The Electronic Design Automation (EDA) Market size was valued at USD 15.67 Bn in 2023 and market revenue is growing at a CAGR of 9.6 %from 2024 to 2030, reaching nearly USD 29.77 Bn by 2030.Electronic Design Automation (EDA) Market Overview

The Electronic Design Automation (EDA) market provides a suite of software tools for semiconductor and electronic system designers, automating the design and verification of integrated circuits (ICs) and printed circuit boards (PCBs). These tools enhance productivity, reduce time-to-market, and improve product quality. Key components include schematic capture, simulation, synthesis, place and route, and verification tools. Schematic capture tools create graphical representations of circuits, simulation tools analyze circuit behavior, and synthesis tools translate high-level descriptions into detailed implementations. Increasingly complex electronic systems drive demand for EDA tools, aiding in managing interactions and meeting performance constraints.To know about the Research Methodology:-Request Free Sample Report According to MMR Study Report In mainland China, the Electronic Design Automation (EDA) Market has seen significant growth, boosted by competitive fabless design firms. Revenue for top Chinese fabless companies doubled to over $24.4 billion, with a surge in venture capital investment, particularly directed towards design firms. This growth is driven by US restrictions on Chinese OEMs, prompting efforts to build domestic supply chains supported by government policies such as R&D grants and tax incentives. China is heavily investing in domestic alternatives for EDA tools and intellectual property (IP), with significant injections from the National Integrated Circuit Industry Investment Fund. Embracing AI chip development and open-source design technologies like RISC-V, Chinese companies aim to reduce dependency on potentially restricted technologies. Major OEMs are also entering chip design to develop alternatives to US server chips, exemplified by Alibaba's ARM-based server CPU initiative.

Electronic Design Automation (EDA) Dynamics

Driver Semiconductor Industry Growth Boost the Electronic Design Automation (EDA) Market Growth The growth of the semiconductor industry significantly boosts the Electronic Design Automation (EDA) market through several interconnected mechanisms. As the semiconductor industry has increase in the demand for more sophisticated and efficient integrated circuits (ICs). This demand stems from various sectors such as consumer electronics, automotive, telecommunications, and industrial automation, among others. The complexity of these ICs necessitates advanced design tools and methodologies to effectively manage the intricacies involved in their development. This is where EDA tools come into play, offering a suite of software solutions for tasks like circuit design, simulation, verification, and layout. The semiconductor industry is characterized by continuous innovation and technological advancements. Emerging technologies such as artificial intelligence (AI), 5G, Internet of Things (IoT), and autonomous vehicles are driving the need for specialized ICs tailored to these applications. EDA tools enable semiconductor companies to design and optimize chips specifically tailored to meet the requirements of these emerging technologies. Also, the semiconductor industry operates in a highly competitive landscape where time-to-market is crucial. EDA tools are important in accelerating the design process, reducing development cycles, and ultimately speeding up time-to-market for new semiconductor products. The growth of the semiconductor industry creates a symbiotic relationship with the Electronic Design Automation (EDA) Market, driving innovation, efficiency, and growth in both sectors.Restrain High Cost of Tools limits Electronic Design Automation (EDA) Market The high cost of Electronic Design Automation (EDA) tools acts as a significant barrier to entry and development within the market, impacting both adoption rates and Electronic Design Automation (EDA) Market growth. The substantial upfront investment required to purchase licenses for EDA software deter small and medium-sized enterprises (SMEs) and startups from accessing advanced design capabilities. These companies often operate on tighter budgets and prioritize cost-saving measures over investing in expensive EDA tools. The ongoing costs associated with maintaining and updating EDA tools further compound the financial burden, particularly for organizations with limited resources. Annual license renewals, support contracts, and additional fees for upgrades or specialized features contribute to the overall cost of ownership, making it difficult for companies to justify the expense, especially if they only require occasional use of the tools. The high cost of EDA tools creates disparities in access to technology, favoring larger corporations with greater financial resources. This disparity stifles innovation and competition within the market, as smaller players struggle to compete on a level playing field. Also, the reluctance to invest in expensive EDA tools leads some companies to rely on outdated or less efficient design methodologies, limiting their ability to compete effectively in an increasingly competitive landscape. The high cost of EDA tools hampers the Electronic Design Automation (EDA) Market growth by inhibiting adoption, constraining innovation, and exacerbating inequalities in access to advanced design technology. Addressing this challenge requires EDA vendors to explore alternative pricing models, offer more flexible licensing options, or provide scaled-down versions of their software tailored to the needs and budgets of smaller organizations. Opportunity Rising Demand for IoT and AI Chips creates lucrative growth opportunities for the Electronic Design Automation (EDA) Market The burgeoning demand for Internet of Things (IoT) and Artificial Intelligence (AI) chips has spurred remarkable growth prospects within the Electronic Design Automation (EDA) market. IoT's expansion into various industries, from healthcare to automotive, necessitates specialized chips to accommodate diverse functionalities such as sensor data processing and connectivity. Similarly, AI's pervasive integration into consumer electronics, autonomous vehicles, and data centers demands sophisticated hardware tailored for neural network operations. As the complexity and performance requirements of IoT and AI applications surge, semiconductor companies are investing heavily in EDA tools to expedite chip design and verification processes. Advanced EDA solutions enable engineers to navigate intricate design challenges, optimize power consumption, and ensure reliability in cutting-edge semiconductor designs. The growing emphasis on energy efficiency and miniaturization amplifies the need for EDA tools capable of streamlining the design of low-power, compact IoT and AI chips. The rising demand for IoT and AI chips underscores the pivotal role of EDA in accelerating innovation and time-to-market for semiconductor manufacturers, fostering lucrative growth opportunities within the Electronic Design Automation (EDA) Market. This symbiotic relationship between technological advancements in IoT, AI, and EDA signifies a promising trajectory for the semiconductor industry's evolution and market growth.

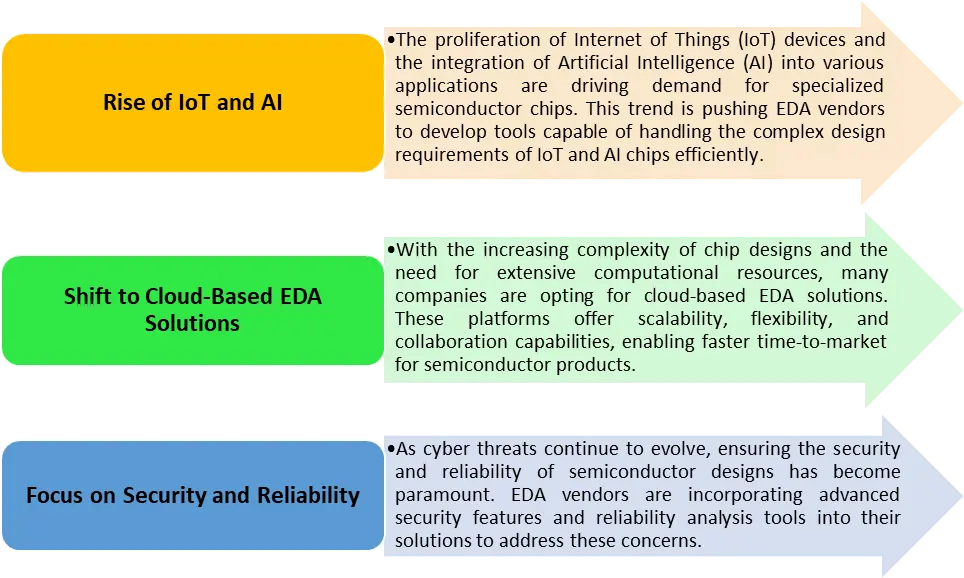

Electronic Design Automation (EDA) Market: Trends

Electronic Design Automation (EDA) Market: Segment Analysis

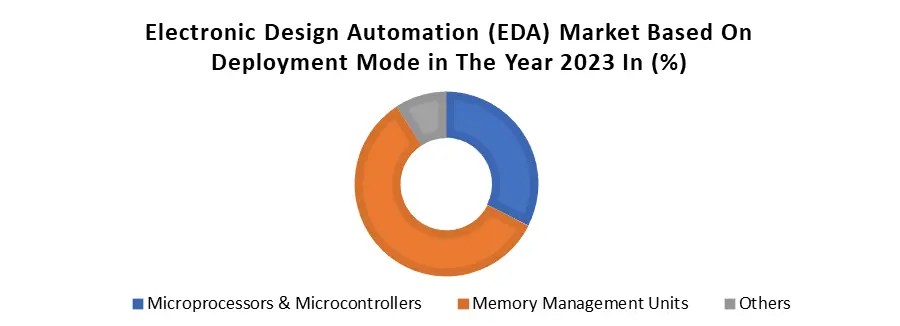

Based on Deployment Mode, the on-premises segment dominated the Electronic Design Automation (EDA) Market in the year 2023. The on-premises segment dominates the Electronic Design Automation (EDA) industry due to its ability to provide superior data security, control, and performance. Many semiconductor companies prioritize maintaining control over their design environments, especially for sensitive IP. Legacy investments in on-premises infrastructure also contribute to its dominance, as migrating to cloud-based solutions require significant effort. On-premises EDA solutions offer better performance and responsiveness, crucial for compute-intensive tasks in chip design. Industries with strict regulatory compliance requirements prefer on-premises solutions for easier adherence. Customization and flexibility are further advantages, allowing companies to tailor their environments and workflows. While cloud-based alternatives are gaining traction, especially for certain use cases, the on-premises segment remains the preferred choice for semiconductor companies seeking maximum control, performance, and compliance. Therefore, the on-premises segment dominated the Electronic Design Automation (EDA) Market.Based on Application, the Memory Management Units segment dominated the Electronic Design Automation (EDA) Market in the year 2023. The Memory Management Units (MMU) segment has emerged as a dominant force in the Electronic Design Automation (EDA) market. MMUs play a critical role in the design of complex semiconductor chips, particularly in ensuring efficient memory access and management. With the increasing demand for high-performance computing and data-intensive applications, semiconductor companies require robust MMU solutions to optimize memory usage and enhance overall chip performance. The proliferation of IoT devices, AI applications, and other data-driven technologies has fueled the demand for semiconductor chips with larger memory capacities and improved memory management capabilities. This trend has driven significant investment and innovation in the MMU segment, as companies seek to develop advanced solutions that meet the evolving requirements of the market. Also, MMU solutions are integral components of System-on-Chip (SoC) designs, which are widely used in a variety of applications, including smartphones, tablets, automotive electronics, and IoT devices. As SoCs become increasingly complex and integrated, the importance of efficient memory management becomes more pronounced, further driving the demand for MMU solutions.

Electronic Design Automation (EDA) Market: Regional Analysis

Asia Pacific Region Dominated the Electronic Design Automation (EDA) Market in the year 2023.Asia Pacific is home to some of the world's largest semiconductor manufacturing hubs, including Taiwan, South Korea, China, and Japan. These countries have invested significantly in developing their semiconductor industries, fostering a thriving ecosystem of semiconductor companies, research institutions, and design service providers. The rapid expansion of consumer electronics, automotive, and industrial sectors in Asia Pacific has boosted the demand for advanced semiconductor chips. With the growing adoption of technologies like IoT, AI, and 5G, there is an increased need for specialized chips designed using EDA tools. Also, the Asia Pacific region benefits from a large pool of skilled engineering talent, particularly in countries like India and China. This abundant talent pool contributes to the development of innovative EDA solutions and supports the growing demand for semiconductor design services. Favorable government policies and initiatives aimed at promoting the semiconductor industry have played a crucial role in driving growth in the Asia Pacific Electronic Design Automation (EDA) Market. These policies include tax incentives, research grants, and infrastructure development projects, which have attracted investment from both domestic and international semiconductor companies. The combination of robust semiconductor manufacturing capabilities, growing end-user industries, a skilled workforce, and supportive government policies has propelled the Asia Pacific region to dominate the EDA market, establishing it as a key hub for semiconductor design and innovation. Several Governments Have Funded the Expansion of Local Semiconductor Design Capabilities such as 1. Europe: - EU-funded European Processor Initiative to design and build a family of high-performance, low-power processors The EU’s European Chips Act seeks to reinforce Europe's capacity to innovate in the design, manufacture, and packaging of advanced chips. 2. India: -The government approved a $600 million Design Linked Incentive program for semiconductors, providing preferential tax treatment for design activities 3. Mainland China: - National Integrated Circuit Investment Fund invests $3 billion in design of Revamped stock market rules to establish STAR Market, on which fabless firms have raised over $50 billion through IPOs 4. South Korea: -The government pledged $1.3 billion over ten years for AI and power chip design. 5. Taiwan: - The government is going to provide $300 million over seven years for semiconductor R&DScope of the Global Electronic Design Automation (EDA) Market: Inquire before buying

Global Electronic Design Automation (EDA) Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 15.67 Bn. Forecast Period 2024 to 2030 CAGR: 9.6% Market Size in 2030: US $ 29.77 Bn. Segments Covered: by Product Category Computer Aided Engineering (CAE) Semiconductor IP (SIP) IC Physical Design & Verification Printed Circuit Board (PCB) & Multi-Chip Module (MCM) by Deployment Mode On-premises Cloud-Based by Application Microprocessors & Microcontrollers Memory Management Units Others by End-User Industry Aerospace & Defense Consumer Electronics Telecom Automotive Industrial Others Electronic Design Automation (EDA) Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Electronic Design Automation (EDA) Market Key players

North America 1. Cadence Design Systems, Inc. - San Jose, California, USA 2. Synopsys, Inc. - Mountain View, California, USA 3. Mentor, a Siemens Business - Wilsonville, Oregon, USA 4. ANSYS, Inc. - Canonsburg, Pennsylvania, USA 5. Altium Limited - La Jolla, California, USA 6. Xilinx Inc.. - San Jose, California, USA 7. Keysight Technologies - Santa Rosa, California, USA 8. Silvaco, Inc. - Santa Clara, California, USA 9. Agnisys, Inc. - Acton, Massachusetts, USA 10. Mentor Graphics (A Siemens Business) - Wilsonville, Oregon, USA 11. National Instruments Corporation - Austin, Texas, USA 12. Keysight Technologies - Santa Clara, California, USA 13. Magma Design Automation (Acquired by Synopsys) - San Jose, California, USA 14. On Semiconductor - Phoenix, Arizona, USA 15. Rambus Inc. - Sunnyvale, California, USA 16. AWR Corporation (A National Instruments Company) - El Segundo, California, USA Asia Pacific 1. Synopsis, Inc. (India) - Bangalore, Karnataka, India 2. Zuken Inc. - Yokohama, Kanagawa, Japan Frequently Asked Questions 1] What segments are covered in the Global Electronic Design Automation (EDA) Market report? Ans. The segments covered in the Electronic Design Automation (EDA) Market report are based on, Product Category, Deployment Mode, Application, End Use Industry and Regions. 2] Which region is expected to hold the highest share of the Global Electronic Design Automation (EDA) Market? Ans. The Asia Pacific region is expected to hold the highest share of the Electronic Design Automation (EDA) Market. 3] What is the market size of the Global Electronic Design Automation (EDA) Market by 2030? Ans. The market size of the Electronic Design Automation (EDA) Market by 2030 is expected to reach US$ 29.77 Bn. 4] What was the market size of the Global Market in 2023? Ans. The market size of the Market in 2023 was valued at US$ 15.67 Bn.

1. Electronic Design Automation (EDA) Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electronic Design Automation (EDA) Market: Dynamics 2.1. Electronic Design Automation (EDA) Market Trends by Region 2.1.1. North America Electronic Design Automation (EDA) Market Trends 2.1.2. Europe Electronic Design Automation (EDA) Market Trends 2.1.3. Asia Pacific Electronic Design Automation (EDA) Market Trends 2.1.4. Middle East and Africa Electronic Design Automation (EDA) Market Trends 2.1.5. South America Electronic Design Automation (EDA) Market Trends 2.2. Electronic Design Automation (EDA) Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electronic Design Automation (EDA) Market Drivers 2.2.1.2. North America Electronic Design Automation (EDA) Market Restraints 2.2.1.3. North America Electronic Design Automation (EDA) Market Opportunities 2.2.1.4. North America Electronic Design Automation (EDA) Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electronic Design Automation (EDA) Market Drivers 2.2.2.2. Europe Electronic Design Automation (EDA) Market Restraints 2.2.2.3. Europe Electronic Design Automation (EDA) Market Opportunities 2.2.2.4. Europe Electronic Design Automation (EDA) Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electronic Design Automation (EDA) Market Drivers 2.2.3.2. Asia Pacific Electronic Design Automation (EDA) Market Restraints 2.2.3.3. Asia Pacific Electronic Design Automation (EDA) Market Opportunities 2.2.3.4. Asia Pacific Electronic Design Automation (EDA) Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electronic Design Automation (EDA) Market Drivers 2.2.4.2. Middle East and Africa Electronic Design Automation (EDA) Market Restraints 2.2.4.3. Middle East and Africa Electronic Design Automation (EDA) Market Opportunities 2.2.4.4. Middle East and Africa Electronic Design Automation (EDA) Market Challenges 2.2.5. South America 2.2.5.1. South America Electronic Design Automation (EDA) Market Drivers 2.2.5.2. South America Electronic Design Automation (EDA) Market Restraints 2.2.5.3. South America Electronic Design Automation (EDA) Market Opportunities 2.2.5.4. South America Electronic Design Automation (EDA) Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electronic Design Automation (EDA) Industry 2.8. Analysis of Government Schemes and Initiatives For Electronic Design Automation (EDA) Industry 2.9. Electronic Design Automation (EDA) Market Trade Analysis 2.10. The Global Pandemic Impact on Electronic Design Automation (EDA) Market 3. Electronic Design Automation (EDA) Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 3.1.1. Computer Aided Engineering (CAE) 3.1.2. Semiconductor IP (SIP) 3.1.3. IC Physical Design & Verification 3.1.4. Printed Circuit Board (PCB) & Multi-Chip Module (MCM) 3.2. Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 3.2.1. On-premises 3.2.2. Cloud-Based 3.3. Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 3.3.1. Microprocessors & Microcontrollers 3.3.2. Memory Management Units 3.3.3. Others 3.4. Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 3.4.1. Aerospace & Defense 3.4.2. Consumer Electronics 3.4.3. Telecom 3.4.4. Automotive 3.4.5. Industrial 3.4.6. Others 3.5. Electronic Design Automation (EDA) Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Electronic Design Automation (EDA) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 4.1.1. Computer Aided Engineering (CAE) 4.1.2. Semiconductor IP (SIP) 4.1.3. IC Physical Design & Verification 4.1.4. Printed Circuit Board (PCB) & Multi-Chip Module (MCM) 4.2. North America Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 4.2.1. On-premises 4.2.2. Cloud-Based 4.3. North America Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 4.3.1. Microprocessors & Microcontrollers 4.3.2. Memory Management Units 4.3.3. Others 4.4. North America Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 4.4.1. Aerospace & Defense 4.4.2. Consumer Electronics 4.4.3. Telecom 4.4.4. Automotive 4.4.5. Industrial 4.4.6. Others 4.5. North America Electronic Design Automation (EDA) Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 4.5.1.1.1. Computer Aided Engineering (CAE) 4.5.1.1.2. Semiconductor IP (SIP) 4.5.1.1.3. IC Physical Design & Verification 4.5.1.1.4. Printed Circuit Board (PCB) & Multi-Chip Module (MCM) 4.5.1.2. United States Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.1.2.1. On-premises 4.5.1.2.2. Cloud-Based 4.5.1.3. United States Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Microprocessors & Microcontrollers 4.5.1.3.2. Memory Management Units 4.5.1.3.3. Others 4.5.1.4. United States Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 4.5.1.4.1. Aerospace & Defense 4.5.1.4.2. Consumer Electronics 4.5.1.4.3. Telecom 4.5.1.4.4. Automotive 4.5.1.4.5. Industrial 4.5.1.4.6. Others 4.5.2. Canada 4.5.2.1. Canada Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 4.5.2.1.1. Computer Aided Engineering (CAE) 4.5.2.1.2. Semiconductor IP (SIP) 4.5.2.1.3. IC Physical Design & Verification 4.5.2.1.4. Printed Circuit Board (PCB) & Multi-Chip Module (MCM) 4.5.2.2. Canada Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.2.2.1. On-premises 4.5.2.2.2. Cloud-Based 4.5.2.3. Canada Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Microprocessors & Microcontrollers 4.5.2.3.2. Memory Management Units 4.5.2.3.3. Others 4.5.2.4. Canada Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 4.5.2.4.1. Aerospace & Defense 4.5.2.4.2. Consumer Electronics 4.5.2.4.3. Telecom 4.5.2.4.4. Automotive 4.5.2.4.5. Industrial 4.5.2.4.6. Others 4.5.3. Mexico 4.5.3.1. Mexico Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 4.5.3.1.1. Computer Aided Engineering (CAE) 4.5.3.1.2. Semiconductor IP (SIP) 4.5.3.1.3. IC Physical Design & Verification 4.5.3.1.4. Printed Circuit Board (PCB) & Multi-Chip Module (MCM) 4.5.3.2. Mexico Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.3.2.1. On-premises 4.5.3.2.2. Cloud-Based 4.5.3.3. Mexico Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Microprocessors & Microcontrollers 4.5.3.3.2. Memory Management Units 4.5.3.3.3. Others 4.5.3.4. Mexico Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 4.5.3.4.1. Aerospace & Defense 4.5.3.4.2. Consumer Electronics 4.5.3.4.3. Telecom 4.5.3.4.4. Automotive 4.5.3.4.5. Industrial 4.5.3.4.6. Others 5. Europe Electronic Design Automation (EDA) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 5.2. Europe Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 5.3. Europe Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 5.4. Europe Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 5.5. Europe Electronic Design Automation (EDA) Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 5.5.1.2. United Kingdom Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.1.3. United Kingdom Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 5.5.2. France 5.5.2.1. France Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 5.5.2.2. France Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.2.3. France Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 5.5.3.2. Germany Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.3.3. Germany Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 5.5.4.2. Italy Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.4.3. Italy Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 5.5.5.2. Spain Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.5.3. Spain Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 5.5.6.2. Sweden Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.6.3. Sweden Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 5.5.7.2. Austria Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.7.3. Austria Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 5.5.8.2. Rest of Europe Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.8.3. Rest of Europe Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6. Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.2. Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.3. Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5. Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.1.2. China Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.1.3. China Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.2.2. S Korea Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.2.3. S Korea Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.3.2. Japan Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.3.3. Japan Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5.4. India 6.5.4.1. India Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.4.2. India Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.4.3. India Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.5.2. Australia Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.5.3. Australia Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.6.2. Indonesia Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.6.3. Indonesia Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.7.2. Malaysia Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.7.3. Malaysia Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.8.2. Vietnam Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.8.3. Vietnam Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.9.2. Taiwan Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.9.3. Taiwan Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 6.5.10.2. Rest of Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.10.3. Rest of Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 7. Middle East and Africa Electronic Design Automation (EDA) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 7.2. Middle East and Africa Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 7.3. Middle East and Africa Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 7.5. Middle East and Africa Electronic Design Automation (EDA) Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 7.5.1.2. South Africa Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.1.3. South Africa Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 7.5.2.2. GCC Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.2.3. GCC Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 7.5.3.2. Nigeria Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.3.3. Nigeria Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 7.5.4.2. Rest of ME&A Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.4.3. Rest of ME&A Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 8. South America Electronic Design Automation (EDA) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 8.2. South America Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 8.3. South America Electronic Design Automation (EDA) Market Size and Forecast, by Application(2023-2030) 8.4. South America Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 8.5. South America Electronic Design Automation (EDA) Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 8.5.1.2. Brazil Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.1.3. Brazil Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 8.5.2.2. Argentina Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.2.3. Argentina Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Electronic Design Automation (EDA) Market Size and Forecast, by Product Category (2023-2030) 8.5.3.2. Rest Of South America Electronic Design Automation (EDA) Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.3.3. Rest Of South America Electronic Design Automation (EDA) Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Electronic Design Automation (EDA) Market Size and Forecast, by End User Industry (2023-2030) 9. Global Electronic Design Automation (EDA) Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electronic Design Automation (EDA) Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cadence Design Systems, Inc. - San Jose, California, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Synopsys, Inc. - Mountain View, California, USA 10.3. Mentor, a Siemens Business - Wilsonville, Oregon, USA 10.4. ANSYS, Inc. - Canonsburg, Pennsylvania, USA 10.5. Altium Limited - La Jolla, California, USA 10.6. Xilinx, Inc. - San Jose, California, USA 10.7. Keysight Technologies - Santa Rosa, California, USA 10.8. Silvaco, Inc. - Santa Clara, California, USA 10.9. Agnisys, Inc. - Acton, Massachusetts, USA 10.10. Mentor Graphics (A Siemens Business) - Wilsonville, Oregon, USA 10.11. National Instruments Corporation - Austin, Texas, USA 10.12. Keysight Technologies - Santa Clara, California, USA 10.13. Magma Design Automation (Acquired by Synopsys) - San Jose, California, USA 10.14. On Semiconductor - Phoenix, Arizona, USA 10.15. Rambus Inc. - Sunnyvale, California, USA 10.16. AWR Corporation (A National Instruments Company) - El Segundo, California, USA 10.17. Synopsis, Inc. (India) - Bangalore, Karnataka, India 10.18. Zuken Inc. - Yokohama, Kanagawa, Japan 11. Key Findings 12. Industry Recommendations 13. Electronic Design Automation (EDA) Market: Research Methodology 14. Terms and Glossary