Global High-Density Interconnect Market size was valued at USD 16.81 Bn. in 2023 and the total High-Density Interconnect revenue is expected to grow by 12.1 % from 2024 to 2030, reaching nearly USD 37.39 Bn.High-Density Interconnect Market Overview:

As the demand for printed circuits has surged, the density and intricacy of interconnects have experienced rapid growth, albeit not as swiftly as observed in the last decade. While most current requirements can be addressed using conventional printed circuit technology, there's a burgeoning category of devices known as "High-Density Interconnects" (HDI) specifically engineered to establish even denser connectivity.To know about the Research Methodology:-Request Free Sample Report HDI circuit boards, distinguished by a superior cabling density per unit area compared to regular printed circuit boards, have become a pivotal advancement. Typically, HDI PCBs incorporate features like micro vias, blind and buried vias, built-up laminations, and high signal performance factors. This evolution in printed circuit board technology aligns with the evolving tech landscape, demanding smaller and faster devices. HDI boards are characterized by their reduced size and fewer vias, pads, copper traces, and spaces. This results in denser wiring, contributing to smaller, lighter, and more compact PCBs with a diminished layer count. Rather than utilizing multiple PCBs in a device, a single HDI board can encapsulate the functionality of all other boards, marking a notable advancement in the High-Density Interconnect market. High-Density Interconnect Market Report Scope: The High-Density Interconnect market is categorized based on Product, End-User, Application, and Region, enabling users to gain insights into various growth factors expected to prevail in the market. This segmentation aids in developing diverse strategies to pinpoint core application areas and identify gaps in the target market. The report offers a comprehensive analysis, presenting meaningful insights, historical data, and statistically supported market statistics validated by industry standards. Additionally, estimates are provided based on a sound set of assumptions and methodologies. The market size has been estimated using a bottom-up approach, with Major Key Players in the High-Density Interconnect market identified through thorough secondary research. Market revenues of these players are determined through a combination of primary and secondary research methods. Secondary research involves scrutinizing annual and financial reports of leading manufacturers, while primary research includes interviews with crucial opinion leaders and industry experts, such as skilled frontline personnel, entrepreneurs, and marketing professionals. Among the prominent global players in the High-Density Interconnect market are Unimicron, Compeq, TTM Technologies, and Unitech. These key players are actively engaged in strategic initiatives like mergers and acquisitions, strategic alliances, joint ventures, and partnerships to foster the growth of their market shares. High-Density Interconnect Market Dynamics: Growing PCB demand for portable applications The High-Density Interconnect market is witnessing a transformative shift within the printed circuit board (PCB) industry, fueled by technological advancements. This evolution extends from conventional low-density PCBs to the remarkable growth potential presented by high-density interconnect HDI boards. Key trends in the PCB industry include the emergence of high-power boards, high-density interconnect boards, flex PCBs, PTFE materials for high-frequency PCBs, miniaturization of PCBs, and the adoption of green PCBs. The escalating demand for PCBs in the communication sector, advancements in connected devices, and innovations in automotive electronics are propelling the growth of the PCB market. Strategically focusing on the production of high-density connection boards and flex PCBs can be advantageous for companies looking to capitalize on the opportunities in the High-Density Interconnect market. By addressing the challenges and prospects within this industry, businesses can effectively cater to the primary target market. HDI boards stand out as one of the fastest-growing PCB technologies, enabling designers to incorporate more components on both sides of the fundamental PCB. This technology, driven by evolving customer expectations, accommodates more I/O in smaller geometries due to reduced component size and pitch. The result is enhanced signal transmission speed, substantial reduction in signal loss, and minimized crossing delays. HDI technology has evolved to meet the demand for smaller devices with superior functionality, particularly in terms of routing traces, leading to a reduced need for numerous PCB layers. The High-Density Interconnect market is witnessing a paradigm shift with the adoption of HDI technology. Device miniaturization creates scope for market growth The High-Density Interconnect market is witnessing a surge in demand driven by the growing need for more compact, high-speed, cost-effective, and efficient technologies in the 3C applications sector encompassing computers/peripherals, consumer electronics, and communication devices. Manufacturers are responding to this demand by developing intricate PCBs in smaller form factors, featuring higher component density capable of functioning at elevated speeds to meet evolving requirements. As the 3C industry continues to advance technologically, PCB designers face the challenge of creating solutions that align with the escalating demand for smaller devices with enhanced features. In the current landscape, the market for advanced PCBs, including High-Density Interconnect (HDI) and IC substrate product types, is thriving. The impetus for this growth is fueled by the pervasive trend toward miniaturization in PCBs, catering to the demand for smaller devices endowed with greater functionality. The High-Density Interconnect market is poised to flourish further as the quest for lightweight and portable devices intensifies, driving the demand for increasingly compact and highly efficient PCBs. The establishment of strategic alliances to minimize production costs is a major opportunity for market growth The Contract Manufacturing landscape is experiencing significant transformations. As Original Equipment Manufacturers (OEMs) increasingly delegate product design and development responsibilities to Electronics Manufacturing Service (EMS) companies, they effectively trim overall expenditures and convert fixed costs into variable expenses—an integral aspect of managing production costs. This trend unfolds substantial opportunities for EMS firms to bolster their revenue streams by diversifying into additional market segments. Numerous PCB manufacturers are deliberating the incorporation of services that can augment their earnings. They are expanding their design services to encompass sub-assemblies and end-products. In terms of quality assurance, there's an extension of their quality testing services. Broadly speaking, the more comprehensive the range of services offered, the more they delve into Joint Design Manufacturing (JDM) and Outsourced Design Manufacturing (ODM). While establishing strategic partnerships proves economically advantageous, various considerations come into play to reap these benefits. EMS and OEMs meticulously assess their existing customer and product portfolios, align their plans with business models, and evaluate value propositions to ensure they are in harmony with consumer needs and management decisions. The High-Density Interconnect market is poised for dynamic growth as these industry shifts reshape the landscape.

High-Density Interconnect Market Segment Analysis

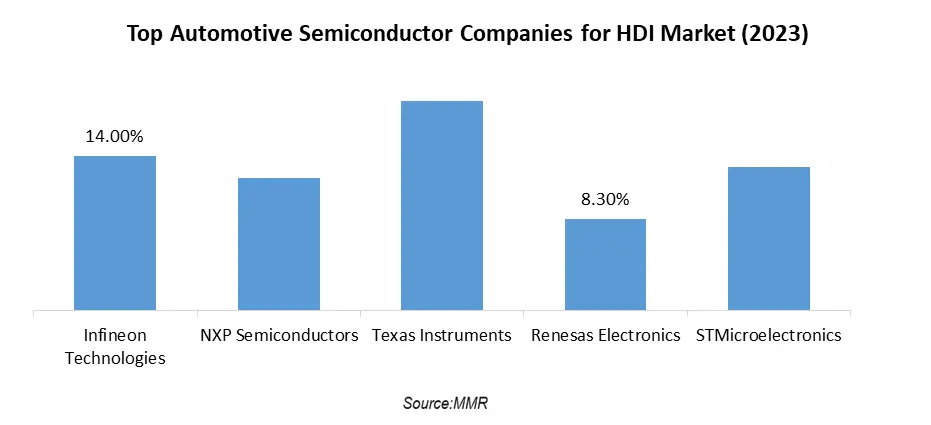

Based on the Application, By Application, the automotive electronics segment is expected to grow at a CAGR of 10.7% during the forecast period. The rapid growth of the electronic industry drives multiple industries' growth. Electronic devices have seen an increase in their use in the automotive sector in recent years. The traditional automotive industry focused on mechanics, power, hydraulics, and transmission. Modern automotive industries, on the other hand, rely more on electronic applications, which are playing a more important and potentially major role in automotive electronics. As a result, these factors have increased the demand for the High-Density Interconnect market. Automatic electrification is utilized for handling, sensing, information transfer, and recording, which would be impossible to perform without printed circuit boards. Due to the demands of automotive modernization and digital innovation, as well as demands for security, comfort, simple operation, and integration within automobiles, PCBs have been widely used in the automotive industry, ranging from simple single-layer PCBs to complicated multi-layer PCBs or high density interconnect (HDI) PCBs that may carry cross-layer blind vias or double build up layers. Traditional single-layer PCBs, double-layer PCBs, and multi-layer PCBs are available for automotive circuit boards, but HDI PCBs have been the main choice for automotive electronic devices in recent years. There is a significant difference between standard HDI PCBs and automotive HDI PCBs: the former prioritizes practicability and many functionalities, servicing consumer electronics, whereas the latter aims for reliability, security, and high quality. Because of the high reliability and safety of automotive HDI PCBs, automotive HDI PCB manufacturers must meet stringent requirements. They have to adhere to an integrated administration system and quality management system, which play an important role in assessing or supporting PCB manufacturers' management levels. Some systems are not owned by PCB designers until they are authenticated by a third party. Automotive PCB manufacturers, for example, must be ISO9001 and ISO/TS16949 certified. HDI PCB manufacturers must have robust technology and a high HDI manufacturing capacity. Manufacturers specializing in automotive circuit boards, in particular, must provide boards with line spacing of at least 75m/75m and two-layer build-up. High-density interconnect PCB manufacturers are expected to have a capability index of the process (CPK) of at least 1.33 and equipment manufacturing capacity (CMK) of at least 1.67. Later manufacturing modifications are not permitted unless customers consent and confirmation are obtained.

High-Density Interconnect Market Regional Insights:

The High-Density Interconnect Market in the Asia Pacific region is expected to grow at a CAGR of 7.9% during the forecast period. The regional growth is primarily attributed to the PCB industry in China. At present, there are approximately 2,500 PCB manufacturers on the Chinese mainland. The PCB industry in China is primarily distributed in the Pearl River Delta, the Yangtze River Delta, and the Bohai Rim, where large component markets, good transportation, and water and electricity conditions are concentrated. Although China's demographic dividend is fading, the labor cost remains cheaper than that of Japan, South Korea, Taiwan, and even Europe and the United States. China, being the world's largest manufacturing country, has a comprehensive industrial chain that includes copper foil, glass fiber, resin, copper-clad laminates, and, lastly, PCBs. PCB is similar to an end product; a large number of electronic products are also manufactured in China. The government has recognized the potential and has implemented several policies to promote it. Particularly after the introduction of "Made in China 2025," it has set higher standards for the PCB sector and boosted the growth of the whole industry to a high level.Taiwan is home to half of the top 10 PCB manufacturers. Only one American company, TTM Technologies, is in the top 10 internationally; the rest are based in Japan and China. Europe has PCB enterprises as well, however, none are as significant as those in Asia and the United States. However, the majority of PCB manufacturing takes place in China. In the United States, PCB production is mostly for low-volume, high-mix specialized boards used in the industrial, medical, defense, and aerospace industries. PCB production on a large scale is centered in Asia, notably in China, Japan, Taiwan, and South Korea. PCB production in the United States has fallen in recent decades as output in China and other Asian nations has surged. Before a shift in production to Asia, the United States produced around $11 billion worth of PCBs each year, according to the trade group IPC International and the United States Partnership for Assured Electronics (USPAE). North America had the most PCB facilities in the world two decades ago with roughly 780. By March 2020, that figure had dropped to an estimated 230, while the number of facilities in China had increased to 1,480 over the same period. Around 150 facilities in China are owned by corporations based outside of China. Competitive Landscape: TTM Technologies, headquartered in the United States, adds to the competitive mix with its significant footprint in the American electronics sector. Austria Technologie & Systemtechnik, based in Austria, brings a European dimension to the landscape, contributing to the global diversity of PCB manufacturers. Unimicron, Compeq Co., and Zhen Ding Tech., all based in Taiwan, are key players in the competitive landscape of the electronics industry, particularly in printed circuit board (PCB) manufacturing. Their presence in Taiwan, a hub for electronics manufacturing, positions them strategically in the global market. Meanwhile, IBIDEN and MEIKO ELECTRONICS from Japan play pivotal roles, leveraging the technological prowess and innovation associated with Japanese electronics manufacturing. This competitive landscape reflects the dynamic nature of the global electronics market, with each company contributing its unique strengths to the industry. Hence, these are the key players, leveraging the technology which proportionally increases the demand for the High-Density Interconnect Market.

High Density Interconnect Market Scope: Inquire before buying

High Density Interconnect Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 16.81 Bn. Forecast Period 2024 to 2030 CAGR: 12.1% Market Size in 2030: US $ 37.39 Bn. Segments Covered: by Product 4–6 Layers HDI 8–10 Layers HDI 10+ Layers HDI by Application Automotive Electronics Computer and Display Communication Devices and Equipment Audiovisual Devices Connected Devices Wearable Devices Others by End-User Automotive Consumer Electronics Telecommunications Medical Others High Density Interconnect Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)High-Density Interconnect Market Key Players

1. Unimicron - Taiwan 2. Compeq Co. - Taiwan 3. TTM Technologies - United States 4. Austria Technologie & Systemtechnik - Austria 5. Zhen Ding Tech. - Taiwan 6. IBIDEN - Japan 7. MEIKO ELECTRONICS - Japan 8. FUJITSU INTERCONNECT TECHNOLOGIES - Japan 9. Tripod Technology Corp. - Taiwan 10. Unitech - Taiwan 11. SAMSUNG ELECTRO-MECHANICS - South Korea 12. Daeduck GDS Co - South Korea 13. DAP Corp. - South Korea 14. Korea Circuit - South Korea 15. CMK - Taiwan 16. NCAB Group - Sweden 17. SIERRA CIRCUITS - United States 18. Multek - United States Frequently Asked Questions: 1] What segments are covered in the Global High-Density Interconnect Market report? Ans. The segments covered in the High-Density Interconnect Market report are based on Product, Application, End User, and Region. 2] Which region is expected to hold the largest share of the Global High-Density Interconnect Market? Ans. The Asia Pacific region is expected to hold the largest share of the High-Density Interconnect Market. The PCB industry in China is primarily distributed in the Pearl River Delta, the Yangtze River Delta, and the Bohai Rim, where large component markets, good transportation, and water and electricity conditions are concentrated. 3] What is the market size of the Global High-Density Interconnect Market by 2030? Ans. The market size of the High-Density Interconnect Market by 2030 is expected to reach US$ 37.39 Bn. 4] What is the forecast period for the Global High-Density Interconnect Market? Ans. The forecast period for the High-Density Interconnect Market is 2024-2030. 5] What was the market size of the Global High-Density Interconnect Market in 2023? Ans. The market size of the High-Density Interconnect Market in 2023 was valued at US$ 16.81 Bn.

1. High-Density Interconnect Market: Research Methodology 2. High-Density Interconnect Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. High-Density Interconnect Market: Dynamics 3.1. High-Density Interconnect Market Trends by Region 3.1.1. North America High-Density Interconnect Market Trends 3.1.2. Europe High-Density Interconnect Market Trends 3.1.3. Asia Pacific High-Density Interconnect Market Trends 3.1.4. Middle East and Africa High-Density Interconnect Market Trends 3.1.5. South America High-Density Interconnect Market Trends 3.2. High-Density Interconnect Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America High-Density Interconnect Market Drivers 3.2.1.2. North America High-Density Interconnect Market Restraints 3.2.1.3. North America High-Density Interconnect Market Opportunities 3.2.1.4. North America High-Density Interconnect Market Challenges 3.2.2. Europe 3.2.2.1. Europe High-Density Interconnect Market Drivers 3.2.2.2. Europe High-Density Interconnect Market Restraints 3.2.2.3. Europe High-Density Interconnect Market Opportunities 3.2.2.4. Europe High-Density Interconnect Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific High-Density Interconnect Market Drivers 3.2.3.2. Asia Pacific High-Density Interconnect Market Restraints 3.2.3.3. Asia Pacific High-Density Interconnect Market Opportunities 3.2.3.4. Asia Pacific High-Density Interconnect Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa High-Density Interconnect Market Drivers 3.2.4.2. Middle East and Africa High-Density Interconnect Market Restraints 3.2.4.3. Middle East and Africa High-Density Interconnect Market Opportunities 3.2.4.4. Middle East and Africa High-Density Interconnect Market Challenges 3.2.5. South America 3.2.5.1. South America High-Density Interconnect Market Drivers 3.2.5.2. South America High-Density Interconnect Market Restraints 3.2.5.3. South America High-Density Interconnect Market Opportunities 3.2.5.4. South America High-Density Interconnect Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For High-Density Interconnect Market 3.8. Analysis of Government Schemes and Initiatives For the High-Density Interconnect Market 3.9. The Global Pandemic Impact on the High-Density Interconnect Market 4. High-Density Interconnect Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030) 4.1. High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 4.1.1. 4–6 Layers HDI 4.1.2. 8–10 Layers HDI 4.1.3. 10+ Layers HDI 4.2. High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 4.2.1. Automotive Electronics 4.2.2. Computer and Display 4.2.3. Communication Devices and Equipment 4.2.4. Audiovisual Devices 4.2.5. Connected Devices 4.2.6. Wearable Devices 4.2.7. Others 4.3. High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 4.3.1. Automotive 4.3.2. Consumer Electronics 4.3.3. Telecommunications 4.3.4. Medical 4.3.5. Others 4.4. High-Density Interconnect Market Size and Forecast, by Region (2024-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America High-Density Interconnect Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030) 5.1. North America High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 5.1.1. 4–6 Layers HDI 5.1.2. 8–10 Layers HDI 5.1.3. 10+ Layers HDI 5.2. North America High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 5.2.1. Automotive Electronics 5.2.2. Computer and Display 5.2.3. Communication Devices and Equipment 5.2.4. Audiovisual Devices 5.2.5. Connected Devices 5.2.6. Wearable Devices 5.2.7. Others 5.3. North America High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 5.3.1. Automotive 5.3.2. Consumer Electronics 5.3.3. Telecommunications 5.3.4. Medical 5.3.5. Others 5.4. North America High-Density Interconnect Market Size and Forecast, by Country (2024-2030) 5.4.1. United States 5.4.1.1. United States High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 5.4.1.1.1. 4–6 Layers HDI 5.4.1.1.2. 8–10 Layers HDI 5.4.1.1.3. 10+ Layers HDI 5.4.1.2. United States High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 5.4.1.2.1. Automotive Electronics 5.4.1.2.2. Computer and Display 5.4.1.2.3. Communication Devices and Equipment 5.4.1.2.4. Audiovisual Devices 5.4.1.2.5. Connected Devices 5.4.1.2.6. Wearable Devices 5.4.1.2.7. Others 5.4.1.3. United States High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 5.4.1.3.1. Automotive 5.4.1.3.2. Consumer Electronics 5.4.1.3.3. Telecommunications 5.4.1.3.4. Medical 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 5.4.2.1.1. 4–6 Layers HDI 5.4.2.1.2. 8–10 Layers HDI 5.4.2.1.3. 10+ Layers HDI 5.4.2.2. Canada High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 5.4.2.2.1. Automotive Electronics 5.4.2.2.2. Computer and Display 5.4.2.2.3. Communication Devices and Equipment 5.4.2.2.4. Audiovisual Devices 5.4.2.2.5. Connected Devices 5.4.2.2.6. Wearable Devices 5.4.2.2.7. Others 5.4.2.3. Canada High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 5.4.2.3.1. Automotive 5.4.2.3.2. Consumer Electronics 5.4.2.3.3. Telecommunications 5.4.2.3.4. Medical 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 5.4.3.1.1. 4–6 Layers HDI 5.4.3.1.2. 8–10 Layers HDI 5.4.3.1.3. 10+ Layers HDI 5.4.3.2. Mexico High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 5.4.3.2.1. Automotive Electronics 5.4.3.2.2. Computer and Display 5.4.3.2.3. Communication Devices and Equipment 5.4.3.2.4. Audiovisual Devices 5.4.3.2.5. Connected Devices 5.4.3.2.6. Wearable Devices 5.4.3.2.7. Others 5.4.3.3. Mexico High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 5.4.3.3.1. Automotive 5.4.3.3.2. Consumer Electronics 5.4.3.3.3. Telecommunications 5.4.3.3.4. Medical 5.4.3.3.5. Others 6. Europe High-Density Interconnect Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030) 6.1. Europe High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 6.2. Europe High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 6.3. Europe High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 6.4. Europe High-Density Interconnect Market Size and Forecast, by Country (2024-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 6.4.1.2. United Kingdom High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 6.4.1.3. United Kingdom High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 6.4.2. France 6.4.2.1. France High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 6.4.2.2. France High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 6.4.2.3. France High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 6.4.3. Germany 6.4.3.1. Germany High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 6.4.3.2. Germany High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 6.4.3.3. Germany High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 6.4.4. Italy 6.4.4.1. Italy High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 6.4.4.2. Italy High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 6.4.4.3. Italy High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 6.4.5. Spain 6.4.5.1. Spain High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 6.4.5.2. Spain High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 6.4.5.3. Spain High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 6.4.6. Sweden 6.4.6.1. Sweden High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 6.4.6.2. Sweden High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 6.4.6.3. Sweden High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 6.4.7. Austria 6.4.7.1. Austria High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 6.4.7.2. Austria High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 6.4.7.3. Austria High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 6.4.8.2. Rest of Europe High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 6.4.8.3. Rest of Europe High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7. Asia Pacific High-Density Interconnect Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030) 7.1. Asia Pacific High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.2. Asia Pacific High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.3. Asia Pacific High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4. Asia Pacific High-Density Interconnect Market Size and Forecast, by Country (2024-2030) 7.4.1. China 7.4.1.1. China High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.1.2. China High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.1.3. China High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4.2. S Korea 7.4.2.1. S Korea High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.2.2. S Korea High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.2.3. S Korea High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4.3. Japan 7.4.3.1. Japan High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.3.2. Japan High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.3.3. Japan High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4.4. India 7.4.4.1. India High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.4.2. India High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.4.3. India High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4.5. Australia 7.4.5.1. Australia High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.5.2. Australia High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.5.3. Australia High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.6.2. Indonesia High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.6.3. Indonesia High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.7.2. Malaysia High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.7.3. Malaysia High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.8.2. Vietnam High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.8.3. Vietnam High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.9.2. Taiwan High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.9.3. Taiwan High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 7.4.10.2. Rest of Asia Pacific High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 7.4.10.3. Rest of Asia Pacific High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 8. Middle East and Africa High-Density Interconnect Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030) 8.1. Middle East and Africa High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 8.2. Middle East and Africa High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 8.3. Middle East and Africa High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 8.4. Middle East and Africa High-Density Interconnect Market Size and Forecast, by Country (2024-2030) 8.4.1. South Africa 8.4.1.1. South Africa High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 8.4.1.2. South Africa High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 8.4.1.3. South Africa High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 8.4.2. GCC 8.4.2.1. GCC High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 8.4.2.2. GCC High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 8.4.2.3. GCC High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 8.4.3.2. Nigeria High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 8.4.3.3. Nigeria High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 8.4.4.2. Rest of ME&A High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 8.4.4.3. Rest of ME&A High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 9. South America High-Density Interconnect Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2030 9.1. South America High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 9.2. South America High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 9.3. South America High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 9.4. South America High-Density Interconnect Market Size and Forecast, by Country (2024-2030) 9.4.1. Brazil 9.4.1.1. Brazil High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 9.4.1.2. Brazil High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 9.4.1.3. Brazil High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 9.4.2. Argentina 9.4.2.1. Argentina High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 9.4.2.2. Argentina High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 9.4.2.3. Argentina High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America High-Density Interconnect Market Size and Forecast, By Product (2024-2030) 9.4.3.2. Rest Of South America High-Density Interconnect Market Size and Forecast, By Application (2024-2030) 9.4.3.3. Rest Of South America High-Density Interconnect Market Size and Forecast, By End User (2024-2030) 10. Global High-Density Interconnect Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading High-Density Interconnect Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Unimicron 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Compeq Co. 11.3. TTM Technologies 11.4. Austria Technologie & Systemtechnik 11.5. Zhen Ding Tech. 11.6. IBIDEN 11.7. MEIKO ELECTRONICS 11.8. FUJITSU INTERCONNECT TECHNOLOGIES 11.9. Tripod Technology Corp. 11.10. Unitech 11.11. SAMSUNG ELECTRO-MECHANICS 11.12. Daeduck GDS Co 11.13. DAP Corp. 11.14. Korea Circuit 11.15. CMK 11.16. NCAB Group 11.17. SIERRA CIRCUITS 11.18. Multek 12. Key Findings 13. Industry Recommendations