OLED Encapsulation Materials Market size was valued at USD 245.2 Mn. in 2022 and the total OLED Encapsulation Materials revenue is expected to grow by 27.3 % from 2023 to 2029, reaching nearly USD 1328.4 Mn.OLED Encapsulation Materials Market Overview:

OLED (Organic Light Emitting Diode) displays are highly favored for their sleek design, flexibility, and exceptional visual quality, making them sought-after in smartphones, televisions, laptops, and automotive applications. Encapsulation materials are crucial for protecting OLED displays from external elements such as moisture, oxygen, and contaminants that can degrade their performance and lifespan. These materials act as a protective barrier, ensuring the preservation of the organic components within OLED structures and maintaining the display's efficiency and reliability over time. The OLED encapsulation materials market's expansion is primarily driven by the rising popularity of OLED displays as they offer vibrant colors, high contrast ratios, wide viewing angles, and energy efficiency, surpassing traditional display technologies. The increasing demand for smartphones, televisions, and other consumer electronics featuring OLED displays is propelling the need for reliable and effective encapsulation materials.OLED Encapsulation Materials Market Snapshot

To know about the Research Methodology :- Request Free Sample Report Technological advancements and innovations in encapsulation technology have also played a significant role in OLED encapsulation materials market growth. To improve barrier qualities, researchers and industry participants have been actively developing new encapsulation materials and processes, such as thin-film encapsulation (TFE) and flexible encapsulation. These developments have resulted in extended gadget lives and greater performance. Furthermore, the car industry's penchant for visually pleasing displays has contributed to the adoption of OLED displays in applications such as instrument clusters, infotainment systems, and lighting. This has further fueled the demand for encapsulation materials suitable for automotive environments. The Asia Pacific region, particularly South Korea, Japan, and China has emerged as a prominent hub for OLED display manufacturing, contributing significantly to the growth of the OLED encapsulation materials market. The presence of leading display manufacturers and material suppliers in this region has facilitated technological advancements and further stimulated market expansion.

OLED Encapsulation Materials Market Dynamics

OLED Encapsulation Materials Market Drivers Automotive Displays are Driving Forces for OLED Encapsulation Materials Market The OLED encapsulation materials market is witnessing substantial growth due to several key drivers. Apple, Samsung, and Xiaomi have all included OLED technology in their flagship models, necessitating the use of high-quality encapsulating materials to preserve these screens. The automotive industry is another significant driver of market growth as it embraces OLED displays to enhance in-car experiences. Luxury automakers such as Audi and BMW are integrating OLED displays into their vehicles, improving instrument clusters and infotainment systems. The automotive sector's emphasis on visually captivating and customizable displays is fueling the demand for specialized encapsulation materials designed for automotive applications. Technological advancements in encapsulation materials also contribute to market growth. Researchers have made significant progress in developing novel materials, including hybrid organic-inorganic films and graphene-based barriers. These materials offer superior barrier properties, effectively safeguarding OLED displays against moisture and oxygen ingress, resulting in extended display lifespan and enhanced performance. Investments in OLED research and development drive material innovations. Leading material manufacturers and display technology companies are actively investing in R&D efforts to advance encapsulation materials. For instance, LG Chem has allocated significant resources to develop flexible encapsulation materials suitable for foldable OLED displays, contributing to technological breakthroughs in the market. The rising popularity of wearable devices, such as smartwatches and fitness trackers, also fuels the demand for miniaturized OLED displays. Encapsulation materials with high flexibility and superior barrier performance are essential to protect these compact and dynamic wearable displays. This trend creates a growing need for encapsulation materials in the market. Supportive government initiatives play a crucial role in driving market growth. Governments worldwide are implementing favorable policies and regulations to promote the adoption of OLED technology. For example, in South Korea, the government has introduced financial incentives and supportive measures to strengthen the OLED industry, attracting investments and propelling market growth. Furthermore, the advantages offered by OLED displays, including their thin profiles, energy efficiency, and superior color reproduction, drive their adoption across various industries. The widespread adoption of OLED displays creates significant demand for encapsulation materials capable of effectively preserving these valuable display characteristics. These key drivers collectively contribute to the growth and expansion of the OLED encapsulation materials market. The increasing demand for OLED displays in smartphones, automotive applications, wearables, and other sectors, combined with technological advancements, investments in R&D, and supportive government initiatives, fuels innovation and drives the market forward.OLED Encapsulation Materials Market by Region Analysis (%) 2022

OLED Encapsulation Materials Market Restraints High Costs Associated with Encapsulation Materials Hamper the OLED Encapsulation Materials Market These materials come at a premium price, significantly adding to the overall manufacturing costs of OLED displays. For instance, the production of flexible encapsulation materials suitable for foldable OLED displays is relatively expensive, affecting their affordability and widespread adoption. Another restraint is the continuous need for improvement in barrier properties. Despite advancements in encapsulation materials, achieving optimal and long-lasting barrier performance against moisture and oxygen remains a challenge. The sensitivity of OLED materials to moisture necessitates highly effective and robust encapsulation solutions that can maintain long-term stability and reliability. Supply chain complexities and the limited availability of encapsulation materials pose additional challenges. As the demand for OLED displays increases, ensuring a stable and reliable supply of encapsulation materials becomes crucial. However, the complex nature of the supply chain, including material sourcing and manufacturing capacity limitations, can lead to bottlenecks that hinder market growth and delay production. OLED Encapsulation Materials Market Opportunity OLED Display Surge Offers Smartphone Manufacturers a Competitive Edge The substantial surge in OLED display technology adoption, reaching a record high of 49% in the global smartphone market, presents a significant opportunity for smartphone manufacturers to embrace OLED displays as a means of market differentiation and delivering a superior visual experience. With OLED displays offering better viewing angles, deeper blacks, enhanced battery life, and the ability to enable slimmer and curved designs, smartphone manufacturers can leverage these advantages to capture market share and stand out from competitors. Incorporating OLED displays into their smartphone lineup, manufacturers can offer consumers a visually stunning experience and the advanced features associated with OLED technology. This opportunity becomes even more compelling considering the dominance of OLED displays in smartphones with a wholesale price of over $250, which currently holds a remarkable 94% market share in Q1'23. Manufacturers can target the high-end smartphone market and benefit from consumers' willingness to invest in higher-quality display and performance devices. Furthermore, as the market for 5G smartphones expands, manufacturers will have more opportunities to integrate OLED screens in low-cost 5G handsets. While some manufacturers choose LCD panels to save money, adding OLED displays in low-cost 5G devices can provide them a competitive advantage. Offering the benefits of OLED technology, such as vibrant colors and enhanced visual clarity, manufacturers can attract customers seeking affordable 5G options without compromising on the display quality. The shifting dynamics among smartphone manufacturers also present an opportunity to leverage OLED displays for market differentiation. While Samsung's use of OLED displays has dropped, other manufacturers can fill the void and capitalize on OLED technology's expanding popularity. Xiaomi, for example, has considerably boosted its use of OLED panels, allowing them to differentiate its products and appeal to users seeking smartphones with greater visual capabilities. OLED Encapsulation Materials Market Segment Analysis: Based on Product Type, the Thin-Film Encapsulation (TFE) segment has emerged as the dominant segment in the OLED encapsulation materials market in the year 2022, due to its superior properties and advantages over other encapsulation methods. TFE involves the deposition of a thin film of organic or inorganic material directly on the OLED device, acting as a protective barrier against moisture and oxygen ingress. One of the key factors driving the dominance of TFE is its excellent barrier properties. TFE offers a high level of protection, effectively preventing the entry of moisture and oxygen that can degrade OLED materials and reduce display performance. This superior barrier performance ensures the long-term stability and durability of OLED displays, making TFE a preferred choice for encapsulation. TFE also provides compatibility with the increasing demand for flexible OLED displays. The thin film deposition process can be applied on flexible substrates, allowing the OLED display to be bent, curved, or even rolled. This flexibility in encapsulation enables the creation of innovative and customizable display solutions, meeting the market's demand for flexible and curved displays. Scalability and cost-effectiveness are additional factors contributing to the dominance of TFE. The manufacturing process for TFE can be integrated into existing OLED production lines, minimizing the need for significant changes or additional infrastructure. This scalability makes TFE a practical choice for mass production, driving its widespread adoption in the industry.

OLED Encapsulation Materials Market ,by Product Type (%) in 2022

Based on the Application, the consumer electronic segment dominated the market in the year 2022 and is expected to continue its dominance during the forecast period. The dominance of the consumer electronics sector in the OLED encapsulation materials market stems from the widespread adoption of OLED displays in various electronic devices. A significant driver behind the dominance of consumer electronics is the integration of OLED displays in smartphones, particularly in flagship models from major manufacturers like Apple, Samsung, and Xiaomi. This integration has generated a strong demand for high-quality encapsulation materials that can effectively protect OLED displays. The slim profile, flexibility, and exceptional image quality of OLED displays make them highly desirable in smartphones, solidifying the consumer electronics segment's dominance in the OLED encapsulation materials market. Moreover, other consumer electronic devices such as televisions, laptops, tablets, and wearable gadgets also contribute to the dominance of this segment. The visual superiority and versatility of OLED displays have made them a preferred choice for these devices, offering immersive viewing experiences and sleek designs. The increasing demand for OLED displays in these consumer electronics has led to a corresponding need for reliable and effective encapsulation materials to ensure long-lasting performance and durability.

OLED Encapsulation Materials Market Revenue Share by Application (%) in 2022

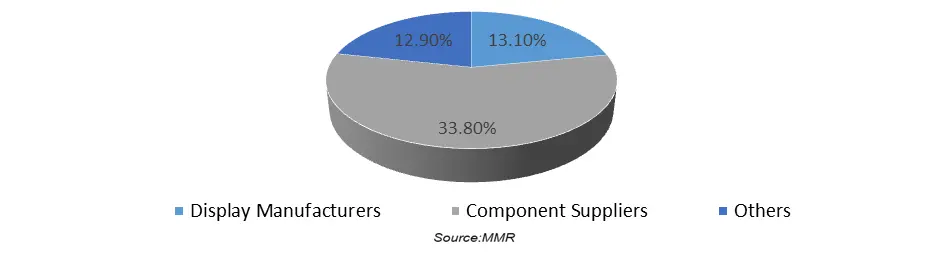

Based on the Distribution Channel, The display manufacturer segment dominated the market in the year 2022 and is expected to continue its dominance during the forecast period. Thanks to their responsibility for creating OLED displays for a range of products such smartphones, televisions, laptops, wearable technology, and automotive displays, these manufacturers are the main factors driving the need for OLED encapsulation materials. With the growing popularity and acceptance of OLED displays, the requirement for high-quality encapsulating materials to safeguard these displays has increased. Display manufacturers require encapsulation materials that offer effective barriers against moisture and oxygen ingress to ensure the longevity and performance of OLED displays. They rely on encapsulation materials that possess excellent barrier properties, high flexibility (to cater to applications like curved or flexible displays), and compatibility with mass production processes. The dominance of display manufacturers in the OLED encapsulation materials market stems from their significant role in the production and integration of OLED displays into various electronic devices. Key players in the display manufacturing industry, such as Samsung Display, LG Display, and BOE Technology Group, play a vital role in driving the adoption and advancements of OLED technology. To meet the growing demand for OLED displays, display manufacturers require a stable and reliable supply of encapsulation materials. They often establish strategic partnerships with material suppliers to ensure a consistent supply chain and gain access to cutting-edge encapsulation technologies.

OLED Encapsulation Materials Market Share, By End Users in 2022 (%)

OLED Encapsulation Materials Market Regional Insights:

Asia Pacific region dominated the market with 43% of the market share in the year 2022 and is expected to continue its dominance during the forecast period. APAC is home to major display manufacturers, including Samsung Display and LG Display, which are driving advancements and production in the OLED display industry. These manufacturers, based in countries such as South Korea, China, and Japan, contribute significantly to the demand for encapsulation materials in the region. China has witnessed substantial growth in OLED display manufacturing and is a key player in the market. Chinese manufacturers like BOE Technology Group, Visionox, and Tianma Microelectronics have expanded their production capabilities, leading to a higher demand for encapsulation materials in the APAC region. The large consumer electronics market in APAC, particularly in countries like China, Japan, and South Korea, drives the adoption of OLED displays in smartphones, televisions, and other electronic devices. This adoption fuels the demand for encapsulation materials to protect and enhance the performance of these displays. APAC's investments in research and development, particularly in South Korea and Japan, have contributed to significant technological advancements in OLED encapsulation materials. These advancements drive market growth and solidify APAC as the dominant region in the OLED encapsulation materials market. While North America and Europe also have a notable presence in the OLED market, APAC holds a higher market share due to the concentration of major display manufacturers, the large consumer electronics market, and ongoing research and development efforts. Prominent companies in the OLED encapsulation materials market within these regions include Samsung SDI (South Korea), LG Chem (South Korea), Universal Display Corporation (United States), Merck KGaA (Germany), and Sumitomo Chemical (Japan). These companies play a vital role in supplying encapsulation materials and driving innovation in the OLED industry.OLED Encapsulation Materials Market Scope: Inquire Before Buying

Global OLED Encapsulation Materials Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 245.2 Mn. Forecast Period 2023 to 2029 CAGR: 27.3% Market Size in 2029: US $ 1328.4 Mn. Segments Covered: by Product Type Thin-Film Encapsulation (TFE) Flexible Encapsulation Rigid Encapsulation by Application Consumer Electronics Automotive Lighting Others by End User Display Manufacturers Component Suppliers Others OLED Encapsulation Materials Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)OLED Encapsulation Materials Market Key Players

1. Samsung SDI Co., Ltd. 2. LG Chem Ltd. 3. Universal Display Corporation 4. Merck KGaA 5. DuPont de Nemours, Inc. 6. Idemitsu Kosan Co., Ltd. 7. Dow Chemical Company 8. Kateeva, Inc. 9. Toray Industries, Inc. 10. Nitto Denko Corporation 11. Novaled GmbH 12. Sumitomo Chemical Co., Ltd. 13. BASF SE 14. E. I. du Pont de Nemours and Company (DuPont) 15. Asahi Glass Co., Ltd. 16. Panasonic Corporation 17. Doosan Corporation 18. Konica Minolta, Inc. 19. Mitsubishi Chemical Corporation 20. Lumtec Co., Ltd. 21. Tokyo Chemical Industry Co., Ltd. 22. Toyo Ink SC Holdings Co., Ltd. 23. Hodogaya Chemical Co., Ltd. 24. Henkel AG & Co. KGaA 25. Showa Denko KK 26. BOE Technology Group 27. Visionox 28. Tianma MicroelectronicsFrequently Asked Questions:

1] What segments are covered in the Global OLED Encapsulation Materials Market report? Ans. The segments covered in the OLED Encapsulation Materials Market report are based on Product Type, Application, End Users, and Regions. 2] Which region is expected to hold the highest share in the Global OLED Encapsulation Materials Market? Ans. The Europe region is expected to hold the highest share of the OLED Encapsulation Materials Market. 3] What is the market size of the Global OLED Encapsulation Materials Market by 2029? Ans. The market size of the OLED Encapsulation Materials Market by 2029 is expected to reach US$ 1328.4 Mn. 4] What is the forecast period for the Global OLED Encapsulation Materials Market? Ans. The forecast period for the OLED Encapsulation Materials Market is 2022-2029. 5] What was the market size of the Global OLED Encapsulation Materials Market in 2022? Ans. The market size of the OLED Encapsulation Materials Market in 2022 was valued at US$ 245.2 Mn.

1. OLED Encapsulation Materials Market: Research Methodology 2. OLED Encapsulation Materials Market: Executive Summary 3. OLED Encapsulation Materials Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. OLED Encapsulation Materials Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. OLED Encapsulation Materials Market: Segmentation (by Value USD and Volume Units) 5.1. OLED Encapsulation Materials Market, by Product Type (2022-2029) 5.1.1. Thin-Film Encapsulation (TFE) 5.1.2. Flexible Encapsulation 5.1.3. Rigid Encapsulation 5.2. OLED Encapsulation Materials Market, by Application (2022-2029) 5.2.1. Consumer Electronics 5.2.2. Automotive 5.2.3. Lighting 5.2.4. Others 5.3. OLED Encapsulation Materials Market, by End Users (2022-2029) 5.3.1. Display Manufacturers 5.3.2. Component Suppliers 5.3.3. Others 5.4. OLED Encapsulation Materials Market, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America OLED Encapsulation Materials Market (by Value USD and Volume Units) 6.1. North America OLED Encapsulation Materials Market, by Product Type (2022-2029) 6.1.1. Thin-Film Encapsulation (TFE) 6.1.2. Flexible Encapsulation 6.1.3. Rigid Encapsulation 6.2. North America OLED Encapsulation Materials Market, by Application (2022-2029) 6.2.1. Consumer Electronics 6.2.2. Automotive 6.2.3. Lighting 6.2.4. Others 6.3. North America OLED Encapsulation Materials Market, by End Users (2022-2029) 6.3.1. Display Manufacturers 6.3.2. Component Suppliers 6.3.3. Others 6.4. North America OLED Encapsulation Materials Market, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe OLED Encapsulation Materials Market (by Value USD and Volume Units) 7.1. Europe OLED Encapsulation Materials Market, by Product Type (2022-2029) 7.2. Europe OLED Encapsulation Materials Market, by Application (2022-2029) 7.3. Europe OLED Encapsulation Materials Market, by End Users (2022-2029) 7.4. Europe OLED Encapsulation Materials Market, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific OLED Encapsulation Materials Market (by Value USD and Volume Units) 8.1. Asia Pacific OLED Encapsulation Materials Market, by Product Type (2022-2029) 8.2. Asia Pacific OLED Encapsulation Materials Market, by Application (2022-2029) 8.3. Asia Pacific OLED Encapsulation Materials Market, by End Users (2022-2029) 8.4. Asia Pacific OLED Encapsulation Materials Market, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa OLED Encapsulation Materials Market (by Value USD and Volume Units) 9.1. Middle East and Africa OLED Encapsulation Materials Market, by Product Type (2022-2029) 9.2. Middle East and Africa OLED Encapsulation Materials Market, by Application (2022-2029) 9.3. Middle East and Africa OLED Encapsulation Materials Market, by End Users (2022-2029) 9.4. Middle East and Africa OLED Encapsulation Materials Market, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America OLED Encapsulation Materials Market (by Value USD and Volume Units) 10.1. South America OLED Encapsulation Materials Market, by Product Type (2022-2029) 10.2. South America OLED Encapsulation Materials Market, by Application (2022-2029) 10.3. South America OLED Encapsulation Materials Market, by End Users (2022-2029) 10.4. South America OLED Encapsulation Materials Market, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Samsung SDI Co., Ltd. 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. LG Chem Ltd. 11.3. Universal Display Corporation 11.4. Merck KGaA 11.5. DuPont de Nemours, Inc. 11.6. Idemitsu Kosan Co., Ltd. 11.7. Dow Chemical Company 11.8. Kateeva, Inc. 11.9. Toray Industries, Inc. 11.10. Nitto Denko Corporation 11.11. Novaled GmbH 11.12. Sumitomo Chemical Co., Ltd. 11.13. BASF SE 11.14. E. I. du Pont de Nemours and Company (DuPont) 11.15. Asahi Glass Co., Ltd. 11.16. Panasonic Corporation 11.17. Doosan Corporation 11.18. Konica Minolta, Inc. 11.19. Mitsubishi Chemical Corporation 11.20. Lumtec Co., Ltd. 11.21. Tokyo Chemical Industry Co., Ltd. 11.22. Toyo Ink SC Holdings Co., Ltd. 11.23. Hodogaya Chemical Co., Ltd. 11.24. Henkel AG & Co. KGaA 11.25. Showa Denko KK 11.26. BOE Technology Group 11.27. Visionox 11.28. Tianma Microelectronics 12. Key Findings 13. Application Recommendation