Medical Waste Management Market was valued at USD 10.14 Bn in 2023 and is expected to reach USD 14.85 Bn by 2030, at a CAGR of 5.6 percent during the forecast period.Medical Waste Management Market Overview

Medical waste management is the proper handling, disposal, and treatment of waste generated in healthcare facilities, laboratories, and other medical-related settings. This type of waste is often referred to as biomedical waste, healthcare waste, or medical waste. Medical waste includes various materials that is potentially hazardous due to their infectious, chemical, or radioactive nature. Proper segregation of waste at the source is crucial. Different types of medical waste, such as sharps, infectious waste, pharmaceutical waste, and radioactive waste, should be separated to facilitate safe disposal.To know about the Research Methodology:-Request Free Sample Report The global medical waste management market has been experiencing steady growth due to an increase in healthcare activities, the generation of medical waste, and the growing awareness of proper waste disposal practices. Stringent regulations regarding medical waste disposal and treatment are a significant driver. Governments and environmental agencies worldwide have imposed strict guidelines to ensure the safe management of medical waste. Increasing emphasis on environmentally sustainable waste management practices is influencing market trends. This includes recycling and waste-to-energy initiatives. The medical waste management market is expected to continue growing as healthcare activities rise globally, and environmental concerns drive the need for responsible waste management practices.

Medical Waste Management Market Dynamics

Stringent Regulatory Framework to boost the Medical Waste Management Market growth The medical waste management market is the imposition of strict regulatory guidelines and standards by governments and environmental agencies globally. Recognizing the potential hazards associated with improper disposal of medical waste, regulatory authorities have established comprehensive frameworks to ensure the safe collection, transportation, treatment, and disposal of medical waste. Compliance with these regulations is not only a legal requirement but is also crucial for protecting public health and the environment. The continual development of healthcare infrastructure, including hospitals, clinics, and diagnostic laboratories, contributes significantly to the growth of the medical waste management market. With an increasing global population and advancements in medical technologies, healthcare activities generate a substantial volume of medical waste. The development of healthcare facilities necessitates the implementation of efficient waste management solutions to handle the diverse types of waste produced. Growing awareness of the environmental impact of medical waste has led to increased demand for responsible waste management practices. The healthcare industry, along with the general public, is increasingly recognizing the need for sustainable and environmentally friendly solutions for medical waste disposal. This shift in mindset is driving the adoption of innovative technologies and practices that minimize the ecological footprint of medical waste management. Ongoing advancements in waste treatment technologies play a crucial role in shaping the medical waste management market. Innovations in sterilization methods, such as autoclaving and microwave treatment, contribute to more effective and environmentally friendly waste disposal. Advanced technologies also offer the potential for recycling certain components of medical waste, aligning with broader trends in circular economy practices. Events like the COVID-19 pandemic underscore the importance of robust medical waste management systems. The increased volume of infectious waste during health crises necessitates responsive and scalable waste management solutions. The pandemic has highlighted the need for contingency planning and enhanced waste management capabilities in the healthcare sector. Proper medical waste management is intrinsically linked to public health, which significantly helps to boost the Medical Waste Management Market growth. Inadequate disposal practices lead to the spread of infections and pose serious health risks to healthcare workers, waste handlers, and the general public. The emphasis on maintaining public health and preventing the transmission of diseases further drives the demand for effective medical waste management. Many healthcare organizations and waste management service providers recognize the importance of corporate social responsibility. Implementing responsible waste management practices not only ensures compliance with regulations but also contributes to the positive public perception of healthcare institutions and waste management companies. High Initial Investment Costs to restrain Medical Waste Management Market growth Establishing advanced medical waste treatment facilities involves significant upfront capital investment. The costs associated with acquiring and implementing high-tech technologies, specialized equipment, and ensuring regulatory compliance is a substantial barrier, particularly for smaller healthcare facilities or waste management companies, which is expected to limit the Medical Waste Management Market growth. This high entry barrier may limit the ability of some entities to invest in comprehensive medical waste management infrastructure. Beyond initial capital investments, ongoing operational costs and maintenance expenses for medical waste management facilities is substantial. Energy consumption, staff training, regulatory compliance monitoring, and routine maintenance of treatment equipment contribute to the overall operational expenses. These ongoing costs strain the financial resources of healthcare facilities and waste management service providers. While regulatory frameworks are a driver for the industry, they also act as a restraint. Compliance with diverse and stringent regulations across different regions and countries poses a challenge. Navigating the complex regulatory landscape requires constant monitoring and adaptation to evolving standards. Meeting compliance requirements is resource-intensive and result in additional costs for stakeholders. In some regions, there is a lack of awareness and education regarding the proper handling and disposal of medical waste. Healthcare facilities and waste generators not fully understand the potential hazards associated with improper waste management practices. Insufficient education and training lead to non-compliance and suboptimal waste segregation at the source, hindering effective medical waste management. In developing regions, inadequate waste management infrastructure poses a significant restraint. Limited access to advanced treatment facilities, transportation challenges, and a lack of resources hinder the implementation of effective medical waste management systems. This leads to unsafe disposal practices, contributing to environmental pollution and public health risks.Medical Waste Management Market Segment Analysis

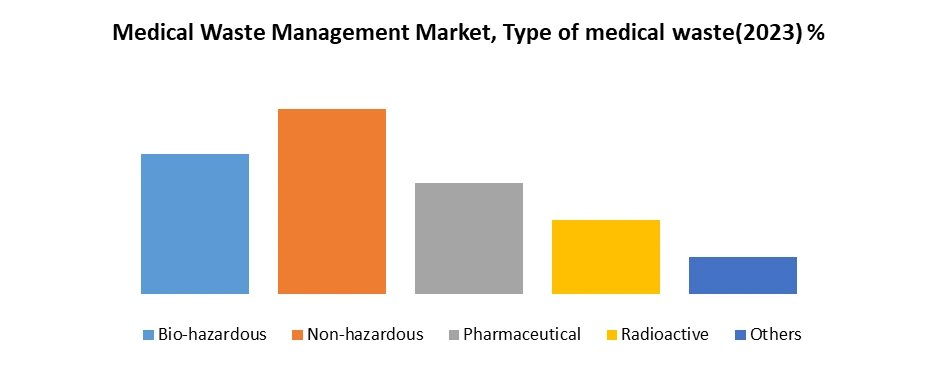

Based on Service, the market is segmented into Treatment, Disposable, and Recycling. Treatment segment dominated the market in 2023 and is expected to hold the largest Medical Waste Management Market share over the forecast period. The treatment segment in the medical waste management market involves the processes and methods employed to render medical waste harmless, reduce its volume, and eliminate potential hazards before final disposal. Proper treatment is a crucial step in the overall medical waste management process to ensure public health and environmental safety. The treatment of medical waste is designed to destroy or inactivate infectious agents, reduce the volume of waste, and address the specific characteristics of different waste streams. Infectious waste, such as used sharps, pathological waste, and microbiological waste, requires specialized treatment to neutralize or destroy pathogens. Common treatment methods for infectious waste include autoclaving (steam sterilization), incineration, and chemical treatment. Autoclaving involves subjecting waste to high-pressure steam, effectively sterilizing it and reducing the risk of infection. Some advanced treatment methods involve converting medical waste into energy through waste-to-energy (WtE) technologies. This approach help address the dual challenges of waste management and energy production, contributing to more sustainable practices, which is expected to boost the Treatment segment growth in Medical Waste Management Market.Based on Type of medical waste, the market is segmented into Bio-hazardous, Non-hazardous, Pharmaceutical, Radioactive, and Others. Non-hazardous segment dominated the market in 2023 and is expected to hold the largest Medical Waste Management Market share over the forecast period. The non-hazardous segment in the medical waste management industry pertains to the category of medical waste that does not pose a significant threat to human health or the environment due to its non-infectious, non-radioactive, and non-hazardous nature. Unlike hazardous medical waste, which includes materials that are potentially infectious, toxic, or radioactive, non-hazardous medical waste is generally considered less risky. However, proper management and disposal are still necessary to ensure environmental sustainability and regulatory compliance. Non-hazardous medical waste includes materials that do not exhibit characteristics of hazardous waste. This category typically encompasses items such as general office waste, non-infectious packaging materials, discarded administrative paperwork, and certain non-infectious patient care items, which is expected to boost the Medical Waste Management Market growth. These materials are not inherently harmful, but they still require responsible disposal to prevent environmental pollution. Effective waste management begins with proper segregation at the source. Healthcare facilities must implement practices to separate non-hazardous medical waste from hazardous waste streams. This facilitates streamlined waste management processes and ensures that non-hazardous waste is treated and disposed of appropriately.

Medical Waste Management Market Regional Insights

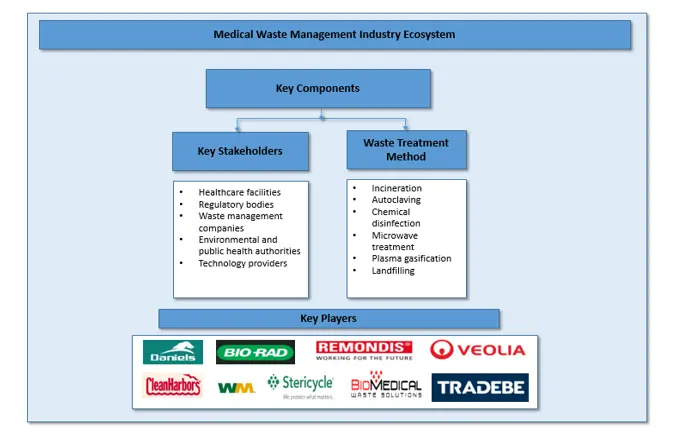

Stringent Regulatory Compliance to boost North America Medical Waste Management Market growth North America, comprising the United States and Canada, has some of the most rigorous regulations governing medical waste management. Regulatory bodies, such as the Environmental Protection Agency (EPA) in the U.S. and provincial environmental agencies in Canada, set strict guidelines to ensure the safe and proper disposal of medical waste. Compliance with these regulations is mandatory for healthcare facilities, driving the demand for comprehensive waste management services. North America has a significant and well-developed healthcare sector with substantial investments in healthcare infrastructure, research, and development, which significantly boosts the North America Medical Waste Management Market growth. The continuous growth in healthcare expenditure contributes to an increase in healthcare activities and, consequently, medical waste generation. This trend fuels the demand for efficient and compliant medical waste management services. The region is at the forefront of adopting advanced technologies in various industries, including healthcare. Innovations in medical waste treatment technologies, such as autoclaving, microwave treatment, and advanced sterilization methods, are prevalent in North America. These technologies enhance the efficiency of waste disposal and align with the region's commitment to adopting cutting-edge solutions. North America places a high emphasis on environmental sustainability and public health. Increased public awareness of the environmental impact of medical waste has led to a growing demand for eco-friendly and responsible waste management practices. This awareness drives healthcare facilities and waste management companies in the region to adopt solutions that minimize environmental impact, which is expected to boost the North America Medical Waste Management Market growth. The trend of healthcare facility consolidation, where smaller facilities merge or are acquired by larger healthcare systems, is notable in North America. Larger healthcare systems often seek centralized and standardized waste management solutions to ensure compliance and efficiency across their facilities, driving the demand for comprehensive waste management services. Partnerships between healthcare institutions and waste management companies are becoming more prevalent in North America. These collaborations aim to streamline waste management processes, implement best practices, and ensure compliance with regulatory standards. The formation of strategic alliances enhances the efficiency and effectiveness of medical waste management services.Medical Waste Management Industry Ecosystem

Scope of Global Medical Waste Management Market: Inquire before buying

Global Medical Waste Management Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 10.14 Bn. Forecast Period 2024 to 2030 CAGR: 5.6% Market Size in 2030: USD 14.85 Bn. Segments Covered: by Services Treatment Disposable Recycling by Type of medical waste Bio-hazardous Non-hazardous Pharmaceutical Radioactive Others by Treatment Incineration Autoclaving Chemical treatment Others by Waste Generator Hospitals Clinics Ambulatory surgical centers Pharmaceutical Companies Biotechnology Companies Others Medical Waste Management Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Medical Waste Management Market KeyPlayers include:

North America: 1. Stericycle, Inc. (Bannockburn, Illinois, USA) 2. Waste Management, Inc. (Houston, Texas, USA) 3. Clean Harbors, Inc. (Norwell, Massachusetts, USA) 4. Veolia Environnement S.A. (Aubervilliers, France) 5. BioMedical Waste Solutions, LLC(Miami, Florida, USA) 6. Stericyle México (Mexico City, Mexico) Europe: 1. Remondis SE & Co. KG (Lünen, Germany) 2. Bio-Rad Laboratories, Inc. (Hercules, California, USA) 3. Daniels Health (Sydney, Australia) 4. Tradebe Healthcare Holdings, LLC (Headquarters: Barcelona, Spain) Asia-Pacific: 1. Sharpsmart Ltd. (Melbourne, Australia) 2. Cleanaway Waste Management Limited (Melbourne, Australia) 3. Triumvirate Environmental (Somerville, Massachusetts, USA) MEA 1. Medical Waste Management (Dubai, UAE) Global/International: 2. Suez S.A. (Paris, France) 3. Republic Services, Inc. (Phoenix, Arizona, USA) 4. GIC Medical Disposal (Ontario, Canada) Frequently asked Questions: 1. What is medical waste management? Ans: Medical waste management involves the proper handling, disposal, and treatment of waste generated in healthcare facilities, laboratories, and other medical-related settings. It includes the management of biomedical waste, healthcare waste, or medical waste, which are potentially hazardous due to its infectious, chemical, or radioactive nature. 2. What types of materials are considered medical waste? Ans: Medical waste includes various materials such as sharps, infectious waste, pharmaceutical waste, and radioactive waste. These materials are potentially harmful and require proper segregation and disposal to ensure public health and environmental safety. 3. Why is proper segregation of medical waste important? Ans: Proper segregation of medical waste at the source is crucial to facilitate safe disposal. Different types of medical waste, each with its unique characteristics, is separated to ensure that the waste is treated and disposed of appropriately. 4. How do technological advancements contribute to medical waste management? Ans: Ongoing advancements in waste treatment technologies, such as autoclaving and microwave treatment, play a crucial role in the medical waste management market. These innovations contribute to more effective and environmentally friendly waste disposal, aligning with the broader trends in circular economy practices. 5. What challenges are faced by the medical waste management market? Ans: High initial investment costs, ongoing operational expenses, and stringent regulatory compliance are significant challenges in the medical waste management market. Limited awareness, resistance to change, and inadequate waste management infrastructure in certain regions also pose restraints to market growth.

1. Medical Waste Management Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.2.1. Medical Waste Management: Market Segmentation 1.2.2. Region Covered 1.3. Executive Summary 2. Global Medical Waste Management Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Key Development 2.5.6. Market Share 2.6. Industry Ecosystem 2.6.1. Key players in the Medical Waste Management ecosystem 2.6.2. Role of companies in the Medical Waste Management ecosystem 2.7. Upcoming Technological and Advancement Initiatives by Key Players 2.8. Market Structure 2.8.1. Market Leaders 2.8.2. Market Followers 2.8.3. Emerging Players 2.9. Consolidation of the Market 2.9.1. Strategic Initiatives and Developments 2.9.2. Mergers and Acquisitions 2.9.3. Collaborations and Partnerships 2.9.4. Product Launches and Innovations 3. Pricing Analysis: 3.1. Average Selling Price of Medical Waste Management Offered by Key Players in the Market 4. Medical Waste Management Market: Dynamics 4.1. Medical Waste Management Market Trends by Region 4.1.1. North America Medical Waste Management Market Trends 4.1.2. Europe Medical Waste Management Market Trends 4.1.3. Asia Pacific Medical Waste Management Market Trends 4.1.4. South America Medical Waste Management Market Trends 4.1.5. Middle East & Africa (MEA) Medical Waste Management Market Trends 4.2. Medical Waste Management MarketDynamics by Region 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.3.1. Threat of New Entrants 4.3.2. Threat of Substitutes 4.3.3. Bargaining Power of Suppliers 4.3.4. Bargaining Power of Buyers 4.3.5. Intensity of Competitive Rivalry 4.4. Trends and Disruption Impacting Customer Business 4.5. Technology Analysis 4.5.1. Incineration 4.5.2. Autoclaving 4.6. Key Stakeholder and Buying Criteria 4.6.1. Influence of Stakeholders on the Buying Process for the Top Applications 4.6.2. Key Buying Criteria for Top Applications 4.7. Regulatory Landscape 4.7.1. Regulation by Region 4.7.2. Tariff and Taxes 4.7.3. Analysis of Government Schemes and Initiatives on the Global Humanoid Robot Industry 4.7.4. Regulatory Bodies, Government Agencies and Other Organizations by Region 4.8. Patent Analysis 4.8.1. Top 10 Patent Holders 4.8.2. Top 10 Companies with Highest Number of Patents 4.8.3. Patent Registration Analysis 4.8.4. Number of Patents Granted Still 2024 5. Medical Waste Management Market: Global Market Size and Forecast by Segmentation 5.1. Medical Waste Management Market Size and Forecast, by Services (2023-2030) 5.1.1. Treatment 5.1.2. Disposable 5.1.3. Recycling 5.2. Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 5.2.1. Bio-hazardous 5.2.2. Non-hazardous 5.2.3. Pharmaceutical 5.2.4. Radioactive 5.2.5. Others 5.3. Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 5.3.1. Incineration 5.3.2. Autoclaving 5.3.3. Chemical treatment 5.3.4. Others 5.4. Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 5.4.1. Hospitals 5.4.2. Clinics 5.4.3. Ambulatory surgical centers 5.4.4. Pharmaceutical Companies 5.4.5. Biotechnology Companies 5.4.6. Others 5.5. Medical Waste Management Market Size and Forecast, by Region (2023-2030) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. South America 5.5.5. MEA 6. North America Medical Waste Management Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 6.1. North America Medical Waste Management Market Size and Forecast, by Services (2023-2030) 6.1.1. Treatment 6.1.2. Disposable 6.1.3. Recycling 6.2. North America Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 6.2.1. Bio-hazardous 6.2.2. Non-hazardous 6.2.3. Pharmaceutical 6.2.4. Radioactive 6.2.5. Others 6.3. North America Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 6.3.1. Incineration 6.3.2. Autoclaving 6.3.3. Chemical treatment 6.3.4. Others 6.4. North America Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 6.4.1. Hospitals 6.4.2. Clinics 6.4.3. Ambulatory surgical centers 6.4.4. Pharmaceutical Companies 6.4.5. Biotechnology Companies 6.4.6. Others 6.5. North America Medical Waste Management Market Size and Forecast, by Country (2023-2030) 6.5.1. United States 6.5.1.1. United States Medical Waste Management Market Size and Forecast, by Services (2023-2030) 6.5.1.1.1. Treatment 6.5.1.1.2. Disposable 6.5.1.1.3. Recycling 6.5.1.2. United States Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 6.5.1.2.1. Bio-hazardous 6.5.1.2.2. Non-hazardous 6.5.1.2.3. Pharmaceutical 6.5.1.2.4. Radioactive 6.5.1.2.5. Others 6.5.1.3. United States Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 6.5.1.3.1. Incineration 6.5.1.3.2. Autoclaving 6.5.1.3.3. Chemical treatment 6.5.1.3.4. Others 6.5.1.4. United States Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 6.5.1.4.1. Hospitals 6.5.1.4.2. Clinics 6.5.1.4.3. Ambulatory surgical centers 6.5.1.4.4. Pharmaceutical Companies 6.5.1.4.5. Biotechnology Companies 6.5.1.4.6. Others 6.5.2. Canada 6.5.2.1. Canada Medical Waste Management Market Size and Forecast, by Services (2023-2030) 6.5.2.1.1. Treatment 6.5.2.1.2. Disposable 6.5.2.1.3. Recycling 6.5.2.2. Canada Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 6.5.2.2.1. Bio-hazardous 6.5.2.2.2. Non-hazardous 6.5.2.2.3. Pharmaceutical 6.5.2.2.4. Radioactive 6.5.2.2.5. Others 6.5.2.3. Canada Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 6.5.2.3.1. Incineration 6.5.2.3.2. Autoclaving 6.5.2.3.3. Chemical treatment 6.5.2.3.4. Others 6.5.2.4. Canada Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 6.5.2.4.1. Hospitals 6.5.2.4.2. Clinics 6.5.2.4.3. Ambulatory surgical centers 6.5.2.4.4. Pharmaceutical Companies 6.5.2.4.5. Biotechnology Companies 6.5.2.4.6. Others 6.5.3. Mexico 6.5.3.1. Mexico Medical Waste Management Market Size and Forecast, by Services (2023-2030) 6.5.3.1.1. Treatment 6.5.3.1.2. Disposable 6.5.3.1.3. Recycling 6.5.3.2. Mexico Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 6.5.3.2.1. Bio-hazardous 6.5.3.2.2. Non-hazardous 6.5.3.2.3. Pharmaceutical 6.5.3.2.4. Radioactive 6.5.3.2.5. Others 6.5.3.3. Mexico Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 6.5.3.3.1. Incineration 6.5.3.3.2. Autoclaving 6.5.3.3.3. Chemical treatment 6.5.3.3.4. Others 6.5.3.4. Mexico Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 6.5.3.4.1. Hospitals 6.5.3.4.2. Clinics 6.5.3.4.3. Ambulatory surgical centers 6.5.3.4.4. Pharmaceutical Companies 6.5.3.4.5. Biotechnology Companies 6.5.3.4.6. Others 7. Europe Medical Waste Management Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 7.1. Europe Medical Waste Management Market Size and Forecast, by Services (2023-2030) 7.2. Europe Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 7.3. Europe Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 7.4. Europe Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 7.5. Europe Medical Waste Management Market Size and Forecast, by Country (2023-2030) 7.5.1. United Kingdom 7.5.1.1. United Kingdom Medical Waste Management Market Size and Forecast, by Services (2023-2030) 7.5.1.2. United Kingdom Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 7.5.1.3. United Kingdom Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 7.5.1.4. United Kingdom Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 7.5.2. France 7.5.2.1. France Medical Waste Management Market Size and Forecast, by Services (2023-2030) 7.5.2.2. France Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 7.5.2.3. France Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 7.5.2.4. France Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 7.5.3. Germany 7.5.3.1. Germany Medical Waste Management Market Size and Forecast, by Services (2023-2030) 7.5.3.2. Germany Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 7.5.3.3. Germany Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 7.5.3.4. Germany Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 7.5.4. Italy 7.5.4.1. Italy Medical Waste Management Market Size and Forecast, by Services (2023-2030) 7.5.4.2. Italy Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 7.5.4.3. Italy Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 7.5.4.4. Italy Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 7.5.5. Spain 7.5.5.1. Spain Medical Waste Management Market Size and Forecast, by Services (2023-2030) 7.5.5.2. Spain Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 7.5.5.3. Spain Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 7.5.5.4. Spain Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 7.5.6. Sweden 7.5.6.1. Sweden Medical Waste Management Market Size and Forecast, by Services (2023-2030) 7.5.6.2. Sweden Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 7.5.6.3. Sweden Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 7.5.6.4. Sweden Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 7.5.7. Austria 7.5.7.1. Austria Medical Waste Management Market Size and Forecast, by Services (2023-2030) 7.5.7.2. Austria Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 7.5.7.3. Austria Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 7.5.7.4. Austria Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 7.5.8. Rest of Europe 7.5.8.1. Rest of Europe Medical Waste Management Market Size and Forecast, by Services (2023-2030) 7.5.8.2. Rest of Europe Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 7.5.8.3. Rest of Europe Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 7.5.8.4. Rest of Europe Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 8. Asia Pacific Medical Waste Management Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 8.1. Asia Pacific Medical Waste Management Market Size and Forecast, by Services (2023-2030) 8.2. Asia Pacific Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 8.3. Asia Pacific Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 8.4. Asia Pacific Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 8.5. Asia Pacific Medical Waste Management Market Size and Forecast, by Country (2023-2030) 8.5.1. China 8.5.1.1. China Medical Waste Management Market Size and Forecast, by Services (2023-2030) 8.5.1.2. China Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 8.5.1.3. China Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 8.5.1.4. China Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 8.5.2. S Korea 8.5.2.1. S Korea Medical Waste Management Market Size and Forecast, by Services (2023-2030) 8.5.2.2. S Korea Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 8.5.2.3. S Korea Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 8.5.2.4. S Korea Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 8.5.3. Japan 8.5.3.1. Japan Medical Waste Management Market Size and Forecast, by Services (2023-2030) 8.5.3.2. Japan Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 8.5.3.3. Japan Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 8.5.3.4. Japan Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 8.5.4. India 8.5.4.1. India Medical Waste Management Market Size and Forecast, by Services (2023-2030) 8.5.4.2. India Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 8.5.4.3. India Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 8.5.4.4. India Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 8.5.5. Australia 8.5.5.1. Australia Medical Waste Management Market Size and Forecast, by Services (2023-2030) 8.5.5.2. Australia Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 8.5.5.3. Australia Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 8.5.5.4. Australia Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 8.5.6. ASEAN 8.5.6.1. ASEAN Medical Waste Management Market Size and Forecast, by Services (2023-2030) 8.5.6.2. ASEAN Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 8.5.6.3. ASEAN Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 8.5.6.4. ASEAN Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 8.5.7. Rest of Asia Pacific 8.5.7.1. Rest of Asia Pacific Medical Waste Management Market Size and Forecast, by Services (2023-2030) 8.5.7.2. Rest of Asia Pacific Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 8.5.7.3. Rest of Asia Pacific Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 8.5.7.4. Rest of Asia Pacific Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 9. South America Medical Waste Management Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 9.1. South America Medical Waste Management Market Size and Forecast, by Services (2023-2030) 9.2. South America Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 9.3. South America Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 9.4. South America Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 9.5. South America Medical Waste Management Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Medical Waste Management Market Size and Forecast, by Services (2023-2030) 9.5.1.2. Brazil Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 9.5.1.3. Brazil Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 9.5.1.4. Brazil Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Medical Waste Management Market Size and Forecast, by Services (2023-2030) 9.5.2.2. Argentina Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 9.5.2.3. Argentina Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 9.5.2.4. Argentina Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Medical Waste Management Market Size and Forecast, by Services (2023-2030) 9.5.3.2. Rest Of South America Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 9.5.3.3. Rest Of South America Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 9.5.3.4. Rest Of South America Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 10. Middle East and Africa Medical Waste Management Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 10.1. Middle East and Africa Medical Waste Management Market Size and Forecast, by Services (2023-2030) 10.2. Middle East and Africa Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 10.3. Middle East and Africa Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 10.4. Middle East and Africa Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 10.5. Middle East and Africa Medical Waste Management Market Size and Forecast, by Country (2023-2030) 10.5.1. South Africa 10.5.1.1. South Africa Medical Waste Management Market Size and Forecast, by Services (2023-2030) 10.5.1.2. South Africa Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 10.5.1.3. South Africa Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 10.5.1.4. South Africa Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 10.5.2. GCC 10.5.2.1. GCC Medical Waste Management Market Size and Forecast, by Services (2023-2030) 10.5.2.2. GCC Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 10.5.2.3. GCC Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 10.5.2.4. GCC Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 10.5.3. Rest Of MEA 10.5.3.1. Rest Of MEA Medical Waste Management Market Size and Forecast, by Services (2023-2030) 10.5.3.2. Rest Of MEA Medical Waste Management Market Size and Forecast, by Type of medical waste (2023-2030) 10.5.3.3. Rest Of MEA Medical Waste Management Market Size and Forecast, by Treatment (2023-2030) 10.5.3.4. Rest Of MEA Medical Waste Management Market Size and Forecast, by Waste Generator (2023-2030) 11. Company Profile: Key Players 11.1. BioMedical Waste Solutions, LLC(Miami, Florida, USA) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. Stericycle, Inc. (Bannockburn, Illinois, USA) 11.3. Waste Management, Inc. (Houston, Texas, USA) 11.4. Clean Harbors, Inc. (Norwell, Massachusetts, USA) 11.5. Veolia Environnement S.A. (Aubervilliers, France) 11.6. BioMedical Waste Solutions, LLC(Miami, Florida, USA) 11.7. Stericyle México (Mexico City, Mexico) 11.8. Remondis SE & Co. KG (Lünen, Germany) 11.9. Bio-Rad Laboratories, Inc. (Hercules, California, USA) 11.10. Daniels Health (Sydney, Australia) 11.11. Tradebe Healthcare Holdings, LLC (Headquarters: Barcelona, Spain) 11.12. Sharpsmart Ltd. (Melbourne, Australia) 11.13. Cleanaway Waste Management Limited (Melbourne, Australia) 11.14. Triumvirate Environmental (Somerville, Massachusetts, USA) 11.15. Medical Waste Management (Dubai, UAE) 11.16. Suez S.A. (Paris, France) 11.17. Republic Services, Inc. (Phoenix, Arizona, USA) 11.18. GIC Medical Disposal (Ontario, Canada) 11.19. Others 12. Key Findings and Analyst Recommendations 12.1. Attractive Opportunities for Players in the Medical Waste Management Market 13. Medical Waste Management Market: Research Methodology 13.1. Market Size Estimation Methodology 13.1.1. Bottom-Up Approach 13.1.2. Top-Down Approach