Opto Electronics Market was valued at USD 7.33 Bn. in 2024 and the total Global Opto Electronics Market revenue is Expected to grow at a CAGR of 10.25% from 2025 to 2032 reaching nearly USD 16 Bn. by 2032.Opto electronics Market Overview

Optoelectronic devices are instruments or components that utilize the interaction between light and electricity, including a wide range of technologies such as photodiodes, LEDs, and photovoltaic cells. The optoelectronics market encompasses a diverse range of devices and technologies that leverage the interaction between light and electricity. With applications spanning from telecommunications to healthcare, the market is experiencing robust growth driven by increasing demand for high-performance optoelectronic components in various industries. The growing adoption of optical communication systems is the major Opto electronics market growth driver. The integration of data-intensive applications such as cloud computing, streaming services, and 5G networks has driven the demand for high-speed, high-bandwidth optical communication solutions. Optoelectronic devices such as lasers, photodetectors, and optical fibres are essential components in these systems, driving substantial market growth. The automotive industry represents a burgeoning market for optoelectronic technologies. Advanced driver-assistance systems (ADAS), including LiDAR (Light Detection and Ranging) sensors and LED headlights, are becoming increasingly prevalent in modern vehicles to enhance safety and improve driving experiences. This trend is expected to continue as autonomous driving technology evolves, further driving the demand for optoelectronic components. Geographically, Asia Pacific is expected major share in the Opto electronics market, driven by the rapid industrialization, technological advancements, and expanding consumer electronics market in countries such as China, Japan, and South Korea.To know about the Research Methodology:-Request Free Sample Report

Opto electronics Market Dynamics:

Expansion of Display Technologies driving the growth of Opto electronics Market The increasing demand for high-speed data transmission in telecommunications and data centers necessitates advanced optoelectronic components such as optical transceivers, particularly with the deployment of 5G networks driving the growth of Opto electronics Market. The automotive sector is embracing optoelectronic technologies, exemplified by the adoption of LiDAR sensors for autonomous driving, enhancing navigation precision in vehicles. Optoelectronics plays a major role in healthcare, with technologies such as optical coherence tomography (OCT) revolutionizing medical imaging for early disease detection and treatment planning. Energy efficiency is another key driver, as the market experiences a shift towards LED lighting solutions, such as those offered by Philips Lighting, which consume less energy and have longer lifespans than traditional lighting options. The demand for high-resolution displays, particularly OLED displays in smartphones and TVs, underscores the significance of optoelectronics in the consumer electronics market.Optoelectronic sensors find extensive applications in industrial automation and consumer electronics, facilitating functions like automatic screen dimming in smartphones using infrared proximity sensors. With the rise of IoT devices, optoelectronic sensors enable smart home automation and environmental monitoring. In security systems, optoelectronics is crucial, powering facial recognition technology for enhanced access control and surveillance. Similarly, VR/AR devices leverage optoelectronic components to create immersive experiences, exemplified by Oculus Rift VR headsets. optoelectronic devices such as solar cells are pivotal in renewable energy systems, contributing to the growth of the solar energy market, as demonstrated by companies such as SunPower. High Initial Costs hindering the growth of Opto electronics Market High manufacturing costs associated with optoelectronic components, such as those used in LEDs, limit affordability for both consumers and manufacturers due to expensive fabrication processes hindering the growth of Opto electronics Market. The intricate fabrication processes required for manufacturing optoelectronic devices, such as OLED displays, result in production bottlenecks and increased manufacturing costs, hindering scalability. Technological limitations, such as heat dissipation issues in LEDs, impact their performance and reliability, particularly in high-power applications such as automotive lighting. Additionally, integrating optoelectronic components into existing systems poses challenges due to compatibility issues and design constraints, exemplified by the complexities involved in integrating LiDAR sensors into vehicles. Compliance with stringent regulatory standards, vulnerability to supply chain disruptions, environmental concerns related to manufacturing processes, and competition from alternative technologies like quantum dot displays and microLEDs further add to the challenges faced by the opto electronics market. Intellectual property rights and patent disputes contribute to market uncertainties and increased litigation costs, affecting innovation and market competitiveness.

Opto electronics Market Segment Analysis

Based on Component Type, Photo Voltaic (PV) Cells dominated the Opto electronics Market in 2024 it finds widespread use in renewable energy systems, particularly solar panels for generating electricity from sunlight, driving adoption in residential, commercial, and industrial sectors. Optocouplers, known for their ability to isolate electrical circuits, are extensively employed in telecommunications, automotive, and medical devices for signal transmission and noise reduction applications. Image sensors, integral to digital cameras and smartphones, dominate the consumer electronics market due to their role in capturing high-quality images and videos. Light Emitting Diodes (LEDs), renowned for their energy efficiency and durability, are increasingly replacing traditional lighting solutions in residential, commercial, and automotive lighting applications, driven by the global push for energy conservation and sustainability. Based on Application the market is segmented into Automotive, Consumer Electronics Telecommunication and Healthcare. Consumer electronics segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Dominance due to widespread integration of opto electronic components like LEDs, image sensors, and laser diodes in smartphones, laptops, TVs, and wearable devices. The growing demand for high-resolution displays, facial recognition and advanced camera functionalities further fuels market growth.

Opto electronics Market Regional Insights

Asia Pacific dominated the Opto electronics Market in 2023, particularly in countries such as China, Japan, and South Korea, rapid industrialization, technological advancements, and a rising consumer electronics market drive significant growth in the optoelectronics sector. The region serves as a manufacturing hub for optoelectronic components, with China emerging as a major producer and consumer of LEDs, photovoltaic cells, and display technologies. Asia-Pacific is Expected to Hold a Significant Share in the global market, primarily due to the region's foremost consumer electronics and automobile markets. Development in optoelectronic devices is expected in other areas, including smart city initiatives, emerging innovations like virtual and simulated reality, big data, the Internet of Things (IoT), and intelligent industrial appliances. North America is fast growing region in Opto electronics Market led by the United States, experiences robust demand for optoelectronic devices in sectors like automotive, healthcare, and aerospace, driven by strong investments in research and development. In Europe, steady growth is fueled by initiatives promoting energy efficiency and sustainability, while south America and the Middle East & Africa regions exhibit growing potential, albeit with challenges like limited technological infrastructure and economic uncertainties impacting Opto electronics Market growth. These regional insights underscore the diverse landscape of the optoelectronics market, shaped by varying economic, technological, and regulatory factors across different regions.Recent Developments:

Date Development June 2022 Alfa Chemistry Materials unveiled a full range of high-quality perovskite materials, ideal for various optoelectronic and photovoltaic projects, addressing significant demand for cost-effective energy materials. March 2022 Nisshinbo Micro Devices Inc. completed the development of the NJL5830R reflective-type optoelectronic sensor for touchless pushbuttons, facilitating infection management in public infrastructure like vending machines and elevators. February 2022 Veeco Instruments reported the purchase of multiple Lumina MOCVD Systems by an optoelectronic component manufacturer to advance photonics applications, highlighting the client's utilization of various Veeco technologies. February 2022 Bolite Optoelectronics introduced the laser-based Bolite SW-L automatic side-wiring system, enabling precise alignment for tiled microLED displays, enhancing production control with autonomous handling and 5 um line width. June 2022 OpenLight, a newly established independent venture by Juniper and Synopsys, unveiled the world's first open silicon photonics architecture with integrated lasers, aiming to empower chip makers in constructing high-performance photonic integrated circuits. Global Opto electronics Market Scope:Inquire before buying

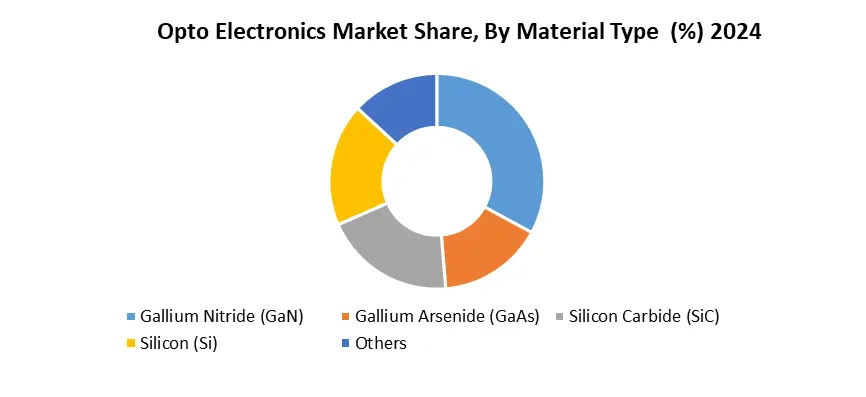

Global Opto electronics Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 7.33 Bn. Forecast Period 2025 to 2032 CAGR: 10.25% Market Size in 2032: USD 16 Bn. Segments Covered: by Component Type Photo Voltaic (PV) Cells Opt couplers Image sensors Light emitting diodes (LED) by Product Type Optical information instruments Optical sources & optoelectronics devices Optical communication Precision instruments Optical materials Optical instruments by Application Automotive Consumer Electronics Telecommunication Healthcare by Material Gallium Nitride (GaN) Gallium Arsenide (GaAs) Silicon Carbide (SiC) Silicon (Si) Others Opto electronics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Opto electronics Market, Key Players

Major Contributors in the Opto electronics Industry in North America: 1. Cree, Inc. - Durham, North Carolina, USA 2. Intel Corporation - Santa Clara, California, USA 3. Texas Instruments - Dallas, Texas, USA 4. Analog Devices, Inc. - Norwood, Massachusetts, USA 5. Broadcom Inc. - San Jose, California, USA Leading players in the Europe Opto electronics Market: 1. Osram Licht AG - Munich, Germany 2. Infineon Technologies AG - Neubiberg, Germany 3. STMicroelectronics - Geneva, Switzerland 4. NXP Semiconductors - Eindhoven, Netherlands 5. Vishay Intertechnology Key players driving the Asia-Pacific Opto electronics Market: 1. Nichia Corporation - Anan, Tokushima, Japan 2. Epistar Corporation - Hsinchu, Taiwan 3. AU Optronics Corp. - Hsinchu, Taiwan 4. LG Innotek - Seoul, South Korea 5. Sharp Corporation - Sakai, JapanFrequently Asked Questions:

Q1. What was the market value of the Opto Electronics Market in 2024? Ans: The Opto Electronics Market was valued at USD 7.33 Billion in 2024. Q2. Which component dominated the market based on component type in 2024? Ans: Photovoltaic (PV) Cells dominated the market in 2023 due to their widespread use in solar energy systems. Q3. What is the expected CAGR of the Opto Electronics Market from 2025 to 2032? Ans: The market is expected to grow at a CAGR of 10.25% during the forecast period 2025–2032. Q4. Which application segment held the largest market share in 2024? Ans: Consumer Electronics dominated the market in 2024 due to the integration of opto electronics in devices like smartphones and TVs. Q5. Which material led the market in 2024 based on material segmentation? Ans: Gallium Arsenide (GaAs) led the market due to its superior performance in high-frequency opto electronic applications.

1. Opto electronics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Opto electronics Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Opto electronics Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Opto electronics Market: Dynamics 3.1. Opto electronics Market Trends by Region 3.1.1. North America Opto electronics Market Trends 3.1.2. Europe Opto electronics Market Trends 3.1.3. Asia Pacific Opto electronics Market Trends 3.1.4. Middle East and Africa Opto electronics Market Trends 3.1.5. South America Opto electronics Market Trends 3.2. Opto electronics Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Opto electronics Market Drivers 3.2.1.2. North America Opto electronics Market Restraints 3.2.1.3. North America Opto electronics Market Opportunities 3.2.1.4. North America Opto electronics Market Challenges 3.2.2. Europe 3.2.2.1. Europe Opto electronics Market Drivers 3.2.2.2. Europe Opto electronics Market Restraints 3.2.2.3. Europe Opto electronics Market Opportunities 3.2.2.4. Europe Opto electronics Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Opto electronics Market Drivers 3.2.3.2. Asia Pacific Opto electronics Market Restraints 3.2.3.3. Asia Pacific Opto electronics Market Opportunities 3.2.3.4. Asia Pacific Opto electronics Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Opto electronics Market Drivers 3.2.4.2. Middle East and Africa Opto electronics Market Restraints 3.2.4.3. Middle East and Africa Opto electronics Market Opportunities 3.2.4.4. Middle East and Africa Opto electronics Market Challenges 3.2.5. South America 3.2.5.1. South America Opto electronics Market Drivers 3.2.5.2. South America Opto electronics Market Restraints 3.2.5.3. South America Opto electronics Market Opportunities 3.2.5.4. South America Opto electronics Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Opto electronics Industry 3.8. Analysis of Government Schemes and Initiatives For Opto electronics Industry 3.9. Opto electronics Market Trade Analysis 3.10. The Global Pandemic Impact on Opto electronics Market 4. Opto electronics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Opto electronics Market Size and Forecast, by Component Type (2024-2032) 4.1.1. Photo Voltaic (PV) Cells 4.1.2. Opt couplers 4.1.3. Image sensors 4.1.4. Light emitting diodes (LED) 4.2. Opto electronics Market Size and Forecast, by Product Type (2024-2032) 4.2.1. Optical information instruments 4.2.2. Optical sources & optoelectronics devices 4.2.3. Optical communication 4.2.4. Precision instruments 4.2.5. Optical materials 4.2.6. Optical instruments 4.3. Opto electronics Market Size and Forecast, by Application (2024-2032) 4.3.1. Automotive 4.3.2. Consumer Electronics 4.3.3. Telecommunication 4.3.4. Healthcare 4.4. Opto electronics Market Size and Forecast, by Material (2024-2032) 4.4.1. Gallium Nitride (GaN) 4.4.2. Gallium Arsenide (GaAs) 4.4.3. Silicon Carbide (SiC) 4.4.4. Silicon (Si) 4.4.5. Others 4.5. Opto electronics Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Opto electronics Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Opto electronics Market Size and Forecast, by Component Type (2024-2032) 5.1.1. Photo Voltaic (PV) Cells 5.1.2. Opt couplers 5.1.3. Image sensors 5.1.4. Light emitting diodes (LED) 5.2. North America Opto electronics Market Size and Forecast, by Product Type (2024-2032) 5.2.1. Optical information instruments 5.2.2. Optical sources & optoelectronics devices 5.2.3. Optical communication 5.2.4. Precision instruments 5.2.5. Optical materials 5.2.6. Optical instruments 5.3. North America Opto electronics Market Size and Forecast, by Application (2024-2032) 5.3.1. Automotive 5.3.2. Consumer Electronics 5.3.3. Telecommunication 5.3.4. Healthcare 5.4. North America Opto electronics Market Size and Forecast, by Material (2024-2032) 5.4.1. Gallium Nitride (GaN) 5.4.2. Gallium Arsenide (GaAs) 5.4.3. Silicon Carbide (SiC) 5.4.4. Silicon (Si) 5.4.5. Others 5.5. North America Opto electronics Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Opto electronics Market Size and Forecast, by Component Type (2024-2032) 5.5.1.1.1. Photo Voltaic (PV) Cells 5.5.1.1.2. Opt couplers 5.5.1.1.3. Image sensors 5.5.1.1.4. Light emitting diodes (LED) 5.5.1.2. United States Opto electronics Market Size and Forecast, by Product Type (2024-2032) 5.5.1.2.1. Optical information instruments 5.5.1.2.2. Optical sources & optoelectronics devices 5.5.1.2.3. Optical communication 5.5.1.2.4. Precision instruments 5.5.1.2.5. Optical materials 5.5.1.2.6. Optical instruments 5.5.1.3. United States Opto electronics Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Automotive 5.5.1.3.2. Consumer Electronics 5.5.1.3.3. Telecommunication 5.5.1.3.4. Healthcare 5.5.1.4. United States Opto electronics Market Size and Forecast, by Material (2024-2032) 5.5.1.4.1. Gallium Nitride (GaN) 5.5.1.4.2. Gallium Arsenide (GaAs) 5.5.1.4.3. Silicon Carbide (SiC) 5.5.1.4.4. Silicon (Si) 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Opto electronics Market Size and Forecast, by Component Type (2024-2032) 5.5.2.1.1. Photo Voltaic (PV) Cells 5.5.2.1.2. Opt couplers 5.5.2.1.3. Image sensors 5.5.2.1.4. Light emitting diodes (LED) 5.5.2.2. Canada Opto electronics Market Size and Forecast, by Product Type (2024-2032) 5.5.2.2.1. Optical information instruments 5.5.2.2.2. Optical sources & optoelectronics devices 5.5.2.2.3. Optical communication 5.5.2.2.4. Precision instruments 5.5.2.2.5. Optical materials 5.5.2.2.6. Optical instruments 5.5.2.3. Canada Opto electronics Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Automotive 5.5.2.3.2. Consumer Electronics 5.5.2.3.3. Telecommunication 5.5.2.3.4. Healthcare 5.5.2.4. Canada Opto electronics Market Size and Forecast, by Material (2024-2032) 5.5.2.4.1. Gallium Nitride (GaN) 5.5.2.4.2. Gallium Arsenide (GaAs) 5.5.2.4.3. Silicon Carbide (SiC) 5.5.2.4.4. Silicon (Si) 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Opto electronics Market Size and Forecast, by Component Type (2024-2032) 5.5.3.1.1. Photo Voltaic (PV) Cells 5.5.3.1.2. Opt couplers 5.5.3.1.3. Image sensors 5.5.3.1.4. Light emitting diodes (LED) 5.5.3.2. Mexico Opto electronics Market Size and Forecast, by Product Type (2024-2032) 5.5.3.2.1. Optical information instruments 5.5.3.2.2. Optical sources & optoelectronics devices 5.5.3.2.3. Optical communication 5.5.3.2.4. Precision instruments 5.5.3.2.5. Optical materials 5.5.3.2.6. Optical instruments 5.5.3.3. Mexico Opto electronics Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Automotive 5.5.3.3.2. Consumer Electronics 5.5.3.3.3. Telecommunication 5.5.3.3.4. Healthcare 5.5.3.4. Mexico Opto electronics Market Size and Forecast, by Material (2024-2032) 5.5.3.4.1. Gallium Nitride (GaN) 5.5.3.4.2. Gallium Arsenide (GaAs) 5.5.3.4.3. Silicon Carbide (SiC) 5.5.3.4.4. Silicon (Si) 5.5.3.4.5. Others 6. Europe Opto electronics Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Opto electronics Market Size and Forecast, by Component Type (2024-2032) 6.2. Europe Opto electronics Market Size and Forecast, by Product Type (2024-2032) 6.3. Europe Opto electronics Market Size and Forecast, by Application (2024-2032) 6.4. Europe Opto electronics Market Size and Forecast, by Material (2024-2032) 6.5. Europe Opto electronics Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Opto electronics Market Size and Forecast, by Component Type (2024-2032) 6.5.1.2. United Kingdom Opto electronics Market Size and Forecast, by Product Type (2024-2032) 6.5.1.3. United Kingdom Opto electronics Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Opto electronics Market Size and Forecast, by Material (2024-2032) 6.5.2. France 6.5.2.1. France Opto electronics Market Size and Forecast, by Component Type (2024-2032) 6.5.2.2. France Opto electronics Market Size and Forecast, by Product Type (2024-2032) 6.5.2.3. France Opto electronics Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Opto electronics Market Size and Forecast, by Material (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Opto electronics Market Size and Forecast, by Component Type (2024-2032) 6.5.3.2. Germany Opto electronics Market Size and Forecast, by Product Type (2024-2032) 6.5.3.3. Germany Opto electronics Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Opto electronics Market Size and Forecast, by Material (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Opto electronics Market Size and Forecast, by Component Type (2024-2032) 6.5.4.2. Italy Opto electronics Market Size and Forecast, by Product Type (2024-2032) 6.5.4.3. Italy Opto electronics Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Opto electronics Market Size and Forecast, by Material (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Opto electronics Market Size and Forecast, by Component Type (2024-2032) 6.5.5.2. Spain Opto electronics Market Size and Forecast, by Product Type (2024-2032) 6.5.5.3. Spain Opto electronics Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Opto electronics Market Size and Forecast, by Material (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Opto electronics Market Size and Forecast, by Component Type (2024-2032) 6.5.6.2. Sweden Opto electronics Market Size and Forecast, by Product Type (2024-2032) 6.5.6.3. Sweden Opto electronics Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Opto electronics Market Size and Forecast, by Material (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Opto electronics Market Size and Forecast, by Component Type (2024-2032) 6.5.7.2. Austria Opto electronics Market Size and Forecast, by Product Type (2024-2032) 6.5.7.3. Austria Opto electronics Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Opto electronics Market Size and Forecast, by Material (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Opto electronics Market Size and Forecast, by Component Type (2024-2032) 6.5.8.2. Rest of Europe Opto electronics Market Size and Forecast, by Product Type (2024-2032) 6.5.8.3. Rest of Europe Opto electronics Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Opto electronics Market Size and Forecast, by Material (2024-2032) 7. Asia Pacific Opto electronics Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.2. Asia Pacific Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.3. Asia Pacific Opto electronics Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5. Asia Pacific Opto electronics Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.1.2. China Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.1.3. China Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.2.2. S Korea Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.2.3. S Korea Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.3.2. Japan Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.3.3. Japan Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5.4. India 7.5.4.1. India Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.4.2. India Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.4.3. India Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.5.2. Australia Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.5.3. Australia Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.6.2. Indonesia Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.6.3. Indonesia Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.7.2. Malaysia Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.7.3. Malaysia Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.8.2. Vietnam Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.8.3. Vietnam Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.9.2. Taiwan Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.9.3. Taiwan Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Opto electronics Market Size and Forecast, by Material (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Opto electronics Market Size and Forecast, by Component Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Opto electronics Market Size and Forecast, by Product Type (2024-2032) 7.5.10.3. Rest of Asia Pacific Opto electronics Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Opto electronics Market Size and Forecast, by Material (2024-2032) 8. Middle East and Africa Opto electronics Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Opto electronics Market Size and Forecast, by Component Type (2024-2032) 8.2. Middle East and Africa Opto electronics Market Size and Forecast, by Product Type (2024-2032) 8.3. Middle East and Africa Opto electronics Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Opto electronics Market Size and Forecast, by Material (2024-2032) 8.5. Middle East and Africa Opto electronics Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Opto electronics Market Size and Forecast, by Component Type (2024-2032) 8.5.1.2. South Africa Opto electronics Market Size and Forecast, by Product Type (2024-2032) 8.5.1.3. South Africa Opto electronics Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Opto electronics Market Size and Forecast, by Material (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Opto electronics Market Size and Forecast, by Component Type (2024-2032) 8.5.2.2. GCC Opto electronics Market Size and Forecast, by Product Type (2024-2032) 8.5.2.3. GCC Opto electronics Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Opto electronics Market Size and Forecast, by Material (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Opto electronics Market Size and Forecast, by Component Type (2024-2032) 8.5.3.2. Nigeria Opto electronics Market Size and Forecast, by Product Type (2024-2032) 8.5.3.3. Nigeria Opto electronics Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Opto electronics Market Size and Forecast, by Material (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Opto electronics Market Size and Forecast, by Component Type (2024-2032) 8.5.4.2. Rest of ME&A Opto electronics Market Size and Forecast, by Product Type (2024-2032) 8.5.4.3. Rest of ME&A Opto electronics Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Opto electronics Market Size and Forecast, by Material (2024-2032) 9. South America Opto electronics Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Opto electronics Market Size and Forecast, by Component Type (2024-2032) 9.2. South America Opto electronics Market Size and Forecast, by Product Type (2024-2032) 9.3. South America Opto electronics Market Size and Forecast, by Application(2024-2032) 9.4. South America Opto electronics Market Size and Forecast, by Material (2024-2032) 9.5. South America Opto electronics Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Opto electronics Market Size and Forecast, by Component Type (2024-2032) 9.5.1.2. Brazil Opto electronics Market Size and Forecast, by Product Type (2024-2032) 9.5.1.3. Brazil Opto electronics Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Opto electronics Market Size and Forecast, by Material (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Opto electronics Market Size and Forecast, by Component Type (2024-2032) 9.5.2.2. Argentina Opto electronics Market Size and Forecast, by Product Type (2024-2032) 9.5.2.3. Argentina Opto electronics Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Opto electronics Market Size and Forecast, by Material (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Opto electronics Market Size and Forecast, by Component Type (2024-2032) 9.5.3.2. Rest Of South America Opto electronics Market Size and Forecast, by Product Type (2024-2032) 9.5.3.3. Rest Of South America Opto electronics Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Opto electronics Market Size and Forecast, by Material (2024-2032) 10. Company Profile: Key Players 10.1. Cree, Inc. - Durham, North Carolina, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Intel Corporation - Santa Clara, California, USA 10.3. Texas Instruments - Dallas, Texas, USA 10.4. Analog Devices, Inc. - Norwood, Massachusetts, USA 10.5. Broadcom Inc. - San Jose, California, USA 10.6. Osram Licht AG - Munich, Germany 10.7. Infineon Technologies AG - Neubiberg, Germany 10.8. STMicroelectronics - Geneva, Switzerland 10.9. NXP Semiconductors - Eindhoven, Netherlands 10.10. Vishay Intertechnology 10.11. Nichia Corporation - Anan, Tokushima, Japan 10.12. Epistar Corporation - Hsinchu, Taiwan 10.13. AU Optronics Corp. - Hsinchu, Taiwan 10.14. LG Innotek - Seoul, South Korea 10.15. Sharp Corporation - Sakai, Japan 11. Key Findings 12. Industry Recommendations 13. Opto electronics Market: Research Methodology 14. Terms and Glossary