Global Electronic Health Records Market size was valued at USD 29.98 Bn in 2023 and is expected to reach USD 48.90 Bn by 2030, at a CAGR of 7.24%.Electronic Health Records Market Overview

An Electronic Health Record (EHR) aids in a digital archive housing an individual's complete medical history, systematically managed by healthcare providers. It encompasses crucial administrative and clinical data, including demographics, progress notes, medications, vital signs, immunizations, and laboratory results. EHRs automate data access, streamlining clinician workflows and supporting evidence-based decision-making, quality management, and outcomes reporting. The Electronic Health Records market, driven by technological advancements, revolutionizes healthcare, fostering patient-clinician relationships and enabling informed decision-making for optimal care outcomes. EHRs are instrumental in reducing medical errors by improving record accuracy and accessibility, and expediting treatment while minimizing test duplication. Their shared nature among diverse healthcare entities facilitates seamless information exchange, contributing to a more integrated and efficient healthcare ecosystem. With the increasing digitization of patient information, EHRs provide to the rising demand for mobile access, underlining their increasing influence in contemporary healthcare practices.To know about the Research Methodology :- Request Free Sample Report The Electronic Health Records industry is undergoing strong growth driven by transformative advancements in healthcare digitization. The adoption of EHR systems has become imperative as healthcare providers recognize their potential to revolutionize patient care, streamline operations and improve overall healthcare delivery. The industry's growth is driven by the growing recognition of the value of comprehensive and easily accessible patient data. Governments and healthcare organizations worldwide are actively promoting EHR adoption through regulatory initiatives, incentivizing interoperability standards and investing in digital infrastructure. The Electronic Health Records market experiences growth as technological advancements, including artificial intelligence, machine learning, and data analytics, elevate healthcare quality, efficiency, and patient engagement through enhanced clinical decision support and personalized medicine. The COVID-19 pandemic has accelerated the adoption of telehealth and remote patient monitoring, underscoring the essential role of interoperable and accessible EHRs in contemporary healthcare. Advancements in cybersecurity measures are addressing concerns about data security and privacy, fostering increased confidence in EHR adoption. The industries are influenced by the growing emphasis on value-based care, accountable care organizations, and population health management, all reliant on efficient and interoperable EHR systems. The Electronic Health Records industry is well-informed for continued growth, boosted by technological innovation, regulatory support and a healthcare landscape increasingly prioritizing digital solutions for comprehensive and patient-centric care.

Electronic Health Records Market Dynamics

Increasing focus on interoperability to boost Electronic Health Records Market Growth Interoperability enables seamless sharing of patient information across different healthcare systems, providers, and organizations. This facilitates better coordination of care among healthcare professionals, leading to improved patient outcomes. When healthcare providers have access to comprehensive and up-to-date patient records, they make more informed decisions about diagnosis and treatment. Interoperability helps eliminate duplicate tests and procedures by allowing different healthcare providers to access the same patient data. This not only reduces costs but also minimizes the chances of errors and ensures that patients receive the most appropriate and timely care. It enhances the overall efficiency of the healthcare system. Interoperability empowers patients by giving them greater control over their health information. Patients access their EHRs, share them with different healthcare providers, and actively participate in their care. In the Electronic Health Records market, the integration of advanced technologies fosters a patient-centric approach, empowering individuals to proactively manage their health through improved access, engagement, and personalized care solutions. The Electronic Health Records landscape is witnessing a growing emphasis on interoperability, denoting the seamless access, integration, and utilization of electronic health data to optimize health outcomes. This emphasis is crucial sensitive nature of health data, posing a challenge to strike a balance between privacy and accessibility. Inadequate interoperability results in incomplete health information, leading to suboptimal outcomes and increased costs. To address this, governments and healthcare organizations globally are actively promoting interoperability through regulatory measures, endorsing standards such as FHIR (Fast Healthcare Interoperability Resources) and investing in digital infrastructure. As populations age, interoperability becomes increasingly critical for delivering effective healthcare. Although the adoption of EHRs has risen, challenges persist in integrating received data into individual patient records. In the Electronic Health Records market, interoperability emerges as a key driver, delivering benefits such as enhanced care coordination, optimized performance through data analysis, and an overall improved healthcare experience by reducing redundant administrative tasks. The introduction of FHIR as an open-source standards framework is revolutionizing healthcare data exchange, enabling seamless movement between systems.Electronic Health Records Market Trend

Accelerating integration of artificial intelligence (AI) and machine learning (ML) technologies Inherent multimodal healthcare data, encompassing Electronic Health Records (EHR), medical images, and multi-omics data, are being fused using advanced AI techniques for a profound understanding of human health and personalized healthcare. This integration workflow involves raw data feeding, multimodal fusion using conventional ML or deep learning algorithms, and subsequent evaluation through clinical outcome predictions. Within the Electronic Health Records market, multimodality fusion models excel over single-modality ones, specifically in neurological disorder diagnosis and prediction, showcasing superior performance in healthcare analytics. From an AI perspective, conventional ML models are widely used, followed closely by DL models. AI applications in EHR systems, such as data extraction, predictive analytics, clinical documentation, and decision support, are poised to revolutionize the healthcare landscape, offering flexibility, incisiveness and improved physician-friendliness. This evolution has revolutionized healthcare, enhancing diagnostic accuracy, personalized treatments, and overall patient monitoring. AI's ability to swiftly analyze extensive clinical documentation aids in uncovering disease markers and trends that might be overlooked conventionally. From early detection through radiological image analysis to predicting outcomes based on electronic health records, the incorporation of AI and ML is reshaping healthcare delivery worldwide. Key players such as IBM, Apple, Microsoft, and Amazon are actively investing in AI technologies for healthcare. Machine Learning, Natural Language Processing and rule-based expert systems are essential components, that enable precise medical diagnoses, personalized treatments, and streamlined administrative processes. This integration not only improves patient care but also drives operational efficiency, marking a paradigm shift in the Electronic Health Records Market towards a future where AI and ML technologies play an essential in healthcare advancements. In European countries, the adoption of Electronic Health Records (EHR) varies, with the Netherlands leading in usage. The Netherlands exhibits a higher share of clinicians embracing EHR systems. Furthermore, there is a notable trend across Europe towards the rapid integration of artificial intelligence (AI) and machine learning (ML) technologies in healthcare, enhancing diagnostic and treatment capabilities.Electronic Health Records Market Restraints High Implementation Costs to hamper Electronic Health Records Market Growth Healthcare organizations need to allocate funds for the procurement of EHR software licenses, servers, computers and networking equipment. The customization and integration of EHR systems are pivotal, demanding alignment with the unique workflows and requirements of healthcare entities. The intricacies of integrating with existing systems and databases entail additional investments in software development, demanding testing, and comprehensive training. Data migration from legacy systems to EHR platforms, a critical implementation aspect is time-consuming and may necessitate specialized expertise, contributing to increased costs. Efficient Electronic Health Records market integration requires comprehensive training for healthcare staff, incurring additional costs in resources, time, and personnel to ensure a smooth transition. Compliance with regulatory standards and the implementation of robust security features to safeguard patient data introduce additional costs to the overall implementation process. Post-implementation, ongoing maintenance and support are dynamic, involving allocations for software updates, troubleshooting and addressing potential issues that may arise over time. The transition to EHR systems leads to a temporary disruption in productivity as healthcare professionals adapt to new workflows, incurring additional costs associated with potential revenue loss during the adjustment period. Vendor lock-in, a potential limitation, restricts the flexibility of healthcare organizations in selecting alternative solutions more aligned with their evolving needs. Achieving interoperability with other healthcare systems and external partners requires supplementary investments in technologies and standards facilitating seamless data exchange.

Electronic Health Records Market Segment Analysis

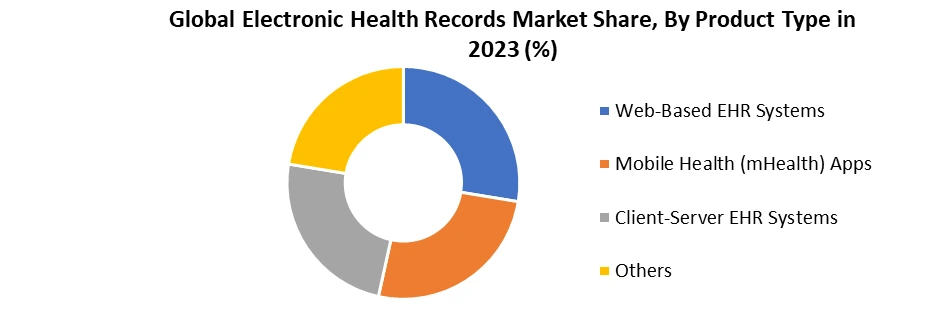

Based on the Product, the market is segmented into Web-Based EHR Systems, Mobile Health (mHealth) Apps, Client-Server EHR Systems and Others. Web-based EHR Systems dominated the largest Electronic Health Records Market share in 2023 and are expected to continue their dominance over the forecast period. Web-based EHR systems efficiently address concerns commonly encountered by independent physicians during EHR adoption. Unlike traditional server-based models, which entail substantial costs for server installation, hardware, software, and ongoing local IT maintenance, web-based EHRs, provided by Software as a Service (SaaS) providers, significantly alleviate costs and implementation timelines. The resilience of cloud-based EHR systems against system meltdowns, natural disasters, and disruptions caused by weather patterns, enhances reliability compared to their server-based counterparts. Data securely stored on the cloud remains readily accessible from any location and at any time, ensuring uninterrupted and convenient usage. Security concerns, particularly regarding patient confidentiality, are meticulously addressed by web-based EHR systems through measures such as risk analyses and data encryption. Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) ensures the secure handling of electronic protected health information (ePHI). The advantages of web-based EHRs extend beyond security, encompassing simplified operations, instant scalability, reduced costs and improved data sharing with security features. These systems provide seamless to practices of varying sizes, from single-physician clinics to large, multi-location and multi-specialty setups. Designed around specialty-specific workflows, web-based EHR systems not only streamline documentation, billing processes, and care delivery but also enhance communication, simplify administrative tasks and boost overall productivity for physicians and staff. Web-based EHR systems emerge as the preferred choice in the Electronic Health Records market, offering a holistic solution characterized by flexibility, cost-effectiveness, security and convenience tailored for the unique needs of independent physicians across diverse healthcare settings.

Electronic Health Records Market Regional Insights

North America dominated the largest Electronic Health Records Market share in 2023 and is expected to continue its dominance over the forecast period. The United States has been a developer in the early adoption of Electronic Health Record (EHR) systems. The initiatives including the Health Information Technology for Economic and Clinical Health (HITECH) Act in 2009 are boosting the adoption of the Electronic Health Records industry in the U.S. This legislation provided financial incentives to healthcare providers, catalysing widespread adoption. North America, particularly the United States, boasts a cutting-edge IT infrastructure, facilitating seamless implementation and integration of EHR systems within healthcare organizations. The region's prominence in the global healthcare market is underscored by the complete size and complexity of its healthcare sector. The demand for efficient healthcare management systems has boosted the adoption of EHR solutions across North America. Regulatory compliance has shaped the EHR landscape, with bodies such as the Centers for Medicare & Medicaid Services (CMS) and the Office of the National Coordinator for Health Information Technology (ONC) setting standards and requirements for widespread EHR adoption. Private sector investments have significantly contributed to the growth of the EHR market in North America. The presence of a strong private sector, characterized by substantial investments in healthcare technology, has fostered innovation and the development of EHR solutions. Simultaneously, efforts to enhance interoperability among healthcare systems have become a driving force behind EHR adoption. The imperative for a seamless exchange of patient information between different healthcare entities has elevated the importance of EHRs in the region. Concerted initiatives in awareness and education have garnered acceptance and utilization of electronic health records among healthcare professionals. Training programs and awareness campaigns have contributed to enhancing the understanding of the benefits associated with EHR systems. The competitive landscape in North America has been ongoing innovations and improvements in EHR technologies. The presence of many vendors and service providers has created a dynamic Electronic Health Records Market, offering a multitude of options for healthcare organizations seeking effective EHR solutions.Electronic Health Records Market Scope: Inquire before buying

Global Electronic Health Records Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 28.98 Bn. Forecast Period 2024 to 2030 CAGR: 7.24% Market Size in 2030: US $ 48.90 Bn. Segments Covered: by Product Web-Based EHR Systems Mobile Health (mHealth) Apps Client-Server EHR Systems Others by End User Hospitals and Healthcare Systems Physician Practices and Clinics Ambulatory Surgical Centers Diagnostic Centers and Laboratories Others Electronic Health Records Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Electronic Health Records Key Players

Global 1. Epic Systems Corporation (Verona, Wisconsin, USA) 2. Cerner Corporation (North Kansas City, Missouri, USA) 3. Siemens Healthineers (Erlangen, Germany) 4. CompuGroup Medical AG (Koblenz, Germany) 5. Netsmart Technologies (Overland Park, Kansas, USA) North America 1. Athenahealth (Watertown, Massachusetts, USA) 2. McKesson Corporation (Irving, Texas, USA) 3. Allscripts Healthcare Solutions (Chicago, Illinois, USA) 4. eClinicalWorks (Westborough, Massachusetts, USA) 5. NextGen Healthcare (Irvine, California, USA) 6. CPSI (Computer Programs and Systems, Inc.) (Mobile, Alabama, USA) 7. MEDITECH (Medical Information Technology, Inc.) (Westwood, Massachusetts, USA) 8. Greenway Health (Tampa, Florida, USA) 9. Aprima Medical Software (Richardson, Texas, USA) 10. MEDHOST (Franklin, Tennessee, USA) 11. Kareo (Irvine, California, USA) 12. NantHealth (Culver City, California, USA) 13. DrChrono (Sunnyvale, California, USA) 14. Azalea Health (Atlanta, Georgia, USA) 15. WRS Health (Goshen, New York, USA) 16. Practice Fusion (San Francisco, California, USA) Europe 1. Siemens Healthineers (Erlangen, Germany) 2. EpicCare (Netherlands) (Houten, Netherlands) 3. CompuGroup Medical AG (Koblenz, Germany) Frequently Asked Questions: 1] What is the growth rate of the Global Electronic Health Records Market? Ans. The Global Electronic Health Records Market is growing at a significant rate of 7.24% during the forecast period. 2] Which region is expected to dominate the Global Electronic Health Records Market? Ans. North America is expected to dominate the Electronic Health Records Market during the forecast period. 3] What is the expected Global Electronic Health Records Market size by 2030? Ans. The Electronic Health Records Market size is expected to reach USD 48.90 Billion by 2030. 4] Which are the top players in the Global Electronic Health Records Market? Ans. The major top players in the Global Electronic Health Records Market are Epic Systems Corporation (Verona, Wisconsin, USA), Cerner Corporation (North Kansas City, Missouri, USA), Siemens Healthineers (Erlangen, Germany), CompuGroup Medical AG (Koblenz, Germany) snd Others. 5] What are the factors driving the Global Electronic Health Records Market growth? Ans. The increasing adoption of digital healthcare solutions and government initiatives and regulatory mandates in many countries are expected to drive market growth during the forecast period.

1. Electronic Health Records Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electronic Health Records Market: Dynamics 2.1. Electronic Health Records Market Trends by Region 2.1.1. North America Electronic Health Records Market Trends 2.1.2. Europe Electronic Health Records Market Trends 2.1.3. Asia Pacific Electronic Health Records Market Trends 2.1.4. Middle East and Africa Electronic Health Records Market Trends 2.1.5. South America Electronic Health Records Market Trends 2.2. Electronic Health Records Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electronic Health Records Market Drivers 2.2.1.2. North America Electronic Health Records Market Restraints 2.2.1.3. North America Electronic Health Records Market Opportunities 2.2.1.4. North America Electronic Health Records Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electronic Health Records Market Drivers 2.2.2.2. Europe Electronic Health Records Market Restraints 2.2.2.3. Europe Electronic Health Records Market Opportunities 2.2.2.4. Europe Electronic Health Records Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electronic Health Records Market Drivers 2.2.3.2. Asia Pacific Electronic Health Records Market Restraints 2.2.3.3. Asia Pacific Electronic Health Records Market Opportunities 2.2.3.4. Asia Pacific Electronic Health Records Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electronic Health Records Market Drivers 2.2.4.2. Middle East and Africa Electronic Health Records Market Restraints 2.2.4.3. Middle East and Africa Electronic Health Records Market Opportunities 2.2.4.4. Middle East and Africa Electronic Health Records Market Challenges 2.2.5. South America 2.2.5.1. South America Electronic Health Records Market Drivers 2.2.5.2. South America Electronic Health Records Market Restraints 2.2.5.3. South America Electronic Health Records Market Opportunities 2.2.5.4. South America Electronic Health Records Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electronic Health Records Industry 2.8. Analysis of Government Schemes and Initiatives For Electronic Health Records Industry 2.9. Electronic Health Records Market Trade Analysis 2.10. The Global Pandemic Impact on Electronic Health Records Market 3. Electronic Health Records Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Electronic Health Records Market Size and Forecast, by Product (2023-2030) 3.1.1. Web-Based EHR Systems 3.1.2. Mobile Health (mHealth) Apps 3.1.3. Client-Server EHR Systems 3.1.4. Others 3.2. Electronic Health Records Market Size and Forecast, by End User (2023-2030) 3.2.1. Hospitals and Healthcare Systems 3.2.2. Physician Practices and Clinics 3.2.3. Ambulatory Surgical Centers 3.2.4. Diagnostic Centers and Laboratories 3.2.5. Others 3.3. Electronic Health Records Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Electronic Health Records Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Electronic Health Records Market Size and Forecast, by Product (2023-2030) 4.1.1. Web-Based EHR Systems 4.1.2. Mobile Health (mHealth) Apps 4.1.3. Client-Server EHR Systems 4.1.4. Others 4.2. North America Electronic Health Records Market Size and Forecast, by End User (2023-2030) 4.2.1. Hospitals and Healthcare Systems 4.2.2. Physician Practices and Clinics 4.2.3. Ambulatory Surgical Centers 4.2.4. Diagnostic Centers and Laboratories 4.2.5. Others 4.3. North America Electronic Health Records Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Electronic Health Records Market Size and Forecast, by Product (2023-2030) 4.3.1.1.1. Web-Based EHR Systems 4.3.1.1.2. Mobile Health (mHealth) Apps 4.3.1.1.3. Client-Server EHR Systems 4.3.1.1.4. Others 4.3.1.2. United States Electronic Health Records Market Size and Forecast, by End User (2023-2030) 4.3.1.2.1. Hospitals and Healthcare Systems 4.3.1.2.2. Physician Practices and Clinics 4.3.1.2.3. Ambulatory Surgical Centers 4.3.1.2.4. Diagnostic Centers and Laboratories 4.3.1.2.5. Others 4.3.2. Canada 4.3.2.1. Canada Electronic Health Records Market Size and Forecast, by Product (2023-2030) 4.3.2.1.1. Web-Based EHR Systems 4.3.2.1.2. Mobile Health (mHealth) Apps 4.3.2.1.3. Client-Server EHR Systems 4.3.2.1.4. Others 4.3.2.2. Canada Electronic Health Records Market Size and Forecast, by End User (2023-2030) 4.3.2.2.1. Hospitals and Healthcare Systems 4.3.2.2.2. Physician Practices and Clinics 4.3.2.2.3. Ambulatory Surgical Centers 4.3.2.2.4. Diagnostic Centers and Laboratories 4.3.2.2.5. Others 4.3.3. Mexico 4.3.3.1. Mexico Electronic Health Records Market Size and Forecast, by Product (2023-2030) 4.3.3.1.1. Web-Based EHR Systems 4.3.3.1.2. Mobile Health (mHealth) Apps 4.3.3.1.3. Client-Server EHR Systems 4.3.3.1.4. Others 4.3.3.2. Mexico Electronic Health Records Market Size and Forecast, by End User (2023-2030) 4.3.3.2.1. Hospitals and Healthcare Systems 4.3.3.2.2. Physician Practices and Clinics 4.3.3.2.3. Ambulatory Surgical Centers 4.3.3.2.4. Diagnostic Centers and Laboratories 4.3.3.2.5. Others 5. Europe Electronic Health Records Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Electronic Health Records Market Size and Forecast, by Product (2023-2030) 5.2. Europe Electronic Health Records Market Size and Forecast, by End User (2023-2030) 5.3. Europe Electronic Health Records Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Electronic Health Records Market Size and Forecast, by Product (2023-2030) 5.3.1.2. United Kingdom Electronic Health Records Market Size and Forecast, by End User (2023-2030) 5.3.2. France 5.3.2.1. France Electronic Health Records Market Size and Forecast, by Product (2023-2030) 5.3.2.2. France Electronic Health Records Market Size and Forecast, by End User (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Electronic Health Records Market Size and Forecast, by Product (2023-2030) 5.3.3.2. Germany Electronic Health Records Market Size and Forecast, by End User (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Electronic Health Records Market Size and Forecast, by Product (2023-2030) 5.3.4.2. Italy Electronic Health Records Market Size and Forecast, by End User (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Electronic Health Records Market Size and Forecast, by Product (2023-2030) 5.3.5.2. Spain Electronic Health Records Market Size and Forecast, by End User (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Electronic Health Records Market Size and Forecast, by Product (2023-2030) 5.3.6.2. Sweden Electronic Health Records Market Size and Forecast, by End User (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Electronic Health Records Market Size and Forecast, by Product (2023-2030) 5.3.7.2. Austria Electronic Health Records Market Size and Forecast, by End User (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Electronic Health Records Market Size and Forecast, by Product (2023-2030) 5.3.8.2. Rest of Europe Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Electronic Health Records Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3. Asia Pacific Electronic Health Records Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.1.2. China Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.2.2. S Korea Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.3.2. Japan Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3.4. India 6.3.4.1. India Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.4.2. India Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.5.2. Australia Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.6.2. Indonesia Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.7.2. Malaysia Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.8.2. Vietnam Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.9.2. Taiwan Electronic Health Records Market Size and Forecast, by End User (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Electronic Health Records Market Size and Forecast, by Product (2023-2030) 6.3.10.2. Rest of Asia Pacific Electronic Health Records Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Electronic Health Records Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Electronic Health Records Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Electronic Health Records Market Size and Forecast, by End User (2023-2030) 7.3. Middle East and Africa Electronic Health Records Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Electronic Health Records Market Size and Forecast, by Product (2023-2030) 7.3.1.2. South Africa Electronic Health Records Market Size and Forecast, by End User (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Electronic Health Records Market Size and Forecast, by Product (2023-2030) 7.3.2.2. GCC Electronic Health Records Market Size and Forecast, by End User (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Electronic Health Records Market Size and Forecast, by Product (2023-2030) 7.3.3.2. Nigeria Electronic Health Records Market Size and Forecast, by End User (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Electronic Health Records Market Size and Forecast, by Product (2023-2030) 7.3.4.2. Rest of ME&A Electronic Health Records Market Size and Forecast, by End User (2023-2030) 8. South America Electronic Health Records Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Electronic Health Records Market Size and Forecast, by Product (2023-2030) 8.2. South America Electronic Health Records Market Size and Forecast, by End User (2023-2030) 8.3. South America Electronic Health Records Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Electronic Health Records Market Size and Forecast, by Product (2023-2030) 8.3.1.2. Brazil Electronic Health Records Market Size and Forecast, by End User (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Electronic Health Records Market Size and Forecast, by Product (2023-2030) 8.3.2.2. Argentina Electronic Health Records Market Size and Forecast, by End User (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Electronic Health Records Market Size and Forecast, by Product (2023-2030) 8.3.3.2. Rest Of South America Electronic Health Records Market Size and Forecast, by End User (2023-2030) 9. Global Electronic Health Records Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electronic Health Records Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Epic Systems Corporation (Verona, Wisconsin, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cerner Corporation (North Kansas City, Missouri, USA) 10.3. Siemens Healthineers (Erlangen, Germany) 10.4. CompuGroup Medical AG (Koblenz, Germany) 10.5. Netsmart Technologies (Overland Park, Kansas, USA) 10.6. Athenahealth (Watertown, Massachusetts, USA) 10.7. McKesson Corporation (Irving, Texas, USA) 10.8. Allscripts Healthcare Solutions (Chicago, Illinois, USA) 10.9. eClinicalWorks (Westborough, Massachusetts, USA) 10.10. NextGen Healthcare (Irvine, California, USA) 10.11. CPSI (Computer Programs and Systems, Inc.) (Mobile, Alabama, USA) 10.12. MEDITECH (Medical Information Technology, Inc.) (Westwood, Massachusetts, USA) 10.13. Greenway Health (Tampa, Florida, USA) 10.14. Aprima Medical Software (Richardson, Texas, USA) 10.15. MEDHOST (Franklin, Tennessee, USA) 10.16. Kareo (Irvine, California, USA) 10.17. NantHealth (Culver City, California, USA) 10.18. DrChrono (Sunnyvale, California, USA) 10.19. Azalea Health (Atlanta, Georgia, USA) 10.20. WRS Health (Goshen, New York, USA) 10.21. Practice Fusion (San Francisco, California, USA) 10.22. Siemens Healthineers (Erlangen, Germany) 10.23. EpicCare (Netherlands) (Houten, Netherlands) 10.24. CompuGroup Medical AG (Koblenz, Germany) 11. Key Findings 12. Industry Recommendations 13. Electronic Health Records Market: Research Methodology 14. Terms and Glossary