The Gelatin Market size was valued at USD 4.41 Billion in 2024 and the total Gelatin revenue is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 7.31 Billion. The Gelatin Market revolves around a versatile and essential food ingredient derived from collagen, a vital protein found in animal skin, bones, and meat. Gelatin is a translucent, colorless, and flavorless substance with unique properties. It is manufactured from the skins of pigs and cows, or demineralized animal bones, which are approved for human consumption by veterinary authorities. Collagen is the precursor of gelatin and is a critical structural protein in both human and animal bodies, featuring a complex amino acid composition, with a high hydroxyproline content. Gelatin is hydrolyzed collagen which after undergoing hydrolysis, serves a multitude of applications across various industries. Its ability to form gel-like structures when mixed with water makes it a popular gelling agent in food products, including desserts, gummy candy, marshmallows, ice creams, dips, and yogurts. It plays a crucial role in pharmaceuticals, where it is commonly used to create drug capsules. The bovine gelatin market is a significant player in industries like food, pharmaceuticals, and cosmetics. Gelatin finds use in cosmetics and photography, featuring in products such as photographic films and papers. Recently, gelatin nanoparticles have gained attention for drug delivery due to their functional structure, allowing for cross-linking and targeting. However, stabilizing and producing consistent gelatin nanoparticles without aggregation remains a challenge, leading to the exploration of various preparation methods. Raw materials for gelatin, derived from bovine bone, hide, pork skin, and seafood processing by-products, influence its yield and properties based on source, pretreatment, temperature, and extraction processes. In terms of nutrition, gelatin, unlike pectin a carbohydrate and source of soluble fiber is rich in protein, offering 19 essential amino acids except for tryptophan. Its protein content makes it valuable for culinary and used in the pharmaceutical gelatin market. The bovine gelatin market continually evolves to meet changing consumer demands, incorporating alternative sources and innovative product formulations while remaining a crucial component in these industries.To know about the Research Methodology :- Request Free Sample Report Gelatin Market Scope and Research Methodology: The Gelatin Market is analyzed across various segments, including application areas such as Food and Beverages, Pharmaceuticals, Health and Nutrition, Cosmetic and Personal Care, and Others. The research methodology begins with data collection from both primary and secondary sources. Primary data is collected through interviews and surveys with industry experts, gelatin manufacturers, and market stakeholders. Secondary data is gathered from industry reports, market studies, government publications, and other credible sources. Data is analyzed using statistical tools and software to derive meaningful insights. Market trends, growth patterns, and forecasts are developed based on this analysis. Future market trends and projections are made using historical data, current market dynamics, and expert opinions. These forecasts consider variables such as market drivers, challenges, and opportunities. A comprehensive competitive analysis is conducted, including the assessment of key players in the Gelatin Market. Their market strategies, product portfolios, and positioning are examined. The Gelatin Market research methodology aims to provide a clear understanding of the market's scope, dynamics, and trends. It helps industry players, investors, and decision-makers make informed choices based on reliable and well-validated data and analysis.

Gelatin Market Dynamics:

Pharmaceutical Applications Fuel the Gelatin Market The gelatin market is driven by an array of versatile applications and its potential to offer numerous health and cosmetic benefits. Gelatin, derived from animal collagen, primarily from cows and pigs, has gained significant popularity as a multi-talented ingredient. It's not only found in the culinary world, providing gummy bears with their consistency and giving yogurts their creamy texture, but it also extends its reach into various industries. The gelatin market's role in promoting skin health. Gelatin is believed to combat the signs of aging, helping to reduce wrinkles and improve skin's elasticity. It's suggested to boost metabolism, making it a sought-after component in dietary supplements. Furthermore, its positive impact on joint health has led to its extensive use in personal care products, where it's incorporated into cosmetics and ointments. This multifaceted utility has created a growing demand for gelatin in the personal care and dietary supplement sectors. Pharmaceutical applications are another major driving force for the gelatin market. Gelatin serves as a crucial thickening agent in various pharmaceutical formulations, such as fluid dosages, sweeteners, and tablet coatings. This utility enhances the appeal of gelatin in the pharmaceutical industry, contributing to increased demand for this versatile protein. The gelatin market is experiencing a surge in demand due to the growing trend of health-consciousness. Consumers are increasingly seeking clean-label products, which has spurred sales of gelatin over the forecast years. This demand is bolstered by the perception that collagen peptide and gelatin production in the body, which is vital for cartilage, bone, and skin health. The consumers have the potential health benefits of gelatin. The multifaceted nature of gelatin, its role in a variety of products, and its association with potential health benefits continue to propel its growth in the market. Gelatin remains a versatile and indispensable ingredient across numerous industries, continually evolving to meet changing consumer demands and preferences. The gelatin art market has emerged as a creative and visually captivating niche within the culinary world. The gelatin art market has gained popularity through social media platforms, where artists showcase their stunning creations, inspiring others to explore and experiment with this unique form of edible art. As interest continues to grow, the gelatin art market represents a fusion of culinary expertise, creativity, and visual appeal, captivating both artists and enthusiasts alike.Gelatin's Transformative Role in Diverse Industries: The gelatin market presents an opportunity, driven by the unique properties and versatility of this animal protein substance. Derived from collagen, a key component found in animal skin and bone, gelatin is a gel-forming substance with a wide range of applications. It is primarily utilized in the food industry and home cookery, but it also finds essential roles in various industrial sectors. The gelatin market lies in its application as a gel-forming agent in food products. Gelatin, in its various forms, is integral to the creation of jellied meats, soups, candies, aspics, and molded desserts. It imparts stability and structure to a variety of food items, contributing to their appealing texture and consistency. Gelatin serves as a stabilizer and emulsifier in the production of ice cream, marshmallows, and emulsion and foam-based products. Its ability to transform from a sol to a gel and back, influenced by factors such as protein and sugar concentration and temperature, makes it an invaluable tool for achieving desired textures and properties in the culinary world. Gelatin extends its reach into other sectors, including pharmaceuticals. It plays a pivotal role in the manufacture of capsules as a key delivery system for medications and supplements. Gelatin finds applications in cosmetics, ointments, lozenges, and plasma products, offering a wide range of opportunities for innovation and development in the pharmaceutical and cosmetic industries. The gelatin market's ability to cater to a diverse range of industries highlights its promising outlook. As consumers and industries alike seek functional and versatile ingredients, the multifaceted nature of gelatin, along with its ability to transform textures and stabilize products, positions it as a valuable component in product development and formulation. With the potential to create appealing food textures, pharmaceutical delivery systems, and cosmetic formulations, gelatin's opportunities continue to expand, making it an indispensable ingredient in various applications and industries. As a stable and easily stored substance, it remains poised to meet evolving consumer and industry demands for years to come.

Rheological Hurdles: Fish Gelatin's Market Potential and Limitations The Gelatin Market encounters challenges in the realm of fish gelatin, where its market share remains relatively small compared to its bovine and porcine counterparts. The limitations that hinder the widespread development of the fish gelatin industry are noteworthy and require attention. A prominent challenge associated with fish gelatin pertains to its rheological properties, which are notably inferior when compared to gelatins derived from land mammals. The primary reason for this discrepancy is the absence of proline-rich regions in fish gelatin. This deficiency restricts the range of applications for fish gelatin, limiting its market potential. However, the growing demand for gelatin on a global scale may incentivize a shift towards fish gelatin as it possesses the potential to meet consumer requirements. A significant aspect of fish gelatin is its ability to utilize fishery discards in its production. This opens opportunities for the sustainable exploitation of water resources, potentially mitigating environmental concerns. It also presents an additional revenue stream for the processing industries. Despite substantial advancements in deriving gelatin from various fish body parts, scaling up the extraction process remains a formidable challenge. Addressing challenges within the collagen peptide and gelatin market, particularly regarding fish gelatin, involves navigating various hurdles such as suboptimal rheological properties, limited availability of preferred fish types, certification issues, quality variations, and intrinsic factors like odor and reduced yields. To increase fish gelatin production, technological advancements are crucial. Strategies involving solutes, bonding agents, adhesion promoters, and hydrocolloid mixtures have shown potential in enhancing fish gelatin's functional properties. This underscores fish gelatin's promise across industries. With innovative solutions tackling these challenges, fish gelatin stands as a competitive and appealing alternative, offering opportunities for manufacturers in the constantly evolving gelatin market. Some Facts About Gelatin: 1.Gelatin is a pure protein, not a fat, despite its gelatinous properties and mouthfeel resembling full-fat products. 2.It is used to replace fat in some dairy products, offering a healthier alternative. 3.Gelatin is a natural food ingredient without the need for e-numbers like many artificial additives. 4.Its thermo-reversible nature allows it to transition between liquid and gel states with temperature changes. 5.Vegetarian versions of gelatin belong to a distinct ingredient category, lacking the sensory properties and versatility of animal-sourced gelatin. 6.Animal-sourced gelatin from pigs, cows, chickens, and fish is safe, clean-labelled, non-GMO, cholesterol-free, non-allergenic (except fish), and gentle on the digestive system. 7.Gelatin can be produced in compliance with halal or kosher dietary requirements. 8.Gelatin supports the circular economy by responsibly sourcing it from animal bones and skins to make the most of the animal for human consumption. 9.By-products from gelatin production, such as proteins, fats, and minerals, are upcycled into various sectors, including feed, pet food, fertilizer, and bioenergy. 10.Gelatin serves multiple purposes, including gelling, foaming, film-forming, thickening, water-binding, emulsifying, stabilizing, adhesion, and fining. 11.Its core applications are in food, pharmaceuticals, nutraceuticals, cosmetics, and photography. Gelatin finds uses in medical devices, wine-making, and musical instrument manufacturing.

Gelatin Market Segment Analysis:

Based on Application, the food and beverage industry dominates the Gelatin market due to its widespread popularity and affordability. It is extensively used to create gelatinous desserts, gummy candies, and various yogurts. Gelatin contributes to the appealing texture and consistency of these products. It is employed in certain meat products to prevent drying and provide an attractive glaze. In the culinary world, stocks and consommés form gels as they cool, adding depth and flavor to various dishes. Gelatin's ability to stabilize emulsions and foams is especially valuable in the production of items like ice cream and marshmallows. Fruit juices, wines, and vinegar benefit from gelatin's impurity-attracting and clarifying properties. The "melt in the mouth" sensation in foods such as marshmallows is a result of the gel breaking down below body temperature, releasing trapped flavors. The pharmaceutical gelatin market relies on gelatin for the manufacture of hard and soft capsules, which are essential for delivering medications and supplements. Hard capsules are formed by dipping a stainless-steel mold into a warm gelatin solution, followed by filling with medication, while soft capsules, known as soft gels, are created from gelatin sheets and filled during production. Gelatin's capacity to encapsulate substances effectively makes it a critical component in pharmaceutical formulations, enabling precise dosing and delivery of medications. Gelatin is often touted for its potential health benefits, although scientific evidence remains limited. It has been suggested to support issues like weak nails, hair, joint pain, arthritis, and osteoporosis. Some individuals use gelatin for weight loss and post-exercise recovery. While the medicinal properties of gelatin are a subject of ongoing discussion, it is evident that its role in health and nutrition is a significant application area. Whether consumed as a supplement or through gelatin-containing foods, it offers a source of protein and can potentially aid joint health, although further research is needed to substantiate its claims. Gelatin's versatility extends to the cosmetic and personal care industry, where it is used in various products such as skin creams, lotions, face masks, shampoos, hair conditioners, hair sprays, nail polishes, and lipsticks. Often referred to as "hydrolyzed animal protein," gelatin provides these products with their desirable attributes. Its moisture-attracting and thickening properties contribute to its creamy texture, making it a valuable ingredient for formulating cosmetics that enhance skin and hair health.Gelatin Market Regional Insights:

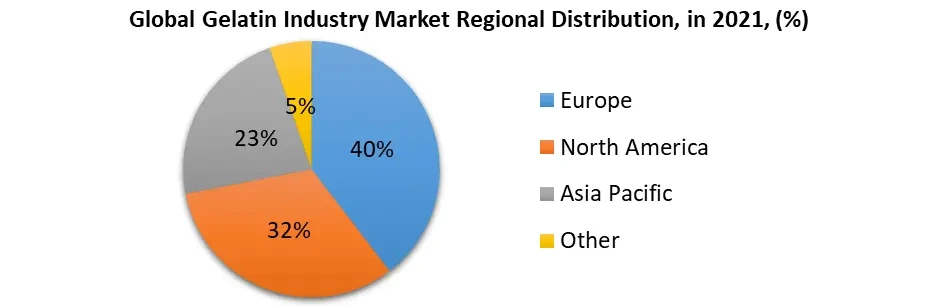

Europe currently dominates the global gelatin market due to its advanced technology and strong economy. Europe remains the world's largest gelatin market, with a substantial market share of about 39.6% of the international gelatin market. Advanced technology and a well-developed economy in Europe have fostered a higher consumption ratio of medicinal gelatin, reflecting the region's technical expertise and economic stability. European gelatin manufacturers have leveraged their technological capabilities and immense market demand to drive continuous development and diversification in the industry. For instance, the utilization of gelatin in various pharmaceutical applications, such as hard capsules, soft capsules, and plasma solubilizers, has expanded its demand. Europe's extensive experience in gelatin production has propelled it to pioneer new uses, ensuring sustained market dominance. In North America, the gelatin market has a robust presence, with a market share of approximately 32.3% of the gelatin market. The traditional markets in the United States, have reached a level of saturation, and their growth momentum is relatively weak. The dominance of established gelatin manufacturers in this region, coupled with a mature market, has prompted a search for new avenues of growth. Despite these challenges, innovative uses of gelatin in pharmaceuticals, cosmetics, and food and beverages continue to drive the industry forward. For example, gelatin's applications in the pharmaceutical sector have extended to solubilizers, medicinal coating materials, and wound protective films, which has contributed to increasing demand. North American companies have been exploring new avenues to stay competitive in a dynamic market. Asia Pacific is another major contributor to the international gelatin market, holding a substantial market share of approximately 22.8%. The region's impressive growth is driven by countries like China and India, which are experiencing rapid industrialization and urbanization. These factors have led to a surge in the use of gelatin in the pharmaceutical, cosmetics, and food and beverage sectors. China, in particular, stands out as a dominant force in the global gelatin market. It has a diverse array of gelatin manufacturers, including Rousselot, Paibao, and Qinghai Gelatin, which have capitalized on advanced industry technology and market demand to meet the evolving needs of various sectors. The widening applications of gelatin products, including innovative uses like wound protective films and microencapsulated outer film coating materials, are generating increasing demand in the Asia Pacific.

Competitive Landscape

Key Players of the Gelatin Market profiled in the report are Darling Ingredients Inc., Ewald-Gelatine GmbH, Foodchem International Corporation, Gelita AG, Geltech Co., Ltd., Great Lakes Gelatin Company, Henan Boom Gelatin Co., Ltd, India Gelatine & Chemicals Ltd., ITALGEL S.p.A., Jellice Pioneer Private Limited, Junca Gelatines SL, Lapi Gelatine Spa, Luohe Wulong Gelatin Co. Ltd., This provides huge opportunities to serve many End-users and customers and expand the Gelatin Market. In November 2022, Nitta Gelatin, Inc. introduced a line of freshwater fish collagen peptide ingredients that have undergone clinical testing and are sourced responsibly. These gelatin-derived peptides are known for their anti-aging properties and their positive impact on skin health. This innovation represents a noteworthy stride in the gelatin market, as it caters to the growing demand for collagen-based products in the health and cosmetic sectors. In November 2022, PB Leiner, a subsidiary of the Tessenderlo Group, unveiled a game-changing product named TEXTURA Tempo Ready. This texturizing gelatin solution, designed for the food service industry, comes in convenient small pouches and is distributed to chefs through select wholesalers. TEXTURA Tempo Ready not only enhances flavor but also provides a unique mouthfeel and exceptional stability over time. This launch underscores the gelatin market's adaptability to cater to evolving culinary demands, offering chefs a versatile ingredient for creating delectable and stable dishes. In October 2022, Darling Ingredients introduced an innovative gelatin product called Quali-Pure, designed specifically for pharmaceutical applications. Quali-Pure is engineered to meet the stringent requirements of various medical applications, including embolization, wound healing, drug delivery, hemostatic procedures, and vaccinations. Notably, it offers controlled endotoxin levels, batch-to-batch consistency, biocompatibility, and biodegradability, making it a vital component for medical devices and ensuring compliance with ISO 22442 and the new EU Medical Device Regulation (MDR) criteria. This development is pivotal in expanding the role of gelatin in the pharmaceutical industry and reinforcing its importance in medical applications. The competitive landscape of the Gelatin market is dynamic and includes a mix of established players, emerging vendors, and niche specialists. Larger players often acquire niche vendors to expand their Gelatin portfolios. This led to consolidation and increased competition. Vendors form strategic partnerships and alliances to offer integrated Gelatin solutions that cover a broader spectrum of data management challenges. The shift toward cloud-based Gelatin solutions is gaining momentum, with cloud providers playing a significant role in the market. Some vendors specialize in specific industry verticals, offering tailored solutions to address industry-specific Gelatin requirements. Informatics (US) is recognized as one of the leading Gelatin Key players in the market. Many solutions related to data management and big data such as data quality, data security, integration, and cloud solutions are provided by the company.Gelatin Industry Ecosystem

Gelatin Market Scope: Inquiry Before Buying

Gelatin Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.41 Bn. Forecast Period 2025 to 2032 CAGR: 6.5% Market Size in 2032: USD 7.31 Bn. Segments Covered: by Type Type A Type B by Function Thickener Stabilizer Gelling Agent Other by Source Porcine Bovine Skin Bovine Bone Fish & Poultry Agar-Agar Carrageenan by Application Food and Beverages Pharmaceuticals Health and Nutrition Cosmetic and Personal Others Gelatin Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Gelatin Market, Key Players:

North America 1. Darling Ingredients Inc 2. Great Lakes Gelatin Company 3. Jellatech Europe 4. Ewald-Gelatine GmbH, 5. ITALGEL S.p.A 6. Jellice Pioneer Private Limited 7. Lapi Gelatine Spa, 8. Weishardt Holding Corporation APAC 9. Foodchem International Corporation 10. Geltech Co., Ltd 11. Henan Boom Gelatin Co.,Ltd 12. India Gelatine 13. C.J. Gelatine 14. Narmada Gelatines 15. Jellice Pioneer Private Limited 16. Luohe Wulong Gelatin Co. Ltd 17. Nitta Gelatin Incorporation 18. Shanghai Al-Amin Biotechnology Co., Ltd 19. Nitta Gelatin FAQs: 1. What are the growth drivers for the Gelatin Market? Ans. Pharmaceutical Applications Fuel the Gelatin Market is expected to be the major driver for the Gelatin Market. 2. What is the major opportunity for the Gelatin Market growth? Ans Gelatin's Transformative Role in Diverse Industries is expected to be a major Opportunity in the Gelatin Market. 3. Which country is expected to lead the global Gelatin Market during the forecast period? Ans. Europe is expected to lead the Gelatin Market during the forecast period. 4. What is the projected market size and growth rate of the Gelatin Market? Ans. The Gelatin Market size was valued at USD 4.41 Billion in 2024 and the total Gelatin revenue is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 7.31 Billion. 5. What segments are covered in the Gelatin Market report? Ans. The segments covered in the Gelatin Market report are by Type, Function, Source, Application, and Region.

1. Gelatin Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Gelatin Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Growth Rate (Y-O-Y in %) 2.5.6. Global Presence 2.5.7. Key Development 2.5.8. Market Share 2.6. Industry Ecosystem 2.6.1. Demand Side 2.6.2. Supply Side 2.6.3. Key players in the Gelatine ecosystem 2.7. Upcoming Technological and Advancement Initiatives by Key Players 2.7.1. Technology Analysis 2.7.1.1. Key Technology 2.7.1.1.1. Application of green technology in gelatin extraction 2.7.1.1.2. Ultrasound assisted extraction 2.7.2. Complementary Technology 2.7.2.1. Gelatin-based injectable hydrogels 2.7.3. Adjacent Technology 2.7.3.1. Collagen –based injectable hydrogels 2.8. Market Structure 2.8.1. Market Leaders 2.8.2. Market Followers 2.8.3. Emerging Players 2.9. Consolidation of the Market 2.9.1. Strategic Initiatives and Developments 2.9.2. Mergers and Acquisitions 2.9.3. Collaborations and Partnerships 2.9.4. Product Launches and Innovations 2.10. Pricing Analysis: Average Selling Price of Gelatin Offered by Key Players in the Market 3. Gelatin Market: Dynamics 3.1. Gelatin Market Trends by Region 3.2. Gelatin Market Dynamics by Region 3.2.1.1. Drivers 3.2.1.2. Restraints 3.2.1.3. Opportunities 3.2.1.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.3.1. Threat of New Entrants 3.3.2. Threat of Substitutes 3.3.3. Bargaining Power of Suppliers 3.3.4. Bargaining Power of Buyers 3.3.5. Intensity of Competitive Rivalry 3.4. PESTLE Analysis 3.5. Key Forces Shaping the Modern World 3.6. Value Chain Analysis 3.6.1. Research and development 3.6.2. Sourcing 3.6.3. Manufacturing 3.6.4. Packaging and Storage 3.6.5. Distribution 3.6.6. End Users 3.7. Supply Chain Analysis 3.8. Patent Analysis 3.9. Pricing Analysis 3.9.1. Average Selling price trend ,2020-2023 3.10. Trade Analysis 3.10.1. Import/ Export Scenario of Gelatin 3.11. Key Stakeholder and Buying Criteria 3.11.1. Influence of Stakeholders on the Buying Process for the Top Applications 3.11.2. Key Buying Criteria for Top Applications 3.12. Regulatory Landscape 3.12.1. Regulation by Region 3.12.2. Tariff and Taxes 3.12.3. Analysis of Government Schemes and Initiatives on the Global Gelatin Industry 3.12.4. Regulatory Bodies, Government Agencies and Other Organizations by Region 3.13. Patent Analysis 4. Gelatin Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 4.1. Gelatin Market Size and Forecast, by Type (2024-2032) 4.1.1. Type A 4.1.2. Type B 4.2. Gelatin Market Size and Forecast, by Function (2024-2032) 4.2.1. Thickener 4.2.2. Stabilizer 4.2.3. Gelling Agent 4.2.4. Other 4.3. Gelatin Market Size and Forecast, by Source (2024-2032) 4.3.1. Porcine 4.3.2. Bovine Skin 4.3.3. Bovine Bone 4.3.4. Fish & Poultry 4.3.5. Agar-Agar 4.3.6. Carrageenan 4.4. Gelatin Market Size and Forecast, by Application (2024-2032) 4.4.1. Food and Beverages 4.4.2. Pharmaceuticals 4.4.3. Health and Nutrition 4.4.4. Cosmetic and Personal 4.4.5. Others 4.5. Gelatin Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. South America 4.5.5. MEA 5. North America Gelatin Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 5.1. North America Gelatin Market Size and Forecast, by Type (2024-2032) 5.1.1. Type A 5.1.2. Type B 5.2. North America Gelatin Market Size and Forecast, by Function (2024-2032) 5.2.1. Thickener 5.2.2. Stabilizer 5.2.3. Gelling Agent 5.2.4. Other 5.3. North America Gelatin Market Size and Forecast, by Source (2024-2032) 5.3.1. Porcine 5.3.2. Bovine Skin 5.3.3. Bovine Bone 5.3.4. Fish & Poultry 5.3.5. Agar-Agar 5.3.6. Carrageenan 5.4. North America Gelatin Market Size and Forecast, by Application (2024-2032) 5.4.1. Food and Beverages 5.4.2. Pharmaceuticals 5.4.3. Health and Nutrition 5.4.4. Cosmetic and Personal 5.4.5. Others 5.5. North America Gelatin Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Gelatin Market Size and Forecast, by Type (2024-2032) 5.5.1.1.1. Type A 5.5.1.1.2. Type B 5.5.1.2. United States Gelatin Market Size and Forecast, by Function (2024-2032) 5.5.1.2.1. Thickener 5.5.1.2.2. Stabilizer 5.5.1.2.3. Gelling Agent 5.5.1.2.4. Other 5.5.1.3. United States Gelatin Market Size and Forecast, by Source (2024-2032) 5.5.1.3.1. Porcine 5.5.1.3.2. Bovine Skin 5.5.1.3.3. Bovine Bone 5.5.1.3.4. Fish & Poultry 5.5.1.3.5. Agar-Agar 5.5.1.3.6. Carrageenan 5.5.1.4. United States Gelatin Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Food and Beverages 5.5.1.4.2. Pharmaceuticals 5.5.1.4.3. Health and Nutrition 5.5.1.4.4. Cosmetic and Personal 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Gelatin Market Size and Forecast, by Type (2024-2032) 5.5.2.1.1. Type A 5.5.2.1.2. Type B 5.5.2.2. Canada Gelatin Market Size and Forecast, by Function (2024-2032) 5.5.2.2.1. Thickener 5.5.2.2.2. Stabilizer 5.5.2.2.3. Gelling Agent 5.5.2.2.4. Other 5.5.2.3. Canada Gelatin Market Size and Forecast, by Source (2024-2032) 5.5.2.3.1. Porcine 5.5.2.3.2. Bovine Skin 5.5.2.3.3. Bovine Bone 5.5.2.3.4. Fish & Poultry 5.5.2.3.5. Agar-Agar 5.5.2.3.6. Carrageenan 5.5.2.4. Canada Gelatin Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Food and Beverages 5.5.2.4.2. Pharmaceuticals 5.5.2.4.3. Health and Nutrition 5.5.2.4.4. Cosmetic and Personal 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Gelatin Market Size and Forecast, by Type (2024-2032) 5.5.3.1.1. Type A 5.5.3.1.2. Type B 5.5.3.2. Mexico Gelatin Market Size and Forecast, by Function (2024-2032) 5.5.3.2.1. Thickener 5.5.3.2.2. Stabilizer 5.5.3.2.3. Gelling Agent 5.5.3.2.4. Other 5.5.3.3. Mexico Gelatin Market Size and Forecast, by Source (2024-2032) 5.5.3.3.1. Porcine 5.5.3.3.2. Bovine Skin 5.5.3.3.3. Bovine Bone 5.5.3.3.4. Fish & Poultry 5.5.3.3.5. Agar-Agar 5.5.3.3.6. Carrageenan 5.5.3.4. Mexico Gelatin Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Food and Beverages 5.5.3.4.2. Pharmaceuticals 5.5.3.4.3. Health and Nutrition 5.5.3.4.4. Cosmetic and Personal 5.5.3.4.5. Others 6. Europe Gelatin Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 6.1. Europe Gelatin Market Size and Forecast, by Type (2024-2032) 6.2. Europe Gelatin Market Size and Forecast, by Function (2024-2032) 6.3. Europe Gelatin Market Size and Forecast, by Source (2024-2032) 6.4. Europe Gelatin Market Size and Forecast, by Application (2024-2032) 6.5. Europe Gelatin Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Gelatin Market Size and Forecast, by Type (2024-2032) 6.5.1.2. United Kingdom Gelatin Market Size and Forecast, by Function (2024-2032) 6.5.1.3. United Kingdom Gelatin Market Size and Forecast, by Source (2024-2032) 6.5.1.4. United Kingdom Gelatin Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Gelatin Market Size and Forecast, by Type (2024-2032) 6.5.2.2. France Gelatin Market Size and Forecast, by Function (2024-2032) 6.5.2.3. France Gelatin Market Size and Forecast, by Source (2024-2032) 6.5.2.4. France Gelatin Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Gelatin Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Germany Gelatin Market Size and Forecast, by Function (2024-2032) 6.5.3.3. Germany Gelatin Market Size and Forecast, by Source (2024-2032) 6.5.3.4. Germany Gelatin Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Gelatin Market Size and Forecast, by Type (2024-2032) 6.5.4.2. Italy Gelatin Market Size and Forecast, by Function (2024-2032) 6.5.4.3. Italy Gelatin Market Size and Forecast, by Source (2024-2032) 6.5.4.4. Italy Gelatin Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Gelatin Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Spain Gelatin Market Size and Forecast, by Function (2024-2032) 6.5.5.3. Spain Gelatin Market Size and Forecast, by Source (2024-2032) 6.5.5.4. Spain Gelatin Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Gelatin Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Sweden Gelatin Market Size and Forecast, by Function (2024-2032) 6.5.6.3. Sweden Gelatin Market Size and Forecast, by Source (2024-2032) 6.5.6.4. Sweden Gelatin Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Gelatin Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Austria Gelatin Market Size and Forecast, by Function (2024-2032) 6.5.7.3. Austria Gelatin Market Size and Forecast, by Source (2024-2032) 6.5.7.4. Austria Gelatin Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Gelatin Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Rest of Europe Gelatin Market Size and Forecast, by Function (2024-2032) 6.5.8.3. Rest of Europe Gelatin Market Size and Forecast, by Source (2024-2032) 6.5.8.4. Rest of Europe Gelatin Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Gelatin Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 7.1. Asia Pacific Gelatin Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Gelatin Market Size and Forecast, by Function (2024-2032) 7.3. Asia Pacific Gelatin Market Size and Forecast, by Source (2024-2032) 7.4. Asia Pacific Gelatin Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Gelatin Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Gelatin Market Size and Forecast, by Type (2024-2032) 7.5.1.2. China Gelatin Market Size and Forecast, by Function (2024-2032) 7.5.1.3. China Gelatin Market Size and Forecast, by Source (2024-2032) 7.5.1.4. China Gelatin Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Gelatin Market Size and Forecast, by Type (2024-2032) 7.5.2.2. S Korea Gelatin Market Size and Forecast, by Function (2024-2032) 7.5.2.3. S Korea Gelatin Market Size and Forecast, by Source (2024-2032) 7.5.2.4. S Korea Gelatin Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Gelatin Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Japan Gelatin Market Size and Forecast, by Function (2024-2032) 7.5.3.3. Japan Gelatin Market Size and Forecast, by Source (2024-2032) 7.5.3.4. Japan Gelatin Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Gelatin Market Size and Forecast, by Type (2024-2032) 7.5.4.2. India Gelatin Market Size and Forecast, by Function (2024-2032) 7.5.4.3. India Gelatin Market Size and Forecast, by Source (2024-2032) 7.5.4.4. India Gelatin Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Gelatin Market Size and Forecast, by Type (2024-2032) 7.5.5.2. Australia Gelatin Market Size and Forecast, by Function (2024-2032) 7.5.5.3. Australia Gelatin Market Size and Forecast, by Source (2024-2032) 7.5.5.4. Australia Gelatin Market Size and Forecast, by Application (2024-2032) 7.5.6. ASEAN 7.5.6.1. ASEAN Gelatin Market Size and Forecast, by Type (2024-2032) 7.5.6.2. ASEAN Gelatin Market Size and Forecast, by Function (2024-2032) 7.5.6.3. ASEAN Gelatin Market Size and Forecast, by Source (2024-2032) 7.5.6.4. ASEAN Gelatin Market Size and Forecast, by Application (2024-2032) 7.5.7. Rest of Asia Pacific 7.5.7.1. Rest of Asia Pacific Gelatin Market Size and Forecast, by Type (2024-2032) 7.5.7.2. Rest of Asia Pacific Gelatin Market Size and Forecast, by Function (2024-2032) 7.5.7.3. Rest of Asia Pacific Gelatin Market Size and Forecast, by Source (2024-2032) 7.5.7.4. Rest of Asia Pacific Gelatin Market Size and Forecast, by Application (2024-2032) 8. South America Gelatin Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 8.1. South America Gelatin Market Size and Forecast, by Type (2024-2032) 8.2. South America Gelatin Market Size and Forecast, by Function (2024-2032) 8.3. South America Gelatin Market Size and Forecast, by Source (2024-2032) 8.4. South America Gelatin Market Size and Forecast, by Application (2024-2032) 8.5. South America Gelatin Market Size and Forecast, by Country (2024-2032) 8.5.1. Brazil 8.5.1.1. Brazil Gelatin Market Size and Forecast, by Type (2024-2032) 8.5.1.2. Brazil Gelatin Market Size and Forecast, by Function (2024-2032) 8.5.1.3. Brazil Gelatin Market Size and Forecast, by Source (2024-2032) 8.5.1.4. Brazil Gelatin Market Size and Forecast, by Application (2024-2032) 8.5.2. Argentina 8.5.2.1. Argentina Gelatin Market Size and Forecast, by Type (2024-2032) 8.5.2.2. Argentina Gelatin Market Size and Forecast, by Function (2024-2032) 8.5.2.3. Argentina Gelatin Market Size and Forecast, by Source (2024-2032) 8.5.2.4. Argentina Gelatin Market Size and Forecast, by Application (2024-2032) 8.5.3. Rest of South America 8.5.3.1. Rest of South America Gelatin Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Rest of South America Gelatin Market Size and Forecast, by Function (2024-2032) 8.5.3.3. Rest of South America Gelatin Market Size and Forecast, by Source (2024-2032) 8.5.3.4. Rest of South America Gelatin Market Size and Forecast, by Application (2024-2032) 9. Middle East and Africa Gelatin Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 9.1. Middle East and Africa Gelatin Market Size and Forecast, by Type (2024-2032) 9.2. Middle East and Africa Gelatin Market Size and Forecast, by Function (2024-2032) 9.3. Middle East and Africa Gelatin Market Size and Forecast, by Source (2024-2032) 9.4. Middle East and Africa Gelatin Market Size and Forecast, by Application (2024-2032) 9.5. Middle East and Africa Gelatin Market Size and Forecast, by Country (2024-2032) 9.5.1. South Africa 9.5.1.1. South Africa Gelatin Market Size and Forecast, by Type (2024-2032) 9.5.1.2. South Africa Gelatin Market Size and Forecast, by Function (2024-2032) 9.5.1.3. South Africa Gelatin Market Size and Forecast, by Source (2024-2032) 9.5.1.4. South Africa Gelatin Market Size and Forecast, by Application (2024-2032) 9.5.2. GCC 9.5.2.1. GCC Gelatin Market Size and Forecast, by Type (2024-2032) 9.5.2.2. GCC Gelatin Market Size and Forecast, by Function (2024-2032) 9.5.2.3. GCC Gelatin Market Size and Forecast, by Source (2024-2032) 9.5.2.4. GCC Gelatin Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest of MEA 9.5.3.1. Rest of MEA Gelatin Market Size and Forecast, by Type (2024-2032) 9.5.3.2. Rest of MEA Gelatin Market Size and Forecast, by Function (2024-2032) 9.5.3.3. Rest of MEA Gelatin Market Size and Forecast, by Source (2024-2032) 9.5.3.4. Rest of MEA Gelatin Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. Darling Ingredients Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis (Technological strengths and weaknesses) 10.1.5. Strategic Analysis (Recent strategic moves) 10.1.6. Recent Developments 10.2. Great Lakes Gelatin Company 10.3. Jellatech 10.4. Ewald-Gelatine GmbH, 10.5. ITALGEL S.p.A 10.6. Jellice Pioneer Private Limited 10.7. Lapi Gelatine Spa, 10.8. Weishardt Holding Corporation 10.9. Foodchem International Corporation 10.10. Geltech Co., Ltd 10.11. Henan Boom Gelatin Co.,Ltd 10.12. India Gelatine 10.13. C.J. Gelatine 10.14. Narmada Gelatines 10.15. Jellice Pioneer Private Limited 10.16. Luohe Wulong Gelatin Co. Ltd 10.17. Nitta Gelatin Incorporation 10.18. Shanghai Al-Amin Biotechnology Co., Ltd 10.19. Nitta Gelatin 11. Key Findings and Analyst Recommendations 11.1. Attractive Opportunities for Players in the Gelatin Market 12. Gelatin Market: Research Methodology 13. Market Size Estimation Methodology 13.1.1. Bottom-Up Approach 13.1.2. Top-Down Approach 13.1.3. Data Triangulation 13.1.4. Research Assumptions 13.1.5. Limitations and Risk Assessment