The Global Dried Fruits Market is entering a transformative era, fueled by the convergence of clean-label consumerism, urban snacking trends, and the growth of digital grocery platforms. Valued at USD 52.4 Billion in 2024, the market is projected to reach USD 78.2 Billion by 2030, expanding at a CAGR of 6.8%.Global Dried Fruits Market Outlook

Once seen as a basic pantry item, dried fruits are now a powerhouse in wellness, sports nutrition, and gift-packaging innovation. This data-rich, insight-forward report by Maximize Market Research uncovers where the value lies, what’s driving demand, and how businesses can capture the next growth wave across global corridors.Dried Fruits Market Scope & Methodology

Base Year: 2024 Forecast Period: 2025–2030 Coverage: 20+ Countries | 5 Regions Methodology: Multi-source triangulation, primary interviews, real-time pricing data, trade routes, and production zone mapping.Dried Fruits Market Quick Stats & Growth Highlights (2024-2030)

Know Your Market Definition & Value Chain: From orchard to shelf — cultivation, dehydration, packaging, distribution. Dried Fruits Market Segment Analysis: By Product: Raisins, Almonds, Cashews, Dates, Berries, Apricots, Figs By Form: Whole, Chopped, Powder, Freeze-Dried By Channel: Modern Trade, Traditional Retail, E-commerce, HoReCa Applications: Snacking, Breakfast Cereals, Bakery, Dairy, Gifting, Supplements.

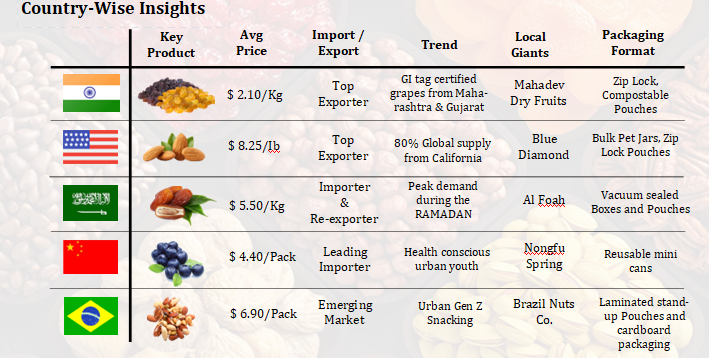

Global Dried Fruits Market: Country-Wise Breakdown by Product Type

Dried Fruits Market: Comprehensive Insights and Evolving Market Size Overview

To know about the Research Methodology :- Request Free Sample Report

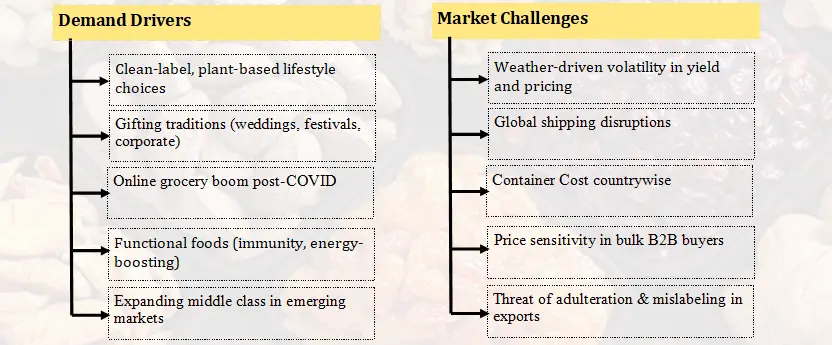

Global Dried Fruits Market: Key Demand Drivers and Emerging Market Challenges Shaping Growth

Global Dried Fruits Market: Revenue Contribution and Growth Dynamics of Organic Nut Mixes Segment

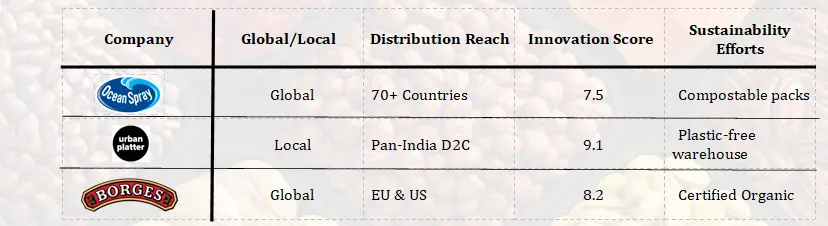

1. Global Leaders: Olam International, Sunbeam Foods, Ocean Spray, Borges, Traina Foods 2. Emerging Disruptors: Nature’s Factory (India), Urban Platter (E-retail), Liwo (Organic wellness)Dried Fruits Competitive Intelligence

Global Dried Fruits Market: Innovation Index and Distribution Reach Analysis of Leading Players

Strategic Growth Plans

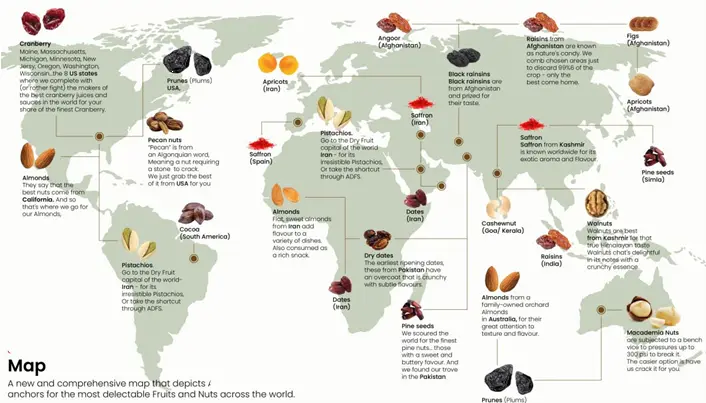

1. Pricing Strategies: Implementing tiered pricing models based on sales channels (e.g., e-commerce, retail chains, HoReCa) and region-specific affordability. Premium pricing leveraged in organic, health-conscious, and festive SKUs. 2. Investments: Surge in foreign direct investments (FDIs) toward agricultural infrastructure including smart cold storage, cluster-based food parks, and integration of blockchain for traceability and transparency. 3. Marketing Trends: Rise of curated gift bundles during festivals, luxury positioning through ornate dried fruit packaging, and Instagram-first designs targeting affluent millennial buyers. 4. R&D Focus: Innovation targeted at extending shelf-life without preservatives, developing functional blends (e.g., protein+fiber dried snacks), and integrating AI-based quality grading systems to reduce waste and improve efficiency.Global Dried Fruits Market: Mapping the World’s Most Traded and In-Demand Fruits & Nuts Hotspots

Dried Fruits Market Segment

The dried fruits market covered in this report is segmented – 1) By Type: Apricots, Dates, Raisins, Figs, Berries, Other Types 2) By Category: Conventional, Organic 3) By Application: Confectioneries, Dairy Products, Bakery Products, Snacks And Bars, Desserts, Cereals, Other Applications Subsegments: 1) By Apricots: Whole Dried Apricots, Diced Dried Apricots 2) By Dates: Medjool Dates, Deglet Noor Dates, Pitted Dates 3) By Raisins: Regular Raisins, Golden Raisins, Sultanas 4) By Figs: Whole Dried Figs, Diced Dried Figs 5) By Berries: dried blueberries, Dried Cranberries, Dried Strawberries 6) By Other Types: Dried Apples, Dried Mangoes, Dried Pineapples, Mixed Dried FruitsKey Questions Answered

• What’s the future of freeze-dried snacks in urban metros? • How are global players protecting margins amid inflation? • What country offers the best ROI for dried fruit processing? • Who’s winning in direct-to-consumer dried fruit delivery?Why This Report?

• 20+ country deep-dives with trade, pricing & distribution analysis • Visual segmentation by product & region • Competitor playbook with strategic priorities & forecasts • Trusted Data Sources: FAOSTAT, UN Comtrade, Euromonitor, APEDA, USDA, Kantar Grocery PanelDried Fruits Market 2025: The Silent Billion-Dollar Boom No One’s Talking About... Yet.

From superfoods to super margins, dried fruits are no longer pantry basics—they’re global power plays. Projected to hit $18.9 Billion by 2030, this market is thriving on: 1. Clean-lable demand 2. Gifting culture 3. Wellness-focused D2C surges 4. India’s agri export push But here’s what only this report reveals: • Who’s quietly gaining market share while others play catch-up • How small brands are out-innovating giants in packaging & digital shelf • Which global zones are turning into export goldmines • And where the big players might be losing their gripThis 250+ page analysis unpacks

Competitive Battlefield: Top players, newcomers & M&A Segment Intelligence: By fruit, form, channel, and price tier Zone-wise Outlook: Global & Indian clusters, future hotspots R&D, Pricing Wars, and Strategic Moves decoded Access the full report now: Request Free Sample Report

1. Dried Fruits Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Dried Fruits Market: Dynamics 2.1. Dried Fruits Market Trends by Region 2.1.1. North America Dried Fruits Market Trends 2.1.2. Europe Dried Fruits Market Trends 2.1.3. Asia Pacific Dried Fruits Market Trends 2.1.4. Middle East and Africa Dried Fruits Market Trends 2.1.5. South America Dried Fruits Market Trends 2.2. Dried Fruits Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Dried Fruits Market Drivers 2.2.1.2. North America Dried Fruits Market Restraints 2.2.1.3. North America Dried Fruits Market Opportunities 2.2.1.4. North America Dried Fruits Market Challenges 2.2.2. Europe 2.2.2.1. Europe Dried Fruits Market Drivers 2.2.2.2. Europe Dried Fruits Market Restraints 2.2.2.3. Europe Dried Fruits Market Opportunities 2.2.2.4. Europe Dried Fruits Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Dried Fruits Market Drivers 2.2.3.2. Asia Pacific Dried Fruits Market Restraints 2.2.3.3. Asia Pacific Dried Fruits Market Opportunities 2.2.3.4. Asia Pacific Dried Fruits Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Dried Fruits Market Drivers 2.2.4.2. Middle East and Africa Dried Fruits Market Restraints 2.2.4.3. Middle East and Africa Dried Fruits Market Opportunities 2.2.4.4. Middle East and Africa Dried Fruits Market Challenges 2.2.5. South America 2.2.5.1. South America Dried Fruits Market Drivers 2.2.5.2. South America Dried Fruits Market Restraints 2.2.5.3. South America Dried Fruits Market Opportunities 2.2.5.4. South America Dried Fruits Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Dried Fruits Industry 2.8. Analysis of Government Schemes and Initiatives For Dried Fruits Industry 2.9. Dried Fruits Market Trade Analysis 2.10. The Global Pandemic Impact on Dried Fruits Market 3. Dried Fruits Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Dried Fruits Market Size and Forecast, by Type (2024-2032) 3.1.1. Table Dates 3.1.2. Dried Grapes 3.1.3. Dried Figs 3.1.6. Dried Cranberries 3.2. Dried Fruits Market Size and Forecast, by Application (2024-2032) 3.2.1. Bakery 3.2.2. Confectionery 3.2.3. Diary & Dessert 3.2.4. Cereal & Snacks 3.2.5. Others 3.3. Dried Fruits Market Size and Forecast, by Nature (2024-2032) 3.3.1. Organic 3.3.2. Conventional 3.4. Dried Fruits Market Size and Forecast, by Form (2024-2032) 3.4.1. Whole/Piece Dried Fruits 3.4.2. Powdered Dried Fruits 3.5. Dried Fruits Market Size and Forecast, by Region (2024-2032) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Dried Fruits Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Dried Fruits Market Size and Forecast, by Type (2024-2032) 4.1.1. Table Dates 4.1.2. Dried Grapes 4.1.3. Dried Figs 4.1.6. Dried Cranberries 4.2. North America Dried Fruits Market Size and Forecast, by Application (2024-2032) 4.2.1. Bakery 4.2.2. Confectionery 4.2.3. Diary & Dessert 4.2.4. Cereal & Snacks 4.2.5. Others 4.3. North America Dried Fruits Market Size and Forecast, by Nature (2024-2032) 4.3.1. Organic 4.3.2. Conventional 4.4. North America Dried Fruits Market Size and Forecast, by Form (2024-2032) 4.4.1. Whole/Piece Dried Fruits 4.4.2. Powdered Dried Fruits 4.5. North America Dried Fruits Market Size and Forecast, by Country (2024-2032) 4.5.1. United States 4.5.1.1. United States Dried Fruits Market Size and Forecast, by Type (2024-2032) 4.5.1.1.1. Table Dates 4.5.1.1.2. Dried Grapes 4.5.1.1.3. Dried Figs 4.5.1.1.6. Dried Cranberries 4.5.1.2. United States Dried Fruits Market Size and Forecast, by Application (2024-2032) 4.5.1.2.1. Bakery 4.5.1.2.2. Confectionery 4.5.1.2.3. Diary & Dessert 4.5.1.2.4. Cereal & Snacks 4.5.1.2.5. Others 4.5.1.3. United States Dried Fruits Market Size and Forecast, by Nature (2024-2032) 4.5.1.3.1. Organic 4.5.1.3.2. Conventional 4.5.1.4. United States Dried Fruits Market Size and Forecast, by Form (2024-2032) 4.5.1.4.1. Whole/Piece Dried Fruits 4.5.1.4.2. Powdered Dried Fruits 4.5.2. Canada 4.5.2.1. Canada Dried Fruits Market Size and Forecast, by Type (2024-2032) 4.5.2.1.1. Table Dates 4.5.2.1.2. Dried Grapes 4.5.2.1.3. Dried Figs 4.5.2.1.6. Dried Cranberries 4.5.2.2. Canada Dried Fruits Market Size and Forecast, by Application (2024-2032) 4.5.2.2.1. Bakery 4.5.2.2.2. Confectionery 4.5.2.2.3. Diary & Dessert 4.5.2.2.4. Cereal & Snacks 4.5.2.2.5. Others 4.5.2.3. Canada Dried Fruits Market Size and Forecast, by Nature (2024-2032) 4.5.2.3.1. Organic 4.5.2.3.2. Conventional 4.5.2.4. Canada Dried Fruits Market Size and Forecast, by Form (2024-2032) 4.5.2.4.1. Whole/Piece Dried Fruits 4.5.2.4.2. Powdered Dried Fruits 4.5.3. Mexico 4.5.3.1. Mexico Dried Fruits Market Size and Forecast, by Type (2024-2032) 4.5.3.1.1. Table Dates 4.5.3.1.2. Dried Grapes 4.5.3.1.3. Dried Figs 4.5.3.1.6. Dried Cranberries 4.5.3.2. Mexico Dried Fruits Market Size and Forecast, by Application (2024-2032) 4.5.3.2.1. Bakery 4.5.3.2.2. Confectionery 4.5.3.2.3. Diary & Dessert 4.5.3.2.4. Cereal & Snacks 4.5.3.2.5. Others 4.5.3.3. Mexico Dried Fruits Market Size and Forecast, by Nature (2024-2032) 4.5.3.3.1. Organic 4.5.3.3.2. Conventional 4.5.3.4. Mexico Dried Fruits Market Size and Forecast, by Form (2024-2032) 4.5.3.4.1. Whole/Piece Dried Fruits 4.5.3.4.2. Powdered Dried Fruits 5. Europe Dried Fruits Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Dried Fruits Market Size and Forecast, by Type (2024-2032) 5.2. Europe Dried Fruits Market Size and Forecast, by Application (2024-2032) 5.3. Europe Dried Fruits Market Size and Forecast, by Nature (2024-2032) 5.4. Europe Dried Fruits Market Size and Forecast, by Form (2024-2032) 5.5. Europe Dried Fruits Market Size and Forecast, by Country (2024-2032) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Dried Fruits Market Size and Forecast, by Type (2024-2032) 5.5.1.2. United Kingdom Dried Fruits Market Size and Forecast, by Application (2024-2032) 5.5.1.3. United Kingdom Dried Fruits Market Size and Forecast, by Nature (2024-2032) 5.5.1.4. United Kingdom Dried Fruits Market Size and Forecast, by Form (2024-2032) 5.5.2. France 5.5.2.1. France Dried Fruits Market Size and Forecast, by Type (2024-2032) 5.5.2.2. France Dried Fruits Market Size and Forecast, by Application (2024-2032) 5.5.2.3. France Dried Fruits Market Size and Forecast, by Nature (2024-2032) 5.5.2.4. France Dried Fruits Market Size and Forecast, by Form (2024-2032) 5.5.3. Germany 5.5.3.1. Germany Dried Fruits Market Size and Forecast, by Type (2024-2032) 5.5.3.2. Germany Dried Fruits Market Size and Forecast, by Application (2024-2032) 5.5.3.3. Germany Dried Fruits Market Size and Forecast, by Nature (2024-2032) 5.5.3.4. Germany Dried Fruits Market Size and Forecast, by Form (2024-2032) 5.5.4. Italy 5.5.4.1. Italy Dried Fruits Market Size and Forecast, by Type (2024-2032) 5.5.4.2. Italy Dried Fruits Market Size and Forecast, by Application (2024-2032) 5.5.4.3. Italy Dried Fruits Market Size and Forecast, by Nature (2024-2032) 5.5.4.4. Italy Dried Fruits Market Size and Forecast, by Form (2024-2032) 5.5.5. Spain 5.5.5.1. Spain Dried Fruits Market Size and Forecast, by Type (2024-2032) 5.5.5.2. Spain Dried Fruits Market Size and Forecast, by Application (2024-2032) 5.5.5.3. Spain Dried Fruits Market Size and Forecast, by Nature (2024-2032) 5.5.5.4. Spain Dried Fruits Market Size and Forecast, by Form (2024-2032) 5.5.6. Sweden 5.5.6.1. Sweden Dried Fruits Market Size and Forecast, by Type (2024-2032) 5.5.6.2. Sweden Dried Fruits Market Size and Forecast, by Application (2024-2032) 5.5.6.3. Sweden Dried Fruits Market Size and Forecast, by Nature (2024-2032) 5.5.6.4. Sweden Dried Fruits Market Size and Forecast, by Form (2024-2032) 5.5.7. Austria 5.5.7.1. Austria Dried Fruits Market Size and Forecast, by Type (2024-2032) 5.5.7.2. Austria Dried Fruits Market Size and Forecast, by Application (2024-2032) 5.5.7.3. Austria Dried Fruits Market Size and Forecast, by Nature (2024-2032) 5.5.7.4. Austria Dried Fruits Market Size and Forecast, by Form (2024-2032) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Dried Fruits Market Size and Forecast, by Type (2024-2032) 5.5.8.2. Rest of Europe Dried Fruits Market Size and Forecast, by Application (2024-2032) 5.5.8.3. Rest of Europe Dried Fruits Market Size and Forecast, by Nature (2024-2032) 5.5.8.4. Rest of Europe Dried Fruits Market Size and Forecast, by Form (2024-2032) 6. Asia Pacific Dried Fruits Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.2. Asia Pacific Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.3. Asia Pacific Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.4. Asia Pacific Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5. Asia Pacific Dried Fruits Market Size and Forecast, by Country (2024-2032) 6.5.1. China 6.5.1.1. China Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.1.2. China Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.1.3. China Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.1.4. China Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5.2. S Korea 6.5.2.1. S Korea Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.2.2. S Korea Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.2.3. S Korea Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.2.4. S Korea Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5.3. Japan 6.5.3.1. Japan Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Japan Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.3.3. Japan Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.3.4. Japan Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5.4. India 6.5.4.1. India Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.4.2. India Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.4.3. India Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.4.4. India Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5.5. Australia 6.5.5.1. Australia Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Australia Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.5.3. Australia Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.5.4. Australia Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5.6. Indonesia 6.5.6.1. Indonesia Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Indonesia Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.6.3. Indonesia Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.6.4. Indonesia Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5.7. Malaysia 6.5.7.1. Malaysia Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Malaysia Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.7.3. Malaysia Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.7.4. Malaysia Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5.8. Vietnam 6.5.8.1. Vietnam Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Vietnam Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.8.3. Vietnam Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.8.4. Vietnam Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5.9. Taiwan 6.5.9.1. Taiwan Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.9.2. Taiwan Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.9.3. Taiwan Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.9.4. Taiwan Dried Fruits Market Size and Forecast, by Form (2024-2032) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Dried Fruits Market Size and Forecast, by Type (2024-2032) 6.5.10.2. Rest of Asia Pacific Dried Fruits Market Size and Forecast, by Application (2024-2032) 6.5.10.3. Rest of Asia Pacific Dried Fruits Market Size and Forecast, by Nature (2024-2032) 6.5.10.4. Rest of Asia Pacific Dried Fruits Market Size and Forecast, by Form (2024-2032) 7. Middle East and Africa Dried Fruits Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Dried Fruits Market Size and Forecast, by Type (2024-2032) 7.2. Middle East and Africa Dried Fruits Market Size and Forecast, by Application (2024-2032) 7.3. Middle East and Africa Dried Fruits Market Size and Forecast, by Nature (2024-2032) 7.4. Middle East and Africa Dried Fruits Market Size and Forecast, by Form (2024-2032) 7.5. Middle East and Africa Dried Fruits Market Size and Forecast, by Country (2024-2032) 7.5.1. South Africa 7.5.1.1. South Africa Dried Fruits Market Size and Forecast, by Type (2024-2032) 7.5.1.2. South Africa Dried Fruits Market Size and Forecast, by Application (2024-2032) 7.5.1.3. South Africa Dried Fruits Market Size and Forecast, by Nature (2024-2032) 7.5.1.4. South Africa Dried Fruits Market Size and Forecast, by Form (2024-2032) 7.5.2. GCC 7.5.2.1. GCC Dried Fruits Market Size and Forecast, by Type (2024-2032) 7.5.2.2. GCC Dried Fruits Market Size and Forecast, by Application (2024-2032) 7.5.2.3. GCC Dried Fruits Market Size and Forecast, by Nature (2024-2032) 7.5.2.4. GCC Dried Fruits Market Size and Forecast, by Form (2024-2032) 7.5.3. Nigeria 7.5.3.1. Nigeria Dried Fruits Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Nigeria Dried Fruits Market Size and Forecast, by Application (2024-2032) 7.5.3.3. Nigeria Dried Fruits Market Size and Forecast, by Nature (2024-2032) 7.5.3.4. Nigeria Dried Fruits Market Size and Forecast, by Form (2024-2032) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Dried Fruits Market Size and Forecast, by Type (2024-2032) 7.5.4.2. Rest of ME&A Dried Fruits Market Size and Forecast, by Application (2024-2032) 7.5.4.3. Rest of ME&A Dried Fruits Market Size and Forecast, by Nature (2024-2032) 7.5.4.4. Rest of ME&A Dried Fruits Market Size and Forecast, by Form (2024-2032) 8. South America Dried Fruits Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Dried Fruits Market Size and Forecast, by Type (2024-2032) 8.2. South America Dried Fruits Market Size and Forecast, by Application (2024-2032) 8.3. South America Dried Fruits Market Size and Forecast, by Nature(2024-2032) 8.4. South America Dried Fruits Market Size and Forecast, by Form (2024-2032) 8.5. South America Dried Fruits Market Size and Forecast, by Country (2024-2032) 8.5.1. Brazil 8.5.1.1. Brazil Dried Fruits Market Size and Forecast, by Type (2024-2032) 8.5.1.2. Brazil Dried Fruits Market Size and Forecast, by Application (2024-2032) 8.5.1.3. Brazil Dried Fruits Market Size and Forecast, by Nature (2024-2032) 8.5.1.4. Brazil Dried Fruits Market Size and Forecast, by Form (2024-2032) 8.5.2. Argentina 8.5.2.1. Argentina Dried Fruits Market Size and Forecast, by Type (2024-2032) 8.5.2.2. Argentina Dried Fruits Market Size and Forecast, by Application (2024-2032) 8.5.2.3. Argentina Dried Fruits Market Size and Forecast, by Nature (2024-2032) 8.5.2.4. Argentina Dried Fruits Market Size and Forecast, by Form (2024-2032) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Dried Fruits Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Rest Of South America Dried Fruits Market Size and Forecast, by Application (2024-2032) 8.5.3.3. Rest Of South America Dried Fruits Market Size and Forecast, by Nature (2024-2032) 8.5.3.4. Rest Of South America Dried Fruits Market Size and Forecast, by Form (2024-2032) 9. Global Dried Fruits Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Dried Fruits Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Kiril Mischeff 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Berrifine A/S 10.3. European Freeze Dry 10.4. Seawind International LLC 10.5. Liogam 10.6. Woodland Foods 10.7. Olam International Limited 10.8. Ocean Spray Cranberries, Inc 10.9. Bergin Fruit and Nut Company, Inc. 10.10. Archer Daniels Midland Company 10.11. Naturz Organics 10.12. Divine Foods 10.13. Graceland Fruit, Inc. 10.14. Döhler 10.15. FutureCeuticals 10.16. Absolute Organic 10.17. Chaucer Foods Ltd 10.18. Sun-Maid Growers of California 10.19. AGRANA Beteiligungs-AG 10.20. Messina Verpakkings 10.21. Others 11. Key Findings 12. Industry Recommendations 13. Dried Fruits Market: Research Methodology 14. Terms and Glossary