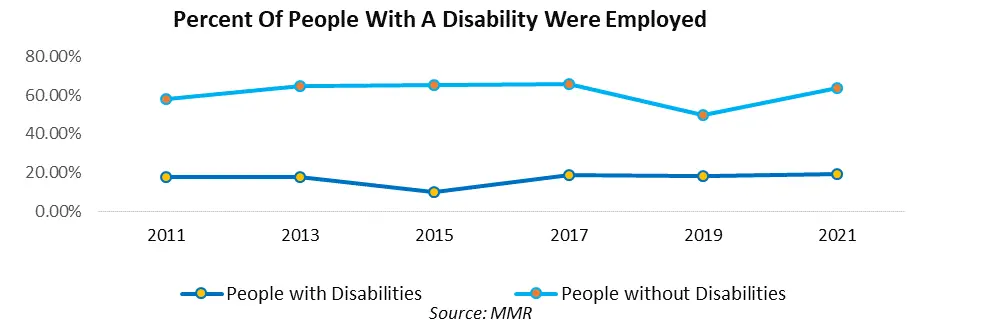

Electric Wheelchair Market was valued at USD 7.18 Billion in 2022, and it is expected to reach USD 14.22 Billion by 2029, exhibiting a CAGR of 10.24% during the forecast period (2023-2029) Electric wheelchair is also known as a motorized wheelchair, electric-powered wheelchair, or power chair. Any seating surface with wheels attached to it is driven by an electrically based power source, usually motors and batteries. A joystick is typically used to choose the intended direction of movement for purposes of movement. This device makes it possible for the user to move around more easily by using electric propulsion. There are an estimated 70 million persons without access to wheelchairs worldwide. Its goal is to grant independence to disabled people who reside in underdeveloped nations. FWM has been working to distribute wheelchairs since 2001, and by the end of 2029, they hope to have distributed another million.To know about the Research Methodology:-Request Free Sample Report The ratio of employment to population in 2021, 19.1 percent of the population was employed by individuals with disabilities. That was an increase from 2020 of 1.2 percentage points. The number of people without a disability rose by 1.9 percentage points in one year to 63.7 percent in 2021. The COVID-19 pandemic's effects on the workforce are shown in the data for both categories.

Electric Wheelchair Market Dynamics:

The MMR report covers all the trends and technologies playing a major role in the growth of the electric wheelchair market over the forecast period. It highlights the drivers, restraints, and opportunities expected to impact the market growth during 2023-2029. Demand for Advanced Electric Wheel Chairs from the Sports Industry is growing Sports like power wheelchair football and power wheelchair hockey among others make use of electric wheel chairs. According to the Victorian Electric Wheel Chair Sports Association, Australia's soccer, hockey, and rugby teams competed in the Victorian Sports League (VPSL) in 2018. The primary goal of this league is to increase the number of players with disabilities who have access to recreational possibilities, which will encourage the use of electric wheelchairs in sporting events. The development of a disability sports facility in India with a $24.7 million budget was approved by the Indian Union government in 2019. More disabled persons now have access to sporting activities because to this facility, and the market for electric wheelchairs will likely grow due to athletes' acceptance of them. Through Disability Sport NI, the Irish Football Association raised more than $88,493 in 2018 for power wheelchairs on behalf of the Department for Communities. The market for electric wheelchairs is expected to be driven by increasing funding from the major sports groups for electric wheelchair sporting activities. Rising Number of Patients with Diseases During the forecast period of 2022-2029, the market for electric wheelchair is expected to grow as a result of factors such as an increase in the number of patients with neurological disorders, an increase in demand for automated medical devices, an upsurge in the world's geriatric population, and an increase in disposable income. On the other hand, growing demand for improved electric wheelchairs from the sports industry and expanding applications from developing countries will both open up new opportunities for the growth of the smart wheelchair market over the course of the forecast period. Acceptance of Home Healthcare is growing Some of the key drivers fuelling the need for electric wheelchair globally include the increase in the prevalence of persons with physical impairments, the popularity of home healthcare, and the general increase in the frequency of road traffic accidents resulting in reduced mobility. Growing Elderly Population Globally The market for electric wheelchairs is being driven by the growing older population around the world. According to World Health Organization figures, the proportion of adults 65 and older in the global population may double from 7% in 2000 to 16% in 2050. The population's proportion of elderly adults could surpass that of youngsters (ages 0 to 14) by that time. Thus, it is projected that a growth in the older population will open up opportunities for the use of electric wheelchairs on the global market. By 2030, the elderly will outnumber children by a ratio of 1.04 to 1, according to the United Nations. The younger generation, which is unable to care for the old, has many job opportunities because to economic progress in nations like India. Manual wheelchairs are tiring for both young people who work hard and senior people who lack upper body strength. Technological Advancement in Electric Wheelchair For effective patient management over the past few years, technology advancements in the domains of patient care, home care, assisted living, and elder care products and services have taken precedence. As a result, smart wheelchair innovations are used in rehab facilities in addition to hospitals. The market for electric wheelchairs is being shaped by technological development. New products are being introduced by numerous businesses to improve the user experience. Such as, The Invacare AVIVA STORM RX power wheelchair was introduced in February 2021 by American medical equipment maker Invacare Corporation. It is a motorised wheelchair with forward-rear wheel drive that offers outstanding technology, functionality, and aesthetics. It is a motorised wheelchair made for outdoor use, although it can also enable independent mobility inside. The Mountain Trike Company will launch its newest electric wheelchair, the ePush, in Birmingham in July 2022. The ePush was developed with a number of user suggestions in mind. With this most recent product, users will be provided with electric support to help them navigate steeper hills, exceedingly difficult terrains, and embark on numerous adventures. A 36V 250W Hub motor, 36V, 12.8Ah Lithium Ion Battery, and a mains charger are included. For instance, the RWD coupled with electronic control system Invacare Aviva Storm Rx power wheelchair can be used for both indoor and outdoor travel. More than 1 billion people worldwide live with a handicap, according to WHO statistics from 2021. Due to shifting demographics and an increase in the burden of chronic diseases, disability is becoming more and more prevalent. Furthermore, 3.8% of the world's population needs assistance because they have severe problems with daily living. As a result, the growing burden of disability is expected to drive up demand for powered wheelchairs, which will fuel market growth over the analysis period. Electric Wheelchair Market Opportunities: Many lucrative opportunities are offered by the healthcare industry to electric wheelchair market as a result of the rapid rise in orthopaedic surgeries. The number of traffic accidents has increased as a result of rising industrialization and urbanisation, which is good for the market's expansion. The patient's high degree of comfort is also proving to be a tremendous prospect for the market. The need for electric wheelchairs that give them enough mobility has expanded along with the number of persons with physical limitations, who are multiplying quickly. The introduction of cutting-edge artificial intelligence technology in electric wheelchairs has given the market a lot of potential. Electric Wheelchair Market Challenges: The electric wheelchair was created to make it possible for the elderly population to move around on their own. Therefore, it has been noted that artificial intelligence is used in the system's mechanism for patient comfort. Patient-experienced technical issues are a barrier to the market's expansion. Given that a wheelchair user is incapacitated, any technical error that is made causes them a lot of pain. The user will have a negative experience if any electric wheelchair component fails. The market's expansion is hampered by this detrimental effect. The electric wheelchair is hefty, making it challenging for users to transport it when travelling. Due to the lack of people with disposable cash and the high price of the electric wheelchair, it is an unaffordable item for the consumer. Stringent Rules and Standards: The growing requirements for electric wheelchair quality assurance to ensure uncompromised operation and safety are also considered to be a market growth restraint. The newly developed products or new competitors must adhere to the rules, for example, before they are released onto the market. This is a considerable barrier to market expansion because the new items must adhere to a number of safety rules, raising their cost and delaying their adoption.Key Trends in Electric Wheelchair Market:

The market for electric wheelchairs may be fuelled by rising sports-related demand. A specific racing competition for the disabled community is held in BMX motocross. It is a well-liked sport in which the disabled community participates in large amounts. The contestants use motorised wheelchairs to accomplish a variety of acrobatics and expert stunts. The market for electric wheelchairs may be growing as a result of the growing participation of the disabled community. It's also expected that a number of technology developments, including WiFi and Bluetooth additions to electric wheelchairs, could hasten the market's expansion. The market for electric wheelchairs may see increased sales as a result of suspension improvements. The first wheelchair equipped with Flexilink full suspension technology has been released by Permobil.Electric Wheelchair Market Segment Analysis:

Based on Product Type, center wheel drive dominated the global electric wheelchair market with a revenue share of more than 39.55% in 2022 as a result of its multipurpose usage & multi-dimensional approach. It helps to move all the wheels with an equal amount of torque, improving the wheelchair's stability and balance. Additionally, it shows to be more resilient than other kinds of systems. It gives the wheelchair a tiny turning radius. The front tire's small weight and ability to navigate through tight spaces make it simple to operate.By End Users, in 2022, the hospitals & clinic segment acquired the highest revenue share in the electric wheelchair market. After an accident or handicap, patients frequently visit a hospital. It is at this phase that the patient is initially advised to use a wheelchair. As a result, the supply of the electric wheelchair segment is now open to the possibility of selling to hospitals. In order to give patients the most comfort and safety possible, these products are also frequently utilized to transport and relocate patients from one location to another. The market demand and sales of electric wheelchairs have increased as a result of the stringent criteria developed for the standardization of hospitals and healthcare facilities. The elderly population in society typically resides at home or in old age facilities where they receive specialised attention and care, making the home care segment the next fastest growing market. The employment of these cutting-edge tools by the caregivers allows them to give patients who are more vulnerable to injury because of their medical condition the maximum amount of comfort and safety. The final section consists of the smaller medical facilities and clinics.

Electric Wheelchair Market Regional Insight:

North America is expected to become a highly lucrative market for electric wheelchairs Over 2022-2029. With the prevalence of various physical immobility problems rising and the ageing populations in North American countries like the U.S. and Canada on the increase, the market for electric wheelchairs is growing fast. Therefore, to take benefit of current prospects, a number of market companies are investing more in research and development (R&D) projects. For instance, Invacare, a top American producer of non-acute medical equipment that includes wheelchairs and mobility scooters, announced the introduction of the AVIVA Storm RX, a new generation of rear-wheel drive electric wheelchair, in 2021. The wheelchair includes a unique open stack design that allows the legs to tuck under the chair by up to 7 degrees, as well as an LED lighting system, adjustable loan compensation interpreters, and other features. The demand in the North American market is expected to increase as a result of numerous such product releases. APAC: Increased traffic caused by the increasing use of automobiles in nations like China, India, South Korea, and others has increased the frequency of road accidents throughout Asia Pacific, excluding Japan. For instance, the National Crime Records Bureau reports that there were almost 467,171 vehicle accidents registered in India in 2019, resulting in approximately 181,113 fatalities. The number of immobility patients has increased due to the growth in road accidents, which is driving up demand for electric wheelchairs in the Asia Pacific market outside of Japan. Europe: The European countries has also shown a significant growth on account of the advanced medical facilities providing by the government to the people. The demand for automated equipment and facilities has increased as a result of the region's fast industrialisation and urbanisation.Country-wise Perspectives:

China has one of the highest rates of traffic accidents worldwide, which results in various injuries. China has the second-largest number of disabled people in the world, behind India. China is the most attractive market in Asia because to its robust medical device industry, which offers goods at significantly lower prices than in other nations. Additionally, it is expected that during the upcoming years, the number of wheelchair manufacturers and wheelchair component suppliers in the country would increase significantly. While big changes are seen in developed markets like the U.S., there have also been significant changes in emerging economies, which is fuelling significant growth in these sectors. Brazilian local producers are working with leading IT firms to release cutting-edge, novel products on the market. For instance, in January 2019, the Brazilian start-up Hoobox Robotics and Intel collaborated to create an adaptor kit that enables virtually any electric wheelchair to be powered by the user's facial expressions. The new Wheelie-7 includes Intel RealSense Depth Camera, Intel Core CPUs, and Intel's Open VINO AI tools to speed up facial recognition software inference and offer instant responsiveness.Electric Wheelchair Market Scope: Inquire before buying

Electric Wheelchair Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 7.18 Bn. Forecast Period 2023 to 2029 CAGR: 10.24% Market Size in 2029: US $ 14.22 Bn. Segments Covered: by Product Type 1. Center Wheel Drive 2. Front Wheel Drive 3. Rear Wheel Drive 4. Standing Electric Wheelchairs by End Users 1. Hospitals & Clinic 2. Home Care 3. Sports Conditioning Electric Wheelchair Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Electric Wheelchair Market, Key Players are

1. Quantum Rehab (US) 2. Karma Medical Products Co., Ltd (US) 3. Pride Mobility Products Corp (US) 4. Invacare Corporation (US) 5. Pride Mobility Products Corp (US) 6. GF Health Products(US) 7. Drive Medical (US) 8. Karman Healthcare (US) 9. Golden Technologies (US) 10. Hoveround Corp (US) 11. 21st Century SCIENTIFIC Inc. (US) 12. Merits Health Products(US) 13. Ottobock (Germany) 14. Levo AG (Switzerland) 15. Permobil AB (Sweden) 16. Matsunaga Manufactory Co., Ltd (Japan) 17. Meyra Group (Germany) 18. Miki Kogyosho Co., Ltd (Japan) 19. Nissin Medical Industries Co., Ltd (Japan) Frequently Asked Questions: 1] What segments are covered in the Global Electric Wheelchair Market report? Ans. The segments covered in the Electric Wheelchair Market report are based on Product Type, and End Users. 2] Which region is expected to hold the highest share in the Global Electric Wheelchair Market? Ans. North America region is expected to hold the highest share in the Electric Wheelchair Market. 3] What is the market size of the Global Electric Wheelchair Market by 2029? Ans. The market size of the Electric Wheelchair Market by 2029 is expected to reach USD 14.22 Bn. 4] What is the forecast period for the Global Electric Wheelchair Market? Ans. The forecast period for the Electric Wheelchair Market is 2023-2029. 5] What was the market size of the Global Electric Wheelchair Market in 2022? Ans. The market size of the Electric Wheelchair Market in 2022 was valued at USD 7.18 Bn.

1. Electric Wheelchair Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electric Wheelchair Market: Dynamics 2.1. Electric Wheelchair Market Trends by Region 2.1.1. North America Electric Wheelchair Market Trends 2.1.2. Europe Electric Wheelchair Market Trends 2.1.3. Asia Pacific Electric Wheelchair Market Trends 2.1.4. Middle East and Africa Electric Wheelchair Market Trends 2.1.5. South America Electric Wheelchair Market Trends 2.2. Electric Wheelchair Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electric Wheelchair Market Drivers 2.2.1.2. North America Electric Wheelchair Market Restraints 2.2.1.3. North America Electric Wheelchair Market Opportunities 2.2.1.4. North America Electric Wheelchair Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electric Wheelchair Market Drivers 2.2.2.2. Europe Electric Wheelchair Market Restraints 2.2.2.3. Europe Electric Wheelchair Market Opportunities 2.2.2.4. Europe Electric Wheelchair Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electric Wheelchair Market Drivers 2.2.3.2. Asia Pacific Electric Wheelchair Market Restraints 2.2.3.3. Asia Pacific Electric Wheelchair Market Opportunities 2.2.3.4. Asia Pacific Electric Wheelchair Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electric Wheelchair Market Drivers 2.2.4.2. Middle East and Africa Electric Wheelchair Market Restraints 2.2.4.3. Middle East and Africa Electric Wheelchair Market Opportunities 2.2.4.4. Middle East and Africa Electric Wheelchair Market Challenges 2.2.5. South America 2.2.5.1. South America Electric Wheelchair Market Drivers 2.2.5.2. South America Electric Wheelchair Market Restraints 2.2.5.3. South America Electric Wheelchair Market Opportunities 2.2.5.4. South America Electric Wheelchair Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electric Wheelchair Industry 2.8. Analysis of Government Schemes and Initiatives For Electric Wheelchair Industry 2.9. Electric Wheelchair Market Trade Analysis 2.10. The Global Pandemic Impact on Electric Wheelchair Market 3. Electric Wheelchair Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 3.1.1. Center Wheel Drive 3.1.2. Front Wheel Drive 3.1.3. Rear Wheel Drive 3.1.4. Standing Electric Wheelchairs 3.2. Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 3.2.1. Hospitals & Clinic 3.2.2. Home Care 3.2.3. Sports Conditioning 3.3. Electric Wheelchair Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Electric Wheelchair Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 4.1.1. Center Wheel Drive 4.1.2. Front Wheel Drive 4.1.3. Rear Wheel Drive 4.1.4. Standing Electric Wheelchairs 4.2. North America Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 4.2.1. Hospitals & Clinic 4.2.2. Home Care 4.2.3. Sports Conditioning 4.3. North America Electric Wheelchair Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 4.3.1.1.1. Center Wheel Drive 4.3.1.1.2. Front Wheel Drive 4.3.1.1.3. Rear Wheel Drive 4.3.1.1.4. Standing Electric Wheelchairs 4.3.1.2. United States Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 4.3.1.2.1. Hospitals & Clinic 4.3.1.2.2. Home Care 4.3.1.2.3. Sports Conditioning 4.7.2. Canada 4.3.2.1. Canada Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 4.3.2.1.1. Center Wheel Drive 4.3.2.1.2. Front Wheel Drive 4.3.2.1.3. Rear Wheel Drive 4.3.2.1.4. Standing Electric Wheelchairs 4.3.2.2. Canada Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 4.3.2.2.1. Hospitals & Clinic 4.3.2.2.2. Home Care 4.3.2.2.3. Sports Conditioning 4.7.3. Mexico 4.3.3.1. Mexico Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 4.3.3.1.1. Center Wheel Drive 4.3.3.1.2. Front Wheel Drive 4.3.3.1.3. Rear Wheel Drive 4.3.3.1.4. Standing Electric Wheelchairs 4.3.3.2. Mexico Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 4.3.3.2.1. Hospitals & Clinic 4.3.3.2.2. Home Care 4.3.3.2.3. Sports Conditioning 5. Europe Electric Wheelchair Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 5.2. Europe Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 5.3. Europe Electric Wheelchair Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 5.3.1.2. United Kingdom Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 5.3.2. France 5.3.2.1. France Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 5.3.2.2. France Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 5.3.3.2. Germany Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 5.3.4.2. Italy Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 5.3.5.2. Spain Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 5.3.6.2. Sweden Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 5.3.7.2. Austria Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 5.3.8.2. Rest of Europe Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6. Asia Pacific Electric Wheelchair Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.2. Asia Pacific Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.7. Asia Pacific Electric Wheelchair Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.1.2. China Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.2.2. S Korea Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.3.2. Japan Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.3.4. India 6.3.4.1. India Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.4.2. India Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.5.2. Australia Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.6.2. Indonesia Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.7.2. Malaysia Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.8.2. Vietnam Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.9.2. Taiwan Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 6.3.10.2. Rest of Asia Pacific Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 7. Middle East and Africa Electric Wheelchair Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 7.2. Middle East and Africa Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 7.7. Middle East and Africa Electric Wheelchair Market Size and Forecast, by Country (2022-2029) 7.7.1. South Africa 7.3.1.1. South Africa Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 7.3.1.2. South Africa Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 7.7.2. GCC 7.3.2.1. GCC Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 7.3.2.2. GCC Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 7.7.3. Nigeria 7.3.3.1. Nigeria Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 7.3.3.2. Nigeria Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 7.3.4.2. Rest of ME&A Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 8. South America Electric Wheelchair Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 8.2. South America Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 8.7. South America Electric Wheelchair Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 8.3.1.2. Brazil Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 8.3.2.2. Argentina Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Electric Wheelchair Market Size and Forecast, by Product Type (2022-2029) 8.3.3.2. Rest Of South America Electric Wheelchair Market Size and Forecast, by End Users (2022-2029) 9. Global Electric Wheelchair Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electric Wheelchair Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Quantum Rehab (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Karma Medical Products Co., Ltd (US) 10.3. Pride Mobility Products Corp (US) 10.4. Invacare Corporation (US) 10.5. Pride Mobility Products Corp (US) 10.6. GF Health Products(US) 10.7. Drive Medical (US) 10.8. Karman Healthcare (US) 10.9. Golden Technologies (US) 10.10. Hoveround Corp (US) 10.11. 21st Century SCIENTIFIC Inc. (US) 10.12. Merits Health Products(US) 10.13. Ottobock (Germany) 10.14. Levo AG (Switzerland) 10.15. Permobil AB (Sweden) 10.16. Matsunaga Manufactory Co., Ltd (Japan) 10.17. Meyra Group (Germany) 10.18. Miki Kogyosho Co., Ltd (Japan) 10.19. Nissin Medical Industries Co., Ltd (Japan) 11. Key Findings 12. Industry Recommendations 13. Electric Wheelchair Market: Research Methodology 14. Terms and Glossary