The Electroceuticals Market size was valued at USD 22.8 Billion in 2023 and the total Electroceuticals Market revenue is expected to grow at a CAGR of 6.3% from 2024 to 2030, reaching nearly USD 34.97 Billion in 2030.Objectives:

Maximize Market Research conducted a brief analysis of the Electroceuticals Market. The purpose of the research is to provide stakeholders in the industry with a thorough insight into the Bioremediation Technology and Services in Electroceuticals Market. The analysis examines all areas of the industry, with a focus on significant companies such as market leaders, followers, and newcomers. The research is an investor's guide since it depicts the competitive analysis of major competitors in the Electroceuticals Market by product, price, financial situation, product portfolio, growth plans, and geographical presence.To know about the Research Methodology :- Request Free Sample Report Electroceuticals are a new category of therapeutic agents which act by targeting the neural circuits of organs. The therapy involves mapping the neural circuitry and delivering neural impulses to these specific targets. The impulse is administered via an implantable device. stimulation of cortical or deep brain regions to treat neurological disorders like Parkinson's disease, dystonia, and epilepsy. The market is driven by factors like the aging population, increased prevalence of neurological and cardiovascular disorders, and rising governmental support for neurodegenerative diseases. Unhealthy food habits and lifestyles have been able to travel across national boundaries thanks to globalization. Globally, processed foods heavy in sugar, salt, and bad fats are easier to find, which has led to an increase in chronic illnesses. Key players in the electroceuticals market include MicroPort Scientific Corporation, Sonova Group, Nevro Corp., BIOTRONIK, Medico S.p.A., Nurotron Biotechnology Co. Ltd., MED-EL, and many more. Asia-Pacific is expected to experience the highest growth rate during the forecast period. Europe is the fastest-growing region with an Electroceutical Market share of over 45.6% in 2023. The region is expected to grow during the forecast period and maintain its dominance by 2030. Europe has strong research capabilities, and advanced healthcare infrastructure contributes to its growth. The improvements in healthcare infrastructure, rising disposable income levels, and a rapidly aging population.

Electroceuticals Market Dynamics:

Rising prevalence of chronic diseases The rising prevalence of chronic diseases is a major factor driving the Electroceuticals market growth. The increasing adoption of electroceuticals for the treatment of various neurological disorders, such as Parkinson’s disease, epilepsy, and depression, is also driving market growth. Chronic diseases such as epilepsy, Parkinson's disease, depression, and chronic pain are becoming increasingly common, creating a larger patient population for electroceuticals to treat. As the global population ages, the demand for healthcare solutions to manage age-related conditions like chronic pain, arthritis, and neurodegenerative diseases is rising. Electroceuticals offer non-invasive or minimally invasive treatment options for these conditions. Genetic predispositions make individuals more susceptible to certain chronic diseases. While genetics alone do not cause these conditions, they interact with environmental factors to increase risk. In some countries, governments and insurance companies are increasingly covering the cost of electroceutical treatments, which is making them more accessible to patients. Advancements in electronic devices are becoming smaller, more sophisticated, and more user-friendly, making them more interesting to patients and healthcare providers.High cost of electroceutical devices High cost of electroceutical devices, which limit their affordability and accessibility for consumers the need for more long-term data on safety and efficacy, and the need for better regulatory frameworks Another challenge is the psychological feelings of denial and side effects associated with invasive electroceuticals, particularly those involving neuromodulation technologies like deep brain stimulation (DBS) these limitations, the industry as a whole is growing steadily owing to factors such as the rising incidence of neurological and cardiovascular illnesses, technical breakthroughs, and regulatory clearance procedures. In Electroceutical device implantation, such as neurostimulators, needs the supervision of neurosurgeons who specialize in neural implant operations and have completed a functional neurosurgery fellowship. There is now a significant supply-demand mismatch for neurologists globally. Given the predicted growth in healthcare demand due to factors such as a larger patient pool and increased illness incidence, this deficit a source of worry. One of the most significant constraints is the difficulty of creating enough qualified neurosurgeons in the needed time frame. The global lack of competent personnel or neuro-physicians and neurosurgeons is predicted to have a detrimental influence on the number of neurosurgical procedures performed each year, and hence the Electroceuticals market demand for electroceutical devices such as neurostimulators.

Electroceutical Market Segment Analysis:

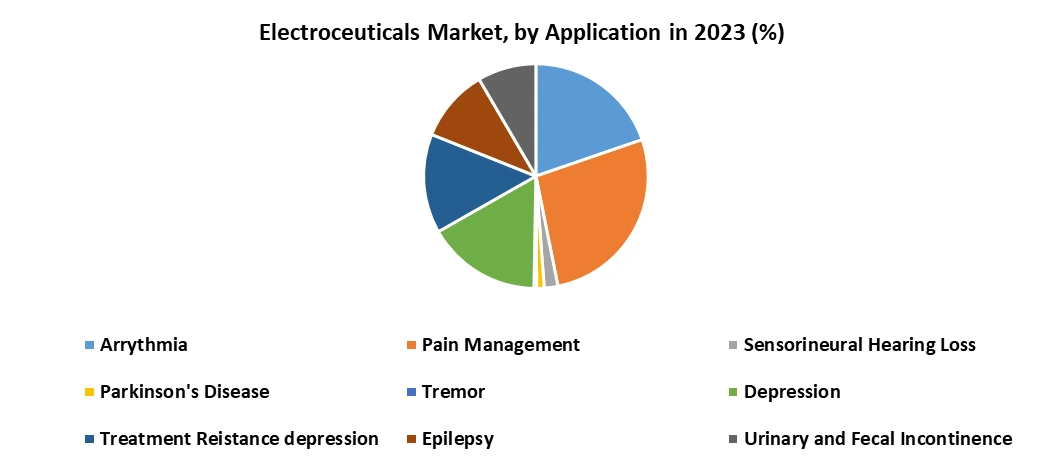

Based on Type, Implantable electroceutical devices segment held the largest market share of about 38% in the Electroceuticals Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 6.3% during the forecast period and maintain its dominance till 2030. These devices cater to a wide variety of medical conditions, including Heart failure are treated with cardiac pacemakers, cardiac resynchronization therapy (CRT) devices, and implantable cardioverter-defibrillators (ICDs) to regulate irregular heart rhythms. In Chronic pain, Electrical pulses are delivered to specific regions of the nervous system by spinal cord stimulators and deep brain stimulators, which relieve chronic back pain, neuropathic pain, and migraines. Rising healthcare spending, particularly in developed economies, is driving the adoption of these advanced medical technologies. Implantable devices are being explored for treating various other conditions, such as depression, urinary incontinence, and sleep apnoea. Advancements in miniaturization, biocompatibility, and battery life are leading to the development of more sophisticated and effective implantable devices. Based on Application, Arrhythmia segment held the largest Electroceuticals market share of about 46.2% in the Electroceutical Market in 2023 and is expected to maintain its dominance till 2030. The global prevalence of cardiac arrhythmias is increasing due to factors such as the aging population, unhealthy lifestyles, and rising incidence of chronic diseases like diabetes and obesity. So, the rising occurrence of cardiac Arrhythmia. Arrhythmia is a condition that affects the heart's rhythm, and electroceuticals such as pacemakers and implantable cardioverter defibrillators (ICDs) are commonly used to treat it. Electroceuticals are used to treat a variety of conditions, including neurological and cardiovascular disorders, chronic pain, and hearing loss, among others.

Electroceutical Market of Regional Insights:

North America dominates the Electroceuticals Market with the largest market share accounting for 45.3% in 2023, the region is expected with a CAGR is 6.8% during the forecast period and maintain its dominance by 2030. 1. Highly developed healthcare systems in the United States and Canada, provide advanced treatment options and adoptive innovation within the industry. North America holds the largest Electroceuticals market share, increased healthcare spending, allowing for greater accessibility to these innovative therapies, and increasing patient pool suffering from neurological and cardiovascular disorders, creating demand for electroceutical solutions. In North America several prominent electroceutical companies like Medtronic, Boston Scientific, and Abbott Laboratories. These companies drive innovation, invest heavily in research and development, and impact the overall Electroceuticals market landscape.Asia-Pacific held an Electroceuticals market share of about 19.5% in the Electroceuticals Market in 2023 and is expected to maintain its dominance till 2030. The region is growing thanks to its large and increasingly wealthy population, rising prevalence of chronic diseases, and government initiatives supporting healthcare development. Asia-Pacific is expected to have the highest CAGR and many more market opportunities in the region in the future. Increasing advancement in technologies in countries such as India, China, and Japan. LAMEA, or Latin America, the Middle East, and Africa is a region that is also involved in the Electroceutical Market. Electroceuticals Market Competitive Landscape: The competitive landscape of the Electroceuticals Market is constantly evolving, with new players emerging and established players adapting their strategies with the rapid industrialization in developing countries like China and India, It is estimated that key players have major growth forecasts in the growing usage of Electroceuticals in the industries. 1) Abbott, along with other prominent companies, is contributing to this growth through continuous investment in research and development, as well as the launch of new products and therapies. 2) Acquisition of Baylis Medical Company Inc: Boston Scientific announced an agreement to acquire Baylis Medical Company Inc, adding new left heart access platforms to electrophysiology 3) Agreement to Purchase Majority Stake of M.I.Tech Co., Ltd: Boston Scientific entered into a definitive agreement to purchase a majority stake of M.I.Tech Co., Ltd from Synergy Innovation Co., Ltd 4) In March 2021, Medtronic plc (Ireland) received US FDA approval for its Intellis platform with differential Target Multiplexed (DTM) Programming to treat chronic intractable back and leg pain. 5) In January 2021, Boston Scientific Corporation (US) received UD FDA approval for its verse Genus DEEP Brain Stimulation system. 6) In January 2021, Medtronic plc (Ireland) acquired Stimgenics LLC (US), a pioneer of DTM, a spinal cord therapy.

Electroceuticals Market Scope: Inquire before buying

Electroceuticals Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 22.8 Bn. Forecast Period 2024 to 2030 CAGR: 6.3% Market Size in 2030: US $ 34.97 Bn. Segments Covered: by Type Implantable Electroceutical Device Non-invasive Electroceutical Devices by Type Arrhythmia Pain Management Sensorineural Hearing Loss Parkinson’s Disease Tremor Depression Treatment-resistant Depression Epilepsy Urinary and Fecal Incontinence by Product Implantable Cardioverter Cardiac Pacemaker Cochlear Implant Spinal Cord Stimulators Deep Brain Stimulators Transcutaneous Electrical Nerve Stimulators Sacral Nerve Stimulator Vagus Nerve Stimulator Defibrillators by End-User Hospitals Others Electroceuticals Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Electroceuticals Market Key players :

North America 1) Abbott Laboratories (Abbott Park) 2) Boston Scientific Corporation (Massachusetts) 3) Medtronic plc (Ireland) 4) St. Jude Medical, Inc. (Minnesota) Europe 1) IONIS Pharmaceuticals, Inc. (Ireland) 2) LivaNova PLC (London) 3) Magstim Therapeutic Limited (United Kingdom) 4) MedTech Europe BV (Heerlen) 5) Nevro Corporation (California) 6) Synapse Medical Products AG (Germany) 7) Cefaly Technology AB (Sweden) Asia-Pacific Region 1) Aangstrom Electronics Co., Ltd. China 2) Bionet Electronics (Shanghai) 3) Acupress Medical (Suzhou) 4) Japan Medical Electronics Co., Ltd. (Japan) 5) LISNA Co., Ltd. (South Korea) 6) Stimwave Technologies, Inc. (China) 7) Kernel Biomedical Co., Ltd. (Suzhou ) Latin America 1) Instituto de Tecnologia e Pesquisa (Brazil) 2) INECO (Argentina) 3) Neurotech Solutions (Argentina) 4) NeuralStim (Mexico) Middle East & Africa 1) Brain Power Ltd ( Israel) 2) Insightec Ltd. (Israel) 3) Neurosoft Ltd. 4) BioStim ( South Africa) Frequently Asked Questions: 1. Which region has the largest share in the Electroceuticals Market? Ans: The North American region held the highest share in 2023. 2. What is the growth rate of the Electroceuticals Market? Ans: The Electroceuticals Market is growing at a CAGR of 6.3% during the forecasting period 2023-2030. 3. What is the market size of the Electroceuticals Market? Ans: The Electroceuticals Market size was valued at USD 22.8 Billion in 2023 reaching nearly USD 34.97 Billion in 2030. 4. What segments are covered in the Electroceuticals Market? Ans: The segments covered in the Electroceuticals Market report are Type, Application, Products, End-Users, and Region. 5. Who are the key players in the Electroceuticals Market? Ans: The important key players in the Electroceuticals Market are

1. Electroceuticals Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Electroceuticals Market: Dynamics 2.1. Electroceuticals Market Trends by Region 2.1.1. North America Electroceuticals Market Trends 2.1.2. Europe Electroceuticals Market Trends 2.1.3. Asia Pacific Electroceuticals Market Trends 2.1.4. Middle East and Africa Electroceuticals Market Trends 2.1.5. South America Electroceuticals Market Trends 2.2. Electroceuticals Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Electroceuticals Market Drivers 2.2.1.2. North America Electroceuticals Market Restraints 2.2.1.3. North America Electroceuticals Market Opportunities 2.2.1.4. North America Electroceuticals Market Challenges 2.2.2. Europe 2.2.2.1. Europe Electroceuticals Market Drivers 2.2.2.2. Europe Electroceuticals Market Restraints 2.2.2.3. Europe Electroceuticals Market Opportunities 2.2.2.4. Europe Electroceuticals Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Electroceuticals Market Drivers 2.2.3.2. Asia Pacific Electroceuticals Market Restraints 2.2.3.3. Asia Pacific Electroceuticals Market Opportunities 2.2.3.4. Asia Pacific Electroceuticals Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Electroceuticals Market Drivers 2.2.4.2. Middle East and Africa Electroceuticals Market Restraints 2.2.4.3. Middle East and Africa Electroceuticals Market Opportunities 2.2.4.4. Middle East and Africa Electroceuticals Market Challenges 2.2.5. South America 2.2.5.1. South America Electroceuticals Market Drivers 2.2.5.2. South America Electroceuticals Market Restraints 2.2.5.3. South America Electroceuticals Market Opportunities 2.2.5.4. South America Electroceuticals Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Electroceuticals Industry 2.8. Analysis of Government Schemes and Initiatives For Electroceuticals Industry 2.9. Electroceuticals Market Trade Analysis 2.10. The Global Pandemic Impact on Electroceuticals Market 3. Electroceuticals Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Electroceuticals Market Size and Forecast, by Type (2023-2030) 3.1.1. Implantable Electroceutical Device 3.1.2. Non-invasive Electroceutical Devices 3.2. Electroceuticals Market Size and Forecast, by Application (2023-2030) 3.2.1. Arrhythmia 3.2.2. Pain Management 3.2.3. Sensorineural Hearing Loss 3.2.4. Parkinson’s Disease 3.2.5. Tremor 3.2.6. Depression 3.2.7. Treatment-resistant 3.2.8. Depression 3.2.9. Epilepsy 3.2.10. Urinary and Fecal Incontinence 3.3. Electroceuticals Market Size and Forecast, by Product (2023-2030) 3.3.1. Implantable Cardioverter 3.3.2. Cardiac Pacemaker 3.3.3. Cochlear Implant 3.3.4. Spinal Cord Stimulators 3.3.5. Deep Brain Stimulators 3.3.6. Transcutaneous Electrical Nerve 3.3.7. Stimulators 3.3.8. Sacral Nerve Stimulator 3.3.9. Vagus Nerve Stimulator 3.3.10. Defibrillators 3.4. Electroceuticals Market Size and Forecast, by End Users (2023-2030) 3.4.1. Hospital 3.4.2. other 3.5. Electroceuticals Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Electroceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Electroceuticals Market Size and Forecast, by Type (2023-2030) 4.1.1. Implantable Electroceutical Device 4.1.2. Non-invasive Electroceutical Devices 4.2. North America Electroceuticals Market Size and Forecast, by Application (2023-2030) 4.2.1. Arrhythmia 4.2.2. Pain Management 4.2.3. Sensorineural Hearing Loss 4.2.4. Parkinson’s Disease 4.2.5. Tremor 4.2.6. Depression 4.2.7. Treatment-resistant 4.2.8. Depression 4.2.9. Epilepsy 4.2.10. Urinary and Fecal Incontinence 4.3. North America Electroceuticals Market Size and Forecast, by Product (2023-2030) 4.3.1. Implantable Cardioverter 4.3.2. Cardiac Pacemaker 4.3.3. Cochlear Implant 4.3.4. Spinal Cord Stimulators 4.3.5. Deep Brain Stimulators 4.3.6. Transcutaneous Electrical Nerve 4.3.7. Stimulators 4.3.8. Sacral Nerve Stimulator 4.3.9. Vagus Nerve Stimulator 4.3.10. Defibrillators 4.4. North America Electroceuticals Market Size and Forecast, by End Users (2023-2030) 4.4.1. Hospital 4.4.2. other 4.5. North America Electroceuticals Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Electroceuticals Market Size and Forecast, by Type (2023-2030) 4.5.1.1.1. Implantable Electroceutical Device 4.5.1.1.2. Non-invasive Electroceutical Devices 4.5.1.2. United States Electroceuticals Market Size and Forecast, by Application (2023-2030) 4.5.1.2.1. Arrhythmia 4.5.1.2.2. Pain Management 4.5.1.2.3. Sensorineural Hearing Loss 4.5.1.2.4. Parkinson’s Disease 4.5.1.2.5. Tremor 4.5.1.2.6. Depression 4.5.1.2.7. Treatment-resistant 4.5.1.2.8. Depression 4.5.1.2.9. Epilepsy 4.5.1.2.10. Urinary and Fecal Incontinence 4.5.1.3. United States Electroceuticals Market Size and Forecast, by Product (2023-2030) 4.5.1.3.1. Implantable Cardioverter 4.5.1.3.2. Cardiac Pacemaker 4.5.1.3.3. Cochlear Implant 4.5.1.3.4. Spinal Cord Stimulators 4.5.1.3.5. Deep Brain Stimulators 4.5.1.3.6. Transcutaneous Electrical Nerve 4.5.1.3.7. Stimulators 4.5.1.3.8. Sacral Nerve Stimulator 4.5.1.3.9. Vagus Nerve Stimulator 4.5.1.3.10. Defibrillators 4.5.1.4. United States Electroceuticals Market Size and Forecast, by End Users (2023-2030) 4.5.1.4.1. Hospital 4.5.1.4.2. other 4.5.2. Canada 4.5.2.1. Canada Electroceuticals Market Size and Forecast, by Type (2023-2030) 4.5.2.1.1. Implantable Electroceutical Device 4.5.2.1.2. Non-invasive Electroceutical Devices 4.5.2.2. Canada Electroceuticals Market Size and Forecast, by Application (2023-2030) 4.5.2.2.1. Arrhythmia 4.5.2.2.2. Pain Management 4.5.2.2.3. Sensorineural Hearing Loss 4.5.2.2.4. Parkinson’s Disease 4.5.2.2.5. Tremor 4.5.2.2.6. Depression 4.5.2.2.7. Treatment-resistant 4.5.2.2.8. Depression 4.5.2.2.9. Epilepsy 4.5.2.2.10. Urinary and Fecal Incontinence 4.5.2.3. Canada Electroceuticals Market Size and Forecast, by Product (2023-2030) 4.5.2.3.1. Implantable Cardioverter 4.5.2.3.2. Cardiac Pacemaker 4.5.2.3.3. Cochlear Implant 4.5.2.3.4. Spinal Cord Stimulators 4.5.2.3.5. Deep Brain Stimulators 4.5.2.3.6. Transcutaneous Electrical Nerve 4.5.2.3.7. Stimulators 4.5.2.3.8. Sacral Nerve Stimulator 4.5.2.3.9. Vagus Nerve Stimulator 4.5.2.3.10. Defibrillators 4.5.2.4. Canada Electroceuticals Market Size and Forecast, by End Users (2023-2030) 4.5.2.4.1. Hospital 4.5.2.4.2. other 4.5.3. Mexico 4.5.3.1. Mexico Electroceuticals Market Size and Forecast, by Type (2023-2030) 4.5.3.1.1. Implantable Electroceutical Device 4.5.3.1.2. Non-invasive Electroceutical Devices 4.5.3.2. Mexico Electroceuticals Market Size and Forecast, by Application (2023-2030) 4.5.3.2.1. Arrhythmia 4.5.3.2.2. Pain Management 4.5.3.2.3. Sensorineural Hearing Loss 4.5.3.2.4. Parkinson’s Disease 4.5.3.2.5. Tremor 4.5.3.2.6. Depression 4.5.3.2.7. Treatment-resistant 4.5.3.2.8. Depression 4.5.3.2.9. Epilepsy 4.5.3.2.10. Urinary and Fecal Incontinence 4.5.3.3. Mexico Electroceuticals Market Size and Forecast, by Product (2023-2030) 4.5.3.3.1. Implantable Cardioverter 4.5.3.3.2. Cardiac Pacemaker 4.5.3.3.3. Cochlear Implant 4.5.3.3.4. Spinal Cord Stimulators 4.5.3.3.5. Deep Brain Stimulators 4.5.3.3.6. Transcutaneous Electrical Nerve 4.5.3.3.7. Stimulators 4.5.3.3.8. Sacral Nerve Stimulator 4.5.3.3.9. Vagus Nerve Stimulator 4.5.3.3.10. Defibrillators 4.5.3.4. Mexico Electroceuticals Market Size and Forecast, by End Users (2023-2030) 4.5.3.4.1. Hospital 4.5.3.4.2. other 5. Europe Electroceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Electroceuticals Market Size and Forecast, by Type (2023-2030) 5.2. Europe Electroceuticals Market Size and Forecast, by Application (2023-2030) 5.3. Europe Electroceuticals Market Size and Forecast, by Product (2023-2030) 5.4. Europe Electroceuticals Market Size and Forecast, by End Users (2023-2030) 5.5. Europe Electroceuticals Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Electroceuticals Market Size and Forecast, by Type (2023-2030) 5.5.1.2. United Kingdom Electroceuticals Market Size and Forecast, by Application (2023-2030) 5.5.1.3. United Kingdom Electroceuticals Market Size and Forecast, by Product (2023-2030) 5.5.1.4. United Kingdom Electroceuticals Market Size and Forecast, by End Users (2023-2030) 5.5.2. France 5.5.2.1. France Electroceuticals Market Size and Forecast, by Type (2023-2030) 5.5.2.2. France Electroceuticals Market Size and Forecast, by Application (2023-2030) 5.5.2.3. France Electroceuticals Market Size and Forecast, by Product (2023-2030) 5.5.2.4. France Electroceuticals Market Size and Forecast, by End Users (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Electroceuticals Market Size and Forecast, by Type (2023-2030) 5.5.3.2. Germany Electroceuticals Market Size and Forecast, by Application (2023-2030) 5.5.3.3. Germany Electroceuticals Market Size and Forecast, by Product (2023-2030) 5.5.3.4. Germany Electroceuticals Market Size and Forecast, by End Users (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Electroceuticals Market Size and Forecast, by Type (2023-2030) 5.5.4.2. Italy Electroceuticals Market Size and Forecast, by Application (2023-2030) 5.5.4.3. Italy Electroceuticals Market Size and Forecast, by Product (2023-2030) 5.5.4.4. Italy Electroceuticals Market Size and Forecast, by End Users (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Electroceuticals Market Size and Forecast, by Type (2023-2030) 5.5.5.2. Spain Electroceuticals Market Size and Forecast, by Application (2023-2030) 5.5.5.3. Spain Electroceuticals Market Size and Forecast, by Product (2023-2030) 5.5.5.4. Spain Electroceuticals Market Size and Forecast, by End Users (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Electroceuticals Market Size and Forecast, by Type (2023-2030) 5.5.6.2. Sweden Electroceuticals Market Size and Forecast, by Application (2023-2030) 5.5.6.3. Sweden Electroceuticals Market Size and Forecast, by Product (2023-2030) 5.5.6.4. Sweden Electroceuticals Market Size and Forecast, by End Users (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Electroceuticals Market Size and Forecast, by Type (2023-2030) 5.5.7.2. Austria Electroceuticals Market Size and Forecast, by Application (2023-2030) 5.5.7.3. Austria Electroceuticals Market Size and Forecast, by Product (2023-2030) 5.5.7.4. Austria Electroceuticals Market Size and Forecast, by End Users (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Electroceuticals Market Size and Forecast, by Type (2023-2030) 5.5.8.2. Rest of Europe Electroceuticals Market Size and Forecast, by Application (2023-2030) 5.5.8.3. Rest of Europe Electroceuticals Market Size and Forecast, by Product (2023-2030) 5.5.8.4. Rest of Europe Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6. Asia Pacific Electroceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.4. Asia Pacific Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5. Asia Pacific Electroceuticals Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.1.2. China Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.1.3. China Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.1.4. China Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.2.2. S Korea Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.2.3. S Korea Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.2.4. S Korea Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Japan Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.3.3. Japan Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.3.4. Japan Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5.4. India 6.5.4.1. India Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.4.2. India Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.4.3. India Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.4.4. India Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Australia Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.5.3. Australia Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.5.4. Australia Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Indonesia Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.6.3. Indonesia Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.6.4. Indonesia Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Malaysia Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.7.3. Malaysia Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.7.4. Malaysia Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Vietnam Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.8.3. Vietnam Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.8.4. Vietnam Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.9.2. Taiwan Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.9.3. Taiwan Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.9.4. Taiwan Electroceuticals Market Size and Forecast, by End Users (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Electroceuticals Market Size and Forecast, by Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Electroceuticals Market Size and Forecast, by Application (2023-2030) 6.5.10.3. Rest of Asia Pacific Electroceuticals Market Size and Forecast, by Product (2023-2030) 6.5.10.4. Rest of Asia Pacific Electroceuticals Market Size and Forecast, by End Users (2023-2030) 7. Middle East and Africa Electroceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Electroceuticals Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Electroceuticals Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Electroceuticals Market Size and Forecast, by Product (2023-2030) 7.4. Middle East and Africa Electroceuticals Market Size and Forecast, by End Users (2023-2030) 7.5. Middle East and Africa Electroceuticals Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Electroceuticals Market Size and Forecast, by Type (2023-2030) 7.5.1.2. South Africa Electroceuticals Market Size and Forecast, by Application (2023-2030) 7.5.1.3. South Africa Electroceuticals Market Size and Forecast, by Product (2023-2030) 7.5.1.4. South Africa Electroceuticals Market Size and Forecast, by End Users (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Electroceuticals Market Size and Forecast, by Type (2023-2030) 7.5.2.2. GCC Electroceuticals Market Size and Forecast, by Application (2023-2030) 7.5.2.3. GCC Electroceuticals Market Size and Forecast, by Product (2023-2030) 7.5.2.4. GCC Electroceuticals Market Size and Forecast, by End Users (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Electroceuticals Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Nigeria Electroceuticals Market Size and Forecast, by Application (2023-2030) 7.5.3.3. Nigeria Electroceuticals Market Size and Forecast, by Product (2023-2030) 7.5.3.4. Nigeria Electroceuticals Market Size and Forecast, by End Users (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Electroceuticals Market Size and Forecast, by Type (2023-2030) 7.5.4.2. Rest of ME&A Electroceuticals Market Size and Forecast, by Application (2023-2030) 7.5.4.3. Rest of ME&A Electroceuticals Market Size and Forecast, by Product (2023-2030) 7.5.4.4. Rest of ME&A Electroceuticals Market Size and Forecast, by End Users (2023-2030) 8. South America Electroceuticals Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Electroceuticals Market Size and Forecast, by Type (2023-2030) 8.2. South America Electroceuticals Market Size and Forecast, by Application (2023-2030) 8.3. South America Electroceuticals Market Size and Forecast, by Product(2023-2030) 8.4. South America Electroceuticals Market Size and Forecast, by End Users (2023-2030) 8.5. South America Electroceuticals Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Electroceuticals Market Size and Forecast, by Type (2023-2030) 8.5.1.2. Brazil Electroceuticals Market Size and Forecast, by Application (2023-2030) 8.5.1.3. Brazil Electroceuticals Market Size and Forecast, by Product (2023-2030) 8.5.1.4. Brazil Electroceuticals Market Size and Forecast, by End Users (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Electroceuticals Market Size and Forecast, by Type (2023-2030) 8.5.2.2. Argentina Electroceuticals Market Size and Forecast, by Application (2023-2030) 8.5.2.3. Argentina Electroceuticals Market Size and Forecast, by Product (2023-2030) 8.5.2.4. Argentina Electroceuticals Market Size and Forecast, by End Users (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Electroceuticals Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Rest Of South America Electroceuticals Market Size and Forecast, by Application (2023-2030) 8.5.3.3. Rest Of South America Electroceuticals Market Size and Forecast, by Product (2023-2030) 8.5.3.4. Rest Of South America Electroceuticals Market Size and Forecast, by End Users (2023-2030) 9. Global Electroceuticals Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Electroceuticals Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Abbott Laboratories (Abbott Park) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Boston Scientific Corporation (Massachusetts) 10.3. Medtronic plc (Ireland) 10.4. St. Jude Medical, Inc. (Minnesota) 10.5. IONIS Pharmaceuticals, Inc. (Ireland) 10.6. LivaNova PLC (London) 10.7. Magstim Therapeutic Limited (United Kingdom) 10.8. MedTech Europe BV (Heerlen) 10.9. Nevro Corporation (California) 10.10. Synapse Medical Products AG (Germany) 10.11. Cefaly Technology AB (Sweden) 10.12. Aangstrom Electronics Co., Ltd. China 10.13. Bionet Electronics (Shanghai) 10.14. Acupress Medical (Suzhou) 10.15. Japan Medical Electronics Co., Ltd. (Japan) 10.16. LISNA Co., Ltd. (South Korea) 10.17. Stimwave Technologies, Inc. (China) 10.18. Kernel Biomedical Co., Ltd. (Suzhou ) 10.19. Instituto de Tecnologia e Pesquisa (Brazil) 10.20. INECO (Argentina) 10.21. Neurotech Solutions (Argentina) 10.22. NeuralStim (Mexico) 10.23. Brain Power Ltd ( Israel) 10.24. Insightec Ltd. (Israel) 10.25. Neurosoft Ltd. 10.26. BioStim ( South Africa) 11. Key Findings 12. Industry Recommendations 13. Electroceuticals Market: Research Methodology 14. Terms and Glossary