Minimally Invasive Surgical Instruments Market size was valued at USD 23.54 Bn. in 2022 and the total Minimally Invasive Surgical Instruments revenue is expected to grow by 8 % from 2023 to 2029, reaching nearly USD 40.35 Bn.Minimally Invasive Surgical Instruments Market Overview:

Minimally invasive surgery is described as surgery performed through a tiny incision rather than a big hole. A surgeon employs a variety of techniques to do surgery while causing the least amount of harm to the body. Less discomfort, fewer problems, and a shorter hospital stay are all connected with minimally invasive surgery. Minimally invasive surgical treatments are used in cardiothoracic surgery, gastric reflux disease, gastroenterology, gynecological surgery, cardiac surgery, pediatric surgery, urogynecology and pelvic reconstructive surgery, and urological surgery. Minimally invasive surgery is used for both diagnostic and therapeutic procedures. Growing healthcare expenditure, an increasing elderly population, and a growth in the frequency of chronic illnesses are the primary drivers impacting the Minimally Invasive Surgical Instruments Market market growth. According to the World Health Organization (WHO), the burden of chronic illnesses is expected to increase to 67% by 2020, with emerging countries accounting for 82% of fatalities. Additionally, a growing number of minimally invasive treatments has been a crucial driver affecting the market growth. The demand for minimally invasive surgery is growing owing to the significant benefits associated with minimum surgical procedures, such as tiny or no incision, short hospital stay, less discomfort, rapid recovery time, less scarring, and less blood loss. The growing popularity of non-robotic minimally invasive surgery has increased the market for minimally invasive surgery instruments. However, issues such as rigorous government regulations and high-cost surgical equipment are hampering the growth of the market for minimally invasive surgical instruments.Report Scope:

The report on Minimally Invasive Surgical Instruments provides a quantitative analysis of market size, price, M&A, demand, and supply chain, investment and expansion plans by key competitors, and predictions. Porter's five forces study explains how buyers and suppliers build supplier-buyer networks and make profit-driven decisions. The present Minimally Invasive Surgical Instruments Market potential is assessed through detailed analysis and segmentation. The analysis will provide investors with a full insight into the industry's future, as well as the elements likely to affect the firm favorably or adversely. The research offers a complete understanding of the market for those investors wishing to invest. This study contains scenarios for the Minimally Invasive Surgical Instruments Market from the past and present, along with projected market numbers. The report's thorough analysis of important competitors, including market leaders, followers, and new entrants, covers every aspect of the market. The research contains strategic profiles of the top market participants, a full examination of their key competencies, and their company-specific plans for the introduction of new products, growth, partnerships, joint ventures, and acquisitions. With its clear portrayal of competitive analysis of significant companies by product, pricing, financial condition, product portfolio, growth strategies, and regional presence in the domestic as well as the local market, the research acts as an investor's guide.To know about the Research Methodology :-Request Free Sample Report

Minimally Invasive Surgical Instruments Market Dynamics:

Market Drivers: Demand is being driven by faster recovery and shorter hospital stays MIS techniques provide various benefits over traditional operations, including reduced post-operative discomfort, fewer serious operational and post-operative problems, quicker recovery times, less scarring, less stress on the immune system, and smaller incisions. Because the benefits of minimally invasive treatments decrease total hospital and treatment costs, MIS procedures are becoming more popular across the world, boosting market growth. Additionally, the growing prevalence of chronic diseases such as cancer and cardiovascular disease, among others, is increasing demand for surgical operations for treatment, boosting market development. According to the World Health Organization's (WHO) 2021 information sheet, noncommunicable diseases (NCDs), often known as chronic illnesses, kill over 41.2 million people each year, accounting for approximately 71.5% of all deaths worldwide. According to the same source, nearly 15 million people aged 30-69 die worldwide each year as a result of NCDs. Thus the high mortality rate from NCDs, the need for therapeutic techniques is growing. Minimally invasive techniques are gaining popularity since they provide more benefits than regular procedures. Considering all the factors the market under consideration is expected to grow during the forecast period. Growing demand for minimally invasive surgical instruments Minimally invasive surgeries (MIS) have experienced a dramatic transition in technology improvements over the years, resulting in a paradigm shift in how surgical operations are conducted in operating rooms. Because of its advantages over traditional open surgical techniques, most surgeons now prefer modern minimally invasive surgical procedures such as laparo-endo single-incision surgery (LESS). These benefits include fewer scars and tissue harm, faster healing times, shorter hospital stays, less blood loss and trauma, a decreased chance of infection, and cheaper total healthcare expenditures. Additionally, in several countries, health insurance companies are increasingly covering minimally invasive operations. Patient’s preference for minimally invasive operations has risen owing to these considerations. Surgical Robot’s client base has grown With multiple acquisitions in 2022, Surgical Science has established a strong foothold in the market for robotic surgical simulation. In terms of both market share and technology, the new groupings of firms maintain a very strong position as the world leader in simulation for robotic surgery. Multiple firms' aims of increasing the value content to the customer base, notably in robotic surgery, increased in Educational goods amid difficult times, and were able to make several acquisitions in accordance with the plans in the year 2022. Several Surgical Robot channels' offers inside hospital implementations are the strongest pillars in the market's expansion. Furthermore, the announcement from the leading medical device supplying businesses about sustained substantial investments in robotic surgery, which has contributed to the expansion of the Robotic Surgery market, defined industries. Several firms build a new state-of-the-art Robotic Surgery R&D facility in 2022 to boost innovation and growth. Companies have purchased innovations and implemented them into the market. For example, following the success of the purchased NAVIO systems, the next-generation robotic platform, CORI Surgical System, was released in 2020. Surgical Robotics teams in the United States, Germany, and other nations across the world are making significant advancements in improving performance. Minimally Invasive Surgical Instruments Market Restraints: Changing regulatory environment in the medical device business Medical device makers face a highly unpredictable regulatory environment. Between 2005 and 2010, the average time necessary to approve a 510 (k) application climbed by 45%, while the time required to achieve premarket clearance increased by 76%. The US FDA requires additional clinical evidence regarding a product's clinical safety and efficacy. This results in greater clinical trial expenditure by firms, delays in the clearance process, and additional cash needs for in-depth post-marketing monitoring investigations. It also raises the possibility of product recalls, especially when firms lack the resources to undertake extra studies to satisfy the FDA's new data requirements. These regulatory delays also limit the growth of the market for minimally invasive surgical devices. Such regulatory measures also make it difficult for small producers to enter the Minimally Invasive Surgical Instruments market. Minimally Invasive Surgical Instruments Market Opportunities: Technological advancement is boosting the demand The important strategic decision taken by industry players that are expected to have a favorable influence on the market include new product releases as a result of technical developments, partnerships, mergers, and acquisitions. Thanks to the development of novel solutions, the market is likely to rise steadily during the forecast period. For example, Fujifilm Medical Systems USA Inc. launched its ELUXEO surgical system in July 2020, which includes both the company's endoscopy and minimally invasive surgery portfolios and assists surgeons in performing flexible and rigid endoscopy from a single tower by providing better visualization. Moreover, growing awareness of the benefits of minimally invasive treatments and increased implementation of robotic-assisted surgical systems globally are likely to drive market growth during the forecast period. Emerging economies such as India, South Korea, Malaysia, and Vietnam, as well as Africa and Middle Eastern nations such as Israel, Saudi Arabia, and the United Arab Emirates, provide considerable growth prospects for key Minimally Invasive Surgical Instruments market players. This is owing to reduced regulatory hurdles, advancements in healthcare infrastructure, an increasing patient population, and increased healthcare expenditure. Additionally, regulatory regulations in the Asia Pacific area are more flexible and business-friendly than in industrialized countries. This, along with increased competition in established regions, has prompted leading companies in the minimally invasive surgical equipment market to concentrate their efforts in emerging areas.Minimally Invasive Surgical Instruments Market Segment Analysis:

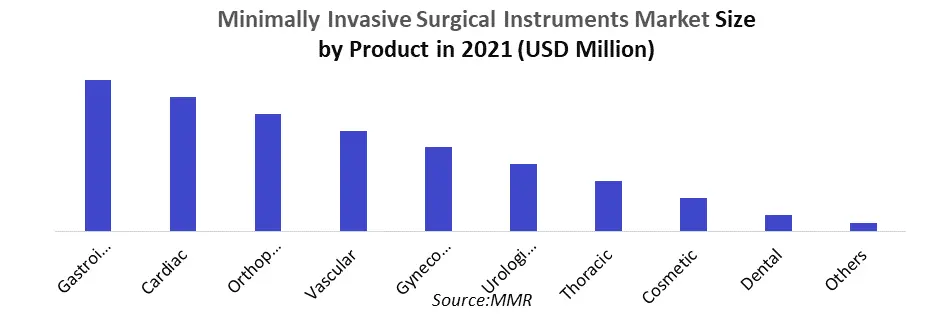

Based on Device, With a Minimally Invasive Surgical Instruments market share of more than 22% in 2022, the portable devices category led the minimally invasive surgical instruments market. Handheld devices used in MIS methods aim to reduce superfluous tissue damage during surgical operations, consequently shortening patient recovery time and lowering discomfort and adverse effects. The majority of MIS devices are single-use items. The portable tools market is being pushed by technological advancements and their increasing use in minimally invasive operations. For example, a low-cost mechanical tool for performing minimally invasive laparoscopic procedures was recently created. Mechanical, robotic, or semi-automated handheld devices are available. With instrument triangulation, handheld devices provide easier access during surgery, lowering the chance of accidents.Based on the Application, the Gastrointestinal Segment is Expected to Hold the Major Market Share. Owing to the increased prevalence of gastrointestinal illnesses in young, adult, and elderly populations worldwide, the gastrointestinal sector is expected to hold a significant market share and develop rapidly throughout the forecast period. Irritable bowel syndrome (IBS), Crohn's disease, peptic ulcers, and other disorders are related to the gastrointestinal system in the body, which includes the gastrointestinal tract, digestive tract, and alimentary canal. The increasing prevalence of gastrointestinal illnesses is the primary driver of Minimally Invasive Surgical Instruments sector growth. For example, according to a July 2020 research study titled "Global prevalence of irritable bowel syndrome according to Rome III or IV criteria: a systematic review and meta-analysis," the pooled prevalence of irritable bowel syndrome from a study in 38 countries was 9.5%, with IBS with mixed bowel habit having the highest prevalence at 34.8%. As a result of the increasing prevalence of IBS, the gastrointestinal segment is expected to rise. Additionally, the increased frequency of gastrointestinal malignancies, such as colon and rectum cancers, is likely to fuel demand for minimally invasive procedures, bolstering market development during the forecast period. For example, according to GLOBOCAN estimates, there are 1,148,515 new cases of colon cancer and 732,210 new cases of rectum cancer worldwide in 2020, and in recent years, minimally invasive surgeries such as laparoscopic or robot surgery have become the predominant treatment option for colon cancer, which is expected to drive the market. Moreover, technical advancements and an increase in product approvals are projected to boost the growth of the studied industry. EndoFresh, for example, gained 510(k) clearance from the US Food and Drug Administration in May 2022 for their EndoFresh Disposable Digestive Endoscopy System, which includes a camera system with a unique all-in-one design, disposable upper GI endoscope, and disposable colonoscope. As a result, the current industry advancements are expected to fuel market expansion throughout the forecast period.

Minimally Invasive Surgical Instruments Market Regional Insights:

North America held a significant share of the minimally invasive surgery devices market in recent years, and this trend is expected to continue during the forecast period, owing to the region's high burden of diseases requiring interventional procedures, growing awareness of minimally invasive procedures, and growing adoption of minimally invasive devices. Because of the high incidence of chronic diseases such as cardiovascular disease, cancer, and neurological diseases, among others, the United States is likely to have a significant market share in the studied industry over the projection period in North America. According to the Centers for Disease Control and Prevention's most recent study, published in September 2022, heart disease is the top cause of death in the United States. About 18.5 million persons aged 20 and over had coronary artery disease, and approximately 360,900 people died in 2019 as a result of coronary heart disease. As a result of the country's high death rate from cardiovascular disorders, the number of procedures is likely to rise. As minimally invasive surgical treatments gain popularity, the market under consideration is likely to expand throughout the forecast period. Furthermore, cancer is one of the most common chronic diseases in the country, which is projected to fuel market expansion in the coming years. According to the GLOBOCAN 2020 study, 101,809 instances of colon cancer, 44,780 cases of rectum cancer, and 26,259 cases of stomach cancer were recorded in the United States, which are predicted to fuel the country's need for interventional procedures. Furthermore, technical developments in different surgical devices from existing major competitors in the market, as well as new product releases, are likely to complement the region's market expansion. For example, AnX Robotica Corporation received De-Novo classification certification from the Food and Drug Administration in June 2020 for its NaviCamTM Magnetically Controlled Capsule Endoscopy (MCCE) system, which allows complete, real-time visualization of the stomach using a pill-sized capsule containing a camera. The physician can also operate it remotely utilizing patented magnetic technology. Furthermore, the NaviCamTM Magnetically Controlled Capsule Endoscopy (MCCE) system got premarketing approval from the Food and Drug Administration in May 2022. As a result, the aforementioned factors are likely to boost the expansion of the region's minimally invasive surgery devices market.Minimally Invasive Surgical Instruments Market Scope: Inquire before buying

Minimally Invasive Surgical Instruments Market Report Coverage Details Base Year: 2022 Forecast Period: 2022-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 23.54 Bn. Forecast Period 2023 to 2029 CAGR: 8% Market Size in 2029: US$ 40.35 Bn. Segments Covered: by Device • Handheld Instruments • Inflation Devices • Cutter Instruments • Guiding Devices • Electrosurgical Devices • Auxiliary Devices • Monitoring & Visualization Devices by Application • Cardiac • Gastrointestinal • Orthopedic • Vascular • Gynecological • Urological • Thoracic • Cosmetic • Dental • Others by End Use • Hospitals • Ambulatory Surgical Centers Minimally Invasive Surgical Instruments Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) • Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina, Columbia and Rest of South America)Minimally Invasive Surgical Instruments Market, Key Players are:

•Medtronic plc (US) • Johnson & Johnson(US) • Applied Medical Resources Corporation(US) • Scanlan International(US) • Wexler Surgical(US) • Zimmer Biomet Holdings(US) • Becton, Dickinson and Company(US) •CooperCompanies(US) • STRAUSS SURGICAL(US) • CONMED Corporation(US) • Stryker Corporation(US) • Abbott Laboratories(US) • Boston Scientific Corporation(US) • Smith & Nephew plc (UK) • Surgical Innovations Group plc (UK) • Surgical Holdings(UK) • Koninklijke Philips N.V.(Netherlands) • FUJIFILM Holdings Corporation (Japan) • HOYA Corporation (Japan) • AMNOTEC International Medical GmbH(Germany) • EndoMed Systems GmbH(Germany) • KLS Martin Group(Germany) • KARL STORZ SE & Co. KG (Germany) • B. Braun Melsungen AG (Germany) • TROKAMED GmbH(Germany) Frequently Asked Questions: 1] What segments are covered in the Global Minimally Invasive Surgical Instruments Market report? Ans. The segments covered in the Minimally Invasive Surgical Instruments Market report are based on Device, Application, End Use and Region. 2] Which region is expected to hold the highest share in the Global Minimally Invasive Surgical Instruments Market? Ans. The North America region is expected to hold the highest share in the Minimally Invasive Surgical Instruments Market. 3] What is the market size of the Global Minimally Invasive Surgical Instruments Market by 2029? Ans. The market size of the Minimally Invasive Surgical Instruments Market by 2029 is expected to reach US$ 40.4 Bn. 4] What is the forecast period for the Global Minimally Invasive Surgical Instruments Market? Ans. The forecast period for the Minimally Invasive Surgical Instruments Market is 2023-2029. 5] What was the market size of the Global Minimally Invasive Surgical Instruments Market in 2022? Ans. The market size of the Minimally Invasive Surgical Instruments Market in 2022 was valued at US$ 23.54 Bn.

1. Global Minimally Invasive Surgical Instruments Market Size: Research Methodology 2. Global Minimally Invasive Surgical Instruments Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Minimally Invasive Surgical Instruments Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Minimally Invasive Surgical Instruments Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Minimally Invasive Surgical Instruments Market Size Segmentation 4.1. Global Minimally Invasive Surgical Instruments Market Size, by Device (2023-2029) • Handheld Instruments • Inflation Devices • Cutter Instruments • Guiding Devices • Electrosurgical Devices • Auxiliary Devices • Monitoring & Visualization Devices 4.2. Global Minimally Invasive Surgical Instruments Market Size, by Application (2023-2029) • Gastrointestinal • Cardiac • Orthopedic • Vascular • Gynecological • Urological • Thoracic • Cosmetic • Dental • Others 4.3. Global Minimally Invasive Surgical Instruments Market Size, by End User (2023-2029) • Hospitals • Ambulatory Surgical Centers 5. North America Minimally Invasive Surgical Instruments Market (2023-2029) 5.1. North America Minimally Invasive Surgical Instruments Market Size, by Device (2023-2029) • Handheld Instruments • Inflation Devices • Cutter Instruments • Guiding Devices • Electrosurgical Devices • Auxiliary Devices • Monitoring & Visualization Devices 5.2. North America Minimally Invasive Surgical Instruments Market Size, by Application (2023-2029) • Gastrointestinal • Cardiac • Orthopedic • Vascular • Gynecological • Urological • Thoracic • Cosmetic • Dental • Others 5.3. North America Minimally Invasive Surgical Instruments Market Size, by End User (2023-2029) • Hospitals • Ambulatory Surgical Centers 5.4. North America Semiconductor Memory Market, by Country (2023-2029) • United States • Canada • Mexico 6. European Minimally Invasive Surgical Instruments Market (2023-2029) 6.1. European Minimally Invasive Surgical Instruments Market, by Device (2023-2029) 6.2. European Minimally Invasive Surgical Instruments Market, by Application (2023-2029) 6.3. European Minimally Invasive Surgical Instruments Market, by End User (2023-2029) 6.4. European Minimally Invasive Surgical Instruments Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Minimally Invasive Surgical Instruments Market (2023-2029) 7.1. Asia Pacific Minimally Invasive Surgical Instruments Market, by Device (2023-2029) 7.2. Asia Pacific Minimally Invasive Surgical Instruments Market, by Application (2023-2029) 7.3. Asia Pacific Minimally Invasive Surgical Instruments Market, by End User (2023-2029) 7.4. Asia Pacific Minimally Invasive Surgical Instruments Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Minimally Invasive Surgical Instruments Market (2023-2029) 8.1. Middle East and Africa Minimally Invasive Surgical Instruments Market, by Device (2023-2029) 8.2. Middle East and Africa Minimally Invasive Surgical Instruments Market, by Application (2023-2029) 8.3. Middle East and Africa Minimally Invasive Surgical Instruments Market, by End User (2023-2029) 8.4. Middle East and Africa Minimally Invasive Surgical Instruments Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Minimally Invasive Surgical Instruments Market (2023-2029) 9.1. South America Minimally Invasive Surgical Instruments Market, by Device (2023-2029) 9.2. South America Minimally Invasive Surgical Instruments Market, by Application (2023-2029) 9.3. South America Minimally Invasive Surgical Instruments Market, by End User (2023-2029) 9.4. South America Minimally Invasive Surgical Instruments Market, by Country (2023-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Medtronic plc 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Johnson & Johnson 10.3. Stryker Corporation 10.4. Abbott Laboratories 10.5. Boston Scientific Corporation 10.6. B. Braun Melsungen AG 10.7. CONMED Corporation 10.8. Smith & Nephew plc 10.9. Zimmer Biomet Holdings 10.10. Becton 10.11. Dickinson and Company 10.12. The Cooper Companies 10.13. HOYA Corporation 10.14. Surgical Innovations Group plc 10.15. Koninklijke Philips N.V. 10.16. FUJIFILM Holdings Corporation 10.17. KARL STORZ SE & Co. KG 10.18. Applied Medical Resources Corporation 10.19. KLS Martin Group 10.20. Scanlan International 10.21. Wexler Surgical 10.22. STRAUSS SURGICAL 10.23. AMNOTEC International Medical GmbH 10.24. EndoMed Systems GmbH 10.25. TROKAMED GmbH 10.26. Surgical Holdings