The Europe Wireless EV Charging Market size was valued at USD 1.96 Billion in 2023 and the total Europe Wireless EV Charging revenue is expected to grow at a CAGR of 36.12 % from 2024 to 2030, reaching nearly USD 16.97 Billion by 2030. Wireless EV Charging liberates electric vehicles from the need for cables during charging, enhancing convenience at home or work. With the ability to park in designated spots and automated steering, it reduces the parking hassle for users. The European Wireless EV Charging Market is witnessing rapid growth due to the surging adoption of electric vehicles across the region. For instance, In 2022, electric cars constituted 21.6% of new EU car registrations, showing substantial growth from 1.74 million in 2021 to nearly two million. Electric vans also grew, securing a 5.5% share, with a 25% increase in newly registered battery electric vehicles dominating the market, coupled with a growing focus on sustainable transportation solutions. Factors contributing to this growth include rising environmental awareness, government incentives promoting EV adoption, and advancements in wireless charging technologies.To know about the Research Methodology :- Request Free Sample Report The Europe Wireless EV Charging Market is witnessing substantial investments in research and development, aimed at enhancing charging efficiency, reducing charging times, and expanding infrastructure. Europe Wireless EV Charging Market players, such as Qualcomm, Witricity Corporation, and Plugless Power, have been actively involved in strategic collaborations, partnerships, and product launches to capitalize on the expanding market opportunities. For instance, Qualcomm has introduced its wireless electric vehicle charging (WEVC) technology, which utilizes resonant magnetic induction for high-efficiency power transfer. Witricity Corporation has been at the forefront of wireless charging innovations, focusing on resonant inductive coupling to improve charging experiences for various EV applications. The continuous efforts towards standardization and interoperability are expected to further drive market growth, making wireless EV charging an integral part of the evolving electric mobility landscape. As the automotive industry continues its shift towards electrification, the Europe Wireless EV Charging Market is expected to play a crucial role in shaping the future of sustainable transportation.

Europe Wireless EV Charging Market Dynamics:

Rising Electric Vehicle Adoption, with Innovations, Boosts Europe's Wireless EV Charging Market Growth The Increasing Electric Vehicle Adoption within the EU. For instance, in 2022, electric cars constituted a substantial 21.6% of new car registrations, totalling close to two million registrations, a significant surge from 1.74 million in 2021 driving the growth of Europe Wireless EV Charging Market. Electric vans also expected growth, capturing a 5.5% share of new registrations in the same year. The increasing numbers are crucial for the EU, as the transport sector is a major contributor to greenhouse gas emissions, necessitating a shift to electric vehicles to meet ambitious climate neutrality objectives. Stricter CO2 fleet targets set by Regulation (EU) 2019/631 further underline the urgency, demanding a 15% reduction by 2025 and a 50% reduction for vans and 55% for cars by 2030, ultimately aiming for zero-CO2 emission targets for new cars and vans from 2035.Government Initiatives and Incentives stand as key drivers in boosting the widespread adoption of electric vehicles, subsequently shaping the landscape of the Europe Wireless EV Charging Market. Germany's proactive financial incentives for EV purchases exemplify a favourable environment that encourages both consumers and businesses to embrace electric mobility. The continuous Advancements in Charging Technology contribute to market expansion, as ongoing innovations in wireless charging efficiency enhance the overall user experience. The critical role of Infrastructure Development is evident in the strategic deployment of wireless charging stations in major cities such as London and Amsterdam, effectively addressing range anxiety and fostering the organic growth of the Europe Wireless EV Charging Market. Partnerships and Collaborations, such as the collaboration between BMW and Qualcomm in advancing wireless charging technology, are accelerating the development and deployment of cutting-edge solutions in the wireless EV charging sector. The market's trajectory is further influenced by the impetus provided by Growing Environmental Awareness, notably reflected in Sweden's ambitious plan to achieve carbon-neutrality by 2045, serving as a significant catalyst for the widespread transition to electric vehicles and, consequently, boosting the Europe Wireless EV Charging Market. The convergence of Rising Urbanization and Smart City Initiatives, exemplified by Barcelona's steadfast commitment to sustainable urban mobility, establishes an environment conducive to the seamless integration of wireless EV charging infrastructure. Limited Energy Grid Capacity with Infrastructure Gaps in Rural Regions Hindering the Europe Wireless EV Charging Market Growth The presence of infrastructure gaps, characterized by a scarcity of charging facilities, particularly in rural or less-developed regions, contributes to range anxiety among electric vehicle (EV) users, creating a hindrance to the widespread adoption of EVs and serving as a barrier to Europe Wireless EV Charging Market growth. Despite the new opportunities that the emergence of electric mobility presents for the power sector, it poses challenges for local distribution grids when faced with the large-scale charging of EVs that is not effectively managed. The rise in electric mobility aligns with broader trends, such as increasing renewable energy adoption and demands for enhanced energy efficiency, placing higher requirements on the grid and power system. The transition from traditional to smarter grids becomes imperative to meet these evolving needs. The challenge associated with the surge in electricity demand from EVs lies not only in the volume but predominantly in the potential increase in peak demand, influenced by factors such as charging speed, time, and location. The uneven distribution of charging events intensifies peaks, creating stress on existing energy grids and necessitating substantial upgrades. In addition to charging infrastructure challenges, the increasing adoption of renewable energy sources adds complexity to the power infrastructure. Supply volatility and distributed generation, particularly from solar PV systems, contribute to intermittency and reverse flows in the grid, stressing the existing systems. Such challenges are already manifesting in regions like Italy, Germany, Belgium, and Northern Ireland, indicating the need for robust grid upgrades to accommodate the growing demands of both EV charging and renewable energy integration. Amid these challenges, ensuring the security of wireless EV charging systems becomes paramount, with potential cybersecurity threats raising concerns about data privacy and system integrity, requiring ongoing evolution of security measures to facilitate market growth.

Europe Wireless EV Charging Market Segment Analysis:

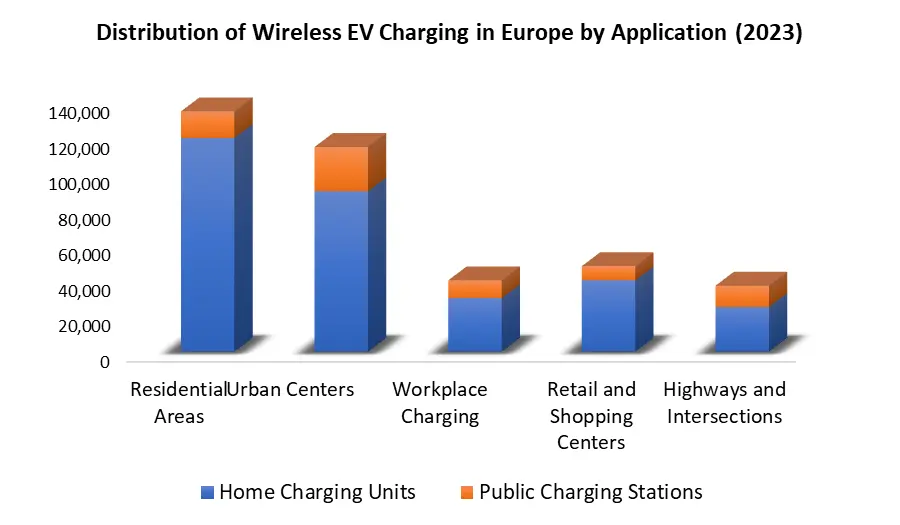

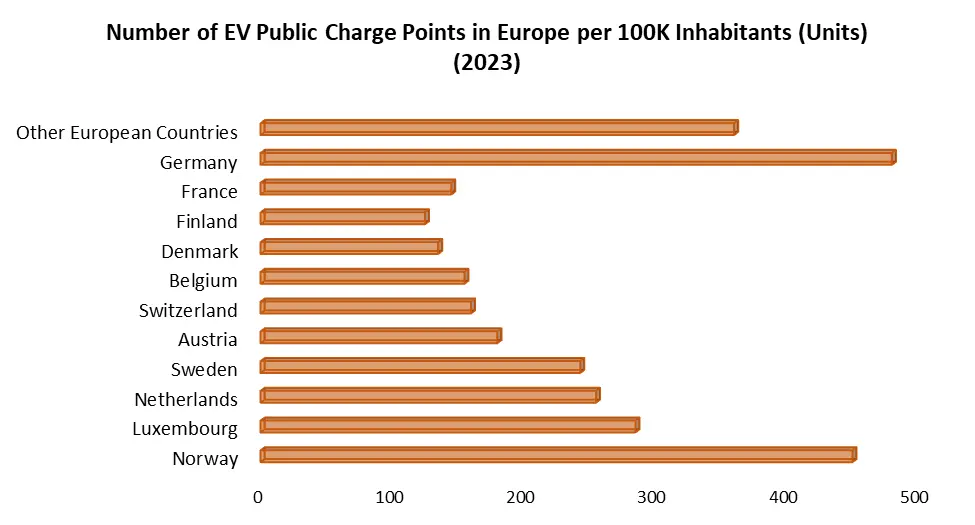

Based on Application, In the Europe Wireless EV Charging Market, home charging predominates, constituting 70% of EV activities, with residential chargers sold mainly in DACH and France. Workplace charging, crucial for those without home chargers, holds a significant share, especially in Nordic countries and France. Public charging, with nearly 550,000 operational points in the EU by Q2 2023, witnesses a notable rise in DC chargers, emphasizing the increasing importance of DC charging technology. The composition shift in charging infrastructure is complemented by variations in public charging points, categorized as "fully" public or "semi-public." Norway, Luxemburg, the Netherlands, Sweden, and Austria lead in infrastructure provision per 100,000 inhabitants. Disparities in infrastructure distribution correlate with varied EV adoption rates, reflecting economic factors. The shift in charging infrastructure composition is accompanied by notable variations in the availability of public charging points, categorized as "fully" public or "semi-public." Fully public charging points, available 24/7 on streets or highways, contrast with semi-public points on private property with access restrictions. A comprehensive study by GridX, covering 28 countries, reveals varying charging station configurations, with most featuring two charging points. Norway, Luxemburg, the Netherlands, Sweden, and Austria emerge as leaders in infrastructure, providing 538, 310, 279, 265, and 198 charging points per 100,000 inhabitants, respectively. Disparities in infrastructure distribution contribute to varied EV adoption rates, reflecting economic factors, where affluent countries such as Sweden, the Netherlands, Finland, and Denmark account for 75% of EU electric car sales, while less affluent countries lag behind. Economic indicators, such as GDP, correlate with expected EV market shares, indicating potential challenges in EV adoption for lower-income countries. The increasing average price of EVs in Europe, from EUR 48,942 in 2015 to EUR 55,821 in 2022, further adds to potential hurdles in adoption for economically challenged regions.

Europe Wireless EV Charging Market Regional Insights:

Germany is a leading region in Europe Wireless EV Charging Market, having substantial investments in wireless charging projects across urban areas and highways. The United Kingdom, Norway, the Netherlands, France, and Sweden have actively embraced wireless charging initiatives, aligning with their commitment to sustainable transportation. Despite progress in these countries, there is a notable regional disparity in the distribution of public EV charging points within the European Union. In 2021, about 50% of the charging infrastructure was concentrated in the Netherlands and Germany, covering only 10% of the EU's landmass, while the remaining 51.2% was spread across the rest. The analysis indicates a clear divide between Western and Eastern Europe, with Western countries enjoying significant advantages in charging infrastructure. Norway, Luxemburg, the Netherlands, Sweden, and Austria lead in EV charging infrastructure, while Eastern and Southern European countries such as Poland, Bulgaria, and Romania lag behind. This divide corresponds to variations in EV adoption rates, with affluent Western European nations dominating EU electric car sales. Additionally, a correlation between GDP and EV market share is observed, with higher GDP countries expected to have a greater market share. However, the rise in average EV prices may pose challenges to adoption in lower-income countries.

Scope of Europe Wireless EV Charging Market : Inquire before buying

Europe Wireless EV Charging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.96 Bn. Forecast Period 2024 to 2030 CAGR: 36.12% Market Size in 2030: US $ 16.97 Bn. Segments Covered: by Component Base Charging Pad (Transmitter) Power Control Unit Vehicle Charging Pad (Receiver) by Power Supply Range 3–<11 kW 11–50 kW >50 kW by Charging type Stationary Wireless Charging System Dynamic Wireless Charging System by Technology Inductive Charging Resonant Inductive Coupling Capacitive Charging by Application Home Charging Unit Public Charging Station Leading players in the Europe Wireless EV Charging Market:

1. Momentum Dynamics Corporation (UK) 2. Qualcomm Halo (UK) 3. ELAP (Italy) 4. WiTricity (Germany) 5. Chargemaster (UK) 6. BlueInductive (Germany) 7. Easee (Norway) 8. Hevo Power (Netherlands) 9. Ceres Power (UK) 10. HEVO (Netherlands) FAQs: 1] What Major Key players in the Europe Wireless EV Charging Market report? Ans. The Major Key players covered in the Europe Wireless EV Charging Market report are Momentum Dynamics Corporation, Qualcomm Halo, ELAP, WiTricity. 2] Which region is expected to hold the highest share in the Europe Wireless EV Charging Market? Ans. Germany region is expected to hold the highest share in the Europe Wireless EV Charging Market. 3] What is the market size of the Europe Wireless EV Charging Market by 2030? Ans. The market size of the Europe Wireless EV Charging Market by 2030 is expected to reach US$ 16.97 Billion. 4] What is the forecast period for the Europe Wireless EV Charging Market? Ans. The forecast period for the Europe Wireless EV Charging Market is 2024-2030. 5] What was the market size of the Europe Wireless EV Charging Market in 2023? Ans. The market size of the Market in 2023 was valued at US$ 1.96 Billion.

1. Europe Wireless EV Charging Market: Research Methodology 2. Europe Wireless EV Charging Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Europe Wireless EV Charging Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Service Segment 3.3.3. Application Segment 3.3.4. Revenue (2023) 3.3.5. Company Locations 3.4. Leading Europe Wireless EV Charging Market Companies, by Market Capitalization 3.5. Market Structure 3.5.1. Market Leaders 3.5.2. Market Followers 3.5.3. Emerging Players 3.6. Mergers and Acquisitions Details 4. Europe Wireless EV Charging Market: Dynamics 4.1. Europe Wireless EV Charging Market Trends 4.2. Europe Wireless EV Charging Market Drivers 4.3. Europe Wireless EV Charging Market Restraints 4.4. Europe Wireless EV Charging Market Opportunities 4.5. Europe Wireless EV Charging Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Technological Roadmap 4.9. Regulatory Landscape 4.10. Key Opinion Leader Analysis for Europe Wireless EV Charging End User 4.11. Analysis of Government Schemes and Initiatives for Europe Wireless EV Charging End User 4.12. The Covid 19 Pandemic Impact on Europe Wireless EV Charging Market 5. Europe Wireless EV Charging Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Wireless EV Charging Market Size and Forecast, by Component (2023-2030) 5.1.1. Base Charging Pad (Transmitter) 5.1.2. Power Control Unit 5.1.3. Vehicle Charging Pad (Receiver) 5.2. Europe Wireless EV Charging Market Size and Forecast, by Power Supply Range (2023-2030) 5.2.1. 3–<11 kW 5.2.2. 11–50 kW 5.2.3. >50 kW 5.3. Europe Wireless EV Charging Market Size and Forecast, by Charging Type (2023-2030) 5.3.1. Stationary Wireless Charging System 5.3.2. Dynamic Wireless Charging System 5.4. Europe Wireless EV Charging Market Size and Forecast, by Technology (2023-2030) 5.4.1. Inductive Charging 5.4.2. Resonant Inductive Coupling 5.4.3. Capacitive Charging 5.5. Europe Wireless EV Charging Market Size and Forecast, by Application (2023-2030) 5.5.1. Home Charging Unit 5.5.2. Public Charging Station 5.6. Europe Wireless EV Charging Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Wireless EV Charging Market Size and Forecast, by Component (2023-2030) 5.6.1.2. United Kingdom Wireless EV Charging Market Size and Forecast, by Power Supply Range (2023-2030) 5.6.1.3. United Kingdom Wireless EV Charging Market Size and Forecast, by Charging Type (2023-2030) 5.6.1.4. United Kingdom Wireless EV Charging Market Size and Forecast, by Technology (2023-2030) 5.6.1.5. United Kingdom Wireless EV Charging Market Size and Forecast, by Application (2023-2030) 5.6.2. France 5.6.2.1. France Wireless EV Charging Market Size and Forecast, by Component (2023-2030) 5.6.2.2. France Wireless EV Charging Market Size and Forecast, by Power Supply Range (2023-2030) 5.6.2.3. France Wireless EV Charging Market Size and Forecast, by Charging Type (2023-2030) 5.6.2.4. France Wireless EV Charging Market Size and Forecast, by Technology (2023-2030) 5.6.2.5. France Wireless EV Charging Market Size and Forecast, by Application (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Wireless EV Charging Market Size and Forecast, by Component (2023-2030) 5.6.3.2. Germany Wireless EV Charging Market Size and Forecast, by Power Supply Range (2023-2030) 5.6.3.3. Germany Wireless EV Charging Market Size and Forecast, by Charging Type (2023-2030) 5.6.3.4. Germany Wireless EV Charging Market Size and Forecast, by Technology (2023-2030) 5.6.3.5. Germany Wireless EV Charging Market Size and Forecast, by Application (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Wireless EV Charging Market Size and Forecast, by Component (2023-2030) 5.6.4.2. Italy Wireless EV Charging Market Size and Forecast, by Power Supply Range (2023-2030) 5.6.4.3. Italy Wireless EV Charging Market Size and Forecast, by Charging Type (2023-2030) 5.6.4.4. Italy Wireless EV Charging Market Size and Forecast, by Technology (2023-2030) 5.6.4.5. Italy Wireless EV Charging Market Size and Forecast, by Application (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Wireless EV Charging Market Size and Forecast, by Component (2023-2030) 5.6.5.2. Spain Wireless EV Charging Market Size and Forecast, by Power Supply Range (2023-2030) 5.6.5.3. Spain Wireless EV Charging Market Size and Forecast, by Charging Type (2023-2030) 5.6.5.4. Spain Wireless EV Charging Market Size and Forecast, by Technology (2023-2030) 5.6.5.5. Spain Wireless EV Charging Market Size and Forecast, by Application (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Wireless EV Charging Market Size and Forecast, by Component (2023-2030) 5.6.6.2. Sweden Wireless EV Charging Market Size and Forecast, by Power Supply Range (2023-2030) 5.6.6.3. Sweden Wireless EV Charging Market Size and Forecast, by Charging Type (2023-2030) 5.6.6.4. Sweden Wireless EV Charging Market Size and Forecast, by Technology (2023-2030) 5.6.6.5. Sweden Wireless EV Charging Market Size and Forecast, by Application (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Wireless EV Charging Market Size and Forecast, by Component (2023-2030) 5.6.7.2. Austria Wireless EV Charging Market Size and Forecast, by Power Supply Range (2023-2030) 5.6.7.3. Austria Wireless EV Charging Market Size and Forecast, by Charging Type (2023-2030) 5.6.7.4. Austria Wireless EV Charging Market Size and Forecast, by Technology (2023-2030) 5.6.7.5. Austria Wireless EV Charging Market Size and Forecast, by Application (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Wireless EV Charging Market Size and Forecast, by Component (2023-2030) 5.6.8.2. Rest of Europe Wireless EV Charging Market Size and Forecast, by Power Supply Range (2023-2030) 5.6.8.3. Rest of Europe Wireless EV Charging Market Size and Forecast, by Charging Type (2023-2030) 5.6.8.4. Rest of Europe Wireless EV Charging Market Size and Forecast, by Technology (2023-2030) 5.6.8.5. Rest of Europe Wireless EV Charging Market Size and Forecast, by Application (2023-2030) 6. Company Profile: Key Players 6.1. Momentum Dynamics Corporation (UK) 6.1.1. Company Overview 6.1.2. Business Portfolio 6.1.3. Financial Overview 6.1.4. SWOT Analysis 6.1.5. Strategic Analysis 6.1.6. Scale of Operation (Small, Medium, and Large) 6.1.7. Details on Partnership 6.1.8. Regulatory Accreditations and Certifications Received by Them 6.1.9. Awards Received by the Firm 6.1.10. Recent Developments 6.2. Qualcomm Halo (UK) 6.3. ELAP (Italy) 6.4. WiTricity (Germany) 6.5. Chargemaster (UK) 6.6. BlueInductive (Germany) 6.7. Easee (Norway) 6.8. Hevo Power (Netherlands) 6.9. Ceres Power (UK) 6.10. HEVO (Netherlands) 7. Key Findings 8. End User Recommendations