Global Neem Oil Marketsize was valued at USD 2.08 Bn in 2023 and Neem Oil Market revenue is expected to reach USD 5.30 Bn by 2030, at a CAGR of 14.3 % over the forecast period (2024-2030).Neem Oil Market Overview

Neem oil is an organic solution used as a pesticide against insects, mites, or fungi bothering your plants. It is used medicinally and in the cosmetics industry as an organic insecticide spray. Organic gardeners love that the oil is safe to use. Neem Oil is harmless for humans and animals, and it's safe even for most wildlife since its insecticidal properties are targeted to specific pests that damage garden plants. It is packed with minerals and antioxidants that shield the skin from environmental harm and work to prevent oxidative stress. Soaps, hair products, hand creams, and pet shampoos are just a few of the cosmetics that are made using cold-pressed neem oil.To know about the Research Methodology :- Request Free Sample Report The report explores the Neem Oil market segments (Type, Application, Form and Region). Data has been provided by market participants, and regions, (North America, Asia Pacific, Europe, Middle East & Africa, and South America). This market report provides a thorough analysis of the rapid advances that are currently taking place across all Technology sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2023. The report investigates the Neem Oil market drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Neem Oil Industry contemporary competitive scenario.

Neem Oil Market Dynamics

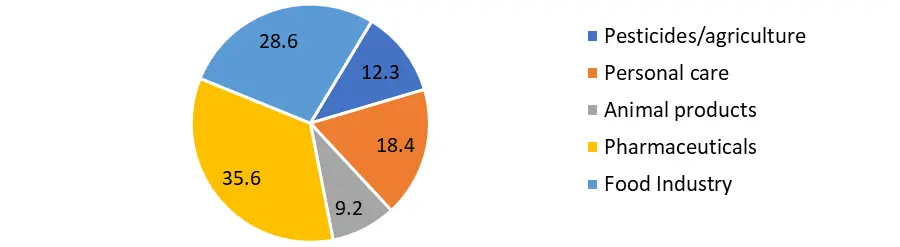

Growing demand for Natural Pesticides to Drive the Market Neem plant is considered the most useful traditional plant in India. The various properties of different parts of the neem tree are used mainly as an insecticide, fertilizer, manure, soil conditioner, urea coating agent, fumigant, etc. In the recent era the major challenge is to increase food production and safeguard food from pests without harming the environment. Pesticides have become an integral component of sustainable agriculture and modern cultural practices. The use of chemical pesticides and fertilizers are in eliminable. This use is expected to influence the demand for the Neem Oil Market over the forecast period. The natural pesticides from Azadirachta indicia are considered less harmful, biodegradable, least persistent, less toxic to the non-target organism and also economic. Fruitful results of the application of formulated neem-based products in agriculture will provide a cost-effective technology to the farming community. Many manufacturers are developing new products regarding neem oil that help to push the market forward. R & D on Neem Oil Formulation Capacity to Boost Market Growth Neem oil is an important traditional medicine and it has been used in agriculture, which is a natural vegetable oil obtained mainly from seeds, kernels, and fruits of the neem tree. It is also obtained in less quantity from other parts of the tree such as flowers and leaves but the yield is maximum from seeds. The yields of neem oil extracted from seed and kernel are about 18–25% and 42–50%, respectively. Neem oil formulations' capacity to kill An. Gambia larvae at relatively low concentrations suggest the possibility of their application as synthetic insecticide alternatives in the management of malaria vectors. Today, this oil is used at 100 μL per 10 g concentration in retail meat inoculated with 4 log CFU mL− 1 of common meat-spoiling microorganisms. It has excellent antimicrobial, antioxidant, pesticide, and insecticidal properties making it an attractive alternative to synthetic chemicals that are used in the application of food preservation, packaging, and storage. Such all factors are expected to boost the Neem Oil Market growth during the forecast period. However, photosensitivity, rapid degradation, and impact on the sensory qualities of food are expected to pose major challenges against applications in food preservation and packaging. The increasing use of neem oil for food packaging as a preservative is a new trend for Neem Oil Market growth. According to MMR research, scientific studies have investigated the use of neem oil in general skincare or as a treatment for skin conditions. Its antigen formulation is formed through its extract.Global Medicinal Use of Neem Oil in Pharmaceutical Industry Share, in 2023(%)

Trends in Neem Oil Market The ability of conventional treatments to achieve cures with the least amount of pain has been trusted in by the whole international medical community. Neem oil sales are being artificially boosted by the market's booming demand for Ayurveda and Unani remedies. Neem oil is now used in a variety of fields, including waste management, agriculture, physiology, and dermatology, in addition to the medical community. It is a powerful anti-dandruff and skin conditioning agent that is added to bio-insecticides and bio-pesticides. Researchers are regrettably becoming increasingly concerned about the emergence of contaminated neem oil on the market, which undermines consumer confidence. This can endanger the market as a whole. However, the issue could be resolved in the presence of stringent laws and controls, which has shown the neem oil business grow internationally. Neem Oil Market Challenges and Restraint Neem contains complex multifunctional compounds, which have variable stability and penetration. Neem oil is being incorporated into several skins and personal care products. The active ingredients and their concentration can vary based on genetic variability, the part of the tree used, growing, storage, and processing conditions. The method of extraction such as acetone, aqueous, methanol, ethanoic, chloroform, and acetonitrile extracts are important as each method gives different compounds with different concentrations. The widespread use of refined neem preparations, which are based on a small number of compounds, might induce resistance. Research on neem oil is still largely based on in vitro or animal models. Other challenges include toxicity, contamination, regulation, and low commercial interest there are several challenges, and newer technologies are improving the outlook towards natural products. Metabolomics can provide accurate data on the metabolites in natural products. Nuclear magnetic resonance spectroscopy and high-resolution mass spectrometry often in combination with liquid chromatography provide comprehensive metabolic profiles. DE replication is done to exclude known compounds. Regulatory guidelines have been developed for heterogenous mixtures from natural products. Although several natural products can affect the microbiome, research on such interactions is still in its infancy.

Neem Oil Market Regional Analysis

The Asia Pacific region held the largest market share accounting for 47% in 2023. Asia Pacific region held the largest market share in 2023 and is expected to sustain its position at a CAGR over the forecast period. The region has a well-established domestic market for neem oil market accounting for over 47% of global demand. This is due to the region's long history of using neem oil for a variety of purposes, including agriculture, personal care, and medicine. The increasing awareness of the benefits of neem oil the growing demand for natural and organic products, and increasing production of neem oil in the region. Europe is another prominent market for neem oil, driven by the rising demand for organic products, sustainable agriculture practices, and strict regulations on chemical pesticides. Countries like Germany, France, and the United Kingdom are the major consumers of neem oil in the region. Moreover, the increasing awareness of neem oil's medicinal properties has led to its growing adoption in the healthcare and personal care sectors. The European market offers significant growth opportunities for neem oil manufacturers, particularly those focusing on product innovation and quality. North America has a major share of the neem oil, with the United States being the dominant country in the region. The growing preference for organic and natural products among consumers, along with stringent regulations on synthetic pesticides, has driven the demand for neem oil in North America. The region also has a well-established agriculture sector that utilizes neem oil for crop protection. Furthermore, the presence of key neem oil manufacturers and increasing investments in research and development activities contribute to the growth of the neem oil market in this region. The objective of the report is to present a comprehensive analysis of the global Neem Oil Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Neem Oil Market dynamic, and structure by analyzing the market segments and projecting the Neem Oil Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Neem Oil Market make the report investor’s guide.Neem Oil Market Segment Analysis

Based on Type The leaf extract segment is dominating the market for plant extract, with a market share of 47.5% in 2023. The demand for leaf extracts was USD xx billion in 2023, and it is forecast to increase at a CAGR of 14.8% from 2024 to 2030. Leaf extracts are rich in antioxidants, vitamins and minerals, which have a variety because of increased demand from numerous end-use sectors, such as personal care, pharmaceuticals, animal feed, and agriculture, the market is forecasted to grow. In addition, rising consumer knowledge of neem's health advantages, particularly in developed nations, is forecast to fuel market growth throughout the forecast period. Based on Application The pharmaceutical industry is dominating the global neem oil market share in 2023. The segment growth is influenced due to its increasing demand for prescription drugs and medication. The food industry is also a major driver of growth in the market due to increasing demand for processed foods and beverages and personal care products are becoming increasingly popular which is driving demand for neem oil used in their productionNeem Oil Market, by Application Market Share (%) in 2023

Neem Oil Market Competitive Landscape

The neem oil market is characterized by intense competition, primarily led by key players like E.I.D. Parry, Neeming Australia Pty Ltd., P.J. Margo Pvt. Ltd., Agro Extract Limited, and Ozone Biotech Pvt. Ltd., wield significant influence in major markets such as India, China, and the United States. Propelled by surging demand for neem oil across diverse sectors like personal care, pharmaceuticals, agriculture, and animal feed. This growth is driven by heightened awareness of neem oil's health benefits, the organic product trend, agricultural challenges posed by pests and diseases, and governmental support for neem oil as a biopesticide. The neem oil market's trajectory, however, is not devoid of challenges including raw material availability, competition from synthetic pesticides, and uneven awareness about neem oil's advantages in certain regions. Despite obstacles, the market is anticipated to expand robustly, with leading companies concentrating on enlarging their offerings and global footprint to cater to the escalating neem oil demand.Neem Oil Market Scope :Inquire before buying

Global Neem Oil Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.08 Bn. Forecast Period 2024 to 2030 CAGR: 14.3% Market Size in 2030: US $ 5.30 Bn. Segments Covered: by Type Leaf Extract Seed Extract Bark Extract by Application Pesticides/agriculture Personal care Animal products Pharmaceuticals Pharmaceutical Industry Food Industry by Form Crude Neem Oil Cold-Pressed Neem Oil Neem Oil Extract Neem Oil Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Neem Oil Market key players include

1. PJ Margo Private Limited 2. Agro Extracts Limited 3. Fortune Biotech Ltd 4. GreeNeem Agri Private Limited 5. Manorama Industries Limited 6. Neem India Products Pvt. Ltd. 7.Ozone Biotech 8. Neeming Australia 9. NOW Foods 10. Fortune Biotech Ltd. 11. SUN BIONATURALS (INDIA) PRIVATE LTD. 12. Banyan Botanicals 13. Group Velocity LLC. 14. Parry's BIO 15. United Industries Corporation 16. Murugappa Group 17. The Velocity Group 18. Agro Extracts Limited 19. Certis USA LLC 20. E.I.D. Parry 21. PJ Margo Pvt. Ltd. Frequently Asked Questions: 1] What segments are covered in the Global Neem Oil Market report? Ans. The segments covered in the Neem Oil Market report are based on Type, Application, Form, and Region. 2] Which region is expected to hold the highest share in the Global Neem Oil Market? Ans. Asia Pacific region is expected to hold the highest share in the Neem Oil Market. 3] What is the market size of the Global Neem Oil Market by 2030? Ans. The market size of the Neem Oil Market by 2030 is expected to reach USD 5.30 Billion. 4] What is the forecast period for the Global Neem Oil Market? Ans. The forecast period for the Neem Oil Market is 2024-2030. 5] What was the market size of the Global Neem Oil Market in 2023? Ans. The market size of the Neem Oil Market in 2023 was valued at USD 2.08 Billion.

1. Neem Oil Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Neem Oil Market: Dynamics 2.1. Neem Oil Market Trends by Region 2.1.1. North America Neem Oil Market Trends 2.1.2. Europe Neem Oil Market Trends 2.1.3. Asia Pacific Neem Oil Market Trends 2.1.4. Middle East and Africa Neem Oil Market Trends 2.1.5. South America Neem Oil Market Trends 2.2. Neem Oil Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Neem Oil Market Drivers 2.2.1.2. North America Neem Oil Market Restraints 2.2.1.3. North America Neem Oil Market Opportunities 2.2.1.4. North America Neem Oil Market Challenges 2.2.2. Europe 2.2.2.1. Europe Neem Oil Market Drivers 2.2.2.2. Europe Neem Oil Market Restraints 2.2.2.3. Europe Neem Oil Market Opportunities 2.2.2.4. Europe Neem Oil Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Neem Oil Market Drivers 2.2.3.2. Asia Pacific Neem Oil Market Restraints 2.2.3.3. Asia Pacific Neem Oil Market Opportunities 2.2.3.4. Asia Pacific Neem Oil Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Neem Oil Market Drivers 2.2.4.2. Middle East and Africa Neem Oil Market Restraints 2.2.4.3. Middle East and Africa Neem Oil Market Opportunities 2.2.4.4. Middle East and Africa Neem Oil Market Challenges 2.2.5. South America 2.2.5.1. South America Neem Oil Market Drivers 2.2.5.2. South America Neem Oil Market Restraints 2.2.5.3. South America Neem Oil Market Opportunities 2.2.5.4. South America Neem Oil Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Neem Oil Industry 2.8. Analysis of Government Schemes and Initiatives For Neem Oil Industry 2.9. Neem Oil Market Trade Analysis 2.10. The Global Pandemic Impact on Neem Oil Market 3. Neem Oil Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Neem Oil Market Size and Forecast, by Type (2023-2030) 3.1.1. Leaf Extract 3.1.2. Seed Extract 3.1.3. Bark Extract 3.2. Neem Oil Market Size and Forecast, by Application (2023-2030) 3.2.1. Pesticides/agriculture 3.2.2. Personal care 3.2.3. Animal products 3.2.4. Pharmaceuticals 3.2.5. Pharmaceutical Industry 3.2.6. Food Industry 3.3. Neem Oil Market Size and Forecast, by Form (2023-2030) 3.3.1. Crude Neem Oil 3.3.2. Cold-Pressed Neem Oil 3.3.3. Neem Oil Extract 3.4. Neem Oil Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Neem Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Neem Oil Market Size and Forecast, by Type (2023-2030) 4.1.1. Leaf Extract 4.1.2. Seed Extract 4.1.3. Bark Extract 4.2. North America Neem Oil Market Size and Forecast, by Application (2023-2030) 4.2.1. Pesticides/agriculture 4.2.2. Personal care 4.2.3. Animal products 4.2.4. Pharmaceuticals 4.2.5. Pharmaceutical Industry 4.2.6. Food Industry 4.3. North America Neem Oil Market Size and Forecast, by Form (2023-2030) 4.3.1. Crude Neem Oil 4.3.2. Cold-Pressed Neem Oil 4.3.3. Neem Oil Extract 4.4. North America Neem Oil Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Neem Oil Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Leaf Extract 4.4.1.1.2. Seed Extract 4.4.1.1.3. Bark Extract 4.4.1.2. United States Neem Oil Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Pesticides/agriculture 4.4.1.2.2. Personal care 4.4.1.2.3. Animal products 4.4.1.2.4. Pharmaceuticals 4.4.1.2.5. Pharmaceutical Industry 4.4.1.2.6. Food Industry 4.4.1.3. United States Neem Oil Market Size and Forecast, by Form (2023-2030) 4.4.1.3.1. Crude Neem Oil 4.4.1.3.2. Cold-Pressed Neem Oil 4.4.1.3.3. Neem Oil Extract 4.4.2. Canada 4.4.2.1. Canada Neem Oil Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Leaf Extract 4.4.2.1.2. Seed Extract 4.4.2.1.3. Bark Extract 4.4.2.2. Canada Neem Oil Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Pesticides/agriculture 4.4.2.2.2. Personal care 4.4.2.2.3. Animal products 4.4.2.2.4. Pharmaceuticals 4.4.2.2.5. Pharmaceutical Industry 4.4.2.2.6. Food Industry 4.4.2.3. Canada Neem Oil Market Size and Forecast, by Form (2023-2030) 4.4.2.3.1. Crude Neem Oil 4.4.2.3.2. Cold-Pressed Neem Oil 4.4.2.3.3. Neem Oil Extract 4.4.3. Mexico 4.4.3.1. Mexico Neem Oil Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Leaf Extract 4.4.3.1.2. Seed Extract 4.4.3.1.3. Bark Extract 4.4.3.2. Mexico Neem Oil Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Pesticides/agriculture 4.4.3.2.2. Personal care 4.4.3.2.3. Animal products 4.4.3.2.4. Pharmaceuticals 4.4.3.2.5. Pharmaceutical Industry 4.4.3.2.6. Food Industry 4.4.3.3. Mexico Neem Oil Market Size and Forecast, by Form (2023-2030) 4.4.3.3.1. Crude Neem Oil 4.4.3.3.2. Cold-Pressed Neem Oil 4.4.3.3.3. Neem Oil Extract 5. Europe Neem Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Neem Oil Market Size and Forecast, by Type (2023-2030) 5.2. Europe Neem Oil Market Size and Forecast, by Application (2023-2030) 5.3. Europe Neem Oil Market Size and Forecast, by Form (2023-2030) 5.4. Europe Neem Oil Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Neem Oil Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Neem Oil Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Neem Oil Market Size and Forecast, by Form(2023-2030) 5.4.2. France 5.4.2.1. France Neem Oil Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Neem Oil Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Neem Oil Market Size and Forecast, by Form(2023-2030) 5.4.3. Germany 5.4.3.1. Germany Neem Oil Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Neem Oil Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Neem Oil Market Size and Forecast, by Form (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Neem Oil Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Neem Oil Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Neem Oil Market Size and Forecast, by Form(2023-2030) 5.4.5. Spain 5.4.5.1. Spain Neem Oil Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Neem Oil Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Neem Oil Market Size and Forecast, by Form (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Neem Oil Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Neem Oil Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Neem Oil Market Size and Forecast, by Form (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Neem Oil Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Neem Oil Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Neem Oil Market Size and Forecast, by Form (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Neem Oil Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Neem Oil Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Neem Oil Market Size and Forecast, by Form (2023-2030) 6. Asia Pacific Neem Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Neem Oil Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Neem Oil Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Neem Oil Market Size and Forecast, by Form (2023-2030) 6.4. Asia Pacific Neem Oil Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Neem Oil Market Size and Forecast, by Form (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Neem Oil Market Size and Forecast, by Form (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Neem Oil Market Size and Forecast, by Form (2023-2030) 6.4.4. India 6.4.4.1. India Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Neem Oil Market Size and Forecast, by Form (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Neem Oil Market Size and Forecast, by Form (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Neem Oil Market Size and Forecast, by Form (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Neem Oil Market Size and Forecast, by Form (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Neem Oil Market Size and Forecast, by Form(2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Neem Oil Market Size and Forecast, by Form (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Neem Oil Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Neem Oil Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Neem Oil Market Size and Forecast, by Form (2023-2030) 7. Middle East and Africa Neem Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Neem Oil Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Neem Oil Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Neem Oil Market Size and Forecast, by Form (2023-2030) 7.4. Middle East and Africa Neem Oil Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Neem Oil Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Neem Oil Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Neem Oil Market Size and Forecast, by Form (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Neem Oil Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Neem Oil Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Neem Oil Market Size and Forecast, by Form (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Neem Oil Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Neem Oil Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Neem Oil Market Size and Forecast, by Form (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Neem Oil Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Neem Oil Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Neem Oil Market Size and Forecast, by Form (2023-2030) 8. South America Neem Oil Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Neem Oil Market Size and Forecast, by Type (2023-2030) 8.2. South America Neem Oil Market Size and Forecast, by Application (2023-2030) 8.3. South America Neem Oil Market Size and Forecast, by Form(2023-2030) 8.4. South America Neem Oil Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Neem Oil Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Neem Oil Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Neem Oil Market Size and Forecast, by Form (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Neem Oil Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Neem Oil Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Neem Oil Market Size and Forecast, by Form (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Neem Oil Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Neem Oil Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Neem Oil Market Size and Forecast, by Form (2023-2030) 9. Global Neem Oil Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Neem Oil Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. PJ Margo Private Limited 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Agro Extracts Limited 10.3. Fortune Biotech Ltd 10.4. GreeNeem Agri Private Limited 10.5. Manorama Industries Limited 10.6. Neem India Products Pvt. Ltd. 10.7. Ozone Biotech 10.8. Neeming Australia 10.9. NOW Foods 10.10. Fortune Biotech Ltd. 10.11. SUN BIONATURALS (INDIA) PRIVATE LTD. 10.12. Banyan Botanicals 10.13. Group Velocity LLC. 10.14. Parry's BIO 10.15. United Industries Corporation 10.16. Murugappa Group 10.17. The Velocity Group 10.18. Agro Extracts Limited 10.19. Certis USA LLC 10.20. E.I.D. Parry 10.21. PJ Margo Pvt. Ltd. 11. Key Findings 12. Industry Recommendations 13. Neem Oil Market: Research Methodology 14. Terms and Glossary