The Nanoelectromechanical Systems Market size was valued at USD 183.15 Billion in 2024 and the total Nanoelectromechanical Systems revenue is expected to grow at a CAGR of 29.7% from 2025 to 2032, reaching nearly USD 1466.72 Billion. The technical and scientific sectors are equally interested in nanoelectromechanical systems (NEMS). Nanoelectromechanical systems (NEMS) are a type of nanoscale technology that combines electrical and mechanical functions. They are made up of miniature electrical and mechanical devices such actuators, beams, sensors, pumps, resonators, and motors. These components transform one type of energy into another that can be measured fast and easily. NEMS are the next logical step in downsizing after microelectromechanical systems, or MEMS devices. NEMS often combine transistor-like nanoelectronics with mechanical actuators, pumps, or motors, forming physical, biological, and chemical sensors. The term comes from common device size in the nanoscale range, which result in low mass, high mechanical resonance frequencies, potentially substantial quantum mechanical effects like zero point motion, and a high surface-to-volume ratio helpful for surface-based sensing mechanisms. Accelerometers and sensors to detect chemical compounds in the air are examples of nanoelectromechanical system applications. These devices can be used as biosensors to measure vital physiological variables such as intracranial pressure, cerebrospinal fluid (CSF) pulsatility, weight load, and strain during surgical operations.To know about the Research Methodology:-Request Free Sample Report

Nanoelectromechanical Systems Market Dynamics

NEMS Technology in Development of Nanotools The market may benefit from high demand for nanosurgical equipment for diagnostics and surgery. They can overcome the constraints of conventional medical equipment inefficiency and high maintenance costs. NEMS technology is also important in the creation of nanotools that may be used to execute complex nanosurgeries within the CNS. In an in vivo mouse model, for example, a recently created nanoknife was effectively utilised to sever specific axons of peripheral nerves. Such technique might someday allow for more accurate mechanical separation of specific white matter bundles during neurosurgical resection, perhaps leading to a considerable improvement in surgical result for patients with brain tumours. Indeed, NEMS technology might open up new pathways for intervention at the cellular and subcellular levels during neurosurgery. Nanowires, for example, might be merged with cellular components to provide a direct bridge between the cell and the external environment under the direction of neurosurgeons, facilitating the transport of biological molecules. With future development, NEMS technology might give neurosurgeons with unparalleled control over the cellular environment within cancer patients' brains. This will stimulate demand for nanoelectromechanical systems. A Trend Towards Miniaturized Electronics The nanoelectromechanical systems market is likely to be driven by rising demand for tiny electronics. Many advantages are associated with the increasing shrinking of electronic components in nanoelectromechanical systems. Smartphones are increasingly multi-purpose electronic devices that can do duties other than making phone calls. Because of its atomic-scale thickness and superb electrical and mechanical characteristics, graphene is an exceptionally promising two-dimensional material for nanoelectromechanical systems (NEMS). Power consumption is one advantage of creating NEMS-based logic or memory. Power consumption has become a significant hurdle in cutting-edge computer systems. This is especially problematic for new low-energy computing applications like autonomous sensor nodes used in the Internet of Things (IoT), wireless communications devices, and innovative mobile computers used in edge computing. All of these applications need logic circuits with much increased energy efficiency. NEMS-based switches provide almost no off-state leakage current, sharp switching characteristics, and strong on-current performance (low resistance in the on-current state). This technique has the potential to enhance energy efficiency by an order of magnitude. NEMS Devices are Built on Advances in Nanotechnology NEMS devices, like other instances of nanotechnology, operate on a nanoscale scale. This implies they have extremely little mass, high resonance frequencies, and may function according to quantum physics' non-intuitive rules by utilising a high surface-to-volume ratio or zero point motion. NEMS devices are also created using conventional nanotechnology manufacturing techniques and processes. Top-down fabrication technologies like as optical fabrication, electron beam lithography, and thermal treatment provide a high level of manufacturing control at the tradeoff of poor resolution. Bottom-up techniques that use chemistry to allow components to self-assemble molecule by molecule. This allows producers to create smaller structures, but it makes controlling the production process more difficult. Carbon nanotube nanomotors are one type of NEMS device made using a hybrid top-down bottom-up production method. Nanoscale sensors and gadgets may enable cost-effective continuous monitoring of bridge, tunnel, rail, parking structures, and pavement structural integrity and performance throughout time. Nanoscale sensors, communications devices, and other nanoelectronics-enabled innovations can also support an improved transportation infrastructure by communicating with vehicle-based systems to assist drivers in maintaining lane position, avoiding collisions, adjusting travel routes to avoid congestion, and improving drivers' interfaces to onboard electronics. NEMS Applications in Science and Technology Investments in life sciences and technology are expected to greatly boost total market demand. A classic example is the emphasis on accuracy in microscopes to speed up research. Swerim AB invested over USD 1 million in 2019 to upgrade its high-resolution scanning electron microscope. In theory, NEMS devices may be used in any electromechanical system. NEMS accelerometers and NEMS sensors, which can detect the presence of chemical compounds in the environment, are examples of current uses. The small scanning needles used in atomic force microscopes are a prominent application of NEMS devices. In today's cutting-edge atomic force microscopy (AFM), NEMS provides smaller, more efficient sensors to detect even fainter atomic forces and chemical signals. NEMS-based cantilevers, which can function at very high frequencies (VHF) of roughly 100 MHz, are also employed in a variety of different sensing and scanning probe devices. In the future generation of computers, NEMS relays may replace conventional semiconductor logic "switches." They are slower than solid-state equivalents, but they do not leak current and cost very little power. Graphene Nanoelectromechanical Systems The future of graphene nanoelectromechanical devices seems bright. Significant progress has been made in the production of graphene nanoscale devices, permitting the construction of atomically thin devices that have the potential to push NEMS beyond what previous NEMS materials have accomplished. Graphene has extraordinary electrical capabilities, and when paired with nanoscale movable structures, it may be possible to construct devices that can interact with single atoms. Carbon nanotubes have enormous potential and exceptional mechanical characteristics. However, because of their integration and control over their position on-chip, mass manufacture of carbon nanotube-based NEMS devices is problematic. Exciting possibilities are presented by hybrid graphene structures that combine solely electrical devices with mechanical motion. One can, for example, investigate the interaction of single electron events on suspended graphene quantum dots, employ vibration modes to investigate and exploit quantum phenomena, and develop upgraded sensors for the post-CMOS age. The combination of biofunctionalized graphene nanoresonators with atomically thin membranes will enable the construction of a wide range of biodevices for use in a number of biotechnological applications. Pioneering NEMS Research & Development NEMS device research is currently a highly new and advanced subject, but scientists are still pushing the boundaries of how far they can take this technology. Researchers have created a nanoscale piezoresistive transducer by suspending silicon between two layers of graphene ribbon. The performance of the NEMS transducer was equivalent to that of transducers now used in accelerometers, and researchers predicted that it will increase the performance of currently available NEMS-based accelerometers. Bio-nanoelectromechanical systems (BioNEMS), which mix biological components with synthetic architectures, are another pioneering research route for NEMS devices. BioNEMS devices may operate as proteins, DNA, and even nanoscale autonomous robots, and have applications in medicine, life sciences, and nanorobotics. The concerns of low-yielding production processes and unreliable manufacturing, which leads to a lot of fluctuation in the quality of devices, are some of the primary obstacles confronting a young NEMS business. However, many researchers and industry developers are increasingly focusing on practical applications, and this setting is expected to alter dramatically in the next years. Futuristic applications in advanced computing, wearable technology, biomedicine, and nanorobotics may be only a few years away. Disadvantages of NEMS Nanodevices to Restraint the Market Growth Wear characteristics of NEMS nanodevices are rather bad. These devices are prone to poor fracture strength and are therefore unsuitable for electrically conducting applications. Because of the tension exerted in the material during the deposition process, NEMS devices are subject to warping. Metallic films made using NEMS devices have lesser strength than semiconductor materials. The materials utilised for nanodevice production using NEMS are more hazardous. As a result, effective gadget handling is required. Handling nanolevel devices presents challenges due to their small size and the unique features of the materials employed. Aside from the harmful elements utilised, the majority are nonbiodegradable materials that require better alternatives to minimise environmental damage. The usage of materials in the NEMS nanodevice fabrication process may have unexpected disastrous implications. Many people will lose their jobs as manufacturing efficiency improves and automation improves.Nanoelectromechanical Systems Market Segment Analysis

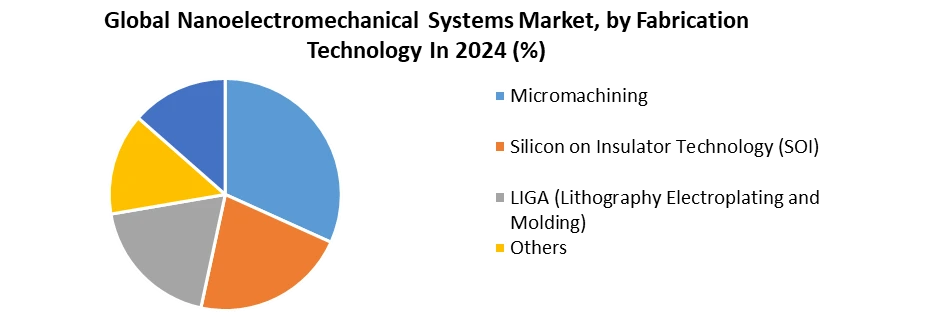

Based on Material Type, the market is segmented into Graphene, Carbon Nanotubes, SiC, SiO2, and Others (ZnO, GaN). Because graphenes are the smallest NEMS, they are expected to take the lead in the global nanoelectromechanical systems market. Despite the fact that graphene was just recently discovered, graphene nanoelectromechanical systems have a promising future. Significant progress has been achieved in the fabrication of graphene nanoscale devices, allowing the fabrication of atomically thin devices with the potential to push NEMS beyond what prior NEMS materials have accomplished. Graphene has amazing electrical properties, and when combined with nanoscale moveable structures, it may allow for the creation of devices capable of interacting with single atoms. Carbon nanotubes have a lot of potential and have incredible mechanical properties. However, mass production of carbon nanotube-based NEMS devices is difficult due to their integration and control over their location on-chip. Graphene, on the other hand, may be produced on a wafer scale using CVD or SiC annealing, and significant progress has been achieved in this area. Based on Application, the market is segmented into Sensing & Control Applications, Solid State Electronics, and Tools & Equipment Application. Aside from its potential use in neuromonitoring, NEMS technology is critical in the development of nanotools that might be used to perform complicated nanosurgeries within the CNS. In an in vivo mouse model, for example, a newly developed nano-knife was successfully used to break particular axons of peripheral neurons. A method like this might one day allow for more precise mechanical separation of specific white matter bundles during neurosurgical resection, perhaps leading to significant improvements in surgical outcomes for patients with brain tumours. Based on Product Type, the market is segmented into Nano-Tweezers, Nano-Cantilevers, Nano-Switches, Nano-Accelerometers, Nano-Fluidic Modules, and Others. Because the product is made from noble elements, nano-tweezers are expected to have the highest market growth. Because of its incredible mechanical strength and strong conducting characteristics, nano accelerometer is one of the most promising materials for a range of applications in nano-electromechanical systems. Nano-optical tweezers are devices that can capture and manipulate things on the nanoscale scale, even single molecules. As a result, they might be used in a variety of nanotechnology and microbiological applications. Nanocantilevers have become critical components of nanomechanical sensors that detect changes in the environment through changes in resonant frequencies or static deflection. They must be capable of operating at set but variable resonance frequencies and/or static deflection ranges.Based on Fabrication Technology, the market is segmented into Micromachining, Silicon on Insulator Technology, Lithography Electroplating and Molding, and Others. The first to profit from large-scale integrated manufacturing processes were NEMS arrays. The NEMS arrays were constructed using CMOS-compatible materials and microelectronic lithography and etching methods. In the design, the response from hundreds of individual resonators was utilised, which were electrically connected to provide natural noise averaging, improved collective power handling capabilities, and fault-tolerant resilience. Robert Bosch GmbH, Stuttgart, Germany, developed an enhanced porous silicon method for producing vacuum cavities in silicon wafers sealed with monocrystalline silicon membranes. Using this technology, Bosch has successfully created pressure sensors for automotive applications. The mass manufacture of MEMS and NEMS resonators for timing devices has come from further improvement of this approach using silicon-on-insulator (SOI) substrates.

Nanoelectromechanical Systems Market Regional Insights

North America is estimated to dominate the Nanoelectromechanical Systems market over the forecast period thanks to the presence of global players in the region. The increasing usage of cutting-edge technologies such as machine learning, artificial intelligence, deep learning, and IoT, and advancements in nanotechnology is expected to boost the North America Nanoelectromechanical Systems market. Asia Pacific is estimated to grow at the fastest CAGR of XX % due to the presence of electronic and automotive industries in the region. Modernization activities and smart city initiatives advocated by governments, have the potential to drive the region’s Nanoelectromechanical Systems industry. The deployment of innovative technologies in India, Japan, and China, and the region’s status as a center for consumer electronics makers, have the potential to propel the industry to new heights. The size of the Europe Nanoelectromechanical Systems Market is expected to grow at a significant rate because of commercial uses of carbon nanotubes and industrial partnerships. Rising demand for wearables and other consumer electronics items may fuel demand in the regional market.Research Methodology

Primary and secondary methods are used for collecting the data in the research report. The research process involves the investigation of various factors affecting the industry, such as historical data, market environment, government policy, competitive landscape, technological innovation, upcoming technologies, current market trends, and technical progress in related industries, as well as market risks, opportunities, market barriers, and challenges. All conceivable elements influencing the markets included in this research study have been considered, examined in depth, validated through primary research, and evaluated to provide the final quantitative and qualitative data. The market size for top-level markets and sub-segments is normalised, and the impact of inflation, economic downturns, regulatory & policy changes, and other variables is factored into the market forecast. This data is combined and added with detailed inputs and analysis, and presented in the report. Extensive primary research was conducted to acquire information and verify and confirm the crucial numbers arrived at after comprehensive market engineering and calculations for market statistics; market size estimations; market breakdown; market forecasts; and data triangulation. Bottom-up technique is widely employed in the whole market engineering process, along with multiple data triangulation methodologies, to perform market estimation and forecasting for the overall market segments and sub-segments covered in this research.Nanoelectromechanical Systems Market Scope: Inquire before buying

Nanoelectromechanical Systems Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 183.15 Bn. Forecast Period 2025 to 2032 CAGR: 29.7% Market Size in 2032: USD 1466.72 Bn. Segments Covered: by Material Type 1.Graphene 2.Carbon Nanotubes 3.SiC 4.SiO2 5.Others (ZnO, GaN) by Application2 1.Tools & Equipment Application 1.1.Scanning Tunneling Microscope (STM) 1.2.Atomic Force Microscope (AFM) 1.3.Mass Spectrometry 1.4.Nano Nozzles

2.Sensing & Control Applications1.1.Automotive Medical 1.2.Industrial Process Control

3.Solid State Electronics1.1.Random Access Memory Application 1.2.Wireless Communication Application

by Product Type 1.Nano-Tweezers 2.Nano-Cantilevers 3.Nano-Switches 4.Nano-Accelerometers 5.Nano-Fluidic Modules by Fabrication Technology 1.Micromachining 2.Silicon on Insulator Technology (SOI) 3.LIGA (Lithography Electroplating and Molding) 4.Others Nanoelectromechanical Systems Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Nanoelectromechanical Systems Market, Key Players are:

1. Agilent Technologies (US) 2.Bruker Corporation (US) 3. Cnano Technology Limited (US) 4. Showa Denko K.K. (Japan) 5. Analog Devices, Inc. (US) 6. Amprius Technologies (US) 7. Broadcom Corporation (US) 8. Sun Innovations, Inc. (US) 9.JBC S.L (US) 10.Electron Microscopy Sciences (US) 11.Ubiquiti Inc. (US) 12. onex technologies inc (US) 13 Inframat Advanced MaterialsTM LLC (US) 14. Applied Nanotools Inc. (canada) 15.Raymor Industries Inc. (canada) 16. Aeotec Limited (Germany) 17. Fraunhofer-Gesellschaft (Germany) 18.Vistec Electron Beam GmbH (Germany) 19.Merck KGaA (Germany) 20.Asylum Research Corporation (UK) 21.Interuniversity Microelectronics Centre (Belgium) Frequently Asked Questions: 1] What segments are covered in the Global Nanoelectromechanical Systems Market report? Ans. The segments covered in the Nanoelectromechanical Systems Market report are based on Material Type, Application, Product Type and Fabrication Technology. 2] Which region is expected to hold the highest share in the Global Nanoelectromechanical Systems Market? Ans. The North America region is expected to hold the highest share in the Nanoelectromechanical Systems Market. 3] What is the market size of the Global Nanoelectromechanical Systems Market by 2032? Ans. The market size of the Nanoelectromechanical Systems Market by 2032 is expected to reach USD 1466.72 Bn. 4] What is the forecast period for the Global Nanoelectromechanical Systems Market? Ans. The forecast period for the Nanoelectromechanical Systems Market is 2025-2032. 5] What was the Global Nanoelectromechanical Systems Market size in 2024? Ans: The Global Nanoelectromechanical Systems Market size was USD 183.15 Billion in 2024.

1. Global Nanoelectromechanical Systems Market Size: Research Methodology 2. Global Nanoelectromechanical Systems Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Nanoelectromechanical Systems Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Nanoelectromechanical Systems Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Nanoelectromechanical Systems Market Size Segmentation 4.1. Global Nanoelectromechanical Systems Market Size, by Material Type (2024-2032) • Graphene • Carbon Nanotubes • SiC • SiO2 • Others (ZnO, GaN) 4.2. Global Nanoelectromechanical Systems Market Size, by Application (2024-2032) • Tools & Equipment Application o Scanning Tunneling Microscope (STM) o Atomic Force Microscope (AFM) o Mass Spectrometry o Nano Nozzles • Sensing & Control Applications o Automotive Medical o Industrial Process Control • Solid State Electronics o Random Access Memory Application o Wireless Communication Application 4.3. Global Nanoelectromechanical Systems Market Size, by Product Type (2024-2032) • Nano-Tweezers • Nano-Cantilevers • Nano-Switches • Nano-Accelerometers • Nano-Fluidic Modules 4.4. Global Nanoelectromechanical Systems Market Size, by Fabrication Technology (2024-2032) • Micromachining • Silicon on Insulator Technology (SOI) • LIGA (Lithography Electroplating and Molding) • Others 5. North America Nanoelectromechanical Systems Market (2024-2032) 5.1. North America Nanoelectromechanical Systems Market Size, by Material Type (2024-2032) • Graphene • Carbon Nanotubes • SiC • SiO2 • Others (ZnO, GaN) 5.2. North America Nanoelectromechanical Systems Market Size, by Application (2024-2032) • Tools & Equipment Application o Scanning Tunneling Microscope (STM) o Atomic Force Microscope (AFM) o Mass Spectrometry o Nano Nozzles • Sensing & Control Applications o Automotive Medical o Industrial Process Control • Solid State Electronics o Random Access Memory Application o Wireless Communication Application 5.3. North America Nanoelectromechanical Systems Market Size, by Product Type (2024-2032) • Nano-Tweezers • Nano-Cantilevers • Nano-Switches • Nano-Accelerometers • Nano-Fluidic Modules 5.4. North America Nanoelectromechanical Systems Market Size, by Fabrication Technology (2024-2032) • Micromachining • Silicon on Insulator Technology (SOI) • LIGA (Lithography Electroplating and Molding) • Others 5.5. North America Nanoelectromechanical Systems Market, by Country (2024-2032) • United States • Canada 6. European Nanoelectromechanical Systems Market (2024-2032) 6.1. Europe Nanoelectromechanical Systems Market, by Material Type (2024-2032) 6.2. Europe Nanoelectromechanical Systems Market, by Application (2024-2032) 6.3. Europe Nanoelectromechanical Systems Market, by Product Type (2024-2032) 6.4. Europe Nanoelectromechanical Systems Market, by Fabrication Technology (2024-2032) 6.5. Europe Nanoelectromechanical Systems Market, by Country (2024-2032) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest of Europe 7. Asia Pacific Nanoelectromechanical Systems Market (2024-2032) 7.1. Asia Pacific Nanoelectromechanical Systems Market, by Material Type (2024-2032) 7.2. Asia Pacific Nanoelectromechanical Systems Market, by Application (2024-2032) 7.3. Asia Pacific Nanoelectromechanical Systems Market, by Product Type (2024-2032) 7.4. Asia Pacific Nanoelectromechanical Systems Market, by Fabrication Technology (2024-2032) 7.5. Asia Pacific Nanoelectromechanical Systems Market, by Country (2024-2032) • China • India • Japan • South Korea • Australia • ASEAN • Rest of APAC 8. Middle East and Africa Nanoelectromechanical Systems Market (2024-2032) 8.1. Middle East and Africa Nanoelectromechanical Systems Market, by Material Type (2024-2032) 8.2. Middle East and Africa Nanoelectromechanical Systems Market, by Application (2024-2032) 8.3. Middle East and Africa Nanoelectromechanical Systems Market, by Product Type (2024-2032) 8.4. Middle East and Africa Nanoelectromechanical Systems Market, by Fabrication Technology (2024-2032) 8.5. Middle East and Africa Nanoelectromechanical Systems Market, by Country (2024-2032) • South Africa • GCC • Egypt • Nigeria • Rest of ME&A 9. South America Nanoelectromechanical Systems Market (2024-2032) 9.1. South America Nanoelectromechanical Systems Market, by Material Type (2024-2032) 9.2. South America Nanoelectromechanical Systems Market, by Application (2024-2032) 9.3. South America Nanoelectromechanical Systems Market, by Product Type (2024-2032) 9.4. South America Nanoelectromechanical Systems Market, by Fabrication Technology (2024-2032) 9.5. South America Nanoelectromechanical Systems Market, by Country (2024-2032) • Brazil • Mexico • Argentina • Rest of South America 10. Company Profile: Key players 10.1. Agilent Technologies (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Bruker Corporation (US) 10.3 Cnano Technology Limited (US) 10.4 Showa Denko K.K. (Japan) 10.5 Analog Devices, Inc. (US) 10.6 Amprius Technologies (US) 10.7 Broadcom Corporation (US) 10.8 Sun Innovations, Inc. (US) 10.9 JBC S.L (US) 10.10 Electron Microscopy Sciences (US) 10.11 Ubiquiti Inc. (US) 10.12 onex technologies inc (US) 10.13 Inframat Advanced MaterialsTM LLC (US) 10.14 Applied Nanotools Inc. (canada) 10.15 Raymor Industries Inc. (canada) 10.16 Aeotec Limited (Germany) 10.17 Fraunhofer-Gesellschaft (Germany) 10.18 Vistec Electron Beam GmbH (Germany) 10.19 Merck KGaA (Germany) 10.20 Asylum Research Corporation (UK) 10.21 Interuniversity Microelectronics Centre (Belgium)