Cytomegalovirus Treatment Market size was valued at US$ 479.2 Mn. in 2022 and the total revenue is expected to grow at a CAGR of 6.1% through 2022 to 2029, reaching nearly US$ 725.4 Mn.Cytomegalovirus Treatment Market Overview:

The cytomegalovirus, which is related to the herpes simplex viruses and causes chickenpox and mononucleosis, is a common herpes virus. CMV is conveyed through body fluids such as blood, saliva, tears, breast milk, urine, sperm, and vaginal secretions and infects persons of all ages. To treat CMV infections, antiviral drugs and antiviral combinations are employed.To know about the Research Methodology :- Request Free Sample Report

Cytomegalovirus Treatment Market Dynamics:

Immunodeficiency is the most important and effective method for preventing CMV infection because it increases the risk of infection and reactivation. The widespread use of combination antiviral medication is lowering HIV infection rates among humans. Direct-acting antiviral drugs combined with cART have an impact on immunological reconstitution and is expected to boost the global Cytomegalovirus Treatment market. The Prevalence of Congenital CMV Infection is increasing Congenital Cytomegalovirus infection affects about one percent of all live births. Although the majority of instances are asymptomatic, almost 5–10 percent of infants with congenital CMV will develop symptoms. When a new-born is infected with CMV, the interferon response is reduced compared to when an adult is infected. During pregnancy, CMV infection and the risk of reactivation of cytomegalovirus infection have been described. Congenital CMV infection can also occur as a result of these factors. Infected new-borns have a terrible prognosis, with a high risk of mental deficiencies, hearing loss, preterm, hepatosplenomegaly, and jaundice. Congenital CMV infection is linked to morbidity and mortality, stressing the need for cytomegalovirus treatment and immunisation to prevent CMV infection. Antiviral drugs like ganciclovir and valganciclovir lower the chance of hearing loss. Because of their oral bioavailability, efficacy, and low toxicity, ganciclovir and valganciclovir are advancements in CMV treatment. There is a need for new medications, as there are currently only a few research projects devoted to anti-cytomegalovirus treatment. CMV Retinitis in AIDS Patients is expected to drive the market growth for Cytomegalovirus Treatment As the rising number of instances of CMV retinitis, the cytomegalovirus treatment market is expected to grow rapidly. In other immunocompromised groups, CMV retinitis is a somewhat rare manifestation of viral illness. In people with AIDS, it is the first sign of CMV infection. Cytomegalovirus retinitis develops in up to 25% of AIDS patients. Necrotizing retinitis is a symptom of cytomegalovirus retinitis, which can lead to retinal organisation and blindness. CMV retinitis and other manifestations of cytomegalovirus illness in HIV-1 patients are opportunistic infections that occur when CD4+ cell numbers are exceedingly low. The market for CMV treatment will be driven by high-value-added active antiretroviral therapy. The rising need for CMV treatment, owing to the rising prevalence of cytomegalovirus retinitis in AIDS patients, is driving the global cytomegalovirus treatment market.Cytomegalovirus Treatment Market Segment Analysis:

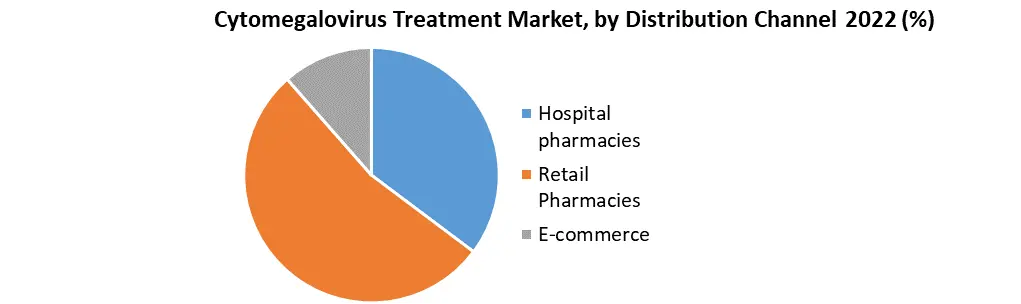

Based on the Application, the market is segmented into Stem Cell Transplantation, Organ Transplantation, Congenital CMV Infection, and Other Applications. Stem Cell Transplantation segment is expected to hold the largest market share of xx% by 2029. The addition of new cell types in stem cell transplantation is expected to benefit the industry, providing significant potential for enterprises to strengthen their market position. As a result, the number of businesses working on cell therapy has extended dramatically in recent years. Some of the key growth drivers for the market are increased funding from the government and private organisations to promote stem cell therapy clinical trials, the creation of effective guidelines for stem cell therapy manufacturing, and the demonstrated effectiveness of products. Furthermore, as the cost of stem cell therapies decreases, customers are becoming more interested in cell therapy. The development of cell banking facilities, as well as the resulting increase of cell production, storage, and characterization, is increasing the volumetric capacities of the global cytomegalovirus (CMV) treatment market. Furthermore, regulatory agencies are working to help innovators so that unique and effective treatments for patients can be introduced as soon as possible. Furthermore, established companies are collaborating with regulatory bodies in order to best fit within the cell therapy regulatory model. Based on the Distribution Channel, the market is segmented into Hospital pharmacies, Retail Pharmacies, and E-commerce. Retail Pharmacies segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. This is attributable to a shift in the epidemiological environment and favourable demographic considerations. The addition of various pharmaceuticals under the OTC category, as well as a desire for self-medication, are expected to drive the Retail Pharmacies segment in the global market during the forecast period.

Regional Insights:

North America region is expected to dominate the Cytomegalovirus Treatment market during the forecast period 2023-2029. North America region is expected to hold the largest market shares of xx% by 2029. The presence of a slew of huge biotechnology industries, a strong legislative environment for fostering cellular therapy development, and the high cost of treatment in the United States are all driving the regional industry forward. Due to superior research quality, considerable government support, and rising research in the sector, the United States is expected to be the leading revenue generator in research compared to other countries. Asia Pacific region is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. The market in growing countries of this region is expected to rise as developers and consumers invest more in educating themselves about sophisticated pharmaceutical procedures. Furthermore, the Cytomegalovirus Treatment market is expected to grow faster in this region due to strong product pipelines in cell-based therapies and a huge patient population. The cost of a stem cell transplant varies by region. The cost of transplantation in the United States, for example, is more than in Germany or China. This will result in increased revenue creation in the global healthcare market by lowering healthcare costs. The objective of the report is to present a comprehensive analysis of the Global Cytomegalovirus Treatment Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Cytomegalovirus Treatment Market dynamic, structure by analyzing the market segments and project the Global Cytomegalovirus Treatment Market size. Clear representation of competitive analysis of key players by Drugs Type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Cytomegalovirus Treatment Market make the report investor’s guide.Cytomegalovirus Treatment Market Scope: Inquire before buying

Global Cytomegalovirus Treatment Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 479.2 Mn. Forecast Period 2023 to 2029 CAGR: 6.1% Market Size in 2029: US $ 725.4 Mn. Segments Covered: by Drugs Type Ganciclovir Valganciclovir Foscarnet Cidofovir Other by Application Stem Cell Transplantation Organ Transplantation Congenital CMV Infection Other Applications by Distribution Channel Hospital pharmacies Retail Pharmacies E-commerce Cytomegalovirus Treatment Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Merck & Co. Inc. 2. Mylan N.V. 3. Chimerix, Inc. 4. Thermo Fisher Scientific 5. Abbott 6. Becton 7. Dickinson and Company 8. Bio-Rad Laboratories, Inc. 9. F. Hoffmann-La Roche Ltd 10. Pfizer 11. Fresenius Kabi Canada 12. Genentech, Inc. 13. Gilead Sciences 14. Teva Canada Limited 15. Shire plc 16. Johnson & Johnson Frequently Asked Questions: 1] Which region is expected to hold the highest share in the Cytomegalovirus Treatment Market? Ans. North America is expected to hold the highest share in the market. 2] Who are the top key players in the Cytomegalovirus Treatment Market? Ans. Merck & Co. Inc., Mylan N.V., Chimerix, Inc., Thermo Fisher Scientific, and Abbott are the top key players in the Cytomegalovirus Treatment Market. 3] Which segment holds the largest market share in the Cytomegalovirus Treatment market by 2029? Ans. Stem Cell Transplantation segment hold the largest market share in the market by 2029. 4] What is the market size of the Cytomegalovirus Treatment market by 2029? Ans. The market size of the market is expected to reach US $725.4 Mn. by 2029. 5] What was the market size of the Cytomegalovirus Treatment market in 2022? Ans. The market size of the market was worth US $479.2 Mn. in 2022.

1. Global Cytomegalovirus Treatment Market: Research Methodology 2. Global Cytomegalovirus Treatment Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Cytomegalovirus Treatment Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Cytomegalovirus Treatment Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Cytomegalovirus Treatment Market Segmentation 4.1 Global Cytomegalovirus Treatment Market, by Drugs Type (2022-2029) • Ganciclovir • Valganciclovir • Foscarnet • Cidofovir • Other 4.2 Global Cytomegalovirus Treatment Market, by Application (2022-2029) • Stem Cell Transplantation • Organ Transplantation • Congenital CMV Infection • Other Applications 4.3 Global Cytomegalovirus Treatment Market, by Distribution Channel (2022-2029) • Hospital pharmacies • Retail Pharmacies • E-commerce 5. North America Cytomegalovirus Treatment Market (2022-2029) 5.1 Global Cytomegalovirus Treatment Market, by Drugs Type (2022-2029) • Ganciclovir • Valganciclovir • Foscarnet • Cidofovir • Other 5.2 Global Cytomegalovirus Treatment Market, by Application (2022-2029) • Stem Cell Transplantation • Organ Transplantation • Congenital CMV Infection • Other Applications 5.3 Global Cytomegalovirus Treatment Market, by Distribution Channel (2022-2029) • Hospital pharmacies • Retail Pharmacies • E-commerce 5.4 North America Cytomegalovirus Treatment Market, by Country (2022-2029) • United States • Canada • Mexico 6. Asia Pacific Cytomegalovirus Treatment Market (2022-2029) 6.1. Asia Pacific Cytomegalovirus Treatment Market, by Drugs Type (2022-2029) 6.2. Asia Pacific Cytomegalovirus Treatment Market, by Application (2022-2029) 6.3. Asia Pacific Cytomegalovirus Treatment Market, by Distribution Channel (2022-2029) 6.4. Asia Pacific Cytomegalovirus Treatment Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Cytomegalovirus Treatment Market (2022-2029) 7.1 Middle East and Africa Cytomegalovirus Treatment Market, by Drugs Type (2022-2029) 7.2. Middle East and Africa Cytomegalovirus Treatment Market, by Application (2022-2029) 7.3. Middle East and Africa Cytomegalovirus Treatment Market, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Cytomegalovirus Treatment Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Cytomegalovirus Treatment Market (2022-2029) 8.1. Latin America Cytomegalovirus Treatment Market, by Drugs Type (2022-2029) 8.2. Latin America Cytomegalovirus Treatment Market, by Application (2022-2029) 8.3. Latin America Cytomegalovirus Treatment Market, by Distribution Channel (2022-2029) 8.4. Latin America Cytomegalovirus Treatment Market, by Country (2022-2029) • Brazil • Argentina • Rest Of Latin America 9. European Cytomegalovirus Treatment Market (2022-2029) 9.1. European Cytomegalovirus Treatment Market, by Drugs Type (2022-2029) 9.2. European Cytomegalovirus Treatment Market, by Application (2022-2029) 9.3. European Cytomegalovirus Treatment Market, by Distribution Channel (2022-2029) 9.4. European Cytomegalovirus Treatment Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Merck & Co. Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Mylan N.V. 10.3. Chimerix, Inc. 10.4. Thermo Fisher Scientific 10.5. Abbott 10.6. Becton 10.7. Dickinson and Company 10.8. Bio-Rad Laboratories, Inc. 10.9. F. Hoffmann-La Roche Ltd 10.10. Pfizer 10.11. Fresenius Kabi Canada 10.12. Genentech, Inc. 10.13. Gilead Sciences 10.14. Teva Canada Limited 10.15. Shire plc 10.16. Johnson & Johnson