Global Hot Beverages Market size was valued at USD 142.71 Bn in 2024, and the total Hot Beverages Market revenue is expected to grow at a CAGR of 4.77% from 2025 to 2032, reaching nearly USD 207.18 Bn.Hot Beverages Market Overview:

Hot Beverages are a great source to remain warm and energetic. The demand for hot beverages is rapidly on the rise. Coffee and tea are the most common and high energetic hot beverages. There are many health benefits of consuming these hot beverages. Hot beverages are helpful for the relaxation of brain muscles, kill unwanted laziness and it also stimulate the energy level. The three most powerful factors that affect the demand for the hot beverages market are taste, convenience, and price.To know about the Research Methodology :- Request Free Sample Report The hot beverages market is expected to witness a sharp growth during the forecast period due to growing consumer interest in varieties of coffee flavors, as well as customer desire for hot beverages with the advantages of de-stressing and detoxifying. There has been a rise in the number of coffee shops and chain store cafés globally. McDonald's also offers coffee as an alternative to their fizzy beverage therefore consumers’ love for hot beverages will never slow down. This has led to an increased Hot Beverages market revenue in the forecast period. In this report, the Hot Beverages market's growth reasons and the market's many segments (Nature, Application, Distribution channel, and Region) are discussed. Data has been given by market players, regions, and specific requirements. This market report includes a comprehensive overview of all the significant improvements that are presently prevailing in all market segments. Key data analysis is presented in the form of statistics, infographics, and presentations. The study discusses the wiring duct market's Drivers, Restraints, Opportunities, and Challenges. The report helps to assess the market growth drivers and determines how to use these drivers as a tool. The report also helps to rectify and resolve issues related to the global Hot Beverages market situation.

Hot Beverages Market Dynamics:

Due to growing awareness of the potentially harmful effects of carbonated drinks, consumers have started to choose hot beverages over carbonated drinks. Knowledge among the youthful population about the health benefits of hot beverages like coffee and tea to preventing harmful diseases like diabetes, blood pressure, and obesity is increased. This factor is boosting the growth of the Hot Beverages market. Manufacturers are using various products and ingredients to produce innovative flavors of tea and coffee with added health benefits, which may help the market for hot beverages to grow in the forecast period. Great varieties of coffee options are available in the market. people love to try new fancy alternatives to straightforward coffee, with cappuccinos, flat whites, Americanos, lattes, and other varieties gaining in popularity. This trend is the major driving factor for the growth of the market. Demand for cold beverage items like iced tea and other cooled beverages may inhibit the expansion of the global hot beverage market. Annual expenditure on coffee and tea in the U.K The below statistic shows total consumer spending on coffee and tea in the United Kingdom (UK) from 2022 to 2029. In 2022, the consumer was spending approximately 3.92 billion British pounds for the consumption of Hot beverages. Hot beverages have always played an important role in the U.K. Recently, however, the increasing popularity of coffee has dented sales of tea. This has been further exaggerated by cheaper and easier access to premium coffee via the likes of coffee pod machines. Approximately 24 million people across the nation consume instant coffee. It is estimated that approx. seven million people drink 2 to 3 cups a day. Tea is also making new trends, however, with loose leaf tea and herbal teas. In France, hot beverages sector was led by the hot coffee in 2023. Hypermarkets & supermarkets are the leading distribution channels of hot beverages in this country. Nestlé is the leading brand in France for coffee. The majority of people in France preferred to drink coffee at breakfast. Tea was selected by only 35% of people in this region. Demand for green tea increased during the forecast period. In addition, manufacturers are introducing Ready-to-Drink (RTD) beverages such as coffee pods which are prepared by dipping it in water. These new innovations are some of the factors that are expected to fuel the global hot beverages market’s growth in the forecast period. However, fluctuating prices of raw materials would slow down the hot beverages market growth rate. Hot beverages are seasonally demanded. which results in throwing down the sales during summers. These factors may hamper the growth of the Hot beverages market during the forecast. Excess consumption of hot beverages is bad for the health. Addiction to coffee and tea may result in anxiety and can lead to isonomy, formation of carcinogens. which is the major restraint for the growth of the Hot Beverages Market.Hot Beverages Market Segment Analysis:

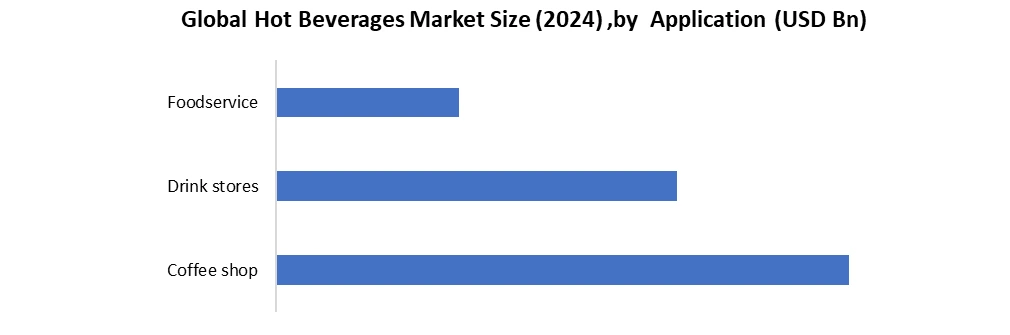

By Type, coffee is the fastest-growing segment, growing at a CAGR of 7.6% during the forecast period. Increased demand for organic coffee had led many manufacturers to produce new and innovative flavors and varieties. Furthermore, coffee shops are focusing on instant and natural coffee. Many young generations prefer coffee as it contains a high amount of caffeine, which helps the body to refresh, which may boost the market growth during the forecast period. The tea segment is expected to grow at a CAGR of 5.3% during the forecast. The Production and Consumption of tea is increased in the Asia Pacific region such as India, China, Thailand, and Pakistan. Manufacturers are focusing on unique flavors of tea to increase their sales. For instance, the Indian Company has made masala tea packs that help to improve the immune system. These are the main factors for driving the market over the forecast period. By Application, the coffee shop segment is expected to grow at a CAGR of 5.6% during the forecast period. changing lifestyles and the growing disposable income are the drivers for the growth coffee shop segment.

Regional Insights:

In Asia Pacific Region the hot beverages market has dominated the market and is expected to grow at the fastest CAGR of 7.9% over the forecast period owing to the increasing number of franchise outlets in this region. Awareness regarding brand is increased amongst the people are a major reason for the market growth in the region. Over the forecast timeframe, the rising population of millennials will be a major audience for the global hot beverage market. In Asia pacific region Consumers are looking for a unique and authentic taste of tea. Millionaires of this region spend more money on coffee and tea. They prefer premium tea while they are going to restaurants. Moreover, the rising population, rising income levels, raising awareness about the benefits of hot beverages are the major drivers for the growth of the hot beverages market in this region. In 2022, Europe held the second-largest share in the market. The market for Hot beverages in western Europe is valued at 30.5 billion USD. Demand for a coffee pod is increased in this region in the last few years. Furthermore, the United Kingdom has a large demand for ready-to-drink or instant coffee products, which is expected to drive hot drink market growth in the coming years. The objective of the report is to present a comprehensive analysis of the Hot Beverages market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps understand the Hot Beverages market dynamics and structure by analyzing the market segments and projecting the Hot Beverages market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Hot Beverages market make the report investor’s guide.Hot Beverages Market Scope: Inquire before buying

Global Hot Beverages Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 142.71 Bn. Forecast Period 2025 to 2032 CAGR: 4.77% Market Size in 2032: USD 207.18 Bn. Segments Covered: by Type Coffee Tea by Ingredient Caffeinated Beverages Decaffeinated Beverages With Additives (sugar, flavors) Organic/Natural Ingredients by Packaging Packets Cans Sachets Bottles Pods/Capsules by Application Coffee shop Drink stores Foodservice Hot Beverages Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Hot Beverages Market, Key Players are:

1. Celestial Seasonings, Inc. 2. Costa Limited 3. Dilmah (Ceylon Tea Services PLC.) 4. Harney & Sons 5. JAB Holding Company 6. JDB (China) Beverages Ltd. 7. Jacobs Douwe Egberts 8. J.M. Smucker Company 9. Kraft Heinz Company 10.Luigi Lavazza S.p.A. 11.McCafé 12.Nestlé S.A. 13.R. Twining and Company Limited 14.Segafredo Zanetti SpA 15.Starbucks Corporation 16.Strauss Group Ltd. 17.Tata Global Beverages 18.Tchibo GmbH 19.Tim Hortons Inc. 20.UCC Ueshima Coffee Co., Ltd. Unilever PLC 21.Yorkshire TeaFAQs:

1. What are the drivers of the Hot Beverages Market? Ans. Due to growing awareness of the potentially harmful effects of carbonated drinks, consumers have started to choose hot beverages over carbonated drinks. Knowledge among the youthful population about the health benefits of hot beverages like coffee and tea to preventing harmful diseases like diabetes, blood pressure, and obesity is increased. This factor is boosting the growth of the Hot Beverages market. 2. What are the Restraints in Hot Beverages Market during the forecast period? Ans. Excess consumption of hot beverages is bad for the health. Addiction to coffee and tea may result in anxiety and can lead to isonomy, formation of carcinogens. which is the major restraint for the growth of the Hot Beverages Market. 3. What is the projected market size & growth rate of the Hot Beverages Market? Ans. Hot Beverages Market size was valued at USD 142.71 Bn. in 2024 and the total Hot Beverages revenue is expected to grow at 4.77% through 2025 to 2032, reaching nearly USD 207.18 Bn. 4. What segments are covered in the Hot Beverages Market report? Ans. The segments covered are by Type, Application, Ingredient, Packaging and Region.

1. Hot Beverages Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Hot Beverages Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Hot Beverages Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Hot Beverages Market: Dynamics 3.1. Hot Beverages Market Trends by Region 3.1.1. North America Hot Beverages Market Trends 3.1.2. Europe Hot Beverages Market Trends 3.1.3. Asia Pacific Hot Beverages Market Trends 3.1.4. Middle East and Africa Hot Beverages Market Trends 3.1.5. South America Hot Beverages Market Trends 3.2. Hot Beverages Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Hot Beverages Market Drivers 3.2.1.2. North America Hot Beverages Market Restraints 3.2.1.3. North America Hot Beverages Market Opportunities 3.2.1.4. North America Hot Beverages Market Challenges 3.2.2. Europe 3.2.2.1. Europe Hot Beverages Market Drivers 3.2.2.2. Europe Hot Beverages Market Restraints 3.2.2.3. Europe Hot Beverages Market Opportunities 3.2.2.4. Europe Hot Beverages Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Hot Beverages Market Drivers 3.2.3.2. Asia Pacific Hot Beverages Market Restraints 3.2.3.3. Asia Pacific Hot Beverages Market Opportunities 3.2.3.4. Asia Pacific Hot Beverages Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Hot Beverages Market Drivers 3.2.4.2. Middle East and Africa Hot Beverages Market Restraints 3.2.4.3. Middle East and Africa Hot Beverages Market Opportunities 3.2.4.4. Middle East and Africa Hot Beverages Market Challenges 3.2.5. South America 3.2.5.1. South America Hot Beverages Market Drivers 3.2.5.2. South America Hot Beverages Market Restraints 3.2.5.3. South America Hot Beverages Market Opportunities 3.2.5.4. South America Hot Beverages Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Hot Beverages Industry 3.8. Analysis of Government Schemes and Initiatives For Hot Beverages Industry 3.9. Hot Beverages Market Trade Analysis 3.10. The Global Pandemic Impact on Hot Beverages Market 4. Hot Beverages Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Hot Beverages Market Size and Forecast, by Type (2024-2032) 4.1.1. Coffee 4.1.2. Tea 4.2. Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 4.2.1. Caffeinated Beverages 4.2.2. Decaffeinated Beverages 4.2.3. With Additives (sugar, flavors) 4.2.4. Organic/Natural Ingredients 4.3. Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 4.3.1. Packets 4.3.2. Cans 4.3.3. Sachets 4.3.4. Bottles 4.3.5. Pods/Capsules 4.4. Hot Beverages Market Size and Forecast, by Application (2024-2032) 4.4.1. Coffee shop 4.4.2. Drink stores 4.4.3. Foodservice 4.5. Hot Beverages Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Hot Beverages Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Hot Beverages Market Size and Forecast, by Type (2024-2032) 5.1.1. Coffee 5.1.2. Tea 5.2. North America Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 5.2.1. Caffeinated Beverages 5.2.2. Decaffeinated Beverages 5.2.3. With Additives (sugar, flavors) 5.2.4. Organic/Natural Ingredients 5.3. North America Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 5.3.1. Packets 5.3.2. Cans 5.3.3. Sachets 5.3.4. Bottles 5.3.5. Pods/Capsules 5.4. North America Hot Beverages Market Size and Forecast, by Application (2024-2032) 5.4.1. Coffee shop 5.4.2. Drink stores 5.4.3. Foodservice 5.5. North America Hot Beverages Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Hot Beverages Market Size and Forecast, by Type (2024-2032) 5.5.1.1.1. Coffee 5.5.1.1.2. Tea 5.5.1.2. United States Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 5.5.1.2.1. Caffeinated Beverages 5.5.1.2.2. Decaffeinated Beverages 5.5.1.2.3. With Additives (sugar, flavors) 5.5.1.2.4. Organic/Natural Ingredients 5.5.1.3. United States Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 5.5.1.3.1. Packets 5.5.1.3.2. Cans 5.5.1.3.3. Sachets 5.5.1.3.4. Bottles 5.5.1.3.5. Pods/Capsules 5.5.1.4. United States Hot Beverages Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Coffee shop 5.5.1.4.2. Drink stores 5.5.1.4.3. Foodservice 5.5.2. Canada 5.5.2.1. Canada Hot Beverages Market Size and Forecast, by Type (2024-2032) 5.5.2.1.1. Coffee 5.5.2.1.2. Tea 5.5.2.2. Canada Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 5.5.2.2.1. Caffeinated Beverages 5.5.2.2.2. Decaffeinated Beverages 5.5.2.2.3. With Additives (sugar, flavors) 5.5.2.2.4. Organic/Natural Ingredients 5.5.2.3. Canada Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 5.5.2.3.1. Packets 5.5.2.3.2. Cans 5.5.2.3.3. Sachets 5.5.2.3.4. Bottles 5.5.2.3.5. Pods/Capsules 5.5.2.4. Canada Hot Beverages Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Coffee shop 5.5.2.4.2. Drink stores 5.5.2.4.3. Foodservice 5.5.3. Mexico 5.5.3.1. Mexico Hot Beverages Market Size and Forecast, by Type (2024-2032) 5.5.3.1.1. Coffee 5.5.3.1.2. Tea 5.5.3.2. Mexico Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 5.5.3.2.1. Caffeinated Beverages 5.5.3.2.2. Decaffeinated Beverages 5.5.3.2.3. With Additives (sugar, flavors) 5.5.3.2.4. Organic/Natural Ingredients 5.5.3.3. Mexico Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 5.5.3.3.1. Packets 5.5.3.3.2. Cans 5.5.3.3.3. Sachets 5.5.3.3.4. Bottles 5.5.3.3.5. Pods/Capsules 5.5.3.4. Mexico Hot Beverages Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Coffee shop 5.5.3.4.2. Drink stores 5.5.3.4.3. Foodservice 6. Europe Hot Beverages Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Hot Beverages Market Size and Forecast, by Type (2024-2032) 6.2. Europe Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 6.3. Europe Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 6.4. Europe Hot Beverages Market Size and Forecast, by Application (2024-2032) 6.5. Europe Hot Beverages Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Hot Beverages Market Size and Forecast, by Type (2024-2032) 6.5.1.2. United Kingdom Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 6.5.1.3. United Kingdom Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 6.5.1.4. United Kingdom Hot Beverages Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Hot Beverages Market Size and Forecast, by Type (2024-2032) 6.5.2.2. France Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 6.5.2.3. France Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 6.5.2.4. France Hot Beverages Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Hot Beverages Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Germany Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 6.5.3.3. Germany Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 6.5.3.4. Germany Hot Beverages Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Hot Beverages Market Size and Forecast, by Type (2024-2032) 6.5.4.2. Italy Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 6.5.4.3. Italy Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 6.5.4.4. Italy Hot Beverages Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Hot Beverages Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Spain Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 6.5.5.3. Spain Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 6.5.5.4. Spain Hot Beverages Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Hot Beverages Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Sweden Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 6.5.6.3. Sweden Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 6.5.6.4. Sweden Hot Beverages Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Hot Beverages Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Austria Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 6.5.7.3. Austria Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 6.5.7.4. Austria Hot Beverages Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Hot Beverages Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Rest of Europe Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 6.5.8.3. Rest of Europe Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 6.5.8.4. Rest of Europe Hot Beverages Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Hot Beverages Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.3. Asia Pacific Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.4. Asia Pacific Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Hot Beverages Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.1.2. China Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.1.3. China Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.1.4. China Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.2.2. S Korea Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.2.3. S Korea Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.2.4. S Korea Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Japan Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.3.3. Japan Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.3.4. Japan Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.4.2. India Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.4.3. India Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.4.4. India Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.5.2. Australia Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.5.3. Australia Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.5.4. Australia Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.6.2. Indonesia Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.6.3. Indonesia Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.6.4. Indonesia Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.7.2. Malaysia Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.7.3. Malaysia Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.7.4. Malaysia Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.8.2. Vietnam Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.8.3. Vietnam Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.8.4. Vietnam Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.9.2. Taiwan Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.9.3. Taiwan Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.9.4. Taiwan Hot Beverages Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Hot Beverages Market Size and Forecast, by Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 7.5.10.3. Rest of Asia Pacific Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 7.5.10.4. Rest of Asia Pacific Hot Beverages Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Hot Beverages Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Hot Beverages Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 8.3. Middle East and Africa Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 8.4. Middle East and Africa Hot Beverages Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Hot Beverages Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Hot Beverages Market Size and Forecast, by Type (2024-2032) 8.5.1.2. South Africa Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 8.5.1.3. South Africa Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 8.5.1.4. South Africa Hot Beverages Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Hot Beverages Market Size and Forecast, by Type (2024-2032) 8.5.2.2. GCC Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 8.5.2.3. GCC Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 8.5.2.4. GCC Hot Beverages Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Hot Beverages Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Nigeria Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 8.5.3.3. Nigeria Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 8.5.3.4. Nigeria Hot Beverages Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Hot Beverages Market Size and Forecast, by Type (2024-2032) 8.5.4.2. Rest of ME&A Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 8.5.4.3. Rest of ME&A Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 8.5.4.4. Rest of ME&A Hot Beverages Market Size and Forecast, by Application (2024-2032) 9. South America Hot Beverages Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Hot Beverages Market Size and Forecast, by Type (2024-2032) 9.2. South America Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 9.3. South America Hot Beverages Market Size and Forecast, by Packaging(2024-2032) 9.4. South America Hot Beverages Market Size and Forecast, by Application (2024-2032) 9.5. South America Hot Beverages Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Hot Beverages Market Size and Forecast, by Type (2024-2032) 9.5.1.2. Brazil Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 9.5.1.3. Brazil Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 9.5.1.4. Brazil Hot Beverages Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Hot Beverages Market Size and Forecast, by Type (2024-2032) 9.5.2.2. Argentina Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 9.5.2.3. Argentina Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 9.5.2.4. Argentina Hot Beverages Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Hot Beverages Market Size and Forecast, by Type (2024-2032) 9.5.3.2. Rest Of South America Hot Beverages Market Size and Forecast, by Ingredient (2024-2032) 9.5.3.3. Rest Of South America Hot Beverages Market Size and Forecast, by Packaging (2024-2032) 9.5.3.4. Rest Of South America Hot Beverages Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Celestial Seasonings, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Costa Limited 10.3. Dilmah (Ceylon Tea Services PLC.) 10.4. Harney & Sons 10.5. JAB Holding Company 10.6. JDB (China) Beverages Ltd. 10.7. Jacobs Douwe Egberts 10.8. J.M. Smucker Company 10.9. Kraft Heinz Company 10.10. Luigi Lavazza S.p.A. 10.11. McCafé 10.12. Nestlé S.A. 10.13. R. Twining and Company Limited 10.14. Segafredo Zanetti SpA 10.15. Starbucks Corporation 10.16. Strauss Group Ltd. 10.17. Tata Global Beverages 10.18. Tchibo GmbH 10.19. Tim Hortons Inc. 10.20. UCC Ueshima Coffee Co., Ltd. Unilever PLC 10.21. Yorkshire Tea 11. Key Findings 12. Industry Recommendations 13. Hot Beverages Market: Research Methodology 14. Terms and Glossary