The Immune Health Supplements Market was valued at USD 26.94 Bn in 2024, and total global Immune Health Supplements Market revenue is expected to grow at a CAGR of 10.5% & reaching nearly USD 59.88 Bn from 2025-2032.Immune Health Supplements Market Overview

Immune Health Supplements is a fast growing sector within the global wellness and preventive healthcare industry, driven by increased self-care awareness, rising incidence of chronic conditions and greater consumer focus on immunity post-COVID-19. The market is gaining traction across age groups due to the growing popularity of clean label, plant-based and clinically supported products. This report by MMR provides strategic overview of dynamic and innovation driven market that spans vitamins, probiotics, herbal extracts, and functional nutrition formulations offered in multiple delivery formats including soft gels, powders, gummies and liquids. Consumers seek proactive solutions to support immune function year round, demand is increasing for supplements featuring ingredients like Vitamin C, D, zinc, turmeric and elderberry. Manufacturers are focusing on R&D led innovations, new product launches and personalized formulations targeting age, lifestyle and gut health. Rise of e-commerce and D2C models has further expanded market reach and accessibility. Our analysis captures market dynamics across ingredient types, source origin, distribution channels and form factors that are reshaping consumer choices and product development strategies.To know about the Research Methodology:- Request Free Sample Report North America dominated global market by strong product penetration, clinical awareness and high consumer spending on immunity products. Asia Pacific has been experiencing rapid growth with companies integrating traditional medicine and local botanicals, Europe’s market is shaped by aging demographics and demand for clinically validated supplements. Emerging regions like South America and Africa show high potential by affordable and herbal based solutions.Leading players like Nestle Health Science, NOW Foods, Blackmores and Dabur are shaping competition by innovation, acquisitions and omnichannel expansion. The report provides insights into key trends, regulatory shifts, clinical advancements and strategic movements across major companies to support stakeholders in navigating this fast evolving, high opportunity segment of the health and wellness industry.

Immune Health Supplements Market Dynamics

Growing Awareness Regarding Self-care and Well Being to Fuel Demand Globally, millions of customers are taking immunity boosters for maintaining their good health. There is a rising interest in personal fitness and thus, it is creating a high demand for immune-boosting products with vitamins and herbal extracts, probiotics, and others. In addition, seasonal health issues including the flu virus have driven the customers’ interest in immune health supplements and are assisting to drive the sales of immunity supplements. For instance, In the U.S., people are more conscious about the wellbeing of their children and hence, they spend dollars to supplement their nutrition. Factors such as surging awareness, increasing consumption of immunity-boosting supplements, and rising disposable incomes are likely to impel the market growth. Furthermore, physicians and consumers are becoming more aware that the immune system plays a vital role in critical areas of health that helps to diminish other chronic health issues. As per researchers, nearly every area of health is affected by the immune system. It includes the digestive system, brain, and cardiovascular system. Since our systems are challenged each day and not only during the seasonal flu, the overall demand for immune boosters will propel the market growth shortly. For instance, Embria has financed multiple clinical research studies presenting EpiCor performing as a multivitamin to demonstrate and balance the immune system offering year-round benefits. Innovation and Formulation of New Immunity Boosters to Drive Market Growth Innovation has been a stable part for manufacturers in the progression of the immune supplement business, as well as in opportunities and business expansion. New product launches with several health benefits are increasing the demand for innovative immunity supplement products. Besides, factors such as a surge in the usage of traditional and new ingredients for supplement manufacturing are responsible for the growth of new innovative immunity boosters. The high risk of infectious diseases has also created a buzz in the development of state-of-the-art and new immune health supplements. Furthermore, owing to the development of nanotechnology, companies are capable of producing their best innovation for boosting supplements. This would further upsurge the supply side with better formulations of supplements having higher benefits. Thus, it is creating a high demand for immunity supplements. For instance, in December 2022, Herbalife Nutrition unveiled its latest product, Immuno turmeric, in the Asia Pacific region. This addition bolstered the company’s portfolio of nutritional supplements to support a robust and healthy immune system. Similarly, in February 2020, Swiss, an Australian wellness company, announced the launch of its new product, Vitamin C and Manuka honey chewing tablets. The product contains lemon and acerola cherry extract, which helps in supporting the immune system. Adverse Effects of Immunity Health Supplements Likely to Limit Adoption Although vitamins and supplements help fill in the gaps in one’s diet, the finest way to take these essential nutrients is to get them straight from food. But, some of the supplements may show adverse effects, particularly when taken before surgery or when combined with other medicines. Immunity health supplements can also cause problems for those who have certain health conditions. In addition, the effects of many supplements haven’t been tested in children, pregnant women, and other groups. Similarly, safety and efficacy concerns persist despite the popularity of Immune supplement products. In particular, some supplements can cause side effects when administered at higher doses or combined with another supplement. Safety concerns can undermine consumer trust and reduce the desire to purchase immune health supplements. There is extensive promotion of the potential advantages, with comparatively less recognition of their possible harmful effects. Also, most emergency department visits are associated with adverse effects from dietary supplements. Moreover, these supplements are regulated as foods, and not as drugs. The Food and Drug Administration doesn’t assess the quality of supplements or evaluate their effects on the body. There are no requirements that the dietary supplements packaging list shows potential adverse effects, nor are there standards for the determined pill size. Thus, it is creating a high risk for the elderly population. All the aforementioned factors are anticipated to inhibit the immune health supplements market growth.Immune Health Supplements Market Segment Analysis

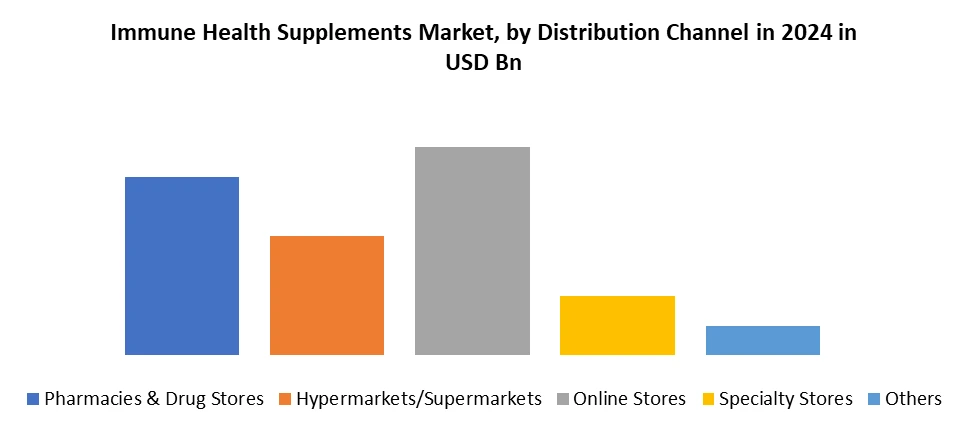

Based on Ingredient Type, the market has been segmented into vitamins, minerals, herbal extracts, probiotics, Omega-3 fatty acids, amino acids, and others. The vitamins segment held a dominant share of the market in 2024. The dominance is due to the growing consumption of vitamin supplements. The omega 3 fatty acids segment is projected to register a higher CAGR by 2032 due to the increasing number of new product launches which are rich in omega-3 fatty acids. It is also widely accessible in liquid and tonic forms. Besides, the herbal extract segment is expected to grow on account of their growing demand and utilization in several foods. In addition, as consumers increasingly look for natural ingredients that are effective and healthy, there is a high demand for botanicals derived from herbal extracts.Based on Distribution Channels, the market has been segmented into hypermarket/supermarket, pharmacies & drug stores, online stores, specialty stores, and others. The pharmacies and drug stores segment dominated in 2024 and is expected to retain its position during the forecast period. Hypermarkets/supermarkets are the most preferred outlets after pharmacies and drug stores. In countries, such as Indonesia, India, and Brazil, people are buying supplements from supermarkets, contributing to the overall revenue generation. Specialty stores entail organic and natural retail outlets. With the rising vegan public, organic chains and natural food stores are in the focus and thus, driving the product demand. They assist as a tool to promote and cite the products in the market. Besides, the online channel segment has gained traction post the hasty internet penetration and progressions in e-commerce shopping sites. The segment is anticipated to become the second-fastest-growing distribution channel in the supplements industry.

Immune Health Supplements Market Regional Analysis

North America Dominated the Immune Health Supplements Market in 2024 and is expected to dominate during the forecast period (2025-2032) The dominance of this region is attributable to the increasing prevalence of lifestyle diseases such as obesity and diabetes, coupled with the growing awareness about self-wellness and health. Following North America is Asia-Pacific, which has seen remarkable growth in the number of immunity booster products sold. This growth is attributed to reasons such as rising urbanization, increasing health consciousness, and rapidly changing lifestyles. For instance, in March 2020, according to an article published in Indian Express, there has been a surge in the bulk production of immunity boosters such as Vitamin C, D, zinc-based products, and elderberry due to COVID-19. Besides, the immune health supplements market in Europe is expected to grow at a significant CAGR owing to the rapidly surging aging population and the prevalence of chronic diseases. In addition to this, market players in this region are making heavy investments, which, in turn, will fuel the demand for these supplements. Latin America & the Middle East & Africa accounted for a comparatively lower share owing to the presence of a huge underpenetrated market.Immune Health Supplements Market Competitive Landscape

Immune health supplements market is led by blend of multinational giants and regionally dominant players, leveraging strong brand equity and robust innovation strategies. North America holds leading position in terms of product innovation and market penetration. Major companies like NOW Foods, Nature’s Bounty Co. and Herbalife Nutrition are at the forefront, investing in functional immunity boosters, botanical formulations and advanced delivery systems. In 2023, NOW introduced its “NOW Immune” range featuring herbal adaptogens, while Nature’s Bounty revamped its “Immune Defence” line to meet daily wellness demands. Europe market is shaped by pharmaceutical and nutraceutical leaders like Bayer AG, Nestle Health Science, Sanofi, and Glanbia PLC. These firms prioritize clinically validated ingredients, probiotic innovations and personalized nutrition. Also, UK based companies like Vita biotics and Reckitt Benckiser are expanding through direct to consumer channels and functional nutrition offerings, aligning with growing consumer demand for tailored health solutions. Asia Pacific region is witnessing significant growth driven by integration of traditional medicine and rising health awareness. Companies like Blackmores, Dabur, Himalaya Wellness and Suntory utilize region specific plant based ingredients. A key development in 2023 was Blackmores’ acquisition by Kirin, which is expected to result in the launch of LC plasma based immune products in Taiwan by early 2025. In Latin America, the Middle East, and Africa, emerging players such as EMS S/A and Vita Health are focusing on cost-effective, herbal or micronutrient based solutions. These firms cater to regional health needs, cultural preferences, and dietary gaps, particularly in underserved markets. Our report offers a strategic analysis of 30 key companies, assessing innovation in ingredients, formulation science, channel strategies, regulatory positioning and recent developments, supported by a detailed benchmarking matrix. Immune Health Supplements Market Key TrendsImmune Health Supplements Market Recent Development • 17th June 2025, Amway (India) launched Nutrilite Triple Protect, a plant-based supplement featuring Acerola Cherry, Turmeric, and Licorice designed to support immunity, reduce inflammation, and boost gut/skin health. The product offers 100 % RDA vitamin C and aligns with rising consumer demand for holistic wellness solutions. • 24th June 2024, Nestlé Health Science (Switzerland) acquired U.S. rights to Vowst from Seres Therapeutics, the first oral fecal transplant pill for recurrent Clostridioides difficile infection therapy. Vowst generated $10.1 M in Q1 2024, and this strengthens Nestlé’s microbiome-based supplement/pharma positioning. • 18th December 2023, Dabur India Ltd. (India) launched a “Science in Action” campaign featuring Dabur Chyawanprash, combining modern scientific messaging with traditional Ayurvedic immunity support; used educational outreach across 22 cities. • 24th July 2023, Dabur (India) launched its ‘Himalayan Shilajit’ resin-format supplement during Amazon India Prime Day in July 2023; positioned as a premium, antioxidant-rich immune health booster from high-altitude Himalayas. • 6th July 2023, Dr. Reddy’s (India) entered the child immunity segment with CeleHealth Kidz Immuno Plus Gummies in July 2023, formulated with Wellmune, prebiotics, vitamins & minerals.

Trends Description Holistic & Natural Formulations Consumers are increasingly preferring plant-based, herbal, and clean-label supplements with ingredients like turmeric, ginger, elderberry, and zinc. Personalized & Targeted Nutrition Brands are offering customized immune solutions based on age, gender, lifestyle, and gut health, often using AI or microbiome diagnostics. Expansion of Delivery Formats Gummies, effervescent tablets, powders, and functional beverages are gaining popularity over traditional capsules and tablets for better compliance. Immune Health Supplements Market Scope: Inquire before buying

Global Immune Health Supplements Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 26.94 Bn. Forecast Period 2025 to 2032 CAGR: 10.5% Market Size in 2032: USD 59.88 Bn. Segments Covered: by Ingredient Type Vitamins Minerals Herbal Botanical Extracts Probiotics Amino Acids Omega-3 Fatty Acids Others by Form Soft Gels/Capsules Tablets Powder Liquids Others by Source Type Plant-Based Animal-Based by Distribution Channel Pharmacies and Drug Stores Hypermarket/Supermarket Online Stores Specialty Stores Others Immune Health Supplements Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Immune Health Supplements Market, Key Players

North America 1. Amway (U.S. 2. Abbott Laboratories (U.S.) 3. NOW Foods (U.S.) 4. Nature’s Bounty Co. (U.S.) 5. GNC Holdings Inc. (U.S.) 6. Herbalife Nutrition Ltd. (U.S.) 7. CVS Health Corporation (U.S.) Europe 8. Bayer AG (Germany) 9. Nestlé Health Science (Switzerland) 10. Glanbia PLC (Ireland) 11. Pharma Nord ApS (Denmark) 12. The Boots Company PLC (UK) 13. Silesia Gerhard Hanke GmbH & Co. KG (Germany) 14. Vitabiotics Ltd. (UK) 15. Sanofi (France) Asia Pacific 16. Suntory Holdings Ltd. (Japan) 17. Dabur India Ltd. (India) 18. Himalaya Wellness Company (India) 19. Blackmores Limited (Australia) 20. BY-HEALTH Co., Ltd. (China) 21. Meiji Holdings Co., Ltd. (Japan) 22. Yuhan Corporation (South Korea) 23. Taisho Pharmaceutical Co., Ltd. (Japan) Middle East & Africa 24. VitaHealth Group (South Africa) 25. Abu Dhabi National Pharmaceuticals Company (UAE) South America 26. EMS S/A (Brazil) 27. Laboratorio Catarinense (Brazil) 28. Nutreov Group (Brazil) Immune Health Supplements Market Frequently Asked Questions 1. Who are the key players in the Immune Health Supplements Market? Ans. NOW Foods, Nature’s Bounty Co., Herbalife Nutrition, Blackmores, Dabur, Himalaya Wellness, Suntory, Bayer AG, Nestle Health Science, Sanofi, and Glanbia PLC are some of the key players of Immune Health Supplements Market. 2. Which segment dominates the Immune Health Supplements Market? Ans. By Ingredient Type, it is the dominating segment in the Immune Health Supplements Market. 3. How big is the Immune Health Supplements Market? Ans. The Global Immune Health Supplements Market size reached USD 26.94 Bn in 2024 and is expected to reach USD 59.88 Bn by 2032, growing at a CAGR of 10.5% during the forecast period. 4. What are the key regions in the global Immune Health Supplements Market? Ans. Based On the region, the Immune Health Supplements Market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and South America. North America dominates the global Immune Health Supplements market. 5. What is the study period of this market? Ans. The Global Market is studied from 2024 to 2032.

1. Immune Health Supplements Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Immune Health Supplements Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Global Immune Health Supplements Market: Dynamics 3.1. Region-wise Trends of Immune Health Supplements Market 3.1.1. North America Immune Health Supplements Market Trends 3.1.2. Europe Immune Health Supplements Market Trends 3.1.3. Asia Pacific Immune Health Supplements Market Trends 3.1.4. Middle East and Africa Immune Health Supplements Market Trends 3.1.5. South America Immune Health Supplements Market Trends 3.2. Immune Health Supplements Market Dynamics 3.2.1. Global Immune Health Supplements Market Drivers 3.2.1.1. Rising Health Awareness 3.2.1.2. Preventive Healthcare Trend 3.2.1.3. Functional Ingredient Demand 3.2.2. Global Immune Health Supplements Market Restraints 3.2.3. Global Immune Health Supplements Market Opportunities 3.2.3.1. Personalized Nutrition 3.2.3.2. E-commerce Expansion 3.2.3.3. Ayurvedic Integration 3.2.4. Global Immune Health Supplements Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Regulatory Frameworks 3.4.2. Aging Population 3.4.3. Biotech Innovation 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Immune Health Supplements Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 4.1.1. Vitamins 4.1.2. Minerals 4.1.3. Herbal Botanical Extracts 4.1.4. Probiotics 4.1.5. Amino Acids 4.1.6. Omega-3 Fatty Acids 4.1.7. Others 4.2. Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 4.2.1. Soft Gels/Capsules 4.2.2. Tablets 4.2.3. Powder 4.2.4. Liquids 4.2.5. Others 4.3. Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 4.3.1. Plant-Based 4.3.2. Animal-Based 4.4. Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 4.4.1. Pharmacies and Drug Stores 4.4.2. Hypermarket/Supermarket 4.4.3. Online Stores 4.4.4. Specialty Stores 4.4.5. Others 4.5. Immune Health Supplements Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Immune Health Supplements Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 5.1.1. Vitamins 5.1.2. Minerals 5.1.3. Herbal Botanical Extracts 5.1.4. Probiotics 5.1.5. Amino Acids 5.1.6. Omega-3 Fatty Acids 5.1.7. Others 5.2. North America Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 5.2.1. Soft Gels/Capsules 5.2.2. Tablets 5.2.3. Powder 5.2.4. Liquids 5.2.5. Others 5.3. North America Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 5.3.1. Plant-Based 5.3.2. Animal-Based 5.4. North America Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.1. Pharmacies and Drug Stores 5.4.2. Hypermarket/Supermarket 5.4.3. Online Stores 5.4.4. Specialty Stores 5.4.5. Others 5.5. North America Immune Health Supplements Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 5.5.1.1.1. Vitamins 5.5.1.1.2. Minerals 5.5.1.1.3. Herbal Botanical Extracts 5.5.1.1.4. Probiotics 5.5.1.1.5. Amino Acids 5.5.1.1.6. Omega-3 Fatty Acids 5.5.1.1.7. Others 5.5.1.2. United States Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 5.5.1.2.1. Soft Gels/Capsules 5.5.1.2.2. Tablets 5.5.1.2.3. Powder 5.5.1.2.4. Liquids 5.5.1.2.5. Others 5.5.1.3. United States Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 5.5.1.3.1. Plant-Based 5.5.1.3.2. Animal-Based 5.5.1.4. United States Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.1.4.1. Pharmacies and Drug Stores 5.5.1.4.2. Hypermarket/Supermarket 5.5.1.4.3. Online Stores 5.5.1.4.4. Specialty Stores 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 5.5.2.1.1. Vitamins 5.5.2.1.2. Minerals 5.5.2.1.3. Herbal Botanical Extracts 5.5.2.1.4. Probiotics 5.5.2.1.5. Amino Acids 5.5.2.1.6. Omega-3 Fatty Acids 5.5.2.1.7. Others 5.5.2.2. Canada Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 5.5.2.2.1. Soft Gels/Capsules 5.5.2.2.2. Tablets 5.5.2.2.3. Powder 5.5.2.2.4. Liquids 5.5.2.2.5. Others 5.5.2.3. Canada Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 5.5.2.3.1. Plant-Based 5.5.2.3.2. Animal-Based 5.5.2.4. Canada Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.2.4.1. Pharmacies and Drug Stores 5.5.2.4.2. Hypermarket/Supermarket 5.5.2.4.3. Online Stores 5.5.2.4.4. Specialty Stores 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 5.5.3.1.1. Vitamins 5.5.3.1.2. Minerals 5.5.3.1.3. Herbal Botanical Extracts 5.5.3.1.4. Probiotics 5.5.3.1.5. Amino Acids 5.5.3.1.6. Omega-3 Fatty Acids 5.5.3.1.7. Others 5.5.3.2. Mexico Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 5.5.3.2.1. Soft Gels/Capsules 5.5.3.2.2. Tablets 5.5.3.2.3. Powder 5.5.3.2.4. Liquids 5.5.3.2.5. Others 5.5.3.3. Mexico Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 5.5.3.3.1. Plant-Based 5.5.3.3.2. Animal-Based 5.5.3.4. Mexico Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.3.4.1. Pharmacies and Drug Stores 5.5.3.4.2. Hypermarket/Supermarket 5.5.3.4.3. Online Stores 5.5.3.4.4. Specialty Stores 5.5.3.4.5. Others 6. Europe Immune Health Supplements Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 6.2. Europe Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 6.3. Europe Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 6.4. Europe Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.5. Europe Immune Health Supplements Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 6.5.1.2. United Kingdom Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 6.5.1.3. United Kingdom Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 6.5.1.4. United Kingdom Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.2. France 6.5.2.1. France Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 6.5.2.2. France Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 6.5.2.3. France Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 6.5.2.4. France Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 6.5.3.2. Germany Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 6.5.3.3. Germany Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 6.5.3.4. Germany Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 6.5.4.2. Italy Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 6.5.4.3. Italy Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 6.5.4.4. Italy Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 6.5.5.2. Spain Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 6.5.5.3. Spain Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 6.5.5.4. Spain Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 6.5.6.2. Sweden Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 6.5.6.3. Sweden Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 6.5.6.4. Sweden Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 6.5.7.2. Russia Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 6.5.7.3. Russia Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 6.5.7.4. Russia Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 6.5.8.2. Rest of Europe Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 6.5.8.3. Rest of Europe Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 6.5.8.4. Rest of Europe Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7. Asia Pacific Immune Health Supplements Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.2. Asia Pacific Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.3. Asia Pacific Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.4. Asia Pacific Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5. Asia Pacific Immune Health Supplements Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.1.2. China Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.1.3. China Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.1.4. China Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.2.2. S Korea Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.2.3. S Korea Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.2.4. S Korea Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.3.2. Japan Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.3.3. Japan Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.3.4. Japan Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.4. India 7.5.4.1. India Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.4.2. India Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.4.3. India Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.4.4. India Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.5.2. Australia Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.5.3. Australia Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.5.4. Australia Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.6.2. Indonesia Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.6.3. Indonesia Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.6.4. Indonesia Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.7.2. Malaysia Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.7.3. Malaysia Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.7.4. Malaysia Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.8.2. Philippines Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.8.3. Philippines Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.8.4. Philippines Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.9.2. Thailand Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.9.3. Thailand Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.9.4. Thailand Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.10.2. Vietnam Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.10.3. Vietnam Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.10.4. Vietnam Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 7.5.11.3. Rest of Asia Pacific Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 7.5.11.4. Rest of Asia Pacific Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8. Middle East and Africa Immune Health Supplements Market Size and Forecast (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 8.2. Middle East and Africa Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 8.3. Middle East and Africa Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 8.4. Middle East and Africa Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.5. Middle East and Africa Immune Health Supplements Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 8.5.1.2. South Africa Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 8.5.1.3. South Africa Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 8.5.1.4. South Africa Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 8.5.2.2. GCC Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 8.5.2.3. GCC Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 8.5.2.4. GCC Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 8.5.3.2. Egypt Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 8.5.3.3. Egypt Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 8.5.3.4. Egypt Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 8.5.4.2. Nigeria Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 8.5.4.3. Nigeria Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 8.5.4.4. Nigeria Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 8.5.5.2. Rest of ME&A Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 8.5.5.3. Rest of ME&A Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 8.5.5.4. Rest of ME&A Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9. South America Immune Health Supplements Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 9.2. South America Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 9.3. South America Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 9.4. South America Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.5. South America Immune Health Supplements Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 9.5.1.2. Brazil Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 9.5.1.3. Brazil Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 9.5.1.4. Brazil Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 9.5.2.2. Argentina Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 9.5.2.3. Argentina Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 9.5.2.4. Argentina Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 9.5.3.2. Colombia Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 9.5.3.3. Colombia Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 9.5.3.4. Colombia Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 9.5.4.2. Chile Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 9.5.4.3. Chile Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 9.5.4.4. Chile Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 9.5.5. Rest of South America 9.5.5.1. Rest of South America Immune Health Supplements Market Size and Forecast, By Ingredient Type (2024-2032) 9.5.5.2. Rest of South America Immune Health Supplements Market Size and Forecast, By Form (2024-2032) 9.5.5.3. Rest of South America Immune Health Supplements Market Size and Forecast, By Source Type (2024-2032) 9.5.5.4. Rest of South America Immune Health Supplements Market Size and Forecast, By Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. NOW Foods (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Amway (U.S. 10.3. Abbott Laboratories (U.S.) 10.4. Nature’s Bounty Co. (U.S.) 10.5. GNC Holdings Inc. (U.S.) 10.6. Herbalife Nutrition Ltd. (U.S.) 10.7. CVS Health Corporation (U.S.) 10.8. Bayer AG (Germany) 10.9. Nestlé Health Science (Switzerland) 10.10. Glanbia PLC (Ireland) 10.11. Pharma Nord ApS (Denmark) 10.12. The Boots Company PLC (UK) 10.13. Silesia Gerhard Hanke GmbH & Co. KG (Germany) 10.14. Vitabiotics Ltd. (UK) 10.15. Sanofi (France) 10.16. Suntory Holdings Ltd. (Japan) 10.17. Dabur India Ltd. (India) 10.18. Himalaya Wellness Company (India) 10.19. Blackmores Limited (Australia) 10.20. BY-HEALTH Co., Ltd. (China) 10.21. Meiji Holdings Co., Ltd. (Japan) 10.22. Yuhan Corporation (South Korea) 10.23. Taisho Pharmaceutical Co., Ltd. (Japan) 10.24. VitaHealth Group (South Africa) 10.25. Abu Dhabi National Pharmaceuticals Company (UAE) 10.26. EMS S/A (Brazil) 10.27. Laboratorio Catarinense (Brazil) 10.28. Nutreov Group (Brazil) 11. Key Findings 12. Industry Recommendations 13. Immune Health Supplements Market: Research Methodology