Global Infection Surveillance Solutions Market was valued at USD 588.54 Million in 2022, and it is expected to reach USD 1604.05 Million by 2029, exhibiting a CAGR of 15.4% during the forecast period (2023-2029).Infection Surveillance Solutions Market Overview

The Global Infection Surveillance Solutions Market is segmented by software, services, and end-users. Based on software, the market is segmented into on-premise software, and web-based software. By services, the market is segmented into product support & maintenance, implementation services, and training & consulting services. Based on end-users, the market is segmented into hospitals (large hospitals, medium sized hospitals, and small hospitals), long-term care facilities, (nursing homes, skilled nursing facilities, and assisted- living facilities), and other end users. Based on region, the market is segmented into North America, Asia Pacific, Europe, Middle East & Africa, and South America.To know about the Research Methodology :- Request Free Sample Report This market's expansion is driven to factors like rising healthcare costs, an increase in chronic illnesses brought on by an ageing population, and an increase in hospital-acquired infections (HAIs). The necessity to detect and monitor the transmission of the COVID-19 infection has intensified as a result of the recent spike in COVID-19 infections. This is also expected to fuel market expansion over the upcoming years. In moreover, government efforts and the increasing attention being paid to patient safety and quality of care are estimated to spur the expansion of the market for infection surveillance solutions globally. However, during the forecast period, the hesitation of medical professionals to adopt cutting-edge healthcare IT solutions is expected to restrain market expansion.

Infection Surveillance Solutions Market Dynamics

Emerging economies: Players in the market for infection surveillance systems may expect to see considerable growth prospects from emerging markets including India, China, Brazil, Russia, and nations in South America and Southeast Asia. India and China are home to a sizable patient population because they account for more than half of the world's population. Public pressure to raise the standard of hospital treatment, rising HAI costs to healthcare systems, the advent of multi-drug-resistant bacteria, and government efforts are all significant factors driving market expansion in these nations. Growing number of surgeries: The number of operations carried out globally has increased significantly over time. Around 235 million major surgical procedures are carried out annually, according to the WHO (2019). This is ascribed to the expanding senior population, the prevalence of obesity and other lifestyle disorders, the rise in spinal injuries, and the rise in sports-related injuries. The frequency of surgical-site infections is increasing as more surgeries are being performed. A surgical-site infection, as defined by the CDC, is an infection that develops following surgery in the area of the body where the surgery was performed. The need for automated infection surveillance is growing as a result of the large number of procedures being conducted. Electronic monitoring systems are being used in hospitals and small clinics to maintain sterile conditions, boost productivity, and prevent HAIs. Thus, it is expected that the increase in surgical procedures would be a major factor in the increased use of infection surveillance systems in the coming future. Data Security Issues: The landscape of healthcare privacy and security has expanded as a result of the increasing reliance on networking and automated technologies (EHR), as well as the changing trends toward healthcare integration and health information exchanges. The interchange of patient data electronically expands the breadth and efficiency of healthcare service, but it also raises concerns about data loss and liability because of increased access. Widespread patient information transfers raise the likelihood of data breaches and pose privacy and security hazards. The healthcare sector in the US saw the second-highest number of data breaches in 2019 combined with the greatest rate of exposure per breach, according to the Identity Theft Resource Center. Medical practitioners' reluctance to use cutting-edge healthcare IT solutions: Medical organisations may manage a variety of clinical and non-clinical operations more efficiently with the use of healthcare IT solutions. However, the effective use of these systems depends mainly on the end users' readiness to switch from conventional paper-based patient records to electronic alternatives, such as healthcare professionals. Many medical personnel do not currently possess the technological know-how necessary to operate sophisticated healthcare IT solutions, and many see the development, upkeep, and use of electronic systems as time-consuming tasks. This makes healthcare practitioners reluctant to use cutting-edge healthcare IT solutions. In addition, in order to enter patient medical data, notes, and prescriptions into EMRs, doctors and other staff members need to possess the necessary technical knowledge and abilities. Physicians are reluctant to embrace these systems due to their complexity and lack of user-friendliness in modern healthcare IT systems. According to MedeFile, many doctors in the US think that implementing healthcare IT solutions takes a lot of time and might negatively affect how well they engage with patients.Infection Surveillance Solutions Market Segment Analysis

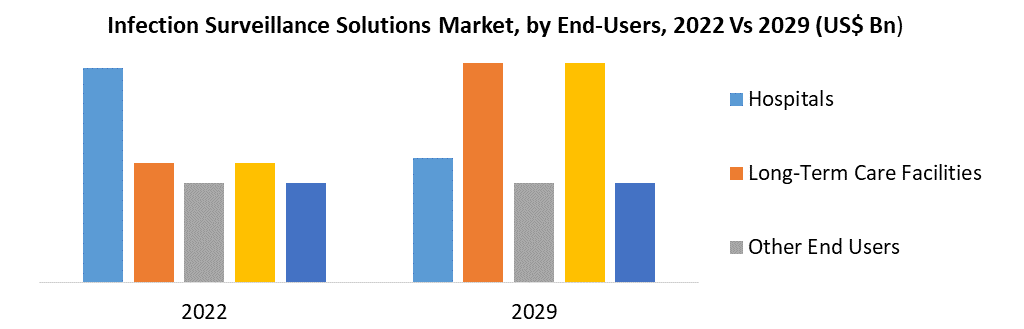

Based on Product Type, the infection surveillance solutions market is segmented into infection surveillance software solutions and infection surveillance services. The infection surveillance software segment held the largest market share in 2022. The high percentage of this market can be linked to the rise in hospital-acquired infections as a result of increased hospital admissions. The software for infection surveillance helps healthcare professionals take action to stop the spread of diseases by monitoring and documenting the occurrence of hospital acquired illnesses. Based on Software, the infection surveillance software market is segmented into on-premise and web-based software. During the forecast period, the web-based category is expected to grow at the fastest rate. The benefits of this market over on-premise software solutions are primarily responsible for its expansion. The most popular infection monitoring software for national level surveillance is web-based since it is less expensive than premise-based, does real-time data processing.Based on Services, the infection surveillance services market is segmented into product support and maintenance services, training and consulting services, and implementation services. The market for infection surveillance services was dominated in 2022 by the product support and maintenance services segment. The provision of product support and maintenance services guarantees that customers (healthcare providers) have access to the technical knowledge base of the vendor firm and may learn application management skills. Based on End User, the infection surveillance solutions market is segmented into hospitals, long-term care facilities, and other end users. The segment for hospitals is expected to rise at the fastest rate over the forecast period. The increased prevalence of surgical site infections and other hospital acquired illnesses linked to rising hospital admissions can be blamed for the expansion of this market segment.

Regional Insights:

North America is estimated to hold the largest share of the market, followed by Europe, the Asia-Pacific region, South America, and the Middle East, and Africa. The Infection Surveillance Solutions market in the U.S. is estimated at US$175.9 Million in the year 2022. The country currently accounts for a 35.26% share in the global market. The significant market share of this area may be attributed to a number of reasons, including an increase in healthcare investments, a growing use of healthcare IT solutions to reduce the rate of rising healthcare costs, and increase in the presence of several companies in the US. Furthermore, the industry has been growing as a result of beneficial government efforts. For instance, the Canadian Nosocomial Infection Surveillance Program (CNISP) was developed to provide information on the prevalence and trends of HAIs at Canadian healthcare facilities by the National Microbiology Laboratory (NML) and the Centre for Communicable Diseases and Infection Control (CCDIC) of the Public Health Agency of Canada. 54 hospitals now take part in the CNISP network. The North America market is expected to reach USD 590 Million and account for 61.7% in terms of revenue share by 2029 end. Due to legislative requirements for the adoption of clinical surveillance systems, hospitals and other healthcare institutions in North America are progressively implementing infection monitoring systems. Healthcare facilities can quickly identify infections with the use of infection surveillance software. Surveillance software in hospitals aids in managing electronic healthcare records and real-time pharmacy and lab reports in order to identify if a patient has developed a HAI, thereby facilitating timely treatment of the infection. The Centers for Disease Control and Prevention (CDC) has estimated that each year, drug-resistant bacteria in the United States alone result in more than 23,000 fatalities and over 2.0 million illnesses. In addition, 400 acute care hospitals reported 18,924 HAI infections in 2016, according to the California Department of Public Health (CDPH). Revenue from the Europe market is also expected to witness high growth during the forecast period. The Europe market is expected to reach a value of about USD 185 Mn, and account for 18.3 % revenue share by 2029 end. Within Europe, Germany is forecast to grow at approximately 16.1% CAGR while Rest of European market (as defined in the study) will reach US$86.4 Million by the end of the analysis period. Around 25,000 individuals in the European Union (EU) pass away each year as a result of antibiotic-resistant germs, according to figures released by the European Commission (EC). There might be 10 million fatalities worldwide per year if the current trend of infection continues until 2050. Due to expanding medical tourism and bettering healthcare infrastructure, the Asia Pacific market is anticipated to rise significantly during the forecast period. The second-largest economy in the world, China, is expected to grow at a CAGR of 17.1 percent over the course of the analysis period to reach an estimated market size of USD 122.8 million in 2026. Japan and Canada are two additional notable geographic markets, with growth rates of 13.6 and 15.7 percent throughout the study period predicted for each. Because there is greater access to and knowledge of cutting-edge medical facilities in the Asia Pacific region, this market is one that is rapidly expanding. However, some of the factors impeding the growth of the market in the Asia Pacific Region include the high cost of systems and limited knowledge of the availability of modern systems. The objective of the report is to present a comprehensive analysis of the global Infection Surveillance Solutions Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Infection Surveillance Solutions Market dynamic, structure by analyzing the market segments and projecting the Infection Surveillance Solutions Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Infection Surveillance Solutions Market make the report investor’s guide.Infection Surveillance Solutions Market Scope: Inquire before buying

Infection Surveillance Solutions Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US 588.54 Mn. Forecast Period 2023 to 2029 CAGR: 15.4% Market Size in 2029: US 1604.05 Mn. Segments Covered: by Software On-Premise Software Web-Based Software by Services Product Support & Maintenance Implementation Services Training & Consulting services by End-Users Hospitals Large Hospitals Medium Sized Hospitals Small Hospitals Long-Term Care Facilities Nursing Homes Skilled Nursing Facilities Assisted- Living Facilities Other End Users Infection Surveillance Solutions Market by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players are:

1. Vecna Technologies, Inc. (US) 2. Becton, Dickinson and Company (US) 3. Sunquest (US) 4. Wolters Kluwer N.V. (Netherlands) 5. Cerner Corporation (US) 6. Premier, Inc. (US) 7. GOJO Industries, Inc. (US) 8. Deb Group Ltd. (UK) 9. Baxter International Inc. (US) 10.BioMerieux SA (France) 11.BioVigil Healthcare Systems (US) 12.RLDatix (UK) 13.CKM Healthcare (Canada) 14.IBM Corporation (US) 15.PeraHealth Inc. (US) 16.Ecolab Inc. (US) 17.VigiLanz Corporation (US) 18.Medexter Healthcare (Austria) 19.CenTrak, Inc. (US) 20.Asolva Inc. (US) 21.PointClickCare (Canada) 22.Harris Healthcare (US) 23.Vitalacy Inc. (US) 24.STANLEY Healthcare (US) 25.Vizzia Technologies (US) Frequently Asked Questions: 1] What segments are covered in the Global Infection Surveillance Solutions Market report? Ans. The segments covered in the Infection Surveillance Solutions Market report are based on Software, Services, and End-Users. 2] Which region is expected to hold the highest share in the Global Infection Surveillance Solutions Market? Ans. The North America region is expected to hold the highest share in the Infection Surveillance Solutions Market. 3] What is the market size of the Global Infection Surveillance Solutions Market by 2029? Ans. The market size of the Infection Surveillance Solutions Market by 2029 is expected to reach USD 1604.05 Mn. 4] What is the forecast period for the Global Infection Surveillance Solutions Market? Ans. The forecast period for the Infection Surveillance Solutions Market is 2023-2029. 5] What was the market size of the Global Infection Surveillance Solutions Market in 2022? Ans. The market size of the Infection Surveillance Solutions Market in 2022 was valued at USD 588.54 Mn.

1. Global Infection Surveillance Solutions Market Size: Research Methodology 2. Global Infection Surveillance Solutions Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Infection Surveillance Solutions Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Infection Surveillance Solutions Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Infection Surveillance Solutions Market Size Segmentation 4.1. Global Infection Surveillance Solutions Market Size, by Software (2022-2029) • On-Premise Software • Web-Based Software 4.2. Global Infection Surveillance Solutions Market Size, by Services (2022-2029) • Product Support & Maintenance • Implementation Services • Training & Consulting services 4.3. Global Infection Surveillance Solutions Market Size, by End-Users (2022-2029) • Hospitals o Large Hospitals o Medium Sized Hospitals o Small Hospitals • Long-Term Care Facilities o Nursing Homes o Skilled Nursing Facilities o Assisted- Living Facilities • Other End Users 5. North America Infection Surveillance Solutions Market (2022-2029) 5.1. North America Infection Surveillance Solutions Market Size, by Software (2022-2029) • On-Premise Software • Web-Based Software 5.2. North America Infection Surveillance Solutions Market Size, by Services (2022-2029) • Product Support & Maintenance • Implementation Services • Training & Consulting services 5.3. North America Infection Surveillance Solutions Market Size, by End-Users (2022-2029) • Hospitals o Large Hospitals o Medium Sized Hospitals o Small Hospitals • Long-Term Care Facilities o Nursing Homes o Skilled Nursing Facilities o Assisted- Living Facilities • Other End Users 5.4. North America Infection Surveillance Solutions Market, by County(2022-2029) • United States • Canada 6. European Infection Surveillance Solutions Market (2022-2029) 6.1. European Infection Surveillance Solutions Market , by Software (2022-2029) 6.2. European Infection Surveillance Solutions Market , by Services (2022-2029) 6.3. European Infection Surveillance Solutions Market , by End-Users (2022-2029) 6.4. European Infection Surveillance Solutions Market , by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Infection Surveillance Solutions Market (2022-2029) 7.1. Asia Pacific Infection Surveillance Solutions Market , by Software (2022-2029) 7.2. Asia Pacific Infection Surveillance Solutions Market , by Services (2022-2029) 7.3. Asia Pacific Infection Surveillance Solutions Market , by End-Users (2022-2029) 7.4. Asia Pacific Infection Surveillance Solutions Market , by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Infection Surveillance Solutions Market (2020-2029) 8.1. Middle East and Africa Infection Surveillance Solutions Market , by Software (2022-2029) 8.2. Middle East and Africa Infection Surveillance Solutions Market , by Services (2022-2029) 8.3. Middle East and Africa Infection Surveillance Solutions Market , by End-Users (2022-2029) 8.4. Middle East and Africa Infection Surveillance Solutions Market , by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Infection Surveillance Solutions Market (2020-2029) 9.1. South America Infection Surveillance Solutions Market , by Software (2022-2029) 9.2. South America Infection Surveillance Solutions Market , by Services (2022-2029) 9.3. South America Infection Surveillance Solutions Market , by End-Users (2022-2029) 9.4. South America Infection Surveillance Solutions Market , by Country (2022-2029) • Brazil • Mexico • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Vecna Technologies, Inc. (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Becton, Dickinson and Company (US) 10.3. Sunquest (US) 10.4. Wolters Kluwer N.V. (Netherlands) 10.5. Cerner Corporation (US) 10.6. Premier, Inc. (US) 10.7. GOJO Industries, Inc. (US) 10.8. Deb Group Ltd. (UK) 10.9. Baxter International Inc. (US) 10.10. BioMerieux SA (France) 10.11. BioVigil Healthcare Systems (US) 10.12. RLDatix (UK) 10.13. CKM Healthcare (Canada) 10.14. IBM Corporation (US) 10.15. PeraHealth Inc. (US) 10.16. Ecolab Inc. (US) 10.17. VigiLanz Corporation (US) 10.18. Medexter Healthcare (Austria) 10.19. CenTrak, Inc. (US) 10.20. Asolva Inc. (US) 10.21. PointClickCare (Canada) 10.22. Harris Healthcare (US) 10.23. Vitalacy Inc. (US) 10.24. STANLEY Healthcare (US)