Asia Pacific RFID Market size was valued at USD 3.34 Bn in 2022 and the total Asia Pacific RFID revenue is expected to grow by 10.4% from 2023 to 2029, reaching nearly USD 6.68 Bn.Asia Pacific RFID Market Overview:

RFID (Radio Frequency Identification) is evolving wireless technology used for tracing, detecting, and identifying. The data recorded is recorded by the RFID tags which are captured with the help of a reader via radio waves and that data is stored in the database. Government initiative plays an important role as the adoption of RFID is increasing. Industries like healthcare, retail, defense, surveillance & security, sports, logistics, and more, are using RFID according to the specific requirements and applications. Asia-Pacific region has the largest population with expanding economies, the focus is on the development of the infrastructure to create chances for the providers. As a result, demand for the Asia Pacific RFID Market is increasing.To know about the Research Methodology :- Request Free Sample Report Increasing adoption in many industries of RFID technology RFID technology is applied by many industries for the particular need including retail, transportation, healthcare, logistics, and others. It has increased the demand in the Asia-Pacific region as growth and development is increasing. The retail sector is growing rapidly and the e-commerce sector is gaining extensive progress as online shopping continues to enlarge in countries like China and India. An increase in the usage of security and access to control the applications and an increase in government initiative is also factor that assists the growth of the Asia Pacific RFID Market. The installation of RFID in manufacturing units is for improving productivity & has the high acceptance of RFID technology. Data security concerns & Lack of standardized regulations may affect the Asia Pacific RFID Market Collection and transmission of data in RFID technology increase the fears about the privacy and security of data. Companies are executing RFID solutions to overcome concerns about data security and guarantee robust data safety measures, which can be challenging. The adoption of RFID technology can hamper the markets as standardized regulations are not present in the Asia-Pacific region. Countries in Asia-Pacific have different regulations and compliance requirements for the implementation of RFID, which leads to complexities and challenges for businesses. These factors can limit the market growth as they can deter Asia Pacific RFID Market. Growing Retail & E-commerce Sectors & Advancements in the Healthcare sector create opportunity Retail & E-commerce has witnessed the largest market share in the year 2022 and is expected to dominate the market during the forecast period. The adoption of smartphones, internet penetration, and changing behavior of consumers has increased the growth. It offers substantial opportunities for RFID technology in the Asia-Pacific region. RFID helps retailers to lessen stock-outs, helps to maintain, and improves inventory accuracy. The healthcare industry is experiencing major growth and advancing technologies as RFID technology plays a crucial role in improving patient safety and inventory control in the healthcare industry. Hospitals, Clinics, Medicals, and Pharmaceuticals have opportunities for implementing or applying RFID technologies in the Asia Pacific RFID Market.

Asia Pacific RFID Market Segment Analysis:

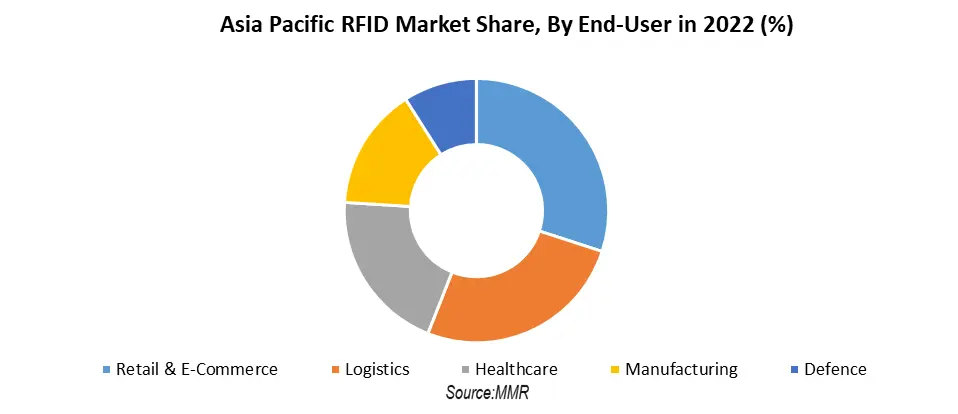

Based on the Frequency, Ultra-High Frequency has dominated the market in the year 2022 and is expected to dominate during the forecast period. The 860-960 MHz frequency range has specifically dominated the Asia Pacific RFID Market because of its reading speed, range, and ability to read tags simultaneously. Ultra-High Frequency RFID technology is well-matched, like EPC Gen2 (Electronic Product Code Generation 2) across the countries and regions. However, High-Frequency RFID is used to control access, contactless payment systems, and ticketing, while Low-Frequency RFID technology is most commonly used for animal tracking and proximity-type applications.Based on the End- User, The Retail & E-Commerce segment has ruled the Asia Pacific RFID Market in terms of revenue in the year 2022 and is witnessed to dominate during the forecast period. The adoption of RFID technology is increasing as the number of businesses requires to manage inventories. There is high demand for this technology in retail for tracking various products. The logistics sector is expected to grow rapidly as RFID technology allows improved tracking, supply efficiency, and traceability. Whereas Healthcare sector is increasing due to applications like patient monitoring, management of medicines, and improving patient safety.

Asia Pacific RFID Market Regional Insights:

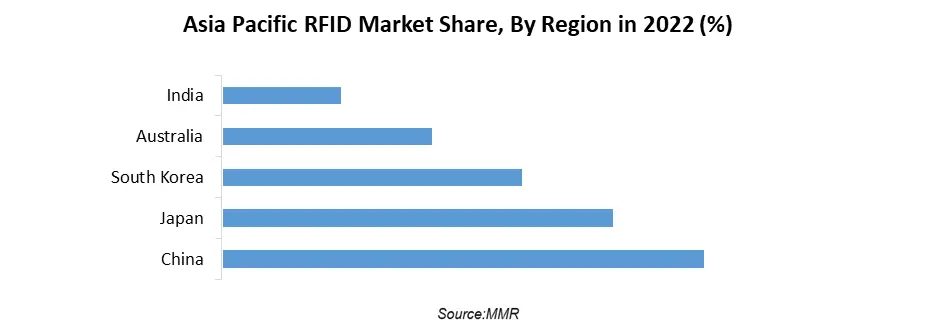

China has dominated the market in the year 2022 and is expected to dominate during the forecast period. In the Asia-Pacific region china is the largest and most rapidly growing market for RFID technology as it has the maximum number of start-ups and technological developments. Initiatives taken by China’s government, particularly for industries like healthcare, logistics, and retail have increased the adoption of RFID. Japan is an early embracer of RFID technology. Whereas Japan focuses on technological innovations and is known for the advancement of RFID technology. Countries such as South Korea, Australia, and India are emerging economies in the market and are likely to grow rapidly during the forecast period.

Asia Pacific RFID Market Scope: Inquire Before Buying

Asia Pacific RFID Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.34 Bn. Forecast Period 2023 to 2029 CAGR: 10.4% Market Size in 2029: US $ 6.68 Bn. Segments Covered: by Offering RFID Tags RFID Reader RFID Software RFID Middleware by Frequency Ultra-High Frequency High-Frequency Low-Frequency by Connectivity Bluetooth WiFi Ultra-Wide Band Others by End-User Retail & E-Commerce Manufacturing Healthcare Transportation Logistics Surveillance & Security Defence Sports Education Automotive Others Asia Pacific RFID Market by Country

China South Korea Japan India Australia Indonesia Malaysia Vietnam Taiwan Bangladesh Pakistan Rest of APACAsia Pacific RFID Market Key Players

1. Impinj 2. Honeywell International 3. Rasilant Technologies 4. Zebra Technologies Corporation 5. Checkpoint Systems 6. NXP Semiconductors N.V. 7. Avery Dennison Corporation 8. HID Global Corporation 9. Fujitsu Limited 10. SMARTRAC N.V. 11. Sato Holdings Corporation 12. Datalogic S.P.A. 13. Invengo Technology Pte. Ltd. 14. Shenzhen Chuangxinjia Smart Card Co.Ltd 15. Jiangsu Xinde RFID Technology Co.Ltd 16. Perfect RFID 17. Yodobashi Camera Co.Ltd 18. Ripro Corporation 19. Jadak TechFrequently Asked Questions:

1] What segments are covered in the Market report? Ans. The segments covered in the Asia Pacific RFID Market report are based on Offerings, Frequency, Connectivity, End-User, and Region. 2] Which country is expected to hold the highest share in the Market? Ans. China is expected to hold the highest share of the Asia-Pacific RFID Market. 3] What is the market size of the Market by 2029? Ans. The market size of the Market by 2029 is expected to reach US$ 6.68 Billion. 4] What is the forecast period for the Market? Ans. The forecast period for the Asia Pacific RFID Market is 2023-2029. 5] What was the market size of the Market in 2022? Ans. The market size of the Market in 2022 was valued at US$ 3.34 Bn.

1. Asia Pacific RFID Market: Research Methodology 2. Asia Pacific RFID Market: Executive Summary 3. Asia Pacific RFID Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Asia Pacific RFID Market: Dynamics 4.1. Market Trends by Region 4.1.1. Asia Pacific 4.2. Market Drivers by Region 4.2.1. Asia Pacific 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. Asia Pacific 5. Asia Pacific RFID Market Size and Forecast by Segments (by Value USD) 5.1. Asia Pacific RFID Market Size and Forecast, by Offerings(2022-2029) 5.1.1. RFID Tags 5.1.2. RFID Reader 5.1.3. RFID Software 5.1.4. RFID Middleware 5.2. Asia Pacific RFID Market Size and Forecast, by Frequency(2022-2029) 5.2.1. Ultra-High Frequency 5.2.2. High-Frequency 5.2.3. Low-Frequency 5.3. Asia Pacific RFID Market Size and Forecast, by Connectivity (2022-2029) 5.3.1. Bluetooth 5.3.2. WiFi 5.3.3. Ultra-Wide Band 5.3.4. Others 5.4. Asia Pacific RFID Market Size and Forecast, by End-User(2022-2029) 5.4.1. Retail & E-Commerce 5.4.2. Manufacturing 5.4.3. Healthcare 5.4.4. Transportation 5.4.5. Logistics 5.4.6. Surveillance & Security 5.4.7. Defence 5.4.8. Sports 5.4.9. Education 5.4.10. Automotive 5.4.11. Others 5.5. Asia Pacific RFID Market Size and Forecast, by Cities(2022-2029) 5.5.1. China 5.5.2. South Korea 5.5.3. Japan 5.5.4. India 5.5.5. Australia 5.5.6. Indonesia 5.5.7. Malaysia 5.5.8. Vietnam 5.5.9. Taiwan 5.5.10. Bangladesh 5.5.11. Pakistan 5.5.12. Rest of APAC 6. Company Profile: Key players 6.1. Impinj 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Honeywell International 6.3. Rasilant Technologies 6.4. Zebra Technologies Corporation 6.5. Checkpoint Systems 6.6. NXP Semiconductors N.V. 6.7. Avery Dennison Corporation 6.8. HID Global Corporation 6.9. Fujitsu Limited 6.10. SMARTRAC N.V. 6.11. Sato Holdings Corporation 6.12. Datalogic S.p.A. 6.13. Invengo Technology Pte. Ltd. 6.14. Shenzhen Chuangxinjia Smart Card Co.Ltd 6.15. Jiangsu Xinde RFID Technology Co.Ltd 6.16. Perfect RFID 6.17. Yodobashi Camera Co.Ltd 6.18. Ripro Corporation 6.19. Jadak Tech 7. Key Findings 8. Industry Recommendation