Metal Stamping Market was valued at US$ 219.03 Bn. in 2022. Global Metal Stamping Market size is expected to grow at a CAGR of 4.4 % through the forecast period.Metal Stamping Market Overview:

With the help of a stamping press, flat metal sheets may be formed into a variety of forms using the intricate manufacturing process known as metal stamping. Numerous metals shaping methods, including punching, blanking, piercing, bending, embossing, coining, and flanging, can be used to accomplish this. Metal stamping is a low-cost method of producing a large number of similar metal components. Several businesses have been making a significant investment in R&D initiatives recently to bring automatic metal stamping technologies for the production of agricultural equipment.To know about the Research Methodology:-Request Free Sample Report

Metal Stamping Market Dynamics:

Market Drivers: Large and rising Automotive Sector: According to MMR, Globally, there were 99,857,971 new car sales or registrations in 2022 compared to 74,971,523 in 2010. Recent years have seen a sharp increase in automobile sales in the Asia-Pacific region. The demand for automotive components from original equipment manufacturers and vehicle manufacturers is essentially rising as a result of the increasing growth of the automotive sector. As technology develops quickly and continuously, metal stamping plays a more and bigger part in vehicle development programs. Automobile firms are continuously creating or acquiring technologies and capabilities like metal stamping to produce vehicles that satisfy these market demands. This is done to address issues like lightweight materials, recycling, and ecologically friendly production methods as well as safety and fuel efficiency concerns. This is increasing the demand for Metal Stamping Market and driving the growth of this market. Increasing investment by key players: Due to the explosive growth of numerous end-user industries like automotive, consumer electronics, aerospace & aviation, industrial machinery, electrical and other electronics, telecommunications, and medical devices in recent years, emerging economies like China, India, Mexico, Brazil, Argentina, and South Africa are now experiencing significant opportunities in the metal stamping market. Numerous manufacturers of metal stamping technology and service providers are deliberately investing in these nations to expand existing metal stamping plants and build new ones in light of the increasing and expected demand for metal parts from these sectors.For example, Weiss-Aug Co. Inc. began operations in Nuevo Leon, Mexico in April 2018 and increased its metal stamping capabilities by bringing in two 22-ton high-speed Bruderer presses. Also, Gestamp spent USD 38.67 million in February 2017 to build a new hot stamping facility in Pune, India. The corporation made this effort in an attempt to meet the growing demand for metal stamping in response to the preference for safer and lighter automobiles. Next-generation and advanced metal stamping: In the metal stamping market, next-generation stamping is starting to gain popularity. The time and money needed to make metal and metallic parts are reduced via next-generation metal stamping. It assisted in the introduction of next-generation tool simulation software to optimize the tooling lineup before the cutting tools by eliminating the expensive process of creating dies. The use of next-generation metal stamping technology for automotive components such as headliners, fenders, side and quarter panels, exhausts, valves, brake shoes, and hangers has risen. Also, this technology is attracting investors. For example, Toyotetsu Canada, a manufacturer of automobile parts, received almost USD 1.2 million in subsidies from the Ontario government in November 2017 through the Southwestern Ontario Development Fund (SWODF). Since they are used in sheet metal stamping, which creates higher contact pressure at die-blank contact than traditional materials, new materials like advanced high strength steels (AHSS) have boosted the need for metal stamping. Also, the top metal stamping firms are creating technologically sophisticated stamping processes, like computer-aided design (CAD) procedures that enable the molding of metal components through extremely exact and accurate computer-generated designs. They are using computerized measurement equipment, which greatly speeds up the processes. The introduction of additive manufacturing and 3D printing technologies as well as intensive research and development (R&D) efforts are driving the market growth. Market Opportunities: Decreased cost of steel: Steel is one of the most popular materials used in metal stamping. Because of changes in the international economy, steel prices have decreased. Additionally, there is a shorter lead time for steel deliveries. The price drop for steel is a great opportunity that can accelerate the demand for metal stamping and increase the growth of the Metal Stamping Market. Increased demand for defense equipment: Nowadays, there are more geopolitical conflicts between different countries, which has raised the demand for defense equipment. The metal stamping market may grow more quickly as a result of this increased demand for this equipment. Adoption of affordable silver plating: Silver plating has the benefit of resulting in considerable manufacturing cost savings when used to plate electronic components instead of gold. Leading firms’ attention was drawn to the production method’ low cost, which may create an additional increase in opportunities for the metal stamping market. Metal Stamping Market COVID-19 Insights: The long-term effects of COVID-19, an unprecedented public health disaster that has harmed almost every sector, are expected to negatively affect industry growth during the forecast period. The firm’s budget for manufacturing metal stampings was reduced as a result of the economic downturn. This affected the business’s operations. As big corporations struggle with labor constraints and attempt to make up for losses in 2022, COVID-19 has had an impact on industrial equipment and electronics system sales 2022. The need for industrial machinery has been hampered by the proliferation of the new COVID19, which has impacted the market for industrial equipment in major manufacturing nations like the United States. There have been many extensive lockdowns in many different locales as well as increased industrial activity as a result of the sharp increase in cases reported in the North America region, notably in the United States. Also, the market participants’ capacity to manufacture metal stamping has been significantly impacted by the absence of business opportunities in the component producer, distributor, and supplier chain. End-user market is expected to drastically decline as a result.Metal Stamping Market Segment Analysis:

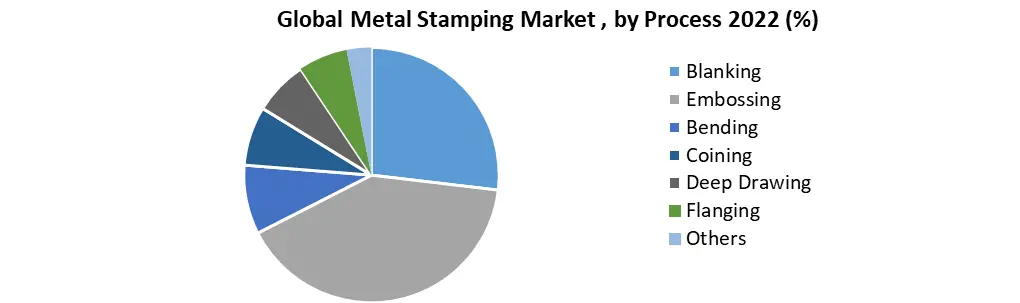

Based on Process, the blanking segment dominated the market with 31% share in 2022.Because it has a precise and better stamping capability, blanking is a crucial component of the automobile production process. To get the required form, the procedure uses a die. In the upcoming years, the segment growth rate is expected to be boosted by blanking’s increasing application in the automotive industry due to its capacity to support mass production lines.As a result, the need for metal blanking is further supported by the development of several big manufacturing chains in the automotive, consumer electronics, and aerospace & aviation sectors.

Metal Stamping Market Regional Insights:

The Asia Pacific region dominated the market with 31 % share in 2022. It is due to the rising demand for automobiles and electronic goods in the region and is expected to grow at the quickest rate during the forecast period The growth is being driven mostly by emerging nations such as China, India, Bangladesh, Indonesia, and Pakistan, where rising demand for smartphones and other consumer electronics is expected to boost the market growth. Growing industrialization, together with infrastructure growth and advancement in the defense sector, are expected to boost demand for equipment and industrial machinery in Asia Pacific region. For example, Apple asked its major manufacturing partners to investigate the possibility of moving 15–30% of its hardware goods from China to India, South East Asia, or Vietnam in March 2022. The North America region is expected to witness significant growth at a CAGR of 4.7% through the forecast period. To lower fuel consumption, automobile manufacturers in the region are concentrating on increasing the manufacturing of lightweight automobiles by employing metals, such as aluminium, in different components. Nearly half of the cars produced in the area as of 2022 have aluminium hoods, and by 2029, it’s expected that this proportion would have increased to 70%. In the upcoming years, it is expected that the need for stamped products would be driven by the rising production of aluminium hoods. The objective of the report is to present a comprehensive analysis of the global Metal Stamping Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Metal Stamping Market dynamic, structure by analyzing the market segments and projecting the Metal Stamping Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Metal Stamping Market make the report investor’s guide.Metal Stamping Market Scope: Inquire before buying

Global Metal Stamping Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 219.03 Bn. Forecast Period 2023 to 2029 CAGR: 4.4% Market Size in 2029: US$ 296.08 Bn. Segments Covered: by Process Blanking Embossing Bending Coining Deep Drawing Flanging Others by Application Automotive Industrial Machinery Consumer Electronics Aerospace and Aviation Electricals and Other Electronics Telecommunications Medical Industry Defense Others by Material Steel Aluminum Copper Others Metal Stamping Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Metal Stamping Market, Key Players are

1. Acro Metal Stamping (U.S.) 2. Manor Tool & Manufacturing Company (U.S.) 3. D&H Industries, Inc (U.S.) 4. Kenmode, Inc. (U.S.) 5. Klesk Metal Stamping Co (U.S.) 6. Clow Stamping Company (U.S.) 7. Goshen Stamping Company (U.S.) 8. Tempco Manufacturing Company, Inc (U.S.) 9. Interplex Holdings Pte. Ltd. (Singapore) 10. CAPARO (UK) 11. Nissan Motor Co., Ltd (Japan) 12. AAPICO Hitech Public Company Limited (Thailand) 13. Gestamp (Spain) Frequently Asked Questions: 1] What segments are covered in the Global Metal Stamping Market report? Ans. The segments covered in the Metal Stamping Market report are based on Process, Application, Material and Region. 2] Which region is expected to hold the highest share in the Global Metal Stamping Market? Ans. The Asia Pacific region is expected to hold the highest share in the Metal Stamping Market. 3] What is the market size of the Global Metal Stamping Market by 2029? Ans. The market size of the Metal Stamping Market by 2029 is expected to reach US$ 296.08 Bn. 4] What is the forecast period for the Global Metal Stamping Market? Ans. The forecast period for the Metal Stamping Market is 2023-2029. 5] What was the market size of the Global Metal Stamping Market in 2022? Ans. The market size of the Metal Stamping Market in 2022 was valued at US$ 219.03 Bn.

1. Global Metal Stamping Market Size: Research Methodology 2. Global Metal Stamping Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Metal Stamping Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Metal Stamping Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Metal Stamping Market Size Segmentation 4.1. Global Metal Stamping Market Size, by Process (2022-2029) • Blanking • Embossing • Bending • Coining • Deep Drawing • Flanging • Others 4.2. Global Metal Stamping Market Size, by Application (2022-2029) • Automotive • Industrial Machinery • Consumer Electronics • Aerospace and Aviation • Electricals and Other Electronics • Telecommunications • Medical Industry • Defense • Others 4.3. Global Metal Stamping Market Size, by Material (2022-2029) • Steel • Aluminum • Copper • Others 5. North America Metal Stamping Market (2022-2029) 5.1. North America Metal Stamping Market Size, by Process (2022-2029) • Blanking • Embossing • Bending • Coining • Deep Drawing • Flanging • Others 5.2. North America Metal Stamping Market Size, by Application (2022-2029) • Automotive • Industrial Machinery • Consumer Electronics • Aerospace and Aviation • Electricals and Other Electronics • Telecommunications • Medical Industry • Defense • Others 5.3. North America Metal Stamping Market Size, by Material (2022-2029) • Steel • Aluminum • Copper • Others 5.4. North America Metal Stamping Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Metal Stamping Market (2022-2029) 6.1. European Metal Stamping Market, by Process (2022-2029) 6.2. European Metal Stamping Market, by Application (2022-2029) 6.3. European Metal Stamping Market, by Material (2022-2029) 6.4. European Metal Stamping Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Metal Stamping Market (2022-2029) 7.1. Asia Pacific Metal Stamping Market, by Process (2022-2029) 7.2. Asia Pacific Metal Stamping Market, by Application (2022-2029) 7.3. Asia Pacific Metal Stamping Market, by Material (2022-2029) 7.4. Asia Pacific Metal Stamping Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Metal Stamping Market (2022-2029) 8.1. Middle East and Africa Metal Stamping Market, by Process (2022-2029) 8.2. Middle East and Africa Metal Stamping Market, by Application (2022-2029) 8.3. Middle East and Africa Metal Stamping Market, by Material (2022-2029) 8.4. Middle East and Africa Metal Stamping Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Metal Stamping Market (2022-2029) 9.1. South America Metal Stamping Market, by Process (2022-2029) 9.2. South America Metal Stamping Market, by Application (2022-2029) 9.3. South America Metal Stamping Market, by Material (2022-2029) 9.4. South America Metal Stamping Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Acro Metal Stamping (U.S.) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Manor Tool & Manufacturing Company (U.S.) 10.3. D&H Industries, Inc (U.S.) 10.4. Kenmode, Inc. (U.S.) 10.5. Klesk Metal Stamping Co (U.S.) 10.6. Clow Stamping Company (U.S.) 10.7. Goshen Stamping Company (U.S.) 10.8. Tempco Manufacturing Company, Inc (U.S.) 10.9. Interplex Holdings Pte. Ltd. (Singapore) 10.10. CAPARO (UK) 10.11. Nissan Motor Co., Ltd (Japan) 10.12. AAPICO Hitech Public Company Limited (Thailand) 10.13. Gestamp (Spain)