Global Juice Concentrates Market size was valued at USD 73.70 Bn in 2022 and is expected to reach USD 103.01 Bn by 2029, at a CAGR of 4.9 % over the forecast period.Juice Concentrates Market Overview

Juice concentrates are defined as fruit or vegetable juices from which nearly all the water content has been extracted. In their natural state, fruit juices are predominantly water, making them challenging to transport efficiently. Through the process of evaporation, the water is removed, transforming fresh juice into a concentrated form that is easily transportable and can be stored for longer durations. This concentrated juice serves not only as a flavor enhancer in various food and beverage items but is commonly diluted with water to craft delightful and revitalizing juice drinks. The renowned example of juice concentrate, widely recognized, is orange juice concentrate, commanding approximately 40% of the global concentrate market. While apple juice concentrate is also prevalent, the variety of fruit juices available in the frozen section of local grocery stores extends beyond these two. The merits of extended shelf life, convenient transportability, and intensified flavor profiles inherent in concentrates present myriad opportunities for incorporating natural flavors into an array of food and beverage products. The Juice Concentrates Market encompasses products derived from fruit juices with the majority of their water content removed. The juice concentrate industry is a dynamic and thriving segment within the broader beverage industry, characterized by the extraction of fruit juices with the majority of their water content removed. This process not only facilitates ease of transport and storage but also intensifies the flavor profile of the resulting concentrated juice. Juice concentrates find applications in a wide array of products, such as beverages, bakery items, confectionery, sauces, and dressings. The concentrated form allows for easier incorporation into various recipes, providing natural flavors and enhancing the overall taste of the end products. The market is expected to witness sustained growth as the demand for natural and convenient flavoring solutions continues to rise. Ongoing innovations in product formulations, coupled with a focus on sustainability, are expected to shape the market's future trajectory.To know about the Research Methodology :- Request Free Sample Report

Juice Concentrates Market Dynamics

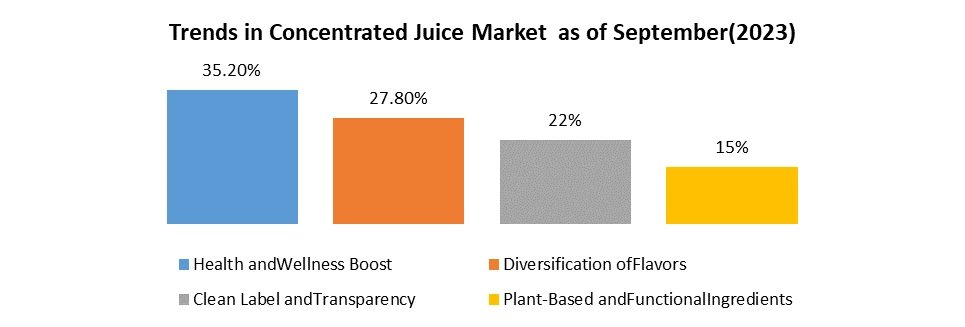

Health and Wellness Trends to boost the Juice Concentrates Market Growth The surge in demand for juice concentrates is intricately tied to the global shift toward health and wellness. Consumers, in their evolving preferences for healthier options, are increasingly drawn to natural and nutritious alternatives, steering clear of artificial additives and sweeteners. Juice concentrates, derived from real fruits and retaining essential nutrients, align seamlessly with this health-conscious consumer behavior, driving their popularity in the Juice Concentrate industry. Consumer preferences in the Juice Concentrates Market are significantly influenced by the inherent convenience associated with these products. The removal of water content not only aligns with evolving consumer preferences but also addresses their demand for easily storable and long-lasting beverage options. This convenience factor appeals not only to consumers but also to producers, fostering widespread use and contributing to the sustained growth of the Juice Concentrate Industry. Consumer preferences continue to evolve, placing a premium on intense and authentic taste experiences. The concentrated nature of juice concentrates becomes a key driver, imparting a robust and intense flavor profile to various food and beverage applications. Innovation in Product Offerings to drive the market growth Innovation stands as a pivotal driver, reflecting the industry's commitment to differentiating products and capturing consumer interest. Juice Concentrate Manufacturers, recognizing the importance of aligning with evolving consumer tastes, invest in research and development to introduce new fruit combinations, exotic flavors, and innovative product formulations. This dedication to offering unique and appealing products positions companies at the forefront of a competitive market landscape. The Juice Concentrates Market responds to growing environmental awareness through a commitment to sustainable practices. The evolving consumer consciousness regarding environmental responsibility influences market dynamics, leading to efforts to reduce water consumption in production, explore eco-friendly packaging options, and implement energy-efficient manufacturing methods. Sustainability initiatives resonate with consumers, contributing to the positive image and sustained growth of juice concentrates. Perception of processing to limit the Juice Concentrates Market growth Consumer perceptions in the Juice Concentrates Market involve processing methods, is a significant restraint for the growth of the market. Some consumers express concerns about the perceived level of processing required to create concentrates. This apprehension influence purchasing decisions, especially among those who prioritize the freshness associated with minimal processing. Strategic communication and education efforts are crucial to dispel misconceptions and highlight the benefits of concentrates. Regulatory scrutiny is a constant factor in the market, affecting labeling, quality standards, and health claims, which directly impacts the Juice Concentrates Market share. Compliance with evolving regulations is essential, requiring industry participants to stay abreast of changes. Strategic approaches involve proactive adaptation to regulatory shifts, ensuring transparency in communication, and fostering trust with consumers through adherence to quality standards. Consumer price sensitivity poses a restraint, particularly in regions where economic factors strongly influence purchasing decisions. Strategic pricing considerations, coupled with a focus on value propositions, become essential. Industry players need to adapt their strategies to navigate economic downturns or fluctuations, ensuring that price points remain competitive without compromising product quality. The market is directly impacted by the prices and availability of raw materials, primarily fruits. Juice Concentrates Market Strategic management involves closely monitoring and adapting to fluctuations in raw material prices. Diversifying sourcing strategies and establishing resilient supply chain practices become strategic imperatives to mitigate the unpredictability associated with raw material dependency. Juice Concentrates Market Opportunities and Trends 1.Health and Wellness Boost Opportunity: Growing consumer awareness of health and wellness is a significant opportunity for the Juice Concentrates Market. With consumers increasingly seeking natural and nutrient-rich options, juice concentrates, derived from real fruits, align well with these health-conscious preferences. Trend: The market is witnessing a surge in demand for juice concentrates positioned as healthier alternatives to sugary beverages. Products that highlight natural ingredients, reduced sugar content, and nutritional benefits are gaining popularity. 2.Diversification of Flavors Opportunity: There is ample opportunity for market players to capitalize on the diversification of flavor preferences. Consumers are exploring a wide range of exotic and unique fruit flavors, creating space for innovative product offerings. Trend: The trend of introducing new fruit combinations, exotic flavors, and blends is gaining momentum. Industry players are leveraging innovation to cater to diverse palates, providing consumers with a variety of choices beyond traditional fruit concentrates. 3.Clean Label and Transparency Opportunity: Transparency in labeling and a focus on clean label products present a significant opportunity. Consumers are increasingly scrutinizing ingredient lists and seeking products with minimal additives and preservatives. Trend: The market is witnessing a trend towards clean label juice concentrates, emphasizing transparency in sourcing and production methods. Products with fewer artificial ingredients and a clear communication of their origin resonate well with conscientious consumers. 4.Plant-Based and Functional Ingredients Opportunity: The rise of plant-based diets and the interest in functional ingredients present opportunities for the Juice Concentrates Market. Consumers are exploring products that offer health benefits beyond basic nutrition. Trend: Juice concentrates with added functional ingredients such as antioxidants, vitamins, and natural flavors are gaining popularity. Additionally, the use of plant-based ingredients aligns with the broader trend of plant-forward and vegan-friendly options.

Juice Concentrates Market Segment Analysis

Based on Type, the market is segmented into Fruit Juice Concentrate, and Vegetable Juice Concentrate. Fruit Juice Concentrate segment dominated the market in 2022 and is expected to hold the largest Juice Concentrates Market share over the forecast period. The Fruit Juice Concentrate segment is growing due to broader consumer demographics in Juice Concentrates Market is influenced by distinct and exhibits notable growth patterns, as revealed by behavioral segmentation analysis. Consumer demographics play a crucial role in shaping the demand for fruit juice concentrates. The appeal of these concentrates is often heightened among health-conscious consumers, spanning various age groups, including millennials and Generation Z, who prioritize natural and nutritious beverage options. Additionally, families with children are drawn to the convenience and versatility of fruit juice concentrates, offering a quick and flavorful solution for varied beverage preferences. Behavioral segmentation unveils insights into consumer preferences and purchasing decisions within the Fruit Juice Concentrate segment. Health-conscious behaviors drive the preference for concentrates perceived as natural and free from artificial additives, which significantly increases the Juice Concentrates Market share. Consumers exhibiting a preference for sustainable and eco-friendly practices are also likely to be drawn to brands emphasizing environmental responsibility in their production processes and packaging. Furthermore, the behavioral analysis highlights the trend of consumers seeking convenient beverage solutions, shaping the demand for ready-to-drink fruit juice concentrates that align with busy, on-the-go lifestyles.Based on Form, the market is segmented into Liquid and Powder. The liquid segment is expected to dominate the market with the largest Juice Concentrates Market Share over the forecast period. Liquid concentrates are formulated by extracting the juice from fruits and then removing a significant portion of the water content through processes such as evaporation. The resulting liquid concentrate retains the natural flavors, colors, and nutritional components of the original fruit juice, albeit in a concentrated form. Liquid concentrates find applications beyond beverages, demonstrating versatility in culinary creations. They are used in the food industry to enhance the flavor profile of various products, including sauces, dressings, desserts, and marinades. The liquid form allows for precise control over flavor intensity in different recipes. Based on Application, the market is segmented into Beverages, Dairy and Frozen Desserts, and Sauces and Dressings. The beverages segment dominated the market in 2022 and is expected to hold the largest Juice Concentrate industry share over the forecast period. The beverages segment involves the incorporation of juice concentrates into a wide variety of drink formulations. Juice concentrates are utilized in beverages to impart natural and intense fruit flavors. The concentrated nature of these products allows for a more robust taste profile, enhancing the overall flavor experience of the beverages. This flavor enhancement is particularly valuable in creating drinks with a refreshing and authentic fruity taste. Juice Concentrate Manufacturers often use juice concentrates as a base for creating custom blends and formulations. This allows for the development of unique and signature beverages by combining different fruit concentrates or incorporating additional ingredients to achieve specific taste profiles. The segment is responsive to seasonal variations and trends, with manufacturers introducing seasonal or limited-edition beverages featuring specific fruit flavors. Additionally, the beverages segment includes specialty offerings, such as exotic fruit blends or beverages with functional ingredients.

Juice Concentrates Market Regional Insight

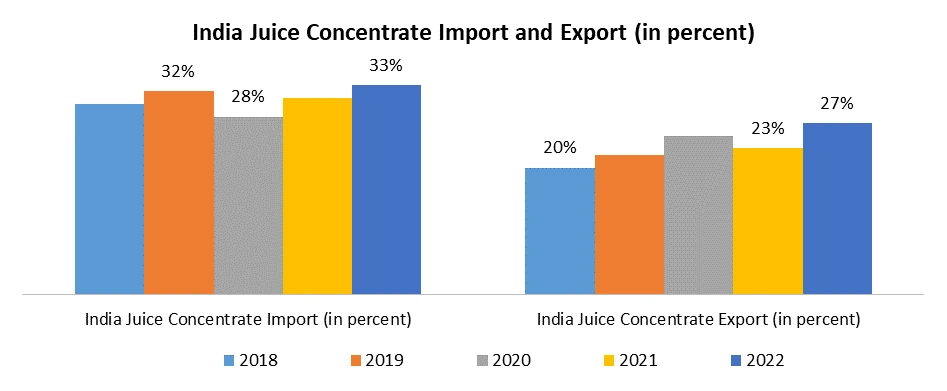

Consumers seeking natural and nutritious alternatives to boost North America Juice Concentrates Market Growths The North America Juice Concentrates Market is propelled by several key drivers, with the United States, Canada, and Mexico playing pivotal roles in shaping the industry dynamics. In the United States, a heightened focus on health and wellness trends has significantly contributed to the increased demand for juice concentrates. Consumers are increasingly seeking natural and nutritious alternatives, and the convenience offered by concentrated fruit juices aligns with the fast-paced lifestyles prevalent in the country. Additionally, the U.S. Juice Concentrates Market benefits from a diverse range of fruit production, allowing for a rich variety of concentrates, including popular choices such as orange and apple. Canada, with its growing health-conscious consumer base, is also a substantial driver in the North American Juice Concentrates Market. The Canada Juice Concentrate industry is witnessing a surge in demand for fruit-based products that provide both flavor and nutritional value. Juice concentrates, with their versatility and natural attributes, meet these preferences and cater to the Canadian consumer's inclination towards convenient yet health-focused choices. Mexico, as a key player in the North American market, contributes to the overall growth of the juice concentrate industry. The Mexican market is characterized by a rich tradition of fruit consumption, and the demand for juice concentrates is bolstered by the country's agricultural abundance. Consumers in Mexico appreciate the intense fruit flavors that concentrates offer, and the market benefits from the proximity to abundant fruit sources, ensuring a steady supply of raw materials.The Juice Concentrates Market in India, positioned within the broader Asia-Pacific region, is characterized by dynamic growth, diverse fruit offerings, and changing consumer preferences. India, with its large and growing population, emerging middle class, and increasing awareness of health and wellness, plays a significant role in shaping the juice concentrate landscape in the Asia-Pacific market. India's rich agricultural landscape contributes to a diverse range of fruit varieties available for juice concentrate production. From tropical fruits like mangoes and guavas to citrus fruits such as oranges and lemons, the country offers a wide array of raw materials for concentrate manufacturers. This abundance supports the production of a variety of fruit concentrates catering to different tastes and preferences. India's position as a major player in the Juice Concentrates Market extends beyond its domestic consumption. The country serves as an exporter of concentrates to other regions, capitalizing on its fruit abundance and production capabilities. This export-oriented approach contributes to the country's influence in the broader Asia-Pacific market.

Juice Concentrates Market Competitive Landscape

The Juice Concentrates Market is characterized by a considerable degree of fragmentation, with numerous players operating across different regions. This fragmentation is attributed to the diversity of fruit sources, product variations, and regional preferences, contributing to a multitude of market participants offering a wide range of juice concentrates. Certain regions play a prominent role in the global Juice Concentrates Market, contributing significantly to production and consumption. Regions like North America, Europe, and Asia-Pacific are focal points for market activity, with each region having its own set of key players and market dynamics. The Juice Concentrates Market competition within is intensified by the diverse range of fruit options and product variations. Companies often differentiate themselves by offering a broad portfolio of concentrates derived from different fruits, catering to varied consumer tastes and preferences. Market players engage in continuous innovation and new product development to stay competitive. This involves the introduction of novel fruit combinations, unique flavor profiles, and formulations that align with emerging consumer trends, such as health and wellness, sustainability, and exotic flavor preferences. Growing consumer awareness and preferences for sustainable products have led many Juice Concentrate companies to emphasize environmentally friendly practices. This includes efforts to reduce water consumption in production, explore eco-friendly packaging options, and implement energy-efficient manufacturing methods. Sustainability initiatives contribute to positive brand perception and differentiation.Juice Concentrates Market Scope: Inquire before buying

Global Juice Concentrates Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 73.70 Bn Forecast Period 2023 to 2029 CAGR: 4.9% Market Size in 2029: US $ 103.01 Bn. Segments Covered: by Type Fruit Juice Concentrate Vegetable Juice Concentrate by Form Liquid Powder by Application Beverages Dairy and Frozen Desserts Sauces and Dressings Juice Concentrates Market, By Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Juice Concentrates Market Key Players:

1. FruitSmart 2. ADM 3. Hop & Stuff 4. Premier Juices Ltd. 5. Sunnysyrup Food Co, Ltd. 6. Northwest Naturals 7. Kerr by Ingredion 8. Tree Top 9. Kerry Group plc.s 10. Döhler GmbH 11. SunOpta 12. Symrise 13. Rudolf Wild GmbH & Co. KG 14. Austria Juice 15. China Kunyu Industrial Co. Limited Frequently Asked Questions 1. What drives the demand for juice concentrates in the market? Ans: The demand is driven by factors such as health and wellness trends, convenience, flavor enhancement, versatility in applications, proximity to fruit production hubs, innovation in product offerings, and sustainability practices. 2. What opportunities and trends are present in the Juice Concentrates Market? Ans: Opportunities include health and wellness trends, diversification of flavors, clean label and transparency, and the rise of plant-based and functional ingredients. Trends involve a surge in demand for healthier alternatives, innovative flavor combinations, and clean label products. 3. How is the Juice Concentrates Market segmented? Ans: The market is segmented based on type (fruit juice concentrate, vegetable juice concentrate), form (liquid, powder), and application (beverages, dairy and frozen desserts, sauces and dressings). The dominant segments include fruit juice concentrate and liquid form in beverages. 4. How does the North America region contribute to the Juice Concentrates Market? Ans. North America, particularly the United States, Canada, and Mexico, plays a pivotal role in driving the Juice Concentrates Market. The region benefits from health-conscious consumer trends, diverse fruit production, and a focus on natural and nutritious alternatives. 5. What is the significance of India in the Asia-Pacific Juice Concentrates Market? Ans. India, with its large population, diverse fruit offerings, and increasing health awareness, plays a significant role in shaping the Juice Concentrates Market in the Asia-Pacific region. The country serves as both a major consumer and exporter of concentrates.

1. Juice Concentrates Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Juice Concentrates Market: Dynamics 2.1. Juice Concentrates Market Trends by Region 2.1.1. Global Juice Concentrates Market Trends 2.1.2. North America Juice Concentrates Market Trends 2.1.3. Europe Juice Concentrates Market Trends 2.1.4. Asia Pacific Juice Concentrates Market Trends 2.1.5. Middle East and Africa Juice Concentrates Market Trends 2.1.6. South America Juice Concentrates Market Trends 2.1.7. Preference Analysis 2.2. Juice Concentrates Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Juice Concentrates Market Drivers 2.2.1.2. North America Juice Concentrates Market Restraints 2.2.1.3. North America Juice Concentrates Market Opportunities 2.2.1.4. North America Juice Concentrates Market Challenges 2.2.2. Europe 2.2.2.1. Europe Juice Concentrates Market Drivers 2.2.2.2. Europe Juice Concentrates Market Restraints 2.2.2.3. Europe Juice Concentrates Market Opportunities 2.2.2.4. Europe Juice Concentrates Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Juice Concentrates Market Drivers 2.2.3.2. Asia Pacific Juice Concentrates Market Restraints 2.2.3.3. Asia Pacific Juice Concentrates Market Opportunities 2.2.3.4. Asia Pacific Juice Concentrates Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Juice Concentrates Market Drivers 2.2.4.2. Middle East and Africa Juice Concentrates Market Restraints 2.2.4.3. Middle East and Africa Juice Concentrates Market Opportunities 2.2.4.4. Middle East and Africa Juice Concentrates Market Challenges 2.2.5. South America 2.2.5.1. South America Juice Concentrates Market Drivers 2.2.5.2. South America Juice Concentrates Market Restraints 2.2.5.3. South America Juice Concentrates Market Opportunities 2.2.5.4. South America Juice Concentrates Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For Juice Concentrate Industry 2.9. Analysis of Government Schemes and Initiatives For Juice Concentrate Industry 2.10. The Global Pandemic Impact on Juice Concentrates Market 2.11. Juice Concentrate Price Trend Analysis (2021-22) 2.12. Global Juice Concentrates Market Trade Analysis (2017-2022) 2.12.1. Global Import of Juice Concentrate 2.12.1.1. Ten Largest Importer 2.12.2. Global Export of Juice Concentrate 2.12.3. Ten Largest Exporter 3. Juice Concentrates Market: Global Market Size and Forecast by Segmentation (by Value) (2022-2029) 3.1. Juice Concentrates Market Size and Forecast, by Type (2022-2029) 3.1.1. Fruit Juice Concentrate 3.1.2. Vegetable Juice Concentrates 3.2. Juice Concentrates Market Size and Forecast, by Form (2022-2029) 3.2.1. Liquid 3.2.2. Powder 3.3. Juice Concentrates Market Size and Forecast, by Application (2022-2029) 3.3.1. Beverages 3.3.2. Dairy and Frozen Desserts 3.3.3. Sauces and Dressings 3.4. Juice Concentrates Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Juice Concentrates Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America Juice Concentrates Market Size and Forecast, by Type (2022-2029) 4.1.1. Fruit Juice Concentrate 4.1.2. Vegetable Juice Concentrate 4.2. North America Juice Concentrates Market Size and Forecast, by Form (2022-2029) 4.2.1. Liquid 4.2.2. Powder 4.3. North America Juice Concentrates Market Size and Forecast, by Application (2022-2029) 4.3.1. Beverages 4.3.2. Dairy and Frozen Desserts 4.3.3. Sauces and Dressings 4.4. North America Juice Concentrates Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Juice Concentrates Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Fruit Juice Concentrate 4.4.1.1.2. Vegetable Juice Concentrate 4.4.1.2. United States Juice Concentrates Market Size and Forecast, by Form (2022-2029) 4.4.1.2.1. Liquid 4.4.1.2.2. Powder 4.4.1.3. United States Juice Concentrates Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Beverages 4.4.1.3.2. Dairy and Frozen Desserts 4.4.1.3.3. Sauces and Dressings 4.4.2. Canada 4.4.2.1. Canada Juice Concentrates Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Fruit Juice Concentrate 4.4.2.1.2. Vegetable Juice Concentrate 4.4.2.2. Canada Juice Concentrates Market Size and Forecast, by Form (2022-2029) 4.4.2.2.1. Liquid 4.4.2.2.2. Powder 4.4.2.3. Canada Juice Concentrates Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Beverages 4.4.2.3.2. Dairy and Frozen Desserts 4.4.2.3.3. Sauces and Dressings 4.4.3. Mexico 4.4.3.1. Mexico Juice Concentrates Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Fruit Juice Concentrate 4.4.3.1.2. Vegetable Juice Concentrate 4.4.3.2. Mexico Juice Concentrates Market Size and Forecast, by Form (2022-2029) 4.4.3.2.1. Liquid 4.4.3.2.2. Powder 4.4.3.3. Mexico Juice Concentrates Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Beverages 4.4.3.3.2. Dairy and Frozen Desserts 4.4.3.3.3. Sauces and Dressings 5. Europe Juice Concentrates Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Europe Juice Concentrates Market Size and Forecast, by Type (2022-2029) 5.2. Europe Juice Concentrates Market Size and Forecast, by Form (2022-2029) 5.3. Europe Juice Concentrates Market Size and Forecast, by Application (2022-2029) 5.4. Europe Juice Concentrates Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Juice Concentrates Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Juice Concentrates Market Size and Forecast, by Form (2022-2029) 5.4.1.3. United Kingdom Juice Concentrates Market Size and Forecast, by Application (2022-2029) 5.4.2. France 5.4.2.1. France Juice Concentrates Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Juice Concentrates Market Size and Forecast, by Form (2022-2029) 5.4.2.3. France Juice Concentrates Market Size and Forecast, by Application (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Juice Concentrates Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Juice Concentrates Market Size and Forecast, by Form (2022-2029) 5.4.3.3. Germany Juice Concentrates Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Juice Concentrates Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Juice Concentrates Market Size and Forecast, by Form (2022-2029) 5.4.4.3. Italy Juice Concentrates Market Size and Forecast, by Application (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Juice Concentrates Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Juice Concentrates Market Size and Forecast, by Form (2022-2029) 5.4.5.3. Spain Juice Concentrates Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Juice Concentrates Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Juice Concentrates Market Size and Forecast, by Form (2022-2029) 5.4.6.3. Sweden Juice Concentrates Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Juice Concentrates Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Juice Concentrates Market Size and Forecast, by Form (2022-2029) 5.4.7.3. Austria Juice Concentrates Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Juice Concentrates Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Juice Concentrates Market Size and Forecast, by Form (2022-2029) 5.4.8.3. Rest of Europe Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Juice Concentrates Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.3. Asia Pacific Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Juice Concentrates Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.4.1.3. China Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.4.2.3. S Korea Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4.3.3. Japan Juice Concentrates Market Size and Forecast, by Beer Style (2022-2029) 6.4.4. India 6.4.4.1. India Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.4.4.3. India Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.4.5.3. Australia Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.4.6.3. Indonesia Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.4.7.3. Malaysia Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.4.8.3. Vietnam Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.4.9.3. Taiwan Juice Concentrates Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Juice Concentrates Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Juice Concentrates Market Size and Forecast, by Form (2022-2029) 6.4.10.3. Rest of Asia Pacific Juice Concentrates Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Juice Concentrates Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Juice Concentrates Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Juice Concentrates Market Size and Forecast, by Form (2022-2029) 7.3. Middle East and Africa Juice Concentrates Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Juice Concentrates Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Juice Concentrates Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Juice Concentrates Market Size and Forecast, by Form (2022-2029) 7.4.1.3. South Africa Juice Concentrates Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Juice Concentrates Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Juice Concentrates Market Size and Forecast, by Form (2022-2029) 7.4.2.3. GCC Juice Concentrates Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Juice Concentrates Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Juice Concentrates Market Size and Forecast, by Form (2022-2029) 7.4.3.3. Nigeria Juice Concentrates Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Juice Concentrates Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Juice Concentrates Market Size and Forecast, by Form (2022-2029) 7.4.4.3. Rest of ME&A Juice Concentrates Market Size and Forecast, by Application (2022-2029) 8. South America Juice Concentrates Market Size and Forecast by (by Value in USD Million) (2022-2029 8.1. South America Juice Concentrates Market Size and Forecast, by Type (2022-2029) 8.2. South America Juice Concentrates Market Size and Forecast, by Form (2022-2029) 8.3. South America Juice Concentrates Market Size and Forecast, by Application (2022-2029) 8.4. South America Juice Concentrates Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Juice Concentrates Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Juice Concentrates Market Size and Forecast, by Form (2022-2029) 8.4.1.3. Brazil Juice Concentrates Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Juice Concentrates Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Juice Concentrates Market Size and Forecast, by Form (2022-2029) 8.4.2.3. Argentina Juice Concentrates Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Juice Concentrates Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Juice Concentrates Market Size and Forecast, by Form (2022-2029) 8.4.3.3. Rest Of South America Juice Concentrates Market Size and Forecast, by Application (2022-2029) 9. Global Juice Concentrates Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Headquarter 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. FruitSmart 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Details on Partnership 10.1.7. Recent Developments 10.2. ADM 10.3. Hop & Stuff 10.4. Premier Juices Ltd. 10.5. Sunnysyrup Food Co, Ltd. 10.6. Northwest Naturals 10.7. Kerr by Ingredion 10.8. Tree Top 10.9. Kerry Group plc.s 10.10. Döhler GmbH 10.11. SunOpta 10.12. Symrise 10.13. Rudolf Wild GmbH & Co. KG 10.14. Austria Juice 10.15. China Kunyu Industrial Co. Limited 11. Key Findings 12. Industry Recommendations 13. Juice Concentrates Market: Research Methodology 14. Terms and Glossary