The Offshore Drilling Rigs Market size was valued at USD 76.4 Billion in 2023 and the total Offshore Drilling Rigs revenue is expected to grow at a CAGR of 6.75 % from 2024 to 2030, reaching nearly USD 127.8 Billion by 2030.Offshore Drilling Rigs Market Overview:

Offshore drilling rigs are specialized structures designed and equipped for the exploration and extraction of oil and natural gas reserves beneath the seabed in offshore environments. These rigs are essential components of the oil and gas industry's upstream sector, facilitating drilling operations in various water depths, ranging from shallow to ultra-deepwater. The Offshore Drilling Rigs market represents a dynamic and critical segment within the broader oil and gas industry, playing a pivotal role in the exploration and extraction of hydrocarbon resources from beneath the seabed. These specialized drilling platforms, including Jack-up Rigs, Semi-Submersible Rigs, and Drill Ships, cater to diverse water depths, providing the industry with a versatile toolkit for offshore operations.To know about the Research Methodology:-Request Free Sample Report Offshore Drilling Rigs market dynamics are shaped by various factors, with global energy demand acting as a primary driver. As the world's thirst for energy continues to rise, the industry experiences a heightened focus on increasing exploration efforts in both traditional and emerging offshore basins. Technological advancements play a crucial role, enabling operations in challenging environments such as deepwater and ultra-deepwater drilling, further fuelling the growth of the Offshore Drilling Rigs market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Offshore Drilling Rigs Market.

Offshore Drilling Rigs Market Dynamics

The Offshore Drilling Rigs Market Demonstrates Dynamic Characteristics, with a Combination of Driving Forces and Constraining Factors Influencing its Growth Trajectory. Amidst the growing energy demand globally, particularly for oil and natural gas, the offshore drilling rigs market experiences notable growth potential. The imperative role of offshore exploration and production in meeting escalating energy needs universal solidifies its position in the industry. Moreover, continuous technological advancements, such as deep water and ultra-deep water drilling capabilities, contribute to the market's innovation in the industry, fostering its growth and potential for market penetration. A pivotal driver for the offshore drilling rigs market is the sustained growth facilitated by exploration activities in new offshore basins and untapped reserves. As conventional onshore reserves deplete, offshore exploration becomes a strategic opportunity for maintaining and increasing oil and gas production. Government initiatives and regulations play a crucial role in shaping the industry landscape. Supportive policies and incentives drive market share by encouraging offshore exploration and production. Conversely, regulations promoting safety and environmental responsibility introduce compliance challenges and costs, affecting market fluctuation. Global offshore investment emerges as a robust driver, with major oil and gas companies and national oil companies investing significantly in offshore projects. This not only contributes to market share growth but also encourages strategic partnerships and collaborations within the industry. Despite these driving forces, the offshore drilling rigs market encounters restraints, including sensitivity to oil price volatility. Fluctuations, especially declines, impact exploration and production budgets, influencing the market's pricing analysis. Additionally, high capital costs associated with setting up and operating offshore drilling operations act as a significant restraint, especially during periods of economic uncertainty, impacting market opportunity. Environmental and regulatory challenges further add complexity to the offshore drilling rigs market. Stringent regulations and concerns about the potential environmental impact pose challenges for industry participants, influencing market share and pricing analysis. Compliance with safety and environmental standards require additional investments, impacting operational timelines and presenting both challenges and opportunities for innovation in the industry. Project delays and uncertainties, influenced by geological challenges, weather conditions, and regulatory approvals, pose challenges, impacting the overall demand for drilling rigs and market penetration. The competition from onshore resources, particularly with advances in technologies like hydraulic fracturing, introduces a set of challenges affecting the offshore drilling rigs market. This competition influences investment decisions and diverts attention and resources, shaping the industry's emerging trends. In conclusion, stakeholders in the offshore drilling rigs market must navigate these complex dynamics, understanding the interplay between driving forces and constraints. Adapting to changing economic conditions, embracing technological advancements, and effectively responding to regulatory landscapes are crucial for ensuring sustained growth, profitability, and successful market penetration in this industry.

Offshore Drilling Rigs Market Segment Analysis

Type: Jack-up rigs, integral to shallow to moderately deep waters, feature retractable legs that can be lowered to the seabed, creating a stable working environment. Their versatility, cost-effectiveness, and operational flexibility make them a preferred choice for shallow water exploration and production. The jack-up segment caters to cost-conscious operators and remains a major segment for meeting regional energy demands in less technically challenging environments. The jack-up rigs hold a significant offshore drilling rigs market segment share, reflecting their dominance and popularity. Semi-submersible rigs, with partially submerged pontoons for stability, excel in rough seas. Suitable for various water depths, they offer flexibility in exploration and drilling activities, particularly in deep and ultra-deep water scenarios. Semi-submersible rigs, with their stability and manoeuvrability, are crucial for handling the challenges posed by greater water depths, contributing significantly to deep and ultra-deep water drilling projects. They represent a booming segment within the offshore drilling rigs market, showcasing growth potential. Drill ships, mobile units equipped for offshore drilling operations, are highly flexible and can operate in diverse water depths. Their mobility and accessibility to remote locations make them valuable for deep and ultra-deepwater exploration. The drill ship segment stands out for its efficiency in swiftly moving between drilling sites, enhancing operational capabilities and proving instrumental in tapping into challenging offshore reserves. It holds a major segment position, contributing significantly to the offshore drilling rigs market share. Application: Shallow water applications involve drilling in water depths up to a few hundred meters, closer to shore and with less technical complexity. Jack-up rigs are commonly used in this segment. Shallow water drilling remains critical, characterized by lower operational costs and shorter project timelines. It serves as a vital regional segment for meeting immediate energy demands, holding a prominent position in the offshore drilling rigs market. Deepwater drilling engages in exploration and production in water depths ranging from several hundred to a few thousand meters. This segment poses technical challenges but offers substantial hydrocarbon reserves. Dominated by semi-submersible rigs and drill ships, the deepwater segment requires advanced technological solutions to unlock and exploit reserves, emphasizing the role of innovation in industry practices. It represents a major regional segment with significant growth potential. Ultra-deepwater drilling surpasses depths of 1,500 meters, representing the frontier of offshore exploration. This segment demands advanced technologies and expertise for successful operations. Drill ships and advanced semi-submersible rigs, equipped with cutting-edge technologies, play a pivotal role in ultra-deepwater exploration. Despite its challenges, this segment presents tremendous growth potential, necessitating substantial investments in technology and safety measures. It emerges as a regional segment with high innovation in the offshore drilling rigs market.Offshore Drilling Rigs Market Regional Analysis

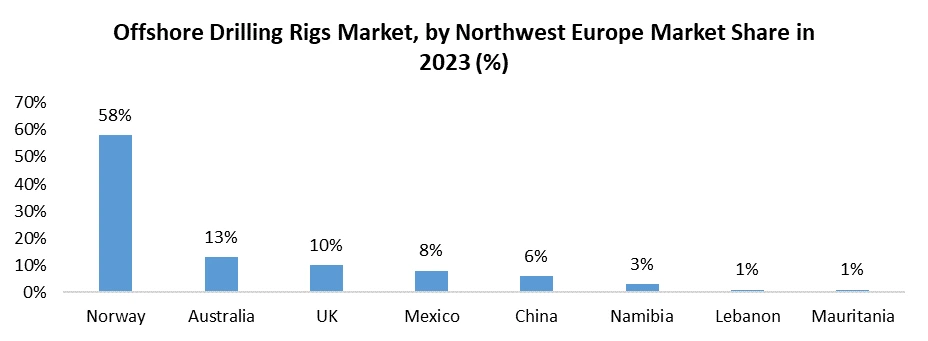

North America is a significant player in the offshore drilling rigs market, driven by the presence of major oil and gas companies, particularly in the Gulf of Mexico. The region boasts a diverse offshore drilling landscape, with a focus on both shallow and deep water exploration. The Gulf of Mexico, with its vast offshore reserves, serves as a major hub for drilling activities. The region experiences a constant demand for advanced drilling technologies to tap into deep water reservoirs. Regulatory frameworks and environmental considerations also play a crucial role in shaping the offshore drilling market in North America. Technological advancements in drilling equipment and a resurgence in exploration activities in the Arctic region present opportunities for market growth. The adoption of innovative solutions for improving safety and environmental sustainability is a key trend in North America's offshore drilling market. Asia Pacific is a rapidly growing region in the offshore drilling industry, driven by increasing energy demand and exploration activities. Countries like China, Australia, and India contribute significantly to the market's expansion, with a focus on deep water and ultra-deep water exploration. The Asia Pacific region experiences a surge in demand for oil and gas, prompting investments in offshore drilling projects. Technological advancements and strategic partnerships with international players contribute to the region's growing prominence in the market. The South China Sea and the Australian offshore basins are key areas of focus, presenting opportunities for market penetration. Investments in renewable energy sources alongside traditional hydrocarbon exploration contribute to the dynamic landscape of the offshore drilling rigs market in Asia Pacific. Europe plays a significant role in the offshore drilling rigs market, with the North Sea being a primary area for exploration and production activities. The region emphasizes environmentally sustainable practices and stringent safety regulations in offshore operations. The North Sea continues to be a major driver for the European offshore drilling market, with a focus on advanced drilling technologies to access reserves in challenging conditions. Regulatory initiatives, including decommissioning projects, shape the market dynamics in Europe. The transition to renewable energy sources and the integration of digital technologies in drilling operations are notable trends in Europe's offshore drilling industry. The region offers opportunities for market innovation and collaboration in addressing environmental concerns. The Middle East and Africa are significant contributors to the offshore drilling rigs market, with the Middle East hosting some of the world's largest oil reserves. Offshore activities in the region are characterized by a focus on deepwater and ultra-deepwater exploration. The Middle East, particularly countries like Saudi Arabia and the United Arab Emirates, invest heavily in offshore drilling projects to maintain and enlarge their oil and gas production capacities. Political stability and favorable economic conditions contribute to the market's growth. The Red Sea and the Eastern Mediterranean are emerging as regions with untapped potential, presenting opportunities for market expansion. Technological advancements in drilling techniques and equipment contribute to the industry's competitiveness in the Middle East and Africa.Offshore Drilling Rigs Market Cutting-edge Safety Measures: How Offshore Rig Automation is changing the Game The Power of Offshore Rig Automation: In Offshore Drilling Rigs Market, Offshore rig automation involves deploying advanced technologies to perform tasks traditionally executed by humans. By harnessing the capabilities of artificial intelligence (AI), Internet of Things (IoT), and robotic systems, automation is significantly improving safety in the oil and gas industry. 1.Reduced human error: Automation eliminates the possibility of human errors caused by fatigue, stress, or distraction. By replacing humans in complex and repetitive tasks, it ensures consistent and accurate execution. 2. Enhanced monitoring: Automation systems continuously monitor critical parameters, detecting anomalies and anticipating potential failures before they occur. Real-time data analysis is crucial in preventing accidents and equipment failures. 3. Improved safety protocols: Offshore rig automation enforces stricter safety protocols. By automating safety procedures, the risk of accidents is reduced, helping protect the lives of workers and minimizing environmental hazards. 4. Efficient emergency response: Automated systems rapidly respond to emergencies, such as well blowouts or spills. They provide real-time data that enables immediate decision-making and swift action, thereby reducing response time and mitigating the impact of accidents. Key Features and Advantages: Offshore rig automation comes with an array of features and advantages that are transforming the industry. 1.Remote monitoring and control: Automation allows real-time monitoring and remote control of drilling equipment and processes. This reduces the need for human presence on offshore rigs, eliminating risks associated with harsh weather conditions and other external factors in the offshore drilling rigs market. 2. Intelligent data analysis: Automation systems process large volumes of data to identify patterns, detect anomalies, and optimize drilling operations. This helps prevent equipment failures, enhancing safety and efficiency. 3. Robotic maintenance: Automated robots perform routine maintenance tasks. They are equipped with sensors and cameras to inspect equipment, reducing the need for human intervention in hazardous areas in the offshore drilling rigs market. 4. Real-time risk assessment: Automation provides continuous risk assessments, identifying potential hazards and offering proactive solutions to minimize risks. This predictive capability enhances safety measures and prevents accidents before they happen. With these key features, offshore rig automation brings several advantages to the table: 1. Increased productivity: Automation streamlines processes, reduces downtime, and enhances efficiency, resulting in increased productivity and cost savings. 2. Enhanced worker safety: By minimizing human involvement in dangerous tasks, automation significantly improves worker safety. It eliminates risks associated with manual labor, reducing the likelihood of injuries and fatalities. 3. Environmental protection: Automation helps prevent oil spills, leaks, and other environmental disasters. By employing advanced monitoring systems, it ensures strict adherence to safety regulations, preserving marine life and ecosystems. 4. Optimized resource utilization: With intelligent data analysis, automation optimizes resource utilization, reducing waste and minimizing the environmental footprint of offshore drilling rigs market operations. Advantages of Automation in Offshore Drilling: The advantages of advanced automation technologies in offshore drilling cannot be overlooked. These game-changing solutions offer numerous benefits to the oil and gas industry: 1. Improved Efficiency: Automation streamlines processes, reduces manual intervention, and improves productivity. This leads to faster drilling, optimized operations, and higher output for offshore drilling companies. 2. Cost Reduction: Automation technologies minimize operational costs by reducing the number of human resources required on rigs and maximizing equipment uptime. This allows offshore drilling companies to maximize profitability and compete in a challenging offshore drilling rigs market. 3. Enhanced Safety: With automation, human errors are minimized, creating a safer work environment for offshore rig workers. This reduces the risk of accidents, injuries, and equipment damage. 4. Data-Driven Decision Making: Advanced automation technologies generate vast amounts of valuable data. By analyzing this data, offshore drilling companies make informed decisions, optimize operations, and increase overall efficiency.

Offshore Drilling Rigs Market Scope:Inquire before buying

Global Offshore Drilling Rigs Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 76.4 Bn. Forecast Period 2024 to 2030 CAGR: 6.75% Market Size in 2030: US $ 127.8 Bn. Segments Covered: by Type Jack up Semi-Submersible Drill Ships by Application Shallow Water Deep Water Ultra Deep Water Offshore Drilling Rigs Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Offshore Drilling Rigs Market Key Players:

Major Global Key Players: 1. Seadrill Limited (United Kingdom) 2. EnscoRowan (United Kingdom) 3. Transocean Ltd (Switzerland) Leading Key Players in North America: 1. Diamond Offshore Drilling (United States) 2. Helmerich & Payne, Inc. (United States) Market Follower key Players in Europe: 1. Maersk Drilling (Denmark) 2. Odfjell Drilling (Norway) 3. Noble Corporation plc (United Kingdom) 4. KCA Deutag (United Kingdom) Prominent Key player Asia Pacific: 1. China Oilfield Services Limited (COSL) (China) 2. Sapura Energy Berhad (Malaysia) 3. Borr Drilling (Bermuda) 4. Japan Drilling Co., Ltd. (Japan) 5. Shelf Drilling Holdings Ltd. (United Kingdom, operational in Asia-Pacific) Market Leader Key Players in Middle East and Africa: 1. SAS Institute Inc. (United Arab Emirates) 2. Teradata Corporation (South Africa) Dominant key Player in South America: 1. Petrobras (Brazil) 2. EnscoRowan (United Kingdom, operational in South America) 3. Constellation Oil Services Holding S.A. (Luxembourg, operational in South America) FAQ’s: 1. What is the Offshore Drilling Rigs Market? Ans: The offshore drilling rigs market involves the exploration and extraction of oil and gas reserves beneath the seabed. It encompasses various types of drilling platforms and equipment used in offshore locations. 2. What are the key types of Offshore Drilling Rigs? Ans: The main types include Jack-up Rigs, Semi-Submersible Rigs, and Drill Ships. Each type serves specific purposes, offering versatility in drilling operations across different water depths. 3. What drives the growth of the Offshore Drilling Rigs Market? Ans: Key drivers include the growing global demand for energy, technological advancements in drilling capabilities, exploration in new basins, government initiatives supporting offshore projects, and global investments by oil and gas companies. 4. What challenges does the market face? Ans: Challenges include volatility in oil prices affecting exploration budgets, high capital costs associated with offshore operations, environmental and regulatory constraints, project delays and uncertainties, and competition from onshore resources. 5. Who are the major players in the Offshore Drilling Rigs Market? Ans: Key global players include Transocean Ltd, Seadrill Limited, EnscoRowan (now Valaris), Noble Corporation, Maersk Drilling, China Oilfield Services Limited (COSL), Sapura Energy Berhad, Petrobras, Saudi Aramco, and Diamond Offshore Drilling.

1. Offshore Drilling Rigs Market: Research Methodology 2. Offshore Drilling Rigs Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Offshore Drilling Rigs Market: Dynamics 3.1. Offshore Drilling Rigs Market Trends by Region 3.1.1. North America Offshore Drilling Rigs Market Trends 3.1.2. Europe Offshore Drilling Rigs Market Trends 3.1.3. Asia Pacific Offshore Drilling Rigs Market Trends 3.1.4. Middle East and Africa Offshore Drilling Rigs Market Trends 3.1.5. South America Offshore Drilling Rigs Market Trends 3.2. Offshore Drilling Rigs Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Offshore Drilling Rigs Market Drivers 3.2.1.2. North America Offshore Drilling Rigs Market Restraints 3.2.1.3. North America Offshore Drilling Rigs Market Opportunities 3.2.1.4. North America Offshore Drilling Rigs Market Challenges 3.2.2. Europe 3.2.2.1. Europe Offshore Drilling Rigs Market Drivers 3.2.2.2. Europe Offshore Drilling Rigs Market Restraints 3.2.2.3. Europe Offshore Drilling Rigs Market Opportunities 3.2.2.4. Europe Offshore Drilling Rigs Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Offshore Drilling Rigs Market Drivers 3.2.3.2. Asia Pacific Offshore Drilling Rigs Market Restraints 3.2.3.3. Asia Pacific Offshore Drilling Rigs Market Opportunities 3.2.3.4. Asia Pacific Offshore Drilling Rigs Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Offshore Drilling Rigs Market Drivers 3.2.4.2. Middle East and Africa Offshore Drilling Rigs Market Restraints 3.2.4.3. Middle East and Africa Offshore Drilling Rigs Market Opportunities 3.2.4.4. Middle East and Africa Offshore Drilling Rigs Market Challenges 3.2.5. South America 3.2.5.1. South America Offshore Drilling Rigs Market Drivers 3.2.5.2. South America Offshore Drilling Rigs Market Restraints 3.2.5.3. South America Offshore Drilling Rigs Market Opportunities 3.2.5.4. South America Offshore Drilling Rigs Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For the Offshore Drilling Rigs Market 3.8. Analysis of Government Schemes and Initiatives For the Offshore Drilling Rigs Market 3.9. The Global Pandemic Impact on the Offshore Drilling Rigs Market 4. Offshore Drilling Rigs Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 4.1. Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 4.1.1. Jack up 4.1.2. Semi-Submersible 4.1.3. Drill Ships 4.2. Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 4.2.1. Shallow Water 4.2.2. Deep Water 4.2.3. Ultra Deep Water 4.3. Offshore Drilling Rigs Market Size and Forecast, by Region (2022-2029) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Offshore Drilling Rigs Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 5.1. North America Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 5.1.1. Jack up 5.1.2. Semi-Submersible 5.1.3. Drill Ships 5.2. North America Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 5.2.1. Shallow Water 5.2.2. Deep Water 5.2.3. Ultra Deep Water 5.3. North America Offshore Drilling Rigs Market Size and Forecast, by Country (2022-2029) 5.3.1. United States 5.3.1.1. United States Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 5.3.1.1.1. Jack up 5.3.1.1.2. Semi-Submersible 5.3.1.1.3. Drill Ships 5.3.1.2. United States Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 5.3.1.2.1. Shallow Water 5.3.1.2.2. Deep Water 5.3.1.2.3. Ultra Deep Water 5.3.2. Canada 5.3.2.1. Canada Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 5.3.2.1.1. Jack up 5.3.2.1.2. Semi-Submersible 5.3.2.1.3. Drill Ships 5.3.2.2. Canada Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 5.3.2.2.1. Shallow Water 5.3.2.2.2. Deep Water 5.3.2.2.3. Ultra Deep Water 5.3.3. Mexico 5.3.3.1. Mexico Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 5.3.3.1.1. Jack up 5.3.3.1.2. Semi-Submersible 5.3.3.1.3. Drill Ships 5.3.3.2. Mexico Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 5.3.3.2.1. Shallow Water 5.3.3.2.2. Deep Water 5.3.3.2.3. Ultra Deep Water 6. Europe Offshore Drilling Rigs Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 6.1. Europe Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 6.2. Europe Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 6.3. Europe Offshore Drilling Rigs Market Size and Forecast, by Country (2022-2029) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 6.3.1.2. United Kingdom Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 6.3.2. France 6.3.2.1. France Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 6.3.2.2. France Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 6.3.3. Germany 6.3.3.1. Germany Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 6.3.3.2. Germany Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 6.3.4. Italy 6.3.4.1. Italy Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 6.3.4.2. Italy Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 6.3.5. Spain 6.3.5.1. Spain Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 6.3.5.2. Spain Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 6.3.6. Sweden 6.3.6.1. Sweden Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 6.3.6.2. Sweden Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 6.3.7. Austria 6.3.7.1. Austria Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 6.3.7.2. Austria Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 6.3.8.2. Rest of Europe Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7. Asia Pacific Offshore Drilling Rigs Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029) 7.1. Asia Pacific Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.2. Asia Pacific Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3. Asia Pacific Offshore Drilling Rigs Market Size and Forecast, by Country (2022-2029) 7.3.1. China 7.3.1.1. China Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.1.2. China Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3.2. S Korea 7.3.2.1. S Korea Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.2.2. S Korea Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3.3. Japan 7.3.3.1. Japan Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.3.2. Japan Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3.4. India 7.3.4.1. India Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.4.2. India Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3.5. Australia 7.3.5.1. Australia Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.5.2. Australia Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3.6. Indonesia 7.3.6.1. Indonesia Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.6.2. Indonesia Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3.7. Malaysia 7.3.7.1. Malaysia Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.7.2. Malaysia Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3.8. Vietnam 7.3.8.1. Vietnam Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.8.2. Vietnam Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3.9. Taiwan 7.3.9.1. Taiwan Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.9.2. Taiwan Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 7.3.10.2. Rest of Asia Pacific Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 8. Middle East and Africa Offshore Drilling Rigs Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029 8.1. Middle East and Africa Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 8.2. Middle East and Africa Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 8.3. Middle East and Africa Offshore Drilling Rigs Market Size and Forecast, by Country (2022-2029) 8.3.1. South Africa 8.3.1.1. South Africa Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 8.3.1.2. South Africa Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 8.3.2. GCC 8.3.2.1. GCC Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 8.3.2.2. GCC Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 8.3.3. Nigeria 8.3.3.1. Nigeria Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 8.3.3.2. Nigeria Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 8.3.4.2. Rest of ME&A Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 9. South America Offshore Drilling Rigs Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2022-2029 9.1. South America Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 9.2. South America Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 9.3. South America Offshore Drilling Rigs Market Size and Forecast, by Country (2022-2029) 9.3.1. Brazil 9.3.1.1. Brazil Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 9.3.1.2. Brazil Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 9.3.2. Argentina 9.3.2.1. Argentina Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 9.3.2.2. Argentina Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Offshore Drilling Rigs Market Size and Forecast, By Type (2022-2029) 9.3.3.2. Rest Of South America Offshore Drilling Rigs Market Size and Forecast, By Application (2022-2029) 10. Global Offshore Drilling Rigs Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Offshore Drilling Rigs Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Seadrill Limited (United Kingdom) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. EnscoRowan (United Kingdom) 11.3. Transocean Ltd (Switzerland) 11.4. Diamond Offshore Drilling (United States) 11.5. Helmerich & Payne, Inc. (United States) 11.6. Maersk Drilling (Denmark) 11.7. Odfjell Drilling (Norway) 11.8. Noble Corporation plc (United Kingdom) 11.9. KCA Deutag (United Kingdom) 11.10. China Oilfield Services Limited (COSL) (China) 11.11. Sapura Energy Berhad (Malaysia) 11.12. Borr Drilling (Bermuda) 11.13. Japan Drilling Co., Ltd. (Japan) 11.14. Shelf Drilling Holdings Ltd. (United Kingdom, operational in Asia-Pacific) 11.15. SAS Institute Inc. (United Arab Emirates) 11.16. Teradata Corporation (South Africa) 11.17. Petrobras (Brazil) 11.18. EnscoRowan (United Kingdom, operational in South America) 11.19. Constellation Oil Services Holding S.A. (Luxembourg, operational in South America) 12. Key Findings 13. Industry Recommendations