as providing paint protection film in the wind and automotive sectors. These moves indicate a dynamic market landscape driven by a combination of technological innovation, sustainability efforts, and strategic expansion initiatives.

Polyurethane market Scope: Inquire before buying

Global Polyurethane Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 80.23 Bn. Forecast Period 2024 to 2030 CAGR: 5.2% Market Size in 2030: US $ 114.41 Bn. Segments Covered: by Raw Material MDI PDI Polyols Others by Product Rigid Foam Flexible Foam Coatings Adhesives & Sealants Elastomers Others by End user Furniture and Interiors Construction Electronics & Appliances Automotive Footwear Packaging Others Global Polyurethane market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Polyurethane Market

North America 1. The Dow Chemical Company (USA) 2. Huntsman Corporation (USA) 3. DuPont de Nemours, Inc. (USA) 4. Carpenter Co. (USA) 5. Woodbridge Foam Corporation (Canada) Europe 1. Covestro AG (Germany) 2. BASF SE (Germany) 3. Trelleborg AB (Sweden) 4. Recticel NV/SA (Belgium) 5. FoamPartner Group (Switzerland) 6. LANXESS AG (Germany) Asia Pacific 1. Wanhua Chemical Group Co., Ltd. (China) 2. Mitsui Chemicals, Inc. (Japan) 3. DIC Corporation (Japan) 4. Sekisui Chemical Co., Ltd. (Japan) 5. INOAC Corporation (Japan) 6. Tosoh Corporation (Japan) 7. UBE Industries, Ltd. (Japan) Frequently Asked Questions 1] What segments are covered in the Global Polyurethane Market report? Ans. The segments covered in the Polyurethane Market report are based on, Raw Material, Product, End User, and Regions. 2] Which region is expected to hold the highest share of the Global Polyurethane Market? Ans. The Asia Pacific region is expected to hold the highest share of the Polyurethane Market. 3] What is the market size of the Global Polyurethane Market by 2023? Ans. The market size of the Polyurethane Market by 2023 is expected to reach US$ 80.23 Bn. 4] What was the market size of the Global Polyurethane Market in 2030? Ans. The market size of the Polyurethane Market in 2030 was valued at US$ 114.41 Bn. 5] Key players in the Polyurethane Market. Ans. The Dow Chemical Company (USA), Huntsman Corporation (USA), DuPont de Nemours, Inc. (USA), Carpenter Co. (USA) and Woodbridge Foam Corporation (Canada).

1. Polyurethane Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Polyurethane Market: Dynamics 2.1. Polyurethane Market Trends by Region 2.1.1. North America Polyurethane Market Trends 2.1.2. Europe Polyurethane Market Trends 2.1.3. Asia Pacific Polyurethane Market Trends 2.1.4. Middle East and Africa Polyurethane Market Trends 2.1.5. South America Polyurethane Market Trends 2.2. Polyurethane Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Polyurethane Market Drivers 2.2.1.2. North America Polyurethane Market Restraints 2.2.1.3. North America Polyurethane Market Opportunities 2.2.1.4. North America Polyurethane Market Challenges 2.2.2. Europe 2.2.2.1. Europe Polyurethane Market Drivers 2.2.2.2. Europe Polyurethane Market Restraints 2.2.2.3. Europe Polyurethane Market Opportunities 2.2.2.4. Europe Polyurethane Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Polyurethane Market Drivers 2.2.3.2. Asia Pacific Polyurethane Market Restraints 2.2.3.3. Asia Pacific Polyurethane Market Opportunities 2.2.3.4. Asia Pacific Polyurethane Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Polyurethane Market Drivers 2.2.4.2. Middle East and Africa Polyurethane Market Restraints 2.2.4.3. Middle East and Africa Polyurethane Market Opportunities 2.2.4.4. Middle East and Africa Polyurethane Market Challenges 2.2.5. South America 2.2.5.1. South America Polyurethane Market Drivers 2.2.5.2. South America Polyurethane Market Restraints 2.2.5.3. South America Polyurethane Market Opportunities 2.2.5.4. South America Polyurethane Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Polyurethane Industry 2.8. Analysis of Government Schemes and Initiatives For Polyurethane Industry 2.9. Polyurethane Market Trade Analysis 2.10. The Global Pandemic Impact on Polyurethane Market 3. Polyurethane Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 3.1.1. MDI 3.1.2. PDI 3.1.3. Polyols 3.1.4. Others 3.2. Polyurethane Market Size and Forecast, by Product (2023-2030) 3.2.1. Rigid Foam 3.2.2. Flexible Foam 3.2.3. Coatings 3.2.4. Adhesives & Sealants 3.2.5. Elastomers 3.2.6. Others 3.3. Polyurethane Market Size and Forecast, by End User (2023-2030) 3.3.1. Furniture and Interiors 3.3.2. Construction 3.3.3. Electronics & Appliances 3.3.4. Automotive 3.3.5. Footwear 3.3.6. Packaging 3.3.7. Others 3.4. Polyurethane Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Polyurethane Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 4.1.1. MDI 4.1.2. PDI 4.1.3. Polyols 4.1.4. Others 4.2. North America Polyurethane Market Size and Forecast, by Product (2023-2030) 4.2.1. Rigid Foam 4.2.2. Flexible Foam 4.2.3. Coatings 4.2.4. Adhesives & Sealants 4.2.5. Elastomers 4.2.6. Others 4.3. North America Polyurethane Market Size and Forecast, by End User (2023-2030) 4.3.1. Furniture and Interiors 4.3.2. Construction 4.3.3. Electronics & Appliances 4.3.4. Automotive 4.3.5. Footwear 4.3.6. Packaging 4.3.7. Others 4.4. North America Polyurethane Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 4.4.1.1.1. MDI 4.4.1.1.2. PDI 4.4.1.1.3. Polyols 4.4.1.1.4. Others 4.4.1.2. United States Polyurethane Market Size and Forecast, by Product (2023-2030) 4.4.1.2.1. Rigid Foam 4.4.1.2.2. Flexible Foam 4.4.1.2.3. Coatings 4.4.1.2.4. Adhesives & Sealants 4.4.1.2.5. Elastomers 4.4.1.2.6. Others 4.4.1.3. United States Polyurethane Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Furniture and Interiors 4.4.1.3.2. Construction 4.4.1.3.3. Electronics & Appliances 4.4.1.3.4. Automotive 4.4.1.3.5. Footwear 4.4.1.3.6. Packaging 4.4.1.3.7. Others 4.4.2. Canada 4.4.2.1. Canada Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 4.4.2.1.1. MDI 4.4.2.1.2. PDI 4.4.2.1.3. Polyols 4.4.2.1.4. Others 4.4.2.2. Canada Polyurethane Market Size and Forecast, by Product (2023-2030) 4.4.2.2.1. Rigid Foam 4.4.2.2.2. Flexible Foam 4.4.2.2.3. Coatings 4.4.2.2.4. Adhesives & Sealants 4.4.2.2.5. Elastomers 4.4.2.2.6. Others 4.4.2.3. Canada Polyurethane Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Furniture and Interiors 4.4.2.3.2. Construction 4.4.2.3.3. Electronics & Appliances 4.4.2.3.4. Automotive 4.4.2.3.5. Footwear 4.4.2.3.6. Packaging 4.4.2.3.7. Others 4.4.3. Mexico 4.4.3.1. Mexico Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 4.4.3.1.1. MDI 4.4.3.1.2. PDI 4.4.3.1.3. Polyols 4.4.3.1.4. Others 4.4.3.2. Mexico Polyurethane Market Size and Forecast, by Product (2023-2030) 4.4.3.2.1. Rigid Foam 4.4.3.2.2. Flexible Foam 4.4.3.2.3. Coatings 4.4.3.2.4. Adhesives & Sealants 4.4.3.2.5. Elastomers 4.4.3.2.6. Others 4.4.3.3. Mexico Polyurethane Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Furniture and Interiors 4.4.3.3.2. Construction 4.4.3.3.3. Electronics & Appliances 4.4.3.3.4. Automotive 4.4.3.3.5. Footwear 4.4.3.3.6. Packaging 4.4.3.3.7. Others 5. Europe Polyurethane Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 5.2. Europe Polyurethane Market Size and Forecast, by Product (2023-2030) 5.3. Europe Polyurethane Market Size and Forecast, by End User (2023-2030) 5.4. Europe Polyurethane Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 5.4.1.2. United Kingdom Polyurethane Market Size and Forecast, by Product (2023-2030) 5.4.1.3. United Kingdom Polyurethane Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 5.4.2.2. France Polyurethane Market Size and Forecast, by Product (2023-2030) 5.4.2.3. France Polyurethane Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 5.4.3.2. Germany Polyurethane Market Size and Forecast, by Product (2023-2030) 5.4.3.3. Germany Polyurethane Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 5.4.4.2. Italy Polyurethane Market Size and Forecast, by Product (2023-2030) 5.4.4.3. Italy Polyurethane Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 5.4.5.2. Spain Polyurethane Market Size and Forecast, by Product (2023-2030) 5.4.5.3. Spain Polyurethane Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 5.4.6.2. Sweden Polyurethane Market Size and Forecast, by Product (2023-2030) 5.4.6.3. Sweden Polyurethane Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 5.4.7.2. Austria Polyurethane Market Size and Forecast, by Product (2023-2030) 5.4.7.3. Austria Polyurethane Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 5.4.8.2. Rest of Europe Polyurethane Market Size and Forecast, by Product (2023-2030) 5.4.8.3. Rest of Europe Polyurethane Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Polyurethane Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.2. Asia Pacific Polyurethane Market Size and Forecast, by Product (2023-2030) 6.3. Asia Pacific Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Polyurethane Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.1.2. China Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.1.3. China Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.2.2. S Korea Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.2.3. S Korea Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.3.2. Japan Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.3.3. Japan Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.4.2. India Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.4.3. India Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.5.2. Australia Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.5.3. Australia Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.6.2. Indonesia Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.6.3. Indonesia Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.7.2. Malaysia Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.7.3. Malaysia Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.8.2. Vietnam Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.8.3. Vietnam Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.9.2. Taiwan Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.9.3. Taiwan Polyurethane Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 6.4.10.2. Rest of Asia Pacific Polyurethane Market Size and Forecast, by Product (2023-2030) 6.4.10.3. Rest of Asia Pacific Polyurethane Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Polyurethane Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 7.2. Middle East and Africa Polyurethane Market Size and Forecast, by Product (2023-2030) 7.3. Middle East and Africa Polyurethane Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Polyurethane Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 7.4.1.2. South Africa Polyurethane Market Size and Forecast, by Product (2023-2030) 7.4.1.3. South Africa Polyurethane Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 7.4.2.2. GCC Polyurethane Market Size and Forecast, by Product (2023-2030) 7.4.2.3. GCC Polyurethane Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 7.4.3.2. Nigeria Polyurethane Market Size and Forecast, by Product (2023-2030) 7.4.3.3. Nigeria Polyurethane Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 7.4.4.2. Rest of ME&A Polyurethane Market Size and Forecast, by Product (2023-2030) 7.4.4.3. Rest of ME&A Polyurethane Market Size and Forecast, by End User (2023-2030) 8. South America Polyurethane Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 8.2. South America Polyurethane Market Size and Forecast, by Product (2023-2030) 8.3. South America Polyurethane Market Size and Forecast, by End User(2023-2030) 8.4. South America Polyurethane Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 8.4.1.2. Brazil Polyurethane Market Size and Forecast, by Product (2023-2030) 8.4.1.3. Brazil Polyurethane Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 8.4.2.2. Argentina Polyurethane Market Size and Forecast, by Product (2023-2030) 8.4.2.3. Argentina Polyurethane Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Polyurethane Market Size and Forecast, by Raw Material (2023-2030) 8.4.3.2. Rest Of South America Polyurethane Market Size and Forecast, by Product (2023-2030) 8.4.3.3. Rest Of South America Polyurethane Market Size and Forecast, by End User (2023-2030) 9. Global Polyurethane Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Polyurethane Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. The Dow Chemical Company (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Huntsman Corporation (USA) 10.3. DuPont de Nemours, Inc. (USA) 10.4. Carpenter Co. (USA) 10.5. Woodbridge Foam Corporation (Canada) 10.6. Covestro AG (Germany) 10.7. BASF SE (Germany) 10.8. Trelleborg AB (Sweden) 10.9. Recticel NV/SA (Belgium) 10.10. FoamPartner Group (Switzerland) 10.11. LANXESS AG (Germany) 10.12. Wanhua Chemical Group Co., Ltd. (China) 10.13. Mitsui Chemicals, Inc. (Japan) 10.14. DIC Corporation (Japan) 10.15. Sekisui Chemical Co., Ltd. (Japan) 10.16. INOAC Corporation (Japan) 10.17. Tosoh Corporation (Japan) 10.18. UBE Industries, Ltd. (Japan) 11. Key Findings 12. Industry Recommendations 13. Polyurethane Market: Research Methodology 14. Terms and Glossary