Global Neurovascular Devices Market size was valued at USD 2.82 Bn in 2023 and is expected to reach USD 4.30 Bn by 2030, at a CAGR of 6.2%.Neurovascular Devices Market Overview

Neurovascular devices cater to critical conditions like ischemic stroke and cerebral aneurysm. These devices, including embolic coils, flow diversion stents, and thrombectomy tools, address the complexities of the brain's vasculature. TE Connectivity specializes in Minimally Invasive Access and delivery devices, offering precise solutions for neurovascular therapies and serving as a key global provider in this specialized field. As life expectancy rises globally, the demand for innovative solutions targeting prevalent conditions in aging populations, like neurovascular disorders, intensifies. Disorders like ischemic stroke and cerebral aneurysms present substantial threats to both quality of life and mortality rates.To know about the Research Methodology :- Request Free Sample Report The Neurovascular Devices Market plays a pivotal role in addressing these challenges by providing essential medical devices tailored to diagnosing and treating these conditions. They include specialized tools for delivering embolic coils and flow diversion stents to prevent aneurysm rupture, as well as devices for clot removal in cerebral blood vessels. The intricate nature of the brain's vasculature demands precision and minimally invasive techniques to ensure patient safety. The Neurovascular Devices industry is experiencing growth due to various key drivers and trends. Primarily, the aging global population increases neurovascular disorder prevalence, necessitating innovative devices for conditions such as ischemic stroke and cerebral aneurysm. Technological advancements are pivotal, enabling sophisticated and minimally invasive device development, incorporating improved imaging for precise diagnosis and advanced materials for heightened efficacy and safety. Increasing adoption of neurothrombectomy devices and flow diversion stents drives market expansion, propelled by growing awareness among healthcare professionals and patients favoring early intervention with neurovascular devices. Research emphasis on novel therapies, aided by government healthcare initiatives, and industry growth through collaborations and acquisitions, augments market growth. The Neurovascular Devices Market thrives on innovation, disease prevalence, raised awareness, and strategic partnerships.

Neurovascular Devices Market Trends

Rapid Advancement and Adoption of Minimally Invasive Procedures and Devices The Neurovascular Devices Market witnesses a transformative trend through the rapid acceptance and advancements in minimally invasive procedures and devices, redefining the medical device landscape. Embraced by both medical practitioners and patients, these techniques minimize invasiveness compared to traditional surgeries, employing smaller incisions aided by imaging technologies and advanced devices, thereby reducing infection risks and recovery times. These minimally invasive devices, offering reduced pain and shorter hospital stays, epitomize progress in healthcare, propelled by continuous technological enhancements. This shift aligns with patient preferences for less invasive procedures, fostering the expansion of these techniques across diverse medical specialties and significantly impacting the evolution of the Market. Rapid advancements and widespread adoption of minimally invasive procedures and devices are steering a significant trend in the Neurovascular Devices Market. Surgeons now wield evolved instruments tailored to perform specialized tasks quickly due to the diverse range of designs often customized by influential opinion leaders. Integrated miniaturized sensors in these devices provide vital anatomical feedback, aiding in procedures with limited visibility. The increase of robot-assisted surgeries, offering precision without direct visualization, stands as a swiftly evolving technology, significantly improving surgical accuracy while minimizing patient trauma and recovery time. Despite hurdles like high equipment costs and specialized training requirements, these advancements persist, propelled by ongoing technological innovations in visualization methods such as high-resolution imaging and real-time anatomical modeling. The seamless integration of robotics, advanced imaging, and minimally invasive techniques across various surgeries marks an influential trend driving the future landscape of the Neurovascular Devices industry.Neurovascular Devices Market Dynamics

The escalating prevalence of neurovascular disorders due to the aging global population boosts Market Growth The escalating prevalence of neurovascular disorders is predominantly associated with the aging global population driving the Neurovascular Devices Market. This category incorporates various irregularities within the blood vessels supplying or within the brain and spinal cord, including ischemic stroke and cerebral aneurysm, both severe and potentially fatal conditions. These disorders often arise due to arterial narrowing, resulting in reduced blood flow to the brain, heightening the risks of strokes. The surge in these conditions has led to the advancement of innovative technologies and surgical techniques, a domain where healthcare institutions such as Virginia Mason Franciscan Health and Dignity Health Neurological Institute lead the way. Advancements in technology and surgical methods have been alleviating the impact of neurovascular diseases. Interventions involving stents to widen constricted arteries, injection of materials into blood vessels to treat malformations or curb tumor blood supply, and microsurgical clipping for repairing brain aneurysms offer a diverse range of treatment options. This array of tools across radiological and surgical specializations significantly enhances physicians' abilities to safely address vascular issues impacting the brain and spine. Leading institutions like the Dignity Health Neurological Institute of Northern California offer state-of-the-art treatments for various neurovascular conditions, encompassing aneurysms, stenosis, and intracranial stenosis, employing innovative solutions from the Neurovascular Devices Market. The complexity of these disorders often presents sudden and severe symptoms, ranging from numbness and muscle weakness to headaches, seizures, and personality changes. Immediate evaluation and care are crucial, especially for potential stroke cases, necessitating prompt emergency treatment. Neurovascular diseases' causative factors are multifaceted, encompassing congenital conditions like arteriovenous malformations (AVMs) arising during fetal development, genetic predispositions, lifestyle habits, and various medical factors. Risk factors, akin to those for heart attacks including diabetes, high blood pressure, smoking, and high cholesterol, contribute to conditions such as carotid artery stenosis and ischemic strokes. Regulatory Landscape and Stringent Approval Processes Hamper Market Growth The Neurovascular Devices Market encounters a significant challenge due to stringent regulatory frameworks governing the introduction of new devices. These regulatory measures, overseen by various global bodies, demand rigorous adherence to safety and efficacy standards. Introducing innovative neurovascular devices involves extensive testing and clinical trials, elongating the approval process and extending the time-to-market. This prolonged journey necessitates substantial financial investments. The evolving and diverse regulatory requisites across different regions heighten complexity, requiring companies to navigate multifaceted approval procedures for global market entry. These intricate compliance protocols pose obstacles, hindering the pace of innovation and delaying access to advanced neurovascular solutions for healthcare providers and patients worldwide. The stringent regulatory landscape extends developmental timelines, elevates costs, and impedes the industry's swift introduction of cutting-edge solutions for neurovascular conditions.Neurovascular Devices Market Segment Analysis

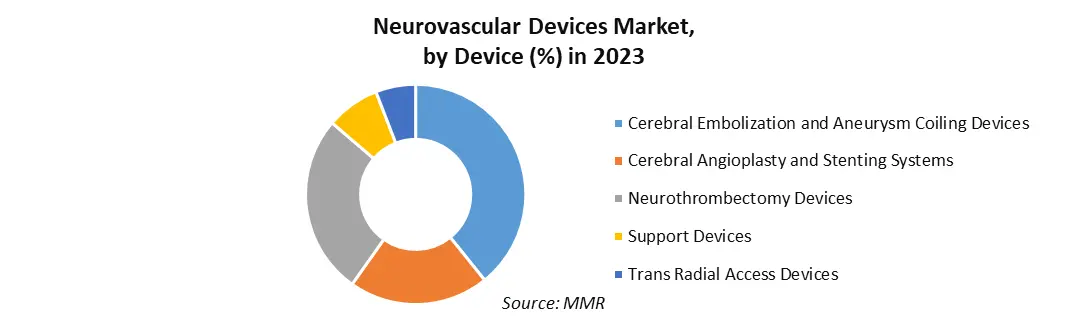

Based on Device: The market is segmented into Cerebral Embolization and Aneurysm Coiling Devices, Cerebral Angioplasty and Stenting Systems, Neurothrombectomy Devices, Support Devices and Trans Radial Access Devices. In 2023, cerebral embolization and aneurysm coiling devices dominated the market with a significant share. Coil embolization, a minimally invasive procedure used for treating aneurysms, involves the use of materials to close the sac, thereby reducing the risk of bleeding. This procedure entails inserting a steerable catheter through the groin and guiding it to the brain. The segment is expected to witness substantial growth during the forecast period due to the increasing prevalence of aneurysms. These devices are further categorized into embolic coils, flow diversion devices, and liquid embolic agents.

Neurovascular Devices Market Regional Insights

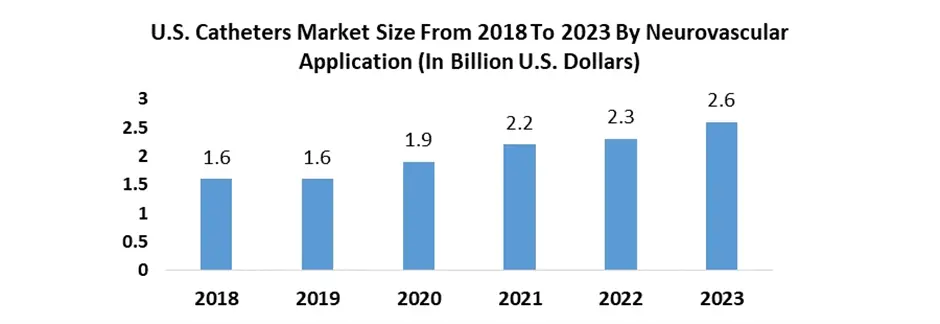

North America held the largest Market share and is expected to dominate the Neurovascular Devices Market growth. North America asserts dominance in the Market due to several key factors. The region boasts a robust healthcare infrastructure with advanced medical facilities and a high adoption rate of innovative medical technologies. This technological ability fosters a conducive environment for the development and uptake of neurovascular devices. The presence of well-established regulatory frameworks, such as the FDA in the United States, ensures stringent but structured approval processes, instilling confidence in the safety and efficacy of these devices. North America's healthcare expenditure is substantial, facilitating greater investment in research and development for neurovascular devices. This financial backing encourages innovation and the introduction of cutting-edge technologies, further propelling market growth. The region also benefits from a higher prevalence of neurovascular disorders, including stroke and aneurysms, which drives the demand for advanced medical devices to address these conditions. The strong presence of key market players and collaborations between industry stakeholders, academic institutions, and research organizations in North America contribute to the market's dominance. These collaborations foster innovation, accelerate product development, and enhance the commercialization of neurovascular devices. Overall, North America's favorable regulatory environment, technological advancements, robust healthcare infrastructure, high healthcare expenditure, and prevalence of neurovascular disorders collectively position it as the dominant region in the Neurovascular Devices Market. North America's dominance in the 2023 Market, holding a 32.44% share, owes to key players such as Stryker Corporation, Penumbra, Inc., Johnson and Johnson, and Merit Medical Systems, Inc. Cerus Endovascular Ltd.'s CE Mark approval for the 0.021-inch Contour Neurovascular System in April 2023 expanded treatment options for saccular intracranial aneurysms. The U.S. Catheters Market size, inclusive of the Neurovascular Devices segment, experienced steady growth from 2018 to 2023, reflecting a significant contribution to the overall expansion of the Neurovascular Devices Market in North America.

Neurovascular Device Market Scope: Inquire before buying

Global Neurovascular Device Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.82 Bn. Forecast Period 2024 to 2030 CAGR: 6.2% Market Size in 2030: US $ 4.30 Bn. Segments Covered: By Device Cerebral Embolization and Aneurysm Coiling Devices Embolic coils Flow diversion devices Liquid embolic agents Cerebral Angioplasty and Stenting Systems Carotid artery stents Embolic protection Neurothrombectomy Devices Clot retrieval devices Suction devices/aspiration catheters Vascular snares Support Devices Micro catheters Micro guidewires Trans Radial Access Devices By Therapeutic Application Stroke Cerebral Artery Cerebral Aneurysm Aneurysmal Subarachnoid Hemorrhage Others Others By End User Hospitals Specialty Clinics Others Global Neurovascular Device Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Neurovascular Device Key Players

1. Medtronic plc (Dublin, Ireland) 2. Johnson & Johnson (New Brunswick, New Jersey, USA) 3. Stryker Corporation (Kalamazoo, Michigan, USA) 4. Terumo Corporation (Tokyo, Japan) 5. Abbott Laboratories (Abbott Park, Illinois, USA) Neurovascular Devices Manufacturers in North America 1. Penumbra, Inc. (Alameda, California, USA) 2. Merit Medical Systems, Inc. (South Jordan, Utah, USA) Neurovascular Devices Manufacturers in Europe 1. Balt Extrusion (Montmorency, France) 2. Acandis GmbH (Pforzheim, Germany) 3. ArtVentive Medical Group, Inc. (Carlsbad, California, USA) 4. Spiegelberg GmbH & Co. KG (Hamburg, Germany) 5. EndoShape, Inc. (Aliso Viejo, California, USA) 6. Penumbra Europe GmbH (Alsbach-Hähnlein, Germany) Neurovascular Devices Manufacturers in Asia Pacific 1. Terumo Corporation (Tokyo, Japan) 2. MicroPort Scientific Corporation (Shanghai, China) 3. Medikit Co., Ltd. (Tokyo, Japan) 4. Penumbra Japan (Tokyo, Japan) 5. Asahi Intecc Co., Ltd. (Aichi, Japan) 6. Kaneka Corporation (Osaka, Japan) Frequently Asked Questions: 1] What is the growth rate of the Global Neurovascular Devices Market? Ans. The Global Neurovascular Devices Market is growing at a significant rate of 6.2% during the forecast period. 2] Which region is expected to dominate the Global Neurovascular Devices Market? Ans. North America is expected to dominate the Neurovascular Devices Market during the forecast period. 3] What is the expected Global Neurovascular Devices Market size by 2030? Ans. The Neurovascular Devices Market size is expected to reach USD 4.30 Billion by 2030. 4] Which are the top players in the Global Neurovascular Devices Market? Ans. The major top players in the Global Neurovascular Devices Market are Medtronic plc (Dublin, Ireland), Johnson & Johnson (New Brunswick, New Jersey, USA),Stryker Corporation (Kalamazoo, Michigan, USA), Terumo Corporation (Tokyo, Japan) , Abbott Laboratories (Abbott Park, Illinois, USA) and Others. 5] What are the factors driving the Global Neurovascular Devices Market growth? Ans. Increasing Prevalence of neurovascular disorders and technological advancements are expected to drive market growth during the forecast period.

1. Neurovascular Device Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Neurovascular Device Market: Dynamics 2.1. Neurovascular Device Market Trends by Region 2.1.1. North America Neurovascular Device Market Trends 2.1.2. Europe Neurovascular Device Market Trends 2.1.3. Asia Pacific Neurovascular Device Market Trends 2.1.4. Middle East and Africa Neurovascular Device Market Trends 2.1.5. South America Neurovascular Device Market Trends 2.2. Neurovascular Device Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Neurovascular Device Market Drivers 2.2.1.2. North America Neurovascular Device Market Restraints 2.2.1.3. North America Neurovascular Device Market Opportunities 2.2.1.4. North America Neurovascular Device Market Challenges 2.2.2. Europe 2.2.2.1. Europe Neurovascular Device Market Drivers 2.2.2.2. Europe Neurovascular Device Market Restraints 2.2.2.3. Europe Neurovascular Device Market Opportunities 2.2.2.4. Europe Neurovascular Device Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Neurovascular Device Market Drivers 2.2.3.2. Asia Pacific Neurovascular Device Market Restraints 2.2.3.3. Asia Pacific Neurovascular Device Market Opportunities 2.2.3.4. Asia Pacific Neurovascular Device Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Neurovascular Device Market Drivers 2.2.4.2. Middle East and Africa Neurovascular Device Market Restraints 2.2.4.3. Middle East and Africa Neurovascular Device Market Opportunities 2.2.4.4. Middle East and Africa Neurovascular Device Market Challenges 2.2.5. South America 2.2.5.1. South America Neurovascular Device Market Drivers 2.2.5.2. South America Neurovascular Device Market Restraints 2.2.5.3. South America Neurovascular Device Market Opportunities 2.2.5.4. South America Neurovascular Device Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Neurovascular Device Industry 2.8. Analysis of Government Schemes and Initiatives For Neurovascular Device Industry 2.9. Neurovascular Device Market Trade Analysis 2.10. The Global Pandemic Impact on Neurovascular Device Market 3. Neurovascular Device Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Neurovascular Device Market Size and Forecast, by Device (2023-2030) 3.1.1. Cerebral Embolization and Aneurysm Coiling Devices 3.1.2. Cerebral Angioplasty and Stenting Systems 3.1.3. Neurothrombectomy Devices 3.1.4. Support Devices 3.1.5. Trans Radial Access Devices 3.2. Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 3.2.1. Stroke 3.2.2. Cerebral Artery 3.2.3. Cerebral Aneurysm 3.2.4. Others 3.3. Neurovascular Device Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospitals 3.3.2. Specialty Clinics 3.3.3. Others 3.4. Neurovascular Device Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Neurovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Neurovascular Device Market Size and Forecast, by Device (2023-2030) 4.1.1. Cerebral Embolization and Aneurysm Coiling Devices 4.1.2. Cerebral Angioplasty and Stenting Systems 4.1.3. Neurothrombectomy Devices 4.1.4. Support Devices 4.1.5. Trans Radial Access Devices 4.2. North America Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 4.2.1. Stroke 4.2.2. Cerebral Artery 4.2.3. Cerebral Aneurysm 4.2.4. Others 4.3. North America Neurovascular Device Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospitals 4.3.2. Specialty Clinics 4.3.3. Others 4.4. North America Neurovascular Device Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Neurovascular Device Market Size and Forecast, by Device (2023-2030) 4.4.1.1.1. Cerebral Embolization and Aneurysm Coiling Devices 4.4.1.1.2. Cerebral Angioplasty and Stenting Systems 4.4.1.1.3. Neurothrombectomy Devices 4.4.1.1.4. Support Devices 4.4.1.1.5. Trans Radial Access Devices 4.4.1.2. United States Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 4.4.1.2.1. Stroke 4.4.1.2.2. Cerebral Artery 4.4.1.2.3. Cerebral Aneurysm 4.4.1.2.4. Others 4.4.1.3. United States Neurovascular Device Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Hospitals 4.4.1.3.2. Specialty Clinics 4.4.1.3.3. Others 4.4.2. Canada 4.4.2.1. Canada Neurovascular Device Market Size and Forecast, by Device (2023-2030) 4.4.2.1.1. Cerebral Embolization and Aneurysm Coiling Devices 4.4.2.1.2. Cerebral Angioplasty and Stenting Systems 4.4.2.1.3. Neurothrombectomy Devices 4.4.2.1.4. Support Devices 4.4.2.1.5. Trans Radial Access Devices 4.4.2.2. Canada Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 4.4.2.2.1. Stroke 4.4.2.2.2. Cerebral Artery 4.4.2.2.3. Cerebral Aneurysm 4.4.2.2.4. Others 4.4.2.3. Canada Neurovascular Device Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Hospitals 4.4.2.3.2. Specialty Clinics 4.4.2.3.3. Others 4.4.3. Mexico 4.4.3.1. Mexico Neurovascular Device Market Size and Forecast, by Device (2023-2030) 4.4.3.1.1. Cerebral Embolization and Aneurysm Coiling Devices 4.4.3.1.2. Cerebral Angioplasty and Stenting Systems 4.4.3.1.3. Neurothrombectomy Devices 4.4.3.1.4. Support Devices 4.4.3.1.5. Trans Radial Access Devices 4.4.3.2. Mexico Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 4.4.3.2.1. Stroke 4.4.3.2.2. Cerebral Artery 4.4.3.2.3. Cerebral Aneurysm 4.4.3.2.4. Others 4.4.3.3. Mexico Neurovascular Device Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Hospitals 4.4.3.3.2. Specialty Clinics 4.4.3.3.3. Others 5. Europe Neurovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Neurovascular Device Market Size and Forecast, by Device (2023-2030) 5.2. Europe Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 5.3. Europe Neurovascular Device Market Size and Forecast, by End User (2023-2030) 5.4. Europe Neurovascular Device Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Neurovascular Device Market Size and Forecast, by Device (2023-2030) 5.4.1.2. United Kingdom Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 5.4.1.3. United Kingdom Neurovascular Device Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Neurovascular Device Market Size and Forecast, by Device (2023-2030) 5.4.2.2. France Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 5.4.2.3. France Neurovascular Device Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Neurovascular Device Market Size and Forecast, by Device (2023-2030) 5.4.3.2. Germany Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 5.4.3.3. Germany Neurovascular Device Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Neurovascular Device Market Size and Forecast, by Device (2023-2030) 5.4.4.2. Italy Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 5.4.4.3. Italy Neurovascular Device Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Neurovascular Device Market Size and Forecast, by Device (2023-2030) 5.4.5.2. Spain Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 5.4.5.3. Spain Neurovascular Device Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Neurovascular Device Market Size and Forecast, by Device (2023-2030) 5.4.6.2. Sweden Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 5.4.6.3. Sweden Neurovascular Device Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Neurovascular Device Market Size and Forecast, by Device (2023-2030) 5.4.7.2. Austria Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 5.4.7.3. Austria Neurovascular Device Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Neurovascular Device Market Size and Forecast, by Device (2023-2030) 5.4.8.2. Rest of Europe Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 5.4.8.3. Rest of Europe Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Neurovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.2. Asia Pacific Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.3. Asia Pacific Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Neurovascular Device Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.1.2. China Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.1.3. China Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.2.2. S Korea Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.2.3. S Korea Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.3.2. Japan Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.3.3. Japan Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.4.2. India Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.4.3. India Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.5.2. Australia Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.5.3. Australia Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.6.2. Indonesia Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.6.3. Indonesia Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.7.2. Malaysia Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.7.3. Malaysia Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.8.2. Vietnam Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.8.3. Vietnam Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.9.2. Taiwan Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.9.3. Taiwan Neurovascular Device Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Neurovascular Device Market Size and Forecast, by Device (2023-2030) 6.4.10.2. Rest of Asia Pacific Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Neurovascular Device Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Neurovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Neurovascular Device Market Size and Forecast, by Device (2023-2030) 7.2. Middle East and Africa Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 7.3. Middle East and Africa Neurovascular Device Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Neurovascular Device Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Neurovascular Device Market Size and Forecast, by Device (2023-2030) 7.4.1.2. South Africa Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 7.4.1.3. South Africa Neurovascular Device Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Neurovascular Device Market Size and Forecast, by Device (2023-2030) 7.4.2.2. GCC Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 7.4.2.3. GCC Neurovascular Device Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Neurovascular Device Market Size and Forecast, by Device (2023-2030) 7.4.3.2. Nigeria Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 7.4.3.3. Nigeria Neurovascular Device Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Neurovascular Device Market Size and Forecast, by Device (2023-2030) 7.4.4.2. Rest of ME&A Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 7.4.4.3. Rest of ME&A Neurovascular Device Market Size and Forecast, by End User (2023-2030) 8. South America Neurovascular Device Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Neurovascular Device Market Size and Forecast, by Device (2023-2030) 8.2. South America Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 8.3. South America Neurovascular Device Market Size and Forecast, by End User(2023-2030) 8.4. South America Neurovascular Device Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Neurovascular Device Market Size and Forecast, by Device (2023-2030) 8.4.1.2. Brazil Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 8.4.1.3. Brazil Neurovascular Device Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Neurovascular Device Market Size and Forecast, by Device (2023-2030) 8.4.2.2. Argentina Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 8.4.2.3. Argentina Neurovascular Device Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Neurovascular Device Market Size and Forecast, by Device (2023-2030) 8.4.3.2. Rest Of South America Neurovascular Device Market Size and Forecast, by Therapeutic Application (2023-2030) 8.4.3.3. Rest Of South America Neurovascular Device Market Size and Forecast, by End User (2023-2030) 9. Global Neurovascular Device Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Neurovascular Device Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Medtronic plc (Dublin, Ireland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Johnson & Johnson (New Brunswick, New Jersey, USA) 10.3. Stryker Corporation (Kalamazoo, Michigan, USA) 10.4. Terumo Corporation (Tokyo, Japan) 10.5. Abbott Laboratories (Abbott Park, Illinois, USA) 10.6. Penumbra, Inc. (Alameda, California, USA) 10.7. Merit Medical Systems, Inc. (South Jordan, Utah, USA) 10.8. Balt Extrusion (Montmorency, France) 10.9. Acandis GmbH (Pforzheim, Germany) 10.10. ArtVentive Medical Group, Inc. (Carlsbad, California, USA) 10.11. Spiegelberg GmbH & Co. KG (Hamburg, Germany) 10.12. EndoShape, Inc. (Aliso Viejo, California, USA) 10.13. Penumbra Europe GmbH (Alsbach-Hähnlein, Germany) 10.14. Terumo Corporation (Tokyo, Japan) 10.15. MicroPort Scientific Corporation (Shanghai, China) 10.16. Medikit Co., Ltd. (Tokyo, Japan) 10.17. Penumbra Japan (Tokyo, Japan) 10.18. Asahi Intecc Co., Ltd. (Aichi, Japan) 10.19. Kaneka Corporation (Osaka, Japan) 11. Key Findings 12. Industry Recommendations 13. Neurovascular Device Market: Research Methodology 14. Terms and Glossary