Livestock Monitoring Market was valued at USD 6.09 Bn. in 2024 and the total Global Livestock Monitoring Market revenue is Expected to grow at a CAGR of 17.2% from 2025 to 2032 reaching nearly USD 21.68 Bn. by 2032.Livestock Monitoring Market Overview:

Livestock monitoring is the systematic observation, tracking, and management of animals raised for agricultural purposes, such as cattle, poultry, swine, and others. This process involves employing various technologies, including sensors, GPS, RFID (Radio-Frequency Identification), and data analytics, to gather real-time information on animal health, behavior, location, and overall well-being. The goal of livestock monitoring is to optimize farming operations, enhance animal productivity, ensure better health management, and improve the efficiency of livestock-related activities within the agricultural industry. The Livestock Monitoring Market has undergone significant evolution, currently standing at the forefront of technological advancement and innovation. With the global livestock industry increasingly embracing modernization, the market for livestock monitoring solutions has witnessed remarkable growth. This growth can be attributed to several factors, including the rising demand for improved livestock management, enhanced productivity, and the need to ensure animal welfare. Technologies such as IoT (Internet of Things), RFID (Radio-Frequency Identification), sensors, GPS tracking systems, and AI (Artificial Intelligence) have revolutionized livestock monitoring, enabling real-time data collection and analysis to monitor the health, behavior, and location of animals. These advancements have resulted in increased adoption rates across various livestock types, including cattle, poultry, swine, and others. Key players in the Livestock Monitoring market have contributed significantly to its development. Companies like DeLaval, Allflex Livestock Intelligence, Afimilk Ltd., and Trimble Inc. have introduced innovative monitoring solutions incorporating cutting-edge technologies. For instance, DeLaval's introduction of advanced milking robots equipped with sensors for monitoring milk quality and cow health, alongside Allflex's RFID-based solutions offering precise livestock identification and health monitoring, exemplify the strides made by market leaders. Additionally, Afimilk's data-driven systems for dairy herd management and Trimble's GPS-enabled livestock tracking systems showcase the industry's commitment to advancing livestock monitoring through sophisticated technologies, ultimately driving the market's growth. The convergence of these technological innovations and the commitment of key market players to provide comprehensive and efficient solutions underscore the promising future trajectory of the Livestock Monitoring Market Demand.To know about the Research Methodology :- Request Free Sample Report

Livestock Monitoring Market Dynamics:

Technological Advancements and Industry Adoption Drives the Livestock Monitoring Market Technological advancements, including the integration of IoT, AI, and RFID, have revolutionized monitoring systems. Companies like Allflex and Quantified AG utilize IoT-based sensors to track animal health and behavior in real-time, enhancing data accuracy for informed decision-making. Moreover, a heightened emphasis on precision livestock farming, exemplified by companies like HerdX, has optimized production through data analytics and monitoring tools, improving efficiency while reducing costs. Concurrently, rising concerns regarding animal health and welfare have fueled the demand for liverstock monitoring market that enhance animal well-being. SCR Dairy and Vital Herd provide wearable devices equipped with sensors to monitor vital parameters, effectively preventing diseases and improving herd health. Government initiatives, such as the EU's regulations on animal identification and traceability, also play a pivotal role in driving adoption by ensuring compliance and food safety. Additionally, the need for remote monitoring and management, coupled with data-driven decision-making, has propelled the market forward. Companies like Afimilk offer cloud-based solutions for remote monitoring, while Connecterra leverages AI-powered analytics to provide actionable insights for informed farm management. Furthermore, the industry's expansion into developing regions like Asia-Pacific and Africa, driven by increasing awareness and investment, signifies a burgeoning market demand for advanced monitoring solutions. Collectively, these drivers underscore the dynamic growth and evolution of the Livestock Monitoring Market, catering to the agriculture industry's evolving needs while fostering sustainable and efficient livestock management practices. For instance, Agriculture Victoria's Livestock Farm Monitor Project provided financial and production data to 124 sheep and beef farmers, supported by over 50 years of funding. Agriculture Victoria Farm Business Economist Sam Henty noted that despite more than 60% of farms investing in new machinery, larger farms demonstrated better cost management by spreading overheads over increased output, resulting in higher returns on assets compared to smaller farms. However, escalating farmland values constrained asset returns due to reduced profitability. Elevated costs, including high fertilizer prices and excessive rainfall, led to a decade-low in phosphorus application rates. Notably, average earnings before interest and tax halved across the state, signaling a significant decline in farm profits, particularly in Gippsland and South West regions, falling below their respective 10-year averages. This downturn contrasts with previous years' robust performance, indicating current challenges impacting livestock farm profitability in Victoria.Livestock Monitoring Market Trends: 1.The adoption of growing Livestock Monitoring Market, and integration of IoT and AI drives real-time data analysis, fostering predictive insights crucial for efficient farm management and productivity enhancement. 2.Wearable sensors and RFID tags are revolutionizing the Livestock Monitoring Market, enabling precise health metric tracking and streamlined livestock management through individual animal identification, bolstering overall efficiency. 3.Cloud-based solutions are pivotal in the Livestock Monitoring Market, empowering remote access and utilization of robust data analytics. This accessibility delivers actionable insights, empowering informed decision-making for farmers, thereby elevating livestock farming practices. 4.Precision farming methodologies dominate the Livestock Monitoring Market, optimizing resource utilization and bolstering production efficiency, thereby revolutionizing and elevating livestock management techniques. 5.The Livestock Monitoring Market witnesses a surge in robotic utilization, particularly in tasks like feeding and health inspections, significantly amplifying operational efficiency and precision in farm management. 6.Environmental sustainability takes center stage in the Livestock Monitoring Market, with integrated monitoring systems crucial in tracking and managing environmental factors, promoting eco-friendly practices and minimizing environmental impact. 7.Enhanced remote monitoring capabilities and user-friendly mobile applications redefine Livestock Monitoring Market standards, simplifying and enhancing livestock management for farmers worldwide. 8.Leveraging big data technologies and satellite mapping revolutionizes the Livestock Monitoring Market, optimizing data management and precision in monitoring practices, ensuring efficient farm operations. 9.Emerging economies spearhead the Livestock Monitoring Market's expansion, fostering industry growth and driving technological innovations, impacting global agricultural practices significantly. 10.Adherence to evolving regulatory standards defines the Livestock Monitoring Market's ethical framework, ensuring animal welfare, and guaranteeing traceability, crucial for maintaining trust and credibility within the industry. Regulatory Standards and Their Impact on Livestock Monitoring Market Growth The high implementation costs associated with integrating sophisticated monitoring technologies pose a significant barrier, particularly for smaller farms. The expenses related to installing IoT sensors or advanced infrastructure can deter smaller operations from embracing these systems, limiting market penetration. Additionally, the lack of stable technological infrastructure in rural areas inhibits the seamless implementation of monitoring solutions, particularly those reliant on stable internet connectivity. Concerns regarding data privacy and security also loom large, as the vast amount of sensitive data collected raises apprehensions about potential breaches or misuse. Addressing the skills gap by providing adequate training and education to farmers is crucial, as the need for specialized knowledge to operate and interpret data from these technologies persists. Resistance to technological change among traditional farmers, interoperability challenges among different systems, and varying regulatory standards across regions further impede the market's growth. Moreover, uncertainties in farm profitability, environmental factors impacting technology reliability, and the limited accuracy of certain monitoring systems collectively contribute to the challenges faced by the Livestock Monitoring Market, slowing down its widespread adoption and scalability. The implementation and adoption of livestock monitoring methods require significant upfront costs, effective farming equipment, and knowledgeable farmers. Farmers must also spend money on sensors, cameras, monitors, RFID tags, GPS systems, and satellite devices, among other hardware, in order to deploy livestock monitoring solutions. This restriction may have a substantial effect on emerging countries like India, China, and Brazil because their farmers' disposable incomes are insufficient to support such cutting-edge solutions. However, technological improvements are expected to bring down the cost of livestock monitoring and management solutions during the forecast period, which in turn spur an increase in demand for sophisticated livestock monitoring market. AI-driven Solutions for Optimal Productivity Boost the Livestock Monitoring Market Technological advancements continue to be a key catalyst, enabling innovative monitoring solutions. Companies like Cainthus harness computer vision and AI for livestock behavior monitoring, showcasing the potential for novel solutions that enhance farm efficiency and animal welfare. Expanding into developing regions, such as Latin America, signifies a substantial market prospect as companies seize the rising demand for advanced monitoring technologies. Precision livestock farming emerges as a focal point, with Connecterra leveraging AI-driven analytics to empower farmers in optimizing productivity and resource utilization. Sustainable practices gain traction, exemplified by Moocall's eco-friendly breeding solutions that align with the growing demand for sustainable farming practices. Integration of IoT and data analytics stands as another significant opportunity; Allflex's utilization of IoT-based sensors illustrates this by providing real-time, accurate data for informed decision-making. Supportive government initiatives, seen in the EU's subsidies for traceability, foster livestock monitoring market growth through incentives for technology adoption Livestock Monitoring Market. Disease management solutions, including Vital Herd's wearable sensors for health monitoring, cater to the escalating demand for proactive disease prevention tools. Robotic automation, exemplified by Lely's robotic milking systems, presents prospects for increased efficiency in livestock management. The surging demand for data-driven insights is met by technologies like Quantified AG's IoT sensors, offering real-time analytics for informed decision-making. Traceability solutions like blockchain, adopted by companies ensuring transparent supply chains, align with consumer demands for food traceability and quality, fostering livestock monitoring market growth through enhanced transparency and consumer trust.

Livestock Monitoring Market Segment Analysis

Based on Animal Type Livestock Monitoring Market Is segmented into Cattle, Poultry, Swine, Equine, and Others. Cattle sub-segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Cattle monitoring applications predominantly focus on health tracking and reproductive management. Technologies such as wearable sensors and RFID tags enable precise health monitoring, aiding in early disease detection and efficient breeding practices. In the Poultry sector, monitoring solutions primarily concentrate on environmental parameters and behavior tracking. Systems incorporating IoT and AI technologies monitor temperature, humidity, and bird behavior, optimizing environmental conditions for enhanced productivity. Based on Component the Livestock Monitoring Market is segmented into Hardware, Software and Services. Hardware segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Dominance due to RFID tags, GPS devices, smart collars, and automated milking systems are the primary tools for real-time animal tracking, health monitoring, and feeding management. High initial adoption costs are offset by long-term efficiency gains, making hardware the largest revenue-generating component.

Livestock Monitoring Market Regional Analysis:

North America region dominated the market in the year 2022 and is expected to continue its dominance during the forecast period. The United States, as a major producer, fosters Livestock Monitoring market growth owing to its advanced technological infrastructure and extensive livestock farming operations. The country showcases a robust demand for monitoring solutions, particularly in cattle and poultry farming, emphasizing health monitoring and precision farming techniques. In tandem, Canada emerges as another significant producer, leveraging sophisticated monitoring technologies in dairy and swine farming, focusing on optimizing feed management and environmental monitoring. As a large consuming region, North America demonstrates an increasing adoption rate of livestock monitoring solutions, driven by a growing emphasis on farm efficiency and animal welfare. The region's import-export data signifies a balanced market, with limited imports mainly for technological advancements and varied export dynamics. North American countries primarily export monitoring technologies and systems to emerging economies, offering innovative solutions and expertise. Import-wise, there's a limited inflow of specialized monitoring equipment from technologically advanced markets, enhancing the region's access to cutting-edge technologies. Overall, North America's Livestock Monitoring Market reflects a dynamic landscape driven by both production prowess and technological advancements, coupled with a growing demand for innovative solutions domestically and a strategic export outlook toward emerging markets.Competitive Landscape:

Livestock Monitoring comprises industry leaders and innovators such as GEA Farm Technologies, DeLaval, and Afimilk Ltd., excelling in comprehensive monitoring solutions. BouMatic, Merck Animal Health, and Dairymaster Ltd. focus on health-centric solutions, while Lely International NV and Fullwood Packo Ltd. specialize in automated systems. Nedap NV, GEA Group Aktiengesellschaft, and Fancom BV emphasize precision farming. Emerging players like Sensaphone, Connecterra, and Cainthus offer IoT-driven solutions, while SmartShepherd, Quantified AG, and Cainthus pioneer AI-based analytics for livestock health and behavior monitoring, creating a competitive landscape driven by diverse technological innovations and specialized market niches.Livestock Monitoring Market Scope: Inquire before buying

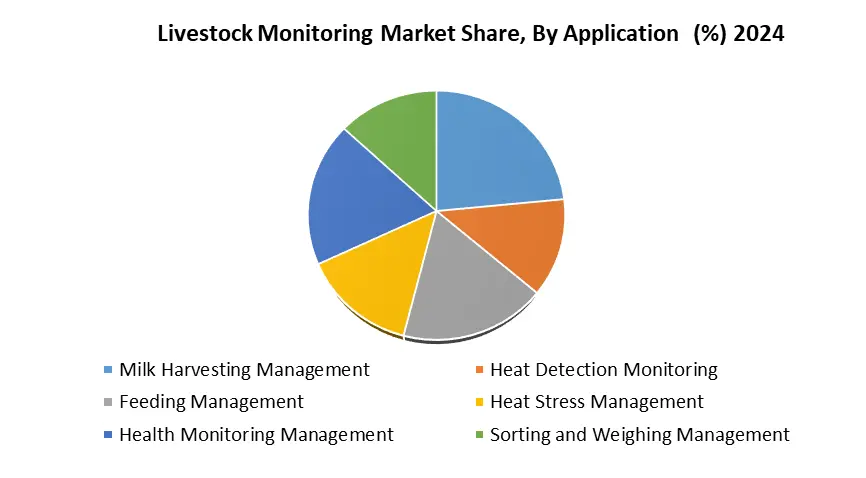

Global Livestock Monitoring Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 6.09 Bn. Forecast Period 2025 to 2032 CAGR: 17.2% Market Size in 2032: USD 21.68 Bn. Segments Covered: by Animal Type Cattle Poultry Swine Equine Others by Component Hardware Software Services by Offering Technology Radio Frequency Identification(RFID) Global Positioning System(GPS) Sensors Others by Application Milk Harvesting Management Heat Detection Monitoring Feeding Management Heat Stress Management Health Monitoring Management Sorting and Weighing Management by End Use Dairy Farms Meat Production Farms Small Farms / Household Farms Large Commercial Farms Livestock Monitoring Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Livestock Monitoring Market, Key Players:

Global Leading Key Players: (with operations in various regions): 1. Afimilk Ltd. 2. Connecterra 3. Cainthus 4. SmartShepherd 5. Quantified AG Europe 1. GEA Farm Technologies 2. DeLaval 3. BouMatic, LLC 4. Merck Animal Health 5. Dairymaster Ltd. 6. Lely International NV 7. Fullwood Packo Ltd. 8. Nedap NV 9. GEA Group Aktiengesellschaft 10. Sensaphone Netherland 1. Fancom BV 2. Nedap NV FAQ: 1] Which region is expected to hold the highest share in the Livestock Monitoring Market? Ans. North American region is expected to hold the highest share in the Livestock Monitoring Market. 2] Who are the top key players in the Livestock Monitoring Market? Ans. GEA Farm Technologies, DeLaval, Afimilk Ltd., BouMatic, LLC, Merck Animal Health, Dairymaster Ltd., and Lely International NV are the top key players in the Livestock Monitoring Market. 3] Which segment is expected to hold the largest market share in the Livestock Monitoring Market by 2032? Ans. The cattle Livestock Type segment is expected to hold the largest market share in the Livestock Monitoring Market by 2032. 4] What is the market size of the Livestock Monitoring Market by 2024? Ans. The market size of the Livestock Monitoring Market is expected to reach USD 6.09 Bn. by 2024. 5] What was the market size of the Livestock Monitoring Market in 2032? Ans. The market size of the Livestock Monitoring Market was worth USD 21.68 Billion in 2032.

1. Livestock Monitoring Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Livestock Monitoring Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Livestock Monitoring Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Livestock Monitoring Market: Dynamics 3.1. Livestock Monitoring Market Trends by Region 3.1.1. North America Livestock Monitoring Market Trends 3.1.2. Europe Livestock Monitoring Market Trends 3.1.3. Asia Pacific Livestock Monitoring Market Trends 3.1.4. Middle East and Africa Livestock Monitoring Market Trends 3.1.5. South America Livestock Monitoring Market Trends 3.2. Livestock Monitoring Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Livestock Monitoring Market Drivers 3.2.1.2. North America Livestock Monitoring Market Restraints 3.2.1.3. North America Livestock Monitoring Market Opportunities 3.2.1.4. North America Livestock Monitoring Market Challenges 3.2.2. Europe 3.2.2.1. Europe Livestock Monitoring Market Drivers 3.2.2.2. Europe Livestock Monitoring Market Restraints 3.2.2.3. Europe Livestock Monitoring Market Opportunities 3.2.2.4. Europe Livestock Monitoring Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Livestock Monitoring Market Drivers 3.2.3.2. Asia Pacific Livestock Monitoring Market Restraints 3.2.3.3. Asia Pacific Livestock Monitoring Market Opportunities 3.2.3.4. Asia Pacific Livestock Monitoring Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Livestock Monitoring Market Drivers 3.2.4.2. Middle East and Africa Livestock Monitoring Market Restraints 3.2.4.3. Middle East and Africa Livestock Monitoring Market Opportunities 3.2.4.4. Middle East and Africa Livestock Monitoring Market Challenges 3.2.5. South America 3.2.5.1. South America Livestock Monitoring Market Drivers 3.2.5.2. South America Livestock Monitoring Market Restraints 3.2.5.3. South America Livestock Monitoring Market Opportunities 3.2.5.4. South America Livestock Monitoring Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Livestock Monitoring Industry 3.8. Analysis of Government Schemes and Initiatives For Livestock Monitoring Industry 3.9. Livestock Monitoring Market Trade Analysis 3.10. The Global Pandemic Impact on Livestock Monitoring Market 4. Livestock Monitoring Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 4.1.1. Cattle 4.1.2. Poultry 4.1.3. Swine 4.1.4. Equine 4.1.5. Others 4.2. Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 4.2.1. Hardware 4.2.2. Software 4.2.3. Services 4.3. Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 4.3.1. Radio Frequency Identification(RFID) 4.3.2. Global Positioning System(GPS) 4.3.3. Sensors 4.3.4. Others 4.4. Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 4.4.1. Milk Harvesting Management 4.4.2. Heat Detection Monitoring 4.4.3. Feeding Management 4.4.4. Heat Stress Management 4.4.5. Health Monitoring Management 4.4.6. Sorting and Weighing Management 4.5. Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 4.5.1. Dairy Farms 4.5.2. Meat Production Farms 4.5.3. Small Farms / Household Farms 4.5.4. Large Commercial Farms 4.6. Livestock Monitoring Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Livestock Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 5.1.1. Cattle 5.1.2. Poultry 5.1.3. Swine 5.1.4. Equine 5.1.5. Others 5.2. North America Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 5.2.1. Hardware 5.2.2. Software 5.2.3. Services 5.3. North America Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 5.3.1. Radio Frequency Identification(RFID) 5.3.2. Global Positioning System(GPS) 5.3.3. Sensors 5.3.4. Others 5.4. North America Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 5.4.1. Milk Harvesting Management 5.4.2. Heat Detection Monitoring 5.4.3. Feeding Management 5.4.4. Heat Stress Management 5.4.5. Health Monitoring Management 5.4.6. Sorting and Weighing Management 5.5. North America Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 5.5.1. Dairy Farms 5.5.2. Meat Production Farms 5.5.3. Small Farms / Household Farms 5.5.4. Large Commercial Farms 5.6. North America Livestock Monitoring Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 5.6.1.1.1. Cattle 5.6.1.1.2. Poultry 5.6.1.1.3. Swine 5.6.1.1.4. Equine 5.6.1.1.5. Others 5.6.1.2. United States Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 5.6.1.2.1. Hardware 5.6.1.2.2. Software 5.6.1.2.3. Services 5.6.1.3. United States Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 5.6.1.3.1. Radio Frequency Identification(RFID) 5.6.1.3.2. Global Positioning System(GPS) 5.6.1.3.3. Sensors 5.6.1.3.4. Others 5.6.1.4. United States Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Milk Harvesting Management 5.6.1.4.2. Heat Detection Monitoring 5.6.1.4.3. Feeding Management 5.6.1.4.4. Heat Stress Management 5.6.1.4.5. Health Monitoring Management 5.6.1.4.6. Sorting and Weighing Management 5.6.1.5. United States Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 5.6.1.5.1. Dairy Farms 5.6.1.5.2. Meat Production Farms 5.6.1.5.3. Small Farms / Household Farms 5.6.1.5.4. Large Commercial Farms 5.6.2. Canada 5.6.2.1. Canada Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 5.6.2.1.1. Cattle 5.6.2.1.2. Poultry 5.6.2.1.3. Swine 5.6.2.1.4. Equine 5.6.2.1.5. Others 5.6.2.2. Canada Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 5.6.2.2.1. Hardware 5.6.2.2.2. Software 5.6.2.2.3. Services 5.6.2.3. Canada Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 5.6.2.3.1. Radio Frequency Identification(RFID) 5.6.2.3.2. Global Positioning System(GPS) 5.6.2.3.3. Sensors 5.6.2.3.4. Others 5.6.2.4. Canada Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Milk Harvesting Management 5.6.2.4.2. Heat Detection Monitoring 5.6.2.4.3. Feeding Management 5.6.2.4.4. Heat Stress Management 5.6.2.4.5. Health Monitoring Management 5.6.2.4.6. Sorting and Weighing Management 5.6.2.5. Canada Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 5.6.2.5.1. Dairy Farms 5.6.2.5.2. Meat Production Farms 5.6.2.5.3. Small Farms / Household Farms 5.6.2.5.4. Large Commercial Farms 5.6.3. Mexico 5.6.3.1. Mexico Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 5.6.3.1.1. Cattle 5.6.3.1.2. Poultry 5.6.3.1.3. Swine 5.6.3.1.4. Equine 5.6.3.1.5. Others 5.6.3.2. Mexico Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 5.6.3.2.1. Hardware 5.6.3.2.2. Software 5.6.3.2.3. Services 5.6.3.3. Mexico Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 5.6.3.3.1. Radio Frequency Identification(RFID) 5.6.3.3.2. Global Positioning System(GPS) 5.6.3.3.3. Sensors 5.6.3.3.4. Others 5.6.3.4. Mexico Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Milk Harvesting Management 5.6.3.4.2. Heat Detection Monitoring 5.6.3.4.3. Feeding Management 5.6.3.4.4. Heat Stress Management 5.6.3.4.5. Health Monitoring Management 5.6.3.4.6. Sorting and Weighing Management 5.6.3.5. Mexico Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 5.6.3.5.1. Dairy Farms 5.6.3.5.2. Meat Production Farms 5.6.3.5.3. Small Farms / Household Farms 5.6.3.5.4. Large Commercial Farms 6. Europe Livestock Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 6.2. Europe Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 6.3. Europe Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 6.4. Europe Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 6.5. Europe Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 6.6. Europe Livestock Monitoring Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 6.6.1.2. United Kingdom Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.1.3. United Kingdom Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 6.6.1.4. United Kingdom Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 6.6.2. France 6.6.2.1. France Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 6.6.2.2. France Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.2.3. France Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 6.6.2.4. France Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 6.6.3.2. Germany Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.3.3. Germany Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 6.6.3.4. Germany Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 6.6.4.2. Italy Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.4.3. Italy Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 6.6.4.4. Italy Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 6.6.5.2. Spain Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.5.3. Spain Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 6.6.5.4. Spain Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 6.6.6.2. Sweden Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.6.3. Sweden Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 6.6.6.4. Sweden Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 6.6.7.2. Austria Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.7.3. Austria Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 6.6.7.4. Austria Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 6.6.8.2. Rest of Europe Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 6.6.8.3. Rest of Europe Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 6.6.8.4. Rest of Europe Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific Livestock Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.2. Asia Pacific Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.3. Asia Pacific Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.4. Asia Pacific Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6. Asia Pacific Livestock Monitoring Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.1.2. China Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.1.3. China Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.1.4. China Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.2.2. S Korea Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.2.3. S Korea Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.2.4. S Korea Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.3.2. Japan Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.3.3. Japan Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.3.4. Japan Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6.4. India 7.6.4.1. India Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.4.2. India Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.4.3. India Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.4.4. India Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.5.2. Australia Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.5.3. Australia Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.5.4. Australia Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.6.2. Indonesia Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.6.3. Indonesia Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.6.4. Indonesia Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.7.2. Malaysia Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.7.3. Malaysia Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.7.4. Malaysia Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.8.2. Vietnam Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.8.3. Vietnam Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.8.4. Vietnam Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.9.2. Taiwan Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.9.3. Taiwan Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.9.4. Taiwan Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 7.6.10.2. Rest of Asia Pacific Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 7.6.10.3. Rest of Asia Pacific Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 7.6.10.4. Rest of Asia Pacific Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa Livestock Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 8.2. Middle East and Africa Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 8.3. Middle East and Africa Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 8.4. Middle East and Africa Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 8.6. Middle East and Africa Livestock Monitoring Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 8.6.1.2. South Africa Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 8.6.1.3. South Africa Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 8.6.1.4. South Africa Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 8.6.2.2. GCC Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 8.6.2.3. GCC Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 8.6.2.4. GCC Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 8.6.3.2. Nigeria Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 8.6.3.3. Nigeria Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 8.6.3.4. Nigeria Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 8.6.4.2. Rest of ME&A Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 8.6.4.3. Rest of ME&A Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 8.6.4.4. Rest of ME&A Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 9. South America Livestock Monitoring Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 9.2. South America Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 9.3. South America Livestock Monitoring Market Size and Forecast, by Offering Technology(2024-2032) 9.4. South America Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 9.5. South America Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 9.6. South America Livestock Monitoring Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 9.6.1.2. Brazil Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 9.6.1.3. Brazil Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 9.6.1.4. Brazil Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 9.6.2.2. Argentina Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 9.6.2.3. Argentina Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 9.6.2.4. Argentina Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Livestock Monitoring Market Size and Forecast, by Animal Type (2024-2032) 9.6.3.2. Rest Of South America Livestock Monitoring Market Size and Forecast, by Component (2024-2032) 9.6.3.3. Rest Of South America Livestock Monitoring Market Size and Forecast, by Offering Technology (2024-2032) 9.6.3.4. Rest Of South America Livestock Monitoring Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Livestock Monitoring Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. Afimilk Ltd. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Connecterra 10.3. Cainthus 10.4. SmartShepherd 10.5. Quantified AG 10.6. GEA Farm Technologies 10.7. DeLaval 10.8. BouMatic, LLC 10.9. Merck Animal Health 10.10. Dairymaster Ltd. 10.11. Lely International NV 10.12. Fullwood Packo Ltd. 10.13. Nedap NV 10.14. GEA Group Aktiengesellschaft 10.15. Sensaphone 10.16. Fancom BV 10.17. Nedap NV 11. Key Findings 12. Industry Recommendations 13. Livestock Monitoring Market: Research Methodology 14. Terms and Glossary