Commercial Greenhouse Market size was valued at US$ 39.75 Bn. in 2023 and the total revenue is expected to grow at a CAGR of 11.8% from 2024 to 2030, reaching nearly US$ 86.79 Bn.Commercial Greenhouse Market Overview:

Commercial Greenhouse Market is expected to reach US$ 86.79 Bn. by 2030. For the growing of flowers, vegetables, fruits, and transplants for planting in general, Commercial Greenhouse Market offers its customers highly stable and controlled surroundings. This makes greenhouse plant growth dependable regardless of climatic, soil, or topographical difficulties. Large amounts of plants are typically produced for consumers by commercial greenhouses. The use of greenhouse farming allows for greater control over the environment in which crops are grown. Producers can have a decent yield if they effectively control the temperature, irrigation system, air humidity, and light. This report focuses on the different segments of the Commercial Greenhouse market (Crop Type, Type, Equipment, and Region). This report offers a detailed analysis of the top industry participants and geographic regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It offers a thorough examination of the phenomenal modern-era growth in the many sectors. Figures, graphics, and slideshows emphasise the essential data analysis from 2018 to 2023. The market drivers, restraints, opportunities, and challenges for Commercial Greenhouse are examined in this report. The MMR report's investment suggestions are based on a thorough examination of the current competitive environment in the Commercial Greenhouse market.To know about the Research Methodology :- Request Free Sample Report

Commercial Greenhouse Market Dynamics:

Higher yields are required while using less water and space. The higher yield of greenhouse farming when compared to traditional farming techniques is one of its key benefits. For farmers to develop a crop from seed through harvesting stages in less time and with limited land area, enclosed facilities provide the best growth conditions. USDA statistics show that in 2023, greenhouse hydroponic tomato yields averaged 10.59 pounds per square foot whereas conventionally produced tomato yields were 1.85 pounds per square foot. As a result, by adding more layers and enlarging the growing space, greenhouse farms can raise the overall crop production. The Food and Agriculture Organization of the United Nations estimates that in order to meet the world's food needs by 2050, food output must rise by 70%. In order to assist fulfil the growing population's demand for food, greenhouse farming is a realistic choice because urbanization is displacing arable land while also reducing the total area of agricultural land. Compared to conventional farming, there is less water waste. In comparison to outdoor farming, greenhouse farming uses an average of 95% less water to produce the same amount of crops. The transpiration process takes place when plants or commodities are produced in vertical greenhouses, making it possible for farmers to reuse the water for irrigation. A small number of crops are suited for greenhouse farming. As it only works well for a small selection of crops, greenhouse farming is not a popular choice among growers. Before starting a greenhouse plantation, a number of factors need to be taken into account, including temperature control, proper water supply management, fertilizer identification and supply, growth mechanism to be used, and individual harvest times for plants. The best crops for vertical farming are fruits and vegetables since they grow more quickly and need less water and sunlight. However, controlled-environment farming can only be used to grow a limited number of fruit and vegetable species. For instance, the leaves, stems, and roots of several fruits and vegetables are all edible. These types of plants are not appropriate for vertical farming. Crops like sugarcane, rice, and wheat are challenging to grow in greenhouses because they need a lot of water and take a long time to harvest. Major crops grown year-round to serve the increasing population in the APAC region include wheat and rice. The difficulty of growing these crops in greenhouses has led to a limited uptake of commercial greenhouse farming in these regions. R&D projects to advance greenhouse agricultural techniques The field of agriculture draws the most R&D from scientists. Challenges posed by climate change and environmental issues have prompted the creation of numerous strategies to guarantee food security globally. Scientists, academics, and farmers are becoming interested in greenhouse farming. To solve the fundamental issue of controlling the environment in temperate regions, experts are attempting to implement greenhouse farming. According to the Advanced Horticulture Research Facility, active cooling techniques can help create the ideal atmosphere. Numerous approaches are being researched, including photovoltaic (PV)-based shading techniques for greenhouse passive cooling. The protected cropping industry's current humidity-control methods are being enhanced, and specialists are spotting potential areas for future research in this field. The European Union's (EU) total budget for 2023 was USD 197.1 billion. Fisheries, agriculture, and rural development accounted for USD 69.2 billion in spending, or 35% of the entire budget.Commercial Greenhouse Market Segment Analysis:

The Commercial Greenhouse Market is segmented by Crop Type, Type, and Equipment. Based on the Crop Type, the market is segmented into Fruits, Vegetables, Flowers & ornamentals, Nursery crops, and others. Vegetables segment is expected to hold the largest market share of xx% by 2023. Vegetables grow beautifully in greenhouses. Vegetables can be grown all year long without having to worry about the weather, temperature, or other environmental factors changing. When vegetables are grown in greenhouses, the crops are shielded from adverse weather conditions like cold, wind, bugs, drought, scorching heat, and animals trying to devour them. Due to the controlling variables present in greenhouses, such as moisture, light, temperature, fertiliser, humidity, and irrigation, growing vegetables there also enables the creation of the best conditions for the crops. Based on the Equipment, the market is segmented into Cooling systems, Heating systems and others. Heating systems segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. One of the essential criteria for the efficient development of plants in commercial greenhouses is heating systems. Plant growth is aided by systems that maintain a consistent temperature and don't release any toxic materials. A heating system is a method for keeping the temperature where it should be. These systems might be distributed or centrally managed. For indoor warmth during cold weather, greenhouses frequently use radiant hot water heating systems. These heating systems use mixing valves to manage the temperature of the heating pipes because flow control allows for efficient temperature regulation.Commercial Greenhouse Market Regional Insights:

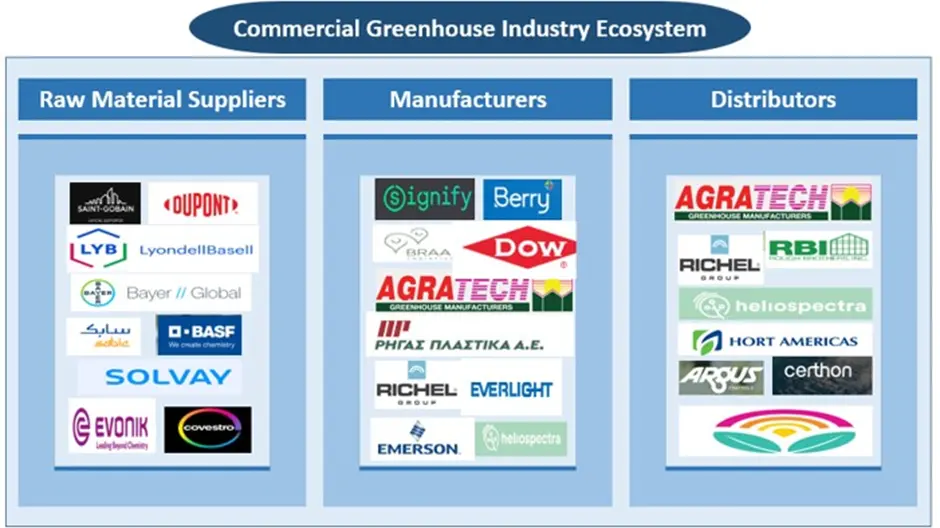

The European region is expected to dominate the Commercial Greenhouse Market during the forecast period 2024-2030. The European region is expected to hold the largest market share of xx% by 2030. Traditionally, Europe has been in the forefront of introducing cutting-edge methods into commercial greenhouse horticulture. Large portions of the Netherlands, Spain, and Turkey are used for greenhouse farming. In contrast, producers in the Netherlands often cultivate their plants without the aid of temperature control technology in straightforward tunnel-like greenhouses. In Scandinavia, where farming is practically impossible in the cold, controlled environment agriculture has thrived. The largest users of commercial greenhouse systems globally are growers in Europe. Since many areas of Europe have a chilly temperature, it is necessary to apply climate control to create an environment that is conducive to plant growth. In numerous other parts of Europe, including Scandinavia, additional lighting is also required to extend the growing season all year long. The main European countries where greenhouse farming is used are Spain and Italy. Countries in Eastern Europe have experienced rapid growth in recent years. Western and Central Europe's commercial greenhouse market is now mature, with demand for greenhouses dropping in a number of nations in line with their respective GDPs. Construction of greenhouses has significantly decreased in Spain, the UK, Germany, Italy, France, and all five of those countries. The main cause of the plastic greenhouse market's sluggish growth in Western and Central Europe is the region's strict rules against the use of plastics. The objective of the report is to present a comprehensive analysis of the Global Commercial Greenhouse Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Commercial Greenhouse Market dynamic and structure by analyzing the market segments and projecting the Global Commercial Greenhouse Market size. Clear representation of competitive analysis of key players by Distribution Channel, price, financial position, product portfolio, growth strategies, and regional presence in the Commercial Greenhouse Market make the report investor’s guide.Commercial Greenhouse Industry Ecosystem:

Commercial Greenhouse Market Scope: Inquire before buying

Global Commercial Greenhouse Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 39.75 Bn. Forecast Period 2024 to 2030 CAGR: 11.8% Market Size in 2030: US $ 86.79 Bn. Segments Covered: by Crop Type Fruits Vegetables Flowers & ornamentals Nursery crops Others by Type Glass greenhouse Plastic greenhouse by Equipment Cooling systems Heating systems Others Commercial Greenhouse Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Commercial Greenhouse Market Key Players

1. Berry Global (US) 2. Signify Holding (Netherlands) 3. Heliospectra AB (Sweden) 4. Plastika Kritis (Greece) 5. Everlight Electronics (Taiwan) 6. Richel Group (France) 7. Argus Control Systems (Canada) 8. Certhon (The Netherlands) 9. Logiqs BV (The Netherlands) 10.LumiGrow (US) 11.Agra-tech, Inc. (US) 12.Rough Brothers, Inc. (US) 13.Hort Americas (US) 14.Top Greenhouses (India) 15.Stuppy Greenhouse (US) 16.The Glasshouse Company (Australia) 17.DeCloet Manufacturing Ltd (Canada) Frequently Asked Questions: 1] Which region is expected to hold the highest share in the Commercial Greenhouse Market? Ans. The European region is expected to hold the highest share in the Commercial Greenhouse Market. 2] Who are the top key players in the Commercial Greenhouse Market? Ans. Berry Global (US), Signify Holding (Netherlands), Heliospectra AB (Sweden), Plastika Kritis (Greece), Everlight Electronics (Taiwan), and Richel Group (France) are the top key players in the Commercial Greenhouse Market. 3] Which segment is expected to hold the largest market share in the Commercial Greenhouse Market by 2030? Ans. Vegetables segment is expected to hold the largest market share in the Commercial Greenhouse Market by 2030. 4] What is the market size of the Commercial Greenhouse Market by 2030? Ans. The market size of the Commercial Greenhouse Market is expected to reach US $ 86.79 Bn. by 2030 5] What was the market size of the Commercial Greenhouse Market in 2023? Ans. The market size of the Commercial Greenhouse Market was worth US $ 39.75 Bn. in 2023.

1. Commercial Greenhouse Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Commercial Greenhouse Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Key Development 2.5.6. Market Share 2.6. Industry Ecosystem 2.6.1. Key players in the Commercial Greenhouse ecosystem 2.6.2. Role of companies in the Commercial Greenhouse ecosystem 2.7. Upcoming Technological and Advancement Initiatives by Key Players 2.8. Market Structure 2.8.1. Market Leaders 2.8.2. Market Followers 2.8.3. Emerging Players 2.9. Consolidation of the Market 2.9.1. Strategic Initiatives and Developments 2.9.2. Mergers and Acquisitions 2.9.3. Collaborations and Partnerships 2.9.4. Product Launches and Innovations 3. Pricing Analysis: 3.1. Average Selling Price of Commercial Greenhouse Offered by Key Players in the Market 4. Commercial Greenhouse Market: Dynamics 4.1. Commercial Greenhouse Market Trends by Region 4.1.1. North America Commercial Greenhouse Market Trends 4.1.2. Europe Commercial Greenhouse Market Trends 4.1.3. Asia Pacific Commercial Greenhouse Market Trends 4.1.4. South America Commercial Greenhouse Market Trends 4.1.5. Middle East & Africa (MEA) Commercial Greenhouse Market Trends 4.2. Commercial Greenhouse Market Dynamics 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.3.1. Threat of New Entrants 4.3.2. Threat of Substitutes 4.3.3. Bargaining Power of Suppliers 4.3.4. Bargaining Power of Buyers 4.3.5. Intensity of Competitive Rivalry 4.4. Value/ Supply Chain Analysis 4.4.1. Research and product development 4.4.2. Raw material sourcing 4.4.3. Production and Processing 4.4.4. Packaging 4.4.5. Distribution 4.4.6. Market and sales 4.5. Ecosystem Analysis 4.6. Key Stakeholder and Buying Criteria 4.7. Microeconomic Indicators 4.8. Regulatory Landscape 4.8.1. Regulation by Region 4.8.2. Tariff and Taxes 4.8.3. Analysis of Government Schemes and Initiatives on the Global Commercial Greenhouse Industry 4.8.4. Regulatory Bodies, Government Agencies and Other Organizations by Region 4.9. Technology Analysis 5. Commercial Greenhouse Market: Global Market Size and Forecast by Segmentation 5.1. Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 5.1.1. Fruits 5.1.2. Vegetables 5.1.3. Flowers & ornamentals 5.1.4. Nursery crops 5.1.5. Others 5.2. Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 5.2.1. Glass greenhouse 5.2.2. Plastic greenhouse 5.3. Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 5.3.1. Cooling systems 5.3.2. Heating systems 5.3.3. Others 5.4. Commercial Greenhouse Market Size and Forecast, by Region (2023-2030) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. South America 5.4.5. MEA 6. North America Commercial Greenhouse Market Size and Forecast by Segmentation (by Value USD Billion) (2023-2030) 6.1. North America Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 6.1.1. Fruits 6.1.2. Vegetables 6.1.3. Flowers & ornamentals 6.1.4. Nursery crops 6.1.5. Others 6.2. North America Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 6.2.1. Glass greenhouse 6.2.2. Plastic greenhouse 6.3. North America Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 6.3.1. Cooling systems 6.3.2. Heating systems 6.3.3. Others 6.4. North America Commercial Greenhouse Market Size and Forecast, by Country (2023-2030) 6.4.1. United States 6.4.1.1. United States Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 6.4.1.1.1. Fruits 6.4.1.1.2. Vegetables 6.4.1.1.3. Flowers & ornamentals 6.4.1.1.4. Nursery crops 6.4.1.1.5. Others 6.4.1.2. United States Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 6.4.1.2.1. Glass greenhouse 6.4.1.2.2. Plastic greenhouse 6.4.1.3. United States Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 6.4.1.3.1. Cooling systems 6.4.1.3.2. Heating systems 6.4.1.3.3. Others 6.4.2. Canada 6.4.2.1. Canada Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 6.4.2.1.1. Fruits 6.4.2.1.2. Vegetables 6.4.2.1.3. Flowers & ornamentals 6.4.2.1.4. Nursery crops 6.4.2.1.5. Others 6.4.2.2. Canada Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 6.4.2.2.1. Glass greenhouse 6.4.2.2.2. Plastic greenhouse 6.4.2.3. Canada Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 6.4.2.3.1. Cooling systems 6.4.2.3.2. Heating systems 6.4.2.3.3. Others 6.4.3. Mexico 6.4.3.1. Mexico Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 6.4.3.1.1. Fruits 6.4.3.1.2. Vegetables 6.4.3.1.3. Flowers & ornamentals 6.4.3.1.4. Nursery crops 6.4.3.1.5. Others 6.4.3.2. Mexico Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 6.4.3.2.1. Glass greenhouse 6.4.3.2.2. Plastic greenhouse 6.4.3.3. Mexico Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 6.4.3.3.1. Cooling systems 6.4.3.3.2. Heating systems 6.4.3.3.3. Others 7. Europe Commercial Greenhouse Market Size and Forecast by Segmentation (by Value USD Billion) (2023-2030) 7.1. Europe Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 7.2. Europe Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 7.3. Europe Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 7.4. Europe Commercial Greenhouse Market Size and Forecast, by Country (2023-2030) 7.4.1. United Kingdom 7.4.1.1. United Kingdom Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 7.4.1.2. United Kingdom Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 7.4.1.3. United Kingdom Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 7.4.2. France 7.4.2.1. France Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 7.4.2.2. France Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 7.4.2.3. France Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 7.4.3. Germany 7.4.3.1. Germany Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 7.4.3.2. Germany Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 7.4.3.3. Germany Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 7.4.4. Italy 7.4.4.1. Italy Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 7.4.4.2. Italy Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 7.4.4.3. Italy Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 7.4.5. Spain 7.4.5.1. Spain Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 7.4.5.2. Spain Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 7.4.5.3. Spain Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 7.4.6. Sweden 7.4.6.1. Sweden Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 7.4.6.2. Sweden Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 7.4.6.3. Sweden Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 7.4.7. Austria 7.4.7.1. Austria Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 7.4.7.2. Austria Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 7.4.7.3. Austria Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 7.4.8. Rest of Europe 7.4.8.1. Rest of Europe Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 7.4.8.2. Rest of Europe Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 7.4.8.3. Rest of Europe Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 8. Asia Pacific Commercial Greenhouse Market Size and Forecast by Segmentation (by Value USD Billion) (2023-2030) 8.1. Asia Pacific Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 8.2. Asia Pacific Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 8.3. Asia Pacific Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 8.4. Asia Pacific Commercial Greenhouse Market Size and Forecast, by Country (2023-2030) 8.4.1. China 8.4.1.1. China Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 8.4.1.2. China Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 8.4.1.3. China Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 8.4.2. S Korea 8.4.2.1. S Korea Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 8.4.2.2. S Korea Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 8.4.2.3. S Korea Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 8.4.3. Japan 8.4.3.1. Japan Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 8.4.3.2. Japan Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 8.4.3.3. Japan Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 8.4.4. India 8.4.4.1. India Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 8.4.4.2. India Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 8.4.4.3. India Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 8.4.5. Australia 8.4.5.1. Australia Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 8.4.5.2. Australia Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 8.4.5.3. Australia Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 8.4.6. ASEAN 8.4.6.1. ASEAN Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 8.4.6.2. ASEAN Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 8.4.6.3. ASEAN Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 8.4.7. Rest of Asia Pacific 8.4.7.1. Rest of Asia Pacific Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 8.4.7.2. Rest of Asia Pacific Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 8.4.7.3. Rest of Asia Pacific Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 9. South America Commercial Greenhouse Market Size and Forecast by Segmentation (by Value USD Billion) (2023-2030) 9.1. South America Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 9.2. South America Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 9.3. South America Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 9.4. South America Commercial Greenhouse Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 9.4.1.2. Brazil Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 9.4.1.3. Brazil Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 9.4.2.2. Argentina Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 9.4.2.3. Argentina Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 9.4.3.2. Rest Of South America Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 9.4.3.3. Rest Of South America Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 10. Middle East and Africa Commercial Greenhouse Market Size and Forecast by Segmentation (by Value USD Billion) (2023-2030) 10.1. Middle East and Africa Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 10.2. Middle East and Africa Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 10.3. Middle East and Africa Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 10.4. Middle East and Africa Commercial Greenhouse Market Size and Forecast, by Country (2023-2030) 10.4.1. South Africa 10.4.1.1. South Africa Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 10.4.1.2. South Africa Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 10.4.1.3. South Africa Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 10.4.2. GCC 10.4.2.1. GCC Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 10.4.2.2. GCC Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 10.4.2.3. GCC Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 10.4.3. Rest Of MEA 10.4.3.1. Rest Of MEA Commercial Greenhouse Market Size and Forecast, by Crop Type (2023-2030) 10.4.3.2. Rest Of MEA Commercial Greenhouse Market Size and Forecast, by Type (2023-2030) 10.4.3.3. Rest Of MEA Commercial Greenhouse Market Size and Forecast, by Equipment (2023-2030) 11. Company Profile: Key Players 11.1. Berry Global (US) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. Berry Global (US) 11.3. Signify Holding (Netherlands) 11.4. Heliospectra AB (Sweden) 11.5. Plastika Kritis (Greece) 11.6. Everlight Electronics (Taiwan) 11.7. Richel Group (France) 11.8. Argus Control Systems (Canada) 11.9. Certhon (The Netherlands) 11.10. Logiqs BV (The Netherlands) 11.11. LumiGrow (US) 11.12. Agra-tech, Inc. (US) 11.13. Rough Brothers, Inc. (US) 11.14. Hort Americas (US) 11.15. Top Greenhouses (India) 11.16. Stuppy Greenhouse (US) 11.17. The Glasshouse Company (Australia) 11.18. DeCloet Manufacturing Ltd (Canada) 11.19. Others 12. Key Findings and Analyst Recommendations 12.1. Attractive Opportunities for Players in the Commercial Greenhouse Market 13. Commercial Greenhouse Market: Research Methodology