Oil & Gas Sensors Market is expected to grow at a CAGR of 5% during the forecast period. Global Oil & Gas Sensors Market is expected to reach US$ 14.35 Bn. by 2029. The report includes the analysis of impact of COVID-19 lock-down on the revenue of market leaders, followers, and disrupters. Since lock down was implemented differently in different regions and countries, impact of same is also different by regions and segments. The report has covered the current short term and long term impact on the market, same will help decision makers to prepare the outline for short term and long term strategies for companies by region.To know about the Research Methodology:-Request Free Sample Report

Oil & Gas Sensors Market Dynamics

Oil and Gas industry is essential for the global economy. Sensors play an essential role in the control and monitoring of the oil and gas industry. Sensors are used in every step of the oil and gas industry; right from oil and gas exploration to refinery. Sensors are used to monitor various parameters which are crucial for stable and reliable operations. Sensors are used in hazardous conditions where human intervention is not possible. Sensors play an essential role in the safety of both man and machines. Factors Such as an increasing adoption of ultrasonic sensors, increasing demand for sensors due to refining capacity additions are propelling the global oil & gas sensors market growth. Further, growing IoT in the oil & gas industry is also propelling the global oil & gas sensors market. Increasing unconventional drilling techniques such as Mpd and directional drilling posing a prominent business opportunity for the Oil & Gas Sensors manufacturers to increase their sales in the coming years. However, there are some challenges that will hinder the growth of the market such as rising investment in the renewable sector would affect the demand for sensors.Oil & Gas Sensors Market Segment Analysis

By type, the pressure sensor type segment leads the global market with 38% market share over forecast period. A pressure sensor usually acts as a transducer, it senses the pressure and converts it into an electric signal. Further, Pressure sensors are also used to measure gauge pressure on casing and tubing on wellheads and on separator vessels. This allows the operator to rapidly adjust the flow of pressure during the drilling operation, resulting in optimizing oil withdrawal rates and deal with conditions such as gas bubbles to increase the safety of the workers working in drilling operations. Increased focus on augmenting production from oil & gas wells and improved economic and operational benefits provided by technology is anticipated to drive the pressure sensor market. By connectivity, the Wireless connectivity sensors account for the largest market share during the forecast period. Wireless sensors have a growing demand as they eliminate cables, resulting in reduced installation, operating costs and maintenance cost. Moreover, wireless sensors have a wide variety of applications in the oil & gas industry varying with different characteristics and requirements.

Oil & Gas Sensors Market Regional Insights

Geographically, The Asia Pacific is expected to exhibit higher growth between 2023 and 2029 owing to increasing adoption of industrial automation in emerging countries such as India and China are some of the key factors behind the growth of the oil & gas sensors market in this region. Moreover, according to IBEF, ONGC (India) is investing USD 2.73 Bn on drilling oil & gas wells from 2023 to 2029. Furthermore, Saudi Aramco is planning to invest in the downstream sector in India. Such factors would drive the oil and gas sensors to advertise in the country. Report covers key developments and company profiles of major key players. Some of the key players operating in this market are Honeywell, Emerson, Lord, Siemens, ABB Ltd, Fortive, Rockwell and Indutrade. These key players exhibit near about 75-80% of global market share. By using various organic and inorganic growth strategies such as joint ventures, merger and acquisition, expansion, patent, new product launches, and strategic alliances these players are increasing their regional presence and business operations. The objective of the report is to present a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, industry-validated market data and projections with a suitable set of assumptions and methodology. The report also helps in understanding Global Oil & Gas Sensors Market dynamics, structure by identifying and analyzing the market segments and project the global market size. Further, report also focuses on competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence. The report also provides PEST analysis, PORTER’s analysis, SWOT analysis to address questions of shareholders to prioritizing the efforts and investment in near future to emerging segment in Global Oil & Gas Sensors Market.Oil & Gas Sensors Market Key Highlights:

• Global Oil & Gas Sensors Market analysis and forecast, in terms of value. • Comprehensive study and analysis of market drivers, restraints and opportunities influencing the growth of the Global Oil & Gas Sensors Market • Global Oil & Gas Sensors Market segmentation on the basis of type, source, end-user, and region (country-wise) has been provided. • Global Oil & Gas Sensors Market strategic analysis with respect to individual growth trends, future prospects along with the contribution of various sub-market stakeholders have been considered under the scope of study. • Global Oil & Gas Sensors Market analysis and forecast for five major regions namely North America, Europe, Asia Pacific, the Middle East & Africa (MEA) and Latin America along with country-wise segmentation. • Profiles of key industry players, their strategic perspective, market positioning and analysis of core competencies are further profiled. • Competitive developments, investments, strategic expansion and competitive landscape of the key players operating in the Global Oil & Gas Sensors Market are also profiled.Oil & Gas Sensors Market Scope: Inquire before buying

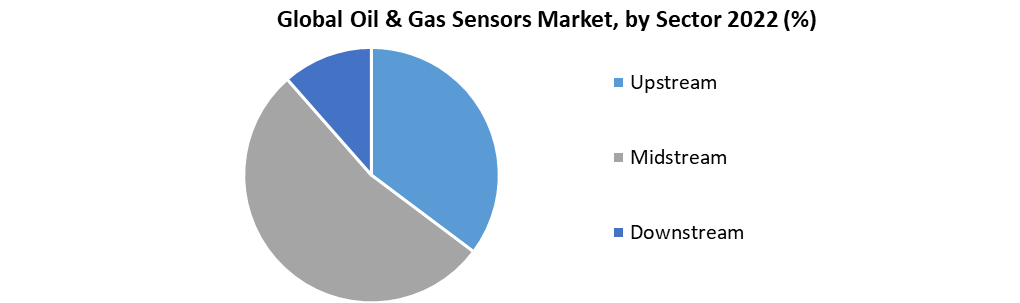

Oil & Gas Sensors Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 10.19 Bn. Forecast Period 2023 to 2029 CAGR: 5% Market Size in 2029: US $ 14.35 Bn. Segments Covered: by Type • Pressure • Level • Flow • Temperature by Connectivity • Wired • Wireless by Application • Remote Monitoring • Condition Monitoring • Analysis by Sector • Upstream • Midstream • Downstream Oil & Gas Sensors Market, by Region

● North America (United States, Canada and Mexico) ● Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) ● Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) ● Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) ● South America (Brazil, Argentina, Columbia and Rest of South America)Oil & Gas Sensors Market, Key Players are:

• Honeywell • Emerson • Lord • Siemens • ABB Ltd • Fortive • Rockwell • Indutrade • MTS Sensor Technology GmbH & Co. Kg • General Electric (GE) • BD Sensors • Bosch • TE Connectivity • BEI Sensors • Fafnir GMBH Frequently Asked Questions: 1. Which region has the largest share in Global Oil & Gas Sensors Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global Oil & Gas Sensors Market? Ans: The Global Oil & Gas Sensors Market is growing at a CAGR of 5% during forecasting period 2023-2029. 3. What is scope of the Global Oil & Gas Sensors Market report? Ans: Global Oil & Gas Sensors Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Oil & Gas Sensors Market? Ans: The important key players in the Global Oil & Gas Sensors Market are – Honeywell, Emerson, Lord, Siemens, ABB Ltd, Fortive, Rockwell, Indutrade, MTS Sensor Technology GmbH & Co. Kg, General Electric (GE), BD Sensors, Bosch, TE Connectivity, BEI Sensors, and Fafnir GMBH 5. What is the study period of this Market? Ans: The Global Oil & Gas Sensors Market is studied from 2022 to 2029.

1. Oil & Gas Sensors Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Oil & Gas Sensors Market: Dynamics 2.1. Oil & Gas Sensors Market Trends by Region 2.1.1. North America Oil & Gas Sensors Market Trends 2.1.2. Europe Oil & Gas Sensors Market Trends 2.1.3. Asia Pacific Oil & Gas Sensors Market Trends 2.1.4. Middle East and Africa Oil & Gas Sensors Market Trends 2.1.5. South America Oil & Gas Sensors Market Trends 2.2. Oil & Gas Sensors Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Oil & Gas Sensors Market Drivers 2.2.1.2. North America Oil & Gas Sensors Market Restraints 2.2.1.3. North America Oil & Gas Sensors Market Opportunities 2.2.1.4. North America Oil & Gas Sensors Market Challenges 2.2.2. Europe 2.2.2.1. Europe Oil & Gas Sensors Market Drivers 2.2.2.2. Europe Oil & Gas Sensors Market Restraints 2.2.2.3. Europe Oil & Gas Sensors Market Opportunities 2.2.2.4. Europe Oil & Gas Sensors Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Oil & Gas Sensors Market Drivers 2.2.3.2. Asia Pacific Oil & Gas Sensors Market Restraints 2.2.3.3. Asia Pacific Oil & Gas Sensors Market Opportunities 2.2.3.4. Asia Pacific Oil & Gas Sensors Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Oil & Gas Sensors Market Drivers 2.2.4.2. Middle East and Africa Oil & Gas Sensors Market Restraints 2.2.4.3. Middle East and Africa Oil & Gas Sensors Market Opportunities 2.2.4.4. Middle East and Africa Oil & Gas Sensors Market Challenges 2.2.5. South America 2.2.5.1. South America Oil & Gas Sensors Market Drivers 2.2.5.2. South America Oil & Gas Sensors Market Restraints 2.2.5.3. South America Oil & Gas Sensors Market Opportunities 2.2.5.4. South America Oil & Gas Sensors Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Oil & Gas Sensors Industry 2.8. Analysis of Government Schemes and Initiatives For Oil & Gas Sensors Industry 2.9. Oil & Gas Sensors Market Trade Analysis 2.10. The Global Pandemic Impact on Oil & Gas Sensors Market 3. Oil & Gas Sensors Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 3.1.1. Pressure 3.1.2. Level 3.1.3. Flow 3.1.4. Temperature 3.2. Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 3.2.1. Wired 3.2.2. Wireless 3.3. Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 3.3.1. Remote Monitoring 3.3.2. Condition Monitoring 3.4. Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 3.4.1. Upstream 3.4.2. Midstream 3.4.3. Downstream 3.5. Oil & Gas Sensors Market Size and Forecast, by Region (2022-2029) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Oil & Gas Sensors Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 4.1.1. Pressure 4.1.2. Level 4.1.3. Flow 4.1.4. Temperature 4.2. North America Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 4.2.1. Wired 4.2.2. Wireless 4.3. North America Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 4.3.1. Remote Monitoring 4.3.2. Condition Monitoring 4.4. North America Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 4.4.1. Upstream 4.4.2. Midstream 4.4.3. Downstream 4.5. North America Oil & Gas Sensors Market Size and Forecast, by Country (2022-2029) 4.5.1. United States 4.5.1.1. United States Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 4.5.1.1.1. Pressure 4.5.1.1.2. Level 4.5.1.1.3. Flow 4.5.1.1.4. Temperature 4.5.1.2. United States Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 4.5.1.2.1. Wired 4.5.1.2.2. Wireless 4.5.1.3. United States Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 4.5.1.3.1. Remote Monitoring 4.5.1.3.2. Condition Monitoring 4.5.1.4. United States Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 4.5.1.4.1. Upstream 4.5.1.4.2. Midstream 4.5.1.4.3. Downstream 4.5.2. Canada 4.5.2.1. Canada Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 4.5.2.1.1. Pressure 4.5.2.1.2. Level 4.5.2.1.3. Flow 4.5.2.1.4. Temperature 4.5.2.2. Canada Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 4.5.2.2.1. Wired 4.5.2.2.2. Wireless 4.5.2.3. Canada Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 4.5.2.3.1. Remote Monitoring 4.5.2.3.2. Condition Monitoring 4.5.2.4. Canada Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 4.5.2.4.1. Upstream 4.5.2.4.2. Midstream 4.5.2.4.3. Downstream 4.5.3. Mexico 4.5.3.1. Mexico Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 4.5.3.1.1. Pressure 4.5.3.1.2. Level 4.5.3.1.3. Flow 4.5.3.1.4. Temperature 4.5.3.2. Mexico Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 4.5.3.2.1. Wired 4.5.3.2.2. Wireless 4.5.3.3. Mexico Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 4.5.3.3.1. Remote Monitoring 4.5.3.3.2. Condition Monitoring 4.5.3.4. Mexico Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 4.5.3.4.1. Upstream 4.5.3.4.2. Midstream 4.5.3.4.3. Downstream 5. Europe Oil & Gas Sensors Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 5.2. Europe Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 5.3. Europe Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 5.4. Europe Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 5.5. Europe Oil & Gas Sensors Market Size and Forecast, by Country (2022-2029) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 5.5.1.2. United Kingdom Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 5.5.1.3. United Kingdom Oil & Gas Sensors Market Size and Forecast, by Application(2022-2029) 5.5.1.4. United Kingdom Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 5.5.2. France 5.5.2.1. France Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 5.5.2.2. France Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 5.5.2.3. France Oil & Gas Sensors Market Size and Forecast, by Application(2022-2029) 5.5.2.4. France Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 5.5.3. Germany 5.5.3.1. Germany Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 5.5.3.2. Germany Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 5.5.3.3. Germany Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 5.5.3.4. Germany Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 5.5.4. Italy 5.5.4.1. Italy Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 5.5.4.2. Italy Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 5.5.4.3. Italy Oil & Gas Sensors Market Size and Forecast, by Application(2022-2029) 5.5.4.4. Italy Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 5.5.5. Spain 5.5.5.1. Spain Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 5.5.5.2. Spain Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 5.5.5.3. Spain Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 5.5.5.4. Spain Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 5.5.6. Sweden 5.5.6.1. Sweden Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 5.5.6.2. Sweden Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 5.5.6.3. Sweden Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 5.5.6.4. Sweden Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 5.5.7. Austria 5.5.7.1. Austria Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 5.5.7.2. Austria Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 5.5.7.3. Austria Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 5.5.7.4. Austria Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 5.5.8.2. Rest of Europe Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 5.5.8.3. Rest of Europe Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 5.5.8.4. Rest of Europe Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6. Asia Pacific Oil & Gas Sensors Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.3. Asia Pacific Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5. Asia Pacific Oil & Gas Sensors Market Size and Forecast, by Country (2022-2029) 6.7.1. China 6.5.1.1. China Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.1.2. China Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.1.3. China Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.5.1.4. China Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5.2. S Korea 6.5.2.1. S Korea Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.2.2. S Korea Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.2.3. S Korea Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.5.2.4. S Korea Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5.3. Japan 6.5.3.1. Japan Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.3.2. Japan Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.3.3. Japan Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.5.3.4. Japan Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5.4. India 6.5.4.1. India Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.4.2. India Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.4.3. India Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.5.4.4. India Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5.5. Australia 6.5.5.1. Australia Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.5.2. Australia Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.5.3. Australia Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.5.5.4. Australia Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5.6. Indonesia 6.5.6.1. Indonesia Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.6.2. Indonesia Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.6.3. Indonesia Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.5.6.4. Indonesia Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5.7. Malaysia 6.5.7.1. Malaysia Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.7.2. Malaysia Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.7.3. Malaysia Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.5.7.4. Malaysia Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5.8. Vietnam 6.5.8.1. Vietnam Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.8.2. Vietnam Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.8.3. Vietnam Oil & Gas Sensors Market Size and Forecast, by Application(2022-2029) 6.5.8.4. Vietnam Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5.9. Taiwan 6.5.9.1. Taiwan Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.9.2. Taiwan Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.9.3. Taiwan Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.5.9.4. Taiwan Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 6.5.10.2. Rest of Asia Pacific Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 6.5.10.3. Rest of Asia Pacific Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 6.5.10.4. Rest of Asia Pacific Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 7. Middle East and Africa Oil & Gas Sensors Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 7.3. Middle East and Africa Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 7.5. Middle East and Africa Oil & Gas Sensors Market Size and Forecast, by Country (2022-2029) 7.5.1. South Africa 7.5.1.1. South Africa Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 7.5.1.2. South Africa Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 7.5.1.3. South Africa Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 7.5.1.4. South Africa Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 7.5.2. GCC 7.5.2.1. GCC Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 7.5.2.2. GCC Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 7.5.2.3. GCC Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 7.5.2.4. GCC Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 7.5.3. Nigeria 7.5.3.1. Nigeria Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 7.5.3.2. Nigeria Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 7.5.3.3. Nigeria Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 7.5.3.4. Nigeria Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 7.5.4.2. Rest of ME&A Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 7.5.4.3. Rest of ME&A Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 7.5.4.4. Rest of ME&A Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 8. South America Oil & Gas Sensors Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 8.2. South America Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 8.3. South America Oil & Gas Sensors Market Size and Forecast, by Application(2022-2029) 8.4. South America Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 8.5. South America Oil & Gas Sensors Market Size and Forecast, by Country (2022-2029) 8.5.1. Brazil 8.5.1.1. Brazil Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 8.5.1.2. Brazil Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 8.5.1.3. Brazil Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 8.5.1.4. Brazil Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 8.5.2. Argentina 8.5.2.1. Argentina Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 8.5.2.2. Argentina Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 8.5.2.3. Argentina Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 8.5.2.4. Argentina Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Oil & Gas Sensors Market Size and Forecast, by Type (2022-2029) 8.5.3.2. Rest Of South America Oil & Gas Sensors Market Size and Forecast, by Connectivity (2022-2029) 8.5.3.3. Rest Of South America Oil & Gas Sensors Market Size and Forecast, by Application (2022-2029) 8.5.3.4. Rest Of South America Oil & Gas Sensors Market Size and Forecast, by Sector (2022-2029) 9. Global Oil & Gas Sensors Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Oil & Gas Sensors Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Honeywell 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Emerson 10.3. Lord 10.4. Siemens 10.5. ABB Ltd 10.6. Fortive 10.7. Rockwell 10.8. Indutrade 10.9. MTS Sensor Technology GmbH & Co. Kg 10.10. General Electric (GE) 10.11. BD Sensors 10.12. Bosch 10.13. TE Connectivity 10.14. BEI Sensors 10.15. Fafnir GMBH 11. Key Findings 12. Industry Recommendations 13. Oil & Gas Sensors Market: Research Methodology 14. Terms and Glossary