Gaming Market was valued at USD 260.12 Billion in 2022, and it is expected to reach USD 620.35 Billion by 2029, exhibiting a CAGR of 13.22% during the forecast period (2023-2029)Gaming Market Overview:

The increased availability of high-speed Internet connections, particularly in emerging nations, has made online gaming more accessible to a wider variety of individuals in recent years. "Gaming" has many uses and is especially popular in academic and professional contexts. The Gaming Market is primarily driven by changing demographics of gamers, costly hardware and software installation and update costs, and the growing prevalence of high-speed Internet access. The Gaming Market is segmented by game type, device type, and end-user. Based on game type, the market is segmented into shooter, action, sports, role-playing, and others.Based on region, the market is segmented into North America, Asia Pacific, Europe, Middle East & Africa, and South America.To know about the Research Methodology :- Request Free Sample Report Research Methodology The Gaming Market report provides an evaluation of the market for the forecast period. The report comprises various segments as well as an analysis of the trends and factors that are playing a substantial role in the market. In the report, the market outlook section mainly encompasses fundamental dynamics of the market which include drivers, restraints, opportunities, and challenges faced by the industry. Based on the understanding of requirements, a secondary research is conducted to identify the segment specifications, qualitative and quantitative data along with the factors responsible for the growth of the market. The secondary source referred for the research are press releases, company annual reports, government websites, and research papers related to market. Moreover, quantitative and qualitative data is extracted from paid database like Reuters, Bloomberg, Hoovers, etc. The secondary research carried out at primary level is verified by primary research. In the report, Porter examines competition, new entrants in the market, supplier power, buyer power, and the threats of the substitute products and services in the market. PESTLE identifies factors like political, economic, sociocultural, technological, legal, and environmental that may affect an organization and its competitive standing. The main approach used to calculate accurate market size is bottom-up market sizing approach, where macro and micro view of all the potential customers, revenue and current market is considered as a whole. On the other hand, the research is also conducted by considering micro level segment that can be realistically targeted and calculated, which results in better forecasting and more accurate data on amore granular level. COVID-19 Impact on Gaming Market Because of COVID-19 pandemic and lockdowns, there was an increase in gaming adoption. People at home looking for social connection found an intriguing distraction in gaming. In lockdown, the corporations saw big increases in gaming time and sales. Tencent Holdings Ltd., for example, saw a 31% increase in its online gaming section in 2020 compared to 2019. Animal Crossing: New Horizons sold 1.88 million copies in Japan in its first three days, despite the COVID-19 pandemic; the firm sold 392 000 consoles in Japan despite the COVID-19 pandemic. The bulk of the worldwide population's coronavirus prevention strategies encouraged a big number of individuals to spend the most of their time at home. People were stressed, anxious, and afraid as a result of the bleak circumstances. Furthermore, they were unable to engage in outdoor activities or social events. All of these reasons combined to operate as a driving force in the consumption of various online games, resulting in the dealing with various mental difficulties. For example, according to World Economic Forum data from September 2020, gaming unit sales in the United States increased by 37 percent year on year to USD 3.3 billion.

Gaming Market Dynamics

Increasing Online Gaming Market in India: Growing younger population, increased disposable income, low-cost internet connectivity, introduction of new gaming genres, and an increase in smartphone and tablet users are some of the factors driving the gaming market. In recent years, India's nascent online gaming business has experienced exceptional growth, propelling it to the top five mobile gaming marketplaces in the world. Online gaming is the next sunrise industry, with a growth rate of 38%. According to a KPMG report, India currently has over 400 gaming firms and 420 million online gamers, ranking second only to China. The trends in the online gaming business are favourable, and analysts expect that the sector will develop rapidly. Currently, India is expected to become one of the world's biggest gaming marketplaces. According to the KPMG research, it has been gradually growing over the previous five years and is estimated to triple in value to $3.9 billion by 2025. From 360 million in 2020 to 390 million in 2021, the overall number of online gamers increased by 8%. According to data, the number of gamers is expected to exceed 450 million by 2023. Gaming Championships' Growing Popularity Will Aid Gaming Market Growth: Various competitions are progressively enticing video game gamers all around the world. Popular games among gamers include PUBG, Overwatch, Call of Duty, League of Legends, and more. These tournaments attract a large audience, which inspires more customers to become professional gamers, either directly or indirectly. As a result, expenditure on upgrading or acquiring new video gaming systems surged. According to Esports Chart statistics, the 2020 League of Legends Championship attracted 3.8 million views. Furthermore, the huge prize money granted by the video game championship encouraged more individuals to play a video game. For example, Times Now News reported in August 2020 that the PUBG Mobile Global Championship had a prize pool of USD 2 million. This draws a large number of gamers that enjoy online gaming styles. Technological Advancement in Gaming: The growing demand for consoles has urged marketers to provide technologically advanced and reasonably priced consoles to the market. For example, Sony Interactive Entertainment LLC released PlayStation 5 in November 2020, with features such as 4K/120 gaming, 8K/60 compatibility, AMD Zen 2 CPU, PS plus collection, revolutionary controller haptics, fast new UI, and super-fast SSD for quicker load times. By the end of December 2021, Sony Interactive Entertainment LLC had sold 17.3 million PlayStation 5 consoles. Virtual reality (VR) and augmented reality (AR) technical advancements have provided several chances to enhance the gaming experience. The growing popularity of free-to-play and multiplayer gaming is luring young people into the gaming industry. Institutes and colleges have begun to provide professional courses so that students may pursue gaming as a career. The University of Hertfordshire, for example, offers an MA in Games Art and Design that may be completed on-campus or online. Youth Preference for Gaming Benefits the Growth of Market: Today, video games are becoming one of the most popular ways for young people to spend their leisure time. It has been critical in increasing market growth. For example, according to data provided in February 2019 by the American Association of Advertising Agencies.Org, 91 percent of generation Z males play video games on a regular basis, which is somewhat higher than the millennial generation's 84 percent. Furthermore, the continuous fall in global young unemployment has resulted in increased purchasing power, which has accelerated the consumption rate. For example, according to World Bank.Org statistics, worldwide youth unemployment in 2018 was 15.19 percent, a 15.37 percent decrease from the previous year. This is expected to boost the growth of the market during the forecast period. Mobile Users Increasingly Attracted to Gaming: Mobile gaming is growing popularity throughout the world as a result of the increasing adoption of 4G technology in smartphones, which has resulted in an increase in the development of appealing online interactive games. As a result, these games draw players from all demographics throughout the world and serve as a catalyst for their expansion. For example, according to data published by the World Economic Forum.Org in May 2020, mobile games represent around 48 percent of the video gaming business. Similarly, the growing popularity of mobile cellular subscriptions has boosted demand for mobile games. For example, according to World Bank.org data, the global mobile cellular subscriber rate in 2019 is 109.397 per one hundred persons.Growing Addiction among Youth to Limit Market Growth: The growing number of gamers who play video games passionately, particularly youngsters, is frequently transformed into an addiction. This interferes with their studies and causes social anxiety. As a result, such activities discourage parents from purchasing a gaming system for their children. According to a well-known addiction rehabilitation organisation named 'The Recovery Village,' there are over 2 billion individuals who play video games globally in April 2021, with 1-10% of gamers having compulsive addiction disorders. Furthermore, video game addiction can lead to mental health difficulties, causing parents to avoid purchasing the product for their children. This is likely to be a constraint on the growth of the market.

Gaming Market Segment Analysis

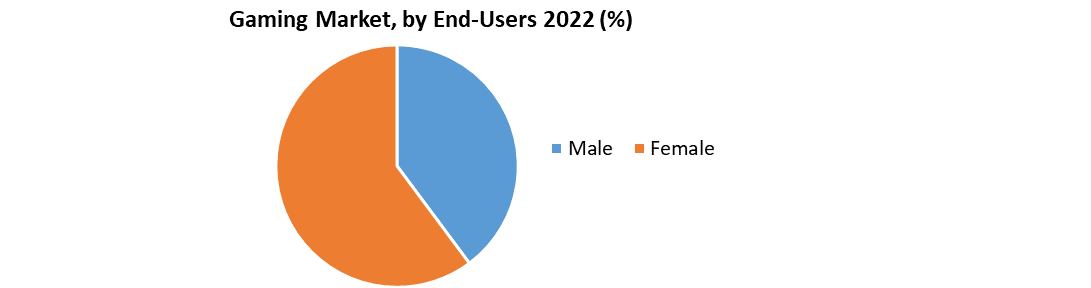

Based on the game type, the market is segmented into shooter, action, sports, role-playing, and others. The shooter sector is expected to have a large gaming market share since most shooter games have 3D realistic graphics, multiplayer capability, enticing weaponry and characters, and obsessively hard tactical tasks. As a result, these play an important part in attracting new gamers to this sort of game. On the other hand, categories like as action, sports, role-playing, and others are seeing significant market growth. These game genres might cater to a certain target demographic, ranging from athletes to ladies, children, and even the elderly. Based on device type, the market is segmented into PC/MMO, Tablet, Mobile Phone, and TV/Console. Because of the growing number of smartphone owners, the mobile phone category is expected to stay dominating. Many game creators are moving their attention to increasing game creation, notably for mobile phones. The PC/MMO, Tablet, and TV/Console market categories are all seeing growth. Most of these devices are preferred by dedicated gamers because they can handle high-definition games that need strong CPUs, graphics cards, and RAM. By end-user, the market is segmented into male and female. The male segment is estimated to be a bigger market due to a large number of games available in the market, such as racing, sports, action, and others, designed to be more male-oriented than females. Hence, this plays a significant contribution in male dominance in the industry. The female segment is increasingly showing a progressive rise, as more females are influenced by online pc gaming platforms such as Twitch, where they can gain loyal fans who are willing to support their channels financially.

Regional Insights

Asia-Pacific is expected to have the greatest market share in the gaming sector, with China, Japan, and South Korea displaying strong development potential. With rising technology use, China is one of Asia's most significant economies. Rising exports and continued innovation in new games and systems are important gaming drivers. China is one of the Asia-Pacific nations that has witnessed a significant COVID-related increase in its gaming companies. The fast increase of mini-games played within mobile applications, such as WeChat, without the need to install another app demands the expansion of China's gaming industry. Mini-games with significant social components are easy to learn and have a wide following in the nation. With the quick expansion of technology adaptation and the existence of many significant gaming firms, such as Sony, Nintendo, Konami, and others, Japan has been a key player in the gaming business for decades. The gaming industry in the nation is growing and is expected to grow considerably throughout the forecast period. Many significant players are expanding their footprint in the area through acquisitions and cooperation initiatives in Japan. For example, in November 2021, the Japanese publisher Sega formed a strategic agreement with Microsoft to build the Super Games platform using the Microsoft Azure cloud platform. Europe is expected to witness substantial growth owing to the flourishing development of esports, attracting more people to video games. For instance, according to the data presented by Ukie.Org. Uk, mentions that in 2019 esports in the United Kingdom was assessed to make an earning of USD 76.53 million. Besides, the industry in this region receiving an increased investment from the federal government for enlargement of the market is likely to fuel the demand. According to the Germany Games Industry Association data, in 2019, the German federal budget contains USD 55.99 million to enhance computer game development. North America is estimated to experience considerable growth in the market. The high popularity of playing video games among older adults has spiked the product's demand. According to the American Association of Retired Person data, in 2019, the United States population of age 50 years and above has constituted 51 million gamers who played an average of 5 hours a week. Besides, most children in this region carry their smart devices, surging the product's utilization. For instance, the data released by the National Public Radio.Org in October 2019 declares that more than half of the children in America own a smartphone. South America has experienced significant growth in the market, which is attributed to the region's increasing number of internet users. As a result, the South American populace is increasingly enjoying online games. Consider the World Bank. According to Org statistics, Brazilian internet users are expected to reach 70.434 percent in 2018, up from 67.471 percent the previous year. The Middle East and Africa are expected to have a considerable market presence. The rapid expansion of smartphone adoption is contributing to an increase in the number of individuals playing mobile games. As a result, this contributes to a faster rate of consumption. According to figures from the Independent Communications Authority of South Africa, smartphone penetration in South Africa increased from 81.7 percent to 91.2 percent in 2019. Objective of the Report The objective of the report is to present a comprehensive analysis of the Gaming Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Gaming Market dynamic, structure by analyzing the market segments and projecting the Gaming Market size. Clear representation of competitive analysis of key players by segment type and regional presence in the Gaming Market make the report investor’s guide.Gaming Market Scope: Inquire before buying

Gaming Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US 260.12 Bn. Forecast Period 2023 to 2029 CAGR: 13.22 % Market Size in 2029: US 620.35 Bn. Segments Covered: by Game Type Action Shooter Role-Playing Sports Others by Device Type Tablet PC/MMO TV/Console Mobile Phone by End-Users Male Female Gaming Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Key Players

1. Sony Interactive Entertainment 2. Microsoft Corporation 3. Nintendo Co., Ltd. 4. Activision Blizzard 5. Electronic Arts (EA) 6. Ubisoft Entertainment 7. Tencent Holdings Limited 8. NetEase, Inc. 9. Take-Two Interactive Software 10. Valve Corporation 11. Epic Games 12. Square Enix Holdings Co., Ltd. 13. Capcom Co., Ltd. 14. CD Projekt S.A. 15. Bandai Namco Entertainment Inc. 16. Krafton, Inc. Frequently Asked Questions: 1] What segments are covered in the Global Gaming Market report? Ans. The segments covered in the Gaming Market report are based on Game Type, Device Type, and End-Users. 2] Which region is expected to hold the highest share in the Global Gaming Market? Ans. The North America region is expected to hold the highest share in the Gaming Market. 3] What is the market size of the Global Gaming Market by 2029? Ans. The market size of the Gaming Market by 2029 is expected to reach USD 620.35Bn. 4] What is the forecast period for the Global Gaming Market? Ans. The forecast period for the Gaming Market is 2023-2029. 5] What was the market size of the Global Gaming Market in 2022? Ans. The market size of the Gaming Market in 2022 was valued at USD 260.12 Bn.

1. Gaming Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 1.4. Evolution of gaming Industry 2. Gaming Market: Dynamics 2.1. Gaming Market Trends 2.2. Gaming Market Dynamics 2.2.1. Drivers 2.2.2. Restraints 2.2.3. Opportunities 2.2.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technological Innovations in Gaming Market 2.5.1. Integration of AR/VR Technologies 2.5.2. Cloud Gaming 2.5.3. Other Technological Innovation 2.6. Regulatory Landscape 2.7. Key Opinion Leader Analysis for the Gaming Industry 2.8. Analysis of Government Schemes and Initiatives for Gaming Industry 2.9. Gaming Market Trade Analysis 2.10. The Global Pandemic Impact on Gaming Market 3. Global Gaming Market: Competitive Landscape 3.1. Top Country's revenue by the Gaming market 3.2. Top Best-Selling Video Game Franchises 3.3. MMR Competition Matrix 3.4. Competitive Landscape 3.5. Key Players Benchmarking 3.5.1. Company Name 3.5.2. Business Segment 3.5.3. End-user Segment 3.5.4. Revenue (2022) 3.5.5. Company Locations 3.6. Leading Gaming Market Companies, by market capitalization 3.7. Market Structure 3.7.1. Market Leaders 3.7.2. Market Followers 3.7.3. Emerging Players 3.8. Mergers and Acquisitions Details 4. Gaming Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. Gaming Market Size and Forecast, by Game Type (2022-2029) 4.1.1. Action 4.1.2. Shooter 4.1.3. Role-Playing 4.1.4. Sports 4.1.5. Others 4.2. Gaming Market Size and Forecast, by Device Type (2022-2029) 4.2.1. Tablet 4.2.2. PC/MMO 4.2.3. TV/Console 4.2.4. Mobile Phone 4.3. Gaming Market Size and Forecast, by End-User (2022-2029) 4.3.1. Male 4.3.2. Female 4.4. Gaming Market Size and Forecast, by Region (2022-2029) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Gaming Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. North America Gaming Market Size and Forecast, by Game Type (2022-2029) 5.1.1. Action 5.1.2. Shooter 5.1.3. Role-Playing 5.1.4. Sports 5.1.5. Others 5.2. North America Gaming Market Size and Forecast, by Device Type (2022-2029) 5.2.1. Tablet 5.2.2. PC/MMO 5.2.3. TV/Console 5.2.4. Mobile Phone 5.3. North America Gaming Market Size and Forecast, by End-User (2022-2029) 5.3.1. Male 5.3.2. Female 5.4. North America Gaming Market Size and Forecast, by Country (2022-2029) 5.4.1. United States 5.4.1.1. United States Gaming Market Size and Forecast, by Game Type (2022-2029) 5.4.1.1.1. Action 5.4.1.1.2. Shooter 5.4.1.1.3. Role-Playing 5.4.1.1.4. Sports 5.4.1.1.5. Others 5.4.1.2. United States Gaming Market Size and Forecast, by Device Type (2022-2029) 5.4.1.2.1. Tablet 5.4.1.2.2. PC/MMO 5.4.1.2.3. TV/Console 5.4.1.2.4. Mobile Phone 5.4.1.3. United States Gaming Market Size and Forecast, by End-User (2022-2029) 5.4.1.3.1. Male 5.4.1.3.2. Female 5.4.2. Canada 5.4.2.1. Canada Gaming Market Size and Forecast, by Game Type (2022-2029) 5.4.2.1.1. Action 5.4.2.1.2. Shooter 5.4.2.1.3. Role-Playing 5.4.2.1.4. Sports 5.4.2.1.5. Others 5.4.2.2. Canada Gaming Market Size and Forecast, by Device Type (2022-2029) 5.4.2.2.1. Tablet 5.4.2.2.2. PC/MMO 5.4.2.2.3. TV/Console 5.4.2.2.4. Mobile Phone 5.4.2.3. Canada Gaming Market Size and Forecast, by End-User (2022-2029) 5.4.2.3.1. Male 5.4.2.3.2. Female 5.4.3. Mexico 5.4.3.1. Mexico Gaming Market Size and Forecast, by Game Type (2022-2029) 5.4.3.1.1. Action 5.4.3.1.2. Shooter 5.4.3.1.3. Role-Playing 5.4.3.1.4. Sports 5.4.3.1.5. Others 5.4.3.2. Mexico Gaming Market Size and Forecast, by Device Type (2022-2029) 5.4.3.2.1. Tablet 5.4.3.2.2. PC/MMO 5.4.3.2.3. TV/Console 5.4.3.2.4. Mobile Phone 5.4.3.3. Mexico Gaming Market Size and Forecast, by End-User (2022-2029) 5.4.3.3.1. Male 5.4.3.3.2. Female 6. Europe Gaming Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Europe Gaming Market Size and Forecast, by Game Type (2022-2029) 6.2. Europe Gaming Market Size and Forecast, by Device Type (2022-2029) 6.3. Europe Gaming Market Size and Forecast, by End-User (2022-2029) 6.4. Europe Gaming Market Size and Forecast, by Country (2022-2029) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Gaming Market Size and Forecast, by Game Type (2022-2029) 6.4.1.2. United Kingdom Gaming Market Size and Forecast, by Device Type (2022-2029) 6.4.1.3. United Kingdom Gaming Market Size and Forecast, by End-User (2022-2029) 6.4.2. France 6.4.2.1. France Gaming Market Size and Forecast, by Game Type (2022-2029) 6.4.2.2. France Gaming Market Size and Forecast, by Device Type (2022-2029) 6.4.2.3. France Gaming Market Size and Forecast, by End-User (2022-2029) 6.4.3. Germany 6.4.3.1. Germany Gaming Market Size and Forecast, by Game Type (2022-2029) 6.4.3.2. Germany Gaming Market Size and Forecast, by Device Type (2022-2029) 6.4.3.3. Germany Gaming Market Size and Forecast, by End-User (2022-2029) 6.4.4. Italy 6.4.4.1. Italy Gaming Market Size and Forecast, by Game Type (2022-2029) 6.4.4.2. Italy Gaming Market Size and Forecast, by Device Type (2022-2029) 6.4.4.3. Italy Gaming Market Size and Forecast, by End-User (2022-2029) 6.4.5. Spain 6.4.5.1. Spain Gaming Market Size and Forecast, by Game Type (2022-2029) 6.4.5.2. Spain Gaming Market Size and Forecast, by Device Type (2022-2029) 6.4.5.3. Spain Gaming Market Size and Forecast, by End-User (2022-2029) 6.4.6. Sweden 6.4.6.1. Sweden Gaming Market Size and Forecast, by Game Type (2022-2029) 6.4.6.2. Sweden Gaming Market Size and Forecast, by Device Type (2022-2029) 6.4.6.3. Sweden Gaming Market Size and Forecast, by End-User (2022-2029) 6.4.7. Austria 6.4.7.1. Austria Gaming Market Size and Forecast, by Game Type (2022-2029) 6.4.7.2. Austria Gaming Market Size and Forecast, by Device Type (2022-2029) 6.4.7.3. Austria Gaming Market Size and Forecast, by End-User (2022-2029) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Gaming Market Size and Forecast, by Game Type (2022-2029) 6.4.8.2. Rest of Europe Gaming Market Size and Forecast, by Device Type (2022-2029) 6.4.8.3. Rest of Europe Gaming Market Size and Forecast, by End-User (2022-2029) 7. Asia Pacific Gaming Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Asia Pacific Gaming Market Size and Forecast, by Game Type (2022-2029) 7.2. Asia Pacific Gaming Market Size and Forecast, by Device Type (2022-2029) 7.3. Asia Pacific Gaming Market Size and Forecast, by End-User (2022-2029) 7.4. Asia Pacific Gaming Market Size and Forecast, by Country (2022-2029) 7.4.1. China 7.4.1.1. China Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.1.2. China Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.1.3. China Gaming Market Size and Forecast, by End-User (2022-2029) 7.4.2. S Korea 7.4.2.1. S Korea Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.2.2. S Korea Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.2.3. S Korea Gaming Market Size and Forecast, by End-User (2022-2029) 7.4.3. Japan 7.4.3.1. Japan Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.3.2. Japan Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.3.3. Japan Gaming Market Size and Forecast, by End-User (2022-2029) 7.4.4. India 7.4.4.1. India Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.4.2. India Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.4.3. India Gaming Market Size and Forecast, by End-User (2022-2029) 7.4.5. Australia 7.4.5.1. Australia Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.5.2. Australia Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.5.3. Australia Gaming Market Size and Forecast, by End-User (2022-2029) 7.4.6. Indonesia 7.4.6.1. Indonesia Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.6.2. Indonesia Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.6.3. Indonesia Gaming Market Size and Forecast, by End-User (2022-2029) 7.4.7. Malaysia 7.4.7.1. Malaysia Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.7.2. Malaysia Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.7.3. Malaysia Gaming Market Size and Forecast, by End-User (2022-2029) 7.4.8. Vietnam 7.4.8.1. Vietnam Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.8.2. Vietnam Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.8.3. Vietnam Gaming Market Size and Forecast, by End-User (2022-2029) 7.4.9. Taiwan 7.4.9.1. Taiwan Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.9.2. Taiwan Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.9.3. Taiwan Gaming Market Size and Forecast, by End-User (2022-2029) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Gaming Market Size and Forecast, by Game Type (2022-2029) 7.4.10.2. Rest of Asia Pacific Gaming Market Size and Forecast, by Device Type (2022-2029) 7.4.10.3. Rest of Asia Pacific Gaming Market Size and Forecast, by End-User (2022-2029) 8. Middle East and Africa Gaming Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. Middle East and Africa Gaming Market Size and Forecast, by Game Type (2022-2029) 8.2. Middle East and Africa Gaming Market Size and Forecast, by Device Type (2022-2029) 8.3. Middle East and Africa Gaming Market Size and Forecast, by End-User (2022-2029) 8.4. Middle East and Africa Gaming Market Size and Forecast, by Country (2022-2029) 8.4.1. South Africa 8.4.1.1. South Africa Gaming Market Size and Forecast, by Game Type (2022-2029) 8.4.1.2. South Africa Gaming Market Size and Forecast, by Device Type (2022-2029) 8.4.1.3. South Africa Gaming Market Size and Forecast, by End-User (2022-2029) 8.4.2. GCC 8.4.2.1. GCC Gaming Market Size and Forecast, by Game Type (2022-2029) 8.4.2.2. GCC Gaming Market Size and Forecast, by Device Type (2022-2029) 8.4.2.3. GCC Gaming Market Size and Forecast, by End-User (2022-2029) 8.4.3. Nigeria 8.4.3.1. Nigeria Gaming Market Size and Forecast, by Game Type (2022-2029) 8.4.3.2. Nigeria Gaming Market Size and Forecast, by Device Type (2022-2029) 8.4.3.3. Nigeria Gaming Market Size and Forecast, by End-User (2022-2029) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Gaming Market Size and Forecast, by Game Type (2022-2029) 8.4.4.2. Rest of ME&A Gaming Market Size and Forecast, by Device Type (2022-2029) 8.4.4.3. Rest of ME&A Gaming Market Size and Forecast, by End-User (2022-2029) 9. South America Gaming Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 9.1. South America Gaming Market Size and Forecast, by Game Type (2022-2029) 9.2. South America Gaming Market Size and Forecast, by Device Type (2022-2029) 9.3. South America Gaming Market Size and Forecast, by End-User (2022-2029) 9.4. South America Gaming Market Size and Forecast, by Country (2022-2029) 9.4.1. Brazil 9.4.1.1. Brazil Gaming Market Size and Forecast, by Game Type (2022-2029) 9.4.1.2. Brazil Gaming Market Size and Forecast, by Device Type (2022-2029) 9.4.1.3. Brazil Gaming Market Size and Forecast, by End-User (2022-2029) 9.4.2. Argentina 9.4.2.1. Argentina Gaming Market Size and Forecast, by Game Type (2022-2029) 9.4.2.2. Argentina Gaming Market Size and Forecast, by Device Type (2022-2029) 9.4.2.3. Argentina Gaming Market Size and Forecast, by End-User (2022-2029) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Gaming Market Size and Forecast, by Game Type (2022-2029) 9.4.3.2. Rest Of South America Gaming Market Size and Forecast, by Device Type (2022-2029) 9.4.3.3. Rest Of South America Gaming Market Size and Forecast, by End-User (2022-2029) 10. Company Profile: Key Players 10.1. Sony Interactive Entertainment 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Microsoft Corporation 10.3. Nintendo Co., Ltd. 10.4. Activision Blizzard 10.5. Electronic Arts (EA) 10.6. Ubisoft Entertainment 10.7. Tencent Holdings Limited 10.8. NetEase, Inc. 10.9. Take-Two Interactive Software 10.10. Valve Corporation 10.11. Epic Games 10.12. Square Enix Holdings Co., Ltd. 10.13. Capcom Co., Ltd. 10.14. CD Projekt S.A. 10.15. Bandai Namco Entertainment Inc. 10.16. Krafton, Inc. 11. Key Findings 12. Industry Recommendations 13. Gaming Market: Research Methodology