Employee Computer Monitoring Software Market was valued at US$ 1073 Mn. in 2021. The Global Employee Computer Monitoring Software Market size is expected to grow at a CAGR of 26 % through the forecast period.Employee Computer Monitoring Software Market Overview:

The employee computer monitoring software is able to record and monitor the employee’s computer file operations, internet access, chat, computer screen, e-mail, etc. Departmental supervisors can monitor and control their teams' computers with the help of the system's hierarchical management. As a result, many businesses are progressively implementing employee computer monitoring software and systems to boost staff productivity.To Know About The Research Methodology :- Request Free Sample Report The employee monitoring software's easy, friendly, and elegant design, as well as its substantial operational flexibility, urges managers to use it. To fully preserve the monitoring information, the software configured security and privacy and accessed employee passwords and software login passwords. The software's accurate and precise statistics assist the workforce manager. Owing to these factors the employee computer monitoring software market will be driven by the growing requirement to effectively manage the workforce in order to maximize productivity.

Employee Computer Monitoring Software Market Dynamics:

In raising organizations' efficiency by enhancing employee productivity, the UAM solution plays a crucial role. To use multiple business applications, a single sign-on solution helps employees. It recognizes employees and sanctions access securely. A single console administration facility is provided by Integrated UAM products, which help to gain comprehensive coverage in organizations and higher visibility. Additionally, to mitigate potential security threats and data loss UAM solution reduces security risks and provides a robust security mechanism that enables organizations. With the help of this solution, users can access the information through their mobile devices; owing to these facilities, the user can work from a remote location. Across a variety of verticals in SMEs and large enterprises, this solution provides a better security experience and is becoming popular. The UAM solution provides strong security to the identifications of super users and secures organizations’ sensitive data from cyber-attacks and unauthorized access. Owing to all these factors, the UAM solution is expected to drive the employee computer monitoring software market. Market Restraints: To develop a strong UAM solution high cost of innovation is required. Organizations are boosting their IT security spending to ensure protection against sophisticated threats, zero-day malware, trojans, and other targeted threats as security breaches and insider attacks become more common. Many firms, including SMEs, are concerned about their investments. Moreover, the cost of developing comprehensive security solutions is high, which translates to higher implementation costs for clients. Budget restrictions are becoming a major disorder to the employee computer monitoring software market's growth. The cost element is proving to be a barrier to efficiently carrying out IT security activities in enterprises. To fulfill every security need, the security investments in SMEs are not sufficient. Thus, to grab the evolving security threats, organizations need to understand which information provided is most important. In emerging economies, the security investments by organizations are lower as compared to the other regions, and these investments should be increased for better protection and safety from developing cyber threats. Market opportunities: UAM solutions can be integrated with IAM and SIEM. Organizations' security posture is improved by integrating UAM with Identity and Access Management (IAM) and SIEM, which provides these systems' features in a unified manner. Enterprises can use the UAM solution to manage security threats and demand regulatory compliance. Integrated UAM solutions are used as a strategic endeavor by organizations to achieve comprehensive protection from external and internal threats. This would allow businesses to focus more on monitoring users and the resources they access. IAM technology manages access and privilege policies, whereas UAM does not. The integration of UAM with IAM, on the other hand, provides IAM users with UAM's powerful security capabilities for defending them against potential security risks. As a result, several vendors are creating agreements with other top companies to provide integrated UAM solutions with IAM and SIEM capabilities, enabling regional enterprises to give complete security. Market Challenges: All user activities are deeply monitored by the UAM solution, and it provides detailed reports on the same. User privacy can often impact owing to in-depth monitoring. To preserve the confidentiality of users simultaneously becomes very challenging for the organization to implement UAM. As a result, the UAM vendors are focusing on developing solutions that achieve a balance between strong security and privacy preservation. They are targeting to develop a policy-based UAM solution that offers notification for the recording policies to users and provides secure access to the captured activities. To maintain privacy and detect insider threats, the solution should monitor the pattern of user activities instead of inspecting the content. To maintain robust security and manage employee privacy, these solutions would help organizations. Trying to avoid the collection of sensitive employee data, such as bank account numbers and data via the HR portal, can help organizations to solve this difficulty.Employee Computer Monitoring Software Market Segment Analysis:

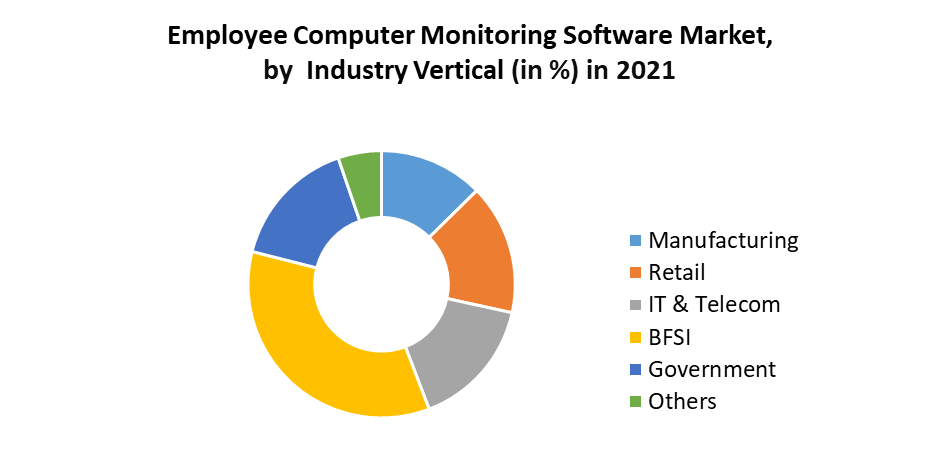

Based on Offering, the solution segment held the largest market share accounting for 59% in 2021. The primary factor driving the growth of the employee monitoring solution market is the growing focus of the organization on the driving efficiencies of the workforce and increased demand for better management of the same. Various enterprises around the various region have implemented the employee computer monitoring software solution, while the remaining are planning to implement the same during the forecast period.Based on the Enterprise Size, the Small & Medium Enterprise segment held the largest market share of 53% in 2021. In recent years, organizations have been focusing on decreasing the overall cost. To track employees and maximize the ROI, the SMEs are primarily investing in the employee computer monitoring software market. However, for large organizations, it is not easy to manage and monitor a large number of employees; as a result, for better visibility and monitoring in the organizations, they adopt employee computer monitoring software. Employee monitoring systems are also being used by a number of businesses to safeguard employee safety and prevent unauthorized access to information. Based on Industry Vertical, the BFSI segment held the largest market share of 31% in 2021. Owing to increased per capita income, the introduction of new products, technological innovation, expanding distribution, networking, and increasing customer knowledge of financial goods, the banking, financial services, and insurance (BFSI) industry is expected to grow. In the previous 15 years, the BFSI industry has undergone significant reforms and will continue to be a primary priority for economic development based on general growth.

Employee Computer Monitoring Software Market Regional Insights:

The North America region dominated the market with 42.9% share in 2021. The North America region is expected to witness significant growth at a CAGR of 27.1% through the forecast period. Owing to the presence of many companies across the region North America is expected to emerge as a dominating region in the employee computer monitoring software market. Employee activity tracking solutions are in high demand owing to rising employee fraud across the region. Employee fraud is linked to over 31% of firm bankruptcies in the United States, according to statistical research published by 'Compare Camp.' As a result of the growing trend of corporate mobility and remote working, demand for employee computer monitoring software is increasing across the region. Another reason driving the growth of the employee computer monitoring software market in North America is the high demand for recognizing employee accountability and productivity, inside threat identification, and increasing company compliance. Europe's highly developed corporate sector is employing workplace monitoring solutions that is driving the market growth. Several European countries have made employee computer monitoring software lawful, which is one of the main reasons for the system's high demand across the region. Employers in Europe have a genuine interest in monitoring their employees' computers in order to protect their privacy. Since this established heritage structure in the employee computer monitoring software market, the market is expected to grow across Europe. The IT and telecom industries in Asia-Pacific are undergoing considerable changes. Across the region, other IT-based commercial operations are also on the rise. The development of IT enterprises in Asia-Pacific will drive the adoption of enhanced workplace monitoring, surveillance, and monitoring solutions. The objective of the report is to present a comprehensive analysis of the Employee Computer Monitoring Software Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Employee Computer Monitoring Software Market dynamic, structure by analyzing the market segments and projecting the Employee Computer Monitoring Software Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Employee Computer Monitoring Software Market make the report investor’s guide.Employee Computer Monitoring Software Market Scope: Inquiry Before Buying

Employee Computer Monitoring Software Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US$ 1073 Mn. Forecast Period 2022 to 2029 CAGR: 26% Market Size in 2029: US$ 6816.5 Mn. Segments Covered: by Component • Solution • Services by Enterprise Size • Solution • Services by Industry Vertical • Manufacturing • Retail • IT & Telecom • BFSI • Government • Others Employee Computer Monitoring Software Market by Region

• North America • Europe • Asia Pacific • South America • Middle East and AfricaEmployee Computer Monitoring Software Market Key Players are:

• Veriato • SysKit • Ekran System • NetFort • TSFactory • Micro Focus • Splunk • Forcepoint • Imperva • NetWrix • Digital Guardian • Birch Grove Software • LogRhythm • Sumo Logic • Balabit • ObserveIT • Dtex Systems • ManageEngine • CyberArk • Rapid7 • Centrify • SolarWinds • Securonix • WALLIX • Teramind Frequently Asked Questions: 1] What segments are covered in the Employee Computer Monitoring Software Market report? Ans. The segments covered in the Employee Computer Monitoring Software Market report are based on Component, Enterprize Size, and End User. 2] Which region is expected to hold the highest share in the Employee Computer Monitoring Software Market? Ans. The North America region is expected to hold the highest share in the Employee Computer Monitoring Software Market. 3] What is the market size of the Employee Computer Monitoring Software Market by 2029? Ans. The market size of the Employee Computer Monitoring Software Market by 2029 is expected to reach US$ 6816.5 Mn. 4] What is the forecast period for the Employee Computer Monitoring Software Market? Ans. The forecast period for the Employee Computer Monitoring Software Market is 2022-2029. 5] What was the market size of the Employee Computer Monitoring Software Market in 2021? Ans. The market size of the Employee Computer Monitoring Software Market in 2021 was valued at US$ 1073 Mn.

1. Global Employee Computer Monitoring Software Market: Research Methodology 2. Global Employee Computer Monitoring Software Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Employee Computer Monitoring Software Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Employee Computer Monitoring Software Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Employee Computer Monitoring Software Market Segmentation 4.1 Global Employee Computer Monitoring Software Market, by Component (2021-2029) • Solution • Services 4.2 Global Employee Computer Monitoring Software Market, by Enterprize Size (2021-2029) • Large Enterprise • Small & Medium Enterprise 4.3 Global Employee Computer Monitoring Software Market, by Industry Vertical (2021-2029) • Manufacturing • Retail • IT & Telecom • BFSI • Government • Others 5. North America Employee Computer Monitoring Software Market(2021-2029) 5.1 North America Employee Computer Monitoring Software Market, by Component (2021-2029) • Solution • Services 5.2 North America Employee Computer Monitoring Software Market, by Enterprize Size (2021-2029) • Large Enterprise • Small & Medium Enterprise 5.3 North America Employee Computer Monitoring Software Market, by Industry Vertical (2021-2029) • Manufacturing • Retail • IT & Telecom • BFSI • Government • Others 5.4 North America Employee Computer Monitoring Software Market, by Country (2021-2029) • United States • Canada • Mexico 6. Europe Employee Computer Monitoring Software Market (2021-2029) 6.1. European Employee Computer Monitoring Software Market, by Component (2021-2029) 6.2. European Employee Computer Monitoring Software Market, by Enterprize Size (2021-2029) 6.3. European Employee Computer Monitoring Software Market, by Industry Vertical (2021-2029) 6.4. European Employee Computer Monitoring Software Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Employee Computer Monitoring Software Market (2021-2029) 7.1. Asia Pacific Employee Computer Monitoring Software Market, by Component (2021-2029) 7.2. Asia Pacific Employee Computer Monitoring Software Market, by Enterprize Size (2021-2029) 7.3. Asia Pacific Employee Computer Monitoring Software Market, by Industry Vertical (2021-2029) 7.4. Asia Pacific Employee Computer Monitoring Software Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Employee Computer Monitoring Software Market (2021-2029) 8.1 Middle East and Africa Employee Computer Monitoring Software Market, by Component (2021-2029) 8.2. Middle East and Africa Employee Computer Monitoring Software Market, by Enterprize Size (2021-2029) 8.3. Middle East and Africa Employee Computer Monitoring Software Market, by Industry Vertical (2021-2029) 8.4. Middle East and Africa Employee Computer Monitoring Software Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Employee Computer Monitoring Software Market (2021-2029) 9.1. South America Employee Computer Monitoring Software Market, by Component (2021-2029) 9.2. South America Employee Computer Monitoring Software Market, by Enterprize Size (2021-2029) 9.3. South America Employee Computer Monitoring Software Market, by Industry Vertical (2021-2029) 9.4 South America Employee Computer Monitoring Software Market, by Country (2021-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Veriatoc 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 SysKit 10.3 Ekran System 10.4 NetFort 10.5 TSFactory 10.6 Micro Focus 10.7 Splunk 10.8 Forcepoint 10.9 Imperva 10.10 NetWrix 10.11 Digital Guardian 10.12 Birch Grove Software 10.13 LogRhythm 10.14 Sumo Logic 10.15 Balabit 10.16 ObserveIT 10.17 Dtex Systems 10.18 ManageEngine 10.19 CyberArk 10.20 Rapid7 10.21 Centrify 10.22 SolarWinds 10.23 Securonix 10.24 WALLIX 10.25 Teramind