The Semiconductor Lithography Equipment Market size was valued at USD 24.58 Billion in 2023 and the total Semiconductor Lithography Equipment Market revenue is expected to grow at a CAGR of 7.32% from 2024 to 2030, reaching nearly USD 35.79 Billion by 2030.Semiconductor Lithography Equipment Market Overview

Semiconductor lithography equipment is crucial for the semiconductor manufacturing process, as it is used to imprint intricate circuit patterns onto silicon wafers. This is achieved by directing a powerful ultraviolet (UV) light through a photomask, which serves as a template for the desired circuit design. The pattern is then transferred onto the silicon wafer, which is coated with a light-sensitive material known as photoresist. In the Semiconductor Lithography Equipment Market.To know about the Research Methodology:-Request Free Sample Report 1. UV Light and Photomasks - Traditional lithography systems utilize ultraviolet light to project circuit patterns from a photomask onto silicon wafers. This process forms the foundational structures of semiconductor devices. 2. Extreme Ultraviolet (EUV) Lithography - In recent advancements, lithography equipment has begun using extreme ultraviolet (EUV) light with a wavelength of 13 nm. EUV lithography allows for the creation of much finer circuit patterns, essential for modern, highly miniaturized semiconductor components. 3. High Precision Requirements - The precision required in positioning and alignment during the lithography process is extremely high. This precision is vital to ensure the accuracy of the circuit patterns and the overall functionality of the semiconductor devices. 4. Cost of Equipment - Due to the complexity and precision required, lithography equipment is notably expensive. The high cost reflects the advanced technology and engineering involved in manufacturing these sophisticated machines. Singapore, March 13, 2023 - Canon has announced the release of the FPA-5550iX i-line stepper, a cutting-edge semiconductor lithography system for front-end processes. This advanced system boasts a large exposure field of 50 x 50 mm and a high resolution of 0.5 micrometres, making it ideal for producing high-precision full-frame CMOS sensors and micro-OLED panels for XR devices. The FPA-5550iX features enhanced alignment capabilities, including a new dark-field detection function, and integrates seamlessly with Canon’s Lithography Plus solution platform for optimal performance and quality control in the Semiconductor Lithography Equipment Market. September 2022 - Canon Inc. launched the "Lithography Plus1" solution platform for semiconductor lithography systems. Canon's more than 50 years of experience in semiconductor lithography system support and the company's vast wealth of data are incorporated into the system to maximize support efficiency and propose and implement optimized system processes. Semiconductor Lithography Equipment Market Drivers and Restraints: The semiconductor lithography equipment market is driven by the increasing demand for advanced consumer electronics, such as smartphones, tablets, and wearable devices, which is propelling the need for more sophisticated and miniaturized semiconductor components. This trend is pushing semiconductor manufacturers to adopt cutting-edge lithography technologies, such as extreme ultraviolet (EUV) lithography, which allows for the production of smaller and more complex circuit patterns on silicon wafers. Additionally, the rise of artificial intelligence (AI), the Internet of Things (IoT), and 5G technologies is further fuelling the demand for high-performance semiconductor devices, thereby boosting the Semiconductor Lithography Equipment Market. The semiconductor lithography equipment market has a significant trend in the transition towards EUV lithography, which uses a wavelength of 13.5 nm to create extremely fine patterns on semiconductor wafers. This technology is crucial for manufacturing the latest generation of chips used in high-performance computing and data centers. Another trend is the increasing automation and digitalization of semiconductor manufacturing processes. The integration of AI and machine learning algorithms in lithography equipment helps improve precision, reduce defects, and enhance overall production efficiency. Also, there is a growing focus on sustainability, with manufacturers investing in eco-friendly lithography solutions that minimize energy consumption and waste in the Semiconductor Lithography Equipment Market. The semiconductor lithography equipment market faces challenges due to the high cost of advanced lithography systems, particularly EUV lithography machines, which cost upwards of USD 150 million each. This significant investment is barrier for many semiconductor manufacturers, particularly smaller firms. Another challenge is the complexity of maintaining and operating these advanced systems, which require specialized knowledge and skills. Additionally, the semiconductor industry is currently grappling with supply chain disruptions and shortages of critical components, which delay the production and deployment of new lithography equipment.

Semiconductor Lithography Equipment Market Segment Analysis

Semiconductor Lithography Equipment Market Growth Based on, Technology The semiconductor lithography equipment market is segmented by technology into ultraviolet (UV) lithography, laser lithography beam, and electron lithography. In 2023, UV lithography, particularly extreme ultraviolet (EUV) lithography, is the dominant segment. EUV lithography has become crucial for producing advanced semiconductor devices due to its ability to create extremely fine and precise patterns on silicon wafers. This technology is essential for manufacturing the latest high-performance chips used in artificial intelligence, 5G, and high-end consumer electronics. The demand for smaller, faster, and more efficient semiconductor devices has driven the adoption of EUV lithography, securing its leading position in the market.Semiconductor Lithography Equipment Market Growth Based on, by Substrate The substrate segment of the semiconductor lithography equipment market includes silicon wafers, silicon insulator wafers, silicon carbide, and gallium nitride (GaN). In 2023, silicon wafers dominate this segment, primarily because they are the most commonly used substrate in the semiconductor industry. Silicon wafers are fundamental in the production of a wide range of semiconductor devices due to their excellent electronic properties, cost-effectiveness, and well-established manufacturing processes. While other substrates like silicon carbide and GaN are gaining traction for specific applications such as power electronics and high-frequency devices, silicon wafers remain the preferred choice for mainstream semiconductor manufacturing.

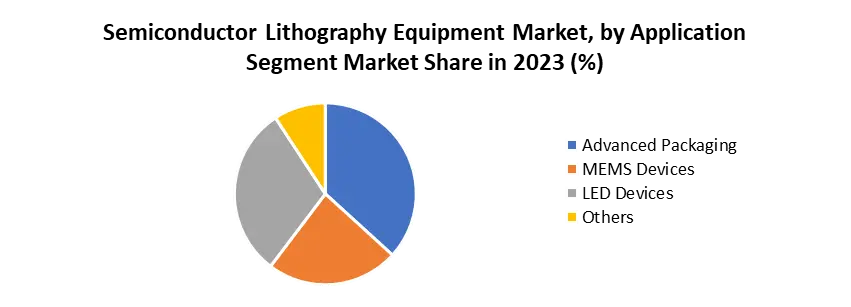

Semiconductor Lithography Equipment Market Growth Based on, by Application The market segmentation by application includes advanced packaging, MEMS devices, LED devices, and others. In 2023, advanced packaging is the leading segment, driven by the increasing complexity and performance requirements of modern semiconductor devices. Advanced packaging technologies, such as 3D packaging and system-in-package (SiP), are essential for enhancing the performance, reducing the size, and improving the power efficiency of semiconductor devices. These technologies are crucial for applications in high-performance computing, mobile devices, and automotive electronics. The growing demand for advanced semiconductor solutions in these areas has propelled advanced packaging to the forefront of the semiconductor lithography equipment market.

Semiconductor Lithography Equipment Market Regional Analysis

North America holds a significant share of the semiconductor lithography equipment market, driven by the presence of major semiconductor manufacturers and technology companies in the United States. The region's robust research and development ecosystem, coupled with substantial investments in advanced semiconductor technologies, underpins its market dominance. The demand for cutting-edge electronics, such as AI processors, 5G infrastructure, and advanced consumer electronics, fuels the growth of the semiconductor lithography equipment market in North America. In 2023, the U.S. continues to be a leader, leveraging its technological advancements and innovation capabilities to maintain a competitive edge in semiconductor manufacturing. In the semiconductor lithography equipment market, the United States and the Netherlands are prominent players, with companies like Applied Materials and ASML holding significant market shares. ASML, headquartered in the Netherlands, is the leading supplier of EUV lithography machines and plays a crucial role in the global semiconductor supply chain. Japan is another key player, with companies like Nikon and Canon being major suppliers of lithography equipment. According to market data, the Asia-Pacific region, particularly Taiwan, South Korea, and China, dominates the semiconductor manufacturing landscape. Taiwan, home to Taiwan Semiconductor Manufacturing Company (TSMC), held a substantial share of the market, followed by South Korea's Samsung and SK Hynix. China is rapidly expanding its semiconductor manufacturing capabilities, aiming to reduce its reliance on foreign technology and become self-sufficient in semiconductor production. In 2023, the Asia-Pacific region accounted for over 35% of the global market, underscoring its dominance in the industry.Semiconductor Lithography Equipment Market Scope: Inquire before buying

Semiconductor Lithography Equipment Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 24.58 Bn. Forecast Period 2024 to 2030 CAGR: 7.32% Market Size in 2030: US $ 35.79 Bn. Segments Covered: by Technology Ultraviolet Laser Lithography Beam Electron Lithography by Substrate Silicon Wafers Silicon Insulator wafer Silicon Carbide GaN by Application Advanced Packaging MEMS Devices LED Devices Others Semiconductor Lithography Equipment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Semiconductor Lithography Equipment Manufacturers include:

1. Canon Inc. 2. Nikon Corporation 3. ASML Holding NV 4. Veeco Instruments Inc. 5. SÜSS MicroTec SE 6. Shanghai Micro Electronics Equipment (Group) Co. Ltd 7. EV Group (EVG) 8. JEOL Ltd 9. Onto Innovation (Rudolph Technologies Inc.) 10. Neutronix Quintel Inc. (NXQ) 11. Newfire Technology Frequently Asked Questions: 1] What is the growth rate of the Global Market? Ans. The Global Market is growing at a significant rate of 7.32% during the forecast period. 2] Which region is expected to dominate the Global Market? Ans. North America is expected to dominate the Semiconductor Lithography Equipment Market during the forecast period. 3] What is the expected Global Market size by 2030? Ans. The Semiconductor Lithography Equipment Market size is expected to reach USD 35.79 Bn by 2030. 4] Which are the top players in the Global Market? Ans. Canon Inc., Nikon Corporation, ASML Holding NV, Veeco Instruments Inc., SÜSS MicroTec SE. 5] What are the factors driving the Global Semiconductor Lithography Equipment Market growth? Ans. The increasing demand for advanced consumer electronics drive the growth of the Semiconductor Lithography Equipment market during the forecast period. 6] Which country held the largest Global Market share in 2023? Ans. In 2023, the United States held the largest share of the market in the North America region.

1. Semiconductor Lithography Equipment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Semiconductor Lithography Equipment Market: Dynamics 2.1. Semiconductor Lithography Equipment Market Trends by Region 2.1.1. North America Semiconductor Lithography Equipment Market Trends 2.1.2. Europe Semiconductor Lithography Equipment Market Trends 2.1.3. Asia Pacific Semiconductor Lithography Equipment Market Trends 2.1.4. Middle East and Africa Semiconductor Lithography Equipment Market Trends 2.1.5. South America Semiconductor Lithography Equipment Market Trends 2.2. Semiconductor Lithography Equipment Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Semiconductor Lithography Equipment Market Drivers 2.2.1.2. North America Semiconductor Lithography Equipment Market Restraints 2.2.1.3. North America Semiconductor Lithography Equipment Market Opportunities 2.2.1.4. North America Semiconductor Lithography Equipment Market Challenges 2.2.2. Europe 2.2.2.1. Europe Semiconductor Lithography Equipment Market Drivers 2.2.2.2. Europe Semiconductor Lithography Equipment Market Restraints 2.2.2.3. Europe Semiconductor Lithography Equipment Market Opportunities 2.2.2.4. Europe Semiconductor Lithography Equipment Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Semiconductor Lithography Equipment Market Drivers 2.2.3.2. Asia Pacific Semiconductor Lithography Equipment Market Restraints 2.2.3.3. Asia Pacific Semiconductor Lithography Equipment Market Opportunities 2.2.3.4. Asia Pacific Semiconductor Lithography Equipment Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Semiconductor Lithography Equipment Market Drivers 2.2.4.2. Middle East and Africa Semiconductor Lithography Equipment Market Restraints 2.2.4.3. Middle East and Africa Semiconductor Lithography Equipment Market Opportunities 2.2.4.4. Middle East and Africa Semiconductor Lithography Equipment Market Challenges 2.2.5. South America 2.2.5.1. South America Semiconductor Lithography Equipment Market Drivers 2.2.5.2. South America Semiconductor Lithography Equipment Market Restraints 2.2.5.3. South America Semiconductor Lithography Equipment Market Opportunities 2.2.5.4. South America Semiconductor Lithography Equipment Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Semiconductor Lithography Equipment Industry 2.8. Analysis of Government Schemes and Initiatives For Semiconductor Lithography Equipment Industry 2.9. Semiconductor Lithography Equipment Market Trade Analysis 2.10. The Global Pandemic Impact on Semiconductor Lithography Equipment Market 3. Semiconductor Lithography Equipment Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 3.1.1. Ultraviolet 3.1.2. Laser Lithography Beam 3.1.3. Electron Lithography 3.1.4. 3.1.5. 3.1.6. 3.1.7. 3.2. Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 3.2.1. Silicon Wafers 3.2.2. Silicon Insulator wafer 3.2.3. Silicon Carbide 3.2.4. GaN 3.3. Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 3.3.1. Advanced Packaging 3.3.2. MEMS Devices 3.3.3. LED Devices 3.3.4. Others 3.4. Semiconductor Lithography Equipment Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Semiconductor Lithography Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 4.1.1. Ultraviolet 4.1.2. Laser Lithography Beam 4.1.3. Electron Lithography 4.2. North America Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 4.2.1. Silicon Wafers 4.2.2. Silicon Insulator wafer 4.2.3. Silicon Carbide 4.2.4. GaN 4.3. North America Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 4.3.1. Advanced Packaging 4.3.2. MEMS Devices 4.3.3. LED Devices 4.3.4. Others 4.4. North America Semiconductor Lithography Equipment Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 4.4.1.1.1. Ultraviolet 4.4.1.1.2. Laser Lithography Beam 4.4.1.1.3. Electron Lithography 4.4.1.2. United States Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 4.4.1.2.1. Silicon Wafers 4.4.1.2.2. Silicon Insulator wafer 4.4.1.2.3. Silicon Carbide 4.4.1.2.4. GaN 4.4.1.3. United States Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Advanced Packaging 4.4.1.3.2. MEMS Devices 4.4.1.3.3. LED Devices 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 4.4.2.1.1. Ultraviolet 4.4.2.1.2. Laser Lithography Beam 4.4.2.1.3. Electron Lithography 4.4.2.2. Canada Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 4.4.2.2.1. Silicon Wafers 4.4.2.2.2. Silicon Insulator wafer 4.4.2.2.3. Silicon Carbide 4.4.2.2.4. GaN 4.4.2.3. Canada Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Advanced Packaging 4.4.2.3.2. MEMS Devices 4.4.2.3.3. LED Devices 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 4.4.3.1.1. Ultraviolet 4.4.3.1.2. Laser Lithography Beam 4.4.3.1.3. Electron Lithography 4.4.3.2. Mexico Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 4.4.3.2.1. Silicon Wafers 4.4.3.2.2. Silicon Insulator wafer 4.4.3.2.3. Silicon Carbide 4.4.3.2.4. GaN 4.4.3.3. Mexico Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Advanced Packaging 4.4.3.3.2. MEMS Devices 4.4.3.3.3. LED Devices 4.4.3.3.4. Others 5. Europe Semiconductor Lithography Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 5.2. Europe Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 5.3. Europe Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 5.4. Europe Semiconductor Lithography Equipment Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 5.4.1.2. United Kingdom Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 5.4.1.3. United Kingdom Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 5.4.2.2. France Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 5.4.2.3. France Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 5.4.3.2. Germany Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 5.4.3.3. Germany Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 5.4.4.2. Italy Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 5.4.4.3. Italy Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 5.4.5.2. Spain Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 5.4.5.3. Spain Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 5.4.6.2. Sweden Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 5.4.6.3. Sweden Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 5.4.7.2. Austria Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 5.4.7.3. Austria Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 5.4.8.2. Rest of Europe Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 5.4.8.3. Rest of Europe Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Semiconductor Lithography Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.3. Asia Pacific Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Semiconductor Lithography Equipment Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.1.2. China Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.1.3. China Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.2.2. S Korea Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.2.3. S Korea Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.3.2. Japan Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.3.3. Japan Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.4.2. India Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.4.3. India Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.5.2. Australia Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.5.3. Australia Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.6.2. Indonesia Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.6.3. Indonesia Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.7.2. Malaysia Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.7.3. Malaysia Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.8.2. Vietnam Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.8.3. Vietnam Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.9.2. Taiwan Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.9.3. Taiwan Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 6.4.10.2. Rest of Asia Pacific Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 6.4.10.3. Rest of Asia Pacific Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Semiconductor Lithography Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 7.3. Middle East and Africa Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Semiconductor Lithography Equipment Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 7.4.1.2. South Africa Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 7.4.1.3. South Africa Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 7.4.2.2. GCC Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 7.4.2.3. GCC Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 7.4.3.2. Nigeria Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 7.4.3.3. Nigeria Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 7.4.4.2. Rest of ME&A Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 7.4.4.3. Rest of ME&A Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 8. South America Semiconductor Lithography Equipment Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 8.2. South America Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 8.3. South America Semiconductor Lithography Equipment Market Size and Forecast, by Application(2023-2030) 8.4. South America Semiconductor Lithography Equipment Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 8.4.1.2. Brazil Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 8.4.1.3. Brazil Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 8.4.2.2. Argentina Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 8.4.2.3. Argentina Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Semiconductor Lithography Equipment Market Size and Forecast, by Technology (2023-2030) 8.4.3.2. Rest Of South America Semiconductor Lithography Equipment Market Size and Forecast, by Substrate (2023-2030) 8.4.3.3. Rest Of South America Semiconductor Lithography Equipment Market Size and Forecast, by Application (2023-2030) 9. Global Semiconductor Lithography Equipment Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Semiconductor Lithography Equipment Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Canon Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Nikon Corporation 10.3. ASML Holding NV 10.4. Veeco Instruments Inc. 10.5. SÜSS MicroTec SE 10.6. Shanghai Micro Electronics Equipment (Group) Co. Ltd 10.7. EV Group (EVG) 10.8. JEOL Ltd 10.9. Onto Innovation (Rudolph Technologies Inc.) 10.10. Neutronix Quintel Inc. (NXQ) 10.11. Newfire Technology 11. Key Findings 12. Industry Recommendations 13. Semiconductor Lithography Equipment Market: Research Methodology 14. Terms and Glossary