The Massive MIMO Market size was valued at US 3.1 Bn in 2023 and market revenue is growing at a CAGR of 32.1 %from 2024 to 2030, reaching nearly USD 21.76 Bn by 2030.Massive MIMO Market Overview

The Massive MIMO market is experiencing a seismic surge, driven by the rapid deployment of 5G networks worldwide. Massive MIMO, an advanced iteration of MIMO technology, revolutionizes wireless communication by deploying a significantly larger number of antennas at base stations. This growth enables precise energy focusing, leading to remarkable enhancements in throughput and efficiency crucial for the seamless operation of 5G networks.To know about the Research Methodology :- Request Free Sample Report According to a recent MMR Study Report, in October 2022, EE, a prominent internet service provider in the UK and part of the BT group, collaborated with Ericsson to pioneer 5G energy efficiency. They introduced ultra-light radio technology, developed by Ericsson, boasting the lightest and smallest Massive MIMO radio yet. This breakthrough innovation promises a staggering 40% reduction in energy usage, aligning with broader sustainability objectives. Initially, EE plans to deploy this cutting-edge equipment in London before expanding to other urban and suburban areas. September 2022 witnessed NEC and Mavenir collaborating to deploy Massive MIMO technology in Orange's 5G standalone (SA) experimental network. This partnership marks a significant milestone in the evolution of Open RAN, transitioning from virtualized to cloudified networks. This factor significantly boost the Massive MIMO Market. By embracing a multi-vendor, cloud-native, and standards-based approach, NEC and Mavenir showcase the immense potential of collaborative efforts in shaping the future of wireless connectivity. These strategic initiatives underscore the pivotal role of Massive MIMO in driving the evolution of 5G networks, promising unparalleled performance and connectivity for users across the World.

Massive MIMO Market: Dynamics

Driver Empowering the Wireless Evolution boosts the Massive MIMO Market growth Massive MIMO stands at the forefront of wireless evolution, igniting transformative changes in communication dynamics. With its deployment of extensive antenna arrays at base stations, Massive MIMO orchestrates a symphony of simultaneous data streams to myriad users, heralding a new era of unparalleled capacity and efficiency. This innovative paradigm shift amplifies spectral efficiency, unlocking faster speeds and seamless connectivity, even within bustling urban hubs, which is expected to boost the Massive MIMO Market growth. Positioned as the cornerstone of 5G networks, Massive MIMO fortifies the infrastructure needed to sustain a spectrum of modern applications, spanning rapid downloads to real-time endeavors such as autonomous driving. Its innate scalability and cost-efficiency render it a compelling choice for operators navigating the future while managing costs judiciously. Amidst an intensely competitive telecommunications landscape, the race to integrate Massive MIMO accelerates, propelled by the imperative to meet escalating data demands and exceed user expectations. As Massive MIMO spearheads the wireless evolution, it promises a horizon where connectivity thrives, reshaping our interactions, productivity, and connectivity experiences. The increasing size of the 5G infrastructure market drives demand for Massive MIMO due to its crucial role in enhancing 5G network capacity and performance and boost the Massive MIMO Market growth.Restrain Cost and Complexity of Massive MIMO Limits the Market Growth The growth of the Massive MIMO market is hindered by the significant cost and complexity associated with deploying and managing these advanced systems. Initial investment requirements pose a substantial barrier for network operators, encompassing the procurement of numerous antennas, sophisticated signal processing equipment, and infrastructure upgrades. These capital expenditures strain budgets, particularly for smaller operators or those in economically challenged regions. Moreover, ongoing operational expenses add to the financial burden, as specialized expertise is needed for configuration, maintenance, and optimization. The complexity of deploying Massive MIMO systems further compounds these challenges, requiring meticulous planning and coordination for site selection, antenna placement, and network optimization. Integration with existing infrastructure and legacy technologies also presents hurdles, necessitating additional investments in compatibility measures. Scalability concerns exacerbate the issue, as expanding Massive MIMO deployments to meet growing demand requires further hardware, spectrum resources, and capacity management. To overcome these barriers, of Massive MIMO Market stakeholders must collaborate to drive innovations in hardware design, software optimization, and deployment methodologies that reduce costs and streamline operations. Regulatory reforms and supportive policies also incentivize investment in next-generation technologies, stimulating market growth and facilitating the widespread adoption of Massive MIMO. Opportunity Rapid 5G Deployment Creates Lucrative Growth Opportunities for the Massive MIMO Market Growth The rapid deployment of 5G networks presents lucrative growth opportunities for the Massive MIMO market. As telecommunications operators worldwide race to roll out 5G technology, the demand for Massive MIMO systems intensifies.5G networks promise ultra-fast data speeds, significantly lower latency, and massive connectivity capabilities, enabling a plethora of innovative applications and services. Also, to fully realize the potential of 5G, operators must deploy advanced antenna systems like Massive MIMO to handle the increased data traffic and support the diverse requirements of 5G use cases. Massive MIMO, with its ability to utilize multiple antennas to serve multiple users simultaneously, is uniquely positioned to meet the capacity and throughput demands of 5G networks. By leveraging Massive MIMO technology, operators enhance network performance, deliver superior user experiences, and unlock new revenue streams. Furthermore, as the deployment of 5G networks expands globally, the demand for Massive MIMO solutions is expected to skyrocket. This presents significant growth opportunities for vendors and service providers operating in the Massive MIMO market. As a result, the Massive MIMO Industry is poised for substantial growth, driven by the rapid and widespread deployment of 5G networks across industries and geographies.

Massive MIMO Market Segment Analysis

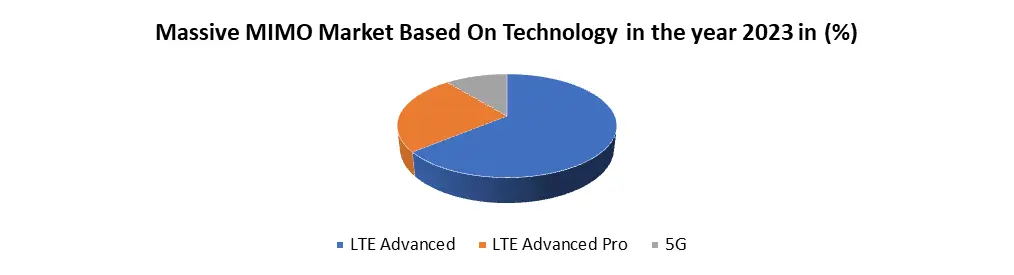

Based on Technology, the LTE Advanced segment dominated the Massive MIMO Market in the year 2023. Due to its widespread adoption and compatibility with existing infrastructure. LTE Advanced offers significant enhancements in data speed, capacity, and efficiency, making it an attractive choice for telecommunications providers seeking to meet the growing demand for high-speed mobile data. Massive MIMO technology, a key component of LTE Advanced, enables multiple antennas to serve multiple users simultaneously, boosting spectral efficiency and overall network performance. As LTE Advanced continues to evolve, incorporating features such as carrier aggregation and higher-order MIMO, it solidifies its position as the preferred technology for deploying Massive MIMO systems. Additionally, the maturity of LTE Advanced infrastructure and its proven track record in real-world deployments give it an edge over emerging technologies in the Massive MIMO space, further cementing its dominance in the of Massive MIMO market.

Massive MIMO Market Regional Analysis:

The Asia Pacific region dominated the Massive MIMO Market in the year 2023. The Asia Pacific region's dominance in the Massive MIMO industry attributed to several factors. The region has a large and rapidly growing population with a high demand for mobile data services. This demand is driven by factors such as increasing smartphone penetration, rising internet usage, and the popularity of bandwidth-intensive applications like video streaming and online gaming. Many countries in the Asia Pacific have been early adopters of 5G technology, which relies heavily on Massive MIMO for its enhanced capacity and coverage capabilities. As a result, telecommunications providers in the region have been deploying Massive MIMO systems to support the rollout of 5G networks and meet the surging demand for data services. The Asia Pacific region is home to several leading telecommunications equipment manufacturers and vendors, who are actively investing in research and development of Massive MIMO technology. This has led to the availability of a wide range of products and solutions tailored to the specific needs of operators in the region. The government initiatives and policies aimed at promoting digital connectivity and infrastructure development have also contributed to the rapid growth of the Massive MIMO market in the Asia Pacific region. These factors combined have positioned the region as a dominant force in the global Massive MIMO industry. Massive MIMO Market: Competitive landscape The Massive MIMO Market is highly competitive the multiple key players dominate the market. The Massive MIMO industry giants majorly focus on innovation, mergers acquisitions, and expansion. For Instance, Jazz, a prominent digital operator in Pakistan, partnered with ZTE to deploy the first 5G technology-based 4G FDD Massive MIMO system. This collaboration aims to enhance network capacity by 15% and boost single-user speeds by an impressive 160%, leveraging features such as Power Boosting and Power Amplifier Enhancement to elevate user experience. Cohere Technologies introduced an innovative MU-MIMO beamforming technology designed to optimize current network and spectrum resources for both 4G and 5G networks. This solution enables operators to leverage existing 4G FDD networks while enhancing the performance of 5G FDD networks, ensuring efficient utilization of resources and maximizing network capacity. Nokia launched the Habrok Radio as part of its AirScale Massive MIMO 5G radio portfolio, offering comprehensive coverage for various use cases and deployment scenarios. These next-generation radios boast 30% lower power consumption, aligning with sustainability goals while delivering high-performance connectivity solutions. These advancements underscore the competitive landscape of the Massive MIMO market, characterized by continuous innovation, strategic partnerships, and a focus on enhancing network performance and efficiency to meet the evolving demands of 5G deployments worldwide.The scope of the Global Massive MIMO Market: Inquire before buying

Global Massive MIMO Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.1 Bn. Forecast Period 2024 to 2030 CAGR: 32.1% Market Size in 2030: US $ 21.76 Bn. Segments Covered: by Technology LTE Advanced LTE Advanced Pro 5G by Type of Antennas 8T8R 16T16R & 32T32R 64T64R 128T128R & above by Spectrum FDD TDD Others (FBMC, OFDM) Massive MIMO Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Massive MIMO Market Key players

North America 1. Cisco Systems, Inc. (United States) 2. Qualcomm Technologies, Inc (United States) 3. Verizon Communications Inc. (United States) 4. AT&T Inc. (United States) Europe 1. Ericsson (Sweden) 2. Nokia Corporation (Finland) 3. Telefonica S.A. (Spain) 4. Deutsche Telekom AG (Germany) 5. Vodafone Group Plc (United Kingdom) 6. Telefonaktiebolaget LM Ericsson (Sweden) Asia Pacific 1. HuaweiTechnologies Co., Ltd. (Shenzhen, China) 2. ZTE Corporation (China) 3. Samsung Electronics Co., Ltd. (South Korea) 4. NEC Corporation (Japan) 5. China Mobile Communications Corporation (China) 6. China Telecommunications Corporation (China) 7. China Unicom (Hong Kong) Limited (China) 8. Fujitsu Limited (Japan) 9. Bharti Airtel Limited (India) Frequently Asked Questions 1] What segments are covered in the Global Massive MIMO Market report? Ans. The segments covered in the Massive MIMO Market report are based on, Technology, Type of Antennas, Spectrum, and Regions. 2] Which region is expected to hold the highest share of the Global Massive MIMO Market? Ans. The Europe region is expected to hold the highest share of the Massive MIMO Market. 3] What is the market size of the Global Massive MIMO Market by 2030? Ans. The market size of the Massive MIMO Market by 2030 is expected to reach US$21.76 Bn. 4] What was the market size of the Global Massive MIMO Market in 2023? Ans. The market size of the Massive MIMO Market in 2023 was valued at US$ 3.1 Bn. 5] Key players in the Massive MIMO Market. Ans. Cisco Systems, Inc. (United States), Qualcomm Technologies, Inc. (United States), Verizon Communications Inc. (United States), and AT&T Inc. (United States).

1. Massive MIMO Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Massive MIMO Market: Dynamics 2.1. Massive MIMO Market Trends by Region 2.1.1. North America Massive MIMO Market Trends 2.1.2. Europe Massive MIMO Market Trends 2.1.3. Asia Pacific Massive MIMO Market Trends 2.1.4. Middle East and Africa Massive MIMO Market Trends 2.1.5. South America Massive MIMO Market Trends 2.2. Massive MIMO Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Massive MIMO Market Drivers 2.2.1.2. North America Massive MIMO Market Restraints 2.2.1.3. North America Massive MIMO Market Opportunities 2.2.1.4. North America Massive MIMO Market Challenges 2.2.2. Europe 2.2.2.1. Europe Massive MIMO Market Drivers 2.2.2.2. Europe Massive MIMO Market Restraints 2.2.2.3. Europe Massive MIMO Market Opportunities 2.2.2.4. Europe Massive MIMO Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Massive MIMO Market Drivers 2.2.3.2. Asia Pacific Massive MIMO Market Restraints 2.2.3.3. Asia Pacific Massive MIMO Market Opportunities 2.2.3.4. Asia Pacific Massive MIMO Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Massive MIMO Market Drivers 2.2.4.2. Middle East and Africa Massive MIMO Market Restraints 2.2.4.3. Middle East and Africa Massive MIMO Market Opportunities 2.2.4.4. Middle East and Africa Massive MIMO Market Challenges 2.2.5. South America 2.2.5.1. South America Massive MIMO Market Drivers 2.2.5.2. South America Massive MIMO Market Restraints 2.2.5.3. South America Massive MIMO Market Opportunities 2.2.5.4. South America Massive MIMO Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Massive MIMO Industry 2.8. Analysis of Government Schemes and Initiatives For Massive MIMO Industry 2.9. Massive MIMO Market Trade Analysis 2.10. The Global Pandemic Impact on Massive MIMO Market 3. Massive MIMO Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Massive MIMO Market Size and Forecast, by Technology (2023-2030) 3.1.1. LTE Advanced 3.1.2. LTE Advanced Pro 3.1.3. 5G 3.2. Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 3.2.1. 8T8R 3.2.2. 16T16R & 32T32R 3.2.3. 64T64R 3.2.4. 128T128R & above 3.3. Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 3.3.1. FDD 3.3.2. TDD 3.3.3. Others (FBMC, OFDM) 3.4. Massive MIMO Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Massive MIMO Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Massive MIMO Market Size and Forecast, by Technology (2023-2030) 4.1.1. LTE Advanced 4.1.2. LTE Advanced Pro 4.1.3. 5G 4.2. North America Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 4.2.1. 8T8R 4.2.2. 16T16R & 32T32R 4.2.3. 64T64R 4.2.4. 128T128R & above 4.3. North America Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 4.3.1. FDD 4.3.2. TDD 4.3.3. Others (FBMC, OFDM) 4.4. North America Massive MIMO Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Massive MIMO Market Size and Forecast, by Technology (2023-2030) 4.4.1.1.1. LTE Advanced 4.4.1.1.2. LTE Advanced Pro 4.4.1.1.3. 5G 4.4.1.2. United States Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 4.4.1.2.1. 8T8R 4.4.1.2.2. 16T16R & 32T32R 4.4.1.2.3. 64T64R 4.4.1.2.4. 128T128R & above 4.4.1.3. United States Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 4.4.1.3.1. FDD 4.4.1.3.2. TDD 4.4.1.3.3. Others (FBMC, OFDM) 4.4.2. Canada 4.4.2.1. Canada Massive MIMO Market Size and Forecast, by Technology (2023-2030) 4.4.2.1.1. LTE Advanced 4.4.2.1.2. LTE Advanced Pro 4.4.2.1.3. 5G 4.4.2.2. Canada Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 4.4.2.2.1. 8T8R 4.4.2.2.2. 16T16R & 32T32R 4.4.2.2.3. 64T64R 4.4.2.2.4. 128T128R & above 4.4.2.3. Canada Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 4.4.2.3.1. FDD 4.4.2.3.2. TDD 4.4.2.3.3. Others (FBMC, OFDM) 4.4.3. Mexico 4.4.3.1. Mexico Massive MIMO Market Size and Forecast, by Technology (2023-2030) 4.4.3.1.1. LTE Advanced 4.4.3.1.2. LTE Advanced Pro 4.4.3.1.3. 5G 4.4.3.2. Mexico Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 4.4.3.2.1. 8T8R 4.4.3.2.2. 16T16R & 32T32R 4.4.3.2.3. 64T64R 4.4.3.2.4. 128T128R & above 4.4.3.3. Mexico Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 4.4.3.3.1. FDD 4.4.3.3.2. TDD 4.4.3.3.3. Others (FBMC, OFDM) 5. Europe Massive MIMO Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Massive MIMO Market Size and Forecast, by Technology (2023-2030) 5.2. Europe Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 5.3. Europe Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 5.4. Europe Massive MIMO Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Massive MIMO Market Size and Forecast, by Technology (2023-2030) 5.4.1.2. United Kingdom Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 5.4.1.3. United Kingdom Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 5.4.2. France 5.4.2.1. France Massive MIMO Market Size and Forecast, by Technology (2023-2030) 5.4.2.2. France Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 5.4.2.3. France Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Massive MIMO Market Size and Forecast, by Technology (2023-2030) 5.4.3.2. Germany Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 5.4.3.3. Germany Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Massive MIMO Market Size and Forecast, by Technology (2023-2030) 5.4.4.2. Italy Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 5.4.4.3. Italy Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Massive MIMO Market Size and Forecast, by Technology (2023-2030) 5.4.5.2. Spain Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 5.4.5.3. Spain Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Massive MIMO Market Size and Forecast, by Technology (2023-2030) 5.4.6.2. Sweden Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 5.4.6.3. Sweden Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Massive MIMO Market Size and Forecast, by Technology (2023-2030) 5.4.7.2. Austria Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 5.4.7.3. Austria Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Massive MIMO Market Size and Forecast, by Technology (2023-2030) 5.4.8.2. Rest of Europe Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 5.4.8.3. Rest of Europe Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6. Asia Pacific Massive MIMO Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.3. Asia Pacific Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4. Asia Pacific Massive MIMO Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.1.2. China Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.1.3. China Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.2.2. S Korea Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.2.3. S Korea Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.3.2. Japan Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.3.3. Japan Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4.4. India 6.4.4.1. India Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.4.2. India Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.4.3. India Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.5.2. Australia Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.5.3. Australia Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.6.2. Indonesia Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.6.3. Indonesia Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.7.2. Malaysia Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.7.3. Malaysia Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.8.2. Vietnam Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.8.3. Vietnam Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.9.2. Taiwan Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.9.3. Taiwan Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Massive MIMO Market Size and Forecast, by Technology (2023-2030) 6.4.10.2. Rest of Asia Pacific Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 6.4.10.3. Rest of Asia Pacific Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 7. Middle East and Africa Massive MIMO Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Massive MIMO Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 7.3. Middle East and Africa Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 7.4. Middle East and Africa Massive MIMO Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Massive MIMO Market Size and Forecast, by Technology (2023-2030) 7.4.1.2. South Africa Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 7.4.1.3. South Africa Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Massive MIMO Market Size and Forecast, by Technology (2023-2030) 7.4.2.2. GCC Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 7.4.2.3. GCC Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Massive MIMO Market Size and Forecast, by Technology (2023-2030) 7.4.3.2. Nigeria Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 7.4.3.3. Nigeria Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Massive MIMO Market Size and Forecast, by Technology (2023-2030) 7.4.4.2. Rest of ME&A Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 7.4.4.3. Rest of ME&A Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 8. South America Massive MIMO Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Massive MIMO Market Size and Forecast, by Technology (2023-2030) 8.2. South America Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 8.3. South America Massive MIMO Market Size and Forecast, by Spectrum(2023-2030) 8.4. South America Massive MIMO Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Massive MIMO Market Size and Forecast, by Technology (2023-2030) 8.4.1.2. Brazil Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 8.4.1.3. Brazil Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Massive MIMO Market Size and Forecast, by Technology (2023-2030) 8.4.2.2. Argentina Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 8.4.2.3. Argentina Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Massive MIMO Market Size and Forecast, by Technology (2023-2030) 8.4.3.2. Rest Of South America Massive MIMO Market Size and Forecast, by Type of Antenans (2023-2030) 8.4.3.3. Rest Of South America Massive MIMO Market Size and Forecast, by Spectrum (2023-2030) 9. Global Massive MIMO Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Massive MIMO Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cisco Systems, Inc. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Qualcomm Technologies, Inc (United States) 10.3. Verizon Communications Inc. (United States) 10.4. AT&T Inc. (United States) 10.5. Ericsson (Sweden) 10.6. Nokia Corporation (Finland) 10.7. Telefonica S.A. (Spain) 10.8. Deutsche Telekom AG (Germany) 10.9. Vodafone Group Plc (United Kingdom) 10.10. Telefonaktiebolaget LM Ericsson (Sweden) 10.11. Huawei Technologies Co., Ltd. (Shenzhen, China) 10.12. ZTE Corporation (China) 10.13. Samsung Electronics Co., Ltd. (South Korea) 10.14. NEC Corporation (Japan) 10.15. China Mobile Communications Corporation (China) 10.16. China Telecommunications Corporation (China) 10.17. China Unicom (Hong Kong) Limited (China) 10.18. Fujitsu Limited (Japan) 10.19. Bharti Airtel Limited (India) 11. Key Findings 12. Industry Recommendations 13. Massive MIMO Market: Research Methodology 14. Terms and Glossary