The Industrial Batteries Market was worth US$ 22.8 Billion in 2022 and is expected to grow at a CAGR of 14.8% to an estimated revenue of US$ 59.91 Billion by 2029. The Industrial Batteries are robust energy storage systems which are specifically engineered to endure rigorous operating conditions, which include intense usage, heightened vibrations and extreme temperatures that would typically challenge conventional batteries. Industrial Batteries excel in powering heavy machinery such as forklifts, electric drills and various other industrial devices, outperforming standard batteries by continuing to function reliably under demanding circumstances. Industrial Batteries are set apart by their ability to thrive in extreme environments where ordinary batteries would falter. They are specifically designed to withstand the harshest conditions, ensuring uninterrupted performance and optimized productivity. This remarkable adaptability has opened doors to an extensive array of applications. For instance, Industrial Batteries play a crucial role in structural stress monitoring on bridges, where they provide reliable power to monitoring systems, even in harsh outdoor environments. Also, these robust energy storage solutions find utility in underwater seismic measurements, demonstrating their versatility in diverse industries. When it comes to industrial operations, relying on the steadfast capabilities of Industrial Batteries can significantly enhance efficiency, minimize downtime and maximize output. Their ability to withstand the rigours of heavy usage, extreme temperatures and intense vibrations is a testament to their superior design and engineering. So, the manufacturing firms and other industries are suggested to integrate this modern concept and install Industrial Batteries in all industrial settings that demand uncompromising performance, longevity and resilience from their power systems. Since 2018, the annual deployed capacity of Industrial Batteries has surged by approximately 200%, signifying their growing importance. From their initial prominence in consumer electronics in the 19 90s and early 2000s, Industrial Batteries now serve a multitude of applications, including grid storage and uninterrupted power systems. They can be utilized at their maximum potential in remote places and inaccessible areas where self-powered equipment is necessary due to challenges associated with battery recharging or replacement. Industrial Batteries consist of basic components like the cathode, anode and electrolyte, where the cathode accounts for majority of the total cost, which is about 30% of the overall battery cost. The most prevalent types employed in industrial applications are lithium-ion, nickel-based and lead-based batteries. The surge in industrial battery deployment highlights their indispensability across sectors, providing dependable and efficient power solutions for critical operations.To know about the Research Methodology :- Request Free Sample Report

Industrial Batteries Market Dynamics

Industrial Batteries Market Drivers The Industrial Batteries market is experiencing substantial growth driven by several key market drivers. One of the most important key drivers is the escalating demand for reliable and uninterrupted power supply across diverse industries, including manufacturing, grid storage facilities, telecommunications and data centres is a significant driver. Industrial Batteries are recognized for their ability to provide backup power during grid outages and in remote areas with limited access to the power grid. This demand for uninterrupted power solutions fuels the market's expansion. Another such market driver includes, the increase in the adoption of renewable energy sources, such as solar and wind power, which creates a strong need for efficient energy storage solutions. Industrial Batteries play an important role in storing surplus energy generated with a higher efficiency and minimum losses from these sources and delivering it when required, thus contributing to the market's growth. Also, the rise in the popularity of modern electric vehicles (EVs) and the consequent expansion of the EV charging infrastructure are bolstering the demand for advanced Industrial Batteries. These batteries are crucial for powering EVs efficiently and supporting the growing charging infrastructure. The notable advancements in battery technologies are stimulating market growth. Ongoing research and development efforts have resulted in the emergence of high-capacity and long-lasting batteries, offering improved performance and extended operational life. These technological advancements are driving the adoption of Industrial Batteries across various sectors. Industrial Batteries Market Trends & Opportunities The market trends and opportunities in the Industrial Batteries sector include, the increase in the adoption of renewable energy resources and the need for efficient energy storage solutions present a substantial opportunity. The demand for uninterrupted power supply across various industries is also a major trend or rather a modern requirement to increase productivity. The expanding electric vehicle market and the growth of EV charging infrastructure offer promising prospects. Advancements in battery technologies, including higher capacity and longer lifespan, are shaping the market. Also, the focus on sustainability and decarbonization creates avenues for industrial battery solutions.Industrial Batteries Market Restraints & Challenges

The Industrial Batteries market consists of multiple restraints and challenges. One key restraint is the high cost associated with Industrial Batteries and the availability of low-cost batteries in the market, particularly in terms of the raw materials and advanced technologies required for the production of Industrial Batteries. This cost factor can limit their widespread adoption, especially in price-sensitive markets. Also, the limited energy density of current battery technologies poses a challenge as industries demand higher energy storage capacities and longer operational lifespans. The disposal and recycling of Industrial Batteries also present challenges due to environmental concerns and the need for proper waste management practices. The regulatory landscape and safety standards surrounding Industrial Batteries are continually evolving, requiring manufacturers to navigate complex compliance requirements. The introduction of new government laws and policies for the Industrial Batteries Industry as well as the disruption of supply chain due to the COVID-19 pandemic has impacted the Industrial Batteries Market Shares at a global level, which took the shape of major restraint for the market. The competitive landscape is also intensifying as more companies enter the market, resulting in increased pricing pressures and the need for differentiation. Successfully addressing these restraints and challenges will be crucial for industry players to ensure sustained growth and market success.Industrial Batteries Market Segment Analysis

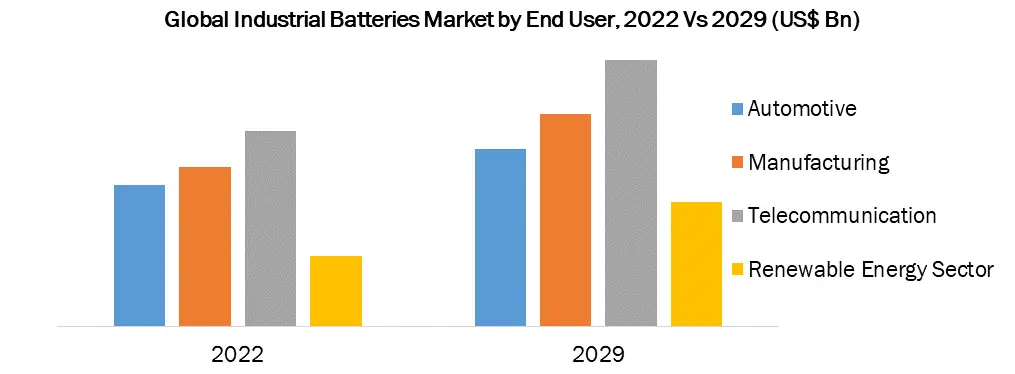

By Type: The Industrial Batteries market segmentation by types is done on the basis of Industrial Batteries available in the market, which include lithium-ion, nickel-based and lead-acid batteries, along with emerging technologies like solid-state and flow batteries. Lithium-ion batteries are widely favoured in multiple medium as well as high power industries for their demand for high energy density, longer lifespan and faster charging capabilities, finding end-user applications in UPS systems, industrial automation and grid-level storage. Nickel-based batteries offer robust performance, while lead-acid batteries are known for affordability and reliability. Emerging technologies like solid-state and flow batteries show potential for higher energy density and improved safety. The growth of the lithium-ion segment is driven by its favourable capacity-to-weight ratio and increasing investments in R&D. Energy storage systems (ESS) utilizing lithium-ion batteries contribute to their demand in renewable energy storage applications as well as sustainability. By End-User: The Industrial Batteries market segmentation by end-user is done on the basis of various sectors available, each relying on battery-powered solutions. Manufacturing industries utilize batteries to ensure uninterrupted operations of equipment and machinery. The telecommunications sector relies on Industrial Batteries for backup power during outages, while data centres depend on reliable battery backup systems to safeguard critical operations. The automotive industry drives demand for advanced battery technologies in electric and hybrid vehicles. The renewable energy sector relies on Industrial Batteries for efficient utilization of renewable sources. The telecommunication sector is expected to grow significantly, driven by the increasing penetration of mobile devices and the demand for satellite TV and internet services. Battery storage technology supports higher electricity generation from renewables. These trends indicate the growing importance of tailored battery solutions for diverse applications across industries.

Industrial Batteries Market: Regional Segment Analysis

Asia-Pacific: Asia Pacific Industrial Batteries Market is a key consumer and producer, driven by growing economies like China, Japan and India. These countries boast a significant number of manufacturers and consumers, contributing to market demand. The growth in the Asia-Pacific region is catalysed by the increase in the demand for renewable energy storage in residential, commercial and utility sectors. The robust manufacturing foundation in the region and rapid growth of the automotive industry further boost demand for industrial vehicles, including battery-operated forklifts. This expansion can be attributed to the economic growth and substantial investments in various industries within the Asia Pacific region. North America: The North America Industrial Batteries Market has a well-established R&D structure for the evolution of the market. Also, market shares for this region have always represented a positive growth. Countries like USA and Canada are the leaders in this region for the increased demand around sustainability. Europe: The European Industrial Batteries Market is prominent with a strong emphasis on sustainable energy solutions. The region is witnessing increasing investments in renewable energy sources, driving the demand for energy storage systems. The automotive industry's transition towards electric vehicles also fuels the demand for advanced battery technologies. Also, the stringent environmental regulations and the presence of key market players contribute to the growth of the Industrial Batteries market in Europe. South America: The South American Industrial Batteries Market shows significant potential, the region's expanding industrial sector, infrastructure development and increasing adoption of renewable energy sources create opportunities for battery-powered solutions. Countries like Brazil and Mexico are witnessing growth in the automotive industry, which further drives the demand for Industrial Batteries. Middle-East & Africa: The Middle East and African Industrial Batteries Market exhibit a prominent growth in the segment, primarily driven by the demand for uninterrupted power supply and the development of renewable energy projects. The region's focus on infrastructure development, expanding telecommunications sector and increasing investments in renewable energy storage systems contribute to the market growth.Competitive Landscape in Industrial Batteries Industry

The competitive landscape of the Industrial Batteries market is highly competitive, with companies focusing on strategies which include product innovation, partnerships, mergers & acquisitions and geographic expansion. They invest in research and development to enhance battery performance, energy density and safety features. Collaborations between battery manufacturers and end-users help develop customized solutions for specific applications. Mergers and acquisitions are undertaken to expand market presence and strengthen product portfolios. Geographic expansion, particularly in emerging markets, is a priority. The market dynamics is driven by continuous innovation and the increasing demand for reliable and efficient power storage solutions. Some of the recent developments include, the collaboration of Exide Industries with its new partner Leclanche SA and the commencement of large-scale production at their lithium-ion battery plant in India in May 2022. The state-of-the-art facility features six automated assembly lines dedicated to manufacturing batteries for automotive and energy storage applications. This strategic move enables Exide Industries to meet the rising demand from the mobility and utility sectors, positioning them to cater to the evolving needs of these industries effectively.Industrial Batteries Market Scope: Inquire before buying

Industrial Batteries Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 22.8 Bn. Forecast Period 2023 to 2029 CAGR: 14.8 % Market Size in 2029: US$ 59.91 Bn. Segments Covered: by Type Lithium-Ion Batteries Nickel-Based Batteries Lead-Acid Batteries Solid-State Batteries Flow Batteries by End-User Manufacturing Sector Telecommunication Sector Automotive Sector Renewable Energy Sector Industrial Batteries Market Regional Insights:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players: Industrial Batteries Industry

1. Panasonic Corporation 2. LG Chem Ltd. 3. Samsung SDI Co., Ltd. 4. BYD Company Ltd. 5. Toshiba Corporation 6. East Penn Manufacturing Co. 7. Exide Technologies 8. Saft Groupe S.A. 9. GS Yuasa Corporation 10. Johnson Controls International plc 11. EnerSys 12. A123 Systems LLC 13. C&D Technologies, Inc. 14. Hitachi Chemical Co., Ltd. 15. Duracell Inc. 16. Enersys Inc. 17. Hoppecke Batterien GmbH & Co. KG 18. Trojan Battery Company 19. FIAMM Energy Technology S.p.A. 20. NorthStar Battery Company, LLC 21. Shenzhen BAK Battery Co., Ltd. 22. Crown Battery Manufacturing Company 23. Narada Power Source Co., Ltd. 24. EverExceed Corporation 25. Leoch International Technology Limited FAQs: 1. What are the growth drivers for the Industrial Batteries Market? Ans. The growth drivers for the Industrial Batteries Market include increasing demand for reliable power supply in various industries and the rise of renewable energy sources, requiring efficient energy storage solutions. 2. What is the major restraint for the Industrial Batteries Market growth? Ans. The major restraint for the Industrial Batteries Market growth is the high initial cost of Industrial Batteries, limiting their widespread adoption and affordability for certain industries and applications. 3. Which region is expected to lead the global Industrial Batteries Market during the forecast period? Ans. Asia-Pacific Industrial Batteries Market is expected to lead the globally, during the forecast period. 4. What is the projected market size & growth rate of the Industrial Batteries Market? Ans. The Industrial Batteries Market size was valued at US$ 22.8 Billion in 2022 and the total revenue is expected to grow at a CAGR of 14.8% from 2022 to 2029, reaching nearly US$ 59.91 Billion. 5. What segments are covered in the Industrial Batteries Market report? Ans. The segments covered in the Industrial Batteries Market report are by Type, End-User and Region.

1. Industrial Batteries Market: Research Methodology 2. Industrial Batteries Market: Executive Summary 3. Industrial Batteries Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Industrial Batteries Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Industrial Batteries Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Industrial Batteries Market Size and Forecast, by Type (2022-2029) 5.1.1. Lithium-Ion Batteries 5.1.2. Nickel-Based Batteries 5.1.3. Lead-Acid Batteries 5.1.4. Solid-State Batteries 5.1.5. Flow Batteries 5.2. Industrial Batteries Market Size and Forecast, by End-User (2022-2029) 5.2.1. Manufacturing Sector 5.2.2. Telecommunication Sector 5.2.3. Automotive Sector 5.2.4. Renewable Energy Sector 5.3. Industrial Batteries Market Size and Forecast, by Region (2022-2029) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Industrial Batteries Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Industrial Batteries Market Size and Forecast, by Type (2022-2029) 6.1.1. Lithium-Ion Batteries 6.1.2. Nickel-Based Batteries 6.1.3. Lead-Acid Batteries 6.1.4. Solid-State Batteries 6.1.5. Flow Batteries 6.2. North America Industrial Batteries Market Size and Forecast, by End-User (2022-2029) 6.2.1. Manufacturing Sector 6.2.2. Telecommunication Sector 6.2.3. Automotive Sector 6.2.4. Renewable Energy Sector 6.3. North America Industrial Batteries Market Size and Forecast, by Country (2022-2029) 6.3.1. United States 6.3.2. Canada 6.3.3. Mexico 7. Europe Industrial Batteries Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Industrial Batteries Market Size and Forecast, by Type (2022-2029) 7.1.1. Lithium-Ion Batteries 7.1.2. Nickel-Based Batteries 7.1.3. Lead-Acid Batteries 7.1.4. Solid-State Batteries 7.1.5. Flow Batteries 7.2. Europe Industrial Batteries Market Size and Forecast, by End-User (2022-2029) 7.2.1. Manufacturing Sector 7.2.2. Telecommunication Sector 7.2.3. Automotive Sector 7.2.4. Renewable Energy Sector 7.3. Europe Industrial Batteries Market Size and Forecast, by Country (2022-2029) 7.3.1. UK 7.3.2. France 7.3.3. Germany 7.3.4. Italy 7.3.5. Spain 7.3.6. Sweden 7.3.7. Austria 7.3.8. Rest of Europe 8. Asia Pacific Industrial Batteries Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Industrial Batteries Market Size and Forecast, by Type (2022-2029) 8.1.1. Lithium-Ion Batteries 8.1.2. Nickel-Based Batteries 8.1.3. Lead-Acid Batteries 8.1.4. Solid-State Batteries 8.1.5. Flow Batteries 8.2. Asia Pacific Industrial Batteries Market Size and Forecast, by End-User (2022-2029) 8.2.1. Manufacturing Sector 8.2.2. Telecommunication Sector 8.2.3. Automotive Sector 8.2.4. Renewable Energy Sector 8.3. Asia Pacific Industrial Batteries Market Size and Forecast, by Country (2022-2029) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Vietnam 8.3.9. Taiwan 8.3.10. Bangladesh 8.3.11. Pakistan 8.3.12. Rest of Asia Pacific 9. Middle East and Africa Industrial Batteries Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Industrial Batteries Market Size and Forecast, by Type (2022-2029) 9.1.1. Lithium-Ion Batteries 9.1.2. Nickel-Based Batteries 9.1.3. Lead-Acid Batteries 9.1.4. Solid-State Batteries 9.1.5. Flow Batteries 9.2. Middle East and Africa Industrial Batteries Market Size and Forecast, by End-User (2022-2029) 9.2.1. Manufacturing Sector 9.2.2. Telecommunication Sector 9.2.3. Automotive Sector 9.2.4. Renewable Energy Sector 9.3. Middle East and Africa Industrial Batteries Market Size and Forecast, by Country (2022-2029) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Egypt 9.3.4. Nigeria 9.3.5. Rest of ME&A 10. South America Industrial Batteries Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Industrial Batteries Market Size and Forecast, by Type (2022-2029) 10.1.1. Lithium-Ion Batteries 10.1.2. Nickel-Based Batteries 10.1.3. Lead-Acid Batteries 10.1.4. Solid-State Batteries 10.1.5. Flow Batteries 10.2. South America Industrial Batteries Market Size and Forecast, by End-User (2022-2029) 10.2.1. Manufacturing Sector 10.2.2. Telecommunication Sector 10.2.3. Automotive Sector 10.2.4. Renewable Energy Sector 10.3. South America Industrial Batteries Market Size and Forecast, by Country (2022-2029) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Rest of South America 11. Company Profile: Key players 11.1. Panasonic Corporation 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. LG Chem Ltd. 11.3. Samsung SDI Co., Ltd. 11.4. BYD Company Ltd. 11.5. Toshiba Corporation 11.6. East Penn Manufacturing Co. 11.7. Exide Technologies 11.8. Saft Groupe S.A. 11.9. GS Yuasa Corporation 11.10. Johnson Controls International plc 11.11. EnerSys 11.12. A123 Systems LLC 11.13. C&D Technologies, Inc. 11.14. Hitachi Chemical Co., Ltd. 11.15. Duracell Inc. 11.16. Enersys Inc. 11.17. Hoppecke Batterien GmbH & Co. KG 11.18. Trojan Battery Company 11.19. FIAMM Energy Technology S.p.A. 11.20. NorthStar Battery Company, LLC 11.21. Shenzhen BAK Battery Co., Ltd. 11.22. Crown Battery Manufacturing Company 11.23. Narada Power Source Co., Ltd. 11.24. EverExceed Corporation 11.25. Leoch International Technology Limited 12. Key Findings 13. Industry Recommendation