The Digital Twin Market size was valued at USD 10.8 Billion in 2023 and the total Digital Twin revenue is expected to grow at a CAGR of 60.4% from 2024 to 2030, reaching nearly USD 120.5 Billion by 2030.Digital Twin Market Overview:

A digital twin is a computer-generated, virtual counterpart of a physical object or system, designed to encompass its entire life cycle. It remains continuously updated through real-time data integration and employs simulation, machine learning, and reasoning techniques to facilitate informed decision-making processes. Engineers optimize a product's performance by altering the physical prototype, which changes at every instance during the design phase, by incorporating digital twins. As a result, a digital prototype developed using a digital twin may be utilized to conduct simulations and be revised at any moment in less time and a lower cost. In manufacturing, a digital twin can be used for configuration management, asset management, process control, performance management, and simulation modelling.To know about the Research Methodology :- Request Free Sample Report Digital Twin is a developing technology that is being supported by advancements in artificial intelligence (AI), the internet of things (IoT), and the availability of massive amounts of data. Despite this, the bulk of industries has yet to embrace and use it. Stakeholders in numerous sectors might utilize digital duplicates of actual things and processes in decision-making processes to boost efficiency and achieve desired results more quickly. Some of the leading key players in the global Digital Twin market include General Electric Company, SAP SE, and Siemens Ltd. They are continuously strategizing on mergers and acquisitions, strategic alliances, joint ventures, and partnerships for the growth of their market shares. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Digital Twin Market.

Digital Twin Market Dynamics:

Increasing Demand for Cloud-Based Platforms and Demand for Cost-Effective Solutions in Industrial Manufacturing bolstering the growth of Digital Twin Market The digital twin market is undergoing substantial growth, propelled by the escalating demand for cloud-based platforms. The inherent benefits of cloud infrastructure, encompassing scalability, flexibility, and accessibility, contribute significantly to the expansion potential of the market. Businesses are leveraging cloud platforms to seamlessly integrate and manage digital twin data, fostering enhanced collaboration and operational streamlining. This trend reflects a positive trajectory for the growth of the Digital Twin Market. The adoption of digital twin technology in industrial manufacturing is fueled by the growing demand for cost-effective solutions. Businesses are actively seeking efficiency and economy in designing, monitoring, and optimizing manufacturing processes. Digital twins, offering a virtual representation for cost-effective prototyping and process optimization, position themselves as key innovations in the industry. This demand emphasizes the market's potential for further growth and penetration in the industrial sector. The digital twin market is significantly shaped by the widespread use of the Industrial Internet of Things (IIoT) in manufacturing and design processes. This integration enhances connectivity, facilitates seamless data exchange, and enables automation. The symbiotic relationship between IIoT and digital twins contributes to the market's share, reflecting an innovative trend in the industry. This dominance enhances operational efficiency, solidifying the market's position and potential for further growth. Challenges in Managing Design Files and Cybersecurity Concerns and Frequent Cyber-Attacks are restraining the Digital Twin Market The global digital twin market encounters a notable restraint in effectively managing design files among suppliers and distributors. The coordination and organization of design files present challenges, impeding the seamless flow of information and collaboration within the digital twin ecosystem. This constraint hinders the optimization of digital twin functionalities, leading to potential inefficiencies in data exchange and collaboration. Addressing these challenges is crucial to mitigate fluctuations and maintain steady growth in the market. Cybersecurity concerns and the prevalence of frequent cyber-attacks constitute significant restraints for the digital twin market. Digital twin systems, handling sensitive data and governing critical processes, are exposed to heightened risks. Ensuring the overall security and reliability of digital twin implementations becomes imperative, necessitating robust cybersecurity measures. Addressing these concerns is crucial for stabilizing the market and overcoming fluctuations caused by cybersecurity threats. The healthcare and pharmaceutical industries have emerged as pivotal drivers for digital twin technology, especially amid the COVID-19 pandemic. Digital twins play a crucial role in monitoring patient health, assessing medication impact, and optimizing pharmaceutical processes. Companies in this space have seized the opportunity to combat health crises by offering innovative solutions, exemplified by Exactcure's digital twin solution to mitigate incorrectly dosed medication. Despite these advancements, companies in the healthcare and pharmaceutical sectors must address challenges related to cybersecurity and effective data management to ensure the successful and secure implementation of digital twin solutions, reinforcing the need for continuous innovation in the industry.

Digital Twin Market Segment Analysis

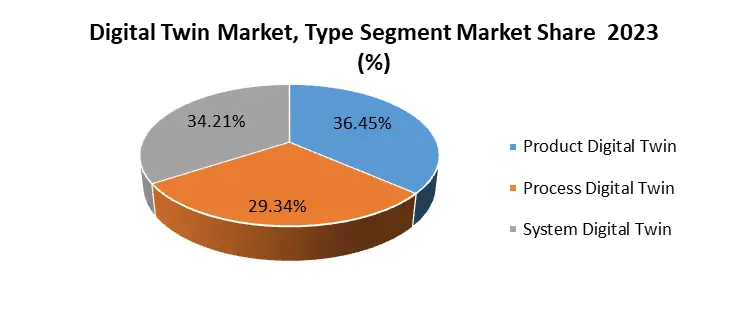

Type: The Type segment, Product Digital Twin serves as a virtual replica of physical products, enabling monitoring, analysis, and optimization throughout their lifecycle. It finds substantial use in manufacturing, automotive, and consumer goods sectors. This segment holds a significant market share, driven by its extensive applications in optimizing product performance and facilitating streamlined product development. Prominent in various regions, with notable growth prospects driven by the increasing demand for product optimization and predictive maintenance. Increasing demand for product optimization, predictive maintenance, and the need for efficient product development processes propel the growth of Product Digital Twin applications. The Process Digital Twin models and simulates workflows, operations, and business processes to enhance efficiency and decision-making. It is widely adopted across industries for achieving process optimization and operational excellence. Enjoying widespread adoption, this segment contributes significantly to the digital twin market, offering insights into refining operational workflows and enhancing business processes. A dominant segment with major shares in various regions, showcasing its role in regional digital twin market growth. Increased focus on operational efficiency, cost reduction, and continuous process innovation are key factors driving the growth of Process Digital Twin applications. The System Digital Twin provides a holistic view of entire systems or ecosystems, offering integrated insights into interconnected products and processes. It is gaining traction, particularly in complex industries such as aerospace, defense, and smart cities. While currently growing, this segment is becoming increasingly important as industries recognize the need for system-level optimization and enhanced collaboration. A prominent segment with major shares regionally, indicating its significant role in regional digital twin market growth. The demand for integrated insights, optimization of system-level performance, and improved collaboration are key drivers for the growth of System Digital Twin applications. Technology: IoT-based Digital Twins segment, integrate with the Internet of Things to enable real-time data collection and analysis, providing enhanced decision-making capabilities. This technology is dominant, widely used across industries, particularly in manufacturing and healthcare. With its broad applications, IoT-based Digital Twins hold a significant market share, addressing the increasing demand for real-time monitoring and data-driven insights. A dominant segment with major shares in various regions, reflecting its crucial role in regional digital twin market growth. The proliferation of IoT devices, coupled with the rising need for real-time monitoring and data analytics, drives the growth of IoT-based Digital Twins. This segment utilizes AR/VR technologies for immersive experiences, allowing users to visualize and interact with digital twins. While still emerging, it is gaining traction in industries like manufacturing and training simulations. Although an emerging technology, AR/VR-based Digital Twins are gaining market share as industries recognize the value of enhanced user experiences and training simulations. A prominent segment with significant regional shares, indicating its increasing importance in regional digital twin market growth. Advancements in AR/VR technologies, coupled with the demand for immersive user experiences and training simulations, are key growth drivers for this segment. Machine Learning-based Digital Twins incorporate machine learning algorithms for predictive analytics, anomaly detection, and continuous learning. This segment is experiencing growing adoption, especially in predictive maintenance and optimization applications. With its applications in predictive analytics, this segment holds a growing market share, addressing the increasing demand for data-driven decision-making. A dominant segment with major regional shares, indicating its vital role in regional digital twin market growth. The increasing focus on predictive analytics, advancements in machine learning, and the need for data-driven decision-making are driving the growth of Machine Learning-based Digital Twins.

Digital Twin Market Regional Analysis

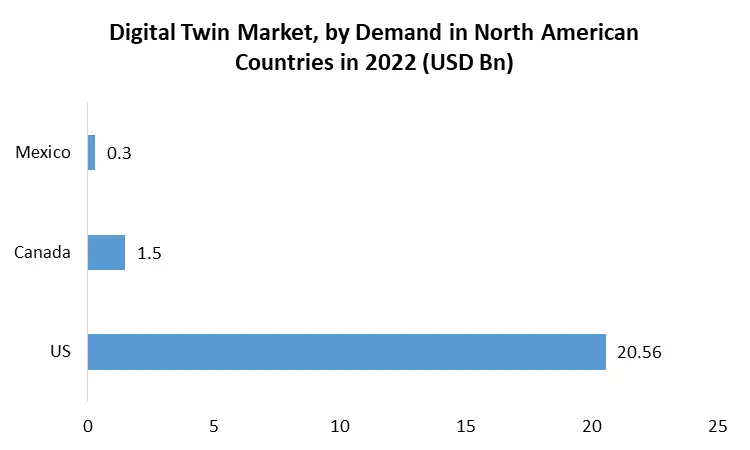

North America stands as a prominent hub in the Digital Twin Market, showcasing a robust emphasis on technological innovation and widespread adoption. The region boasts major industry players and a mature technological ecosystem, contributing significantly to its leadership in digital twin applications. The growth in North America is attributed to factors such as a high degree of digitalization, advanced manufacturing practices, and a strong focus on innovation and operational efficiency. The United States, as a major player in North America, significantly influences the regional growth of the Digital Twin Market. The innovative technological landscape and substantial investments contribute to the expanding market share in the U.S. various segments, including IoT-based Digital Twins and Product Digital Twins, command substantial market shares. The manufacturing and healthcare sectors play a pivotal role in propelling the demand for digital twin technologies in this region. With a well-established industrial landscape, North America experiences dynamic growth in digital twin applications across diverse industries, notably in manufacturing, healthcare, and automotive. The Asia Pacific region is witnessing a rapid surge in the adoption of digital twin technologies, primarily fuelled by the growth of manufacturing and smart infrastructure projects. Emerging economies within the region contribute significantly to the increasing demand for digital twin solutions. IoT-based Digital Twins and Machine Learning-based Digital Twins are gaining prominence, addressing the evolving needs of industries such as automotive, healthcare, and energy. Asia Pacific demonstrates substantial growth in digital twin applications, particularly within the manufacturing sector, where smart production and Industry 4.0 initiatives are at the forefront. The region's digital twin market growth is driven by factors such as a large manufacturing base, government initiatives supporting digitalization, and a growing emphasis on smart city development. Europe emerges as a mature market for digital twin applications, boasting a strong presence in manufacturing, aerospace, and healthcare. The region places a significant focus on sustainable practices, propelling the widespread adoption of digital twin technologies. Process Digital Twins and System Digital Twins hold substantial shares, aligning with Europe's emphasis on efficient business processes and integrated systems. Europe exhibits steady growth in digital twin applications, particularly in precision manufacturing, sustainable practices, and advancements in healthcare systems. Stringent regulatory standards, environmental consciousness, and a collaborative approach to innovation are key contributors to the sustained growth of digital twin applications in Europe. Germany, a key player in the European market, holds a significant share in the Digital Twin Market, driven by its advanced manufacturing practices and emphasis on technological innovation. The Middle East and Africa are emerging as adopters of digital twin technologies, driven by the development of smart cities, infrastructure projects, and a growing focus on digital transformation. IoT-based Digital Twins and System Digital Twins gain traction, addressing the specific needs of urban planning, energy management, and infrastructure development within the region. The region experiences gradual but significant growth in digital twin applications, with an increasing focus on leveraging technology for sustainable development across various sectors. Digital Twin Market Competitive Landscape The Digital Twin market features a dynamic and competitive landscape with various key players striving for market dominance. As industries across sectors increasingly adopt digital twin technologies, the competition intensifies. Here's an overview of some prominent players contributing to the competitiveness of the Digital Twin Market. IBM, a global market player, has recently signed a definitive agreement to acquire Equine Global, an Indonesian-based ERP specialist, and cloud consulting services provider. This move aims to extend Digital Twin Market regional growth in US as IBM Consulting’s resources and capabilities, facilitating business modernization in Indonesia and advancing hybrid cloud and AI strategies in the region. The acquisition positions IBM as a major market share holder, addressing the growing demand for digital transformation services in Indonesia and offering end-to-end advisory services for strategy, implementation, and managed services. IBM is major market share holder key company. IBM, a leading key player, has acquired Manta Software Inc, a data lineage platform, to enhance its capabilities within watsonx.ai, watsonx.data, and watsonx.governance. This acquisition aims to address the increasing importance of data quality and explainability in businesses integrating AI into their workflows. The acquisition strengthens IBM's position as a prominent manufacturer in the AI and data governance space, offering businesses comprehensive visibility into their data environments. IBM, a major market share holder, has entered into a definitive agreement to acquire Apptio Inc., a leader in financial and operational IT management and optimization (FinOps) software, for $4.6 billion. This strategic move is expected to accelerate IBM's IT automation capabilities and enhance business value across technology investments. The acquisition addresses the challenges of managing complex IT environments across hybrid and multi-cloud setups, offering integrated visibility into technology spend. IBM, a global market player, has signed an agreement to acquire Agyla SAS, a cloud professional services firm in France. This acquisition aims to expand IBM Consulting’s localized cloud expertise for French clients, contributing to the company’s hybrid cloud and AI strategy in the region. The move aligns with the increasing demand for trusted partners in hybrid cloud journeys, positioning IBM Consulting as a major market share holder to provide end-to-end services for large-scale digital transformations in France. Siemens, a global market player, and Intel have signed a Memorandum of Understanding to collaborate on driving digitalization and sustainability in microelectronics manufacturing. The collaboration focuses on advancing manufacturing efforts, evolving factory operations, and ensuring cybersecurity. The partnership aims to support a resilient global industry ecosystem, addressing the crucial role of semiconductors in lowering carbon footprints and enabling sustainable solutions. Siemens and Mecalux have partnered to optimize picking tasks in warehouses and logistics centers using artificial intelligence. The solution, based on Siemens Xcelerator, enhances order processing by utilizing Simatic Robot Pick AI technology. The collaboration leverages Siemens' expertise as a leading key player in industrial automation technologies, offering a solution that improves efficiency in order processing in warehouses.Digital Twin Market Scope: Inquire before buying

Global Digital Twin Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 10.8 Bn. Forecast Period 2024 to 2030 CAGR: 60.4% Market Size in 2030: US $ 120.5 Bn. Segments Covered: by Type Product Digital Twin Process Digital Twin System Digital Twin by Technology IoT-based Digital Twins Augmented Reality (AR) & Virtual Reality (VR) Digital Twins Machine Learning-based Digital Twins by End User Industry Manufacturing Healthcare Aerospace and Defence Automotive Energy and Utilities Digital Twin Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Digital Twin Market Key Players:

Major Global Key Players: 1. Huawei Technologies Co., Ltd. (Shenzhen, China) 2. Honeywell International Inc. (Charlotte, North Carolina, USA) Established Key Players in North America: 1. General Electric Company (Boston, Massachusetts, USA) 2. Microsoft Corporation (Redmond, Washington, USA) 3. PTC (Needham, Massachusetts, USA) 4. Alphabet Inc. (Mountain View, California, USA) 5. Dell (Round Rock, Texas, USA) 6. Cisco Systems, Inc. (San Jose, California, USA) 7. IBM Corporation (Armonk, New York, USA) 8. ANSYS (Canonsburg, Pennsylvania, USA) 9. Oracle (Redwood City, California, USA) 10. SWIM.AI (San Jose, California, USA) 11. Rockwell Automation (Milwaukee, Wisconsin, USA) 12. Accenture Plc (Dublin, Ireland) 13. AT&T (Dallas, Texas, USA) 14. Tibco Software Inc. (Palo Alto, California, USA) 15. Schnitger Corporation (San Rafael, California, USA) 16. CSC (Tysons, Virginia, USA) Emerging Manufacturers in Asia Pacific: 1. Wipro Ltd. (Bangalore, Karnataka, India) 2. Forbesindia.com (Mumbai, Maharashtra, India) Prominent Key Players in Europe: 1. Siemens Ltd. (Munich, Germany) 2. SAP SE (Walldorf, Germany) 3. Bosch Software Innovations GmbH (Immenstaad am Bodensee, Germany) 4. AVEVA Group plc (Cambridge, United Kingdom) 5. Dassault Systemes (Vélizy-Villacoublay, France) 6. Capgemini SE (Paris, France) FAQ’s: 1. What is a digital twin in the context of the market? Ans: A digital twin in the market refers to a virtual representation of a physical product, system, or process. It aids in real-time monitoring, analysis, and optimization. 2. How does the digital twin market benefit businesses? Ans: The market benefits businesses by enhancing operational efficiency, predicting maintenance needs, and facilitating data-driven decision-making, leading to cost savings and improved productivity. 3. What industries are leveraging digital twin technology? Ans: Various industries, including manufacturing, healthcare, automotive, and smart cities, are adopting digital twin technology to optimize processes, enhance product development, and improve overall performance. 4. What role does IoT play in the digital twin market? Ans: Internet of Things (IoT) is integral to the digital twin market, enabling the connection of physical assets to their virtual counterparts. This connectivity enhances data collection and analysis for more accurate digital representations. 5. How is the digital twin market addressing cybersecurity concerns? Ans: The market focuses on implementing robust cybersecurity measures to protect sensitive data associated with digital twins, ensuring the secure deployment and operation of virtual models. 6. What factors are driving the growth of the digital twin market? Ans: Factors such as the increasing adoption of IoT, advancements in cloud computing, and the demand for predictive maintenance solutions are driving the growth of the digital twin market.

1. Digital Twin Market: Research Methodology 2. Digital Twin Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Digital Twin Market: Dynamics 3.1. Digital Twin Market Trends by Region 3.1.1. North America Digital Twin Market Trends 3.1.2. Europe Digital Twin Market Trends 3.1.3. Asia Pacific Digital Twin Market Trends 3.1.4. Middle East and Africa Digital Twin Market Trends 3.1.5. South America Digital Twin Market Trends 3.2. Digital Twin Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Digital Twin Market Drivers 3.2.1.2. North America Digital Twin Market Restraints 3.2.1.3. North America Digital Twin Market Opportunities 3.2.1.4. North America Digital Twin Market Challenges 3.2.2. Europe 3.2.2.1. Europe Digital Twin Market Drivers 3.2.2.2. Europe Digital Twin Market Restraints 3.2.2.3. Europe Digital Twin Market Opportunities 3.2.2.4. Europe Digital Twin Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Digital Twin Market Drivers 3.2.3.2. Asia Pacific Digital Twin Market Restraints 3.2.3.3. Asia Pacific Digital Twin Market Opportunities 3.2.3.4. Asia Pacific Digital Twin Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Digital Twin Market Drivers 3.2.4.2. Middle East and Africa Digital Twin Market Restraints 3.2.4.3. Middle East and Africa Digital Twin Market Opportunities 3.2.4.4. Middle East and Africa Digital Twin Market Challenges 3.2.5. South America 3.2.5.1. South America Digital Twin Market Drivers 3.2.5.2. South America Digital Twin Market Restraints 3.2.5.3. South America Digital Twin Market Opportunities 3.2.5.4. South America Digital Twin Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Digital Twin Market 3.8. Analysis of Government Schemes and Initiatives For Digital Twin Market 3.9. The Global Pandemic Impact on Digital Twin Market 4. Digital Twin Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Digital Twin Market Size and Forecast, by Type (2023-2030) 4.1.1. Product Digital Twin 4.1.2. Process Digital Twin 4.1.3. System Digital Twin 4.2. Digital Twin Market Size and Forecast, by Technology (2023-2030) 4.2.1. IoT-based Digital Twins 4.2.2. Augmented Reality (AR) & Virtual Reality (VR) Digital Twins 4.2.3. Machine Learning-based Digital Twins 4.3. Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 4.3.1. Manufacturing 4.3.2. Healthcare 4.3.3. Aerospace and Defense 4.3.4. Automotive 4.3.5. Energy and Utilities 4.4. Digital Twin Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Digital Twin Market Size and Forecast, by Type (2023-2030) 5.1.1. Product Digital Twin 5.1.2. Process Digital Twin 5.1.3. System Digital Twin 5.2. North America Digital Twin Market Size and Forecast, by Technology (2023-2030) 5.2.1. IoT-based Digital Twins 5.2.2. Augmented Reality (AR) & Virtual Reality (VR) Digital Twins 5.2.3. Machine Learning-based Digital Twins 5.3. North America Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 5.3.1. Manufacturing 5.3.2. Healthcare 5.3.3. Aerospace and Defense 5.3.4. Automotive 5.3.5. Energy and Utilities 5.4. North America Digital Twin Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Digital Twin Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1. Product Digital Twin 5.4.1.1.2. Process Digital Twin 5.4.1.1.3. System Digital Twin 5.4.1.2. United States Digital Twin Market Size and Forecast, by Technology (2023-2030) 5.4.1.2.1. IoT-based Digital Twins 5.4.1.2.2. Augmented Reality (AR) & Virtual Reality (VR) Digital Twins 5.4.1.2.3. Machine Learning-based Digital Twins 5.4.1.3. United States Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 5.4.1.3.1. Manufacturing 5.4.1.3.2. Healthcare 5.4.1.3.3. Aerospace and Defense 5.4.1.3.4. Automotive 5.4.1.3.5. Energy and Utilities 5.4.2. Canada 5.4.2.1. Canada Digital Twin Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1. Product Digital Twin 5.4.2.1.2. Process Digital Twin 5.4.2.1.3. System Digital Twin 5.4.2.2. Canada Digital Twin Market Size and Forecast, by Technology (2023-2030) 5.4.2.2.1. IoT-based Digital Twins 5.4.2.2.2. Augmented Reality (AR) & Virtual Reality (VR) Digital Twins 5.4.2.2.3. Machine Learning-based Digital Twins 5.4.2.3. Canada Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 5.4.2.3.1. Manufacturing 5.4.2.3.2. Healthcare 5.4.2.3.3. Aerospace and Defense 5.4.2.3.4. Automotive 5.4.2.3.5. Energy and Utilities 5.4.3. Mexico 5.4.3.1. Mexico Digital Twin Market Size and Forecast, by Type (2023-2030) 5.4.3.1.1. Product Digital Twin 5.4.3.1.2. Process Digital Twin 5.4.3.1.3. System Digital Twin 5.4.3.2. Mexico Digital Twin Market Size and Forecast, by Technology (2023-2030) 5.4.3.2.1. IoT-based Digital Twins 5.4.3.2.2. Augmented Reality (AR) & Virtual Reality (VR) Digital Twins 5.4.3.2.3. Machine Learning-based Digital Twins 5.4.3.3. Mexico Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 5.4.3.3.1. Manufacturing 5.4.3.3.2. Healthcare 5.4.3.3.3. Aerospace and Defense 5.4.3.3.4. Automotive 5.4.3.3.5. Energy and Utilities 6. Europe Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Digital Twin Market Size and Forecast, by Type (2023-2030) 6.2. Europe Digital Twin Market Size and Forecast, by Technology (2023-2030) 6.3. Europe Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 6.4. Europe Digital Twin Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Digital Twin Market Size and Forecast, by Type (2023-2030) 6.4.1.2. United Kingdom Digital Twin Market Size and Forecast, by Technology (2023-2030) 6.4.1.3. United Kingdom Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 6.4.2. France 6.4.2.1. France Digital Twin Market Size and Forecast, by Type (2023-2030) 6.4.2.2. France Digital Twin Market Size and Forecast, by Technology (2023-2030) 6.4.2.3. France Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Digital Twin Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Germany Digital Twin Market Size and Forecast, by Technology (2023-2030) 6.4.3.3. Germany Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Digital Twin Market Size and Forecast, by Type (2023-2030) 6.4.4.2. Italy Digital Twin Market Size and Forecast, by Technology (2023-2030) 6.4.4.3. Italy Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Digital Twin Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Spain Digital Twin Market Size and Forecast, by Technology (2023-2030) 6.4.5.3. Spain Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Digital Twin Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Sweden Digital Twin Market Size and Forecast, by Technology (2023-2030) 6.4.6.3. Sweden Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Digital Twin Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Austria Digital Twin Market Size and Forecast, by Technology (2023-2030) 6.4.7.3. Austria Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Digital Twin Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Rest of Europe Digital Twin Market Size and Forecast, by Technology (2023-2030) 6.4.8.3. Rest of Europe Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7. Asia Pacific Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Digital Twin Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.3. Asia Pacific Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4. Asia Pacific Digital Twin Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.1.2. China Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.1.3. China Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.2.2. S Korea Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.2.3. S Korea Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Japan Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.3.3. Japan Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4.4. India 7.4.4.1. India Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.4.2. India Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.4.3. India Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.5.2. Australia Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.5.3. Australia Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.6.2. Indonesia Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.6.3. Indonesia Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.7.2. Malaysia Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.7.3. Malaysia Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.8.2. Vietnam Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.8.3. Vietnam Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.9.2. Taiwan Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.9.3. Taiwan Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Digital Twin Market Size and Forecast, by Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Digital Twin Market Size and Forecast, by Technology (2023-2030) 7.4.10.3. Rest of Asia Pacific Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 8. Middle East and Africa Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Digital Twin Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Digital Twin Market Size and Forecast, by Technology (2023-2030) 8.3. Middle East and Africa Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 8.4. Middle East and Africa Digital Twin Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Digital Twin Market Size and Forecast, by Type (2023-2030) 8.4.1.2. South Africa Digital Twin Market Size and Forecast, by Technology (2023-2030) 8.4.1.3. South Africa Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Digital Twin Market Size and Forecast, by Type (2023-2030) 8.4.2.2. GCC Digital Twin Market Size and Forecast, by Technology (2023-2030) 8.4.2.3. GCC Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Digital Twin Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Nigeria Digital Twin Market Size and Forecast, by Technology (2023-2030) 8.4.3.3. Nigeria Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Digital Twin Market Size and Forecast, by Type (2023-2030) 8.4.4.2. Rest of ME&A Digital Twin Market Size and Forecast, by Technology (2023-2030) 8.4.4.3. Rest of ME&A Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 9. South America Digital Twin Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Digital Twin Market Size and Forecast, by Type (2023-2030) 9.2. South America Digital Twin Market Size and Forecast, by Technology (2023-2030) 9.3. South America Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 9.4. South America Digital Twin Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Digital Twin Market Size and Forecast, by Type (2023-2030) 9.4.1.2. Brazil Digital Twin Market Size and Forecast, by Technology (2023-2030) 9.4.1.3. Brazil Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Digital Twin Market Size and Forecast, by Type (2023-2030) 9.4.2.2. Argentina Digital Twin Market Size and Forecast, by Technology (2023-2030) 9.4.2.3. Argentina Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Digital Twin Market Size and Forecast, by Type (2023-2030) 9.4.3.2. Rest Of South America Digital Twin Market Size and Forecast, by Technology (2023-2030) 9.4.3.3. Rest Of South America Digital Twin Market Size and Forecast, by End-user Industry (2023-2030) 10. Global Digital Twin Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Digital Twin Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. General Electric Company 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. General Electric Company 11.3. SAP SE 11.4. Forbesindia.com 11.5. Siemens Ltd. 11.6. Tibco Software Inc. 11.7. Microsoft Corporation 11.8. Schnitger Corporation 11.9. PTC 11.10. Alphabet Inc. 11.11. Dell 11.12. Bosch Software Innovations GmbH 11.13. Cisco Systems, Inc. 11.14. CSC 11.15. AT&T 11.16. IBM Corporation 11.17. ANSYS 11.18. Oracle 11.19. SWIM.AI 11.20. ABB 11.21. AVEVA Group plc 11.22. Dassault Systemes 11.23. Wipro Ltd. 11.24. Rockwell Automation 11.25. Capgemini SE 11.26. Bentley Systems 11.27. Accenture Plc 12. Key Findings 13. Industry Recommendations