Citrus Fiber Market size was valued at USD 42.7 Billion in 2023 and the Citrus Fiber Market revenue is expected to reach USD 72.6 Billion by 2030, at a CAGR of 5.9 % over the forecast period.Citrus Fiber Market Overview

Citrus fiber, also known as citrus pulp or citrus peel fiber, is a natural dietary fiber formed from citrus fruit waste byproducts, typically orange, lemon, and other citrus fruit peels. Because of its functional qualities, it is an important ingredient in the food sector. Citrus fiber is high in both soluble and insoluble fiber, and it has a variety of health benefits, including enhanced digestive health, lower cholesterol levels, and blood sugar management. It is commonly used as a thickener, stabilizer, and texturizer in a variety of food products such as sauces, dressings, baked goods, and meat products to improve texture, moisture retention, and shelf life. Furthermore, its propensity to absorb and retain water makes it a beneficial element in the formulation of low-fat and low-calorie foods.To know about the Research Methodology :- Request Free Sample Report Citrus Fiber is not limited to a specific geographical region. The Citrus Fiber Market has a global presence, with consumers across different continents interested in these supplements. This Citrus Fiber Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Citrus Fiber Market report showcases the Citrus Fiber market situation with Dynamics, Market Segment, Regional Analysis, and Top Competitor's Market Position.

Citrus Fiber Market Dynamics

Citrus Fiber Witnessing Growing Demand from Food & Beverages Industry Citrus fiber consists of insoluble or soluble fibrous ingredients of citrus fruits such as orange, lemon, and limes. Citrus fiber is used in several applications in various industries. In food products, citrus pulp fiber is used as an ingredient to improve water retention properties. Moreover, they are attracting increasing interest from the producers of plant-based beverages to enhance taste and texture and replace chemical-based ingredients. The high surface area and composition of citrus fiber allow water holding, emulsification, and gelling while using at very low levels. Furthermore, citrus products are growing in popularity as a rich source of vitamins, minerals, and dietary fiber that are necessary for normal growth and development and overall nutritional well-being. The increasing demand for natural food ingredients is driving the global citrus fiber market during the forecast period. The growing rate of worldwide consumption offers bigger and better opportunities for citrus fiber, including its use as plant-based meats. Citrus fiber is used in aggregate with constituents such as agar, native starch, and psyllium to replace methylcellulose, which is needed in plant-based meats to provide thermal gelling. When used with liquid oil, citrus fiber helps reduce the saturated fat, which is maintained and bound by the hydrophobic ingredients of this natural fiber to thicken the oil to function more like solid fats. Furthermore, the texture and bite properties of citrus fiber do not change with heating or time. Other industrial applications include drinkable yogurts to replace hydrocolloids used as thickeners and emulsifiers and deliver enhanced creaminess. The growing consumer preference for natural, clean label and healthy ingredients in food and beverage products is anticipated to increase the growth rate of the citrus fiber market. Slowdown in Global Food & Beverages Industry Heavily Impacts Demand for Citrus Fiber The unexpected breakout of coronavirus disease quickly spread across the world, several nations decided to initiate the norms of social distancing and lockdowns in their societies. The chaotic reality of the current pandemic has not only affected the health and quality of life of people, but has also disturbed the global economy, supply chains, and countries all over the world. The major end users of the citrus fiber market, including the food & beverage manufacturing industry, witnessed an unanticipated disruption that hindered its grip on the global raw materials supply chain as major cities shut down for several months in key industrial nations. Consumer buying behavior in the citrus fiber market does not bode well for premium, natural, or unadulterated food products. For most of the year 2023, manufacturers have experienced less consumer expenditure, a rise in the price of conventional food products, and a lack of availability of imported food products or ingredients, and others. As the pandemic is nearing its end in most countries, businesses are expected to launch innovative strategies and competitive advertising to flatten the demand curve in the upcoming future. However, as the impact continues in most countries in the Asia Pacific and the Middle East, it is expected that the high pricing trend will be followed in the food & beverage industry. Post-pandemic, the production rate of end-use industries is anticipated to rise, thus driving the global citrus fiber market.Citrus Fiber Market Segment Analysis

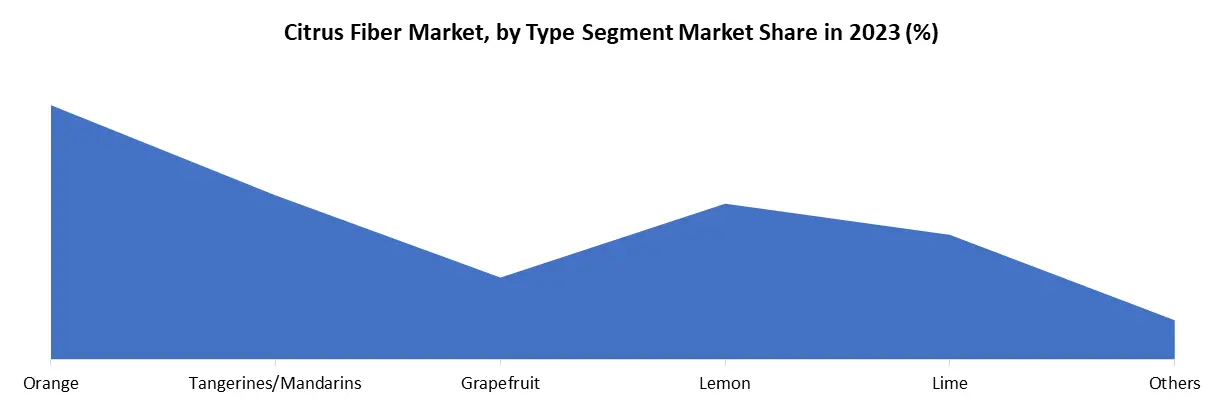

The citrus fiber market is segmented based on application, source, and region. Based on application, the market is categorized into bakery, sauces & seasonings, meat & egg replacement, desserts & ice-creams, beverages, flavorings, and coatings, snacks & meals, and others. By source, it is fragmented into orange, tangerines/mandarins, grapefruit, lemon, lime, and others. The bakery segment in the market held the major share and is likely to remain the same throughout the citrus fiber market forecast period. Citrus fibers in the bakery industry increase bread product freshness over time by binding accessible water, particularly water released by starch gluten in wheat to minimize staling. Moreover, this natural ingredient has advantages in baked goods, including moisture retention, oil or fat reduction, emulsification, and shelf-life freshness. Hence, citrus fiber is predicted to grow during the forecast period. Citrus fiber is made up of both, insoluble and soluble fibrous components found in citrus fruits including oranges, lemons, and limes. This fiber plays a vital role in the bakery industry. The surface area of citrus fiber is large, which ensures high water holding capacity, which is important in baking. Citrus fiber binds water securely and absorbs water generated by other components due to its composition and surface area. As a result, bakery items maintain moisture for a longer period. Moreover, this natural ingredient has advantages in baked goods, including moisture retention, oil or fat reduction, emulsification, and shelf-life freshness. The orange segment held the major share in the Citrus Fiber market. Oranges are low-calorie and high-nutrient citrus fruits. It is popular because of its inherent sweetness, range of varieties available, and variety of uses. The vitamin C content of this famous citrus fruit is particularly well-known. Oranges include a variety of different plant compounds and antioxidants that may help to reduce inflammation and fight diseases. Nutrients in oranges offer a range of health benefits such as the antioxidant vitamin C aids in preventing the development of cancer-causing free radicals. It is also high in fiber and potassium, both of which are beneficial for heart health. Oranges are low-calorie and high-nutrient citrus fruits. It is popular owing to its inherent sweetness, range of varieties available, and variety of uses. Vitamin C content in orange is particularly well-known in the Citrus Fiber market. Oranges include a variety of different plant compounds and antioxidants that may help to reduce inflammation and fight diseases. Nutrients in oranges offer a range of health benefits such as antioxidant vitamin C aid to prevent the development of cancer-causing free radicals. It is also high in fiber and potassium, both of which are beneficial for heart health.

Citrus Fiber Market Regional Analysis

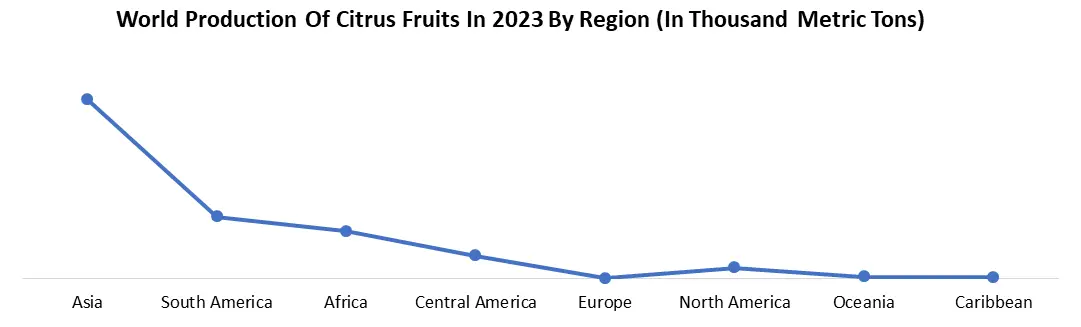

North America has the highest citrus fiber market share in 2023. The surge in demand for fortified foods & beverages in countries such as the U.S., Canada, and Mexico is leading a new path for the development of the citrus fibers market in North America. Changes in dietary patterns among consumers, combined with a growing population of urban people drive growth of the citrus fibers market. The rise in consumption of such fibers in North America leads to the citrus fiber market growth. The surge in demand for fortified foods & beverages in countries such as the U.S., Canada, and Mexico is leading a new path for the development of the citrus fiber market in North America. Change in dietary patterns among consumers, combined with a growing population of urban people drives the growth of the citrus fiber market. The rise in consumption of such fibers in North America led to the growth of the citrus fiber market. The Asia Pacific region accounted for the majority of the global market share in 2023 and is expected to grow in light of the rising dietary food industry in India, China, Thailand, and Vietnam. The region is projected to consistently grow at the same growth rates in the coming years owing to the rising awareness and knowledge among the population regarding the advantages of citrus fiber. Moreover, with increasing consumer preferences for dietary fibers, the citrus fiber market is growing substantially, and the key market players are investing in research and development of processing technology, which is creating newer growth opportunities for the market.

Citrus Fiber Market Scope: Inquire before buying

Global Citrus Fiber Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 42.7 Bn. Forecast Period 2024 to 2030 CAGR: 5.9% Market Size in 2030: US $ 72.6 Bn. Segments Covered: by Application Bakery Sauces and Seasonings Meat and Egg Replacement Desserts and Ice-Creams Beverages, Flavorings, and Coatings Snacks and Meals Others by Type Orange Tangerines/Mandarins Grapefruit Lemon Lime Others Citrus Fiber Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Citrus Fiber Key Players Include

1. BASF 2. Citrus Extracts LLC 3. Lucid Colloids Ltd. 4. Naturex SA 5. CEAMSA 6. Carolina Ingredients 7. Golden Health 8. EDGE Ingredients 9. Fiberstar, Inc. 10. Cargill 11. Incorporated 12. Quadra Chemicals Ltd. 13. AMC Group 14. Nans Products 15. FGF Trapani 16. Hebei Lemont Biotechnology Co., Ltd. 17. Herbafood Ingredients GmbH 18. JRS Silvateam Ingredients S.r.l. 19. Ingredients by Nature 20. CP Kelco 21. Ingredion Incorporated 22. Koninklijke DSM N.V. Frequently Asked Questions in the Citrus Fiber Market: 1. Which region has the largest share in Global Citrus Fiber Market? Ans: North America region holds the highest share in 2023. 2. What is the growth rate of Global Citrus Fiber Market? Ans: The Global Citrus Fiber Market is growing at a CAGR of 5.9% during the forecasting period 2024-2030. 3. What is scope of the Global Citrus Fiber market report? Ans: Global Citrus Fiber Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Citrus Fiber market? Ans: The important key players in the Global Citrus Fiber Market are – Dow Chemical Company,BASF SE,Tata & Lyle,Glanbia plc,Ashland 3M,Chemelco,Palsgaard,Tolsa Group,Koninklijke DSM N.V,Akzo Nobel N.V.,Galactic SA .,Kerry Group Plc,Cargill, Incorporated,Advanced food and Systems,Nexira,CP Kelco,Ingredion Incorporated, 5. What is the study period of this market? Ans: The Global Citrus Fiber Market is studied from 2023 to 2030.

1. Citrus Fiber Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Citrus Fiber Market: Dynamics 2.1. Citrus Fiber Market Trends by Region 2.1.1. North America Citrus Fiber Market Trends 2.1.2. Europe Citrus Fiber Market Trends 2.1.3. Asia Pacific Citrus Fiber Market Trends 2.1.4. Middle East and Africa Citrus Fiber Market Trends 2.1.5. South America Citrus Fiber Market Trends 2.2. Citrus Fiber Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Citrus Fiber Market Drivers 2.2.1.2. North America Citrus Fiber Market Restraints 2.2.1.3. North America Citrus Fiber Market Opportunities 2.2.1.4. North America Citrus Fiber Market Challenges 2.2.2. Europe 2.2.2.1. Europe Citrus Fiber Market Drivers 2.2.2.2. Europe Citrus Fiber Market Restraints 2.2.2.3. Europe Citrus Fiber Market Opportunities 2.2.2.4. Europe Citrus Fiber Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Citrus Fiber Market Drivers 2.2.3.2. Asia Pacific Citrus Fiber Market Restraints 2.2.3.3. Asia Pacific Citrus Fiber Market Opportunities 2.2.3.4. Asia Pacific Citrus Fiber Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Citrus Fiber Market Drivers 2.2.4.2. Middle East and Africa Citrus Fiber Market Restraints 2.2.4.3. Middle East and Africa Citrus Fiber Market Opportunities 2.2.4.4. Middle East and Africa Citrus Fiber Market Challenges 2.2.5. South America 2.2.5.1. South America Citrus Fiber Market Drivers 2.2.5.2. South America Citrus Fiber Market Restraints 2.2.5.3. South America Citrus Fiber Market Opportunities 2.2.5.4. South America Citrus Fiber Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Citrus Fiber Industry 2.8. Analysis of Government Schemes and Initiatives For Citrus Fiber Industry 2.9. Citrus Fiber Market Trade Analysis 2.10. The Global Pandemic Impact on Citrus Fiber Market 3. Citrus Fiber Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Citrus Fiber Market Size and Forecast, by Application (2023-2030) 3.1.1. Bakery 3.1.2. Sauces and Seasonings 3.1.3. Meat and Egg Replacement 3.1.4. Desserts and Ice-Creams 3.1.5. Beverages, Flavorings, and Coatings 3.1.6. Snacks and Meals 3.1.7. Others 3.2. Citrus Fiber Market Size and Forecast, by Type (2023-2030) 3.2.1. Orange 3.2.2. Tangerines/Mandarins 3.2.3. Grapefruit 3.2.4. Lemon 3.2.5. Lime 3.2.6. Others 3.3. Citrus Fiber Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Citrus Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Citrus Fiber Market Size and Forecast, by Application (2023-2030) 4.1.1. Bakery 4.1.2. Sauces and Seasonings 4.1.3. Meat and Egg Replacement 4.1.4. Desserts and Ice-Creams 4.1.5. Beverages, Flavorings, and Coatings 4.1.6. Snacks and Meals 4.1.7. Others 4.2. North America Citrus Fiber Market Size and Forecast, by Type (2023-2030) 4.2.1. Orange 4.2.2. Tangerines/Mandarins 4.2.3. Grapefruit 4.2.4. Lemon 4.2.5. Lime 4.2.6. Others 4.3. North America Citrus Fiber Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Citrus Fiber Market Size and Forecast, by Application (2023-2030) 4.3.1.1.1. Bakery 4.3.1.1.2. Sauces and Seasonings 4.3.1.1.3. Meat and Egg Replacement 4.3.1.1.4. Desserts and Ice-Creams 4.3.1.1.5. Beverages, Flavorings, and Coatings 4.3.1.1.6. Snacks and Meals 4.3.1.1.7. Others 4.3.1.2. United States Citrus Fiber Market Size and Forecast, by Type (2023-2030) 4.3.1.2.1. Orange 4.3.1.2.2. Tangerines/Mandarins 4.3.1.2.3. Grapefruit 4.3.1.2.4. Lemon 4.3.1.2.5. Lime 4.3.1.2.6. Others 4.3.2. Canada 4.3.2.1. Canada Citrus Fiber Market Size and Forecast, by Application (2023-2030) 4.3.2.1.1. Bakery 4.3.2.1.2. Sauces and Seasonings 4.3.2.1.3. Meat and Egg Replacement 4.3.2.1.4. Desserts and Ice-Creams 4.3.2.1.5. Beverages, Flavorings, and Coatings 4.3.2.1.6. Snacks and Meals 4.3.2.1.7. Others 4.3.2.2. Canada Citrus Fiber Market Size and Forecast, by Type (2023-2030) 4.3.2.2.1. Orange 4.3.2.2.2. Tangerines/Mandarins 4.3.2.2.3. Grapefruit 4.3.2.2.4. Lemon 4.3.2.2.5. Lime 4.3.2.2.6. Others 4.3.3. Mexico 4.3.3.1. Mexico Citrus Fiber Market Size and Forecast, by Application (2023-2030) 4.3.3.1.1. Bakery 4.3.3.1.2. Sauces and Seasonings 4.3.3.1.3. Meat and Egg Replacement 4.3.3.1.4. Desserts and Ice-Creams 4.3.3.1.5. Beverages, Flavorings, and Coatings 4.3.3.1.6. Snacks and Meals 4.3.3.1.7. Others 4.3.3.2. Mexico Citrus Fiber Market Size and Forecast, by Type (2023-2030) 4.3.3.2.1. Orange 4.3.3.2.2. Tangerines/Mandarins 4.3.3.2.3. Grapefruit 4.3.3.2.4. Lemon 4.3.3.2.5. Lime 4.3.3.2.6. Others 5. Europe Citrus Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Citrus Fiber Market Size and Forecast, by Application (2023-2030) 5.2. Europe Citrus Fiber Market Size and Forecast, by Type (2023-2030) 5.3. Europe Citrus Fiber Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Citrus Fiber Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom Citrus Fiber Market Size and Forecast, by Type (2023-2030) 5.3.2. France 5.3.2.1. France Citrus Fiber Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France Citrus Fiber Market Size and Forecast, by Type (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Citrus Fiber Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany Citrus Fiber Market Size and Forecast, by Type (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Citrus Fiber Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy Citrus Fiber Market Size and Forecast, by Type (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Citrus Fiber Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain Citrus Fiber Market Size and Forecast, by Type (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Citrus Fiber Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden Citrus Fiber Market Size and Forecast, by Type (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Citrus Fiber Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria Citrus Fiber Market Size and Forecast, by Type (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Citrus Fiber Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6. Asia Pacific Citrus Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Citrus Fiber Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3.4. India 6.3.4.1. India Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Citrus Fiber Market Size and Forecast, by Type (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Citrus Fiber Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Citrus Fiber Market Size and Forecast, by Type (2023-2030) 7. Middle East and Africa Citrus Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Citrus Fiber Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Citrus Fiber Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Citrus Fiber Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Citrus Fiber Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa Citrus Fiber Market Size and Forecast, by Type (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Citrus Fiber Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC Citrus Fiber Market Size and Forecast, by Type (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Citrus Fiber Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria Citrus Fiber Market Size and Forecast, by Type (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Citrus Fiber Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A Citrus Fiber Market Size and Forecast, by Type (2023-2030) 8. South America Citrus Fiber Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Citrus Fiber Market Size and Forecast, by Application (2023-2030) 8.2. South America Citrus Fiber Market Size and Forecast, by Type (2023-2030) 8.3. South America Citrus Fiber Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Citrus Fiber Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil Citrus Fiber Market Size and Forecast, by Type (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Citrus Fiber Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina Citrus Fiber Market Size and Forecast, by Type (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Citrus Fiber Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America Citrus Fiber Market Size and Forecast, by Type (2023-2030) 9. Global Citrus Fiber Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Citrus Fiber Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. BASF 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Citrus Extracts LLC 10.3. Lucid Colloids Ltd. 10.4. Naturex SA 10.5. CEAMSA 10.6. Carolina Ingredients 10.7. Golden Health 10.8. EDGE Ingredients 10.9. Fiberstar, Inc. 10.10. Cargill 10.11. Incorporated 10.12. Quadra Chemicals Ltd. 10.13. AMC Group 10.14. Nans Products 10.15. FGF Trapani 10.16. Hebei Lemont Biotechnology Co., Ltd. 10.17. Herbafood Ingredients GmbH 10.18. JRS Silvateam Ingredients S.r.l. 10.19. Ingredients by Nature 10.20. CP Kelco 10.21. Ingredion Incorporated 10.22. Koninklijke DSM N.V. 11. Key Findings 12. Industry Recommendations 13. Citrus Fiber Market: Research Methodology 14. Terms and Glossary