Global Emotion Analytics Market size was valued at USD 2.99 Bn. in 2023 and the total Emotion Analytics revenue is expected to grow by 16.7 % from 2024 to 2030, reaching nearly USD 8.81 Bn.Emotion Analytics Market Overview:

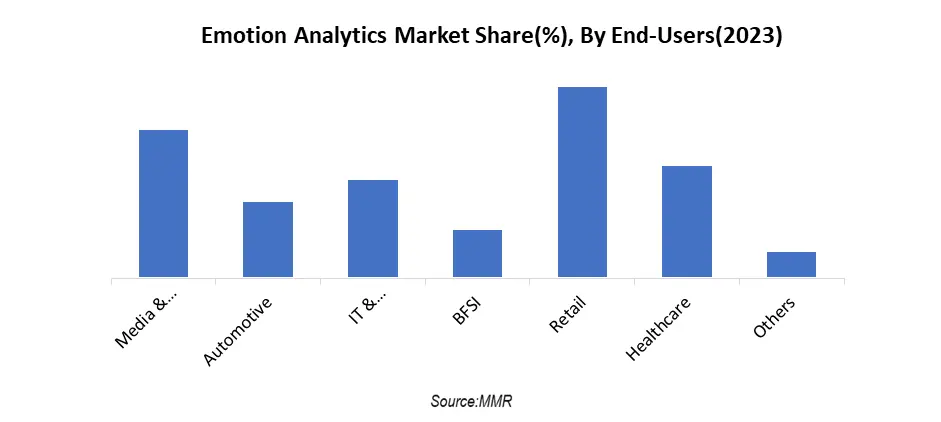

Emotion analytics, a specialized software designed for assessing an individual’s emotions and perspectives, plays a pivotal role in extracting insights from verbal and nonverbal communication. This comprehensive approach encompasses speech analytics, video analytics, facial analytics, and various other advanced emotion analytics software solutions. The emotion analytics market is witnessing substantial growth driven by the increasing demand for recognition applications. The surge in popularity of wearable devices, the widespread adoption of mobile and cloud-based biometric technologies, and the growing reliance on artificial intelligence and big data analytics are expected to further propel the growth of the emotion analytics market. However, challenges such as a lack of government initiatives and technological awareness act as constraints for the emotion analytics sector. Overcoming these hurdles crucial for unlocking the full potential of the emotion analytics market, ensuring its continued growth and impact.To know about the Research Methodology :- Request Free Sample Report The retail sector in the end-user segment dominates the market in the year 2023 and is expected to dominate during the forecast period. Major market key players such as Lexalytics, Lionbridge, Affectiva Inc, Emotient, Eyeris (EmoVu), IBM Corp., etc are the companies that contribute uniquely to the emotion analytics landscape, showcasing diverse approaches and applications within the rapidly evolving field of understanding and interpreting human emotions. Affectiva stands out in the emotion analytics landscape with its advanced emotion recognition technology. The company's algorithms of deep learning enable it to analyze facial expressions, voice tones, and gestures, providing valuable insights into human emotions.

Emotion Analytics Market: Drivers

The burgeoning need for informed decision-making related to understanding human behavior stands as a pivotal catalyst propelling the growth of the emotion analytics market. Numerous companies are integrating emotional analytics technology into their processes, driven by the imperative of making critical decisions. The convergence of emotional analytics with the Internet of Things (IoT) is set to redefine marketing strategies in the foreseeable future, enhancing organizations' comprehension of human emotions. The widespread adoption of biometric advancements particularly focused on smartphones and the cloud, is becoming prevalent across diverse sectors. These factors collectively contribute to the global growth of the emotion analytics market. Key drivers for the emotion analytics market include the escalating volume of video content, the imperative role it plays in critical decision-making, and the growing emphasis on understanding human behavior within organizations. The integration of emotional analytics with the Internet of Things represents a transformative dimension in commercial applications, offering enhanced insights into human emotions. The widespread adoption of biometric approaches, particularly in mobile and cloud environments, is becoming increasingly pervasive across diverse organizational landscapes. These factors collectively propel the robust growth of the global emotion analytics market. Increasing Automotive Industry Demand The surge in demand for emotion analytics market in the automotive industry is reshaping the market landscape, driven by a growing recognition of the pivotal role emotions play in shaping user experiences and safety. Automotive manufacturers and technology providers are increasingly turning to emotion analytics to gain deeper insights into driver and passenger emotions, enhancing both the driving experience and overall vehicle safety. In the automotive sector, emotion analytics is being leveraged to understand the emotional state of drivers in real-time. This includes detecting signs of fatigue, stress, or distraction, allowing for proactive safety measures and interventions. Emotion analytics contributes to the development of human-machine interfaces (HMIs) that respond dynamically to user emotions, creating a more personalized and intuitive driving environment. The demand for emotion analytics in the automotive industry is fueled by the race towards autonomous vehicles. As vehicles evolve into sophisticated data centers on wheels, the ability to comprehend and respond to human emotions becomes paramount. Emotion analytics facilitates the creation of AI-driven systems that adapt to passengers' emotional states, fostering trust and comfort in autonomous driving scenarios. Trends and Opportunities: The Emotion Analytics market is witnessing a notable trend in the increasing application of emotion recognition, particularly within the automobile industry, and this positive trajectory is expected to persist throughout the forecast period. Recognizing the significance of emotions in consumer engagement, the automotive sector is making substantial investments in emotion recognition technologies. Faced with heightened competition, companies within the automobile industry are strategically leveraging emotion analytics to connect with individuals on an emotional level, aiming to convert them into potential customers and formulate effective customer retention and acquisition strategies. There is a growing focus among vehicle manufacturers and original equipment manufacturers on monitoring the emotions of car drivers to enhance car safety measures. The reliable identification of emotions is considered a pivotal advancement that facilitates the deployment of precise human-machine interfaces in automobiles, promising an improved driving experience in next-generation vehicles and public transit. Consequently, the increasing adoption of emotion recognition and analysis in the automotive sector emerges as a significant Emotion Analytics Market development expected to shape the industry landscape over the projection period. Market Growth Restraints: Over the forecast period, the high cost of adoption and use of emotion analytics operate as a market restriction. Through speech, body posture, and other gestures, emotion analytics technologies only give analysis with 75%-85% accuracy. As a result, the difficulty of emotion analytics software to effectively evaluate human emotions is hindering market growth. Additionally, the absence of a clear scientific reason for associating an expression with a certain emotion is expected to hamper the global emotion analytics market's growth. Emotion Analytics Market: Market Trends The Emotion Analytics Market is witnessing substantial growth propelled by diverse factors, with shifting consumer preferences and an increasing demand for convenience foods at the forefront. The report underscores the surging popularity of natural and clean-label ingredients, particularly sourced from herbs, spices, fruits, and vegetables. Notably, plant-based flavors are experiencing heightened demand as consumers embrace plant-centric diets. A pivotal driver in the market is the growing emphasis on health and wellness, leading consumers to actively seek low-sodium and natural Emotion Analytics. The report also highlights the escalating popularity of ethnic flavors representing various global regions, coupled with innovative flavor combinations such as sweet and savory or spicy and sweet. Moreover, the convenience foods sector emerges as a key catalyst, driving the integration of Emotion Analytics into ready-to-eat meals, snacks, and beverages. The report emphasizes the increasing significance of online retail as a critical channel for Emotion Analytics distribution, providing consumers with a convenient avenue to purchase their preferred products and have them delivered to their doorstep. The speech analytics segment held the largest market share in 2023 The emotions analytics market is classified into four types: speech analytics, face analytics, text analytics, and video analytics. Due to increased demand and usage of voice-based smart home devices or assistants such as Amazon Echo and Google Nest, the speech analytics market is expected to grow rapidly throughout the forecast period. With smartphones and smart home gadgets, an increasing number of people are utilizing their voices to search the internet. The growing relevance of speech analytics in contact centers, as well as the growing number of enterprises adopting speech analytics in the retail industry, are the major reasons expected to drive the speech analytics segment in 2023.The Artificial Intelligence market is growing dramatically The emotion analytics market is divided into technological segments such as pattern recognition, 3D modeling, biometrics and neuroscience, artificial intelligence, record management, and others. Because of the rising implementation of novel technologies such as AI in emotion analytics and other applications, the Artificial Intelligence (AI) category is expected to hold the largest market share by 2030. AI technology is used to study human emotions, allowing firms to get customer insights and grow their enterprises. This fosters the growth of the artificial intelligence segment.

The on-cloud sector is growing rapidly The emotion analytics market is segmented into on-cloud and on-premise. Because of the increased use of cloud-based technologies for emotion analytics, the on-cloud segment is expected to hold a significant market share by 2030. AI, facial recognition, and other cloud-based software and tools are being utilized for a variety of applications such as analyzing customer preferences, identifying human emotions, and others. These are the primary drivers driving the growth of the on-cloud sector. The retail sector commands a large market share The emotion analytics market is segmented by end-users into media and entertainment, automotive, IT and telecommunication, BFSI, retail, healthcare, and others. The retail segment is expected to grow significantly throughout the forecast period, as e-commerce gains favor over conventional and physical storefronts around the world. The fight among various burgeoning e-commerce enterprises to dominate the industry and grow their consumer base is heating up. Online retailers are increasingly relying on emotion analytics to uncover the latest trends and client preferences by monitoring customer voices to produce insights. These are the primary drivers driving the retail segment growth.

Emotion Analytics Market Regional Insights:

The North American region, with influential countries like the US and Canada, boasting substantial retail markets, high R&D expenditures, and robust demand for IoT, smart wearables, and advertising, is poised to command a significant share of the global Emotion Analytics Market. Marketers in this region are at the forefront of leveraging technology to gain deeper insights into consumer behavior. The expected surge in advertising spending is expected to drive the adoption of emotion analytics technologies, with marketers increasingly embracing tools that provide valuable insights for data-driven decision-making. Group M reports a substantial 24.3% increase in global ad income for media owners as the market rebounded from the impact of the coronavirus outbreak, reaching USD 772.4 billion in revenue. Projections indicate that by 2030, the market is set to surpass USD 1 trillion, with North America leading as the largest regional ad Emotion Analytics Market, followed by the Asia Pacific. The United States, as a major retail marketplace, significantly contributes to retail, including e-commerce, making it a focal point for marketers looking to target the right demographic. The region's escalating retail sales empower merchants to invest more in technology, including emotion analytics tools, to enhance customer insights. Simultaneously, North America emerges as a pivotal market for IoT in both consumer and industrial sectors, with an estimated 5.9 billion IoT connections by 2030, aiding marketers in acquiring authentic customer data and refining ad strategies. Looking ahead, the Asia Pacific (APAC) region is poised for significant growth in the Emotion Analytics Market. Factors such as the growing service industries in China and India, increasing digitization rates, a rise in contact center counts, government support for biometrics implementation, robust technology penetration, and the presence of dynamic economies like Singapore, South Korea, Japan, Malaysia, Thailand, and China contribute to the region's promising Emotion Analytics Market outlook. The fast-paced industrialization and intensified competition among businesses in the APAC region, coupled with a focus on delivering superior customer service, are driving market growth over the forecast period.Competitive Landscape: Lexalytics brings a unique perspective to the emotion analytics market by specializing in text and sentiment analysis. The company excels in natural language processing and has developed advanced tools for extracting sentiment, opinions, and emotions from textual data. Acquired by Apple, Emotient was at the forefront of facial expression analysis and emotion detection. The company's technology, based on artificial intelligence and machine learning, had applications in diverse fields, including retail, healthcare, and education. While Emotient is no longer an independent entity, its contributions to the early development of emotion analytics technologies have left a lasting impact on the industry. Lionbridge, a global leader in translation and localization services, has expanded its capabilities to include emotion analytics. Leveraging its linguistic expertise, Lionbridge provides sentiment analysis solutions that offer a nuanced understanding of customer sentiments across diverse languages and cultures. Eyeris, operating under the brand EmoVu, specializes in facial emotion recognition technology for video analysis. The company's solutions find applications in areas such as automotive safety, retail, and advertising. Eyeris has gained recognition for its ability to analyze complex human emotions in real-time from video feeds, providing valuable insights for enhancing user experiences and safety measures. The objective of the report is to present a comprehensive analysis of the Emotion Analytics Market including all the stakeholders of the Product Form Factor. The past and current status of the Product Form Factor withmarket size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the Product Form Factor with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which gives a clear futuristic view of the Product Form Factor to the decision-makers. The report also helps in understanding the Emotion Analytics Market dynamics, and structure by analyzing the market segments and projecting the Emotion Analytics Market size. Clear representation of competitive analysis of key players By Type, price, financial position, Type of Receiver Product Form Factor portfolio, growth strategies, and regional presence in the Stand-Alone Radio receiver market makes the report an investor’s guide.

Emotion Analytics Market Scope: Inquire before buying

Emotion Analytics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.99 Bn. Forecast Period 2024 to 2030 CAGR: 16.7% Market Size in 2030: US $ 8.81 Bn. Segments Covered: by Type Text Analytics Facial Analytics Speech Analytics Video Analytics by Technology Pattern recognition 3D modeling Biometrics & neuroscience Artificial intelligence Record management Others by Deployment On-cloud On-premise by End-Users Media & Entertainment Automotive IT & telecommunication BFSI Retail Healthcare Others Emotion Analytics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America) Emotion Analytics Market Key Players for North America 1. Affectiva Inc (US) 2. Lexalytics (US) 3. Lionbridge (US) 4. Emotient, Inc. (US) 5. Eyeris(EmoVu) (US) 6. IBM Corp. (US) 7. Kairos AR Inc (US) 8. Microsoft Corp (US) 9. Neuromore Inc (US) 10. SAS Institute Inc (US) 11. Google (US) 12. Cogito (US) 13. Retainad Virtual Reality Inc (US) 14. Repustate (Canada) Emotion Analytics Market Key Players for Europe 1. Realeyes (UK) 2. TextRazor Ltd. (UK) 3. Adoreboard (UK) 4. Tobii (Sweden) 5. Sentiance (Belgium) 6. Aylien (Ireland) 7. SAP AG (Germany) 8. iMotions A/S (Denmark) 9. nViso SA (Switzerland) 10. Noldus Information Technology (Netherlands) Emotion Analytics Market Key Players for the Middle East and Africa 1. Beyond Verbal (Israel) Frequently Asked Questions: 1] What segments are covered in the Global Emotion Analytics Market report? Ans. The segments covered in the Emotion Analytics Market report are based on the Type, Nature, Application, End-Users, and Region. 2] Which region is expected to hold the largest share of the Global Emotion Analytics Market? Ans. The North American region is expected to hold the largest share of the Emotion Analytics Market. The United States, as a major retail marketplace, significantly contributes to retail. 3] What is the market size of the Global Emotion Analytics Market by 2030? Ans. The market size of the Emotion Analytics Market by 2030 is expected to reach US$ 8.81 Bn. 4] What is the forecast period for the Global Emotion Analytics Market? Ans. The forecast period for the Emotion Analytics Market is 2024-2030. 5] What was the market size of the Global Emotion Analytics Market in 2023? Ans. The market size of the Emotion Analytics Market in 2023 was valued at US$ 2.99 Bn.

1. Emotion Analytics Market: Research Methodology 2. Emotion Analytics Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Emotion Analytics Market: Dynamics 3.1. Emotion Analytics Market Trends by Region 3.1.1. North America Emotion Analytics Market Trends 3.1.2. Europe Emotion Analytics Market Trends 3.1.3. Asia Pacific Emotion Analytics Market Trends 3.1.4. Middle East and Africa Emotion Analytics Market Trends 3.1.5. South America Emotion Analytics Market Trends 3.2. Emotion Analytics Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Emotion Analytics Market Drivers 3.2.1.2. North America Emotion Analytics Market Restraints 3.2.1.3. North America Emotion Analytics Market Opportunities 3.2.1.4. North America Emotion Analytics Market Challenges 3.2.2. Europe 3.2.2.1. Europe Emotion Analytics Market Drivers 3.2.2.2. Europe Emotion Analytics Market Restraints 3.2.2.3. Europe Emotion Analytics Market Opportunities 3.2.2.4. Europe Emotion Analytics Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Emotion Analytics Market Drivers 3.2.3.2. Asia Pacific Emotion Analytics Market Restraints 3.2.3.3. Asia Pacific Emotion Analytics Market Opportunities 3.2.3.4. Asia Pacific Emotion Analytics Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Emotion Analytics Market Drivers 3.2.4.2. Middle East and Africa Emotion Analytics Market Restraints 3.2.4.3. Middle East and Africa Emotion Analytics Market Opportunities 3.2.4.4. Middle East and Africa Emotion Analytics Market Challenges 3.2.5. South America 3.2.5.1. South America Emotion Analytics Market Drivers 3.2.5.2. South America Emotion Analytics Market Restraints 3.2.5.3. South America Emotion Analytics Market Opportunities 3.2.5.4. South America Emotion Analytics Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Emotion Analytics Market 3.8. Analysis of Government Schemes and Initiatives For Emotion Analytics Market 3.9. The Global Pandemic Impact on Emotion Analytics Market 4. Emotion Analytics Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 4.1. Emotion Analytics Market Size and Forecast, By Type (2024-2030) 4.1.1. Text Analytics 4.1.2. Facial Analytics 4.1.3. Speech Analytics 4.1.4. Video Analytics 4.2. Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 4.2.1. Pattern recognition 4.2.2. 3D modeling 4.2.3. Biometrics & neuroscience 4.2.4. Artificial intelligence 4.2.5. Record management 4.2.6. Others 4.3. Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 4.3.1. On-cloud 4.3.2. On-premise 4.4. Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 4.4.1. Media & Entertainment 4.4.2. Automotive 4.4.3. IT & telecommunication 4.4.4. BFSI 4.4.5. Retail 4.4.6. Healthcare 4.4.7. Others 4.5. Emotion Analytics Market Size and Forecast, by Region (2024-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Emotion Analytics Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 5.1. North America Emotion Analytics Market Size and Forecast, By Type (2024-2030) 5.1.1. Text Analytics 5.1.2. Facial Analytics 5.1.3. Speech Analytics 5.1.4. Video Analytics 5.2. North America Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 5.2.1. Pattern recognition 5.2.2. 3D modeling 5.2.3. Biometrics & neuroscience 5.2.4. Artificial intelligence 5.2.5. Record management 5.2.6. Others 5.3. North America Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 5.3.1. On-cloud 5.3.2. On-premise 5.4. North America Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 5.4.1. Media & Entertainment 5.4.2. Automotive 5.4.3. IT & telecommunication 5.4.4. BFSI 5.4.5. Retail 5.4.6. Healthcare 5.4.7. Others 5.5. North America Emotion Analytics Market Size and Forecast, by Country (2024-2030) 5.5.1. United States 5.5.1.1. United States Emotion Analytics Market Size and Forecast, By Type (2024-2030) 5.5.1.1.1. Text Analytics 5.5.1.1.2. Facial Analytics 5.5.1.1.3. Speech Analytics 5.5.1.1.4. Video Analytics 5.5.1.2. United States Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 5.5.1.2.1. Pattern recognition 5.5.1.2.2. 3D modeling 5.5.1.2.3. Biometrics & neuroscience 5.5.1.2.4. Artificial intelligence 5.5.1.2.5. Record management 5.5.1.2.6. Others 5.5.1.3. United States Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 5.5.1.3.1. On-cloud 5.5.1.3.2. On-premise 5.5.1.4. United States Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 5.5.1.4.1. Media & Entertainment 5.5.1.4.2. Automotive 5.5.1.4.3. IT & telecommunication 5.5.1.4.4. BFSI 5.5.1.4.5. Retail 5.5.1.4.6. Healthcare 5.5.1.4.7. Others 5.5.2. Canada 5.5.2.1. Canada Emotion Analytics Market Size and Forecast, By Type (2024-2030) 5.5.2.1.1. Text Analytics 5.5.2.1.2. Facial Analytics 5.5.2.1.3. Speech Analytics 5.5.2.1.4. Video Analytics 5.5.2.2. Canada Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 5.5.2.2.1. Pattern recognition 5.5.2.2.2. 3D modeling 5.5.2.2.3. Biometrics & neuroscience 5.5.2.2.4. Artificial intelligence 5.5.2.2.5. Record management 5.5.2.2.6. Others 5.5.2.3. Canada Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 5.5.2.3.1. On-cloud 5.5.2.3.2. On-premise 5.5.2.4. Canada Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 5.5.2.4.1. Media & Entertainment 5.5.2.4.2. Automotive 5.5.2.4.3. IT & telecommunication 5.5.2.4.4. BFSI 5.5.2.4.5. Retail 5.5.2.4.6. Healthcare 5.5.2.4.7. Others 5.5.3. Mexico 5.5.3.1. Mexico Emotion Analytics Market Size and Forecast, By Type (2024-2030) 5.5.3.1.1. Text Analytics 5.5.3.1.2. Facial Analytics 5.5.3.1.3. Speech Analytics 5.5.3.1.4. Video Analytics 5.5.3.2. Mexico Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 5.5.3.2.1. Pattern recognition 5.5.3.2.2. 3D modeling 5.5.3.2.3. Biometrics & neuroscience 5.5.3.2.4. Artificial intelligence 5.5.3.2.5. Record management 5.5.3.2.6. Others 5.5.3.3. Mexico Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 5.5.3.3.1. On-cloud 5.5.3.3.2. On-premise 5.5.3.4. Mexico Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 5.5.3.4.1. Media & Entertainment 5.5.3.4.2. Automotive 5.5.3.4.3. IT & telecommunication 5.5.3.4.4. BFSI 5.5.3.4.5. Retail 5.5.3.4.6. Healthcare 5.5.3.4.7. Others 6. Europe Emotion Analytics Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 6.1. Europe Emotion Analytics Market Size and Forecast, By Type (2024-2030) 6.2. Europe Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 6.3. Europe Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 6.4. Europe Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 6.5. Europe Emotion Analytics Market Size and Forecast, by Country (2024-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Emotion Analytics Market Size and Forecast, By Type (2024-2030) 6.5.1.2. United Kingdom Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 6.5.1.3. United Kingdom Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 6.5.1.4. United Kingdom Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 6.5.2. France 6.5.2.1. France Emotion Analytics Market Size and Forecast, By Type (2024-2030) 6.5.2.2. France Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 6.5.2.3. France Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 6.5.2.4. France Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 6.5.3. Germany 6.5.3.1. Germany Emotion Analytics Market Size and Forecast, By Type (2024-2030) 6.5.3.2. Germany Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 6.5.3.3. Germany Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 6.5.3.4. Germany Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 6.5.4. Italy 6.5.4.1. Italy Emotion Analytics Market Size and Forecast, By Type (2024-2030) 6.5.4.2. Italy Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 6.5.4.3. Italy Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 6.5.4.4. Italy Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 6.5.5. Spain 6.5.5.1. Spain Emotion Analytics Market Size and Forecast, By Type (2024-2030) 6.5.5.2. Spain Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 6.5.5.3. Spain Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 6.5.5.4. Spain Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 6.5.6. Sweden 6.5.6.1. Sweden Emotion Analytics Market Size and Forecast, By Type (2024-2030) 6.5.6.2. Sweden Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 6.5.6.3. Sweden Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 6.5.6.4. Sweden Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 6.5.7. Austria 6.5.7.1. Austria Emotion Analytics Market Size and Forecast, By Type (2024-2030) 6.5.7.2. Austria Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 6.5.7.3. Austria Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 6.5.7.4. Austria Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Emotion Analytics Market Size and Forecast, By Type (2024-2030) 6.5.8.2. Rest of Europe Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 6.5.8.3. Rest of Europe Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 6.5.8.4. Rest of Europe Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7. Asia Pacific Emotion Analytics Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030) 7.1. Asia Pacific Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.2. Asia Pacific Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.3. Asia Pacific Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.4. Asia Pacific Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5. Asia Pacific Emotion Analytics Market Size and Forecast, by Country (2024-2030) 7.5.1. China 7.5.1.1. China Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.1.2. China Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.1.3. China Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.1.4. China Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5.2. S Korea 7.5.2.1. S Korea Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.2.2. S Korea Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.2.3. S Korea Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.2.4. S Korea Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5.3. Japan 7.5.3.1. Japan Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.3.2. Japan Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.3.3. Japan Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.3.4. Japan Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5.4. India 7.5.4.1. India Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.4.2. India Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.4.3. India Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.4.4. India Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5.5. Australia 7.5.5.1. Australia Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.5.2. Australia Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.5.3. Australia Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.5.4. Australia Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.6.2. Indonesia Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.6.3. Indonesia Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.6.4. Indonesia Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.7.2. Malaysia Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.7.3. Malaysia Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.7.4. Malaysia Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.8.2. Vietnam Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.8.3. Vietnam Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.8.4. Vietnam Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.9.2. Taiwan Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.9.3. Taiwan Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.9.4. Taiwan Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Emotion Analytics Market Size and Forecast, By Type (2024-2030) 7.5.10.2. Rest of Asia Pacific Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 7.5.10.3. Rest of Asia Pacific Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 7.5.10.4. Rest of Asia Pacific Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 8. Middle East and Africa Emotion Analytics Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030 8.1. Middle East and Africa Emotion Analytics Market Size and Forecast, By Type (2024-2030) 8.2. Middle East and Africa Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 8.3. Middle East and Africa Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 8.4. Middle East and Africa Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 8.5. Middle East and Africa Emotion Analytics Market Size and Forecast, by Country (2024-2030) 8.5.1. South Africa 8.5.1.1. South Africa Emotion Analytics Market Size and Forecast, By Type (2024-2030) 8.5.1.2. South Africa Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 8.5.1.3. South Africa Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 8.5.1.4. South Africa Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 8.5.2. GCC 8.5.2.1. GCC Emotion Analytics Market Size and Forecast, By Type (2024-2030) 8.5.2.2. GCC Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 8.5.2.3. GCC Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 8.5.2.4. GCC Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria Emotion Analytics Market Size and Forecast, By Type (2024-2030) 8.5.3.2. Nigeria Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 8.5.3.3. Nigeria Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 8.5.3.4. Nigeria Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Emotion Analytics Market Size and Forecast, By Type (2024-2030) 8.5.4.2. Rest of ME&A Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 8.5.4.3. Rest of ME&A Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 8.5.4.4. Rest of ME&A Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 9. South America Emotion Analytics Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2030 9.1. South America Emotion Analytics Market Size and Forecast, By Type (2024-2030) 9.2. South America Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 9.3. South America Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 9.4. South America Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 9.5. South America Emotion Analytics Market Size and Forecast, by Country (2024-2030) 9.5.1. Brazil 9.5.1.1. Brazil Emotion Analytics Market Size and Forecast, By Type (2024-2030) 9.5.1.2. Brazil Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 9.5.1.3. Brazil Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 9.5.1.4. Brazil Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 9.5.2. Argentina 9.5.2.1. Argentina Emotion Analytics Market Size and Forecast, By Type (2024-2030) 9.5.2.2. Argentina Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 9.5.2.3. Argentina Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 9.5.2.4. Argentina Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Emotion Analytics Market Size and Forecast, By Type (2024-2030) 9.5.3.2. Rest Of South America Emotion Analytics Market Size and Forecast, By Technology (2024-2030) 9.5.3.3. Rest Of South America Emotion Analytics Market Size and Forecast, By Deployment (2024-2030) 9.5.3.4. Rest Of South America Emotion Analytics Market Size and Forecast, By End-Users (2024-2030) 10. Global Emotion Analytics Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Frequency Bands Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Emotion Analytics Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Affectiva Inc (US) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Lexalytics (US) 11.3. Lionbridge (US) 11.4. Emotient, Inc. (US) 11.5. Eyeris(EmoVu) (US) 11.6. IBM Corp. (US) 11.7. Kairos AR Inc (US) 11.8. Microsoft Corp (US) 11.9. Neuromore Inc (US) 11.10. SAS Institute Inc (US) 11.11. Google (US) 11.12. Cogito (US) 11.13. Retainad Virtual Reality Inc (US) 11.14. Beyond Verbal (Israel) 11.15. Tobii (Sweden) 11.16. Sentiance (Belgium) 11.17. Repustate (Canada) 11.18. Aylien (Ireland) 11.19. Realeyes (UK) 11.20. TextRazor Ltd. (UK) 11.21. Adoreboard (UK) 11.22. SAP AG (Germany) 11.23. iMotions A/S (Denmark) 11.24. nViso SA (Switzerland) 11.25. Noldus Information Technology (Netherlands) 12. Key Findings 13. Industry Recommendations