The Diabetes Foot Ulcers Treatment Market was valued at USD 8.79 Bn in 2024, and the total revenue of the Diabetes Foot Ulcers Treatment Market is expected to grow at a CAGR of 7.1% from 2025 to 2032, reaching nearly USD 15.22 Bn by 2032, driven by rising diabetes prevalence, advanced wound care therapies, and innovative medical devices.Diabetes Foot Ulcers Treatment Market Overview:

The Diabetes Foot Ulcers Treatment market is a dynamic sector driven by the increasing demand for natural colorants, nutritional supplements, and functional ingredients. Diabetes Foot Ulcers Treatment, natural pigments present in plants and microorganisms, play a pivotal role in the vibrant colors of fruits and vegetables while offering notable antioxidant properties. The global Diabetes Foot Ulcers Treatment market experiences robust growth, fueled by rising awareness of health benefits and the surging demand for clean-label products in the food and beverage industry. These natural pigments find applications not only in the food sector but also in pharmaceuticals, cosmetics, animal feed, and the nutraceutical industry. Factors contributing to the growth of the Diabetes Foot Ulcers Treatment market include the expanding application scope, the trend towards natural and organic products, and increasing consumer preference for health-conscious choices. The market is further propelled by the regulatory landscape, with stringent regulations favoring natural ingredients over synthetic additives. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Diabetes Foot Ulcers Treatment Market.To know about the Research Methodology :- Request Free Sample Report Competitive Landscapes:

Diabetes Foot Ulcers Treatment Market Dynamics

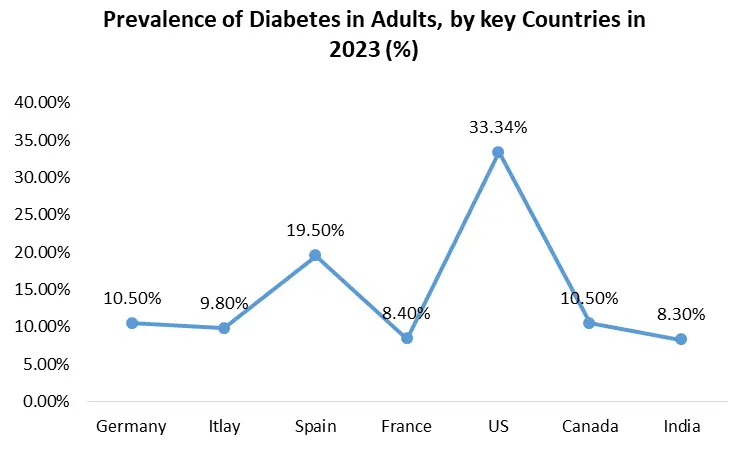

New treatments set to replace conventional diabetic foot ulcers treatment Diabetic foot ulcer (DFU) is a serious complication of diabetes mellitus, affecting roughly 25% of diabetic patients. Various traditional therapies are implemented to effectively treat DFU. Emerging technologies such as bioprinting and electrospinning, present an exciting opportunity to improve current treatment strategies through the development of 3D scaffolds. Even with this comprehensive approach, there is still room for improvement in DFU outcomes. Nowadays, several adjuvant therapies have been studied to reduce DFU healing times and amputation rates. Stakeholders launch new healthcare devices to gain an advantage in the current competitive language Quality improvement in healthcare, and the development of medical devices having the most prevalent treatment approaches are driving the global diabetes foot ulcer treatment market. Revolutionized management in healthcare settings and local wound care devices with surgical debridement provide lucrative opportunities for the global Diabetes Foot Ulcers Treatment market. Ongoing advancements in medical technologies, particularly in wound care and regenerative therapies, open doors for more effective and innovative treatment options for diabetes foot ulcers. This includes the development of advanced medical devices and treatment modalities aimed at improving wound healing outcomes. The integration of these technologies can contribute to the growth of the Diabetes Foot Ulcers Treatment Market. The global surge in the diabetic population acts as a catalyst for the expansion of the diabetes foot ulcers treatment market. The increasing prevalence of diabetes provides a larger patient pool, fostering opportunities for pharmaceutical companies and healthcare providers to offer specialized treatment solutions. This growing patient base contributes to the market potential of diabetes foot ulcers treatment. Rising awareness among patients and healthcare professionals regarding the significance of early detection and comprehensive treatment of foot ulcers creates a demand for specialized products and therapies. This increased awareness encourages proactive measures, potentially reducing the severity of foot ulcers. As awareness grows, the Diabetes Foot Ulcers Treatment Market witnesses increased penetration. Collaborations and partnerships between pharmaceutical companies, research institutions, and healthcare providers are pivotal in accelerating research and development efforts. Such collaborations contribute to the discovery of novel treatment modalities, therapeutic approaches, and innovative solutions for diabetes foot ulcers. Collaborative research efforts drive innovation in the industry and lead to the emergence of new trends. The integration of telemedicine and remote monitoring technologies offers opportunities to enhance patient engagement and provide timely intervention. These technologies can play a crucial role in reducing the severity and complications associated with diabetes foot ulcers by enabling remote monitoring of patients and facilitating virtual consultations. The incorporation of telemedicine contributes to emerging trends in the Diabetes Foot Ulcers Treatment Market.

Diabetes Foot Ulcers Treatment Market Segment Analysis

Based on Treatment Type, the Global Diabetes Foot Ulcers Treatment Market is segmented into Wound Care Dressing, Wound Care Devices, Active Therapies, Home Health Care and Others. The Wound Care Dressing segment dominated the market in 2024 and is expected to command a market share of xx% by 2032. Recent developments in wound dressings and biosensing may allow for the quantitative, real-time representation of the wound environment, including exudate levels, pathogen concentrations, and tissue regeneration. The development of such sensing capability could enable more strategic, personalised care at the onset of ulceration and limit the infection leading to amputation. Currently, there is a wide variety of commercially available polymeric wound dressings that have proven to enhance healing. Treatment strategies, along with the unique combination of comfort, promotion of reepithelialisation, and prevention of further trauma, are showing the treatment development in the sector. The modern bandage has been used for recent wound care techniques and shows the advancement in the healthcare sector. The government spent billions of dollars and endless hours pouring into research geared towards the development of the latest wound dressing innovations. There are dressing techniques and materials aplenty for the management of both acute and chronic non-healing wounds. Manufacturers have been developing modern dressings to manipulate the wound environment. A hugely diversified range of products available in the current market and an appropriate selection process for the dressing of any wound are driving the global diabetes foot ulcer treatment market. Based on End-User, the hospital segment commanded the largest share of xx% in the global diabetic foot ulcer treatment market. The hospital management promotes the shortest, safest hospital stay and provides an effective transition out of the hospital that prevents acute complications and readmission. Hospitals and local health systems involve diabetes specialist teams in the recovery phase and winter planning. The Long-Term Plan commits to ensuring universal coverage of diabetes inpatient specialist nurse teams are urgently actioned for effective treatment routines. Diabetes Inpatient teams are deployed effectively to maximise their value and provide safe, effective care for people with diabetes. Technology such as web-linked glucose meters, ketone meters, electronic patient records, inpatient diabetes dashboards, and video call equipment is available in all hospitals. Hospitals and local health systems provide appropriate support and protection for staff's physical and mental well-being.Diabetes Foot Ulcers Treatment Market Regional Analysis

North America, particularly the US, plays a pivotal role in the Diabetes Foot Ulcers Treatment Market, showcasing robust regional growth. The well-established healthcare infrastructure in the US, coupled with a high prevalence of diabetes, contributes significantly to the market's advancement. The region's focus on preventive diabetic care and continuous investments in research and development underlines its position as a key player in the global diabetes foot ulcers treatment landscape. The Asia Pacific region, with a spotlight on countries like India, China, and Indonesia, is witnessing dynamic growth in diabetes foot ulcers treatment. The rising diabetic population, fuelled by lifestyle changes and urbanization, enhances the market potential in this region. Increasing awareness campaigns, coupled with improvements in healthcare infrastructure, propel Asia Pacific as a key contributor to the global Market. Europe, marked by mature yet significant markets like Germany, France, and the United Kingdom, holds a notable market share in diabetes foot ulcers treatment. The region's high prevalence of diabetes aligns with a strong emphasis on research and development. Collaborations between pharmaceutical companies and research institutions further solidify Europe's position in adopting innovative treatment approaches. This collaborative landscape contributes to the market share of diabetes foot ulcers treatment in Europe. The Middle East and Africa are experiencing a surge in awareness about diabetes foot ulcers, leading to an increased focus on specialized treatments. The region, including countries in the Gulf Cooperation Council (GCC), is witnessing significant investments in healthcare, contributing to substantial regional growth in the Market. The unique dynamics of MEA, characterized by increasing healthcare infrastructure and awareness campaigns, position it as an emerging player in the global market.Diabetes Foot Ulcers Treatment Market Scope: Inquire before buying

Global Diabetes Foot Ulcers Treatment Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 8.79 Bn. Forecast Period 2025 to 2032 CAGR: 7.1% Market Size in 2032: USD 15.22 Bn. Segments Covered: by Ulcer Type Neuropathic Ulcer Ischemic Ulcers Neuro-ischemic Ulcer by Treatment Type Wound Care Dressing Wound Care Devices Active Therapies Home Health Care Others by End User Hospitals Clinics Ambulatory Surgical Centers Homecare Settings Diabetes Foot Ulcers Treatment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Diabetes Foot Ulcers Treatment Market, Key Players

Major Global Key Players: 1. Medtronic plc (Dublin, Ireland) 2. Becton, Dickinson and Company (BD) (Franklin Lakes, New Jersey, United States) 3. Cardinal Health, Inc. (Dublin, Ohio, United States) 4. Integra LifeSciences Corporation (Princeton, New Jersey, United States) 5. Ethicon, Inc. (a subsidiary of Johnson & Johnson) (Somerville, New Jersey, United States) 6. Misonix, Inc. (Farmingdale, New York, United States) 7. Organogenesis, Inc.(Canton, Massachusetts, United States) 8. Dermagraft, a subsidiary of Organogenesis (Canton, Massachusetts, United States) 9. Osiris Therapeutics, Inc. (Columbia, Maryland, United States) 10. Smith & Nephew plc (for regions other than Europe) (London, United Kingdom) Leading Key Players in North America: 1. Johnson & Johnson (United States) 2. 3M Healthcare (United States) 3. Acelity L.P. Inc. (United States) Market Follower key Players in Europe: 1. Smith & Nephew plc (United Kingdom) 2. Mölnlycke Health Care AB (Sweden) 3. ConvaTec Group Plc (United Kingdom) Prominent Key player Asia Pacific: 1. Coloplast A/S (Denmark) 2. Terumo Corporation (Japan) 3. B. Braun Melsungen AG (Germany) Leading key player in Middle East & Africa: 1. Smith & Nephew (South Africa) 2. Mundipharma International Limited (Singapore)FAQ’s:

1. What is the Diabetes Foot Ulcers Treatment Market? Ans: The Diabetes Foot Ulcers Treatment Market refers to the industry focused on developing and providing medical solutions, therapies, and products for the effective treatment of foot ulcers in diabetic patients. 2. What Factors Contribute to Market Growth? Ans: Key growth factors include technological advancements, a growing diabetic population, increased awareness about early detection, collaborative research efforts, and the integration of telemedicine and remote monitoring technologies. 3. Which Regions Show Significant Market Growth? Ans: North America, Asia Pacific, Europe, the Middle East and Africa exhibit significant growth in the Diabetes Foot Ulcers Treatment Market. These regions are characterised by varying healthcare infrastructures and diabetes prevalence. 4. Who are the Key Players in the Diabetes Foot Ulcers Treatment Market? Ans: Major players in the market include Johnson & Johnson, 3M Healthcare, Acelity L.P. Inc., Smith & Nephew plc, Mölnlycke Health Care AB, ConvaTec Group Plc, Coloplast A/S, Terumo Corporation, and B. Braun Melsungen AG, among others. 5. What Challenges Does the Market Face? Ans: Challenges include high treatment costs, limited reimbursement policies, patient compliance issues, the risk of infections, healthcare infrastructure disparities, and regulatory hurdles in bringing new treatments to the market.

1. Diabetes Foot Ulcers Treatment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Diabetes Foot Ulcers Treatment Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Diabetes Foot Ulcers Treatment Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Diabetes Foot Ulcers Treatment Market: Dynamics 3.1. Diabetes Foot Ulcers Treatment Market Trends by Region 3.1.1. North America Diabetes Foot Ulcers Treatment Market Trends 3.1.2. Europe Diabetes Foot Ulcers Treatment Market Trends 3.1.3. Asia Pacific Diabetes Foot Ulcers Treatment Market Trends 3.1.4. Middle East and Africa Diabetes Foot Ulcers Treatment Market Trends 3.1.5. South America Diabetes Foot Ulcers Treatment Market Trends 3.2. Diabetes Foot Ulcers Treatment Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Diabetes Foot Ulcers Treatment Market Drivers 3.2.1.2. North America Diabetes Foot Ulcers Treatment Market Restraints 3.2.1.3. North America Diabetes Foot Ulcers Treatment Market Opportunities 3.2.1.4. North America Diabetes Foot Ulcers Treatment Market Challenges 3.2.2. Europe 3.2.2.1. Europe Diabetes Foot Ulcers Treatment Market Drivers 3.2.2.2. Europe Diabetes Foot Ulcers Treatment Market Restraints 3.2.2.3. Europe Diabetes Foot Ulcers Treatment Market Opportunities 3.2.2.4. Europe Diabetes Foot Ulcers Treatment Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Diabetes Foot Ulcers Treatment Market Drivers 3.2.3.2. Asia Pacific Diabetes Foot Ulcers Treatment Market Restraints 3.2.3.3. Asia Pacific Diabetes Foot Ulcers Treatment Market Opportunities 3.2.3.4. Asia Pacific Diabetes Foot Ulcers Treatment Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Diabetes Foot Ulcers Treatment Market Drivers 3.2.4.2. Middle East and Africa Diabetes Foot Ulcers Treatment Market Restraints 3.2.4.3. Middle East and Africa Diabetes Foot Ulcers Treatment Market Opportunities 3.2.4.4. Middle East and Africa Diabetes Foot Ulcers Treatment Market Challenges 3.2.5. South America 3.2.5.1. South America Diabetes Foot Ulcers Treatment Market Drivers 3.2.5.2. South America Diabetes Foot Ulcers Treatment Market Restraints 3.2.5.3. South America Diabetes Foot Ulcers Treatment Market Opportunities 3.2.5.4. South America Diabetes Foot Ulcers Treatment Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Diabetes Foot Ulcers Treatment Industry 3.8. Analysis of Government Schemes and Initiatives For Diabetes Foot Ulcers Treatment Industry 3.9. Diabetes Foot Ulcers Treatment Market Trade Analysis 3.10. The Global Pandemic Impact on Diabetes Foot Ulcers Treatment Market 4. Diabetes Foot Ulcers Treatment Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 4.1.1. Neuropathic Ulcer 4.1.2. Ischemic Ulcers 4.1.3. Neuro-ischemic Ulcer 4.2. Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 4.2.1. Wound Care Dressing 4.2.2. Wound Care Devices 4.2.3. Active Therapies 4.2.4. Home Health Care 4.2.5. Others 4.3. Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 4.3.1. Hospitals 4.3.2. Clinics 4.3.3. Ambulatory Surgical Centers 4.3.4. Homecare Settings 4.4. Diabetes Foot Ulcers Treatment Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Diabetes Foot Ulcers Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 5.1.1. Neuropathic Ulcer 5.1.2. Ischemic Ulcers 5.1.3. Neuro-ischemic Ulcer 5.2. North America Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 5.2.1. Wound Care Dressing 5.2.2. Wound Care Devices 5.2.3. Active Therapies 5.2.4. Home Health Care 5.2.5. Others 5.3. North America Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 5.3.1. Hospitals 5.3.2. Clinics 5.3.3. Ambulatory Surgical Centers 5.3.4. Homecare Settings 5.4. North America Diabetes Foot Ulcers Treatment Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 5.4.1.1.1. Neuropathic Ulcer 5.4.1.1.2. Ischemic Ulcers 5.4.1.1.3. Neuro-ischemic Ulcer 5.4.1.2. United States Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 5.4.1.2.1. Wound Care Dressing 5.4.1.2.2. Wound Care Devices 5.4.1.2.3. Active Therapies 5.4.1.2.4. Home Health Care 5.4.1.2.5. Others 5.4.1.3. United States Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 5.4.1.3.1. Hospitals 5.4.1.3.2. Clinics 5.4.1.3.3. Ambulatory Surgical Centers 5.4.1.3.4. Homecare Settings 5.4.2. Canada 5.4.2.1. Canada Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 5.4.2.1.1. Neuropathic Ulcer 5.4.2.1.2. Ischemic Ulcers 5.4.2.1.3. Neuro-ischemic Ulcer 5.4.2.2. Canada Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 5.4.2.2.1. Wound Care Dressing 5.4.2.2.2. Wound Care Devices 5.4.2.2.3. Active Therapies 5.4.2.2.4. Home Health Care 5.4.2.2.5. Others 5.4.2.3. Canada Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 5.4.2.3.1. Hospitals 5.4.2.3.2. Clinics 5.4.2.3.3. Ambulatory Surgical Centers 5.4.2.3.4. Homecare Settings 5.4.3. Mexico 5.4.3.1. Mexico Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 5.4.3.1.1. Neuropathic Ulcer 5.4.3.1.2. Ischemic Ulcers 5.4.3.1.3. Neuro-ischemic Ulcer 5.4.3.2. Mexico Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 5.4.3.2.1. Wound Care Dressing 5.4.3.2.2. Wound Care Devices 5.4.3.2.3. Active Therapies 5.4.3.2.4. Home Health Care 5.4.3.2.5. Others 5.4.3.3. Mexico Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 5.4.3.3.1. Hospitals 5.4.3.3.2. Clinics 5.4.3.3.3. Ambulatory Surgical Centers 5.4.3.3.4. Homecare Settings 6. Europe Diabetes Foot Ulcers Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 6.2. Europe Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 6.3. Europe Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 6.4. Europe Diabetes Foot Ulcers Treatment Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 6.4.1.2. United Kingdom Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 6.4.1.3. United Kingdom Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 6.4.2. France 6.4.2.1. France Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 6.4.2.2. France Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 6.4.2.3. France Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 6.4.3.2. Germany Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 6.4.3.3. Germany Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 6.4.4.2. Italy Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 6.4.4.3. Italy Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 6.4.5.2. Spain Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 6.4.5.3. Spain Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 6.4.6.2. Sweden Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 6.4.6.3. Sweden Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 6.4.7.2. Austria Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 6.4.7.3. Austria Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 6.4.8.2. Rest of Europe Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 6.4.8.3. Rest of Europe Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Diabetes Foot Ulcers Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.2. Asia Pacific Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.3. Asia Pacific Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4. Asia Pacific Diabetes Foot Ulcers Treatment Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.1.2. China Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.1.3. China Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.2.2. S Korea Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.2.3. S Korea Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.3.2. Japan Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.3.3. Japan Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4.4. India 7.4.4.1. India Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.4.2. India Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.4.3. India Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.5.2. Australia Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.5.3. Australia Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.6.2. Indonesia Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.6.3. Indonesia Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.7.2. Malaysia Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.7.3. Malaysia Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.8.2. Vietnam Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.8.3. Vietnam Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.9.2. Taiwan Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.9.3. Taiwan Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 7.4.10.3. Rest of Asia Pacific Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Diabetes Foot Ulcers Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 8.2. Middle East and Africa Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 8.3. Middle East and Africa Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 8.4. Middle East and Africa Diabetes Foot Ulcers Treatment Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 8.4.1.2. South Africa Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 8.4.1.3. South Africa Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 8.4.2.2. GCC Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 8.4.2.3. GCC Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 8.4.3.2. Nigeria Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 8.4.3.3. Nigeria Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 8.4.4.2. Rest of ME&A Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 8.4.4.3. Rest of ME&A Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 9. South America Diabetes Foot Ulcers Treatment Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 9.2. South America Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 9.3. South America Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User(2024-2032) 9.4. South America Diabetes Foot Ulcers Treatment Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 9.4.1.2. Brazil Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 9.4.1.3. Brazil Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 9.4.2.2. Argentina Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 9.4.2.3. Argentina Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Diabetes Foot Ulcers Treatment Market Size and Forecast, by Ulcer Type (2024-2032) 9.4.3.2. Rest Of South America Diabetes Foot Ulcers Treatment Market Size and Forecast, by Treatment Type (2024-2032) 9.4.3.3. Rest Of South America Diabetes Foot Ulcers Treatment Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Medtronic plc (Dublin, Ireland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Becton, Dickinson and Company (BD) (Franklin Lakes, New Jersey, United States) 10.3. Cardinal Health, Inc. (Dublin, Ohio, United States) 10.4. Integra LifeSciences Corporation (Princeton, New Jersey, United States) 10.5. Ethicon, Inc. (a subsidiary of Johnson & Johnson) (Somerville, New Jersey, United States) 10.6. Misonix, Inc. (Farmingdale, New York, United States) 10.7. Organogenesis, Inc.(Canton, Massachusetts, United States) 10.8. Dermagraft, a subsidiary of Organogenesis (Canton, Massachusetts, United States) 10.9. Osiris Therapeutics, Inc. (Columbia, Maryland, United States) 10.10. Smith & Nephew plc (for regions other than Europe) (London, United Kingdom) 10.11. Johnson & Johnson (United States) 10.12. 3M Healthcare (United States) 10.13. Acelity L.P. Inc. (United States) 10.14. Smith & Nephew plc (United Kingdom) 10.15. Mölnlycke Health Care AB (Sweden) 10.16. ConvaTec Group Plc (United Kingdom) 10.17. Coloplast A/S (Denmark) 10.18. Terumo Corporation (Japan) 10.19. B. Braun Melsungen AG (Germany) 10.20. Smith & Nephew (South Africa) 10.21. Mundipharma International Limited (Singapore) 11. Key Findings 12. Industry Recommendations 13. Diabetes Foot Ulcers Treatment Market: Research Methodology 14. Terms and Glossary