By 2029, the Global Lubricant Anti-Wear Agents Market is expected to reach US $818.43 Million, thanks to growth in the Type, Application, and Sales Channel segment. The report analyzes market dynamics by region and end-user industries.Lubricant Anti-Wear Agents Market Overview:

The global lubricant anti-wear agents market was valued at US $698 Mn. in 2022, and it is expected to reach US $818.43 Mn. by 2029 with a CAGR of 2.3% during the forecast period. Anti-wear agents, often known as AW additives. These are lubricating agents that prevent metal-to-metal friction between gears parts. One of the important drivers is the collaborations, as well as plant expansions by many prominent manufacturers in the lubricant anti-wear agent’s market. The lubricant anti-wear agents’ market is expected to grow at a CAGR of 2.3% during the forecast period, thanks to lucrative market opportunities in the BRIC (Brazil, Russia, India, and China) areas, as well as increased demand for renewable energy.To know about the Research Methodology :- Request Free Sample Report

COVID–19 Influence on Global Lubricant Anti-Wear Agents Market:

The pandemic of COVID-19 spread to every nation in the world, causing the World Health Organization (WHO) to declare it a public health emergency. Every industry has been affected by the epidemic, including the lubricant anti-wear agents’ market. To prevent the spread of the virus, manufacturing operations were temporarily suspended or restricted in several nations under government-imposed lockdowns. As lubricants have a wide range of applications in manufacturing industries; thus, demand fell in the first half of 2020 but is expected to rise during the forecast period.Lubricant Anti-Wear Agents Market Dynamics:

The automobile sectors lubricating oil agents market is driven by rising sales of passenger automobiles and commercial vehicles. Engine oil, gear oil, transmission fluid, and hydraulic fluid all contain lubricant anti-wear compounds to prevent adhesive wear and protect metal components. As per the EAMA, (European Automobile Manufacturers Association) total motor vehicles in the European Union grew by 6.030,000 automobiles from 302,461,697 in 2017 to 308,392,804 in 2018. Also, over the last five years, the pace of motorization in the Asia Pacific has been constantly rising. As a result, increased demand for automobiles is expected to drive up demand for lubricants, which in turn will drive up demand for lubricant anti-wear agents. The consumption of petroleum products is related to global warming, which is a global issue. Their use has a variety of negative environmental effects, like rising sea levels, high temperatures, severe flooding, and droughts, which are all becoming prevalent. As per the UCS (Union of Concerned Scientists), trucks and cars contribute to around one-fifth of all US emission levels, releasing around 24 pounds of CO2 (Carbon dioxide) and other global-warming pollutants for each gallon of gas used. As a result, many forms of alternative fuels that can replace gasoline and reduce pollution have been developed. Thus, fuel alternatives like biodiesel, ethanol, natural gas, and others are replacing gasoline leading to limitations for the use of anti-wear agents. During the forecast period, the BRICS countries (Brazil, Russia, India, China, and South Africa) are expected to account for a considerable market for lubricant anti-wear agents. As per the World Bank analysis, the BRICS nations contribute about 41% of the global population, which is 31% higher than the G7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States), and this number is expected to grow much more. The BRICS nations together contribute to nearly a fifth of the global economy. The BRICS countries are expected to contribute to over 50 % of global growth between 2016 and 2021. Governments in these countries place a high focus on industrial development to meet the demands of their huge populations. Thus, this is expected to drive all the associated sectors providing lucrative growth opportunities for the anti-wear agents’ market. Since oil costs are so important in the lubricant agent industry, any structural changes in the oil market had an impact on the market for lubricant anti-wear agents. The fluctuation of crude oil prices puts lubricant anti-wear agent manufacturers in a difficult position, limiting earnings. Crude oil is the raw material for anti-wear agents, therefore volatile crude oil prices have impacted the lubricant anti-wear agent value chain in recent years. Oil prices have been above US $100 per barrel in countries that consume a lot of energy since 2011, and have recently dropped to almost US $50 per barrel in March 2022. As a result, lubricant anti-wear manufacturers are facing uncertainty related to shifting crude oil prices. The decision to buy crude oil becomes problematic due to shifting base oil prices, as manufacturers are unaware of the prices at which they should buy crude oil. Thus, it is challenging the growth of the anti-wear agent market globally.Lubricant Anti-Wear Agents Market Segment Analysis:

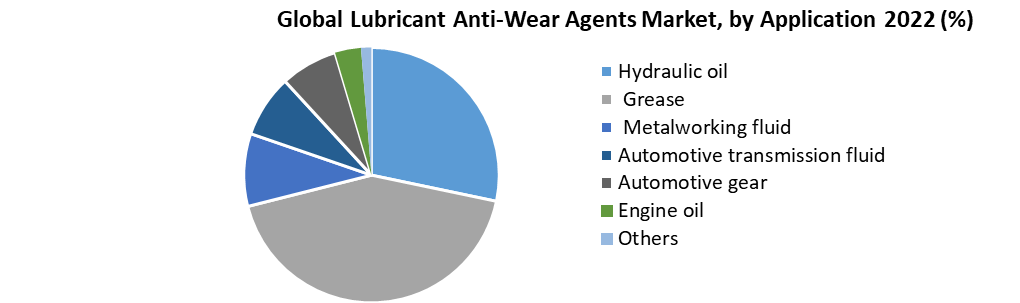

Based on Type, the global Lubricant Anti-wear Agents market is segmented into six types as follows, Zinc Di-thiophosphate (ZDP), Zinc dialkyl Di-thiophosphate (ZDDP), Tricresyl phosphate (TCP), Halocarbons, Stearic acid, and Glycerol mono-oleate. Based on Application, the global lubricant anti-wear agents market is segmented into seven types as follows, hydraulic oil, grease, metalworking fluid, automotive transmission fluid, automotive gear oil, engine oil, and others. In 2022, the Engine oil segment was dominant and held xx% of the overall market share and it is expected to grow at a CAGR of xx% over the forecast period. Engine oil lubricants represent more than half of the lubricant market and so have a much higher demand. They primarily help to prolong the life of automobiles in a variety of situations, like pressure, temperature, and speed. Lubricant’s primary function is to reduce friction and heat generated by moving parts of vehicles, as well as to prevent various pollutants from causing harm. Based on Sales Channel, the global lubricant anti-wear agents market is segmented into two types as follows, captive and merchant. In 2022, the Captive segment was dominant and held xx% of the overall market share and it is expected to grow at a CAGR of xx% over the forecast period. A captive sales channel is a company's operations unit that supports services like manufacturing and sales, among others. It is a separate legal entity that runs and collaborates with the parent company on operational affairs. This enables the organization to reduce total costs associated with the production of lubricants for diverse purposes while maintaining the appropriate additive quality standards. The function of additive suppliers such as lubricant additive component manufacturers and package makers that sell ready-to-use lubricant additive packages is reduced in a captive sales channel.

Lubricant Anti-Wear Agents Market Regional Insights:

In 2022, Asia Pacific was the dominant region and held the highest share 43.57% of the global Lubricant Anti-wear Agents market. During the forecast period, it is also expected to grow with the highest CAGR of xx%. This is mostly related to increased demand from the automotive industry as a result of the rising population. Lubricating oil agents are predominantly made and exported from the Asia Pacific given low labor and production costs. With over 27.8 million automobiles, China is the world's largest automaker. In addition, used automobile sales have seen a huge increase in the country. Automobile vehicle sales have been rising in India in recent years. As a result, the number of active automobiles has increased, resulting in an increasing need for lubricants.Recent Advancements:

• In August 2022, Afton Chemical Company is expanding its blending capabilities for Gasoline Performance Additives (GPA) at its Singapore chemical additive manufacturing facility to focus on global lean supply chain solutions which will enable faster support and effective supply in Asia. This will also give the additional infrastructure required to support the company's global long-term expansion objectives. • In July 2022, QuantiQ Distribuidora Ltd. will be Chevron Oronite's distributor in Brazil, according to the deal. QuantiQ Distribuidora Ltd will distribute Chevron Oronite lubricant additives under the contract, which would enhance the company's supply chain. • In January 2022, InterActive S.A., which specializes in the distribution of lubricant additives in the Israeli, Greek, and Cypriot markets, was acquired by Krahn Chemie GmbH. Krahn Chemie Group is expected to gain a strong foothold in the Israeli market as a result of this strategic acquisition. • In January 2022, Vertellus purchased Bercen Chemicals, which will contribute to the company's current portfolio and serve the North American lubricant additives industry. • In October 2022, the expansion of Afton Chemical Corporation's Japan Technology Center in Tsukuba was completed. This will help to improve the testing capability for lubricant additives. • In April 2022, a groundbreaking ceremony was performed by Mitsui Chemicals for a new factory for Lucant, a leading brand in the Lubrizol Additives business division. The new plant will help meet the increased demand for lubricants in the market. The objective of the report is to present a comprehensive analysis of the global Lubricant Anti-wear Agents market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Lubricant Anti-wear Agents market dynamics, structure by analyzing the market segments and project the global Lubricant Anti-wear Agents market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Lubricant Anti-wear Agents market make the report investor’s guide.Global Lubricant Anti-Wear Agents Market Scope: Inquire before buying

Global Lubricant Anti-Wear Agents Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 698 Mn. Forecast Period 2023 to 2029 CAGR: 2.3% Market Size in 2029: US $ 818.43 Mn. Segments Covered: by Type • Zinc Di-thiophosphate (ZDP) • Zinc dialkyl Di-thiophosphate (ZDDP) • Tricresyl phosphate (TCP) • Halocarbons • Stearic acid • Glycerol mono-oleate by Application • Hydraulic oil • Grease • Metalworking fluid • Automotive transmission fluid • Automotive gear • Engine oil • Others by Sales Channel • Captive • Merchant Lubricant Anti-Wear Agents Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Lubricant Anti-Wear Agents Market, Key Players are:

• Afton Chemical • BASF SE • Chevron Oronite • Solvay • Lanxess • Bercen Chemicals • The Lubrizol Corporation • New Market Corporation • Infineum International Limited • Tianhe Chemicals Group Limited • Baker Hughes • Clariant • ENI • Dorf Ketal • Cerion • Eurolub • Wuxi South Petroleum Additives • Vanderbilt Chemicals • OthersFrequently Asked Questions:

1. What is the forecast period considered for the Lubricant Anti-wear Agents market report? Ans. The forecast period for the Lubricant Anti-wear Agents market is 2023-2029. 2. Which key factors are hindering the growth of the Lubricant Anti-wear Agents market? Ans. The alternative for gasoline fuel like biodiesel, natural gas, ethanol, and many others are the key factors expected to hinder the growth of the Lubricant Anti-wear Agents market. 3. What is the compound annual growth rate (CAGR) of the Lubricant Anti-wear Agents market for the next 6 years? Ans. The global Lubricant Anti-wear Agents market is expected to grow at a CAGR of 2.3% during the forecast period (2023-2029). 4. What are the key factors driving the growth of the Lubricant Anti-wear Agents market? Ans. The increasing demand for anti-wear agents from the automobile sector is driving and expected to drive the growth of the market during the forecast period. 5. Which are the worldwide major key players covered for the Lubricant Anti-wear Agents market report? Ans. Afton Chemical, BASF SE, Chevron Oronite, Solvay, Lanxess, Bercen Chemicals, The Lubrizol Corporation, New Market Corporation, Infineum International Limited, Tianhe Chemicals Group Limited, Baker Hughes, Clariant, ENI, Dorf Ketal, Cerion, Eurolub, Wuxi South Petroleum Additives, Vanderbilt Chemicals, and Others.

1.Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Lubricant Anti-Wear Agents Market Size, by Market Value (US $Mn.) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Lubricant Anti-wear Agents Market 3.4. Geographical Snapshot of the Lubricant Anti-wear Agents Market, By Manufacturer share 4. Global Lubricant Anti-Wear Agents Market Overview, 2023-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Lubricant Anti-wear Agents Market 5. Supply Side and Demand Side Indicators 6. Global Lubricant Anti-Wear Agents Market Analysis and Forecast, 2023-2029 6.1. Global Lubricant Anti-Wear Agents Products Market Size & Y-o-Y Growth Analysis. 7. Global Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 7.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 7.1.1. Zinc Di-thiophosphate (ZDP) 7.1.2. Zinc dialkyl Di-thiophosphate (ZDDP) 7.1.3. Tricresyl phosphate (TCP) 7.1.4. Halocarbons 7.1.5. Stearic acid 7.1.6. Glycerol mono-oleate 7.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 7.2.1. Hydraulic oil 7.2.2. Grease 7.2.3. Metalworking fluid 7.2.4. Automotive transmission fluid 7.2.5. Automotive gear 7.2.6. Engine oil 7.2.7. Others 7.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 7.3.1. Captive 7.3.2. Merchant 8. Global Lubricant Anti-Wear Agents Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2023-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 9.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 9.1.1. Zinc Di-thiophosphate (ZDP) 9.1.2. Zinc dialkyl Di-thiophosphate (ZDDP) 9.1.3. Tricresyl phosphate (TCP) 9.1.4. Halocarbons 9.1.5. Stearic acid 9.1.6. Glycerol mono-oleate 9.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 9.2.1. Hydraulic oil 9.2.2. Grease 9.2.3. Metalworking fluid 9.2.4. Automotive transmission fluid 9.2.5. Automotive gear 9.2.6. Engine oil 9.2.7. Others 9.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 9.3.1. Captive 9.3.2. Merchant 10. North America Lubricant Anti-Wear Agents Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2023-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 11.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 11.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 11.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 12. Canada Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 12.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 12.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 12.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 13. Mexico Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 13.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 13.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 13.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 14. Europe Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 14.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 14.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 14.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 15. Europe Lubricant Anti-Wear Agents Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2023-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 16.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 16.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 16.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 17. France Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 17.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 17.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 17.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 18. Germany Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 18.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 18.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 18.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 19. Italy Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 19.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 19.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 19.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 20. Spain Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 20.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 20.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 20.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 21. Sweden Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 21.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 21.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 21.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 22. CIS Countries Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 22.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 22.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 22.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 23. Rest of Europe Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 23.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 23.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 23.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 24. Asia Pacific Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 24.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 24.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 24.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 25. Asia Pacific Lubricant Anti-Wear Agents Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2023-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 26.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 26.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 26.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 27. India Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 27.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 27.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 27.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 28. Japan Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 28.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 28.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 28.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 29. South Korea Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 29.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 29.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 29.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 30. Australia Fungicide Market Analysis and Forecasts, 2023-2029 30.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 30.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 30.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 31. ASEAN Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 31.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 31.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 31.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 32. Rest of Asia Pacific Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 32.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 32.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 32.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 33. Middle East Africa Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 33.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 33.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 33.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 34. Middle East Africa Lubricant Anti-Wear Agents Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2023-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 35.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 35.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 35.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 36. GCC Countries Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 36.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 36.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 36.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 37. Egypt Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 37.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 37.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 37.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 38. Nigeria Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 38.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 38.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 38.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 39. Rest of ME&A Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 39.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 39.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 39.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 40. South America Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 40.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 40.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 40.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 41. South America Lubricant Anti-Wear Agents Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2023-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 42.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 42.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 42.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 43. Argentina Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 43.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 43.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 43.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 44. Rest of South America Lubricant Anti-Wear Agents Market Analysis and Forecasts, 2023-2029 44.1. Market Size (Value) Estimates & Forecast By Type, 2023-2029 44.2. Market Size (Value) Estimates & Forecast By Application, 2023-2029 44.3. Market Size (Value) Estimates & Forecast By Sales Channel, 2023-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Lubricant Anti-Wear Agents Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Application, and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment, and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 45.3. Company Profile: Key Players 45.3.1. Afton Chemical 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. BASF SE 45.3.3. Chevron Oronite 45.3.4. Solvay 45.3.5. Lanxess 45.3.6. Bercen Chemicals 45.3.7. The Lubrizol Corporation 45.3.8. NewMarket Corporation 45.3.9. Infineum International Limited 45.3.10. Tianhe Chemicals Group Limited 45.3.11. Baker Hughes 45.3.12. Clariant 45.3.13. ENI 45.3.14. Dorf Ketal 45.3.15. Cerion 45.3.16. Eurolub 45.3.17. Wuxi South Petroleum Additives 45.3.18. Vanderbilt Chemicals 45.3.19. Others 46. Primary Key Insights