MRI Market was valued at USD 6.30 Bn in 2023 and is expected to reach USD 9.47 Bn by 2030, at a CAGR of 6 % during the forecast period.MRI Market Overview

MRI stands for Magnetic Resonance Imaging. It's a medical imaging technique used to visualize the internal structures of the body in detail. MRI uses a powerful magnetic field, radio waves, and a computer to generate images of organs and tissues. Unlike X-rays or CT scans, MRI does not use ionizing radiation, making it safer for certain populations, such as pregnant women. MRI is commonly used to diagnose a wide range of conditions, including but not limited to brain and spinal cord disorders, joint and musculoskeletal problems, tumors, and injuries. It provides excellent soft tissue contrast, particularly useful for imaging the brain, spinal cord, muscles, and internal organs. The utilization of MRI in radiation therapy treatment planning has been steadily growing. From 2006 to 2019, its usage surged from 6% to 28%. The RT Pro Edition for MAGNETOM Sola and MAGNETOM Vida represents a significant advancement in this regard, as they are the first MR scanners equipped with BioMatrix Technology. This innovation addresses the challenges posed by patient variability during radiation therapy treatment planning. Both MAGNETOM Sola and MAGNETOM Vida offer exceptional soft-tissue contrast and provide imaging capabilities that offer valuable insights for physicians regarding tumor extent and functional parameters. By seamlessly integrating this additional modality into existing processes, significant value is added to radiotherapy practices, thereby enhancing the clinical capabilities of the institution. The global MRI market size has been substantial, driven by the increasing prevalence of chronic diseases, rising geriatric population, technological advancements, and growing demand for non-invasive diagnostic techniques. The market has been valued in billions of dollars. Technological advancements is significant driver of growth in the MRI market. Manufacturers are continually improving MRI systems to enhance image quality, reduce scan times, and increase patient comfort. Innovations such as higher field strengths, advanced coil designs, and software improvements have contributed to the market's growth. The MRI market is geographically diverse, with significant demand from North America, Europe, Asia-Pacific, and other regions. Emerging economies, such as China, India, and Brazil, have been experiencing rapid growth in MRI installations due to increasing healthcare infrastructure development and rising healthcare expenditures.To know about the Research Methodology :- Request Free Sample Report

MRI Market Dynamics

Prevalence of Chronic Diseases to boost MRI Market growth The rising prevalence of chronic diseases, such as cardiovascular diseases, cancer, and neurological disorders, has been a major driver of the MRI market. MRI's ability to provide detailed anatomical and functional information without exposing patients to ionizing radiation makes it a preferred imaging modality for diagnosing and monitoring these conditions. The world's population is aging rapidly, leading to an increased incidence of age-related diseases and conditions that require medical imaging for diagnosis and treatment planning. As the elderly population grows, there is a greater demand for non-invasive imaging techniques like MRI to assess and manage age-related health issues, such as stroke, dementia, osteoarthritis, and cancer. Continuous advancements in MRI technology have driven market growth by improving image quality, reducing scan times, enhancing patient comfort, and expanding the range of applications. Innovations such as higher field strengths, advanced coil designs, parallel imaging techniques, and motion correction algorithms have made MRI more accurate, efficient, and accessible for clinicians and patients alike. MRI's versatility in imaging various anatomical structures and its ability to differentiate soft tissues with excellent contrast resolution have made it indispensable in various medical specialties, including neurology, orthopedics, cardiology, oncology, and abdominal imaging, which significantly boost the MRI Market growth. The clinical utility of MRI for diagnosing and monitoring conditions such as brain tumors, spinal cord injuries, musculoskeletal disorders, and heart diseases drives its widespread adoption across healthcare settings. Unlike X-rays and CT scans, which involve ionizing radiation, MRI uses a powerful magnetic field and radio waves to generate images, making it safer for patients, particularly children and pregnant women. The non-invasive nature of MRI reduces the risk of radiation exposure and minimizes the need for contrast agents, making it an attractive option for medical imaging, especially in pediatric and prenatal care. The shift towards decentralized healthcare delivery and the need for point-of-care imaging solutions have spurred demand for portable and compact MRI systems. These systems offer greater accessibility, flexibility, and cost-effectiveness, enabling imaging in remote or underserved areas, emergency departments, ambulatory care settings, and outpatient clinics. High Cost of Acquisition and Maintenance to restrain MRI Market growth High cost associated with acquiring and maintaining MRI systems is a significant restraint for the MRI Market. The initial capital investment for purchasing MRI equipment, along with ongoing expenses for maintenance, upgrades, and servicing, is prohibitive for healthcare facilities, particularly in resource-constrained settings. The need for specialized infrastructure, such as magnet shielding and dedicated MRI suites, adds to the overall cost of implementation. MRI technology is not uniformly accessible across all regions, especially in low- and middle-income countries where healthcare infrastructure and resources are limited. The high cost of MRI equipment, coupled with challenges related to electricity supply, trained personnel, and infrastructure constraints, restricts the availability of MRI services in underserved areas. This lack of accessibility exacerbates healthcare disparities and impedes timely diagnosis and treatment for patients in need. MRI systems are subject to stringent regulatory requirements and certification standards imposed by regulatory authorities in different countries. Compliance with regulations related to safety, performance, electromagnetic compatibility, and radiation exposure necessitates thorough testing and validation of MRI equipment, which prolong the time-to-market for new products and increase development costs. Updates to regulatory guidelines or changes in certification requirements require manufacturers to modify existing MRI systems, impacting product availability and market competitiveness. MRI faces competition from alternative imaging modalities, such as X-ray computed tomography (CT), positron emission tomography (PET), ultrasound, and molecular imaging techniques, which is expected to restrain MRI Market growth. Each modality offers unique advantages and limitations depending on the clinical indication, patient characteristics, and imaging requirements. The choice of imaging modality is often influenced by factors such as cost-effectiveness, availability, accessibility, radiation dose, and diagnostic accuracy, leading to competition among imaging technologies within the healthcare market.MRI Market Segment Analysis

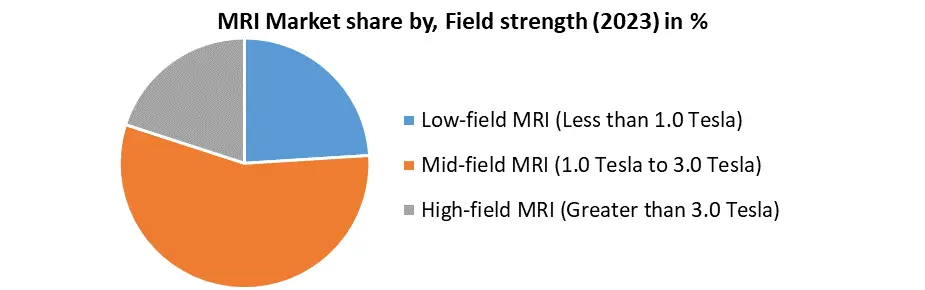

Based on Technology, the market is segmented into Closed MRI Systems, Open MRI Systems, and Wide-bore MRI Systems. The closed MRI Systems segment dominated the market in 2023 and is expected to hold the largest MRI Market share over the forecast period. The segment of Closed MRI Systems in the Magnetic Resonance Imaging market refers to traditional MRI systems where the patient is fully enclosed within the scanner bore during the imaging process. Closed MRI systems are characterized by a cylindrical bore surrounded by a strong magnet and radiofrequency coils, creating a tunnel-like structure in which the patient lies during the scan. Closed MRI systems have a fully enclosed design, with the patient positioned inside the bore of the scanner. This design provides a controlled environment for imaging, minimizing external interference and ensuring consistent image quality. Closed MRI systems are versatile and are used for imaging a wide range of anatomical areas and clinical applications, including neuroimaging, musculoskeletal imaging, abdominal imaging, cardiac imaging, breast imaging, and oncology, which significantly boost the MRI market growth. They are capable of detecting and diagnosing various diseases, injuries, and abnormalities across different medical specialties.Based on Field Strength, the market is segmented into Low-field MRI (Less than 1.0 Tesla), Mid-field MRI (1.0 Tesla to 3.0 Tesla), and High-field MRI (Greater than 3.0 Tesla). Mid-field MRI (1.0 Tesla to 3.0 Tesla) dominated the market in 2023 and is expected to hold the largest MRI Market share over the forecast period. Mid-field MRI systems operate at magnetic field strengths ranging from 1.0 Tesla to 3.0 Tesla. This moderate field strength enables these systems to generate high-quality images with good spatial resolution and contrast, suitable for a wide range of clinical applications. Mid-field MRI systems are versatile and are used for imaging various anatomical areas and clinical indications across different medical specialties. They are capable of imaging the brain, spine, musculoskeletal system, abdomen, pelvis, cardiovascular system, and other body regions with excellent detail and diagnostic accuracy.

MRI Market Regional Insights

Technological Advancements to boost North America MRI Market growth North America is a hub for medical technology innovation, with significant investments in research and development. Technological advancements in MRI, such as higher field strengths, improved image resolution, faster scan times, and advanced software capabilities, drive MRI market growth by enhancing diagnostic accuracy, patient comfort, and clinical workflow efficiency. Healthcare expenditure in North America is among the highest globally, driven by factors such as increasing healthcare demand, technological advancements, and healthcare policy initiatives. The availability of healthcare insurance coverage and government-funded healthcare programs also contributes to higher utilization of medical imaging services, including MRI, further fueling MRI market growth. The United States leads in MRI technology innovation, with significant investments in research and development. Advanced MRI systems with higher field strengths, improved imaging capabilities, and enhanced software functionalities are driving MRI market growth. The U.S. has the highest healthcare expenditure globally, driven by factors such as increasing demand for healthcare services, aging population, and healthcare policy initiatives. This high expenditure supports the adoption and utilization of advanced imaging modalities like MRI. : MRI is widely utilized across various medical specialties in the U.S., including neurology, oncology, cardiology, orthopedics, and abdominal imaging. The demand for MRI services is driven by the need for accurate diagnosis, treatment planning, and disease monitoring across diverse patient populations. In Canada, government initiatives and funding support healthcare infrastructure development, including the acquisition of advanced medical imaging equipment like MRI systems. Investments in healthcare technology aim to improve patient care and access to diagnostic services across different provinces.Mexico presents emerging market opportunities for MRI manufacturers and suppliers due to the growing demand for medical imaging services. Market development efforts focus on providing cost-effective MRI solutions tailored to the needs of healthcare providers and patients in diverse healthcare settings. Mexico's healthcare sector is experiencing increasing demand for advanced medical technologies, including MRI, driven by population growth, urbanization, and rising healthcare awareness. Healthcare providers are investing in upgrading their facilities and acquiring modern imaging equipment to meet the growing demand for diagnostic services.

MRI Market Scope: Inquiry Before Buying

MRI Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.30 Bn. Forecast Period 2024 to 2030 CAGR: 6% Market Size in 2030: US $ 9.47 Bn. Segments Covered: by Technology Closed MRI Systems Open MRI Systems Wide-bore MRI Systems by Field Strength Low-field MRI (Less than 1.0 Tesla) Mid-field MRI (1.0 Tesla to 3.0 Tesla) High-field MRI (Greater than 3.0 Tesla) by Application Neurology Orthopedics Cardiology Oncology Imaging Pediatrics by End-User Hospitals Diagnostic Imaging Centers Research Institutions Ambulatory Surgical Centers MRI Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading MRI key players include:

North America: 1. GE Healthcare (United States) 1. Siemens Healthineers AG (United States) 2. Philips Healthcare (United States) 3. Canon Medical Systems Corporation (United States) 4. Hitachi Medical Corporation (United States) 5. Smart Scan Medical Imaging, LLC (Florida) Europe: 6. Aspect Imaging (Israel) 7. DMS Group (Brazil) 8. Esaote SpA (Italy) 9. Bracco Imaging S.p.A. (Italy) Asia-Pacific: 10. Neusoft Medical Systems Co., Ltd. (China) 11. United Imaging Healthcare Co., Ltd. (China) 12. Mindray Medical International Limited (China) 13. Hologic, Inc. (Australia) 14. Toshiba Medical Systems Corporation (Japan) 15. Medison Co., Ltd. (South Korea) 16. Allengers Medical Systems Limited (India) Middle East & Africa: 17. Alliance Medical Group (United Arab Emirates) 18. Al-Hayat Medical Center (Qatar)Frequently Asked Questions:

1. Which regions are experiencing significant growth in the MRI market? Ans: North America, Europe, Asia-Pacific, and emerging economies such as China, India, and Brazil are experiencing rapid growth in the MRI market due to increasing healthcare infrastructure development and rising healthcare expenditures. 2. What are the main factors restraining the growth of the MRI market? Ans: High cost of acquisition and maintenance, regulatory challenges, competition from alternative imaging modalities, and lack of accessibility in certain regions are key factors restraining the growth of the MRI market. 3. What are the different segments of the MRI market based on technology and field strength? Ans: The MRI market is segmented based on technology into Closed MRI Systems, Open MRI Systems, and Wide-bore MRI Systems. Based on field strength, it's segmented into Low-field MRI, Mid-field MRI, and High-field MRI. 4. Which segment dominates the MRI market based on field strength, and why? Ans: Mid-field MRI (1.0 Tesla to 3.0 Tesla) dominates the MRI market due to its balance between imaging quality, clinical versatility, and cost-effectiveness, making it suitable for a wide range of clinical applications. 5. What are the benefits of integrating MRI into radiation therapy treatment planning? Ans: Integrating MRI into radiation therapy treatment planning offers several benefits, including addressing the challenges of patient variability, providing exceptional soft tissue contrast, and offering valuable insights for physicians regarding tumor extent and functional parameters.

1. MRI Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global MRI Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. MRI Market Companies Share 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. MRI Market: Dynamics 3.1. MRI Market Trends by Region 3.1.1. North America MRI Market Trends 3.1.2. Europe MRI Market Trends 3.1.3. Asia Pacific MRI Market Trends 3.1.4. Middle East and Africa MRI Market Trends 3.1.5. South America MRI Market Trends 3.2. MRI Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America MRI Market Drivers 3.2.1.2. North America MRI Market Restraints 3.2.1.3. North America MRI Market Opportunities 3.2.1.4. North America MRI Market Challenges 3.2.2. Europe 3.2.2.1. Europe MRI Market Drivers 3.2.2.2. Europe MRI Market Restraints 3.2.2.3. Europe MRI Market Opportunities 3.2.2.4. Europe MRI Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific MRI Market Drivers 3.2.3.2. Asia Pacific MRI Market Restraints 3.2.3.3. Asia Pacific MRI Market Opportunities 3.2.3.4. Asia Pacific MRI Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa MRI Market Drivers 3.2.4.2. Middle East and Africa MRI Market Restraints 3.2.4.3. Middle East and Africa MRI Market Opportunities 3.2.4.4. Middle East and Africa MRI Market Challenges 3.2.5. South America 3.2.5.1. South America MRI Market Drivers 3.2.5.2. South America MRI Market Restraints 3.2.5.3. South America MRI Market Opportunities 3.2.5.4. South America MRI Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for MRI Industry 3.8. The Global Pandemic Impact on MRI Market 4. MRI Market: Global Market Size and Forecast by Segmentation (by Value) (2023-2030) 4.1. MRI Market Size and Forecast, By Technology (2023-2030) 4.1.1.1. Closed MRI Systems 4.1.1.2. Open MRI Systems 4.1.1.3. Wide-bore MRI Systems 4.2. MRI Market Size and Forecast, By Field Strength (2023-2030) 4.2.1. Low-field MRI (Less than 1.0 Tesla) 4.2.2. Mid-field MRI (1.0 Tesla to 3.0 Tesla) 4.2.3. High-field MRI (Greater than 3.0 Tesla) 4.3. MRI Market Size and Forecast, By Application (2023-2030) 4.3.1. Neurology 4.3.2. Orthopedics 4.3.3. Cardiology 4.3.4. Oncology 4.3.5. Imaging 4.3.6. Pediatrics 4.4. MRI Market Size and Forecast, By End-User (2023-2030) 4.4.1. Hospitals 4.4.2. Diagnostic Imaging Centers 4.4.3. Research Institutions 4.4.4. Ambulatory Surgical Centers 4.5. MRI Market Size and Forecast, by region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America MRI Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America MRI Market Size and Forecast, By Technology(2023-2030) 5.1.1.1. Closed MRI Systems 5.1.1.2. Open MRI Systems 5.1.1.3. Wide-bore MRI Systems 5.2. North America MRI Market Size and Forecast, By Field Strength (2023-2030) 5.2.1. Low-field MRI (Less than 1.0 Tesla) 5.2.2. Mid-field MRI (1.0 Tesla to 3.0 Tesla) 5.2.3. High-field MRI (Greater than 3.0 Tesla) 5.3. North America MRI Market Size and Forecast, By Application (2023-2030) 5.3.1. Neurology 5.3.2. Orthopedics 5.3.3. Cardiology 5.3.4. Oncology 5.3.5. Imaging 5.3.6. Pediatrics 5.4. North America MRI Market Size and Forecast, By End-User (2023-2030) 5.4.1. Hospitals 5.4.2. Diagnostic Imaging Centers 5.4.3. Research Institutions 5.4.4. Ambulatory Surgical Centers 5.5. North America MRI Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States MRI Market Size and Forecast, By Technology(2023-2030) 5.5.1.1.1. Closed MRI Systems 5.5.1.1.2. Open MRI Systems 5.5.1.1.3. Wide-bore MRI Systems 5.5.1.2. United States MRI Market Size and Forecast, By Field Strength (2023-2030) 5.5.1.2.1. Low-field MRI (Less than 1.0 Tesla) 5.5.1.2.2. Mid-field MRI (1.0 Tesla to 3.0 Tesla) 5.5.1.2.3. High-field MRI (Greater than 3.0 Tesla) 5.5.1.3. United States MRI Market Size and Forecast, By Application (2023-2030) 5.5.1.3.1. Neurology 5.5.1.3.2. Orthopedics 5.5.1.3.3. Cardiology 5.5.1.3.4. Oncology 5.5.1.3.5. Imaging 5.5.1.3.6. Pediatrics 5.5.1.4. United States MRI Market Size and Forecast, By End-User (2023-2030) 5.5.1.4.1. Hospitals 5.5.1.4.2. Diagnostic Imaging Centers 5.5.1.4.3. Research Institutions 5.5.1.4.4. Ambulatory Surgical Centers 5.5.2. Canada 5.5.2.1. Canada MRI Market Size and Forecast, By Technology(2023-2030) 5.5.2.1.1.1. Closed MRI Systems 5.5.2.1.1.2. Open MRI Systems 5.5.2.1.1.3. Wide-bore MRI Systems 5.5.2.2. Canada MRI Market Size and Forecast, By Field Strength (2023-2030) 5.5.2.2.1. Low-field MRI (Less than 1.0 Tesla) 5.5.2.2.2. Mid-field MRI (1.0 Tesla to 3.0 Tesla) 5.5.2.2.3. High-field MRI (Greater than 3.0 Tesla) 5.5.2.3. Canada MRI Market Size and Forecast, By Application (2023-2030) 5.5.2.3.1. Neurology 5.5.2.3.2. Orthopedics 5.5.2.3.3. Cardiology 5.5.2.3.4. Oncology 5.5.2.3.5. Imaging 5.5.2.3.6. Pediatrics 5.5.2.4. Canada MRI Market Size and Forecast, By End-User (2023-2030) 5.5.2.4.1. Hospitals 5.5.2.4.2. Diagnostic Imaging Centers 5.5.2.4.3. Research Institutions 5.5.2.4.4. Ambulatory Surgical Centers 5.5.3. Mexico 5.5.3.1. Mexico MRI Market Size and Forecast, By Technology(2023-2030) 5.5.3.1.1.1. Closed MRI Systems 5.5.3.1.1.2. Open MRI Systems 5.5.3.1.1.3. Wide-bore MRI Systems 5.5.3.2. Mexico MRI Market Size and Forecast, By Field Strength (2023-2030) 5.5.3.2.1. Low-field MRI (Less than 1.0 Tesla) 5.5.3.2.2. Mid-field MRI (1.0 Tesla to 3.0 Tesla) 5.5.3.2.3. High-field MRI (Greater than 3.0 Tesla) 5.5.3.3. Mexico MRI Market Size and Forecast, By Application (2023-2030) 5.5.3.3.1. Neurology 5.5.3.3.2. Orthopedics 5.5.3.3.3. Cardiology 5.5.3.3.4. Oncology 5.5.3.3.5. Imaging 5.5.3.3.6. Pediatrics 5.5.3.4. Mexico MRI Market Size and Forecast, By End-User (2023-2030) 5.5.3.4.1. Hospitals 5.5.3.4.2. Diagnostic Imaging Centers 5.5.3.4.3. Research Institutions 5.5.3.4.4. Ambulatory Surgical Centers 6. Europe MRI Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe MRI Market Size and Forecast, By Technology(2023-2030) 6.2. Europe MRI Market Size and Forecast, By Field Strength (2023-2030) 6.3. Europe MRI Market Size and Forecast, By Application (2023-2030) 6.4. Europe MRI Market Size and Forecast, By End-User (2023-2030) 6.5. Europe MRI Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom MRI Market Size and Forecast, By Technology(2023-2030) 6.5.1.2. United Kingdom MRI Market Size and Forecast, By Field Strength (2023-2030) 6.5.1.3. United Kingdom MRI Market Size and Forecast, By Application (2023-2030) 6.5.1.4. United Kingdom MRI Market Size and Forecast, By End-User (2023-2030) 6.5.2. France 6.5.2.1. France MRI Market Size and Forecast, By Technology(2023-2030) 6.5.2.2. France MRI Market Size and Forecast, By Field Strength (2023-2030) 6.5.2.3. France MRI Market Size and Forecast, By Application (2023-2030) 6.5.2.4. France MRI Market Size and Forecast, By End-User (2023-2030) 6.5.3. Germany 6.5.3.1. Germany MRI Market Size and Forecast, By Technology(2023-2030) 6.5.3.2. Germany MRI Market Size and Forecast, By Field Strength (2023-2030) 6.5.3.3. Germany MRI Market Size and Forecast, By Application (2023-2030) 6.5.3.4. Germany MRI Market Size and Forecast, By End-User (2023-2030) 6.5.4. Italy 6.5.4.1. Italy MRI Market Size and Forecast, By Technology(2023-2030) 6.5.4.2. Italy MRI Market Size and Forecast, By Field Strength (2023-2030) 6.5.4.3. Italy MRI Market Size and Forecast, By Application (2023-2030) 6.5.4.4. Italy MRI Market Size and Forecast, By End-User (2023-2030) 6.5.5. Spain 6.5.5.1. Spain MRI Market Size and Forecast, By Technology(2023-2030) 6.5.5.2. Spain MRI Market Size and Forecast, By Field Strength (2023-2030) 6.5.5.3. Spain MRI Market Size and Forecast, By Application (2023-2030) 6.5.5.4. Spain MRI Market Size and Forecast, By End-User (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden MRI Market Size and Forecast, By Technology(2023-2030) 6.5.6.2. Sweden MRI Market Size and Forecast, By Field Strength (2023-2030) 6.5.6.3. Sweden MRI Market Size and Forecast, By Application (2023-2030) 6.5.6.4. Sweden MRI Market Size and Forecast, By End-User(2023-2030) 6.5.7. Austria 6.5.7.1. Austria MRI Market Size and Forecast, By Technology(2023-2030) 6.5.7.2. Austria MRI Market Size and Forecast, By Field Strength (2023-2030) 6.5.7.3. Austria MRI Market Size and Forecast, By Application (2023-2030) 6.5.7.4. Austria MRI Market Size and Forecast, By End-User (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe MRI Market Size and Forecast, By Technology(2023-2030) 6.5.8.2. Rest of Europe MRI Market Size and Forecast, By Field Strength (2023-2030) 6.5.8.3. Rest of Europe MRI Market Size and Forecast, By Application (2023-2030) 6.5.8.4. Rest of Europe MRI Market Size and Forecast, By End-User(2023-2030) 7. Asia Pacific MRI Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific MRI Market Size and Forecast, By Technology(2023-2030) 7.2. Asia Pacific MRI Market Size and Forecast, By Field Strength (2023-2030) 7.3. Asia Pacific MRI Market Size and Forecast, By Application (2023-2030) 7.4. Asia Pacific MRI Market Size and Forecast, By End-User(2023-2030) 7.5. Asia Pacific MRI Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China MRI Market Size and Forecast, By Technology(2023-2030) 7.5.1.2. China MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.1.3. China MRI Market Size and Forecast, By Application (2023-2030) 7.5.1.4. China MRI Market Size and Forecast, By End-User(2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea MRI Market Size and Forecast, By Technology(2023-2030) 7.5.2.2. S Korea MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.2.3. S Korea MRI Market Size and Forecast, By Application (2023-2030) 7.5.2.4. S Korea MRI Market Size and Forecast, By End-User(2023-2030) 7.5.3. Japan 7.5.3.1. Japan MRI Market Size and Forecast, By Technology(2023-2030) 7.5.3.2. Japan MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.3.3. Japan MRI Market Size and Forecast, By Application (2023-2030) 7.5.3.4. Japan MRI Market Size and Forecast, By End-User(2023-2030) 7.5.4. India 7.5.4.1. India MRI Market Size and Forecast, By Technology(2023-2030) 7.5.4.2. India MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.4.3. India MRI Market Size and Forecast, By Application (2023-2030) 7.5.4.4. India MRI Market Size and Forecast, By End-User(2023-2030) 7.5.5. Australia 7.5.5.1. Australia MRI Market Size and Forecast, By Technology(2023-2030) 7.5.5.2. Australia MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.5.3. Australia MRI Market Size and Forecast, By Application (2023-2030) 7.5.5.4. Australia MRI Market Size and Forecast, By End-User(2023-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia MRI Market Size and Forecast, By Technology(2023-2030) 7.5.6.2. Indonesia MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.6.3. Indonesia MRI Market Size and Forecast, By Application (2023-2030) 7.5.6.4. Indonesia MRI Market Size and Forecast, By End-User(2023-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia MRI Market Size and Forecast, By Technology(2023-2030) 7.5.7.2. Malaysia MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.7.3. Malaysia MRI Market Size and Forecast, By Application (2023-2030) 7.5.7.4. Malaysia MRI Market Size and Forecast, By End-User(2023-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam MRI Market Size and Forecast, By Technology(2023-2030) 7.5.8.2. Vietnam MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.8.3. Vietnam MRI Market Size and Forecast, By Application (2023-2030) 7.5.8.4. Vietnam MRI Market Size and Forecast, By End-User (2023-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan MRI Market Size and Forecast, By Technology(2023-2030) 7.5.9.2. Taiwan MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.9.3. Taiwan MRI Market Size and Forecast, By Application (2023-2030) 7.5.9.4. Taiwan MRI Market Size and Forecast, By End-User(2023-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific MRI Market Size and Forecast, By Technology(2023-2030) 7.5.10.2. Rest of Asia Pacific MRI Market Size and Forecast, By Field Strength (2023-2030) 7.5.10.3. Rest of Asia Pacific MRI Market Size and Forecast, By Application (2023-2030) 7.5.10.4. Rest of Asia Pacific MRI Market Size and Forecast, By End-User (2023-2030) 8. Middle East and Africa MRI Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. Middle East and Africa MRI Market Size and Forecast, By Technology(2023-2030) 8.2. Middle East and Africa MRI Market Size and Forecast, By Field Strength (2023-2030) 8.3. Middle East and Africa MRI Market Size and Forecast, By Application (2023-2030) 8.4. Middle East and Africa MRI Market Size and Forecast, By End-User(2023-2030) 8.5. Middle East and Africa MRI Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa MRI Market Size and Forecast, By Technology(2023-2030) 8.5.1.2. South Africa MRI Market Size and Forecast, By Field Strength (2023-2030) 8.5.1.3. South Africa MRI Market Size and Forecast, By Application (2023-2030) 8.5.1.4. South Africa MRI Market Size and Forecast, By End-User(2023-2030) 8.5.2. GCC 8.5.2.1. GCC MRI Market Size and Forecast, By Technology(2023-2030) 8.5.2.2. GCC MRI Market Size and Forecast, By Field Strength (2023-2030) 8.5.2.3. GCC MRI Market Size and Forecast, By Application (2023-2030) 8.5.2.4. GCC MRI Market Size and Forecast, By End-User(2023-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria MRI Market Size and Forecast, By Technology(2023-2030) 8.5.3.2. Nigeria MRI Market Size and Forecast, By Field Strength (2023-2030) 8.5.3.3. Nigeria MRI Market Size and Forecast, By Application (2023-2030) 8.5.3.4. Nigeria MRI Market Size and Forecast, By End-User(2023-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A MRI Market Size and Forecast, By Technology(2023-2030) 8.5.4.2. Rest of ME&A MRI Market Size and Forecast, By Field Strength (2023-2030) 8.5.4.3. Rest of ME&A MRI Market Size and Forecast, By Application (2023-2030) 8.5.4.4. Rest of ME&A MRI Market Size and Forecast, By End-User (2023-2030) 9. South America MRI Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America MRI Market Size and Forecast, By Technology(2023-2030) 9.2. South America MRI Market Size and Forecast, By Field Strength (2023-2030) 9.3. South America MRI Market Size and Forecast, By Application (2023-2030) 9.4. South America MRI Market Size and Forecast, By End-User (2023-2030) 9.5. South America MRI Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil MRI Market Size and Forecast, By Technology(2023-2030) 9.5.1.2. Brazil MRI Market Size and Forecast, By Field Strength (2023-2030) 9.5.1.3. Brazil MRI Market Size and Forecast, By Application (2023-2030) 9.5.1.4. Brazil MRI Market Size and Forecast, By End-User (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina MRI Market Size and Forecast, By Technology(2023-2030) 9.5.2.2. Argentina MRI Market Size and Forecast, By Field Strength (2023-2030) 9.5.2.3. Argentina MRI Market Size and Forecast, By Application (2023-2030) 9.5.2.4. Argentina MRI Market Size and Forecast, By End-User (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America MRI Market Size and Forecast, By Technology(2023-2030) 9.5.3.2. Rest Of South America MRI Market Size and Forecast, By Field Strength (2023-2030) 9.5.3.3. Rest Of South America MRI Market Size and Forecast, By Application (2023-2030) 9.5.3.4. Rest Of South America MRI Market Size and Forecast, By End-User (2023-2030) 10. Company Profile: Key Players 10.1. GE Healthcare (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Siemens Healthineers AG (United States) 10.3. Philips Healthcare (United States) 10.4. Canon Medical Systems Corporation (United States) 10.5. Hitachi Medical Corporation (United States) 10.6. Smart Scan Medical Imaging, LLC (Florida) 10.7. Europe: 10.8. Aspect Imaging (Israel) 10.9. DMS Group (Brazil) 10.10. Esaote SpA (Italy) 10.11. Bracco Imaging S.p.A. (Italy) 10.12. Asia-Pacific: 10.13. Neusoft Medical Systems Co., Ltd. (China) 10.14. United Imaging Healthcare Co., Ltd. (China) 10.15. Mindray Medical International Limited (China) 10.16. Hologic, Inc. (Australia) 10.17. Toshiba Medical Systems Corporation (Japan) 10.18. Medison Co., Ltd. (South Korea) 10.19. Allengers Medical Systems Limited (India) 10.20. Middle East & Africa: 10.21. Alliance Medical Group (United Arab Emirates) 10.22. Al-Hayat Medical Center (Qatar) 11. Key Findings and Analyst Recommendations 12. MRI Market: Research Methodology