Fatty Acid Market size was valued at USD 21.03 Billion in 2023 and the total Fatty Acid Revenue is expected to grow at a CAGR of 5.3 % from 2024 to 2030, reaching nearly USD 30.19 Billion in 2030.Fatty Acid Market Overview:

Fatty acids are long hydrocarbon chains present in triglycerides and phospholipids. The growing utilization of fatty acids in household & industrial cleaning, and pharmaceutical & nutraceutical products is expected to drive the market growth. Fatty chemicals are used primarily as ingredients in formulated industrial or consumer products or as precursors of other chemicals. In either case, customers for oleochemicals are other manufacturers. Virtually all domestic sales of fatty chemicals are direct manufacturer-to-manufacturer transactions. Although small quantities or imports are handled by specialized dealers or agents. The Fatty acids market is controlled by food and dietary supplements. It is owing to the rising implementation and consumption of various dietary and nutrition supplements in daily diets to maintain health. Fatty acids that own no double bonds and are linear in structure are called saturated fatty acids, fatty acids with single, double bonds are monounsaturated fatty acids, whereas fatty acids with multiple double bonds are known as polyunsaturated fatty acids. Essential fatty acids cannot be synthesized within the human body and are obtained from various external sources such as plants, vegetable oils, nuts & seeds, animal fats, and others.To know about the Research Methodology :- Request Free Sample Report Major companies operating in the fatty acids market are focused on using recycled raw materials in fatty acids manufacturing to decrease carbon emissions thereby achieving sustainability. Companies are experimenting and developing fatty acids from sources such as CO2 emissions (Waste carbon), and organic waste such as leftover fruit and vegetables. Cetoleic acid, associated with a specific type of fatty acid, is exemplified by Grøntvedt Biotech's launch of CETO3 in February 2023.

Fatty Acid Market Dynamics:

Exploring the Growth Dynamics of the Fatty Acids Market The fatty acids Market is being driven by the rising demand for cosmetics and personal care products. Fatty acids are the emollients and emulsifiers in the cosmetics industry, used to replenish and soothe the skin. The major factors driving the growth of the increasing demand for glycerine to manufacture propylene glycol and epichlorohydrin, government regulations promoting the use of eco-friendly products, the broader use of C18 in oilfield and drilling applications, the rise in the functional food and dietary supplements demand and increasing the number of chronic diseases is projected to propel the growth of the fatty acids market. The growing awareness and the need of customers related to healthy eating and the health advantages of essential fatty acids are estimated to cushion the growth of the fatty acids market. On the other hand, the variations in the costs of raw materials are projected to impede the growth of the fatty acids market in the forecast period.Enzymatic Pre-Splitting Technology and Omega Fatty Acids The introduction of enzymatic pre-splitting technology is one of the emerging trends making a significant impact on the global fatty acid market. The innovative approach to fatty acid production is revolutionizing the industry by offering more sustainable and efficient methods. Enzymatic pre-splitting technology involves the use of enzymes to break down triglycerides, which are the main constituents of fats and oils, into their fatty acid components. The process occurs before the traditional chemical extraction or refining steps. By employing enzymes, manufacturers selectively hydrolyze triglycerides into specific fatty acids, allowing for more precise control over the fatty acid composition of the end product. Omega fatty acid supplements are used more frequently owing to growing health consciousness. Fish oils are rich in omega fatty acids. Essential components for the human body. Omega-3 supplements are used as dietary supplements or therapeutic supplements and aid in the relief of rheumatoid arthritis symptoms. Health Concerns and Raw Material Costs Impacting the Fatty Acids Market Growth Several prevalent health conditions and unfavorable effects of excessive fatty acid consumption are expected to impede market growth. Owing to their association with elevated cholesterol levels and an increased risk of heart disease, saturated fatty acids are frequently associated with adverse health effects. The cost of raw materials is continuously increasing or fluctuating owing to factors such as transportation & logistics, increasing demand, and more, which is affecting the price of fatty acids. Thus, the volatility and increase in prices of raw materials such as oils and fats are expected to create a significant challenge for the fatty acids market manufacturers through the forecast period.

Fatty Acid Market Segment Analysis:

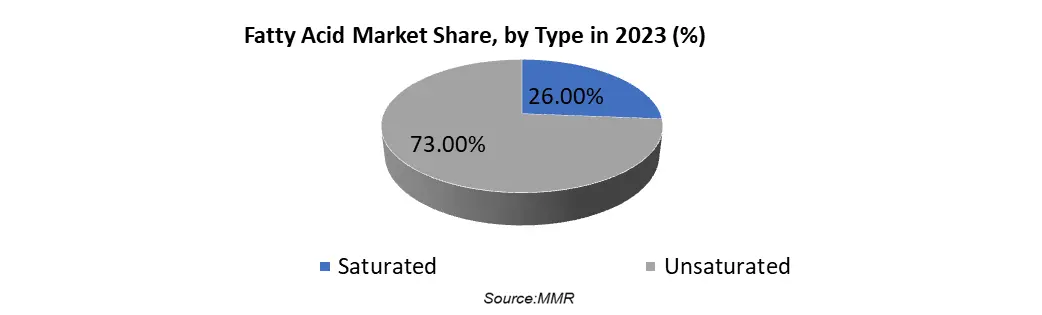

By Type, the unsaturated type dominated the market with the highest market share of 73 % in 2023. The unsaturated fats are extracted from nuts, avocados, canola, olive oil, and soybean among others. It helps in the production of chemokines, which attract the immune cells to the infected area and subsequently, improve the immune system. It has led to increased demand for dietary supplement applications across the globe. Its high share is attributable to its increasing penetration in the pharmaceutical industry. Rising demand for clean and healthy food products and ingredients owing to the health-conscious behavior among consumers are factors driving adoption in the European region. Polyunsaturated fatty acids include omega-3 fatty acids and omega-6 fatty acids. They have become an ideal replacement for saturated and trans fats, and offer numerous health benefits. PUFAs reduce triglycerides, prevent arrhythmia, lower blood pressure, control blood sugar, and reduce the risk of diabetes. Consumers in the United States frequently use high-nutritional products for general wellness. To increase their customer base, various manufacturers use components like polyunsaturated fatty acids in their products.

Fatty Acid Market Regional Insight:

Asia Pacific dominated the fatty acids growth trajectory with the highest market share of 38% in 2023. Fatty acids have significant use across industrial applications such as cosmetics, lubricants, and plastics. Owing to the presence of crucial raw material suppliers across the region. The easy availability of raw materials combined with enormous industrial consumption is encouraging fatty acid producers to raise their production capacities across Asia Pacific (APAC). Supplement and functional foods are primarily consumed to ensure the intake of nutritional constituents important to the human body. Growing awareness regarding a reduction in calorie intake among gym professionals and athletes in several countries including China, Italy, India, and the U.S. is likely to promote the use of omega-3 in sports supplements and functional food products. The increasing importance of fatty acids on a global level owing to the implementation of new advertising campaigns by companies such as Koninklijke DSM N.V. and BASF SE is expected to have a significant impact on the market growth. In addition, the soap industry is another factor contributing to the lucrativeness of the fatty acids market in Asia Pacific. Being one of the oldest sectors, soap manufacturing holds a significant share in the Indian FMCG industry. Increasing awareness of hygiene and adoption of hygiene standards particularly in rural areas is paving new opportunities for soap manufacturers. The anti-aging pharmaceuticals and cosmetic products segment is witnessing strong demand from individuals aged between 30 and 50 years in the region, which is dominated by developed countries such as the US with high per capita income and strong spending power. Rising demand from several end-use industries including household cleaning, pharmaceutical, and food & beverage among others is expected to augment product consumption in North America. The U.S. is one of the key consumers of fatty acids. It is also home to well-established players such as BASF SE, Cargill Incorporated, and Eastman Chemical Company. The abundant availability of raw materials coupled with the rising demand for nutraceutical products is expected to drive the market demand over the forecast period. The US and Canada are the major contributing countries in terms of revenue to the growth of the regional fatty acid market in 2023. The personal care and cosmetic industry is growing at a significant rate in North America.Fatty Acid Market Competitive Landscape: In July 2023, Novartis AG, a Switzerland-based pharmaceutical company, acquired DTx Pharma Inc. for an undisclosed sum. With the acquisition, Novartis aims to improve its RNA-based treatment capabilities by incorporating DTx’s fatty acids ligand-conjugated oligonucleotide (FALCON) platform into its siRNA toolbox. DTx Pharma Inc. is a Canada-based biotechnology company that employs its unique fatty acid ligand-conjugated oligonucleotide (FALCON) platform to create siRNA treatments for neurological disorders. In APRIL 2023, KLK Emmerich GmbH (“KLKE”) a subsidiary of Kuala Lumpur Kepong Berhad (“KLK”), under its resource-based manufacturing division known as KLK OLEO, recently completed its acquisition of a controlling stake in Temix Oleo SpA (“Temix Oleo”) for an undisclosed sum. The transaction was completed after receiving all necessary approvals and fulfilling all customary closing conditions. In December 2023, ADM has agreed to acquire Revela Foods, a Wisconsin-based developer and manufacturer of dairy flavor ingredients and solutions. Revela, which is projected to reach nearly $240 million in sales by the end of 2023, adds new capabilities to ADM’s global Flavors portfolio in the dairy Flavors and Savory Flavors segments.

Fatty Acid Market Scope: Inquire before buying

Fatty Acid Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 21.03 Bn. Forecast Period 2024 to 2030 CAGR: 5.3% Market Size in 2030: US $ 30.19 Bn. Segments Covered: by Type Saturated Unsaturated by Form Oil Powder Capsule by End-use Household & Industrial Cleaning Food & Beverage Pharmaceutical & Nutraceutical Personal Care & Cosmetics Industrial Fatty Acid Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Fatty Acid Market Key Players:

1. Akzo Nobel (Netherland) 2. BASF SE(Germany) 3. Evonik Indutsries AG (Germany) 4. Eastman Chemical Company (U.S) 5. DOW Chemical Company (U.S) 6. Archer Denials Midland Company (ADM) (US) 7. EVO Chemicals, Inc. (U.S) 8. Cargill Incorporated (U.S) 9. Croda International Plc (U. k) 10. Wilmar International Limited (Singapore) 11. Oleon N.V. (Belgium) 12. Vantage Specialty Chemicals 13. FMC Corporation 14. Koninklijke DSM NV 15. Omega Protein Company 16. Aker Biomarine AS 17. Nutritional Lipids 18. Enzymotec Ltd. 19. Kuraray Co. Ltd. (Japan) 20. Ajinomoto Co., Inc (Japan) 21. Godrej Industries Limited (India) Frequently Asked Questions: 1] What segments are covered in the Fatty Acid Market report? Ans. The segments covered in the Fatty Acid Market report are based on, Type, Form, and End Users. 2] Which region is expected to hold the highest share in the Fatty Acid Market? Ans. The Asia Pacific region is expected to hold the highest share of the Fatty Acid Market. 3] What is the market size of the Fatty Acid Market by 2030? Ans. The market size of the Fatty Acid Market by 2030 will be USD 30.19 Billion. 4] What is the forecast period for the Fatty Acid Market? Ans. The Forecast period for the Fatty Acid Market is 2024- 2030.

1. Fatty Acid Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Fatty Acid Market: Dynamics 2.1. Fatty Acid Market Trends by Region 2.1.1. North America Fatty Acid Market Trends 2.1.2. Europe Fatty Acid Market Trends 2.1.3. Asia Pacific Fatty Acid Market Trends 2.1.4. Middle East and Africa Fatty Acid Market Trends 2.1.5. South America Fatty Acid Market Trends 2.2. Fatty Acid Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Fatty Acid Market Drivers 2.2.1.2. North America Fatty Acid Market Restraints 2.2.1.3. North America Fatty Acid Market Opportunities 2.2.1.4. North America Fatty Acid Market Challenges 2.2.2. Europe 2.2.2.1. Europe Fatty Acid Market Drivers 2.2.2.2. Europe Fatty Acid Market Restraints 2.2.2.3. Europe Fatty Acid Market Opportunities 2.2.2.4. Europe Fatty Acid Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Fatty Acid Market Drivers 2.2.3.2. Asia Pacific Fatty Acid Market Restraints 2.2.3.3. Asia Pacific Fatty Acid Market Opportunities 2.2.3.4. Asia Pacific Fatty Acid Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Fatty Acid Market Drivers 2.2.4.2. Middle East and Africa Fatty Acid Market Restraints 2.2.4.3. Middle East and Africa Fatty Acid Market Opportunities 2.2.4.4. Middle East and Africa Fatty Acid Market Challenges 2.2.5. South America 2.2.5.1. South America Fatty Acid Market Drivers 2.2.5.2. South America Fatty Acid Market Restraints 2.2.5.3. South America Fatty Acid Market Opportunities 2.2.5.4. South America Fatty Acid Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Fatty Acid Industry 2.8. Analysis of Government Schemes and Initiatives For Fatty Acid Industry 2.9. Fatty Acid Market Trade Analysis 2.10. The Global Pandemic Impact on Fatty Acid Market 3. Fatty Acid Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Fatty Acid Market Size and Forecast, by Type (2023-2030) 3.1.1. Saturated 3.1.2. Unsaturated 3.2. Fatty Acid Market Size and Forecast, by Form (2023-2030) 3.2.1. Oil 3.2.2. Powder 3.2.3. Capsule 3.3. Fatty Acid Market Size and Forecast, by End User (2023-2030) 3.3.1. Household & Industrial Cleaning 3.3.2. Food & Beverage 3.3.3. Pharmaceutical & Nutraceutical 3.3.4. Personal Care & Cosmetics 3.3.5. Industrial 3.4. Fatty Acid Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Fatty Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Fatty Acid Market Size and Forecast, by Type (2023-2030) 4.1.1. Saturated 4.1.2. Unsaturated 4.2. North America Fatty Acid Market Size and Forecast, by Form (2023-2030) 4.2.1. Oil 4.2.2. Powder 4.2.3. Capsule 4.3. North America Fatty Acid Market Size and Forecast, by End User (2023-2030) 4.3.1. Household & Industrial Cleaning 4.3.2. Food & Beverage 4.3.3. Pharmaceutical & Nutraceutical 4.3.4. Personal Care & Cosmetics 4.3.5. Industrial 4.4. North America Fatty Acid Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Fatty Acid Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Saturated 4.4.1.1.2. Unsaturated 4.4.1.2. United States Fatty Acid Market Size and Forecast, by Form (2023-2030) 4.4.1.2.1. Oil 4.4.1.2.2. Powder 4.4.1.2.3. Capsule 4.4.1.3. United States Fatty Acid Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Household & Industrial Cleaning 4.4.1.3.2. Food & Beverage 4.4.1.3.3. Pharmaceutical & Nutraceutical 4.4.1.3.4. Personal Care & Cosmetics 4.4.1.3.5. Industrial 4.4.2. Canada 4.4.2.1. Canada Fatty Acid Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Saturated 4.4.2.1.2. Unsaturated 4.4.2.2. Canada Fatty Acid Market Size and Forecast, by Form (2023-2030) 4.4.2.2.1. Oil 4.4.2.2.2. Powder 4.4.2.2.3. Capsule 4.4.2.3. Canada Fatty Acid Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Household & Industrial Cleaning 4.4.2.3.2. Food & Beverage 4.4.2.3.3. Pharmaceutical & Nutraceutical 4.4.2.3.4. Personal Care & Cosmetics 4.4.2.3.5. Industrial 4.4.3. Mexico 4.4.3.1. Mexico Fatty Acid Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Saturated 4.4.3.1.2. Unsaturated 4.4.3.2. Mexico Fatty Acid Market Size and Forecast, by Form (2023-2030) 4.4.3.2.1. Oil 4.4.3.2.2. Powder 4.4.3.2.3. Capsule 4.4.3.3. Mexico Fatty Acid Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Household & Industrial Cleaning 4.4.3.3.2. Food & Beverage 4.4.3.3.3. Pharmaceutical & Nutraceutical 4.4.3.3.4. Personal Care & Cosmetics 4.4.3.3.5. Industrial 5. Europe Fatty Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Fatty Acid Market Size and Forecast, by Type (2023-2030) 5.2. Europe Fatty Acid Market Size and Forecast, by Form (2023-2030) 5.3. Europe Fatty Acid Market Size and Forecast, by End User (2023-2030) 5.4. Europe Fatty Acid Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Fatty Acid Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Fatty Acid Market Size and Forecast, by Form (2023-2030) 5.4.1.3. United Kingdom Fatty Acid Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Fatty Acid Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Fatty Acid Market Size and Forecast, by Form (2023-2030) 5.4.2.3. France Fatty Acid Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Fatty Acid Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Fatty Acid Market Size and Forecast, by Form (2023-2030) 5.4.3.3. Germany Fatty Acid Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Fatty Acid Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Fatty Acid Market Size and Forecast, by Form (2023-2030) 5.4.4.3. Italy Fatty Acid Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Fatty Acid Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Fatty Acid Market Size and Forecast, by Form (2023-2030) 5.4.5.3. Spain Fatty Acid Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Fatty Acid Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Fatty Acid Market Size and Forecast, by Form (2023-2030) 5.4.6.3. Sweden Fatty Acid Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Fatty Acid Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Fatty Acid Market Size and Forecast, by Form (2023-2030) 5.4.7.3. Austria Fatty Acid Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Fatty Acid Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Fatty Acid Market Size and Forecast, by Form (2023-2030) 5.4.8.3. Rest of Europe Fatty Acid Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Fatty Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.3. Asia Pacific Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Fatty Acid Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.1.3. China Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.2.3. S Korea Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.3.3. Japan Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.4.3. India Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.5.3. Australia Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.6.3. Indonesia Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.7.3. Malaysia Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.8.3. Vietnam Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.9.3. Taiwan Fatty Acid Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Fatty Acid Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Fatty Acid Market Size and Forecast, by Form (2023-2030) 6.4.10.3. Rest of Asia Pacific Fatty Acid Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Fatty Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Fatty Acid Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Fatty Acid Market Size and Forecast, by Form (2023-2030) 7.3. Middle East and Africa Fatty Acid Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Fatty Acid Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Fatty Acid Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Fatty Acid Market Size and Forecast, by Form (2023-2030) 7.4.1.3. South Africa Fatty Acid Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Fatty Acid Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Fatty Acid Market Size and Forecast, by Form (2023-2030) 7.4.2.3. GCC Fatty Acid Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Fatty Acid Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Fatty Acid Market Size and Forecast, by Form (2023-2030) 7.4.3.3. Nigeria Fatty Acid Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Fatty Acid Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Fatty Acid Market Size and Forecast, by Form (2023-2030) 7.4.4.3. Rest of ME&A Fatty Acid Market Size and Forecast, by End User (2023-2030) 8. South America Fatty Acid Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Fatty Acid Market Size and Forecast, by Type (2023-2030) 8.2. South America Fatty Acid Market Size and Forecast, by Form (2023-2030) 8.3. South America Fatty Acid Market Size and Forecast, by End User(2023-2030) 8.4. South America Fatty Acid Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Fatty Acid Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Fatty Acid Market Size and Forecast, by Form (2023-2030) 8.4.1.3. Brazil Fatty Acid Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Fatty Acid Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Fatty Acid Market Size and Forecast, by Form (2023-2030) 8.4.2.3. Argentina Fatty Acid Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Fatty Acid Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Fatty Acid Market Size and Forecast, by Form (2023-2030) 8.4.3.3. Rest Of South America Fatty Acid Market Size and Forecast, by End User (2023-2030) 9. Global Fatty Acid Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Fatty Acid Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Akzo Nobel (Netherland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. BASF SE(Germany) 10.3. Evonik Indutsries AG (Germany) 10.4. Eastman Chemical Company (U.S) 10.5. DOW Chemical Company (U.S) 10.6. Archer Denials Midland Company (ADM) (US) 10.7. EVO Chemicals, Inc. (U.S) 10.8. Cargill Incorporated (U.S) 10.9. Croda International Plc (U. k) 10.10. Wilmar International Limited (Singapore) 10.11. Oleon N.V. (Belgium) 10.12. Vantage Specialty Chemicals 10.13. FMC Corporation 10.14. Koninklijke DSM NV 10.15. Omega Protein Company 10.16. Aker Biomarine AS 10.17. Nutritional Lipids 10.18. Enzymotec Ltd. 10.19. Kuraray Co. Ltd. (Japan) 10.20. Ajinomoto Co., Inc (Japan) 10.21. Godrej Industries Limited (India) 11. Key Findings 12. Industry Recommendations 13. Fatty Acid Market: Research Methodology 14. Terms and Glossary